IN THE INCOME TAX APPELLATE TRIBUNAL MUMBAI BENCH - ITAT

IN THE INCOME TAX APPELLATE TRIBUNAL MUMBAI BENCH - ITAT

IN THE INCOME TAX APPELLATE TRIBUNAL MUMBAI BENCH - ITAT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

54. Aggrieved, the Revenue is in appeal on the following grounds :1. On the facts and in the circumstances of the case and in law, the Ld.CIT(A) erred in holding that the payment made to M/s TIBCO Software Inc.,USA for the purpose of computer software does not amount to businessreceipts and in the absence of any Permanent Establishment in India, thebusiness profit arising in the transaction is not taxable in India.2. On the facts and in the circumstances of the case and in law, the Ld.CIT(A) failed to appreciate that the payment for obtaining computersoftware is in the nature of royalty which is liable for taxation in India.5. Shri Narendra Singh, learned CIT-DR has represented the Revenueand Shri Arvind Sonde learned counsel, argued on behalf of the assessee. Bothparties agreed that the issue in question is covered by the following case laws:i) Hewlett-Packard (India) P. Ltd. vs. ITO (IT) 5 SOT 660.ii)Samsung Electronics Company Ltd. vs. ITO, <strong>ITAT</strong> BangalaoreBench, 276 ITR (<strong>ITAT</strong>) 1.iii) Motorola Inc v. DCIT (Delhi SB) 270 ITR (<strong>ITAT</strong>) 62.iv)Lucent Technologies Hindustan Ltd. vs. ITO, <strong>ITAT</strong> Bangalore Bench,Bangalore, 270 ITR (<strong>ITAT</strong>) 62.v) Airports Authority of India (AAR), 323 ITR 211.The learned DR, nevertheless relied upon the conclusions drawn by the AO andsubmitted that the Department has not accepted the decisions of the Tribunal citedherein above. Mr. Sonde, on the other hand, filed the detailed charts and case lawsin support of the contention that under identical facts and circumstances of the

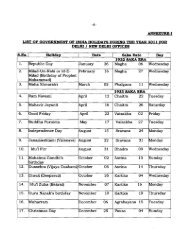

712 1184/Mum/2009 M/s. Tibco SoftwareInc.13 1185/Mum/2009 Landmark GraphicsCorporation14 1187/Mum/2009 M/s. FinancialEngineeringAssociates Inc15 1188/Mum/2009 M/s. First VirtualCommunicationsIncUSAUSAUSAUSAInformation Technology Software includingsmart socket RT server bundle Integration.For supply of desk top SGI Octane software forO&G Business.Supply of VaR Works and Make VC software.Providing software for visual conferencingservices through internet.16 1190/Mum/2009 SOTS Inc USA Information Technology Software consist ofInforwave Database, data colleciton module andslice management for data collection andretention.All the software was purchased for the internal use of the assessee and isoperational software. The assessee was granted non-exclusive, perpetual,,irrevocable, royalty free, worldwide license to use the number of copies of thesoftware enumerated in the agreement solely for internal operation, including useof software for ASP Services and web housing services where a software is notdirectly accessible to third party.8. The general terms and conditions and the restrictions under which thesaid software is provided to the assessee, under the license agreement are asfollows :i) The assessee is not entitled to use the software for ASP Services onbehalf of third party.ii) The assessee has no right to use, copy, duplicate or display thesoftware except as specifically provided in the agreement.iii) The assessee cannot make more copies of the software than what isspecified in the agreement.

8iv) The assessee cannot provide access to the software to any one, otherthan assessee’s employees, contractors or consultants under a writtencontract by which all of them would be bound by the terms and conditions asare applicable to the assessee on purchase of software.v) The assessee cannot sell license, distribute, pledge, lease, rent orcommercially share (including timeshare) the above software or any rightstherein.vi) The assessee cannot use the software for purposes of providing aservice bureau, including without limitation, for providing third partyhosting or third party application, integration or application service provideror any other similar service.vii) The assessee cannot modify, translate, reverse engineer, decrypt,decompile, disassemble, create directive works based on, or otherwiseattempt to discover the above mentioned software source code or underlyingideas or algorithms.9. Another important fact is that, the software has been supplied to theassessee on computer disk from outside India on FOB basis. The non-residentcompanies/parties, from whom the assessee has obtained the software, do not havea Permanent Establishment in India. The first appellate authority extracted theoperative part of the license agreement at para 2.3 page 9 and 10 of her order inAppeal No.CIT(A)-XXXI/DDIT(IT)2(1)IT-303/02-03/07-08 dated 29-10-2007which is extracted for ready reference as these would demonstrate the generalterms and conditions, which have been summarized in para 8 above :

9“1. License……….Capitalized terms used herein shall have the meaning set forth on the CoverPages and as set forth herein, including the last section hereof entitled“Definitions”. TIBCO hereby grants Licenses a non-exclusive, perpetual,irrevocable (except in the event of a material breach of the Agreement),royalty free, worldwide license to use the number of copies of TIBCOSoftware set forth on the Cover Pages at Licensee’s premises, solely forLicensee’s own internal operations, including use of the TIBCO Software asits backend infrastructure for application service provider services (“ASPServices”) and Web Housing services, where the TIBCO Software is notdirectly accessible to any third party utilizing the ASP Services and WebHousing provided, however, that in no event may Licensee use the TIBCOSoftware for purposes of providing ASP Services on behalf of a third party.No right to use, copy, duplicate or display the TIBCO Software is granted,except as expressly provided herein.2. Limits…………….Licensee agrees not to (directly or indirectly, and in whole or in part): (a)make more copies of the TIBCO Software than the number of copies, exceptfor a reasonable number of copies for backup and archival purposes; (b)provide access to the TIBCO Software to anyone other than Licensee’semployees, contractors, or consultants under written contract with Licenseeagreeing to be bound by terms at least as protective of TIBCO as those inthis Agreement (“Authorized Users”; (c) sublicense, distribute pledge, lease,rent, or commercially share (including timeshare) the TIBCO Software orany of Licensee’s rights herein;(d) except as provided in Section 1 above,use the TIBCO Software for purposes of providing a service bureau,including without limitation, providing third party hosting, or third-partyapplication integration or application service provider type services, or forany similar services; (e) use the TIBCO Software in connection with anyultra-hazardous activity, or any other activity for which its failure mightresult in serious property damage, or death or serious bodily injury; or (f)modify, translate, reverse engineer, decrypt, decompile, disassemble, cratederivative works based on, or otherwise attempt to discover the TIBCOSoftware source code or underlying ideas or algorithms.

103. Limited WarrantiesTIBCO warrants that; (a) for thirty days following initial delivery of theTIBCO Software to Licensee, the unmodified TIBCO Software, undernormal us on the Platform for which it is intended, will perform all materialfunctions described in its documentation. (b) that TIBCO has the right togrant the licenses and other rights set forth herein, and (c) apart from thelicense keys the TIBCO Software licensed as of the Effective Date (and allupdates made available from time to time) will be free of any code whichallows a remote disabling of the TIBCO Software and TIBCO will notintentionally interfere with Licensee’s use of the Software. If a defect isreported to TIBCO during such thirty-day period. TIBCO may either repairaccording to the Silver program severity level as defined in the MaintenanceAddendum and the Cover Pages or replace the TIBCO Software or failingboth, provide Licensee with a full refund. In the event of a refund, thisAgreement shall terminate. In the event a refund is provided for asubsequent license purchase of other TIBCO Software, this Agreement willonly terminate with regard to those licensed copies, TIBCO shall resolveclaims related to (b) in the manner provided in the Section entitled“indemnity”. The foregoing shall be Licensee’s sole and exclusive remediesand the entire liability of TIBCO and its licensors for any breach of theselimited warranties under (a) NO TIBCO AGENT OR EMPLOYEE ISAUTHORIZED TO MAKE ANY MODIFICATIONS, EXTENSIONS ORADDITIONS TO <strong>THE</strong>SE LIMITED WARRANTIES.EXCEPT AS PROVIDED ABOVE <strong>THE</strong> TIBCO SOFTWARE ANDSERVICES ARE PROVIDED “AS IS” AND ALL O<strong>THE</strong>R EXPRESS ORIMPLIED CONDITIONS, REPRESENTATIONS AND WARRANTIES<strong>IN</strong>CLUD<strong>IN</strong>G, WITHOUT LIM<strong>ITAT</strong>ION ANY IMPLIED WARRANTYOR MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE(EVEN IF <strong>IN</strong>FORMED OF SUCH PURPOSE), OR ARIS<strong>IN</strong>G FROM ACOURSE OF DEAL<strong>IN</strong>G, USAGE, OR TRAE PRACTICE, ARE HEREBYEXCLUDED TO <strong>THE</strong> EXTENT ALLOWED BY APPLICABLE LAW.NO WARRANTY IS MADE THAT <strong>THE</strong> TIBCO SOFTWARE’SFUNCTIONALITY OR SERVICES WILL MEET LICENSEE’SREQUIREMENTS, OR THAT <strong>THE</strong> OPERATION OF <strong>THE</strong> TIBCOSOFTWARE OR SERVICES WILL BE UN<strong>IN</strong>TERRUPTED OR ERROR-FREE.”

12purchased a copy of the copyrighted article, namely, a computer programmewhich was called “software “. Therefore, the remittance made by theappellant for purchase of software was not an income in India, hence no taxwas to be deducted in India under section 195 of the Act.”In this decision, the Tribunal has dealt with all the issues raised by the AO in hisorder, such as applicability of section 9(1)(vi), as to whether it is a ‘Patent’,invention or whether it is an intellectual property and all the issues were concludedin favour of the interpretation that, the payment for purchase of software, cannotbe brought under any of these terms so as to label it as a ‘Royalty’.The Delhi Sppecial Bench of the Tribunal in the case of Motorola Inc vs. DCIT 95ITD 269 (S.B.) in the following paras held as follows :“155. It appears to us from a close examination of the manner in which thecase has proceeded before the Income-tax authorities and the argumentsaddressed before us that the crux of the issue is whether the payment is for acopyright or for a copyrighted article. If it is for copyright, it should beclassified as royalty both under the Income-tax Act and under the DTAAand it would be taxable in the hands of the assessee on that basis. If thepayments is really for a copyrighted article, then it only represents thepurchase price of the article and therefore, cannot be considered as royaltyeither under the Act or under the DTAA. This issue really is the key to theentire controversy and we may now proceed to address this issue.156 We must look into the meaning of the word “copyright” as given in theCopyright Act, 1957 Section 14 of this Act defines “Copyright” as “theexclusive right subject to the Provisions of this Act, to do or authorize thedoing of any of the following acts in respect of a work or any substantial partthereof, namely:(a) in the case of a literary, dramatic or musical work, not being acomputer programme,-

13(i) to reproduce the work in any material form includingthe storing of it in any medium by electronic means:(ii) to issue copies of the work to the public not beingcopies already in circulation;(iii) to perform the work in public, or communicate it tothe public;(iv) to make any cinematograph film or sound recordingin respect of the work;(v) to make any translation of the work;(vi) to make any adaptation of the work;(vii) to do, in relation to a translation or an adaptation ofthe work, any of the acts specified in relation to the workin sub-clauses (i) to (vi);(b) in the case of a computer programme,-(i) to do any of the acts specified in Cl. (a);(ii) to sell or give on commercial rental for sale or forcommercial rental any copy of the computer programme;Provided that such commercial rental does not apply in respect of computerprogrammes where the programme itself is not the essential object of therental,(c) in the case of an artistic work,-(i) to reproduce the work in any material form includingdepiction in three dimensions of a two dimensional workor in two-dimensions of a three-dimensional work;

14(ii) to communicate the work to the public;(iii) to issue copies of the work to the public not beingcopies already in circulation;(iv) to include the work in any cinematograph film;(v) to make any adaptation of the work;(vi) to do in relation to an adaptation of the work any ofthe acts specified in relation to the work in sub-clause (i)to (iv);(d) in the case of cinematograph film,-(i) to make a copy of the film, including a photograph ofany image forming part thereof;(ii) to sell or give on hire, or offer for sale or hire, anycopy of the film, regardless of whether such copy hasbeen sold or given on hire on earlier occasions;(iii) to communicate the film to the public;(e) in the case of a sound recording,-(i) to make any other sound recording embodying it;(ii) to sell or give on hire, or offer for sale or hire, anycopy of the sound recording regardless of whether suchcopy has been sold or given on hire on earlier occasions;(iii) to communicate the sound recording to the public.Explanation – For the purposes of this section, a copy which has been soldonce shall be deemed to be a copy already in circulation.”

15It is clear from the above definition that a computer programme mentionedin clause (b) of the section has all the rights mentioned in clause (a) and inaddition also the right to sell or give on commercial rental or offer for sale orfor commercial rental any copy of the computer programme. This additionalright was substituted w.e.f. 15.1.2000. The difference between the earlierprovision and the present one is not of any relevance. What is to be noted isthat the right mentioned in sub-clause (ii) of clause (b) of Section 14 isavailable only to the owner of the computer programme. It follows that ifany of the cellular operators does not have any of the rights mentioned inclauses (a) and (b) of section 14, it would mean that it does not have anyright in a copyright. In that case, the payment made by the cellular operatorcannot be characterized as royalty either under the Income-tax Act or underthe DTAA. The question, therefore, to be answered is whether any of theoperators can exercise any of the rights mentioned in the above provisionswith reference to the software supplied by the assessee.Further, the Delhi Special Bench of <strong>ITAT</strong> in paras 162, 168 and 169 held asfollows:162. A conjoint reading of the terms of the supply contract and theprovisions of the Copyright Act, 1957 clearly shows that the cellularoperator cannot exploit the computer software commercially which is thevery essence of a copyright. In other words a holder of a copyright ispermitted to exploit the copyright commercially and if he is not permitted todo so then what he has acquired cannot be considered as a copyright. In thatcase, it can only be said that he has acquired a copyrighted article. A smallexample may clarify the position. The purchaser of a book on income-taxacquires only a copyrighted article. On the other hand, a recording companywhich has recorded a vocalist has acquired the copyright in the musicrendered and is, therefore, permitted to exploit the recording commercially.In this case the music recording company has not merely acquired acopyrighted article in the form of a recording, but has actually acquired acopyright to reproduce the music and exploit the same commercially. In the

16present case what JTM or any other cellular operator has acquired under thesupply contract is only the copyrighted software, which is an article by itselfand not any copyright therein.168. The actual regulations bring out the distinction very clearly between thecopyright right and a copyrighted article. They also specify the four rightswhich, if acquired by the transferee, constitute him the owner of a copyrightright. They are:(a) The right to make copies of the computer programme for purposesof distribution to the public by sale or other transfer of ownership, orby rental, lease, or lending.(ii) The right to prepare derivative computer programmes based uponthe copyrighted computer programme(iii) The right to make a public performance of the computerprogramme.(iv) The right to publically display the computer programme.169. A copyrighted article has been defined in the regulation (page 147 ofthe paper book) as including a copy of a computer programme from whichthe work can be perceived, reproduced or otherwise communicated eitherdirectly or with the aid of a machine or device. The copy of the programmemay be fixed in the magnetic medium of a floppy disc or in the mainmemory or hard drive of a computer or in any other medium.Finally, the Special Bench of <strong>ITAT</strong>, Delhi, in para No. 184 concluded as follows :184. In view of the foregoing discussion, we hold that the software suppliedwas a copyrighted article and not a copyright right, and the paymentreceived by the assessee in respect of the software cannot be considered asroyalty either under the Income-tax Act or the DTAA .

17The tests laid down in para 168 of the decisionwhen applied to the terms andconditions stated in para 8 of his order, we have to hold that the payment is for acopyrighted article and not for copyright itself. Similarly, the AO’s observation onwhich it is a Patent, invention etc. have been dealt in this order. Applying thisbinding order to the facts of the case, we have to hold that the payment made bythe assessee in respect of the software cannot be considered a ‘royalty’ either underthe Income-tax Act or under the DTAA. Once it is not “Royalty” under theIncome-tax Act, the assessee has to succeed and it has to be held that no Tax needto be deducted at source, as the payment is “business income” of the partyreceiving the payment, as that non-resident party does not have a PermanentEstablishment in India, as per the D.T.A.A.. The question of taxing the same inIndia does not arise. All the issues raised by the AO have also been dealt with inthese cases.Though we have held that the assessee has to succeed under the IndianIncome tax itself and hence there is no requirement of examining the term‘Royalty’ under the Indo-US DTAA, as we have heard the parties on this issuealso, we hold as follows :The definition of the term “Royalty” under the Indo-USA D.T.A.A. is as under :The term ‘Royalties” as used in this Article 12(3) means:(a) Payments of any kind received as consideration for the use of, or right touse, any copyright of a literary, artistic to use, any copyright of a literact,artistic or scientific work, including cinematograph, films or work onfilms, tapes or other means of reproduction for use in connection withradio or television broadcasting, any patent, trademark, design or model,

18plan, secret formula or process or for information concerning industrial,commercial or scientific experience, including gains derived from thealienation of any such rights or properly which are contingent on theproductivity, or use or disposition thereof, and(b) Payments of any kind received as a consideration for the use of, or theright to use any industrial, commercial or scientific equipment, other thanpayments derived by an enterprise described in Para 1 or art. 8(Shippingand Air Transport) from activities described in Para 2(c) or 3 art. 8.This definition is much narrower and restricted than the definition of “Royalty”under the Income-tax Act. In the case of Samsung Electronic co. Ltd. (supra) theBench has considered this issue and had given a finding, that under the Indo-USDTAA, payment made for a copyrighted article is not “Royalty” and that onlyArticle ‘7’ is attractedThe Bangalore A-Bench of Tribunal in the case of Hewlett-Packard (India)(P) Ltd.vs. ITO 5 SOT 660 (Bang) held as follows :“ Section 9(1)(vi) provides that royalty receivable by a non-resident from aperson in India is deemed to accrue or arise in India. Further, section 90(2)provides that if the provisions of Tax Treaty between India and the countryof the non-resident are more beneficial to such non-resident, then theprovisions of Tax Treaty shall override the provisions of the Act [para 6).Article 12(3) of the India-USA DTAA defines the term ‘royalty’. As per theIndia-USA DTAA royalty in respect of the subject-matter of a copyrightincludes only the payments for the use i.e., exploitation of the copyright ofsuch literary/artistic or scientific work. Therefore, in order to be classified asroyalty, the right of the person in possession of the subject-matter of acopyright should be to utilize such copyright in the manner which isotherwise protected by the respective copyright law in favour of the ownerof the copyright. The use of a copyright of a copyrighted work is differentfrom use of such work itself. The acquisition of a product, wherein thesubject-matter of copyright is embedded, without right to exploit the

19copyright, does not amount to use or right to use the copyright of suchliterary/artistic/scientific i.e., copyrighted work [para 6].Further, as per clause 13.1 of the OECD model commentary, payments madefor acquisition of partial rights in copyright would represent a royalty wherethe consideration is for the right to use the programmes in a manner thatwould, without such license, constitute an infringement of the copyright. Inother words, the payment can constitute royalty only if the transferor grantsto the transferee the right to use the copyright of the product. If, on the otherhand, the use of the programmes by the transferee (by acquiring a copy ofsuch programme) is in a manner which does not constitute infringement ofthe copyright, the payment therefor would not amount to royalty.Therefore, under the OECD model commentary also payments for acquiringa copy of a computer programme would not be treated as payments for rightto use the copyright in the computer programmes. Accordingly suchpayments are to be considered s commercial income under article 7 and notas royalty under article 12 of the India-USA DTAA [paras 6.2 and 6.3].Further, the computer programme may be copyright as intellectual propertydoes not alter the fact that once in the form of a floppy disc or other medium,the programme is tangible, movable and available in the market place. Thefact that some programmes may be tailored for specific purposes need notalter their status as ‘goods’ because the code definition included ‘speciallymanufactured goods’’. In the case of Tata Consultancy Services v. State ofAndhra Pradesh [2004] 271 ITR 401 / 141 Taxman 132 the Apex Court afterciting several decisions of the Courts of the USA has noted that acquisitionof a copy of computer programmes, which is a copyrighted article, amountsto sale of such article [para 6.7].Therefore, the payment made by the assessee to ‘H’ was not in the nature ofroyalty but was subject-matter of article 7 of the India-USA DTAA. Furtherit was an admitted fact that H, did not have any permanent establishment inIndia. Therefore, the assessee had no obligation to deduct tax at source onsuch payments made to H, USA. Therefore, the claim of the assessee wasliable to be allowed.[para 6.8].Applying these propositions to the facts of the case, we uphold the order of the firstappellate authority wherein it is held that :

20a) It is now established law that Computer software after being put on to amedia and then sold, becomes goods like any other Audio Cassette orpainting on canvas or a book and that the AO is wrong in holding thatComputer software on a media, continues to be an intellectual propertyright and that the AO was wrong in treating this computer software as a“Patent” or as “Invention”. Thus the payment cannot be termed as“Royalty”.b) That the definition of the term ‘Royalty’ in article 12(3) of the Indo-USDTAA is more restrictive than what is provided in section 9(1)(vii) of theIncome-tax Act, 1961 and that in such a situation the provisions of theDouble Taxation Avoidance Agreement override the domestic law.c) That the assessee has purchased a copyrighted article and not thecopyright itself. There is no transfer of any part of copyright.d) As what is paid is not “royalty” under the Indo-US DTAA, and as it iscovered under Article 7, which deals with “Business Profit” and as theforeign party does not have a Permanent Establishment in India, the sameis not taxable in India and hence the assessee is not required to deduct taxat source from the said payment.13. In view of the above discussion, we uphold the order of the firstappellate authority and dismiss these appeals of the Revenue.

2114. In the result, all the appeals filed by the Revenue are dismissed.Order pronounced in the open court on 29 th Oct. , 2010.Sd/-(R.V. Easwar)PresidentSd/-(J. Sudhakar Reddy)Accountant MemberMumbai,Dated: 29 th Oct., 2010.WakodeCopy to :1. Appellant2. Respondent3. C.I.T.4. CIT(A)5. DR, L-Bench(True copy)By OrderAsstt. Registrar,<strong>ITAT</strong>, Mumbai Benches,Mumbai.Wakode