NIG Prospectus - London Stock Exchange

NIG Prospectus - London Stock Exchange NIG Prospectus - London Stock Exchange

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10a : 3776 Section 10a8 ReservesGain onSale oftreasuryForeigncurrencyShare Statutory General Revaluation shares translationpremium1111reserve1111reserve1111reserve1111reserve1111reserve1111Total1111KD ‘000 KD ‘000 KD ‘000 KD ‘000 KD ‘000 KD ‘000 KD ‘000Balance at31 December 2006 .......... 152,691 85,334 25,621 350 800 (481) 264,315Transfer of excessdepreciation ...................... – – – (118) – – (118)Currency translationdifferences ........................ – – – 2 – (12) (10)Profit on disposal oftreasury shares .................. –1111–1111–1111–11111,7901111–11111,7901111Balances at31 March 2007.................. 152,691 85,334 25,621 234 2,590 (493) 265,9771111 1111 1111 1111 1111 1111 1111Balance at31 December 2005 .......... 28,234 61,270 25,159 322 236 418 115,639Transfer of excessdepreciation ...................... – – – (2) – – (2)Currency translationdifferences ........................ – – – 2 – (43) (41)Transfer on partialdisposal ofsubsidiary .......................... –1111(150)1111–1111–1111–1111–1111(150)1111Balances at31 March 2006.................. 28,234 61,120 25,159 322 236 375 115,4461111 1111 1111 1111 1111 1111 11119 Segmental analysisThe group’s primary format for reporting segment information is business segments and the groupprimarily operates in three business segments: investment, building materials and specialistengineering. The segment information are as follows:Investment Building materials Specialist engineering Total11112111112 11112111112 11112111112 1111211111231 March 31 March 31 March 31 March 31 March 31 March 31 March 31 March200711112200611112200711112200611112200711112200611112200711112200611112KD ‘000 KD ‘000 KD ‘000 KD ‘000 KD ‘000 KD ‘000 KD ‘000 KD ‘000Segment revenue ...................... 78,349 111125,878 111127,502 111127,438 1111220,348 1111211,554 11112106,199 24,870Less:Investments income.................. (74,899) (2,638)Share of profits of associates.... (3,450) (3,240)Unallocated sales ...................... 8841111254111112Sales as per consolidatedstatement of income ................ 28,734 1111219,53311112Segment profit .......................... 74,681 1111233,891 111121,642 111121,658 11112601 1111273 1111276,924 35,622Finance costs ............................ (10,213) (6,074)Unallocated income .................. 7161111210111112Profit for the period as perconsolidated statement ofincome ...................................... 67,427 29,64911112 11112F-11

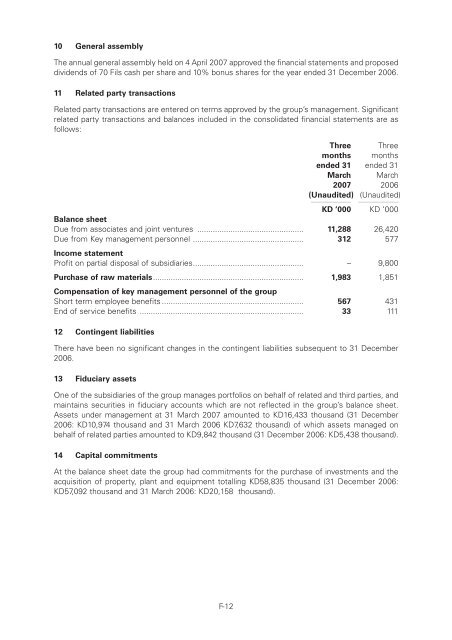

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10a : 3776 Section 10a10 General assemblyThe annual general assembly held on 4 April 2007 approved the financial statements and proposeddividends of 70 Fils cash per share and 10% bonus shares for the year ended 31 December 2006.11 Related party transactionsRelated party transactions are entered on terms approved by the group’s management. Significantrelated party transactions and balances included in the consolidated financial statements are asfollows:Three Threemonths monthsended 31 ended 31March March2007 2006(Unaudited)11111(Unaudited)11111KD ‘000 KD ‘000Balance sheetDue from associates and joint ventures ................................................ 11,288 26,420Due from Key management personnel .................................................. 312 577Income statementProfit on partial disposal of subsidiaries.................................................. – 9,800Purchase of raw materials.................................................................... 1,983 1,851Compensation of key management personnel of the groupShort term employee benefits ................................................................ 567 431End of service benefits .......................................................................... 33 11112 Contingent liabilitiesThere have been no significant changes in the contingent liabilities subsequent to 31 December2006.13 Fiduciary assetsOne of the subsidiaries of the group manages portfolios on behalf of related and third parties, andmaintains securities in fiduciary accounts which are not reflected in the group’s balance sheet.Assets under management at 31 March 2007 amounted to KD16,433 thousand (31 December2006: KD10,974 thousand and 31 March 2006 KD7,632 thousand) of which assets managed onbehalf of related parties amounted to KD9,842 thousand (31 December 2006: KD5,438 thousand).14 Capital commitmentsAt the balance sheet date the group had commitments for the purchase of investments and theacquisition of property, plant and equipment totalling KD58,835 thousand (31 December 2006:KD57,092 thousand and 31 March 2006: KD20,158 thousand).F-12

- Page 62 and 63: Level: 8 - From: 8 - Thursday, Augu

- Page 64 and 65: Level: 8 - From: 8 - Thursday, Augu

- Page 66 and 67: Level: 8 - From: 8 - Thursday, Augu

- Page 68 and 69: Level: 8 - From: 8 - Thursday, Augu

- Page 70 and 71: Level: 8 - From: 8 - Thursday, Augu

- Page 72 and 73: Level: 8 - From: 8 - Thursday, Augu

- Page 74 and 75: Level: 8 - From: 8 - Thursday, Augu

- Page 76 and 77: Level: 8 - From: 8 - Thursday, Augu

- Page 78 and 79: Level: 8 - From: 8 - Thursday, Augu

- Page 80 and 81: Level: 8 - From: 8 - Thursday, Augu

- Page 82 and 83: Level: 8 - From: 8 - Thursday, Augu

- Page 84 and 85: Level: 8 - From: 8 - Thursday, Augu

- Page 86 and 87: Level: 8 - From: 8 - Thursday, Augu

- Page 88 and 89: Level: 8 - From: 8 - Thursday, Augu

- Page 90 and 91: Level: 8 - From: 8 - Thursday, Augu

- Page 92 and 93: Level: 8 - From: 8 - Thursday, Augu

- Page 94 and 95: Level: 8 - From: 8 - Thursday, Augu

- Page 96 and 97: Level: 8 - From: 8 - Thursday, Augu

- Page 98 and 99: Level: 8 - From: 8 - Thursday, Augu

- Page 100 and 101: Level: 8 - From: 8 - Thursday, Augu

- Page 102 and 103: Level: 8 - From: 8 - Thursday, Augu

- Page 104 and 105: Level: 8 - From: 8 - Thursday, Augu

- Page 106 and 107: Level: 8 - From: 8 - Thursday, Augu

- Page 108 and 109: Level: 8 - From: 8 - Thursday, Augu

- Page 110 and 111: Level: 8 - From: 8 - Thursday, Augu

- Page 114 and 115: Level: 8 - From: 8 - Thursday, Augu

- Page 116 and 117: Level: 8 - From: 8 - Thursday, Augu

- Page 118 and 119: Level: 8 - From: 8 - Thursday, Augu

- Page 120 and 121: Level: 8 - From: 8 - Thursday, Augu

- Page 122 and 123: Level: 8 - From: 8 - Thursday, Augu

- Page 124 and 125: Level: 8 - From: 8 - Thursday, Augu

- Page 126 and 127: Level: 8 - From: 8 - Thursday, Augu

- Page 128 and 129: Level: 8 - From: 8 - Thursday, Augu

- Page 130 and 131: Level: 8 - From: 8 - Thursday, Augu

- Page 132 and 133: Level: 8 - From: 8 - Thursday, Augu

- Page 134 and 135: Level: 8 - From: 8 - Thursday, Augu

- Page 136 and 137: Level: 8 - From: 8 - Thursday, Augu

- Page 138 and 139: Level: 8 - From: 8 - Thursday, Augu

- Page 140 and 141: Level: 8 - From: 8 - Thursday, Augu

- Page 142 and 143: Level: 8 - From: 8 - Thursday, Augu

- Page 144 and 145: Level: 8 - From: 8 - Thursday, Augu

- Page 146 and 147: Level: 8 - From: 8 - Thursday, Augu

- Page 148 and 149: Level: 8 - From: 8 - Thursday, Augu

- Page 150 and 151: Level: 8 - From: 8 - Thursday, Augu

- Page 152 and 153: Level: 8 - From: 8 - Thursday, Augu

- Page 154 and 155: Level: 8 - From: 8 - Thursday, Augu

- Page 156 and 157: Level: 8 - From: 8 - Thursday, Augu

- Page 158 and 159: Level: 8 - From: 8 - Thursday, Augu

- Page 160 and 161: Level: 8 - From: 8 - Thursday, Augu

Level: 8 – From: 8 – Thursday, August 9, 2007 – 2:20 pm – mac5 – 3776 Section 10a : 3776 Section 10a10 General assemblyThe annual general assembly held on 4 April 2007 approved the financial statements and proposeddividends of 70 Fils cash per share and 10% bonus shares for the year ended 31 December 2006.11 Related party transactionsRelated party transactions are entered on terms approved by the group’s management. Significantrelated party transactions and balances included in the consolidated financial statements are asfollows:Three Threemonths monthsended 31 ended 31March March2007 2006(Unaudited)11111(Unaudited)11111KD ‘000 KD ‘000Balance sheetDue from associates and joint ventures ................................................ 11,288 26,420Due from Key management personnel .................................................. 312 577Income statementProfit on partial disposal of subsidiaries.................................................. – 9,800Purchase of raw materials.................................................................... 1,983 1,851Compensation of key management personnel of the groupShort term employee benefits ................................................................ 567 431End of service benefits .......................................................................... 33 11112 Contingent liabilitiesThere have been no significant changes in the contingent liabilities subsequent to 31 December2006.13 Fiduciary assetsOne of the subsidiaries of the group manages portfolios on behalf of related and third parties, andmaintains securities in fiduciary accounts which are not reflected in the group’s balance sheet.Assets under management at 31 March 2007 amounted to KD16,433 thousand (31 December2006: KD10,974 thousand and 31 March 2006 KD7,632 thousand) of which assets managed onbehalf of related parties amounted to KD9,842 thousand (31 December 2006: KD5,438 thousand).14 Capital commitmentsAt the balance sheet date the group had commitments for the purchase of investments and theacquisition of property, plant and equipment totalling KD58,835 thousand (31 December 2006:KD57,092 thousand and 31 March 2006: KD20,158 thousand).F-12