NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange NIG Prospectus - London Stock Exchange

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10c : 3776 Section 10cConsolidated statement of incomeRestatedYear Yearended ended31 Dec. 31 Dec.Note 200511112200411112KD ‘000 KD ‘000Sales ........................................................................................ 104,740 106,987Cost of sales............................................................................ (82,185)11112(88,835)11112Gross profit ............................................................................ 22,555 18,152Income from investments ...................................................... 4 173,009 54,017Share of profits of associates and joint ventures.................... 15,193 5,152Profit on disposal of investment properties ............................ – 161Change in fair value of investment properties ........................ – 1,544Other operating income .......................................................... 412 263Distribution costs .................................................................... (7,014) (6,956)General, administrative and other expenses .......................... (22,106)11112(13,163)11112Profit from operations .......................................................... 5 182,049 59,170Profit on partial disposal of associates .................................... 11 72,124 5,187Net (loss)/profit on disposal of subsidiaries/businesses.......... 6 (2,357) 560Finance costs .......................................................................... (18,735) (10,193)Impairment in value of property, plant and equipment .......... (1,709) –Loss on revaluation of freehold property ................................ – (307)Amortisation of goodwill ........................................................ – (2,174)Impairment in value of goodwill .............................................. 9 (13,086) (2,422)(Loss)/gain on foreign exchange .............................................. (1,865) 921Provision for onerous property leases and dilapidations ........ (2,129) (1,345)Provision for doubtful debts .................................................... (2,295) (1,262)Product development costs written off .................................. (183) (629)Reorganisation, redundancy, guarantee and other costs ........ (3,678)11112(966)11112Profit for the year .................................................................. 208,136 46,540Taxation .................................................................................. 7 (2,439) (902)Contribution to Kuwait Foundation for the Advancement ofSciences .............................................................................. (2,362) (424)Directors’ remuneration .......................................................... (200) (120)National Labour Support Tax.................................................... (4,581)11112(817)11112Net profit for the year .......................................................... 198,554 1111244,27711112Attributable to:Shareholders of the parent.................................................. 189,517 42,217Minority interest .................................................................. 9,037111122,06011112................................................................................................ 198,554 1111244,27711112Earnings per share attributable to the shareholders of theparent .................................................................................. 8 257 Fils 58 Fils11112 1111211112 11112The notes set out on pages 9 to 34 form an integral part of these consolidated financial statementsF-49

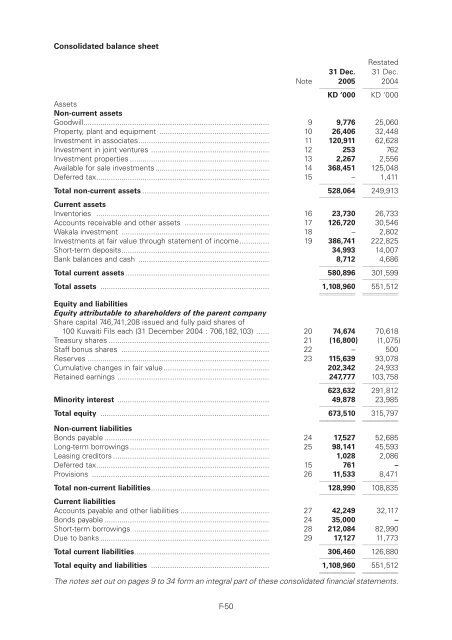

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10c : 3776 Section 10cConsolidated balance sheetRestated31 Dec. 31 Dec.Note 200511112200411112KD ‘000 KD ‘000AssetsNon-current assetsGoodwill........................................................................................ 9 9,776 25,060Property, plant and equipment .................................................... 10 26,406 32,448Investment in associates.............................................................. 11 120,911 62,628Investment in joint ventures ........................................................ 12 253 762Investment properties .................................................................. 13 2,267 2,556Available for sale investments...................................................... 14 368,451 125,048Deferred tax.................................................................................. 15 –111121,41111112Total non-current assets ............................................................ 528,06411112249,91311112Current assetsInventories .................................................................................. 16 23,730 26,733Accounts receivable and other assets ........................................ 17 126,720 30,546Wakala investment ...................................................................... 18 – 2,802Investments at fair value through statement of income.............. 19 386,741 222,825Short-term deposits...................................................................... 34,993 14,007Bank balances and cash .............................................................. 8,712111124,68611112Total current assets .................................................................... 580,89611112301,59911112Total assets ................................................................................ 1,108,960 551,51211112 1111211112 11112Equity and liabilitiesEquity attributable to shareholders of the parent companyShare capital 746,741,208 issued and fully paid shares of100 Kuwaiti Fils each (31 December 2004 : 706,182,103) ...... 20 74,674 70,618Treasury shares ............................................................................ 21 (16,800) (1,075)Staff bonus shares ...................................................................... 22 – 500Reserves ...................................................................................... 23 115,639 93,078Cumulative changes in fair value.................................................. 202,342 24,933Retained earnings ........................................................................ 247,77711112103,75811112623,632 291,812Minority interest ........................................................................ 49,8781111223,98511112Total equity ................................................................................ 673,510 11112315,79711112Non-current liabilitiesBonds payable .............................................................................. 24 17,527 52,685Long-term borrowings .................................................................. 25 98,141 45,593Leasing creditors .......................................................................... 1,028 2,086Deferred tax.................................................................................. 15 761 –Provisions .................................................................................... 26 11,533111128,47111112Total non-current liabilities........................................................ 128,99011112108,83511112Current liabilitiesAccounts payable and other liabilities .......................................... 27 42,249 32,117Bonds payable .............................................................................. 24 35,000 –Short-term borrowings ................................................................ 28 212,084 82,990Due to banks ................................................................................ 29 17,1271111211,77311112Total current liabilities................................................................ 306,46011112126,88011112Total equity and liabilities ........................................................ 1,108,960 551,51211112 1111211112 11112The notes set out on pages 9 to 34 form an integral part of these consolidated financial statements.F-50

- Page 100 and 101: Level: 8 - From: 8 - Thursday, Augu

- Page 102 and 103: Level: 8 - From: 8 - Thursday, Augu

- Page 104 and 105: Level: 8 - From: 8 - Thursday, Augu

- Page 106 and 107: Level: 8 - From: 8 - Thursday, Augu

- Page 108 and 109: Level: 8 - From: 8 - Thursday, Augu

- Page 110 and 111: Level: 8 - From: 8 - Thursday, Augu

- Page 112 and 113: Level: 8 - From: 8 - Thursday, Augu

- Page 114 and 115: Level: 8 - From: 8 - Thursday, Augu

- Page 116 and 117: Level: 8 - From: 8 - Thursday, Augu

- Page 118 and 119: Level: 8 - From: 8 - Thursday, Augu

- Page 120 and 121: Level: 8 - From: 8 - Thursday, Augu

- Page 122 and 123: Level: 8 - From: 8 - Thursday, Augu

- Page 124 and 125: Level: 8 - From: 8 - Thursday, Augu

- Page 126 and 127: Level: 8 - From: 8 - Thursday, Augu

- Page 128 and 129: Level: 8 - From: 8 - Thursday, Augu

- Page 130 and 131: Level: 8 - From: 8 - Thursday, Augu

- Page 132 and 133: Level: 8 - From: 8 - Thursday, Augu

- Page 134 and 135: Level: 8 - From: 8 - Thursday, Augu

- Page 136 and 137: Level: 8 - From: 8 - Thursday, Augu

- Page 138 and 139: Level: 8 - From: 8 - Thursday, Augu

- Page 140 and 141: Level: 8 - From: 8 - Thursday, Augu

- Page 142 and 143: Level: 8 - From: 8 - Thursday, Augu

- Page 144 and 145: Level: 8 - From: 8 - Thursday, Augu

- Page 146 and 147: Level: 8 - From: 8 - Thursday, Augu

- Page 148 and 149: Level: 8 - From: 8 - Thursday, Augu

- Page 152 and 153: Level: 8 - From: 8 - Thursday, Augu

- Page 154 and 155: Level: 8 - From: 8 - Thursday, Augu

- Page 156 and 157: Level: 8 - From: 8 - Thursday, Augu

- Page 158 and 159: Level: 8 - From: 8 - Thursday, Augu

- Page 160 and 161: Level: 8 - From: 8 - Thursday, Augu

- Page 162 and 163: Level: 8 - From: 8 - Thursday, Augu

- Page 164 and 165: Level: 8 - From: 8 - Thursday, Augu

- Page 166 and 167: Level: 8 - From: 8 - Thursday, Augu

- Page 168 and 169: Level: 8 - From: 8 - Thursday, Augu

- Page 170 and 171: Level: 8 - From: 8 - Thursday, Augu

- Page 172 and 173: Level: 8 - From: 8 - Thursday, Augu

- Page 174 and 175: Level: 8 - From: 8 - Thursday, Augu

- Page 176 and 177: Level: 8 - From: 8 - Thursday, Augu

- Page 178 and 179: Level: 8 - From: 8 - Thursday, Augu

- Page 180 and 181: Level: 8 - From: 8 - Thursday, Augu

- Page 182 and 183: Level: 8 - From: 8 - Thursday, Augu

- Page 184 and 185: Level: 8 - From: 8 - Thursday, Augu

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10c : 3776 Section 10cConsolidated balance sheetRestated31 Dec. 31 Dec.Note 200511112200411112KD ‘000 KD ‘000AssetsNon-current assetsGoodwill........................................................................................ 9 9,776 25,060Property, plant and equipment .................................................... 10 26,406 32,448Investment in associates.............................................................. 11 120,911 62,628Investment in joint ventures ........................................................ 12 253 762Investment properties .................................................................. 13 2,267 2,556Available for sale investments...................................................... 14 368,451 125,048Deferred tax.................................................................................. 15 –111121,41111112Total non-current assets ............................................................ 528,06411112249,91311112Current assetsInventories .................................................................................. 16 23,730 26,733Accounts receivable and other assets ........................................ 17 126,720 30,546Wakala investment ...................................................................... 18 – 2,802Investments at fair value through statement of income.............. 19 386,741 222,825Short-term deposits...................................................................... 34,993 14,007Bank balances and cash .............................................................. 8,712111124,68611112Total current assets .................................................................... 580,89611112301,59911112Total assets ................................................................................ 1,108,960 551,51211112 1111211112 11112Equity and liabilitiesEquity attributable to shareholders of the parent companyShare capital 746,741,208 issued and fully paid shares of100 Kuwaiti Fils each (31 December 2004 : 706,182,103) ...... 20 74,674 70,618Treasury shares ............................................................................ 21 (16,800) (1,075)Staff bonus shares ...................................................................... 22 – 500Reserves ...................................................................................... 23 115,639 93,078Cumulative changes in fair value.................................................. 202,342 24,933Retained earnings ........................................................................ 247,77711112103,75811112623,632 291,812Minority interest ........................................................................ 49,8781111223,98511112Total equity ................................................................................ 673,510 11112315,79711112Non-current liabilitiesBonds payable .............................................................................. 24 17,527 52,685Long-term borrowings .................................................................. 25 98,141 45,593Leasing creditors .......................................................................... 1,028 2,086Deferred tax.................................................................................. 15 761 –Provisions .................................................................................... 26 11,533111128,47111112Total non-current liabilities........................................................ 128,99011112108,83511112Current liabilitiesAccounts payable and other liabilities .......................................... 27 42,249 32,117Bonds payable .............................................................................. 24 35,000 –Short-term borrowings ................................................................ 28 212,084 82,990Due to banks ................................................................................ 29 17,1271111211,77311112Total current liabilities................................................................ 306,46011112126,88011112Total equity and liabilities ........................................................ 1,108,960 551,51211112 1111211112 11112The notes set out on pages 9 to 34 form an integral part of these consolidated financial statements.F-50