NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange NIG Prospectus - London Stock Exchange

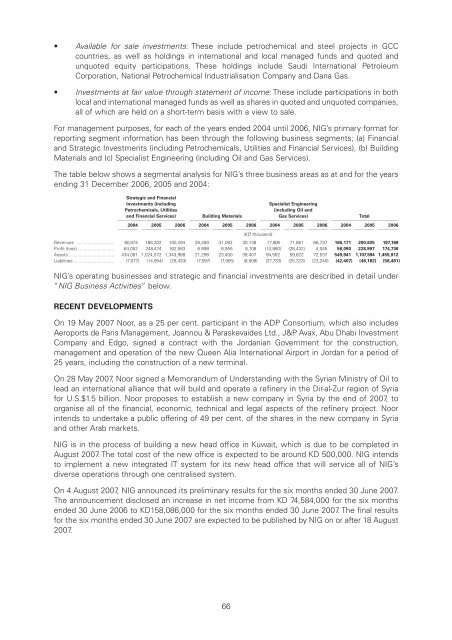

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:19 pm – mac5 – 3776 Section 07 : 3776 Section 07• Available for sale investments: These include petrochemical and steel projects in GCCcountries, as well as holdings in international and local managed funds and quoted andunquoted equity participations. These holdings include Saudi International PetroleumCorporation, National Petrochemical Industrialisation Company and Dana Gas.• Investments at fair value through statement of income: These include participations in bothlocal and international managed funds as well as shares in quoted and unquoted companies,all of which are held on a short-term basis with a view to sale.For management purposes, for each of the years ended 2004 until 2006, NIG’s primary format forreporting segment information has been through the following business segments; (a) Financialand Strategic Investments (including Petrochemicals, Utilities and Financial Services), (b) BuildingMaterials and (c) Specialist Engineering (including Oil and Gas Services).The table below shows a segmental analysis for NIG’s three business areas as at and for the yearsending 31 December 2006, 2005 and 2004:Strategic and FinancialInvestments (includingSpecialist EngineeringPetrochemicals, Utilities(including Oil andand Financial Services) Building Materials Gas Services) Total11111111344 11111111344 11111111344 111111113442004 2005 2006 2004 2005 2006 2004 2005 2006 2004 2005 2006112 112 112 112 112 112 112 112 112 112 112 112(KD thousand)Revenues .............................. 60,874 188,202 100,294 26,489 31,062 30,138 77,808 71,661 66,737 165,171 290,925 197,169Profit (loss) ............................ 64,052 248,474 162,583 6.898 8,955 8,108 (14,860) (28,432) 4,045 56,090 228,997 174,736Assets .................................... 434,081 1,024,572 1,343,968 21,298 23,400 39,407 94,562 59,622 72,537 549,941 1,107,594 1,455,912Liabilities ................................ (7,077) (14,954) (26,433) (7,597) (7,905) (8,808) (27,733) (25,323) (23,240) (42,407) (48,182) (58,481)NIG’s operating businesses and strategic and financial investments are described in detail under“NIG Business Activities” below.RECENT DEVELOPMENTSOn 19 May 2007 Noor, as a 25 per cent. participant in the ADP Consortium, which also includesAeroports de Paris Management, Joannou & Paraskevaides Ltd., J&P Avax, Abu Dhabi InvestmentCompany and Edgo, signed a contract with the Jordanian Government for the construction,management and operation of the new Queen Alia International Airport in Jordan for a period of25 years, including the construction of a new terminal.On 28 May 2007, Noor signed a Memorandum of Understanding with the Syrian Ministry of Oil tolead an international alliance that will build and operate a refinery in the Dir-al-Zur region of Syriafor U.S.$1.5 billion. Noor proposes to establish a new company in Syria by the end of 2007, toorganise all of the financial, economic, technical and legal aspects of the refinery project. Noorintends to undertake a public offering of 49 per cent. of the shares in the new company in Syriaand other Arab markets.NIG is in the process of building a new head office in Kuwait, which is due to be completed inAugust 2007. The total cost of the new office is expected to be around KD 500,000. NIG intendsto implement a new integrated IT system for its new head office that will service all of NIG’sdiverse operations through one centralised system.On 4 August 2007, NIG announced its preliminary results for the six months ended 30 June 2007.The announcement disclosed an increase in net income from KD 74,584,000 for the six monthsended 30 June 2006 to KD158,086,000 for the six months ended 30 June 2007. The final resultsfor the six months ended 30 June 2007 are expected to be published by NIG on or after 18 August2007.66

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:19 pm – mac5 – 3776 Section 07 : 3776 Section 07STRATEGYStrategies for Core Operating BusinessIn 2006, NIG adopted a new seven year growth-oriented strategy focussed on the developmentof its six Core Operating Businesses through its subsidiary companies. This new strategy wasdeveloped following a strategic study undertaken by Booz Allen Hamilton, a leading internationalconsultancy services firm specifically for strategic consultancy, and aims to increase NIG’s shareof assets in its Core Operating Businesses from approximately 30 per cent. as at 31 December2006 to approximately 50 to 70 per cent. by 2013.To this end, NIG seeks to achieve the following strategic goals in each of the following CoreOperating Businesses:Building MaterialsNIG intends to grow its sales of building materials by continuing to develop a new range ofproducts to appeal to changing customer preferences, by acquiring other building materialcompanies with a complementary product range and by exporting its high value added productsto other GCC countries. In addition, NIG intends to increase production capacity in specific sectorsof its building materials division to meet increased demand for specific products.Specialist EngineeringDuring 2005, BI Group restructured its businesses to increase the profitability of its corebusinesses, which lead to the disposal of a certain non core business. BI Group is currentlyfocusing on its core businesses such as the engineering division, plastic division and metalsdivision.PetrochemicalsIkarus intends to pursue acquisitions, joint ventures and alliances in sectors which arecomplementary to its petrochemical operations.Financial ServicesNoor develops innovative strategies to ensure it offers its clients a wide range of financial services.Noor continuously monitors new technologies and markets to be integrated or developed inassociation with NIG’s subsidiaries and associate companies.UtilitiesCombined National Industries Company for Energy KSCC intends to focus on the utility industryin the GCC region, the wider Middle East and Asia in order to capitalise on investmentopportunities in the water and power generation sectors. Specifically, NIG expects the demand forelectricity to grow over the next ten years and accordingly expects governments to invest inincreasing their electricity generation capacity.Oil and Gas ServicesProclad’s strategy lies in providing cost effective and competitive services to the oil and gasindustry both locally and globally through its ten subsidiaries. NIG believes that Proclad’scompetitive advantage lies in the fact that it provides an integrated corrosion resistant solution, byoffering a supply of metal pipes and cladding as well as offering maintenance and refurbishingservices.67

- Page 15 and 16: Level: 8 - From: 8 - Thursday, Augu

- Page 17 and 18: Level: 8 - From: 8 - Thursday, Augu

- Page 19: Level: 8 - From: 8 - Thursday, Augu

- Page 22: Level: 8 - From: 8 - Thursday, Augu

- Page 25 and 26: Level: 8 - From: 8 - Thursday, Augu

- Page 27 and 28: Level: 8 - From: 8 - Thursday, Augu

- Page 29 and 30: Level: 8 - From: 8 - Thursday, Augu

- Page 31 and 32: Level: 8 - From: 8 - Thursday, Augu

- Page 33 and 34: Level: 8 - From: 8 - Thursday, Augu

- Page 35 and 36: Level: 8 - From: 8 - Thursday, Augu

- Page 37 and 38: Level: 8 - From: 8 - Thursday, Augu

- Page 39 and 40: Level: 8 - From: 8 - Thursday, Augu

- Page 41 and 42: Level: 8 - From: 8 - Thursday, Augu

- Page 43 and 44: Level: 8 - From: 8 - Thursday, Augu

- Page 45 and 46: Level: 8 - From: 8 - Thursday, Augu

- Page 47 and 48: Level: 8 - From: 8 - Thursday, Augu

- Page 49 and 50: Level: 8 - From: 8 - Thursday, Augu

- Page 52 and 53: Level: 8 - From: 8 - Thursday, Augu

- Page 54 and 55: Level: 8 - From: 8 - Thursday, Augu

- Page 56 and 57: Level: 8 - From: 8 - Thursday, Augu

- Page 58 and 59: Level: 8 - From: 8 - Thursday, Augu

- Page 60 and 61: Level: 8 - From: 8 - Thursday, Augu

- Page 62 and 63: Level: 8 - From: 8 - Thursday, Augu

- Page 64 and 65: Level: 8 - From: 8 - Thursday, Augu

- Page 68 and 69: Level: 8 - From: 8 - Thursday, Augu

- Page 70 and 71: Level: 8 - From: 8 - Thursday, Augu

- Page 72 and 73: Level: 8 - From: 8 - Thursday, Augu

- Page 74 and 75: Level: 8 - From: 8 - Thursday, Augu

- Page 76 and 77: Level: 8 - From: 8 - Thursday, Augu

- Page 78 and 79: Level: 8 - From: 8 - Thursday, Augu

- Page 80 and 81: Level: 8 - From: 8 - Thursday, Augu

- Page 82 and 83: Level: 8 - From: 8 - Thursday, Augu

- Page 84 and 85: Level: 8 - From: 8 - Thursday, Augu

- Page 86 and 87: Level: 8 - From: 8 - Thursday, Augu

- Page 88 and 89: Level: 8 - From: 8 - Thursday, Augu

- Page 90 and 91: Level: 8 - From: 8 - Thursday, Augu

- Page 92 and 93: Level: 8 - From: 8 - Thursday, Augu

- Page 94 and 95: Level: 8 - From: 8 - Thursday, Augu

- Page 96 and 97: Level: 8 - From: 8 - Thursday, Augu

- Page 98 and 99: Level: 8 - From: 8 - Thursday, Augu

- Page 100 and 101: Level: 8 - From: 8 - Thursday, Augu

- Page 102 and 103: Level: 8 - From: 8 - Thursday, Augu

- Page 104 and 105: Level: 8 - From: 8 - Thursday, Augu

- Page 106 and 107: Level: 8 - From: 8 - Thursday, Augu

- Page 108 and 109: Level: 8 - From: 8 - Thursday, Augu

- Page 110 and 111: Level: 8 - From: 8 - Thursday, Augu

- Page 112 and 113: Level: 8 - From: 8 - Thursday, Augu

- Page 114 and 115: Level: 8 - From: 8 - Thursday, Augu

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:19 pm – mac5 – 3776 Section 07 : 3776 Section 07• Available for sale investments: These include petrochemical and steel projects in GCCcountries, as well as holdings in international and local managed funds and quoted andunquoted equity participations. These holdings include Saudi International PetroleumCorporation, National Petrochemical Industrialisation Company and Dana Gas.• Investments at fair value through statement of income: These include participations in bothlocal and international managed funds as well as shares in quoted and unquoted companies,all of which are held on a short-term basis with a view to sale.For management purposes, for each of the years ended 2004 until 2006, <strong>NIG</strong>’s primary format forreporting segment information has been through the following business segments; (a) Financialand Strategic Investments (including Petrochemicals, Utilities and Financial Services), (b) BuildingMaterials and (c) Specialist Engineering (including Oil and Gas Services).The table below shows a segmental analysis for <strong>NIG</strong>’s three business areas as at and for the yearsending 31 December 2006, 2005 and 2004:Strategic and FinancialInvestments (includingSpecialist EngineeringPetrochemicals, Utilities(including Oil andand Financial Services) Building Materials Gas Services) Total11111111344 11111111344 11111111344 111111113442004 2005 2006 2004 2005 2006 2004 2005 2006 2004 2005 2006112 112 112 112 112 112 112 112 112 112 112 112(KD thousand)Revenues .............................. 60,874 188,202 100,294 26,489 31,062 30,138 77,808 71,661 66,737 165,171 290,925 197,169Profit (loss) ............................ 64,052 248,474 162,583 6.898 8,955 8,108 (14,860) (28,432) 4,045 56,090 228,997 174,736Assets .................................... 434,081 1,024,572 1,343,968 21,298 23,400 39,407 94,562 59,622 72,537 549,941 1,107,594 1,455,912Liabilities ................................ (7,077) (14,954) (26,433) (7,597) (7,905) (8,808) (27,733) (25,323) (23,240) (42,407) (48,182) (58,481)<strong>NIG</strong>’s operating businesses and strategic and financial investments are described in detail under“<strong>NIG</strong> Business Activities” below.RECENT DEVELOPMENTSOn 19 May 2007 Noor, as a 25 per cent. participant in the ADP Consortium, which also includesAeroports de Paris Management, Joannou & Paraskevaides Ltd., J&P Avax, Abu Dhabi InvestmentCompany and Edgo, signed a contract with the Jordanian Government for the construction,management and operation of the new Queen Alia International Airport in Jordan for a period of25 years, including the construction of a new terminal.On 28 May 2007, Noor signed a Memorandum of Understanding with the Syrian Ministry of Oil tolead an international alliance that will build and operate a refinery in the Dir-al-Zur region of Syriafor U.S.$1.5 billion. Noor proposes to establish a new company in Syria by the end of 2007, toorganise all of the financial, economic, technical and legal aspects of the refinery project. Noorintends to undertake a public offering of 49 per cent. of the shares in the new company in Syriaand other Arab markets.<strong>NIG</strong> is in the process of building a new head office in Kuwait, which is due to be completed inAugust 2007. The total cost of the new office is expected to be around KD 500,000. <strong>NIG</strong> intendsto implement a new integrated IT system for its new head office that will service all of <strong>NIG</strong>’sdiverse operations through one centralised system.On 4 August 2007, <strong>NIG</strong> announced its preliminary results for the six months ended 30 June 2007.The announcement disclosed an increase in net income from KD 74,584,000 for the six monthsended 30 June 2006 to KD158,086,000 for the six months ended 30 June 2007. The final resultsfor the six months ended 30 June 2007 are expected to be published by <strong>NIG</strong> on or after 18 August2007.66