Annual Report 2006 - Munters

Annual Report 2006 - Munters

Annual Report 2006 - Munters

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

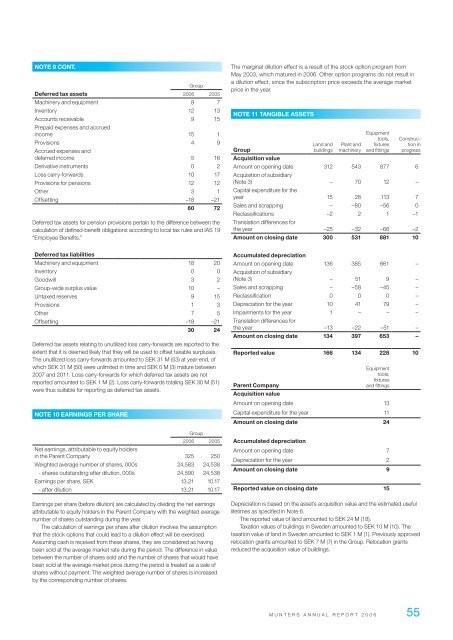

NOTE 9 Cont.GroupDeferred tax assets <strong>2006</strong> 2005Machinery and equipment 8 7Inventory 12 13Accounts receivable 9 15Prepaid expenses and accruedincome 15 1Provisions 4 9Accrued expenses anddeferred income 5 16Derivative instruments 0 2Loss carry-forwards 10 17Provisions for pensions 12 12Other 3 1Offsetting –18 –2160 72Deferred tax assets for pension provisions pertain to the difference between thecalculation of defined-benefit obligations according to local tax rules and IAS 19“Employee Benefits.”The marginal dilution effect is a result of the stock option program fromMay 2003, which matured in <strong>2006</strong>. Other option programs do not result ina dilution effect, since the subscription price exceeds the average marketprice in the year.NOTE 11 TANGIBLE ASSETSGroupAcquisition valueLand andbuildingsPlant andmachineryEquipmenttools,fixturesand fittingsConstructioninprogressAmount on opening date 312 543 877 6Acquisition of subsidiary(Note 3) – 70 12 –Capital expenditure for theyear 15 28 113 7Sales and scrapping – –80 –56 0Reclassifications –2 2 1 –1Translation differences forthe year –25 –32 –66 –2Amount on closing date 300 531 881 10Deferred tax liabilitiesMachinery and equipment 18 20Inventory 0 0Goodwill 3 2Group-wide surplus value 10 –Untaxed reserves 9 15Provisions 1 3Other 7 5Offsetting –18 –2130 24Deferred tax assets relating to unutilized loss carry-forwards are reported to theextent that it is deemed likely that they will be used to offset taxable surpluses.The unutilized loss carry-forwards amounted to SEK 31 M (53) at year-end, ofwhich SEK 31 M (50) were unlimited in time and SEK 0 M (3) mature between2007 and 2011. Loss carry-forwards for which deferred tax assets are notreported amounted to SEK 1 M (2). Loss carry-forwards totaling SEK 30 M (51)were thus suitable for reporting as deferred tax assets.NOTE 10 EARNINGS PER SHAREGroup<strong>2006</strong> 2005Net earnings, attributable to equity holdersin the Parent Company 325 250Weighted average number of shares, 000s 24,583 24,538- shares outstanding after dilution, 000s 24,590 24,538Earnings per share, SEK 13.21 10.17- after dilution 13.21 10.17Earnings per share (before dilution) are calculated by dividing the net earningsattributable to equity holders in the Parent Company with the weighted averagenumber of shares outstanding during the year.The calculation of earnings per share after dilution involves the assumptionthat the stock options that could lead to a dilution effect will be exercised.Assuming cash is received from these shares, they are considered as havingbeen sold at the average market rate during the period. The difference in valuebetween the number of shares sold and the number of shares that would havebeen sold at the average market price during the period is treated as a sale ofshares without payment. The weighted average number of shares is increasedby the corresponding number of shares.Accumulated depreciationAmount on opening date 136 385 661 –Acquisition of subsidiary(Note 3) – 51 9 –Sales and scrapping – –58 –45 –Reclassification 0 0 0 –Depreciation for the year 10 41 79 –Impairments for the year 1 – – –Translation differences forthe year –13 –22 –51 –Amount on closing date 134 397 653 –<strong>Report</strong>ed value 166 134 228 10Parent CompanyAcquisition valueEquipmenttools,fixturesand fittingsAmount on opening date 13Capital expenditure for the year 11Amount on closing date 24Accumulated depreciationAmount on opening date 7Depreciation for the year 2Amount on closing date 9<strong>Report</strong>ed value on closing date 15Depreciation is based on the asset’s acquisition value and the estimated usefullifetimes as specified in Note 6.The reported value of land amounted to SEK 24 M (18).Taxation values of buildings in Sweden amounted to SEK 10 M (10). Thetaxation value of land in Sweden amounted to SEK 1 M (1). Previously approvedrelocation grants amounted to SEK 7 M (7) in the Group. Relocation grantsreduced the acquisition value of buildings.M U N T E R S A N N U A L R E P O R T 2 0 0 6 55