WEBroker Travel Insurance Policy summary - Online Travel Insurance

WEBroker Travel Insurance Policy summary - Online Travel Insurance

WEBroker Travel Insurance Policy summary - Online Travel Insurance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

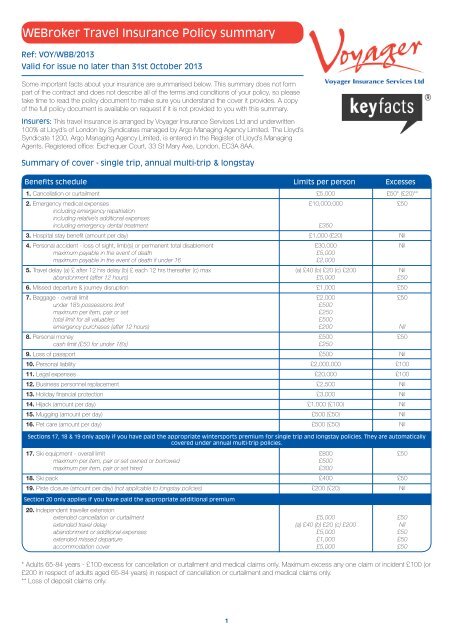

<strong>WEBroker</strong> <strong>Travel</strong> <strong>Insurance</strong> <strong>Policy</strong> <strong>summary</strong>Ref: VOY/WBB/2013Valid for issue no later than 31st October 2013Some important facts about your insurance are summarised below. This <strong>summary</strong> does not formpart of the contract and does not describe all of the terms and conditions of your policy, so pleasetake time to read the policy document to make sure you understand the cover it provides. A copyof the full policy document is available on request if it is not provided to you with this <strong>summary</strong>.Insurers: This travel insurance is arranged by Voyager <strong>Insurance</strong> Services Ltd and underwritten100% at Lloyd’s of London by Syndicates managed by Argo Managing Agency Limited. The Lloyd’sSyndicate 1200, Argo Managing Agency Limited, is entered in the Register of Lloyd’s ManagingAgents. Registered office: Exchequer Court, 33 St Mary Axe, London, EC3A 8AA.Summary of cover - single trip, annual multi-trip & longstayBenefits schedule Limits per person Excesses1. Cancellation or curtailment2. Emergency medical expensesincluding emergency repatriationincluding relative’s additional expensesincluding emergency dental treatment3. Hospital stay benefit (amount per day)4. Personal accident - loss of sight, limb(s) or permanent total disablementmaximum payable in the event of deathmaximum payable in the event of death if under 165. <strong>Travel</strong> delay (a) £ after 12 hrs delay (b) £ each 12 hrs thereafter (c) maxabandonment (after 12 hours)6. Missed departure & journey disruption7. Baggage - overall limitunder 18’s possessions limitmaximum per item, pair or settotal limit for all valuablesemergency purchases (after 12 hours)8. Personal moneycash limit (£50 for under 18’s)9. Loss of passport10. Personal liability11. Legal expenses12. Business personnel replacement13. Holiday financial protection14. Hijack (amount per day)15. Mugging (amount per day)16. Pet care (amount per day)Sections 17, 18 & 19 only apply if you have paid the appropriate wintersports premium for single trip and longstay policies. They are automaticallycovered under annual multi-trip policies.17. Ski equipment - overall limitmaximum per item, pair or set owned or borrowedmaximum per item, pair or set hired18. Ski pack19. Piste closure (amount per day) (not applicable to longstay policies)£5,000£10,000,000£350£1,000 (£20)£30,000£5,000£2,000(a) £40 (b) £20 (c) £200£5,000£1,000£2,000£500£250£500£200£500£250£500£2,000,000£20,000£2,500£3,000£1,000 (£100)£500 (£50)£500 (£50)£800£500£300£400£200 (£20)£50* (£20)**£50NilNilNil£50£50£50Nil£50Nil£100£100NilNilNilNilNil£50£50NilSection 20 only applies if you have paid the appropriate additional premium20. Independent traveller extension20. extended cancellation or curtailment20. extended travel delayabandonment or additional expenses20. extended missed departureaccommodation cover£5,000(a) £40 (b) £20 (c) £200£5,000£1,000£5,000£50Nil£50£50£50* Adults 65-84 years - £100 excess for cancellation or curtailment and medical claims only. Maximum excess any one claim or incident £100 (or£200 in respect of adults aged 65-84 years) in respect of cancellation or curtailment and medical claims only.** Loss of deposit claims only.1

<strong>WEBroker</strong> <strong>Travel</strong> <strong>Insurance</strong> <strong>Policy</strong> <strong>summary</strong>Ref: VOY/WBB/2013Valid for issue no later than 31st October 2013Types of policies available and policy durationsPolicies are available for single trips up to 45 days, longstay trips up to 15 months or on an annualbasis for multiple trips. An annual multi-trip policy runs for 12 months from the date specified andprovides cover for an unlimited number of trips starting within that period, provided that no singletrip is intended to be for longer than the maximum number of days shown in the benefits schedulefor the cover you have bought. A single trip or longstay policy provides cover for the duration of thetrip shown in your policy documentation.Who can be covered?Policies can be arranged for individuals, couples or families, subject to the maximum age limitshown in your benefits schedule. A family policy provides cover for to two adults and theirdependent children aged 17 and under or 20 and under if still in full time education and all normallyresiding together at the same address. Cover for families shall apply where the appropriate premiumhas been paid. On annual multi-trip policies, all insureds are entitled to travel independently of eachother providing all travellers are named on the policy schedule.Significant and/or unusual conditions and exclusionsHealth - this insurance contains restrictions regarding pre-existing medical conditions of the peopletravelling and of other people upon whose health the trip depends. You are advised to read the documentcarefully.Sports & activities (including wintersports) - you may not be insured if you are going to take part insports & activities where there is a generally recognised risk of injury. Please check that this insurancecovers you, or ask us.Excesses - under some sections of this insurance, claims will be subject to an excess. This meanseach person will be responsible for paying the first part of their claim under each applicable section.Baggage - these claims are paid based on the value of the goods at the time you lose them and not ona ‘new for old’ or replacement cost basis. Deductions will be made in respect of wear, tear anddepreciation.Reasonable care - you need to take all reasonable care to protect yourself and your property, as youwould if you were not insured. Any amounts the insurers will pay for property left unattended in a publicplace or unattended vehicle is very limited, as specified in the wording.Important conditions relating to health & activities & changes in circumstance - you mustanswer the important conditions relating to health & activities shown in the policy wording truthfully and tothe best of your knowledge and contact us if required. If you do not do so then any related claim may bereduced or rejected or your policy may become invalid.Notification of claims - you must advise the claims handlers of any possible claim as soon aspossible. You must supply them with full details of all the circumstances and any other information anddocuments we may require.Relevant policy referenceImportant conditions relating to health & activitiesand health exclusions.General exclusions 8, 9, 10 & 11 and Activitiescover levels.Benefits schedule & important feature 6.Sections 7, 8, 9, 15 & 17, Special exclusionsand important feature 4.7, 8, 9, 15 & 17, Special exclusions andimportant feature 4 & 7 and general conditions5 & 9.Important conditions relating to health &activites, general conditions 1 & 2 & section 1 -cancellation or curtialment conditions a & b.Section 1 - cancellation or curtailment condition a& general conditions 2 & 4.CANCELLATION RIGHTWe hope you are happy with the cover this policy provides. However if after reading this certificate, this insurance does not meet with your requirements, pleasereturn it to the issuing agent, within 14 days of receipt and we will refund your premium. We reserve the right to deduct from the rebate of premium the reasonablecosts incurred in processing the original sale and cancellation. We shall not be bound to accept renewal of any insurance and may at any time cancel anyinsurance document by sending 14 days notice to you at your last known address. Provided the premium has been paid in full, you shall be entitled to aproportionate rebate of premium in respect of the unexpired period showing on the insurance.MAKING A CLAIMFor all claims other than medical emergencies please request an appropriate claim form by telephoning the number below. Please quote Voyager <strong>WEBroker</strong>.ONE Claims Ltd, 1-4 Limes Court, Hoddesdon, Hertfordshire, EN11 8EP. Tel: +44 (0) 1992 708 729. Fax: +44 (0) 1992 450 717. Please have yourcertificate number to hand, and have ready any documents you may have that could be relevant to your claim.In the event of illness or injury during your trip which will require hospitalisation, you must notify ONE Assist Ltd. Tel: + 44 (0) 1992 454 276. Fax: + 44 (0) 1992708 721. Please quote Voyager <strong>WEBroker</strong>.HOW TO MAKE A COMPLAINTWe hope you will be pleased with the service we provide. However, if you have a complaint about the sale of your policy or about a claim, please follow thecomplaints procedure shown in the policy wording.If you are still dissatisfied you may refer your case to the Financial Ombudsman Service (FOS). Please note that you have six months from the date of our financialresponse in which to refer your complaints to the FOS. Referral to the FOS will not affect your right to take legal action.FINANCIAL SERVICES COMPENSATION SCHEMEWe are covered by the Financial Services Compensation Scheme. You may be entitled to compensation from the scheme if we are unable to meet our obligationsto you under this contract. If you are entitled to compensation under the scheme, the level and extent of the compensation would depend on the nature of thiscontract. Further information can be obtained from the Financial Services Compensation Scheme (7th Floor Lloyds Chambers, Portsoken Street, London E1 8BN)by phone on 020 7892 7300 and on their website at www.fscs.org.uk.2

<strong>WEBroker</strong> <strong>Travel</strong> <strong>Insurance</strong> <strong>Policy</strong>Ref: VOY/WBB/2013Valid for issue no later than 31st October 2013Summary of cover - single trip, annual multi-trip & longstayBenefits schedule1. Cancellation or curtailment2. Emergency medical expensesincluding emergency repatriationincluding relative’s additional expensesincluding emergency dental treatment3. Hospital stay benefit (amount per day)4. Personal accident - loss of sight, limb(s) or permanent total disablementmaximum payable in the event of deathmaximum payable in the event of death if under 165. <strong>Travel</strong> delay (a) £ after 12 hrs delay (b) £ each 12 hrs thereafter (c) maxabandonment (after 12 hours)6. Missed departure & journey disruption7. Baggage - overall limitunder 18’s possessions limitmaximum per item, pair or settotal limit for all valuablesemergency purchases (after 12 hours)8. Personal moneycash limit (£50 for under 18’s)9. Loss of passport10. Personal liability11. Legal expenses12. Business personnel replacement13. Holiday financial protection14. Hijack (amount per day)15. Mugging (amount per day)16. Pet care (amount per day)17. Ski equipment - overall limitmaximum per item, pair or set owned or borrowedmaximum per item, pair or set hired18. Ski pack19. Piste closure (amount per day) (not applicable to longstay policies)20. Independent traveller extension20. extended cancellation or curtailment20. extended travel delayabandonment or additional expenses20. extended missed departureaccommodation cover* Adults 65-84 years - £100 excess for cancellation or curtailment and medical claims only. Maximum excess any oneclaim or incident £100 (or £200 in respect of adults aged 65-84 years) in respect of cancellation or curtailment andmedical claims only.** Loss of deposit claims only.Territorial limitsYou are covered for trips to countries within thefollowing areas provided that you have paid theappropriate premium, as shown in your certificate.Area 1Area 2Area 3Area 4Limits per person Excesses£5,000£10,000,000Sections 17, 18 & 19 only apply if you have paid the appropriate wintersports premium for singletrip and longstay policies. They are automatically covered under annual multi-trip policies.£350£1,000 (£20)£30,000£5,000£2,000(a) £40 (b) £20 (c) £200£5,000£1,000£2,000£500£250£500£200£500£250£500£2,000,000£20,000£2,500£3,000£1,000 (£100)£500 (£50)£500 (£50)£800£500£300£400£200 (£20)Section 20 only applies if you have paid the appropriate additional premium<strong>Policy</strong> features tableAnnual multi-trip featuresMaximum age at date of purchaseMaximum period per trip (if aged 70-74)Business travelUK trips (min 2 nights using pre-bookedpre-paid accommodation or transport)Family members can travel separatelyWintersports - up to total maximum ofMaximum age at date of departureMaximum period per trip<strong>Travel</strong> completed byMaximum age at date of departureMaximum period per trip<strong>Travel</strong> completed bySingle trip featuresLongstay features7445 days (22 days)YesYesYes21 days8445 days01/11/20146415 months01/03/2015£5,000(a) £40 (b) £20 (c) £200£5,000£1,000£5,000£50* (£20)**£50*The United Kingdom and Northern Ireland.The continent of Europe West of the Uralmountains, any country with aMediterranean coastline, (excluding Algeria,Libya, Syria and Israel) Channel Islands, theCanary Islands, the Isle of Man, Madeiraand Iceland.Worldwide excluding North America &Caribbean.Worldwide including North America &Caribbean.If you have bought the annual multi-trip option, trips whollywithin your home country are also insured but only if theyinclude a minimum of 2 nights away from home usingpre-booked and pre-paid accommodation or transport.For longstay policies, rating is determined by where themajority of time will be spent.NilNilNil£50£50£50Nil£50Nil£100£100NilNilNilNilNil£50£50Nil£50Nil£50£50£5024 HOUR MEDICAL EMERGENCYAND REPATRIATION SERVICEThe nominated emergency service referred to inthis policy is operated by ONE Assist Ltd.If you or a member of your party have to go to hospital asan in-patient during your trip, require medical treatmentthat will cost more than £250 (or its equivalent in localcurrency) or need to travel home differently to your originalplans, ONE Assist Ltd must be contacted BEFOREmaking any arrangements. If this is not possible becausethe condition requires immediate treatment to save life orlimb, ONE Assist Ltd must be contacted as soon aspossible thereafter (see condition (a) of section 2 -emergency medical expenses). Failure to obtain properauthorisation will mean the insurers are not liable for theexpenses.In the event of illness or injury during your trip which willrequire hospitalisation, you must notify ONE Assist Ltd.Tel: + 44 (0) 1992 454 276Fax: + 44 (0) 1992 708 721Please quote Voyager <strong>WEBroker</strong>You can use this service outside your home countryduring your trip. If you have a medical emergency pleasecontact ONE Assist Ltd as soon as possible.Outpatient treatmentFor simple out-patient costs you should settle the clinicbill directly and claim this back upon your return.Special noticeThis is not a private medical insurance and only givescover in the event of an accident or sudden illness thatrequires emergency treatment whilst abroad. In theevent of any medical treatment becoming necessarywhich results in a claim under this insurance, you willbe expected to allow insurers or their representativesunrestricted reasonable access to your medical recordsand information.How to make a claimFor all claims other than medical emergencies pleaserequest an appropriate claim form by telephoning thenumber below. Please quote Voyager <strong>WEBroker</strong>.ONE Claims Ltd,1-4 Limes Court, Hoddesdon, Hertfordshire,EN11 8EP.Tel: +44 (0) 1992 708 729Fax: +44 (0) 1992 450 717Please have your certificate number to hand, and haveready any documents you may have that could berelevant to your claim (for example medical certificates,travel tickets, boarding passes, letters from authorities/public transport providers/airlines, depending on whichsection of cover you are claiming for). If you do not haveany documents with you, your claim might be delayed,please ask the operator for assistance.You may need to get additional information about yourclaim while you are away. You may also be asked tosend us additional information and documentation (we willgive you advice if this becomes necessary). The natureof the documentation we need may include hotel bills,hospital bills, pharmacy receipts and/or taxi receipts andwill depend on your individual circumstances and thetype of claim you are making. Please read the generalconditions contained in this policy document and therelevant sections of your policy for more information. Wemay refuse to reimburse you for any expenses for whichyou cannot provide receipts or bills.1

Important conditions relating to health & activitiesPlease consider these questions very carefully in relation to yourself and your travelling companionsinsured by us.To avoid unnecessary extra cost, you should only contact the screening service if the answer to any of questions 1, 2 or3 is YES. If all the appropriate answers are NO then there is no need to contact Healthcheck and your condition(s) will beinsured.Please note that if you do contact Healthcheck and go through a full screening when the appropriate answers are all NOthen you will have to pay the appropriate additional premium quoted if you wish to cover your declared conditions.1234Within the last 12 months, have any of you suffered from, been investigatedfor, diagnosed with, received treatment or taken any medication for;a. any cancer or malignant condition.b. any lung related condition (other than stable, well controlled asthma thatrequires not more than 2 medications, including inhalers).c. any heart related condition (including angina)?NB – You must contact Healthcheck if you take regular medication for anyof these conditions.Please noteImportant featuresNoDo any of you suffer from any other medical condition that has requiredreferral to or consultation with a specialist clinic or hospital for treatment, testsor investigation within the 12 months prior to the date this insurance wasarranged or the date that you subsequently made arrangements for a trip?NB – Continuing regular medication that is taken at home for a stable, wellcontrolled condition does not amount to ‘treatment; in this context and sodoes not need to be screened. If you have stable conditions that require nomore than two routine check-ups/reviews per year each then you do notneed to be screened.Has your doctor increased your regular prescribed medication in thelast three months?NoNoYour medical conditions (if any) will be coveredWe would like to draw your attention to some importantfeatures of your insurance including:1. <strong>Insurance</strong> documentYou should read this document carefully. It gives fulldetails of what is and is not covered and theconditions of the cover. Cover can vary from onepolicy to another so you should familiarise yourself withthis particular insurance.2. Conditions and exclusionsSpecific conditions and exclusions apply to individualsections of your insurance, whilst general exclusionsand conditions will apply to the whole of yourinsurance.3. HealthThis insurance contains restrictions regarding preexistingmedical conditions of the people travelling andof other people upon whose health the trip depends.You are advised to read the document carefully.4. Property claimsThese claims are paid based on the value of thegoods at the time you lose them and not on a ‘newfor old’ or replacement cost basis. Deductions will bemade in respect of wear, tear and depreciation.5. LimitsThis insurance has limits on the amount the insurer willpay under each section. Some sections also includeother specific limits, for example, for any one item orfor valuables in total.6. ExcessesUnder some sections of this insurance, claims will besubject to an excess. This means each person will beresponsible for paying the first part of their claim undereach applicable section.There is no cover for claimsrelated directly or indirectlyto these conditions unlessdeclared to us and confirmedin writing.However, cover may beavailable by contacting<strong>WEBroker</strong> Healthcheck on0845 003 5244Please note that there will bean additional premium chargedif you use this service, theamount of which variesand is determined by thedetails declared. Any specialterms that are necessarywill be explained to you andconfirmed in writing.Are you planning to take part in any hazardous activities (see general exclusions on page 7) or are you aware ofany other circumstances that could reasonably be expected to give rise to a claim, such as the state of health of aclose relative whose health may cause you to cancel or curtail your trip? If so, please contact Voyager <strong>Insurance</strong>Services on 01483 562662.You are not covered for any related claims if you;• have any medical condition as a result of which a medical practitioner has advised you not to travel or would havedone so had you sought his or her advice.• have been given a terminal prognosis.• are on a waiting list for treatment or investigation.YesYesYes7. Reasonable careYou need to take all reasonable care to protect yourselfand your property, as you would if you were notinsured. Any amounts the insurers will pay for propertyleft unattended in a public place or unattended vehicleis very limited, as specified in the wording.8. Sports & activitiesYou may not be insured if you are going to take part insports & activities where there is a generallyrecognised risk of injury. Please check that thisinsurance covers you, or ask us.9. Customer serviceWe always try to provide a high level of service.However, if you think we have not lived up to yourexpectations, please refer to the wording whichoutlines our customer service & complaints procedure.10. Cancellation rightsThis insurance contains a 14 day ‘cooling off’ periodduring which you can return it and get a full refund,providing you have not travelled and there are noclaims. We reserve the right to deduct from therebate of premium the reasonable costs incurred inprocessing the original sale and cancellation.11. Fraudulent claimsIt is a criminal offence to make a fraudulent claim.DefinitionsBaggage means personal belongings, including clothingworn, and personal luggage owned or borrowed by youthat you take with you on your trip.Breakdown means that the vehicle in which you aretravelling stops as a result of mechanical or electricalfailure due to any cause other than lack of fuel, oil orwater.Business colleague means any person that youwork closely with whose absence for a period of oneor more complete days necessitates the cancellationor curtailment of the trip as certified by a director of thebusiness.Curtailment/curtail means cutting your planned tripshort by early return to your home country or admission tohospital as an inpatient so that you lose the benefit ofaccommodation you have paid for.End supplier means any service providers of majorelements of your booked itinerary, including transport,accommodation and ground arrangements that arebooked directly with them and paid for before the start ofyour trip.Family means two adults and all of their children(including foster children) aged 17 and under (20 andunder if in full time education). All persons must live at thesame address.Home country means your usual place of residence inthe United Kingdom, Channel Islands or Isle of Man.Illness means any disease, infection or bodily disorderwhich is unexpectedly contracted by you whilst on yourtrip or unexpectedly manifests itself for the first time duringyour trip.North America means the United States of America,Canada, Mexico and the Caribbean islands includingBahamas & Bermuda.Personal money means cash, being banknotes andcoins, travellers’ cheques, travel tickets andaccommodation vouchers carried by you for yourpersonal use.Pre-existing medical condition means anycondition that has required referral to or consultationwith a specialist clinic or hospital for treatment, tests orinvestigation within the 12 months prior to:1. the date that this insurance was arranged, or2. the date that you subsequently made arrangements fora trip (if this is an annual multi-trip policy), or3. the date that you extended the original period ofinsurance, whichever is the latest.Public transport means any aeroplane, ship, train orcoach on which you are booked to travel.Relative means husband or wife (or partner with whomyou are living at the same address), parent, grandparent,parent-in-law, brother, sister, child, grandchild, brother-inlaw,sister-in-law, son-in-law, daughter-in-law or fiancé(e).Resident means a person who permanently resides inthe United Kingdom, Channel Islands or Isle of Man and isregistered with a medical practitioner in their homecountry.Ski equipment means skis, snowboards, ski-poles,bindings, ski-boots and snowboard boots.Trip means any holiday, leisure or business trip whichbegins and ends in your home country and for which youhave paid the appropriate premium.Unattended means out of your immediate control andsupervision such that you are unable to prevent loss, theftor damage occurring.Valuables means cameras and other photographicequipment, audio and video equipment, computers,all discs, CDs, tapes and cassettes, other electronicor electrical equipment of any kind, spectacles and/or sunglasses, telescopes and binoculars, jewellery,watches, furs and items made of or containing preciousor semi-precious stones or metals.We, us and our means the insurers.You and your means each person for whom thepremium has been paid and whose age does not exceedthe maximum shown in the policy features table. Youmust be resident in the United Kingdom, Channel Islandsor Isle of Man and registered with a medical practitioner inyour home country. Each person is separately insured.2

Section 1Cancellation or curtailment(Cover under this section starts from the date shown onyour certificate or the date travel is booked, whichever isthe later).You are covered up to the amount shown in thebenefits schedule for your part of the unused travel andaccommodation costs (including unused pre-bookedexcursions up to a value of £100) that have been paid orwhere there is a contract to pay that cannot be recoveredfrom anywhere else if it is necessary to cancel or curtailthe planned trip because of any of the following eventsinvolving you or a travelling companion that first occurduring the period of insurance;a. the accidental bodily injury, unexpected illness ordeath of you, your travelling companion, your businesscolleague or person with whom you intended to stay.b. the accidental bodily injury, unexpected illness or deathof your relative or that of a travelling companion, abusiness colleague or person with whom you intendedto stay.c. receipt of a summons for jury service, beingsubpoenaed as a court witness or being placed incompulsory quarantine.d. unexpected requirement for emergency andunavoidable duty as a member of the armed forces,police, fire, nursing, ambulance or coastguard servicesresulting in cancellation of previously agreed leave.e. redundancy, provided that you are entitled to paymentunder the current redundancy payments legislationand that at the time of booking your trip you had noreason to believe that you would be made redundant.f. your presence being required to make your propertysafe and secure following fire, flood or burglary thatcauses damage at your home within 48 hours prior toyour departure, or whilst you are away.g. your car becoming unusable as a result of theft, fire oraccident within 7 days prior to your departure. Thisonly applies if you are planning to go on a self-drivetrip in the car.You are not covered fora. the amount of the excess shown in the benefitsscheduleb. anything not listed above in the items you are coveredfor.c. any directly or indirectly related claims if, within the last12 months, you or your travelling companions havesuffered from, been investigated, treated for ordiagnosed with;i. any cancer or malignant condition.ii. any lung related condition (other than stable, wellcontrolled asthma that requires no more than 2medications, including inhalers).iii. any heart related condition (including angina).iv. any pre-existing medical condition (as defined).We may agree not to apply (c) above or to accept thisinsurance at special terms but only if you supply us withdetails of your condition. Please contact <strong>WEBroker</strong>Healthcheck on 0845 003 5244.d. any pre-existing medical condition that as far as youare aware affects anyone else who is not travellingwith you but whose illness may cause you to cancel orcurtail your trip.e. any directly or indirectly related claims if, at the timethis insurance was arranged or, if later, each time youmake arrangements for a trip or you extend the originalperiod of your insurance you;i. are travelling against the advice of your doctors.ii. are travelling specifically to seek or you know you willneed medical treatment while you are away.iii. are waiting for medical or surgical treatment.iv. have been diagnosed with a terminal condition.v. were aware of any other circumstances that couldreasonably be expected to give rise to a claim.f. any costs incurred in respect of visas obtained inconnection with the trip.g. disinclination to travel.h. failure to obtain the necessary passport, visa or permitfor your trip.i. the cost of this policy.Please note that curtailment claims will be calculatedfrom the day you return to your home country or areadmitted to hospital as an inpatient. Your claim will bebased solely on the number of complete nights’accommodation lost. In respect of travel expenses, wewill pay for any additional costs but not for the loss of yourpre-booked arrangements.ConditionsIt is a requirement of this insurance that if you;a. (for cancellation) become aware of any circumstanceswhich make it necessary for you to cancel your trip,you must advise your tour operator or travel agent inwriting as soon as possible. The maximum amountwe will pay will be limited to the applicable cancellationcharges at that time.b. (for curtailment) wish to return home earlier than youroriginal plans and claim any additional costs under thisinsurance, you must contact our nominatedemergency service and obtain their agreement to thenew arrangements. Failure to do so will affect theassessment of your claim.Please also refer to the general exclusions andconditions.Section 2Emergency medical expensesIf you or a member of your party have to go to hospital asan in-patient during your trip, require medical treatmentthat will cost more than £250 (or its equivalent in localcurrency) or need to travel home differently to your originalplans, ONE Assist must be contacted BEFORE makingany arrangements. If this is not possible because thecondition requires immediate treatment to save life orlimb, ONE Assist must be contacted as soon as possiblethereafter (see condition (a) of section 2 - emergencymedical expenses). Failure to obtain proper authorisationwill mean the insurers are not liable for the expenses.You are covered up to the amount shown in thebenefits schedule for either the necessary and reasonablecosts incurred as a result of you sustaining accidentalbodily injury, unexpected illness or death during your tripin respect of;a. emergency medical, surgical and hospital treatmentand transportation. At the sole discretion of ournominated emergency service, who reserve the rightto make the final decision as to whether or not it ismedically necessary, this also includes the cost ofrepatriation to your home country, by whatever meansdeemed medically necessary. The cost of emergencydental treatment to natural teeth is covered up to £350provided that it is for the immediate relief of pain only.b. additional travel and accommodation expenses (on abed & breakfast basis) to enable you to return home ifyou are unable to travel as originally planned.c. additional travel and accommodation expenses (on abed & breakfast basis) for;i. a travelling companion to stay with you andaccompany you home, orii. a relative or friend to travel from your home countryto stay with you and accompany you home.d. returning your remains to your home or of a funeral inthe country where you died, up to the equivalent costof returning your remains to your home country.e. with the prior agreement of our nominated emergencyservice, your necessary additional travel expenses toreturn home following the death, injury or illness of atravelling companion insured by us or of your (or yourtravelling companion’s) relative or business colleague inyour home country.You are not covered fora. the amount of the excess shown in the benefitsschedule in respect of each claim unless a recoverycan be made under the terms of any E.U. or any otherreciprocal arrangement.b. any directly or indirectly related claims if, within the last12 months, you or your travelling companions havesuffered from, been investigated, treated for ordiagnosed with;i. any cancer or malignant condition.ii. any lung related condition (other than stable, wellcontrolled asthma that requires no more than 2medications, including inhalers).iii. any heart related condition (including angina).iv. any pre-existing medical condition (as defined).We may agree not to apply (b) above or to accept thisinsurance at special terms but only if you supply us withdetails of your condition. Please contact <strong>WEBroker</strong>Healthcheck on 0845 003 5244.c. any pre-existing medical condition that as far as youare aware affects anyone else who is not travellingwith you but whose illness may cause you to cancel orcurtail your trip.d. any directly or indirectly related claims if, at the timethis insurance was arranged or, if later, each time youmake arrangements for a trip or you extend the originalperiod of your insurance, you:3i. are travelling against the advice of your doctor.ii. are travelling specifically to seek or you know you willneed medical treatment while you are away.iii. are waiting for medical or surgical treatment.iv. have been diagnosed with a terminal condition.v. were aware of any other circumstances that couldreasonably be expected to give rise to a claim.e. any treatment or surgery;i. which is not immediately necessary and can waituntil you return home. We reserve the right to repatriateyou when you are fit to travel in the opinion of ournominated emergency service.ii. which in the opinion of our nominated emergencyservice is considered to be cosmetic, experimental orelective.iii. carried out in your home country or more than 12months after the expiry of this insurance.iv. not given within the terms of any reciprocal healthagreements, wherever such agreements exist.f. exploratory tests unless they are normally conductedas a direct result of the condition which requiredreferral to hospital.g. claims related to manual labour unless declared to andaccepted by us.h. the additional cost of accommodation in a single orprivate room, unless it is medically necessary or thereis no alternative.i. the costs of medication or treatment that you knew atthe time of your departure would need to be continuedduring your trip.j. the costs of replacing or repairing false teeth or ofdental work involving the use of precious metals.k. the normal costs or losses otherwise associated withpregnancy (including multiple pregnancy) or childbirth.This includes, but is not limited to, delivery bycaesarean section or any other medically or surgicallyassisted delivery which does not cause medicalcomplications. The policy does, however, cover youshould complications arise with your pregnancy due toaccidental injury or unexpected illness which occurswhile on your trip.ConditionsPlease note that it is essential under the terms of thisinsurance that;a. our nominated emergency service is contactedimmediately and their prior authority obtained if itappears likely that you require admission to hospital,you require medical treatment which will cost morethan £250 (or its equivalent in local currency) or if youwish to return home earlier than your original plans. If itis not possible to notify them in advance because thecondition requires immediate treatment to save life orlimb our nominated emergency service must benotified as soon as possible. Failure to do so will affectthe assessment of your claim.b. wherever possible you must use medical facilities thatentitle you to the benefits of any reciprocal healthagreements, such as the EHIC in Europe andMEDICARE in Australia.Please also refer to the general exclusions andconditions.Reciprocal health agreementsEU, EEA or SwitzerlandIf you are travelling to countries within the European Union(EU), the European Economic Area (EEA) or Switzerlandyou are strongly advised to obtain a European Health<strong>Insurance</strong> Card (EHIC). You can apply for an EHIC eitheron line at www.ehic.org.uk or by telephoning 0845 6062030. This will entitle you to benefit from the health carearrangements which exist between countries within theEU/EEA or Switzerland. In the event of liability beingaccepted for a medical expense which has been reducedby the use of a European Health <strong>Insurance</strong> Card we willnot apply the deduction of excess under section 2 -emergency medical expenses.AustraliaIf you require medical treatment in Australia you must enrolwith a local MEDICARE office. You do not need to enrolon arrival but you must do this after the first occasion youreceive treatment. In-patient and out-patient treatment ata public hospital is then available free of charge. Details ofhow to enrol and the free treatment available can be foundby visiting the MEDICARE website on www.medicareaustralia.gov.au or by emailing medicare@medicareaustralia.gov.au. Alternatively please call our nominatedemergency service for guidance. If you are admitted tohospital contact must be made with our nominatedemergency service as soon as possible and their authorityobtained in respect of any treatment NOT available underMEDICARE.

Section 9Loss of passportYou are covered up to the amount shown in thebenefits table following loss or theft of your passportfor any reasonable additional necessary travel andaccommodation costs, including the cost of anyemergency passports, visas or permits incurred to enableyou to continue your trip or return to your home country.You are not covered fora. loss or theft either from an unattended motor vehicle atany time or from baggage whilst in transit unless youare carrying it.b. the cost of a permanent replacement for the passportitself.Please also refer to the special exclusions andconditions shown below and to the generalexclusions and conditions.Special exclusions applicable to sections7, 8 & 9You are not covered fora. more than £100 in total under these sections inrespect of loss or theft of anything left unattended in apublic place, including on a beach.b. any loss or theft unless reported to the police within24 hours of discovering the loss, and a written reportobtained in the country where the incident occurred.c. loss of bonds or securities of any kind.d. delay, detention, seizure or confiscation by customs orother officials.Special conditions applicable to sections7, 8 & 9It is a requirement of this insurance that you must;a. in the event of a claim,i. provide receipts or other documentation to proveownership and value, especially in respect of valuablesand any items for which you are claiming more than£100, andii. retain any damaged items for our inspection. Failureto exercise all reasonable care may result in your claimbeing reduced or declined.b. take care of your property at all times and take allpractical steps to recover any item lost or stolen.Please also refer to the general exclusions andconditions.Section 10Personal liabilityYou are covered up to the amount shown in thebenefits schedule, plus legal costs incurred with ourwritten consent, if you are held legally liable for causing;a. accidental bodily injury to someone else, orb. accidental loss or damage to someone else’s property,including your temporary trip accommodation and itscontents.You are not covered fora. the amount of the excess shown in the benefitsschedule in respect of each claim.b. any liability arising from loss or damage to property that is;i. owned by you or a member of your family or yourtravelling companions, orii. in your care, custody or control, other than yourtemporary trip accommodation and its contents, notowned by you or a member of your family or yourtravelling companions.c. any liability for bodily injury, loss or damage;i. to your employees or members of your family orhousehold or your travelling companions or to theirproperty.ii. arising out of or in connection with your trade,profession or business, or assumed under contract.iii. arising out of the ownership, possession, use oroccupation of land or buildings.iv. arising out of the ownership, possession or use ofmotorised vehicles, yachts or motorised waterbornecraft, airborne craft of any description, animals orfirearms and weapons.v. arising out of your criminal, malicious or deliberateacts.vi. arising out of dangerous sports or pastimesincluding contact sports unless declared to andaccepted by us.ConditionsIf something happens that is likely to result in a claim, youmust immediately notify the claims handlers in writing. Youmust not discuss or negotiate your claim with any thirdparty without the written consent of the claims handlers.Any related correspondence or documentation that youreceive must be sent immediately, unanswered, to theclaims handlers.Please also refer to the general exclusions andconditions.Section 11Legal expensesYou are covered up to the amount shown in thebenefits schedule for legal costs and expenses incurredin pursuit of a claim for compensation or damages froma third party who causes your death or bodily injury orillness during your trip.You are not covered fora. the amount of the excess shown in the benefitsschedule in respect of each claim.b. any costs and expenses;i. to pursue a claim against any member of your familyor any of your travelling companionsii. incurred without prior written permission from theclaims handlersiii. which are to be based directly or indirectly on theamount of any awardiv. to pursue a claim as part of or on behalf of a groupor organisationv. if we think an action is unlikely to succeed or if wethink the costs will be greater than any awardvi. to pursue a claim against us, our agent or anyinsurer acting on this policyvii. to pursue legal action relating directly or indirectly tomedical negligence or any allegation thereof.Conditionsa. We will have complete control over the appointment ofany solicitor(s) acting on your behalf and of any legalproceedings.b. We will be entitled to repayment of any amounts paidunder this section in the event that you are awardedlegal costs as part of any judgement or settlementc. We will be entitled to add any amounts we have paidunder all sections of this insurance to the claim againstthe third party and to recover such amounts from anycompensation awarded to you.Please also refer to the general exclusions andconditions.Section 12Business personnel replacementYou are covered up to the amount shown in thebenefits schedule for reasonable necessary additionaltravel and accommodation expenses (on a bed &breakfast basis) for you or a business colleague tocomplete essential business commitments that were leftunfinished by your death, injury or illness occurring duringyour trip.You are not covered fora. the amount of the excess shown in the benefitsschedule in respect of each claim.b. anything that you are not covered for under section 2 -emergency medical expenses.Please also refer to the general exclusions andconditions.Section 13Holiday financial protectionYou are covered up to the amount shown in thebenefits schedule in total for costs you incur as a result ofinsolvency of your travel end supplier.Insolvency prior to departureIrrecoverable sums paid in advance if the end supplierbecomes insolvent before your departure, orInsolvency after departureIf the end supplier becomes insolvent after yourdeparture;i. extra pro rata costs you have to pay to replace thatpart of the end suppliers arrangements to a similarstandard to that which was originally booked, orii. if curtailment of the trip is unavoidable - the cost ofreturn transport to your home country to a similarstandard to that which was originally booked.NoteWhere possible you should contact us before you makealternative arrangements so that we can agree to thecosts.You are not covered fora. end supplier arrangements that were booked if youwere outside your home country at the time ofbooking.b. end supplier arrangements that form part of aninclusive trip.c. the financial failure of the end supplier if;i. they become insolvent or if they are known to beunder any threat of insolvency at the date your policyor travel tickets for your journey were bought(whichever is the later).ii. they are a tour organiser, travel agency, bookingagent or consolidator.iii. they are bonded or insured elsewhere (even if thebond or insurance is insufficient to meet the claim).d. monies that are recoverable elsewhere or by any othermeans.e. any loss for which a third party is liable or which canbe recovered by other legal means.Please also refer to the general exclusions andconditions.Section 14HijackYou are covered up to the amount shown in thebenefits schedule for each complete 24 hour period andin total if you are prevented from reaching your scheduleddestination as a result of the aircraft or sea vessel inwhich you are travelling being hijacked.You are not covered fora. any claim relating to the payment of ransomb. any claim where the hijack has not been reported toor investigated by the police or local authority and awritten report provided to us confirming that you wereinvolved and the duration of the hijack during whichyou were unlawfully detained.Please also refer to the general exclusions andconditions.Section 15MuggingYou are covered up to the amount shown in thebenefits schedule for each complete 24 hour period andin total if you are hospitalised during your trip becauseof bodily injuries sustained during a mugging or similarviolent and unprovoked attack.You are not covered for any claim unlessa. you can provide a report from the local police toconfirm the incidentb. our nominated emergency service were contacted assoon as possible after your admission to hospitalc. you can provide medical evidence from the treatingdoctor to confirm the injuries and treatment given.Please also refer to the general exclusions andconditions.Section 16Pet careYou are covered up to the amount shown in thebenefits schedule for each complete 24 hour periodand in total for extra kennel and/or cattery costs for yourdog or cat if you are delayed in returning from your tripbecause of death, injury or illness or there is a delay tothe public transport system that cannot be avoided.You are not covered for any claim unless you canprovide written confirmation of either the cause andduration of the delay from the public transport provideror, where appropriate, medical evidence to confirm thedeath, illness or injury.Please also refer to the general exclusions andconditions.Wintersports sections 17, 18 and 19The following sections only apply if you have paid theappropriate additional wintersports premium for single tripand longstay policies. They are automatically includedunder the annual multi-trip option.5

Section 17Ski equipment & other expensesYou are covered up to the amounts shown in thebenefits schedule, after making reasonable allowance forwear, tear and depreciation and subject to the specialcondition shown below for;a. loss or theft of, or damage to ski equipment owned orborrowed by you.b. loss or theft of, or damage to ski equipment hired byyou.c. the cost of necessary hire of ski equipment following;i. loss or theft of, or damage to, your ski equipmentinsured by us, orii. the delayed arrival of your ski equipment, subject toyou being deprived of their use for not less than 12hours.You are not covered fora. the amount of the excess shown in the benefitsschedule for each claim other than claims for hirecosts.b. ski equipment stolen from an unattended motor vehiclebetween the hours of 9 p.m. and 8 a.m. or, if stolen atany other time, unless they were forcibly removedwhilst locked and whilst out of sight wherever possibleeither inside the vehicle or to a purpose designed skirack.c. damage to ski equipment whilst in use for race trainingor racing.d. your damaged ski equipment unless returned to theUnited Kingdom for our inspection.e. loss or theft of ski equipment not reported to the policewithin 24 hours of discovering the loss and a writtenreport or reference obtained in the country where theincident occurred.f. loss or theft of, or damage to, ski equipment whilst intransit unless reported to the carrier and a PropertyIrregularity Report obtained.g. loss or theft of, or damage to, ski equipment over 5years old.h. loss or theft of ski equipment left unattended in apublic placeSpecial conditions applicable to section 17In respect of loss or damage to ski equipment, we will notpay more than the proportion shown below depending onthe age of the equipment.Age of equipment Proportion of original purchase priceUp to 1 yearUp to 2 yearsUp to 3 yearsUp to 4 yearsUp to 5 yearsOver 5 yearsIt is a requirement of this insurance that you must, in theevent of a claim, provide receipts or other documentationto prove ownership and value, especially in respect of anyitems for which you are claiming more than £100.Please also refer to the general exclusions andconditions.Section 18Ski pack85%65%45%30%20%NILYou are covered up to the amounts shown in thebenefits schedule for the proportionate value of any skipass, ski hire or ski school fee that you are unable to usefollowing;a. accidental injury or sickness that prevents you fromskiing, as medically certified, orb. loss or theft of your ski pass.You are not covered fora. the amount of the excess shown in the benefitsschedule for each claim.b. any claim not substantiated by a police and/or amedical report.Please also refer to the general exclusions andconditions.Section 19Piste closure(Valid for the period 1st December to 31st March only)You are covered for the daily amount shown in yourbenefits schedule for each day that it is not possible toski because all lifts are closed due to a complete lack ofsnow, adverse conditions or avalanche danger in your pre-booked trip resort, up to the total amount shown either;a. for the costs you have paid for travel to an alternativeresort including the necessary additional cost of a skipass, orb. a compensation payment to you after you return whereno alternative is available.You are not covered if you arranged this insurance orbooked your trip within 14 days of departure and at thattime conditions in your planned resort were such that itwas likely to be not possible to ski.Conditionsa. you must provide written confirmation from the resortauthorities or ski lift operators for the period that therewas no skiing available owing to the closure of all skilifts.b. you must submit receipts for the travel and ski passcosts that you wish to claim.Please also refer to the general exclusions andconditions.Section 20Independent traveller extensionExtended cancellation or curtailmentWhat is coveredSection 1 – cancellation or curtailment is extended toinclude the following cover.We will pay you up to the amount shown in the benefitsschedule for any irrecoverable unused travel andaccommodation costs (including unused pre-bookedexcursions up to a value of £100) and other pre-paidcharges which you have paid or are contracted to pay,together with any reasonable additional travel expensesincurred if;a. you were not able to travel and use your bookedaccommodation, orb. the trip was curtailed before completion;as a result of the <strong>Travel</strong> Advice Unit of the Foreign andCommonwealth Office (FCO) or the World HealthOrganistation (WHO) or regulatory authority in a countryto/from which you are travelling issuing a directive;1. prohibiting all travel or all but essential travel to, or2. recommending evacuation from;the country or specific area or event to which you aretravelling, providing the directive came into force after youpurchased this insurance or booked the trip (whicheveris the later), or in the case of curtailment after you had leftyour home country to commence the trip.Extended travel delayWhat is coveredSection 5 – travel delay is extended to include thefollowing cover.We will pay you either;<strong>Travel</strong> delay1. up to the amounts (a), (b) and (c) shown in the benefitsschedule if the public transport on which you arebooked to travel is cancelled or delayed, leading toyour departure being delayed for more than 12 hoursat the departure point of any connection, orAbandonment or additional expenses2. up to the amount shown in the benefits schedule inrespect of;a. irrecoverable unused accommodation and travel costs(including unused pre-booked excursions up to a valueof £100) and other pre-paid charges which you havepaid or are contracted to pay because you choose toabandon your trip as a result of;i. the public transport on which you are booked totravel from your home country being cancelled ordelayed for more than 12 hours, orii. you being denied boarding (because there are toomany passengers for the seats available) and no othersuitable alternative flight can be provided within 12hours, orb. suitable additional accommodation (on a bed &breakfast basis) and travel expenses necessarilyincurred in reaching your overseas destination and/orin returning to your home country, as a result of;i. the public transport on which you are booked totravel being cancelled, delayed for more than 12hours, diverted or redirected after take off, or6ii. you being denied boarding (because there are toomany passengers for the seats available) and no othersuitable alternative flight can be provided within 12 hoursand you choose to make other travel arrangements.The amount payable will be calculated after deduction ofthe amount of the refund on your ticket(s) together withany compensation from the public transport provider.You cannot claim under both subsection 1 or subsection2 for the same event.Extended missed departureWhat is coveredSection 6 – missed departure is extended to include thefollowing cover.We will pay you up to the amount shown in the benefitsschedule for necessary additional accommodation (on abed & breakfast basis) and travel expenses that you incurin reaching your destination if you arrive at any departurepoint shown on your pre-booked itinerary too late toboard the public transport on which you are booked totravel as a result of;a. strike, industrial action, adverse weather conditions, ordisruption due to a volcanic eruption, orb. you being denied boarding (because there are toomany passengers for the seats available) and no othersuitable alternative flight could be provided within atime that would enable you to make your plannedonward journey.Accommodation costsWhat is coveredWe will pay you up to the amount shown in the benefitsschedule for either;1. any irrecoverable unused accommodation costs(including unused pre-booked excursions up to a valueof £100) and other pre-paid charges which you havepaid or are contracted to pay because you were notable to travel and use your booked accommodation, or2. reasonable additional accommodation and transportcosts incurred;a. up to the standard of your original booking, if you needto move to other accommodation on arrival or at anyother time during the trip because you cannot use yourbooked accommodation, orb. with the prior authorisation of our nominatedemergency service, to repatriate you to your homecountry if it becomes necessary to curtail the trip;as a result of the insolvency of the providers of theaccommodation, fire, flood, earthquake, explosion,tsunami, landslide, avalanche, volcanic eruption, hurricane,storm or an outbreak of food poisoning or an infectiousdisease affecting your accommodation or resort.You cannot claim under subsection 1 and subsection 2for the same event.You are not covered fora. the amount of the excess shown in the benefitsschedule in respect of each claim, except for claimsunder subsection 1 of the extended travel delay cover.b. any claim under this section which is also coveredunder section 1 – cancellation or curtailment, section5 – travel delay or section 6 – missed departure for thesame event.c. claims arising directly or indirectly from;i. strike, industrial action or a directive prohibiting alltravel or all but essential travel, to the country or specificarea or event to which you were travelling existing orbeing publicly announced by the date you purchasedthis insurance or at the time of booking any trip.ii. an aircraft or sea vessel being withdrawn fromservice (temporary or otherwise) on therecommendation of the Civil Aviation Authority, PortAuthority or any such regulatory body in a country to/from which you are travelling.iii. denied boarding due to your drug use, alcohol orsolvent abuse or your inability to provide a validpassport, visa or other documentation required by thepublic transport provider or their handling agents.iv. any costs incurred by you which are recoverablefrom the providers of the accommodation (or theiradministrators) or for which you receive or areexpected to receive compensation or reimbursement.v. any costs incurred by you which are recoverablefrom the public transport provider or for which youreceive or are expected to receive compensation,damages, refund of tickets, meals, refreshments,accommodation, transfers, communication facilities orany other assistance.vi. any accommodation costs, charges and expenseswhere the public transport operator has offeredreasonable alternative travel arrangements.vii. any costs for normal day to day living such as foodand drink which you would have expected to payduring your trip.

Special conditions relating to claims(applicable to all extended sections of cover)a. if you fail to notify the travel agent, tour operator orprovider of transport or accommodation as soon asyou find out it is necessary to cancel the trip, theamount we will pay will be limited to the cancellationcharges that would have otherwise applied.b. you must get (at your own expense) writtenconfirmation from the provider of the accommodation(or their administrators), the local police or relevantauthority that you could not use your accommodationand the reason for this.c. (for curtailment claims only) you must tell ournominated emergency service as soon as possible ofany circumstances making it necessary for you toreturn home and before any arrangements are madefor your repatriation.d. you must check in according to the itinerary suppliedto you unless your tour operator or airline hasrequested you not to travel to the airport.e. you must get (at your own expense) writtenconfirmation from the scheduled public transportoperator (or their handling agents) of the cancellation,number of hours of delay or involuntarily deniedboarding and the reason for these together with detailsof any alternative transport offered.f. you must comply with the terms of contract of thescheduled public transport operator and seek financialcompensation, assistance or a refund of your ticketfrom them, in accordance with the terms and/or(where applicable) your rights under EU Air PassengersRights legislation in the event of denied boarding,cancellation or long delay of flights.g. you must get (at your own expense) writtenconfirmation from the scheduled public transportoperator/accommodation provider that reimbursementwill not be provided.General conditions1. You must tell us all relevant facts. A relevant fact isone that is likely to influence us in accepting yourinsurance. This could be the state of your health orthat of a close relative or any planned hazardousactivities. If you are in any doubt as to whether a factis relevant, you should tell us. If you do not tell us thismay result in your claim being invalid (please refer toquestion 4 of important conditions relating to health &activities on page 2).2. You must notify Voyager <strong>Insurance</strong> Services Ltd on01483 562662 as soon as possible about any changein circumstances which affects your policy, includingyou, a person you are travelling with, a close businessassociate or relative receiving confirmation of a new orchanged medical condition or currently being undermedical investigation, change in sporting activity orleisure activities you intend to participate in duringyour trip or any additional persons(s) to be insuredunder this policy. We have the right to re-assess yourcoverage, policy terms and/or premium after youhave advised us of any such change this may includeus accepting a claim for the cancellation chargesapplicable at that time if no suitable or alternative coverfor your changed circumstances can be provided. Ifyou do not advise us of any change then any relatedclaim may be reduced or rejected or your policy maybecome invalid.3. You must notify Voyager <strong>Insurance</strong> Services Ltd on01483 562662 if your plans for your trip include travelto areas affected or threatened by war or similar risksas set out in general exclusion 1. We reserve the rightnot to cover such trips or, if we will cover them, toapply special terms or conditions and/or charge anadditional premium as we think appropriate. No coverfor such trips shall attach unless you accept suchterms, including any additional premium, before youdepart.4. You must advise the claims handlers of any possibleclaim as soon as possible. You must supply themwith full details of all the circumstances and any otherinformation and documents we may require.5. You must keep any damaged articles that you wish toclaim for and, if requested, send them to the claimshandlers at your own expense. If we pay a claim forthe full value of an article, it will become our property.6. You must agree to have medical examination(s) ifrequired. In the event of your death, we are entitledto have a post mortem examination. All suchexaminations will be at our expense.7. You must assist us to obtain or pursue a recovery orcontribution from any third party or other insurers(including the Department of Work & Pensions) byproviding all necessary details and by completing anyforms.8. You must pay us back within 1 month of demand anyamounts that we have paid on your behalf that are notcovered by this insurance.9. You must take all reasonable steps to avoid orminimise any loss that might result in you making aclaim under this insurance.10. You must comply with all the terms, provisions,conditions and endorsements of this insurance. Failureto do so may result in a claim being declined.11. Except for claims under section 3 - hospital staybenefit, section 4 - personal accident, section 5 -travel delay, section 14 - hijack, section 15 - mugging& section 16 pet care, this insurance shall only beliable for its proportionate share of any loss or damagethat is covered by any other insurance.12. We may take action in your name but at our ownexpense to recover for our benefit the amount of anypayment made under this insurance.13. We may at our option discharge any liability underthis insurance by replacing or repairing any article orarticles lost or damaged, or by issuing you with a creditvoucher.14. No refund of premium will be allowed after thecooling off period following the date of purchase of thisinsurance nor after any travel has begun.15. This insurance is non-transferable. If a trip iscancelled for any reason other than that described insection 1 - cancellation or curtailment then the coverfor that trip terminates immediately and no refund ofpremium in whole or part will be made.16. If you or anyone acting on your behalf makes anyclaim knowing it to be false or fraudulent in any waythen this insurance shall become void, premiums nonrefundableand all claims shall be forfeited.General exclusionsYou are not covered for claims arising out of:1. loss or damage directly or indirectly occasioned by,happening through or in consequence of war, invasion,acts of foreign enemies, terrorism, hostilities (whetherwar be declared or not), civil war, rebellion, revolution,insurrection, military or usurped power or confiscationor nationalisation, or requisition or destruction of ordamage to property by or under the order of anygovernment or public or local authority. This is notapplicable, however, in respect of claims under section2 - emergency medical expenses arising throughterrorism other than losses arising from nuclear,chemical and biological exposures unless you plannedto travel to areas that were publicly known to beaffected or threatened by such risks. (Please seegeneral condition 3)2. loss, damage, expense or indemnity incurred as aresult of travelling to an area that the Foreign andCommonwealth Office (or its equivalent in other EUcountries) have advised against travel provided thatsuch loss, damage, expense or indemnity is directly orindirectly related to any such circumstances that arethe reason for the advice.3. loss, damage, expense or indemnity directly orindirectly resulting from or attributable to radioactivecontamination of any nature.4. loss, destruction or damage directly occasioned bypressure waves caused by aircraft and other flyingobjects travelling at sonic or supersonic speeds.5. you travelling in an aircraft other than as a fare payingpassenger in a fully licensed passenger carryingaircraft.6. your suicide or attempted suicide or your deliberateexposure to unnecessary danger (except in an attemptto save human life).7. sexually transmitted diseases or the influence ofalcohol or drugs.8. your participation that was planned or intended at thetime of arranging this insurance in activities of ahazardous nature except as listed on page 9 under theactivities levels Leisure, Action & Action Plus, (wherethe appropriate additional premium has been paid),unless declared to and accepted by us. We reservethe right to apply special terms and conditions (whichmay include additional premiums) and coverage will besubject to your compliance with them.9. wintersports, other than curling, toboganning andrecreational ice-skating, except when this insurance istaken in connection with a wintersports trip and theappropriate premium paid as provided for under theactivities levels Leisure, Action or Action Plus. In noevent, however, is cover granted for wintersports ifyou are aged over 74 or for ski or skibob racing inmajor events, ski jumping or the use of skeletons orbob-sleighs.10.scuba diving if you are;i. not qualified for the dive undertaken unless you areaccompanied by a properly qualified instructor, orii. diving to a greater depth than 30m, oriii. diving alone, oriv. diving in wrecks or at night.11.racing or race training of any kind (other than on footor sailing) except as provided for under the activitieslevels Leisure, Action or Action Plus.12.you taking part in civil commotions or riots of any kind.13.any consequential loss of any kind, except as may bespecifically provided for in this insurance.14.you breaking or failing to comply with any lawwhatsoever.15.manual labour of any kind unless declared to andaccepted by us.16.your financial incapacity, whether directly or indirectlyrelated to the claim except as provided for undersection 1 - cancellation or curtailment (e).17.the bankruptcy or insolvency of a tour operator, travelagent, transport company or accommodation supplierexcept as provided for under section 13 - holidayfinancial protection of the policy.18.a tour operator failing to supply advertised facilities.19.any government regulation or act.20.you travelling against any health requirementsstipulated by the carrier, their handling agents or anyother public transport provider.21.you travelling against the advice of a medicalpractitioner.7

Certification of coverThe schedule, together with the policy wording, certifiesthat insurance has been effected between you and theinsurer. In return for payment of the premium specified inthe schedule, the insurer agrees to insure you inaccordance with the terms and conditions contained in orendorsed on these documents. The insurer has enteredinto a Binding Authority Contract (referenceB6002ADLVOYBA12) with Voyager <strong>Insurance</strong> ServicesLtd which the insured has authorised Voyager <strong>Insurance</strong>Services Ltd to sign and issue these documents on itsbehalf.InsurersThis insurance is underwritten 100% at Lloyd’s of Londonby Syndicates managed by Argo Managing AgencyLimited. The Lloyd’s Syndicate 1200, Argo ManagingAgency Limited, is entered in the Register of Lloyd’sManaging Agents. Registered office: Exchequer Court, 33St Mary Axe, London, EC3A 8AA.Our regulatorVoyager <strong>Insurance</strong> Services Ltd and Argo ManagingAgency Limited are authorised and regulated by theFinancial Services Authority. You can visit the FinancialServices Authority website, which includes a register ofall regulated companies, at www.fsa.gov.uk or you cantelephone them on 0845 606 1234.Financial Services CompensationSchemeWe are covered by the Financial Services CompensationScheme. You may be entitled to compensation fromthe scheme if we are unable to meet our obligationsto you under this contract. If you are entitled tocompensation under the scheme, the level and extentof the compensation would depend on the nature of thiscontract. Further information can be obtained from theFinancial Services Compensation Scheme (7th FloorLloyds Chambers, Portsoken Street, London E1 8BN) byphone on 020 7892 7300 and on their website at www.fscs.org.uk.Data Protection Act 1998We will collect certain information about you in the courseof considering your application and conducting ourrelationship with you. This information will be processedfor the purposes of underwriting your insurance cover,managing any insurance issued, administering claimsand fraud prevention. We may pass your information toa qualified medical practitioner, other insurers, reinsurers,other parties who provide services under policy andloss adjusters for these purposes. This may involve thetransfer of your information to countries which do not havedata protection laws. You may have the right of accessto, and correction of, information that is held about you.Please contact our compliance officer to exercise eitherof these rights. Some of the information may be classifiedas ‘sensitive’ – that is information about physical andmental health and employment records. Data protectionlaws impose specific conditions in relation to sensitiveinformation including, in some circumstances, the needto obtain your explicit consent before the information maybe processed. By finalising your insurance application,you consent to the processing and transfer of informationdescribed in this notice. Without this consent we wouldnot be able to consider your applicationComplaints procedureWe will do everything possible to ensure that you receivea high standard of service. If you are not satisfied with theservice received please contact us.When you contact us please give us your name andcontact telephone number. Please also quote your policyand/or claim number and the type of policy you hold.Step one – Initiating your complaintDoes your complaint relate to:A. The sale of your policy?B. A claim on your policy?If A, you need to contact the agent from where youbought your policy or;Voyager <strong>Insurance</strong> Services Ltd13-21 High Street,Guildford,Surrey,GU1 3DGTel: 01483 562662Email: enquiries@voyagerins.comIf B, you can write to;<strong>Policy</strong>holder and Market AssistanceOne Lime Street, London, EC3M 7HATel: 0207 327 5693Email: complaints@lloyds.comWe expect that the majority of complaints will be quicklyand satisfactorily resolved at this stage, but if you are notsatisfied, you can take the issue further:Step two – If you remain dissatisfiedIf you are still dissatisfied you may refer your case to theFinancial Ombudsman Service (FOS).The Financial Ombudsman ServiceSouth Quay Plaza183 Marsh WallLondon, E14 9SRTel: 0300 123 9123 or 0800 023 4567Fax: 020 7964 1001Email: complaint.info@financial-ombudsman.org.ukThe FOS is an independent body that arbitrate oncomplaints about general insurance products and otherfinancial services. It will only consider complaints afterwe have provided you with written confirmation that ourinternal complaints procedure has been exhausted.Please note that you have six months from the date of ourfinancial response in which to refer your complaints to theFOS. Referral to the FOS will not affect your right to takelegal action.Period of insuranceIf you have paid the appropriate annual multi trip travelinsurance premium and you are under 75 years old, theoverall period of insurance shall be for 12 months startingfrom the date shown. This insurance then covers anunlimited number of holiday/leisure trips starting withinthat period, provided that no single trip is intended to befor longer than the maximum number of days shown inthe policy features table for the cover you have bought.Wintersports are covered up to the total number of daysshown in the policy features table.Except as stated below, cover for each separate tripunder this insurance starts when you leave your homeor place of business in your home country at the start ofyour trip, and finishes as soon as you return to your homeor place of business in your home country for any reason.If you have paid the appropriate longstay travel insurancepremium, this insurance allows you to return to your homecountry for short term visits of up to two weeks, as longas they are not subject to a claim. Cover is temporarilysuspended for the duration of these visits.You are only covered for the period for which a premiumhas been paid and in any event the total period of anyone trip must not exceed the period shown in the policyfeatures table.For cancellation only (section 1), cover starts from thedate shown on your certificate or the date you book yourtrip, whichever is the later.If you are going on a one-way trip all cover will finish 48hours after your arrival in the country of final destination.If your return is unavoidably delayed for an insuredreason, cover will be extended free of charge for theperiod of delay.Cancellation rightsWe hope you are happy with the cover this policy provides.However if after reading this certificate, this insurancedoes not meet with your requirements, please return it tothe issuing agent, within 14 days of receipt and we willrefund your premium. We reserve the right to deduct fromthe rebate of premium the reasonable costs incurred inprocessing the original sale and cancellation. We shall notbe bound to accept renewal of any insurance and may atany time cancel any insurance document by sending 14days notice to you at your last known address. Providedthe premium has been paid in full, you shall be entitledto a proportionate rebate of premium in respect of theunexpired period showing on the insurance.8