NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange NIG Prospectus - London Stock Exchange

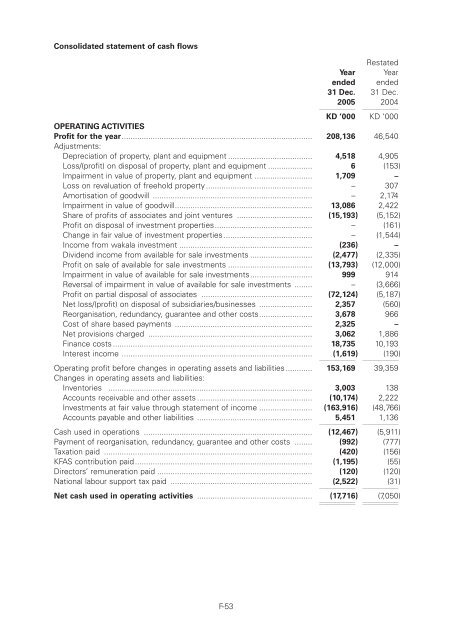

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10c : 3776 Section 10cConsolidated statement of cash flowsRestatedYear Yearended ended31 Dec. 31 Dec.200511112200411112KD ‘000 KD ‘000OPERATING ACTIVITIESProfit for the year...................................................................................... 208,136 46,540Adjustments:Depreciation of property, plant and equipment ...................................... 4,518 4,905Loss/(profit) on disposal of property, plant and equipment .................... 6 (153)Impairment in value of property, plant and equipment .......................... 1,709 –Loss on revaluation of freehold property ................................................ – 307Amortisation of goodwill ........................................................................ – 2,174Impairment in value of goodwill.............................................................. 13,086 2,422Share of profits of associates and joint ventures .................................. (15,193) (5,152)Profit on disposal of investment properties............................................ – (161)Change in fair value of investment properties ........................................ – (1,544)Income from wakala investment ............................................................ (236) –Dividend income from available for sale investments ............................ (2,477) (2,335)Profit on sale of available for sale investments ...................................... (13,793) (12,000)Impairment in value of available for sale investments............................ 999 914Reversal of impairment in value of available for sale investments ........ – (3,666)Profit on partial disposal of associates .................................................. (72,124) (5,187)Net loss/(profit) on disposal of subsidiaries/businesses ........................ 2,357 (560)Reorganisation, redundancy, guarantee and other costs........................ 3,678 966Cost of share based payments .............................................................. 2,325 –Net provisions charged .......................................................................... 3,062 1,886Finance costs .......................................................................................... 18,735 10,193Interest income ...................................................................................... (1,619)11112(190)11112Operating profit before changes in operating assets and liabilities ............ 153,169 39,359Changes in operating assets and liabilities:Inventories ............................................................................................ 3,003 138Accounts receivable and other assets .................................................... (10,174) 2,222Investments at fair value through statement of income ........................ (163,916) (48,766)Accounts payable and other liabilities .................................................... 5,451111121,13611112Cash used in operations ............................................................................ (12,467) (5,911)Payment of reorganisation, redundancy, guarantee and other costs ........ (992) (777)Taxation paid .............................................................................................. (420) (156)KFAS contribution paid................................................................................ (1,195) (55)Directors’ remuneration paid ...................................................................... (120) (120)National labour support tax paid ................................................................ (2,522)11112(31)11112Net cash used in operating activities .................................................... (17,716) (7,050)11112 1111211112 11112F-53

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10c : 3776 Section 10cConsolidated statement of cash flows (continued)RestatedYear Yearended ended31 Dec. 31 Dec.Note 200511112200411112KD ‘000 KD ‘000INVESTING ACTIVITIESPurchase of property, plant and equipment ............................ (4,720) (4,709)Proceeds from sale of property, plant and equipment............ 982 929Cash invested on acquisition of subsidiaries/businesses........ – (1,003)Net cash inflow on disposal of subsidiaries ............................ 532 30,975Proceeds from sale of investment properties ........................ – 1,022Investment in associated companies ...................................... (57,612) (8,511)Proceeds from partial disposal of associates .......................... 16,774 8,013Proceeds on reduction of capital in associated company ...... – 575Dividend received from associates ........................................ 3,692 5,917Wakala investment .................................................................. – (2,802)Proceed on realisation of wakala investment.......................... 3,038 –Purchase of available for sale investments.............................. (91,988) (41,763)Proceeds from sale of available for sale investments ............ 28,032 30,202Dividend income received from available for sale investments 2,477 2,335Interest income received ........................................................ 1,6191111219011112Net cash (used in)/from investing activities ...................... (97,174)1111221,37011112FINANCING ACTIVITIESFinance lease payments.......................................................... (1,058) 1,399Proceeds from issue of bonds ................................................ – 17,685Net increase in long-term borrowings .................................... 62,548 16,359Net increase/(decrease) in short-term borrowings .................. 119,094 (26,755)Dividend paid .......................................................................... (20,969) (20,796)Finance costs paid .................................................................. (16,615) (10,045)Purchase of treasury shares.................................................... (24,839) (6,819)Proceeds from sale of treasury shares .................................. 10,382 11,327Increase/(decrease) in minority interest .................................. 5,96611112(1,271)11112Net cash from/(used in) financing activities ...................... 134,50911112(18,916)11112Net increase/(decrease) in cash and cash equivalents............ 19,619 (4,596)Translation difference .............................................................. 3911112911111219,658 (4,505)Cash and cash equivalents at beginning of the year .............. 6,9201111211,42511112Cash and cash equivalents at end of the year .................. 29 26,578 6,92011112 1111211112 11112The notes set out on pages 9 to 34 form an integral part of these consolidated financial statements.F-54

- Page 104 and 105: Level: 8 - From: 8 - Thursday, Augu

- Page 106 and 107: Level: 8 - From: 8 - Thursday, Augu

- Page 108 and 109: Level: 8 - From: 8 - Thursday, Augu

- Page 110 and 111: Level: 8 - From: 8 - Thursday, Augu

- Page 112 and 113: Level: 8 - From: 8 - Thursday, Augu

- Page 114 and 115: Level: 8 - From: 8 - Thursday, Augu

- Page 116 and 117: Level: 8 - From: 8 - Thursday, Augu

- Page 118 and 119: Level: 8 - From: 8 - Thursday, Augu

- Page 120 and 121: Level: 8 - From: 8 - Thursday, Augu

- Page 122 and 123: Level: 8 - From: 8 - Thursday, Augu

- Page 124 and 125: Level: 8 - From: 8 - Thursday, Augu

- Page 126 and 127: Level: 8 - From: 8 - Thursday, Augu

- Page 128 and 129: Level: 8 - From: 8 - Thursday, Augu

- Page 130 and 131: Level: 8 - From: 8 - Thursday, Augu

- Page 132 and 133: Level: 8 - From: 8 - Thursday, Augu

- Page 134 and 135: Level: 8 - From: 8 - Thursday, Augu

- Page 136 and 137: Level: 8 - From: 8 - Thursday, Augu

- Page 138 and 139: Level: 8 - From: 8 - Thursday, Augu

- Page 140 and 141: Level: 8 - From: 8 - Thursday, Augu

- Page 142 and 143: Level: 8 - From: 8 - Thursday, Augu

- Page 144 and 145: Level: 8 - From: 8 - Thursday, Augu

- Page 146 and 147: Level: 8 - From: 8 - Thursday, Augu

- Page 148 and 149: Level: 8 - From: 8 - Thursday, Augu

- Page 150 and 151: Level: 8 - From: 8 - Thursday, Augu

- Page 152 and 153: Level: 8 - From: 8 - Thursday, Augu

- Page 156 and 157: Level: 8 - From: 8 - Thursday, Augu

- Page 158 and 159: Level: 8 - From: 8 - Thursday, Augu

- Page 160 and 161: Level: 8 - From: 8 - Thursday, Augu

- Page 162 and 163: Level: 8 - From: 8 - Thursday, Augu

- Page 164 and 165: Level: 8 - From: 8 - Thursday, Augu

- Page 166 and 167: Level: 8 - From: 8 - Thursday, Augu

- Page 168 and 169: Level: 8 - From: 8 - Thursday, Augu

- Page 170 and 171: Level: 8 - From: 8 - Thursday, Augu

- Page 172 and 173: Level: 8 - From: 8 - Thursday, Augu

- Page 174 and 175: Level: 8 - From: 8 - Thursday, Augu

- Page 176 and 177: Level: 8 - From: 8 - Thursday, Augu

- Page 178 and 179: Level: 8 - From: 8 - Thursday, Augu

- Page 180 and 181: Level: 8 - From: 8 - Thursday, Augu

- Page 182 and 183: Level: 8 - From: 8 - Thursday, Augu

- Page 184 and 185: Level: 8 - From: 8 - Thursday, Augu

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10c : 3776 Section 10cConsolidated statement of cash flowsRestatedYear Yearended ended31 Dec. 31 Dec.200511112200411112KD ‘000 KD ‘000OPERATING ACTIVITIESProfit for the year...................................................................................... 208,136 46,540Adjustments:Depreciation of property, plant and equipment ...................................... 4,518 4,905Loss/(profit) on disposal of property, plant and equipment .................... 6 (153)Impairment in value of property, plant and equipment .......................... 1,709 –Loss on revaluation of freehold property ................................................ – 307Amortisation of goodwill ........................................................................ – 2,174Impairment in value of goodwill.............................................................. 13,086 2,422Share of profits of associates and joint ventures .................................. (15,193) (5,152)Profit on disposal of investment properties............................................ – (161)Change in fair value of investment properties ........................................ – (1,544)Income from wakala investment ............................................................ (236) –Dividend income from available for sale investments ............................ (2,477) (2,335)Profit on sale of available for sale investments ...................................... (13,793) (12,000)Impairment in value of available for sale investments............................ 999 914Reversal of impairment in value of available for sale investments ........ – (3,666)Profit on partial disposal of associates .................................................. (72,124) (5,187)Net loss/(profit) on disposal of subsidiaries/businesses ........................ 2,357 (560)Reorganisation, redundancy, guarantee and other costs........................ 3,678 966Cost of share based payments .............................................................. 2,325 –Net provisions charged .......................................................................... 3,062 1,886Finance costs .......................................................................................... 18,735 10,193Interest income ...................................................................................... (1,619)11112(190)11112Operating profit before changes in operating assets and liabilities ............ 153,169 39,359Changes in operating assets and liabilities:Inventories ............................................................................................ 3,003 138Accounts receivable and other assets .................................................... (10,174) 2,222Investments at fair value through statement of income ........................ (163,916) (48,766)Accounts payable and other liabilities .................................................... 5,451111121,13611112Cash used in operations ............................................................................ (12,467) (5,911)Payment of reorganisation, redundancy, guarantee and other costs ........ (992) (777)Taxation paid .............................................................................................. (420) (156)KFAS contribution paid................................................................................ (1,195) (55)Directors’ remuneration paid ...................................................................... (120) (120)National labour support tax paid ................................................................ (2,522)11112(31)11112Net cash used in operating activities .................................................... (17,716) (7,050)11112 1111211112 11112F-53