NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange NIG Prospectus - London Stock Exchange

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10c : 3776 Section 10cd. During the 4th quarter of 2005 the group disposed 4% of its stake in its 20% ownedassociate, Kuwait National Real Estate Investment and Services Company – KSC (Closed),for a cash consideration of KD4,131 thousand resulting in a profit of KD2,302 thousande. During the 4th quarter of 2005 the group disposed 3% of its stake in its 31% ownedassociate, Kuwait Privatization Project Holding Company – SAK (Closed), for a cashconsideration of KD4,597 thousand resulting in a profit of KD2,910 thousand.f. During the 4th quarter of 2005 the group disposed 35% of its investment in, MabaneeCompany SAK (Closed), for a cash consideration of KD95,550 thousand, resulting in a profitof KD70,286 thousand. During December 2005 out of the total sales proceeds the groupreceived an amount of KD9,550 thousand, and the balance due, amounting to KD 86,000thousand has been shown under accounts receivable & other assets as at the balance sheetdate. Subsequent to the balance sheet date the group received KD38,220 thousand out ofthe amount due and the balance amount is due to be received by the end of the 1st quarterof 2006.Disposal during 2004:a. During the previous year the group disposed 2% of its stake in its 22% owned associate,Kuwait Cement Company – SAK (Closed), for a cash consideration of KD5,575 thousandresulting in a profit of KD3,481 thousand.b. During the previous year the group disposed a total of 1.6% of its stake in its 49% ownedassociate, Mabanee Company – SAK for a cash consideration of KD2,438 thousand resultingin a profit of KD1,706 thousand.Share of associates’ assets and liabilities:2005KD ‘00011112Assets .......................................................................................................................... 140,308Liabilities ........................................................................................................................ 19,397Share of associates’ revenue and profit:Revenue.......................................................................................................................... 23,510Profit .............................................................................................................................. 15,193Investment in quoted associates with a carrying value of KD75,580 thousand have a fair value ofKD179,747 thousand.12 Investment in joint venturesCountry ofregistration1111211112200511112200411112KD ‘000 KD ‘000Perry Baromedical Inc. (50%) (see note 6 b) ...... United States – 512Greco Mexican Gas Meter Joint venture (50%) .. Mexico 2531111225011112253 1111276211112Included above is goodwill on joint ventures amounting to KD Nil at 31 December 2005 (2004 :KD512 thousand).F-69

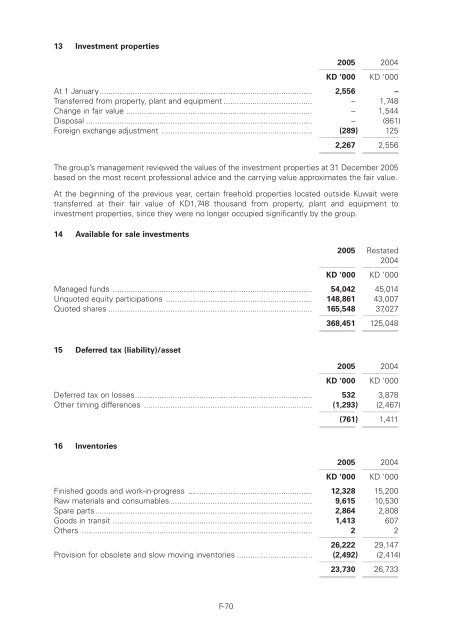

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10c : 3776 Section 10c13 Investment properties200511112200411112KD ‘000 KD ‘000At 1 January................................................................................................ 2,556 –Transferred from property, plant and equipment ........................................ – 1,748Change in fair value .................................................................................... – 1,544Disposal ...................................................................................................... – (861)Foreign exchange adjustment .................................................................... (289)11112125111122,267 111122,55611112The group’s management reviewed the values of the investment properties at 31 December 2005based on the most recent professional advice and the carrying value approximates the fair value.At the beginning of the previous year, certain freehold properties located outside Kuwait weretransferred at their fair value of KD1,748 thousand from property, plant and equipment toinvestment properties, since they were no longer occupied significantly by the group.14 Available for sale investments2005 Restated11112200411112KD ‘000 KD ‘000Managed funds .......................................................................................... 54,042 45,014Unquoted equity participations .................................................................. 148,861 43,007Quoted shares ............................................................................................ 165,5481111237,02711112368,451 11112125,0481111215 Deferred tax (liability)/asset200511112200411112KD ‘000 KD ‘000Deferred tax on losses................................................................................ 532 3,878Other timing differences ............................................................................ (1,293)11112(2,467)11112(761) 111121,4111111216 Inventories200511112200411112KD ‘000 KD ‘000Finished goods and work-in-progress ........................................................ 12,328 15,200Raw materials and consumables ................................................................ 9,615 10,530Spare parts.................................................................................................. 2,864 2,808Goods in transit .......................................................................................... 1,413 607Others ........................................................................................................ 21111221111226,222 29,147Provision for obsolete and slow moving inventories .................................. (2,492)11112(2,414)1111223,730 1111226,73311112F-70

- Page 120 and 121: Level: 8 - From: 8 - Thursday, Augu

- Page 122 and 123: Level: 8 - From: 8 - Thursday, Augu

- Page 124 and 125: Level: 8 - From: 8 - Thursday, Augu

- Page 126 and 127: Level: 8 - From: 8 - Thursday, Augu

- Page 128 and 129: Level: 8 - From: 8 - Thursday, Augu

- Page 130 and 131: Level: 8 - From: 8 - Thursday, Augu

- Page 132 and 133: Level: 8 - From: 8 - Thursday, Augu

- Page 134 and 135: Level: 8 - From: 8 - Thursday, Augu

- Page 136 and 137: Level: 8 - From: 8 - Thursday, Augu

- Page 138 and 139: Level: 8 - From: 8 - Thursday, Augu

- Page 140 and 141: Level: 8 - From: 8 - Thursday, Augu

- Page 142 and 143: Level: 8 - From: 8 - Thursday, Augu

- Page 144 and 145: Level: 8 - From: 8 - Thursday, Augu

- Page 146 and 147: Level: 8 - From: 8 - Thursday, Augu

- Page 148 and 149: Level: 8 - From: 8 - Thursday, Augu

- Page 150 and 151: Level: 8 - From: 8 - Thursday, Augu

- Page 152 and 153: Level: 8 - From: 8 - Thursday, Augu

- Page 154 and 155: Level: 8 - From: 8 - Thursday, Augu

- Page 156 and 157: Level: 8 - From: 8 - Thursday, Augu

- Page 158 and 159: Level: 8 - From: 8 - Thursday, Augu

- Page 160 and 161: Level: 8 - From: 8 - Thursday, Augu

- Page 162 and 163: Level: 8 - From: 8 - Thursday, Augu

- Page 164 and 165: Level: 8 - From: 8 - Thursday, Augu

- Page 166 and 167: Level: 8 - From: 8 - Thursday, Augu

- Page 168 and 169: Level: 8 - From: 8 - Thursday, Augu

- Page 172 and 173: Level: 8 - From: 8 - Thursday, Augu

- Page 174 and 175: Level: 8 - From: 8 - Thursday, Augu

- Page 176 and 177: Level: 8 - From: 8 - Thursday, Augu

- Page 178 and 179: Level: 8 - From: 8 - Thursday, Augu

- Page 180 and 181: Level: 8 - From: 8 - Thursday, Augu

- Page 182 and 183: Level: 8 - From: 8 - Thursday, Augu

- Page 184 and 185: Level: 8 - From: 8 - Thursday, Augu

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10c : 3776 Section 10c13 Investment properties200511112200411112KD ‘000 KD ‘000At 1 January................................................................................................ 2,556 –Transferred from property, plant and equipment ........................................ – 1,748Change in fair value .................................................................................... – 1,544Disposal ...................................................................................................... – (861)Foreign exchange adjustment .................................................................... (289)11112125111122,267 111122,55611112The group’s management reviewed the values of the investment properties at 31 December 2005based on the most recent professional advice and the carrying value approximates the fair value.At the beginning of the previous year, certain freehold properties located outside Kuwait weretransferred at their fair value of KD1,748 thousand from property, plant and equipment toinvestment properties, since they were no longer occupied significantly by the group.14 Available for sale investments2005 Restated11112200411112KD ‘000 KD ‘000Managed funds .......................................................................................... 54,042 45,014Unquoted equity participations .................................................................. 148,861 43,007Quoted shares ............................................................................................ 165,5481111237,02711112368,451 11112125,0481111215 Deferred tax (liability)/asset200511112200411112KD ‘000 KD ‘000Deferred tax on losses................................................................................ 532 3,878Other timing differences ............................................................................ (1,293)11112(2,467)11112(761) 111121,4111111216 Inventories200511112200411112KD ‘000 KD ‘000Finished goods and work-in-progress ........................................................ 12,328 15,200Raw materials and consumables ................................................................ 9,615 10,530Spare parts.................................................................................................. 2,864 2,808Goods in transit .......................................................................................... 1,413 607Others ........................................................................................................ 21111221111226,222 29,147Provision for obsolete and slow moving inventories .................................. (2,492)11112(2,414)1111223,730 1111226,73311112F-70