Form ITR-7 - Taxmann

Form ITR-7 - Taxmann

Form ITR-7 - Taxmann

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

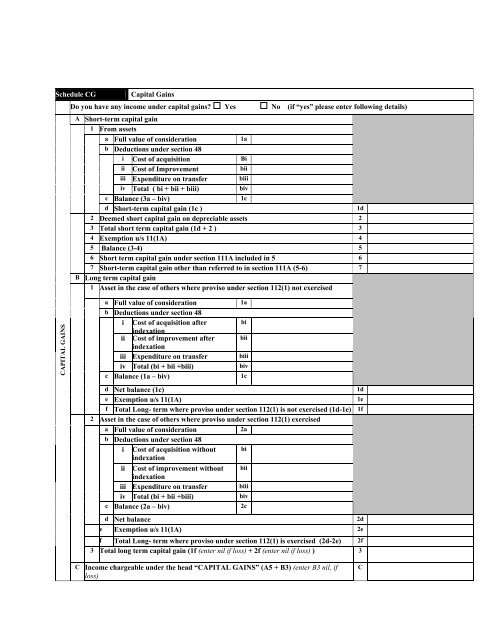

Schedule CGCapital GainsDo you have any income under capital gains? Yes No (if “yes” please enter following details)A Short-term capital gain1 From assetsa Full value of consideration1ab Deductions under section 48i Cost of acquisition Biii Cost of Improvement biiiii Expenditure on transfer biiiiv Total ( bi + bii + biii) bivc Balance (3a – biv)1cd Short-term capital gain (1c )1d2 Deemed short capital gain on depreciable assets 23 Total short term capital gain (1d + 2 ) 34 Exemption u/s 11(1A) 45 Balance (3-4) 56 Short term capital gain under section 111A included in 5 67 Short-term capital gain other than referred to in section 111A (5-6) 7B Long term capital gain1 Asset in the case of others where proviso under section 112(1) not exercisedCAPITAL GAINSa Full value of considerationb Deductions under section 48i Cost of acquisition afterindexationii Cost of improvement afterindexationiii Expenditure on transferiv Total (bi + bii +biii)c Balance (1a – biv)1abibiibiiibiv1cd Net balance (1c)1de Exemption u/s 11(1A)1ef Total Long- term where proviso under section 112(1) is not exercised (1d-1e) 1f2 Asset in the case of others where proviso under section 112(1) exerciseda Full value of considerationb Deductions under section 48i Cost of acquisition withoutindexationii Cost of improvement withoutindexationiii Expenditure on transferiv Total (bi + bii +biii)c Balance (2a – biv)d Net balance2de Exemption u/s 11(1A) 2ef Total Long- term where proviso under section 112(1) is exercised (2d-2e) 2f3 Total long term capital gain (1f (enter nil if loss) + 2f (enter nil if loss) ) 32abibiibiiibiv2cC Income chargeable under the head “CAPITAL GAINS” (A5 + B3) (enter B3 nil, ifloss)C

![“FORM NO. 3CEB [See rule 10E] Report from an ... - Taxmann](https://img.yumpu.com/45480232/1/190x245/form-no-3ceb-see-rule-10e-report-from-an-taxmann.jpg?quality=85)