Schedules forming part of the Financial ... - Thomas Cook India

Schedules forming part of the Financial ... - Thomas Cook India

Schedules forming part of the Financial ... - Thomas Cook India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

6<br />

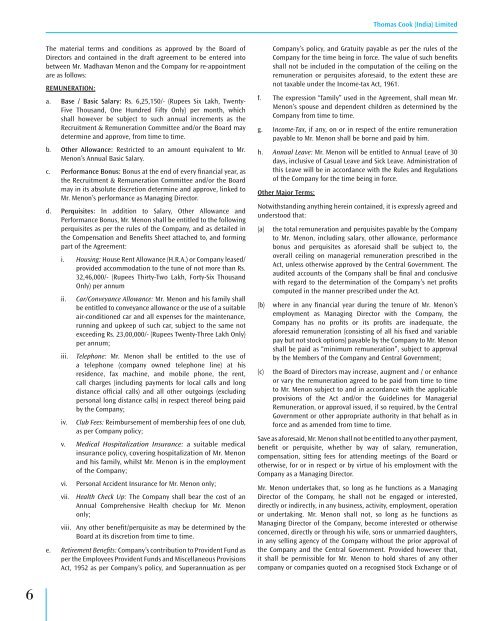

The material terms and conditions as approved by <strong>the</strong> Board <strong>of</strong><br />

Directors and contained in <strong>the</strong> draft agreement to be entered into<br />

between Mr. Madhavan Menon and <strong>the</strong> Company for re-appointment<br />

are as follows:<br />

REMUNERATION:<br />

a. Base / Basic Salary: Rs. 6,25,150/- (Rupees Six Lakh, Twenty-<br />

Five Thousand, One Hundred Fifty Only) per month, which<br />

shall however be subject to such annual increments as <strong>the</strong><br />

Recruitment & Remuneration Committee and/or <strong>the</strong> Board may<br />

determine and approve, from time to time.<br />

b. O<strong>the</strong>r Allowance: Restricted to an amount equivalent to Mr.<br />

Menon’s Annual Basic Salary.<br />

c. Performance Bonus: Bonus at <strong>the</strong> end <strong>of</strong> every financial year, as<br />

<strong>the</strong> Recruitment & Remuneration Committee and/or <strong>the</strong> Board<br />

may in its absolute discretion determine and approve, linked to<br />

Mr. Menon’s performance as Managing Director.<br />

d. Perquisites: In addition to Salary, O<strong>the</strong>r Allowance and<br />

Performance Bonus, Mr. Menon shall be entitled to <strong>the</strong> following<br />

perquisites as per <strong>the</strong> rules <strong>of</strong> <strong>the</strong> Company, and as detailed in<br />

<strong>the</strong> Compensation and Benefits Sheet attached to, and <strong>forming</strong><br />

<strong>part</strong> <strong>of</strong> <strong>the</strong> Agreement:<br />

i. Housing: House Rent Allowance (H.R.A.) or Company leased/<br />

provided accommodation to <strong>the</strong> tune <strong>of</strong> not more than Rs.<br />

32,46,000/- (Rupees Thirty-Two Lakh, Forty-Six Thousand<br />

Only) per annum<br />

ii. Car/Conveyance Allowance: Mr. Menon and his family shall<br />

be entitled to conveyance allowance or <strong>the</strong> use <strong>of</strong> a suitable<br />

air-conditioned car and all expenses for <strong>the</strong> maintenance,<br />

running and upkeep <strong>of</strong> such car, subject to <strong>the</strong> same not<br />

exceeding Rs. 23,00,000/- (Rupees Twenty-Three Lakh Only)<br />

per annum;<br />

iii. Telephone: Mr. Menon shall be entitled to <strong>the</strong> use <strong>of</strong><br />

a telephone (company owned telephone line) at his<br />

residence, fax machine, and mobile phone, <strong>the</strong> rent,<br />

call charges (including payments for local calls and long<br />

distance <strong>of</strong>ficial calls) and all o<strong>the</strong>r outgoings (excluding<br />

personal long distance calls) in respect <strong>the</strong>re<strong>of</strong> being paid<br />

by <strong>the</strong> Company;<br />

iv. Club Fees: Reimbursement <strong>of</strong> membership fees <strong>of</strong> one club,<br />

as per Company policy;<br />

v. Medical Hospitalization Insurance: a suitable medical<br />

insurance policy, covering hospitalization <strong>of</strong> Mr. Menon<br />

and his family, whilst Mr. Menon is in <strong>the</strong> employment<br />

<strong>of</strong> <strong>the</strong> Company;<br />

vi. Personal Accident Insurance for Mr. Menon only;<br />

vii. Health Check Up: The Company shall bear <strong>the</strong> cost <strong>of</strong> an<br />

Annual Comprehensive Health checkup for Mr. Menon<br />

only;<br />

viii. Any o<strong>the</strong>r benefit/perquisite as may be determined by <strong>the</strong><br />

Board at its discretion from time to time.<br />

e. Retirement Benefits: Company’s contribution to Provident Fund as<br />

per <strong>the</strong> Employees Provident Funds and Miscellaneous Provisions<br />

Act, 1952 as per Company’s policy, and Superannuation as per<br />

<strong>Thomas</strong> <strong>Cook</strong> (<strong>India</strong>) Limited<br />

Company’s policy, and Gratuity payable as per <strong>the</strong> rules <strong>of</strong> <strong>the</strong><br />

Company for <strong>the</strong> time being in force. The value <strong>of</strong> such benefits<br />

shall not be included in <strong>the</strong> computation <strong>of</strong> <strong>the</strong> ceiling on <strong>the</strong><br />

remuneration or perquisites aforesaid, to <strong>the</strong> extent <strong>the</strong>se are<br />

not taxable under <strong>the</strong> Income-tax Act, 1961.<br />

f. The expression “family” used in <strong>the</strong> Agreement, shall mean Mr.<br />

Menon’s spouse and dependent children as determined by <strong>the</strong><br />

Company from time to time.<br />

g. Income-Tax, if any, on or in respect <strong>of</strong> <strong>the</strong> entire remuneration<br />

payable to Mr. Menon shall be borne and paid by him.<br />

h. Annual Leave: Mr. Menon will be entitled to Annual Leave <strong>of</strong> 30<br />

days, inclusive <strong>of</strong> Casual Leave and Sick Leave. Administration <strong>of</strong><br />

this Leave will be in accordance with <strong>the</strong> Rules and Regulations<br />

<strong>of</strong> <strong>the</strong> Company for <strong>the</strong> time being in force.<br />

O<strong>the</strong>r Major Terms:<br />

Notwithstanding anything herein contained, it is expressly agreed and<br />

understood that:<br />

(a) <strong>the</strong> total remuneration and perquisites payable by <strong>the</strong> Company<br />

to Mr. Menon, including salary, o<strong>the</strong>r allowance, performance<br />

bonus and perquisites as aforesaid shall be subject to, <strong>the</strong><br />

overall ceiling on managerial remuneration prescribed in <strong>the</strong><br />

Act, unless o<strong>the</strong>rwise approved by <strong>the</strong> Central Government. The<br />

audited accounts <strong>of</strong> <strong>the</strong> Company shall be final and conclusive<br />

with regard to <strong>the</strong> determination <strong>of</strong> <strong>the</strong> Company’s net pr<strong>of</strong>its<br />

computed in <strong>the</strong> manner prescribed under <strong>the</strong> Act.<br />

(b) where in any financial year during <strong>the</strong> tenure <strong>of</strong> Mr. Menon’s<br />

employment as Managing Director with <strong>the</strong> Company, <strong>the</strong><br />

Company has no pr<strong>of</strong>its or its pr<strong>of</strong>its are inadequate, <strong>the</strong><br />

aforesaid remuneration (consisting <strong>of</strong> all his fixed and variable<br />

pay but not stock options) payable by <strong>the</strong> Company to Mr. Menon<br />

shall be paid as “minimum remuneration”, subject to approval<br />

by <strong>the</strong> Members <strong>of</strong> <strong>the</strong> Company and Central Government;<br />

(c) <strong>the</strong> Board <strong>of</strong> Directors may increase, augment and / or enhance<br />

or vary <strong>the</strong> remuneration agreed to be paid from time to time<br />

to Mr. Menon subject to and in accordance with <strong>the</strong> applicable<br />

provisions <strong>of</strong> <strong>the</strong> Act and/or <strong>the</strong> Guidelines for Managerial<br />

Remuneration, or approval issued, if so required, by <strong>the</strong> Central<br />

Government or o<strong>the</strong>r appropriate authority in that behalf as in<br />

force and as amended from time to time.<br />

Save as aforesaid, Mr. Menon shall not be entitled to any o<strong>the</strong>r payment,<br />

benefit or perquisite, whe<strong>the</strong>r by way <strong>of</strong> salary, remuneration,<br />

compensation, sitting fees for attending meetings <strong>of</strong> <strong>the</strong> Board or<br />

o<strong>the</strong>rwise, for or in respect or by virtue <strong>of</strong> his employment with <strong>the</strong><br />

Company as a Managing Director.<br />

Mr. Menon undertakes that, so long as he functions as a Managing<br />

Director <strong>of</strong> <strong>the</strong> Company, he shall not be engaged or interested,<br />

directly or indirectly, in any business, activity, employment, operation<br />

or undertaking. Mr. Menon shall not, so long as he functions as<br />

Managing Director <strong>of</strong> <strong>the</strong> Company, become interested or o<strong>the</strong>rwise<br />

concerned, directly or through his wife, sons or unmarried daughters,<br />

in any selling agency <strong>of</strong> <strong>the</strong> Company without <strong>the</strong> prior approval <strong>of</strong><br />

<strong>the</strong> Company and <strong>the</strong> Central Government. Provided however that,<br />

it shall be permissible for Mr. Menon to hold shares <strong>of</strong> any o<strong>the</strong>r<br />

company or companies quoted on a recognised Stock Exchange or <strong>of</strong>