NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange NIG Prospectus - London Stock Exchange

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10b : 3776 Section 10bA full independent valuation of all freehold properties held by NIC Holding (Guernsey) and NIG(Guernsey) Limited was obtained as at 1 January 1999 and the valuation was incorporated into theconsolidated financial statements. The directors of the group consider that there has been nosignificant change in the market value since the last valuation of these properties.Property on leasehold land, plant and machinery with a net book value of KD1,271 thousand aresecured against the Musharaka bonds (see Note 24).Property under construction represents the cost incurred on the expansion of one of thesubsidiaries existing factories and the construction of a new office building for the samesubsidiary. This amount will be transferred to the appropriate asset categories when the assets areready for their intended use.11 Investment in associatesThe significant associates of the group as at 31 December 2006 and 2005 are as follows:Percentageownership111122311112200611112200511112Kuwait Ceramic Factory Company – WLL ................................................ 49% 49%Kuwait Rocks Company – SAK (Closed)...................................................... 38% 38%KES Power Ltd. .......................................................................................... 40% 40%Kuwait Privatization Project Holding Company – SAK (Closed) .................. 28% 28%Al Raya International Real Estate – KSC (Closed) ...................................... 23% 23%Kuwait Cement Company – SAK (Closed) .................................................. 22% 22%Marsa Alam Holding Company – KSC (Closed) .......................................... 20% 20%Eastern United Petroleum Services Company – KSC (Closed) .................. 20% 20%Kuwait National Real Estate Investment and Services Company– KSC (Closed) ........................................................................................ 16% 16%All of the above associates are registered in Kuwait except for KES Power Ltd., which is registeredin the Cayman Islands.Significant influence in Kuwait National Real Estate Investment and Services Company – KSC(Closed) is demonstrated by representation of two directors of the group on the board of directorsof each of the investee’s.Disposal during 2005:a. The group disposed 4% of its stake in its 20% owned associate, Kuwait National Real EstateInvestment and Services Company – KSC (Closed), for a cash consideration of KD4,131thousand resulting in a profit of KD2,302 thousandb. The group disposed 3% of its stake in its 31% owned associate, Kuwait Privatization ProjectHolding Company – SAK (Closed), for a cash consideration of KD4,597 thousand resulting ina profit of KD2,910 thousand.c. The group disposed 35% of its investment in, Mabanee Company SAK (Closed), for a cashconsideration of KD95,550 thousand, resulting in a profit of KD70,286 thousand.F-35

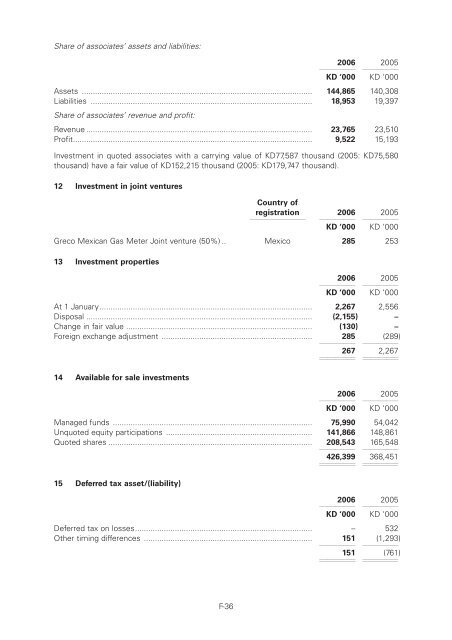

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10b : 3776 Section 10bShare of associates’ assets and liabilities:200611112200511112KD ‘000 KD ‘000Assets ........................................................................................................ 144,865 140,308Liabilities .................................................................................................... 18,953 19,397Share of associates’ revenue and profit:Revenue ...................................................................................................... 23,765 23,510Profit............................................................................................................ 9,522 15,193Investment in quoted associates with a carrying value of KD77,587 thousand (2005: KD75,580thousand) have a fair value of KD152,215 thousand (2005: KD179,747 thousand).12 Investment in joint venturesCountry ofregistration11112112200611112200511112KD ‘000 KD ‘000Greco Mexican Gas Meter Joint venture (50%) .. Mexico 285 25313 Investment properties200611112200511112KD ‘000 KD ‘000At 1 January................................................................................................ 2,267 2,556Disposal ...................................................................................................... (2,155) –Change in fair value .................................................................................... (130) –Foreign exchange adjustment .................................................................... 28511112(289)11112267 111122,2671111214 Available for sale investments200611112200511112KD ‘000 KD ‘000Managed funds .......................................................................................... 75,990 54,042Unquoted equity participations .................................................................. 141,866 148,861Quoted shares ............................................................................................ 208,54311112165,54811112426,399 11112368,4511111215 Deferred tax asset/(liability)200611112200511112KD ‘000 KD ‘000Deferred tax on losses................................................................................ – 532Other timing differences ............................................................................ 15111112(1,293)11112151 11112(761)11112F-36

- Page 86 and 87: Level: 8 - From: 8 - Thursday, Augu

- Page 88 and 89: Level: 8 - From: 8 - Thursday, Augu

- Page 90 and 91: Level: 8 - From: 8 - Thursday, Augu

- Page 92 and 93: Level: 8 - From: 8 - Thursday, Augu

- Page 94 and 95: Level: 8 - From: 8 - Thursday, Augu

- Page 96 and 97: Level: 8 - From: 8 - Thursday, Augu

- Page 98 and 99: Level: 8 - From: 8 - Thursday, Augu

- Page 100 and 101: Level: 8 - From: 8 - Thursday, Augu

- Page 102 and 103: Level: 8 - From: 8 - Thursday, Augu

- Page 104 and 105: Level: 8 - From: 8 - Thursday, Augu

- Page 106 and 107: Level: 8 - From: 8 - Thursday, Augu

- Page 108 and 109: Level: 8 - From: 8 - Thursday, Augu

- Page 110 and 111: Level: 8 - From: 8 - Thursday, Augu

- Page 112 and 113: Level: 8 - From: 8 - Thursday, Augu

- Page 114 and 115: Level: 8 - From: 8 - Thursday, Augu

- Page 116 and 117: Level: 8 - From: 8 - Thursday, Augu

- Page 118 and 119: Level: 8 - From: 8 - Thursday, Augu

- Page 120 and 121: Level: 8 - From: 8 - Thursday, Augu

- Page 122 and 123: Level: 8 - From: 8 - Thursday, Augu

- Page 124 and 125: Level: 8 - From: 8 - Thursday, Augu

- Page 126 and 127: Level: 8 - From: 8 - Thursday, Augu

- Page 128 and 129: Level: 8 - From: 8 - Thursday, Augu

- Page 130 and 131: Level: 8 - From: 8 - Thursday, Augu

- Page 132 and 133: Level: 8 - From: 8 - Thursday, Augu

- Page 134 and 135: Level: 8 - From: 8 - Thursday, Augu

- Page 138 and 139: Level: 8 - From: 8 - Thursday, Augu

- Page 140 and 141: Level: 8 - From: 8 - Thursday, Augu

- Page 142 and 143: Level: 8 - From: 8 - Thursday, Augu

- Page 144 and 145: Level: 8 - From: 8 - Thursday, Augu

- Page 146 and 147: Level: 8 - From: 8 - Thursday, Augu

- Page 148 and 149: Level: 8 - From: 8 - Thursday, Augu

- Page 150 and 151: Level: 8 - From: 8 - Thursday, Augu

- Page 152 and 153: Level: 8 - From: 8 - Thursday, Augu

- Page 154 and 155: Level: 8 - From: 8 - Thursday, Augu

- Page 156 and 157: Level: 8 - From: 8 - Thursday, Augu

- Page 158 and 159: Level: 8 - From: 8 - Thursday, Augu

- Page 160 and 161: Level: 8 - From: 8 - Thursday, Augu

- Page 162 and 163: Level: 8 - From: 8 - Thursday, Augu

- Page 164 and 165: Level: 8 - From: 8 - Thursday, Augu

- Page 166 and 167: Level: 8 - From: 8 - Thursday, Augu

- Page 168 and 169: Level: 8 - From: 8 - Thursday, Augu

- Page 170 and 171: Level: 8 - From: 8 - Thursday, Augu

- Page 172 and 173: Level: 8 - From: 8 - Thursday, Augu

- Page 174 and 175: Level: 8 - From: 8 - Thursday, Augu

- Page 176 and 177: Level: 8 - From: 8 - Thursday, Augu

- Page 178 and 179: Level: 8 - From: 8 - Thursday, Augu

- Page 180 and 181: Level: 8 - From: 8 - Thursday, Augu

- Page 182 and 183: Level: 8 - From: 8 - Thursday, Augu

- Page 184 and 185: Level: 8 - From: 8 - Thursday, Augu

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10b : 3776 Section 10bShare of associates’ assets and liabilities:200611112200511112KD ‘000 KD ‘000Assets ........................................................................................................ 144,865 140,308Liabilities .................................................................................................... 18,953 19,397Share of associates’ revenue and profit:Revenue ...................................................................................................... 23,765 23,510Profit............................................................................................................ 9,522 15,193Investment in quoted associates with a carrying value of KD77,587 thousand (2005: KD75,580thousand) have a fair value of KD152,215 thousand (2005: KD179,747 thousand).12 Investment in joint venturesCountry ofregistration11112112200611112200511112KD ‘000 KD ‘000Greco Mexican Gas Meter Joint venture (50%) .. Mexico 285 25313 Investment properties200611112200511112KD ‘000 KD ‘000At 1 January................................................................................................ 2,267 2,556Disposal ...................................................................................................... (2,155) –Change in fair value .................................................................................... (130) –Foreign exchange adjustment .................................................................... 28511112(289)11112267 111122,2671111214 Available for sale investments200611112200511112KD ‘000 KD ‘000Managed funds .......................................................................................... 75,990 54,042Unquoted equity participations .................................................................. 141,866 148,861Quoted shares ............................................................................................ 208,54311112165,54811112426,399 11112368,4511111215 Deferred tax asset/(liability)200611112200511112KD ‘000 KD ‘000Deferred tax on losses................................................................................ – 532Other timing differences ............................................................................ 15111112(1,293)11112151 11112(761)11112F-36