NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange NIG Prospectus - London Stock Exchange

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:19 pm – mac5 – 3776 Section 07 : 3776 Section 07NIG’s principal strategic investments outside Kuwait as at 31 December 2006 were as follows:Country ofYear ofOperations111112Stake (%)111112investment111112InvestmentSaudi International Petrochemical Company(SIPCHEM) ............................................................ Saudi Arabia 8.00 1999National Industrialisation Company (Tasnee) ............ Saudi Arabia 5.00 2000Egyptian Kuwait Holding Company .......................... Egypt 5.25 1997Kuwait Syrian Holding Company .............................. Syria 10.00 2002Iraq Holding Company .............................................. Kuwait 4.2 2003Kuwait Jordan Holding Company .............................. Jordan 10.00 2004Jordan Telecom ........................................................ Jordan 10.00 2006Dana Gas .................................................................. UAE 2.3 2005Karachi Electric Supply Company.............................. Pakistan 28.6 2005Investment Policies and Risk ManagementIn 2004, NIG, in co-operation with KPMG, implemented a complete set of investment policies,which include guidance and procedures for risk management. These are closely followed for bothlocal and international investments. Investment reports are presented to the InvestmentCommittee at their weekly meetings. The Investment Committee is committed to complying withNIG’s defined investment thresholds and approval protocols.MAJOR SHAREHOLDERSAs at 31 December 2006, NIG’s share capital was KD 107 million comprising 1,070.3 millionshares of 100 fils nominal value each. NIG benefits from a strong and stable shareholder base.Approximately 30 per cent. of NIG’s shares are held by major institutional investors, 29 per cent.are held by prominent Kuwaiti trading families, including the Al-Khorafi, Al Rabia, Al-Rashid, Al-Saad, Al-Fulaij and Behbehani groups whilst the rest are largely held by the general public. Theshares of NIG are traded on both the KSE and the DFM.The only two shareholders who own in excess of 5 per cent. of the total outstanding shares areKuwait Cement Company (8 per cent.) and Public Institute of Social Security (5 per cent.).INSURANCENIG believes that it has all the necessary insurance policies for the operation of its businesses andthat each of its subsidiaries (whether local or international) which need insurance cover havesatisfactory cover.INFORMATION TECHNOLOGY (IT)Currently, NICBM’s IT department also services NIG’s IT requirements. NIG is in the process ofconstructing a new head office in Kuwait and intends to provide a new integrated IT system forthis office. NIG expect to invest up to US$1 million on this system in the next six months. Thissystem will also improve NIG’s back-up systems, which will be located both in a separate buildingto the head office and off-site.REGULATIONNIG is committed to complying with the requirements of the numerous regulatory bodies whichimplement the laws and regulations which apply to NIG, including the KSE, the Dubai FinancialMarket and the Ministry of Commerce and Industry.82

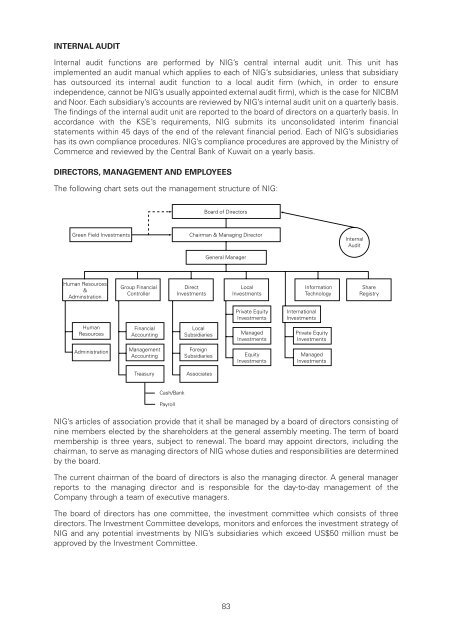

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:19 pm – mac5 – 3776 Section 07 : 3776 Section 07INTERNAL AUDITInternal audit functions are performed by NIG’s central internal audit unit. This unit hasimplemented an audit manual which applies to each of NIG’s subsidiaries, unless that subsidiaryhas outsourced its internal audit function to a local audit firm (which, in order to ensureindependence, cannot be NIG’s usually appointed external audit firm), which is the case for NICBMand Noor. Each subsidiary’s accounts are reviewed by NIG’s internal audit unit on a quarterly basis.The findings of the internal audit unit are reported to the board of directors on a quarterly basis. Inaccordance with the KSE’s requirements, NIG submits its unconsolidated interim financialstatements within 45 days of the end of the relevant financial period. Each of NIG’s subsidiarieshas its own compliance procedures. NIG’s compliance procedures are approved by the Ministry ofCommerce and reviewed by the Central Bank of Kuwait on a yearly basis.DIRECTORS, MANAGEMENT AND EMPLOYEESThe following chart sets out the management structure of NIG:Board of DirectorsGreen Field InvestmentsChairman & Managing DirectorGeneral ManagerInternalAuditHuman Resources&AdminstrationGroup FinancialControllerDirectInvestmentsLocalInvestmentsInformationTechnologyShareRegistryPrivate EquityInvestmentsInternationalInvestmentsHumanResourcesFinancialAccountingLocalSubsidiariesManagedInvestmentsPrivate EquityInvestmentsAdministrationManagementAccountingForeignSubsidiariesEquityInvestmentsManagedInvestmentsTreasuryAssociatesCash/BankPayrollNIG’s articles of association provide that it shall be managed by a board of directors consisting ofnine members elected by the shareholders at the general assembly meeting. The term of boardmembership is three years, subject to renewal. The board may appoint directors, including thechairman, to serve as managing directors of NIG whose duties and responsibilities are determinedby the board.The current chairman of the board of directors is also the managing director. A general managerreports to the managing director and is responsible for the day-to-day management of theCompany through a team of executive managers.The board of directors has one committee, the investment committee which consists of threedirectors. The Investment Committee develops, monitors and enforces the investment strategy ofNIG and any potential investments by NIG’s subsidiaries which exceed US$50 million must beapproved by the Investment Committee.83

- Page 31 and 32: Level: 8 - From: 8 - Thursday, Augu

- Page 33 and 34: Level: 8 - From: 8 - Thursday, Augu

- Page 35 and 36: Level: 8 - From: 8 - Thursday, Augu

- Page 37 and 38: Level: 8 - From: 8 - Thursday, Augu

- Page 39 and 40: Level: 8 - From: 8 - Thursday, Augu

- Page 41 and 42: Level: 8 - From: 8 - Thursday, Augu

- Page 43 and 44: Level: 8 - From: 8 - Thursday, Augu

- Page 45 and 46: Level: 8 - From: 8 - Thursday, Augu

- Page 47 and 48: Level: 8 - From: 8 - Thursday, Augu

- Page 49 and 50: Level: 8 - From: 8 - Thursday, Augu

- Page 52 and 53: Level: 8 - From: 8 - Thursday, Augu

- Page 54 and 55: Level: 8 - From: 8 - Thursday, Augu

- Page 56 and 57: Level: 8 - From: 8 - Thursday, Augu

- Page 58 and 59: Level: 8 - From: 8 - Thursday, Augu

- Page 60 and 61: Level: 8 - From: 8 - Thursday, Augu

- Page 62 and 63: Level: 8 - From: 8 - Thursday, Augu

- Page 64 and 65: Level: 8 - From: 8 - Thursday, Augu

- Page 66 and 67: Level: 8 - From: 8 - Thursday, Augu

- Page 68 and 69: Level: 8 - From: 8 - Thursday, Augu

- Page 70 and 71: Level: 8 - From: 8 - Thursday, Augu

- Page 72 and 73: Level: 8 - From: 8 - Thursday, Augu

- Page 74 and 75: Level: 8 - From: 8 - Thursday, Augu

- Page 76 and 77: Level: 8 - From: 8 - Thursday, Augu

- Page 78 and 79: Level: 8 - From: 8 - Thursday, Augu

- Page 80 and 81: Level: 8 - From: 8 - Thursday, Augu

- Page 84 and 85: Level: 8 - From: 8 - Thursday, Augu

- Page 86 and 87: Level: 8 - From: 8 - Thursday, Augu

- Page 88 and 89: Level: 8 - From: 8 - Thursday, Augu

- Page 90 and 91: Level: 8 - From: 8 - Thursday, Augu

- Page 92 and 93: Level: 8 - From: 8 - Thursday, Augu

- Page 94 and 95: Level: 8 - From: 8 - Thursday, Augu

- Page 96 and 97: Level: 8 - From: 8 - Thursday, Augu

- Page 98 and 99: Level: 8 - From: 8 - Thursday, Augu

- Page 100 and 101: Level: 8 - From: 8 - Thursday, Augu

- Page 102 and 103: Level: 8 - From: 8 - Thursday, Augu

- Page 104 and 105: Level: 8 - From: 8 - Thursday, Augu

- Page 106 and 107: Level: 8 - From: 8 - Thursday, Augu

- Page 108 and 109: Level: 8 - From: 8 - Thursday, Augu

- Page 110 and 111: Level: 8 - From: 8 - Thursday, Augu

- Page 112 and 113: Level: 8 - From: 8 - Thursday, Augu

- Page 114 and 115: Level: 8 - From: 8 - Thursday, Augu

- Page 116 and 117: Level: 8 - From: 8 - Thursday, Augu

- Page 118 and 119: Level: 8 - From: 8 - Thursday, Augu

- Page 120 and 121: Level: 8 - From: 8 - Thursday, Augu

- Page 122 and 123: Level: 8 - From: 8 - Thursday, Augu

- Page 124 and 125: Level: 8 - From: 8 - Thursday, Augu

- Page 126 and 127: Level: 8 - From: 8 - Thursday, Augu

- Page 128 and 129: Level: 8 - From: 8 - Thursday, Augu

- Page 130 and 131: Level: 8 - From: 8 - Thursday, Augu

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:19 pm – mac5 – 3776 Section 07 : 3776 Section 07INTERNAL AUDITInternal audit functions are performed by <strong>NIG</strong>’s central internal audit unit. This unit hasimplemented an audit manual which applies to each of <strong>NIG</strong>’s subsidiaries, unless that subsidiaryhas outsourced its internal audit function to a local audit firm (which, in order to ensureindependence, cannot be <strong>NIG</strong>’s usually appointed external audit firm), which is the case for NICBMand Noor. Each subsidiary’s accounts are reviewed by <strong>NIG</strong>’s internal audit unit on a quarterly basis.The findings of the internal audit unit are reported to the board of directors on a quarterly basis. Inaccordance with the KSE’s requirements, <strong>NIG</strong> submits its unconsolidated interim financialstatements within 45 days of the end of the relevant financial period. Each of <strong>NIG</strong>’s subsidiarieshas its own compliance procedures. <strong>NIG</strong>’s compliance procedures are approved by the Ministry ofCommerce and reviewed by the Central Bank of Kuwait on a yearly basis.DIRECTORS, MANAGEMENT AND EMPLOYEESThe following chart sets out the management structure of <strong>NIG</strong>:Board of DirectorsGreen Field InvestmentsChairman & Managing DirectorGeneral ManagerInternalAuditHuman Resources&AdminstrationGroup FinancialControllerDirectInvestmentsLocalInvestmentsInformationTechnologyShareRegistryPrivate EquityInvestmentsInternationalInvestmentsHumanResourcesFinancialAccountingLocalSubsidiariesManagedInvestmentsPrivate EquityInvestmentsAdministrationManagementAccountingForeignSubsidiariesEquityInvestmentsManagedInvestmentsTreasuryAssociatesCash/BankPayroll<strong>NIG</strong>’s articles of association provide that it shall be managed by a board of directors consisting ofnine members elected by the shareholders at the general assembly meeting. The term of boardmembership is three years, subject to renewal. The board may appoint directors, including thechairman, to serve as managing directors of <strong>NIG</strong> whose duties and responsibilities are determinedby the board.The current chairman of the board of directors is also the managing director. A general managerreports to the managing director and is responsible for the day-to-day management of theCompany through a team of executive managers.The board of directors has one committee, the investment committee which consists of threedirectors. The Investment Committee develops, monitors and enforces the investment strategy of<strong>NIG</strong> and any potential investments by <strong>NIG</strong>’s subsidiaries which exceed US$50 million must beapproved by the Investment Committee.83