Schedules forming part of the Financial ... - Thomas Cook India

Schedules forming part of the Financial ... - Thomas Cook India

Schedules forming part of the Financial ... - Thomas Cook India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SCHEDULE “Q” : NOTES TO THE FINANCIAL STATEMENTS<br />

<strong>Thomas</strong> <strong>Cook</strong> (<strong>India</strong>) Limited<br />

<strong>Schedules</strong> <strong>forming</strong> <strong>part</strong> <strong>of</strong> <strong>the</strong> <strong>Financial</strong> Statements<br />

for <strong>the</strong> year ended 31st December, 2011<br />

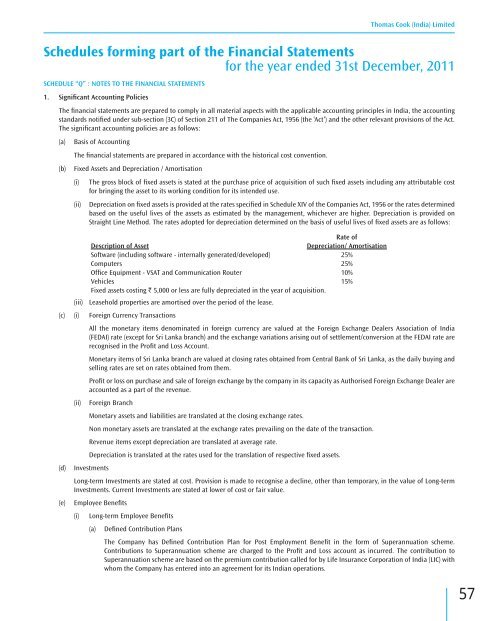

1. Significant Accounting Policies<br />

The financial statements are prepared to comply in all material aspects with <strong>the</strong> applicable accounting principles in <strong>India</strong>, <strong>the</strong> accounting<br />

standards notified under sub-section (3C) <strong>of</strong> Section 211 <strong>of</strong> The Companies Act, 1956 (<strong>the</strong> ‘Act’) and <strong>the</strong> o<strong>the</strong>r relevant provisions <strong>of</strong> <strong>the</strong> Act.<br />

The significant accounting policies are as follows:<br />

(a) Basis <strong>of</strong> Accounting<br />

The financial statements are prepared in accordance with <strong>the</strong> historical cost convention.<br />

(b) Fixed Assets and Depreciation / Amortisation<br />

(i) The gross block <strong>of</strong> fixed assets is stated at <strong>the</strong> purchase price <strong>of</strong> acquisition <strong>of</strong> such fixed assets including any attributable cost<br />

for bringing <strong>the</strong> asset to its working condition for its intended use.<br />

(ii) Depreciation on fixed assets is provided at <strong>the</strong> rates specified in Schedule XIV <strong>of</strong> <strong>the</strong> Companies Act, 1956 or <strong>the</strong> rates determined<br />

based on <strong>the</strong> useful lives <strong>of</strong> <strong>the</strong> assets as estimated by <strong>the</strong> management, whichever are higher. Depreciation is provided on<br />

Straight Line Method. The rates adopted for depreciation determined on <strong>the</strong> basis <strong>of</strong> useful lives <strong>of</strong> fixed assets are as follows:<br />

Description <strong>of</strong> Asset<br />

Rate <strong>of</strong><br />

Depreciation/ Amortisation<br />

S<strong>of</strong>tware (including s<strong>of</strong>tware - internally generated/developed) 25%<br />

Computers 25%<br />

Office Equipment - VSAT and Communication Router 10%<br />

Vehicles 15%<br />

Fixed assets costing ` 5,000 or less are fully depreciated in <strong>the</strong> year <strong>of</strong> acquisition.<br />

(iii) Leasehold properties are amortised over <strong>the</strong> period <strong>of</strong> <strong>the</strong> lease.<br />

(c) (i) Foreign Currency Transactions<br />

All <strong>the</strong> monetary items denominated in foreign currency are valued at <strong>the</strong> Foreign Exchange Dealers Association <strong>of</strong> <strong>India</strong><br />

(FEDAI) rate (except for Sri Lanka branch) and <strong>the</strong> exchange variations arising out <strong>of</strong> settlement/conversion at <strong>the</strong> FEDAI rate are<br />

recognised in <strong>the</strong> Pr<strong>of</strong>it and Loss Account.<br />

Monetary items <strong>of</strong> Sri Lanka branch are valued at closing rates obtained from Central Bank <strong>of</strong> Sri Lanka, as <strong>the</strong> daily buying and<br />

selling rates are set on rates obtained from <strong>the</strong>m.<br />

Pr<strong>of</strong>it or loss on purchase and sale <strong>of</strong> foreign exchange by <strong>the</strong> company in its capacity as Authorised Foreign Exchange Dealer are<br />

accounted as a <strong>part</strong> <strong>of</strong> <strong>the</strong> revenue.<br />

(ii) Foreign Branch<br />

Monetary assets and liabilities are translated at <strong>the</strong> closing exchange rates.<br />

Non monetary assets are translated at <strong>the</strong> exchange rates prevailing on <strong>the</strong> date <strong>of</strong> <strong>the</strong> transaction.<br />

Revenue items except depreciation are translated at average rate.<br />

Depreciation is translated at <strong>the</strong> rates used for <strong>the</strong> translation <strong>of</strong> respective fixed assets.<br />

(d) Investments<br />

Long-term Investments are stated at cost. Provision is made to recognise a decline, o<strong>the</strong>r than temporary, in <strong>the</strong> value <strong>of</strong> Long-term<br />

Investments. Current Investments are stated at lower <strong>of</strong> cost or fair value.<br />

(e) Employee Benefits<br />

(i) Long-term Employee Benefits<br />

(a) Defined Contribution Plans<br />

The Company has Defined Contribution Plan for Post Employment Benefit in <strong>the</strong> form <strong>of</strong> Superannuation scheme.<br />

Contributions to Superannuation scheme are charged to <strong>the</strong> Pr<strong>of</strong>it and Loss account as incurred. The contribution to<br />

Superannuation scheme are based on <strong>the</strong> premium contribution called for by Life Insurance Corporation <strong>of</strong> <strong>India</strong> (LIC) with<br />

whom <strong>the</strong> Company has entered into an agreement for its <strong>India</strong>n operations.<br />

57