Mobile Banking For Inclusive Growth - Punjab National Bank ...

Mobile Banking For Inclusive Growth - Punjab National Bank ...

Mobile Banking For Inclusive Growth - Punjab National Bank ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

vol. VI no. 1 quarterly journal january-march-2010<strong>Mobile</strong> <strong><strong>Bank</strong>ing</strong> <strong>For</strong> <strong>Inclusive</strong> <strong>Growth</strong>1

e-trackEditorPratima TrivediEditorial TeamAmbrish MishraPramod DikshitSanjay SrivastavaNidhi GoyalPrinted bye-trackDharmendra TewariSwastik Printing Press27, Mai Gi Ki Bagiya,Kapoorthala Crossing,Mahanagar, Lucknow<strong>Mobile</strong> : 9415419300punjab national bank instituteof information technologyVibhuti Khand, Gomti Nagar,Lucknow--226 010 (U.P.)T : +91 522 2721442, 2721174F : +91 522 2721201, 2721441E-mail : bankingtech@pnbiit.co.inURL : www.pnbiit.comThought for the quarterThe heights by great men reached andkept were not obtained by sudden flight.But they, while their companions slept,were toiling upward in the night.Thomas S. MonsonFrom the editorDear Readers,<strong>Mobile</strong> banking has taken off during the lastcouple of years. The widespread use of mobile phonesin our country offers a platform for financialtransactions that can facilitate financial inclusion ofpeople who would otherwise be outside the purview ofthe financial system. A combination of technology andinnovative business practices is rapidly changing theway in which people conduct financial transactions.Article “<strong>Mobile</strong> banking for <strong>Inclusive</strong> <strong>Growth</strong>” hasbeen incorporated in this volume of e track, tohighlight various issues relating to it.With a view to inter-connect the ATMs in the country and facilitate easybanking for the common man, the IDRBT conceptualized, developed andimplemented the <strong>National</strong> Financial Switch. The <strong>National</strong> Financial Switchfacilitates routing of ATM transactions through inter-connectivity between the<strong>Bank</strong>'s Switches, thereby enabling the citizens of the country to utilize anyATM of a connected bank. At present the switch has been handed over byIDRBT to NPCI. The article “<strong>National</strong> Financial Switch”throws light onvarious issues relating to it.Reserve <strong>Bank</strong> of India has come out with Standardisation andEnhancement of Security Features in Cheque <strong>For</strong>ms and prescribed certainbenchmarks towards achieving standardisation of cheques, known as CTS-2010. These specifications are added in this serving of e track to make thereaders aware of it.Special Economic Zones have become the most talked about in theIndian economic circles, but due to its ambiguous policy, it has faced strongopposition from the leftist parties, activities, farmer groups, economist andurban planner during 2006. However now it is been realized that they are thepockets of manufacturing excellence which apart from export growth andattracting FDI are contributing significantly towards the generation leading tothe increased economic growth of the country. The article “Special EconomicZones: Engines of <strong>Growth</strong>” covers various intricacies relating to it at large.Information Technology has entered every nook and corner of the<strong><strong>Bank</strong>ing</strong> Industry. Various consequences of it are covered in the article “ImpactOf Information Technology On <strong><strong>Bank</strong>ing</strong> Sector”.Hope you will savor this serving of e track ……Happy Reading…………..Pratima Trivedie-mail : pratima@pnbiit.co.inContentsFrom the pen of the Chairman 3Did you know ? Ashish Bajpai 4From the Director's desk P K Malhotra 5<strong>Mobile</strong> <strong><strong>Bank</strong>ing</strong> <strong>For</strong> <strong>Inclusive</strong> <strong>Growth</strong> Dr S N Ghosal 6<strong>National</strong> Financial Switch (NFS) Prof. (Dr.) Firdos T.Shroff 10Tips & Tweaks Piyush Mishra 12Standardisation and Enhancement of Security Features in Cheque <strong>For</strong>ms 13Special Economic Zones: Engines of <strong>Growth</strong> Anchal Singh 17Impact of Information Technology On <strong><strong>Bank</strong>ing</strong> Sector. Sadhana Misra 22Financial / Technical news 26January-March-20102

e-trackFROM THE PEN OF THE CHAIRMANShri K. R. Kamath, Chairman & Managing Director, <strong>Punjab</strong> <strong>National</strong> <strong>Bank</strong>on his visit to PNBIIT on 13th March 2010The Chairman and Managing Director of <strong>Punjab</strong> <strong>National</strong> <strong>Bank</strong> Shri K.R. Kamath visited the Instituteon 13.03.2010. His visit was marked by lighting the lamp before Devi Saraswati statue and planting of asapling in the Institutes premises. Before addressing the Sr. Executives and Incumbent In charges of branchesof <strong>Punjab</strong> <strong>National</strong> <strong>Bank</strong> in Lucknow Circle, Shri Kamath toured the PNBIIT campus and penned thefollowing in visitors' book:"I am very much impressed by the IIT and the whole setup. While I salute the leadership whichconceived this, it is now in our hands to nurture this institute and facilitate it's all round growth to make itthe premier I.T. Training institute for banking in the country. Let us all work towards this.My compliments and good wishes to the Director and the Team."1 23 4Shri KR Kamath , Chairman and Managing Director <strong>Punjab</strong> <strong>National</strong> <strong>Bank</strong> and Chairman PNBIIT lighting the lamp (1),Planting the sapling (2), Writing in the visitor's book (3) and addressing the Senior Executives and Incumbent Incharges ofLucknow Circle ( 4).He is accompanied by Shri Rohtash Kumar , FGM, Shri B L Gupta , Circle Head Lucknow, Shri PK Malhotra, Director PNBIIT,Shri Ambrish Mishra , AGM , PNBIIT, Shri Pramod Dikshit , Dy Director, PNBIIT and others.3January-March-2010

e-trackREADER'S COMMENTSI have received the latest issue (October-December' 09 ) of your Institute's quarterly journal 'e-track'and gone through the same. I have found the contents of the journal to be quite informative, not only for the<strong><strong>Bank</strong>ing</strong> fraternity but also for the readers at large. The article on Human Resource Outsourcing deservesspecial mention as organizations today are increasingly adopting HR outsourcing as a tool to gaincompetitive edge over their counterparts.I compliment the efforts put in by the editorial team of PNBIIT in bringing out this informative journal.You can tap the Space bar to scroll down on aWeb page one screenful. Add the Shift key toscroll back up.You can type just the name of the website inthe URL and press crtl + enter keys to addwww as prefix and .com as suffix.Alt + d = takes you to the address bar of mostmodern web browsers and Windows (file)explorer.Ctrl + tab to switch next tab for internetexplorer or google chrome, ctrl +t for newtab, ctrl + w to close tab.When typing out an email address, it doesn'tmatter if you're typing in CAPS or lowercase.Triple-clicking a word will highlight theentire paragraph.When jotting down notes with Windowsdandy little Notepad program (find it inAccessories), press F5 to instantly andautomatically to put time stamp your notationwith the current date and time.In Microsoft Word – Shift + F3 makes a wordchange from all uppercase to all lowercase tojust the first letter upper case and so on.USE window +L button to lock yourcomputer.Alt +enter opens a new tab for whatever youtyped in the address bar in most browsers.Alt + F4 quits the current program. IfDID YOU KNOW …….B. P. Sharma, General Manger-HR<strong>Punjab</strong> <strong>National</strong> <strong>Bank</strong>, Head Office, New Delhinothing's open, it'll bring up the shutdownoptions.Ctrl + W closes only the active window.On your keyboard,hit windows key + E to bring upwindows explorer.hit windows key + F to bring up searchwindow.Windows Key + M - Minimize allwindowsWindows Key + Shift + M - Maximizeall windowsGoogle has a language translation tool that isreal slick at translate.google. com You canselect what language to translate from and to,copy paste in the paragraph or website, andwithin a few seconds the text is translated foryou.The number of megapixels does notdetermine a camera's picture quality; that's amarketing myth. The sensor size is far moreimportant. (Use Google to find it. <strong>For</strong>example, search for “sensor size NikonD90.”)Compiled By – Ashish Bajpai, student ofAdvanced diploma in <strong><strong>Bank</strong>ing</strong> Technology(ADBT–III) PNBIIT, LucknowJanuary-March-20104

FROM THE DIRECTOR'S DESKe-trackTechnology reduces cost on one hand and enhances reach and efficiency on theother. Efficient leveraging of technology based on well defined business strategy is thekey to determine the business growth of any organisation more particularly banks.Effective implementation of technology will help the banks in taking on thecompetition successfully and furthering their achievement in the area of financialinclusion as well.Internet <strong><strong>Bank</strong>ing</strong> facilitated 'Anywhere Anytime <strong><strong>Bank</strong>ing</strong>' immensely in the last few years. However touse this channel, the customer needs a PC, internet/broadband connection and adequate computer literacy.These prerequisite coupled with perceived fear of breach of security due to phishing is posing significantchallenge in its wider and deeper acceptance.These concerns are addressed by <strong>Mobile</strong> banking because of relatively minuscule cost, convenience,ease of use and consumer confidence demonstrated by the sheer number of mobile users in the country.Consequently mobile banking or m-banking will find greater acceptance and enable mobile phone users toaccess basic financial services even when they are miles away from the nearest branch or home computer.Customers will be able access their banks on the go – be it while shopping, or waiting for their bus to work, ortraveling or simply chatting before their orders come through in a restaurant.Introduction of <strong>Mobile</strong> <strong><strong>Bank</strong>ing</strong> is sure to make 'Anywhere Anytime <strong><strong>Bank</strong>ing</strong>' a reality in true senseand spirit and enable inclusive growth.Happy <strong>Mobile</strong> <strong><strong>Bank</strong>ing</strong> to all readers.P K Malhotra(Director)pkmalhotra@pnbiit.co.in5January-March-2010

e-trackThere is no doubt that the need not only revisiting but also rewriting. In factmost popular mandate in doles and subsidies provided by the state not onlydeveloping countries is to fail to reach through such intermediation by the stateoutreach poor by creating but on the other hand weakens the self confidenceemployment opportunities and and initiative of the poor and make them more andproviding financial support to more dependent on the state as if state is next to godthe poor through state interventions. Obviously to ameliorate their misery and poverty. Thissuch intermediation often fail to reach the poor as obviously over the years have made them laggardsthese intermediaries floated by the state are loaded and fatalistic.with bureaucrats and politicians who are more proneto exploit the poor and ignorant rather than toEncourage Disintermediation To Reach ThePooroutreach the bottom of the pyramid and or to holdIt is therefore imperative to conceive tools andtheir hands in running their farms or firms and totechnologies to outreach poor with leastprovide succor to overcome calamities they oftenintermediation and creating direct accessibility toencounter. Indeed it is widely held view that ruralfinance and other support services. In fact themicro- entrepreneurs are not capable to organizerevolution in information technology has created anthemselves to conceive, run and bear risk of anyopportunity to reach directly to the customerssustainable economic enterprises and therefore theyirrespective of time and place. It has becomeneed support and hand holding by the statepossible outreach people residing in far flung ruralgovernment and or economic institutions promotedareas and has access to finance and services at anyand run by the state and people (PPP). No wondertime i.e. 24 hours. This has created new paradigmthat state policies and programs for alleviation offor financial institutions particularly banks as haspoverty are all routed through state political andbeen portrayed below.economic institutions.Failed IntermediationIt is an irony that in practice it has beenobserved that such intermediation has failed tooutreach bottom of the pyramid as because theseinstitutions are found in practice keener to fill theirpockets rather than provide succor and support to thepoor. Seibel and Parhasib and Benjamin andPiperek in their research studies (1990 & 1997) havebrought out very vividly that the traditionalapproach of funding the bottom of the pyramid onlythrough state intervention as has been generallypracticed due to perhaps the influence of Keynes'stheory of state intervention to prop up the economyJanuary-March-2010MOBILE BANKING FOR INCLUSIVE GROWTH6NEW PARADIGM:Emerging Opportunities-Dr S N GhosalPROBLEM IMPERFECT MARKET ORGANIZED MARKETROLEDEPENDING UPON STATEHELPLOWER COST & RISKBETTER ACCESSIBILITYEMERGENCE OF NEW COsTO UNDERTAKE RATINGSUSTAINABILITY IGNORED INCREASED AWARENESSEVOLUTION OF RISK ASSESSING INSTITUTIONSIt is obvious therefore that the new paradigmhas provided greater opportunity to banks andfinancial institutions to outreach rural and far flungareas to cater financial services and products to

e-trackpeople of those areas. In fact in the last decade banks In a recent study made by the POLITICALand other financial institutions have developed the AND ECONOMICS RESEARCH COUNCILdelivery technology dynamically in terms of client (PERC) of the Brookings Institution has brought outoutreach and enlarging the space. These institutions that value of non conventional data based on billparticularly banks have acquired technology payment history etc if put to use could be of somesupport like ATM , biometric security and internet value as follows:banking along with core banking and electronic 1. It would enhance the reliability of measuringmoney transfer hardware and software. This has credit risk by only 10 per cent;obviously led them to consider the possibility and2. It would also help enhancement of measuringfeasibility to introduce mobile banking. In fact somecredit score by 22.4% only.banks have already availed this facility in a limitedway to facilitate money transfer and payment Help Building Comprehensive Databasesystem. However the most asked for facility that It is obvious therefore mobile bankingmobile banking is expected to provide is reach out transactions that are presently practiced could helpvillagers to enable them to avail financial facilities to a very limited extent to measure and evaluate riskswith ease and least cost. In fact RBI is also keen to of all types banking transactions. The mostintroduce mobile banking facilities by banks. In this important challenge therefore is to make it feasibleregard it has already circulated guidelines and has to use data made available through MNO, Mset up a working group under the CHAIRPERSON banking, and M payment system should beof a deputy Governor Mrs. Thorat to find out suitable comprehensive and dependable information forstrategy to help banks to introduce this facility. credit and other financial risk assessment. ToChallenges To Be Encountereddevelop the same obviously the first step would be toasses the present gap that could not be filled by theHowever there are some difficulties indata made available though MNO and <strong>Mobile</strong>adopting such facilities; of these major one is the nonpayment facilities that are now available throughavailability of reliable data with regard to themobile phones. That would also be necessary tofinancial health and transactions of rural people. Theexamine the level of interest of all stakeholders tovolume of data the mobile network operatorsbuild comprehensive database for their use. This(MNO) usually collect on the basis user's transactionwould obviously not just one time exercise as therecords are not adequate to assess risk and provideinterest of stakeholders would vary with the growthcomprehensive banking services thoughof volume and customers and also technology totransactions like bill payment could reflect throughenhance reachable and reduce cost.its regularity, frequency and volume some idea withregard to financial capability and avidity of users ofsuch facilities. In fact that need to be collectedCase Study On <strong>Mobile</strong> <strong><strong>Bank</strong>ing</strong> In KenyaThe Project And How It Worksshould reveal not only the credit worthiness of theThe project provides commercial bankingcustomer but also their capability and capacity toservices to remote rural communities in Kenya.take risk and proneness to save and spend withinThese financial services are provided at villagetheir means.satellite centers, which are mobile banking units7January-March-2010

e-trackattached to existing branches. The units are located overall is profitable There is also clear evidence thatat strategic market centers servicing surrounding other commercial banks invillages and serve each area once or twice a week onKenya is responding to this new competitivemarket days. They provide customers with the sameenvironment. Branch closures are less common andfinancial services as in normal branches, such asbanks are focusing heavily on how to harness thedeposits and savings, money transfers, andtechnology of mobile communications to enableremittance processing and loans. The service helpstransactions and thus increase their reach Need Toto reduce congestion in banks existing branches, asDevelop Collaborative Mode <strong>For</strong> Indiawell as increases the bank's penetration. <strong>Mobile</strong>However as has been pointed out by K.C.customers pay the same rates for their transactions asCHAKRAVARTY Dy. Govern or of R.B.I.thatat branches plus a small fee for the mobile access.indeed it is a great opportunity for banks to outreachThe mobile banks consist of an all terrain four-wheelthe bottom of the pyramid but there is need todrive vehicles, are manned by 2-3 bank employeesdevelop an effective collaboration between mobilewho meet customers at designated market places onservice provider and banks. He also emphasized thatfixed days each week. Once there, the team servesit would be necessary to open accounts with the bankcustomers from buildings that have been rented outbefore bank could provide banking services andat the market places. The mobile units use solarproducts to him. In fact he has rightly raised somepower to run a computerized transaction processinglimitations of banks to fast forward this scheme.system that is directly linked to the home branchesThese are as follows:via GPS and satellite.1. <strong><strong>Bank</strong>ing</strong> technology is of recent origin andThe Innovationtherefore there is need for scaling up the sameThe mobile bank project reverses a long termand that would obviously take some time andtrend for commercial banks in Kenya to withdrawinvestment;from rural areas. Satellite centers with sufficient2. Payment facilities are only one area wherebusiness volumes can become fixed branches,banks could be active and for that also there isenabling the mobile unit to take services to new andneed to develop appropriate delivery model;more remote customers.andThis model can be easily replicated. Equity3. The recent initiative taken by RBI to permithas been approached by a number of banksbanks to appoint correspondents need to bethroughout Africa interested in understanding andtrained to the latest gadgets of mobileadopting this model for their own operations.telephony and internet banking.The ResultsIn fact he was frank enough to opine that banksThe results have been impressive. There areare laggards and therefore to expedite thenow more than 120 villages covered by mobile units,introduction of the system one has to look fora six fold increase over the original target of 20, andalternative non-bank models.the units are servicing some 40,000 new customers,Open Up Opportunities To Mfisof which nearly half are women. Average transactiontimes are 3 minutes, compared to the norm of 10 Even if one may not hold such a pessimisticminutes at normal branches. The mobile business view, it cannot be overlooked that there existJanuary-March-20108

e-trackconsiderable gap in the technology and database thathinders the development of a suitable model forbanks to reach the poor to provide comprehensivebanking services to the rural poor. In fact mobilebanking is a subset of electronic banking. It may bedefined as a method to deliver financial servicesusing mobile communication technologies such asGSM and CDMA including mobile devices such ascellular phones and personal digital assistance. Infact under M banking customer can carry out basicfinancial transactions like remittances andpayments.Recent Models Evolved <strong>For</strong> CollaborationPresently there are four types of M.bankingmodel viz. wap, sms, and pda and sim toolkit.WAP (wireless application model) is based onmicro website and the model is similar to internetbanking.SMS banking is based on GSM standardservice to exchange text messages that a customercould send to obtain information or to provide aninformation and or instruction to the banker.PDA model is designed with a mobile phone toprovide more access and to store data to enablecustomer to operate on individual software. Ittherefore helps processing loan applications also.Similarly mobile phone with SIM toolkits alsoenhances the capacity of users and banks to delivermore services.Collaboration of Internet, <strong>Mobile</strong> And <strong>Bank</strong>sHowever to make mobile banking a real toolfor disintermediation which is perhaps the primeneed in India to avoid corruption and high cost itwould be necessary to avail the latest developmentin mobiles that provide storage and internetfacilities. In this regard Google has advancedconsiderably and one would expect as the presenttrend indicates the prices of these handsets wouldcome down and become affordable. Further it wouldalso be helpful to strengthen the organizations likeFinancial information network (FINO) to buildnecessary financial portals to help banks to drawupon these as and when considered necessary.In fact it would be imperative to developbiometric ATMs along with mobile phones in theinitial stage as that would help educating the ruralyouths to become familiar with these technologiesand would not hesitate to contact directly the banksfor seeking their services and products. In this regardit is really encouraging news that banks have startedexploring the ways to leverage the UniqueIdentification Number project. In fact it isinteresting news that after meeting the officials ofUIN 14 banks and telecom companies as well asofficials of RBI had a meeting to identify a model tointegrate these innovations for inclusive growth.Latest InitiativeIt is however heartening to note that anagreement has been signed at the behest of IBAwhere it has been agreed that on a revenue sharingbasis banks could utilize 1,3 million vendor networkof mobile operators to offer mobile bankingservices. Indeed it is an happy inaugural as bankswould be able to recruit vendors of telecomoperators as their correspondents. No doubt it wouldhelp banks to enlarge their reach as thesecorrespondents would act as an agent of sale forboth. In fact this negotiation was going on for quitesome time but due to strong opposition from telecomfirms it was stalled. It is therefore surprising to findsuch sudden change of mindset of telecomoperators. But all is well that ends well.Dr S N Ghosal is retired General Managerfrom United <strong>Bank</strong> of India. He was also Adjunctfaculty of ICFAI, Business School, Kolkatta9January-March-2010

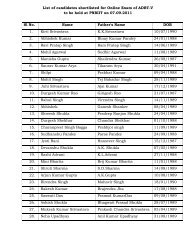

e-trackIntroduction : The list of banks connected to the NFS include :In a major step towards usheringin convenience-banking for thecitizens of the country, theIDRBT has set up the <strong>National</strong>Financial Switch (NFS). Dr.Y.V.Reddy, Shri. G.N.Bajpai, and Shri C.S.Rao,dedicated the <strong>National</strong> Financial Switch to theNation on August 27, 2004. The <strong>National</strong> FinancialSwitch has been handed over by IDRBT to NPCI.The NFS comprises a <strong>National</strong> Switch tofacilitate inter-connectivity between the <strong>Bank</strong>s'Switches and Inter-<strong>Bank</strong> Payment Gateway forauthentication & routing the payment details ofvarious e-commerce transactions, e-governmentactivities, etc.The Institute used to charge Rs. 2/- forproviding this facility of switching (routing) thetransactions of various member banks. With a viewto encouraging all banks to the join NFS networkfor widening the coverage of ATMs and therebyproviding easier access to customers as also topromote greater use of ATM as an importantpayment system infrastructure, the IDRBT waivedoff the switching fee of Rs. 2/- with effect fromDecember 3, 2007.The NFS is the largest network of sharedATMs in the country connected 28,773 ATMs of 31participating banks as on June 30, 2008 and 49,880ATMs of 37 participating banks as on December 31,2009 respectively.NATIONAL FINANCIAL SWITCH (NFS)Sl. No. <strong>Bank</strong>-Prof. (Dr.) Firdos T.ShroffNo. of ATM's1. Allahabad <strong>Bank</strong> 2112. Andhra <strong>Bank</strong> 7663. Axis <strong>Bank</strong> 37774. <strong>Bank</strong> of Baroda 12055. <strong>Bank</strong> of India 5046. <strong>Bank</strong> of Maharashtra 3457. Canara <strong>Bank</strong> 20138. Central <strong>Bank</strong> of India 4009. City Union <strong>Bank</strong> 15210. Corporation <strong>Bank</strong> 104611. Dena <strong>Bank</strong> 34612. Development Credit <strong>Bank</strong> 11313. HDFC <strong>Bank</strong> 365514. ICICI <strong>Bank</strong> 478915. IDBI <strong>Bank</strong> 113216. Indian <strong>Bank</strong> 83217. Indian Overseas <strong>Bank</strong> 58318. IndusInd <strong>Bank</strong> Limited 40719. Lakshmi Vilas <strong>Bank</strong> 15020. Oriental <strong>Bank</strong> of Commerce 89921. <strong>Punjab</strong> <strong>National</strong> <strong>Bank</strong> 280022. Standard Chartered <strong>Bank</strong> 23923. State <strong>Bank</strong> of India 1744124. Syndicate <strong>Bank</strong> 112125. Tamilnad Mercantile <strong>Bank</strong> Ltd. 13526. The Catholic Syrian <strong>Bank</strong> Ltd. 14627. The Cosmos Cooperative <strong>Bank</strong> Ltd. 8628. The Dhanalakshmi <strong>Bank</strong> Ltd. 7229. The Jammu and Kashmir <strong>Bank</strong> Ltd. 24830. The Karnataka <strong>Bank</strong> Ltd. 19431. The Karur Vysya <strong>Bank</strong> Ltd. 34132. The South Indian <strong>Bank</strong> Ltd. 28033. UCO <strong>Bank</strong> 42034. Union <strong>Bank</strong> of India 221535. United <strong>Bank</strong> of India 24636. Vijaya <strong>Bank</strong> 36737. YES <strong>Bank</strong> Ltd. 204January-March-201010

e-trackfrom April 1, 2008, customers would not pay anycharge for use of their own bank's ATMs. Use ofother banks' ATMs would also not attract any feeexcept when used for cash withdrawal for which themaximum charge levied should be brought down toRs.20 per withdrawal by March 31, 2008. All cashwithdrawals from all ATMs is offered free witheffect from April 1, 2009.The <strong>National</strong> Financial Switch (NFS),established by the IDRBT, acts as the apex levelswitch and facilitates connectivity among ATMswitches of all member banks.The RTGS system is in operation since March2004. Apart from settling inter-bank transactionsand time-critical transactions on behalf ofcustomers, it facilitates settlement of all retail paper-based and electronic clearings taking place inMumbai, and CCIL operated clearings includingthat related to the <strong>National</strong> Financial Switch (NFS)in multilateral net settlement batch mode.RTGS is open till 4.30 p.m. for customertransactions and up to 6.00 p.m. for inter-banktransactions on week days. On Saturdays, the RTGSfunctions till 12.30 p.m. for customer transactionsand till 2.00 p.m. for inter-bank transactions. Theintegration of the RTGS system with the Reserve<strong>Bank</strong>'s internal offices of the Reserve <strong>Bank</strong> as alsotransfer funds from one office to another. Thissystem has been functioning smoothly. The facilityis now available at all the 16 offices of the Reserve<strong>Bank</strong>. At present, 71 member banks are using thefacility.Reference :www.idrbt.ac.inThere is a default inter-change switching feebetween the banks, if the banks do not have theirown mutual agreements.Pricing Structure of the <strong>National</strong> FinancialSwitch is as follows:A. Cash Withdrawal1. Interchange Fees: Rs. 18/- per transaction +Service Tax as applicableB. Balance InquiryInterchange Fees: Rs. 8/- per transaction +Service Tax as applicableSettlement Charges: Rs.100/- + Service Tax asapplicable per settlement per bankThe <strong>National</strong> Financial Switch allowsconnecting directly to the individual bank's switchor through their shared ATM Network Switches. It isa win-win situation for all the banks and moreimportantly, for the customers.The Clearing Corporation of India Limited(CCIL) is the clearing and settlement agency for theswitch, which also facilitates the NFS DisasterRecovery Site from its premises at Mumbai.An NFS User Group has been set up todeliberate various issues related with theprocedures, fee, etc., and a Steering Committeeconsisting of the banks' top management resolvesvarious issues related to the <strong>National</strong> FinancialSwitch and policies from time to time.NFS vis-à-vis Automated Teller Machines(ATMs):The number of ATMs is steadily increasingand the usage of ATMs has gone up substantiallyduring the last few years. ATMs are primarily usedfor cash withdrawal and balance enquiry. It wasobserved that the service charges levied for use ofATMs were not uniform and transparent.Accordingly, the Reserve <strong>Bank</strong>, in March 2008, setguidelines for service charges. As per the guidelines,Prof. (Dr.) Firdos T. Shroff is Director,Chetana's R. K. Institute of Management & Research& Fellow, Indian Institute of <strong><strong>Bank</strong>ing</strong>& Finance, Mumbai.He can be contacted at : firdos_shroff@yahoo.com11January-March-2010

e-trackGoogle Searching just got EasierTIPS & TWEAKSToday, our working schedule is too hectic and unfortunately we have only 24 hrs, we want to searcheverything quickly. Internet is just like a sea of knowledge where we can search every thing but problem isthat where should we search and what and how should we search for better results. I am going to give yousome tips which would help in better searching.<strong>For</strong> example, I am taking words 'pnbiit', avadh and 'sachin'Sno Job Where it searches<strong>For</strong> link1searching<strong>For</strong>2 informationalsearch of site3456<strong>For</strong> file typesearch like pdf,word, doc, txt,ppt etc.<strong>For</strong> URLsearching<strong>For</strong> textsearching<strong>For</strong> titlesearchingSearches for presence of linkeverywhere in all sitesSearches for informationabout a urlSearch the sites for keywordsin specified such file formatsSearches only in URLs not inthe whole web pageSearches only in textanywhere in webpageSearches only in the title ofthe webpageCommands totype in Googlesearch Barlink:urlInfo:urlfiletype:inurl: urlintext: wordintitle:Examplelink: pnbiit.comInfo: pnbiit.comsachin filetype:pdfinurl: pnbiit.comIntext: pnbiitintitle: sachin•<strong>For</strong> more depth searching we can add any of above styles with a space .•<strong>For</strong> many word searching at a time we can use allinurl:,allintitle: etc. or allintitle: word1 word2word3 …etc. <strong>For</strong> example: allintitle: pnbiit avadh•<strong>For</strong> exact word searching the word to be searched should be taken within double quotes(“………………”).•We can use Google as a calculator. We can give mathematical expressions directly in search box.o Typing 2*2 +8 will give you the result 12.o On using the expressions along with '+' prefix, Google will search for the content of exactexpression rather than giving the result of the expression.Compiled By – Piyush Misra , student of Advanced diploma in<strong><strong>Bank</strong>ing</strong> Technlgy (ADBT–III) at PNBIIT , LucknowJanuary-March-201012

e-trackSTANDARDISATION AND ENHANCEMENT OF SECURITY FEATURES INCHEQUE FORMS(Reference : RBI/2009-10/323, DPSS, CO.CHD No 1832/04.07.05/2009-10 dated 22.02.10 - http://www.rbi.org.in)Paper-based cheque clearing continues to be one of the popular modes of initiating paymenttransactions in the country. During the period April-December 2009, clearing houses in the country haveprocessed on an average around 4.5 million cheques every day. Several measures have been initiated byReserve <strong>Bank</strong> of India to ensure that this retail payment product functions in a safe and efficient manner.Over a period of time, banks have added a variety of patterns and design of cheque forms to aidsegmentation, branding, identification, etc., as also incorporated therein a number of security features toreduce the incidence of cheque misuse, tampering, alterations, etc. Growing use of multi-city and payable-atparcheques for handling of cheques at any branches of a bank, introduction of Cheque Truncation System(CTS) at New Delhi for image-based cheque processing, increasing popularity of Speed Clearing for localprocessing of outstation cheques, etc., are a few aspects that led to looking into the need, if any, forprescription of certain minimum security features in cheques printed, issued and handled by banks andcustomers uniformly across the banking industry.Against the above backdrop, a Working Group was set-up by the Reserve <strong>Bank</strong> of India for examiningfurther standardisation of cheque forms and enhancement of security features therein. The Working Groupcomprised various stakeholders viz. commercial banks, paper manufacturers, security printers, etc., apartfrom Reserve <strong>Bank</strong> of India. Recommendations of the Working Group were discussed internally as alsoforwarded to Indian <strong>Bank</strong>s' Association (IBA), <strong>National</strong> Payments Corporation of India (NPCI) and selectbanks for their views. The feedback from these institutions has been received and duly considered.It has since been decided to prescribe certain benchmarks towards achieving standardisation ofcheques issued by banks across the country. These include provision of mandatory minimum securityfeatures on cheque forms like quality of paper, watermark, bank's logo in invisible ink, void pantograph,etc., and standardisation of field placements on cheques. In addition, certain desirable features are also beingsuggested which could be implemented by banks based on their need and risk perception. The set of minimumsecurity features would not only ensure uniformity across all cheque forms issued by banks in the country butalso help presenting banks while scrutinising / recognising cheques of drawee banks in an image-basedprocessing scenario. The homogeneity in security features is expected to act as a deterrent against chequefrauds, while the standardisation of field placements on cheque forms would enable straight-throughprocessingby use of optical / image character recognition technology.The benchmark prescriptions shall be known as "CTS-2010 standard", specifications of which arestated Next page-13January-March-2010

e-track"CTS-2010 Standard" for Cheque <strong>For</strong>ms – Specifications1. Mandatory features1.1 Paper (At Manufacturing Stage) : Status quo shall be maintained in relation to paper specificationsas it exists currently. Details of current specifications are contained in the document 'Mechanisedcheque processing using MICR technology - Procedural Guidelines', available at -http://www.rbi.org.in/ scripts/PublicationsView.aspx?id=4551.Additionally, paper should be image friendly and have protection against alterations by havingchemical sensitivity to acids, alkalis, bleaches and solvents giving a visible result after a fraudulentattack. CTS-2010 Standard paper should not glow under Ultra-Violet (UV) light i.e., it should be UVdull. This shall ensure that the feel of cheques is uniform across banks.1.2 Watermark (At Manufacturing Stage) : All cheques shall carry a standardised watermark, with thewords “CTS-INDIA” which can be seen when held against any light source. This would make itdifficult for any fraudster to photocopy or print an instrument since this paper would be available onlyto security printers handling cheque printing. The watermark should be oval in shape and diametercould be 2.6 to 3.0 cms. Each cheque must hold atleast one full watermark. Sample watermarks thatwould be used in CTS will be finalised in consultation with Indian <strong>Bank</strong>s' Association (IBA) / <strong>National</strong>Payments Corporation of India (NPCI) and could (illustratively) appear as under -1.3 VOID pantograph (At Printing Stage): Pantograph with hidden / embedded “COPY” or “VOID”feature shall be included in the cheques. This feature should not be visible on the scanned image at theresolution specified in CTS but should be clearly visible in photocopies and scanned colour images asresolution used in such cases would be above the prescribed CTS standards. This would act as adeterrent against colour photocopy or scanned colour images of a cheque.1.4 <strong>Bank</strong>'s logo printed with invisible ink (ultra-violet ink) (At Printing Stage) : <strong>Bank</strong>'s logo shall beprinted in ultra-violet (UV) ink. The logo will be captured by / visible in UV-enabled scanners / lamps.It will establish genuineness of a cheque.1.5 Field placements of a cheque : Placement of significant fields on the cheque forms shall be mandated.However, placement of additional fields shall be left to banks. This will enable data capturing byJanuary-March-201014

e-trackOptical / Image Character Recognition (OCR / ICR) engines in offline mode and help banks inautomating their payment processes. A sample cheque with recommended field placements is placed at4 below.1.6 Mandating colours and background : Light / Pastel colours shall be mandated for cheques so thatPrint / Dynamic Contrast Ratio (PCR / DCR) is more than 60% for ensuring better quality and contentof images. The colours will be finalised in consultation with IBA /NPCI.1.7 Clutter free background : Background of cheques shall be kept as clutter free as possible forimproving quality and clarity of images.1.8 Prohibiting alterations / corrections on cheques : No changes / corrections should be carried out onthe cheques (other than for date validation purposes, if required). <strong>For</strong> any change in the payee's name,courtesy amount (amount in figures) or legal amount (amount in words), etc., fresh cheque formsshould be used by customers. This would help banks to identify and control fraudulent alterations.1.9 Printing of account field : All cheques should, as far as possible, be issued with the account numberfield pre-printed. This should be considered must for current account holders and corporate customers.1.10 Use of UV feature on cheque images : Though bank's logo in UV ink is a strong deterrent for forgeryand duplicate cheques, there are challenges in terms of increased image size, stabilisation of UVtechnology in CTS environment, availability of UV-enabled scanners, etc., in implementing thisfeature. However, the benefits outweigh the limitations and hence this feature shall be incorporated.Presenting banks can subject instruments beyond a threshold value to UV verification using the UVlamps currently available for currency note verification. In case UV technology stabilises in future, theUV image view could be incorporated in CTS as an additional image view or by dropping one of theexisting image views.2. Desirable features2.1 In addition to the mandatory security features as above, banks can consider including additionalsecurity features as per their risk perception like (i) supplementary watermark containing their ownlogo, (ii) embedded fluorescent fibres, (iii) fugitive ink, (iv) secondary fluorescent ink, (v) microlettering,(vi) toner fusing, (vii) check-sum, (viii) patterns, (ix) floral designs, (x) bleeding ink, (xi)structural magnetics, (xii) security thread, (xiii) hot stamped holograms on multi-city cheques anddemand drafts, (xiv) auto-detection tools, (xv) use of UV band on sensitive and key areas of interest ona cheque such as Legal Amount Recognition (Amount in Words), Courtesy Amount Recognition(Amount in Figures), Signature, Beneficiary Name, (xvi) pre-encoding of amount field on the MICRband for demand drafts / pay orders (above a self-decided cut-off) before issue to customers, (xvii) useof check-sum on the face of demand drafts / pay orders (other than the MICR band), etc.2.2 Use of additional features by banks will be subject to the features being compatible with CTSrequirements. While incorporating additional features, banks should take care that –i. The additional security features do not overlap or be very close or clash against the prescribed15January-March-2010

e-trackminimum security features.ii. The features are compatible with CTS specifications.iii. The features are not image heavy, i.e., increase the image size.iv. They should not block any important data on images or hinder payment processing.v. Presenting banks are not expected to verify the additional features.3. Implementation modality3.1 IBA and NPCI shall be jointly vested with the task of certifying additional / optional security features.IBA and NPCI would ensure that the additional / optional features are compatible with CTS and MICRclearing schemes before releasing them to banks.3.2 IBA and NPCI shall be entrusted with the responsibility for impanelment of vendors with capability toprovide the new security standards.3.3 Use of UV image view in CTS is being kept on hold for the present. The decision would be revisited infuture once UV technology stabilises.4. Layout of a sample cheque leaf4.1 The layout of a cheque leaf and location of various security features as prescribed above would appearas under –Appeal: As a part of our drive to make the contents of Journal more pertinent and germane to thereaders we welcome articles on latest topics of <strong><strong>Bank</strong>ing</strong> / Information Technology. Articles may beof about 1000 words. Published articles are suitably remunerated.Theme of articles for next issue is “ e banking”January-March-201016

SPECIAL ECONOMIC ZONES: ENGINES OF GROWTHe-track-Anchal SinghAbstractlaws regarding export andSEZs have become the most talked about in import are broadminded andthe Indian economic circles, but due to its liberal as compared to rest partambiguous policy, it has faced strong opposition of the country.from the leftist parties, activitist, farmer groups, SEZ can be defined aseconomist and urban planner during 2006. “specifically delineated dutyHowever now it is been realized that they are free enclave and shall be deemedthe pockets of manufacturing excellence which to be foreign territory for the purpose of tradeapart from export growth and attracting FDI are operations and duties and tariffs.” –EXIM Policycontributing significantly towards the generation 2000 Chp 9 Para 30.leading to the increased economic growth of the Since the inception of the SEZ policy in Indiacountry.SEZs are in operation and more than 140 SEZs haveThis paper explores the Indian policy been approvedframework for an SEZ, it further discusses its During 1990s, eight EPZs are converted intosignificance highlighting in terms of exports, SEZ with a view to create an environment forinvestment and employment in our economy which achieving a rapid growth in exports The followingis witnessing a high trajectory where consumption table give a detailed information regarding thelevels are soaring and investment are riding high major EPZ converted into SEZ ..The study is primarily based on the secondary datagathered through reports of government1. Kandla (Gujarat) : 1965 (265 Acres)organization and websites.2. Seepz (Maharashtra) : 1975 (110 Acres)Evolution of SEZ3. Noida (U.P.) : 1986 (310 Acres)The Indian SEZ policy dates back to the year4. Madras (Tamil Nadu) : 1986 (262 Acre)2000 when Government announced the policy forsetting up SEZ in the country in line with the5. Falta (West Bengal) : 1986 (280 Acres)international practices. The first EPZ was set up in 6. Visakhapatnam : 1994 (360 Acres)Ireland in 1959, whereas the first Asian zone was the (Andhra Pradesh)Kandla EPZ established by the Indian Government 7. Surat (Gujarat) : 1998 (103 Acres)in 1956.When the Soviet Union was split, India 8. Cochin (Kerala) : 1998 (103 Acres)opened up its economy in 1992, for fulfilling itsThe Indian government first launched thestrategy of export led growth. India was one of theconcept of SEZ in EXIM Policy 2000 to boost thefirst in the Asia to recognize the effectiveness of thecountry's exports and attract F.D.I. Under this policy,Export Processing Zone.the zone was designated as duty free enclave andA Special Economic Zone are in short SEZ is deemed to be foreign territory only for tradea geographically bound zones where the economic operations and duties and tariffs.17January-March-2010

e-trackWith a view to provide a significant thrust to Moreover, for promoting infrastructural facilitiesthe policy, the government enacted, the SEZ Act for export production SEZ was set up in the public2005 and it became operative from 10th February private, joint sector or by the State government. In2006, with the SEZ rules vetted and approved for the fact the planning for SEZ programme to ensure thenotification.SEZ FRAMEWORKexport led growth by attracting FDI and otherprivate sector instrument and thus using SEZ ascatalyst in the reform, economic development ,employment creation and regional development.Fiscal Incentives and RegulatoryBenefits (Preferential policyFramework)The purpose of the Special Economic Zone isconceived to be acceleration of economicSEZdevelopment in a part of the country mainly owningto external strategy investors particularly by therealization of anyone or all of the followingIntegrated Information (Self contained and self managed) objectives.The concept embraces the strategic 1. Generation of additional economic activity.positioning of the zone in the world markets by 2. Development of new technological solutionleveraging on the strong backward linkages with and their use in national economyhinterland /Domestic Tariff Area (DTA) <strong>For</strong> 3. Promotion of exports of goods and services.undertaking SEZ acting one should have a multi-4. Increasing competitiveness of products anddisciplinary expertise in the fields of business ,services.economics , Finance , legal and urban and5. Making use of already existing industrial andinfrastructure planning.economic infrastructure.Administrative Set-up for SEZs6. Creating employment opportunities.i) SEZ are governed by three tier administrative7. Making use of natural resources with respectset –upii)iii)Thrust on Self Certification and inzone environment (Hassel freeoperating Environment)The Board of Approval is the apex body in thedepartmentThe unit Approval Committee at the zonallevel dealing with approval of units in the SEZand other related issues andEach zone is headed by a DevelopmentCommissioner, who also leads the unit ApprovalCommittee.The SEZ rules provide the simplifiedprocedures for development, operation andmaintenance of the Special Economic Zones forsetting up and conducting business in SEZ.to natural environment.India's Policy On SEZ -A SnapshotDeveloper of SEZ may import /procure goodswithout payment of duty for the development,operation and maintenance.Income tax exemption for a block of 10 year in15 years at the option of developer as persection-80-IA of the Income Tax Act.Full freedom in allocation of developed plotsto approved SEZ units on purely commercialbasis.Full authority to provide services like water,electricity, security, restaurants, recreationJanuary-March-201018

centers etc on commercial lines.<strong>For</strong>eign investment permitted to developtownship within the SEZ with residentialareas, markets, play grounds, clubs, recreationcenters etc.Develop Standard Design Factory (SDF)building in exiting Special Economic Zones.Income Tax exemption to Investor's in SEZ'sunder section 10(23) G of Income Tax Act.e-tracklosses an account of land acquisition The tablehighlights the exports from the functioning of SEZduring the four years.Table : 1 ExportExemption from Service Tax Investment 2006-07 34,615 52%made by individuals etc.2007-08 66,638 92%In SEZ company also eligible for exemptionu/s 88 of IT Act.Source : www.sezindia.nic.in.ExportsDevelopments promoted to transfer Exports from the SEZ during 2004-05 haveinfrastructure facility for operations and registered a growth of 32% in rupee terms over themaintenance u/s 80 –I-A of IT Act. previous year .Exports during 2005-06 were 22, 840Generation, Transmission and Distribution of crore as compared to RS. 18, 314 crores during thePower in SEZs allowed.corresponding period of last year. At present , 1948Benefits of SEZunit during the operating in the year SPZsproviding directly in the year SEZs providingIndian SEZ is considered as catalyst fordirect employment to about 1.10 lakhs personstransforming our planned economy into a marketabout 40%^ are women .Private investment byeconomy which has two facets. Firstly, SEZ fulfillsentrepreneurs for establishing units in the SEZs arethe objective of export led growth by facilitatingabout crores.inflow of FDI in the country. Secondly our Northernand Central States are far behind the coastal StatesCurrent investment and employmentregarding industrial units as well as investment India has approved 513 SEZ till date out ofincluding domestic and FDI, and here SEZs play a which 250 have been notified. It is expected thatcrucial role in reversing this trend of economic expected investment will cross US$45.73 billionslugging.Dec 2009 generating incremental employment toBenefits derived from the SEZ s can be800, 000 lakh people. Further during the last threemeasured in terms of investment, employment,months, investment is expected to cross US $ 3.65exports and infrastructural developmentbillion by various firms. At present around nearlyadditionally generated. The benefit derived from the18.52 billion have been invested in SEZs, generatingmultiplier effect of the investment and additionalemployment for around 350,000people as pereconomic activity in the SEZ and the employmentstatistics from the government SEZ site.generated will outweigh the tax exemption and theYearValue (Rs. Crore)<strong>Growth</strong> rate (Overperson year)2003-04 13,854 39%2004-05 18,314 32%2005-06 22,840 25%19January-March-2010

e-trackstTable: 2 Employments (Direct) in SEZ (as on 31 Dec.2007)Employmentas on Feb 2006Table: 3 Sector Wise Distribution Of Approved SEZPresent employeeson Dec 31 st 2007Incremental Employmentgenerated since coming intoforce of SEZ Act ’057 SEZs set up by the Central 122236 183354 61118govt.SEZ set up by the State12468 364630 23995Govt/Pvt SEZ during theperiod 2000-05.SEZ notified under the SEZ --- 61015 61015Act 2005Total Employment 134704 280832 146128Incremental employment generated in SEZs on whole 1, 46,128 persons.Sectors <strong>For</strong>mal Approvals In-principle approvals Notified SEZsIT/ITES/Electronic Hardware 147 31 40Textiles 13 14 1Pharma 13 6 3Multi-products 9 54 4Bio-tech 9 4 1Engineering 5 8 1Multi-Services/Services 6 9 1Electronics 2 4Auto 3 4 1Footwear 4 1 1Gems and Jewellery 3 3 1Power 3 3 -FTWZ 2 4 -Stainless steel 2 1 -Food processing 2 2 -Non-Conventional Energy 1 - 1Petrochemicals 1 - 1Agro 1 - -Portbased-multiproducts 4 - -Others 4 14 7Grand Total 234 162 63January-March-201020

<strong>For</strong>malIn -Principlee-trackconceptualized and planned carefully according tosustainability principles keeping in view economic,social and environmental factors.<strong>For</strong>eign companies have emerged to establishtheir presence in the territories and therefore varioussops are provided to foreign investors, for setting upexport oriented units (EOUs), Special EconomicZones (SEZs) or industrial and electronics hardwareparks. SEZs in India have increased theirperformance, size, road and port connectivity andIndian government should try to fulfill its agenda ofcommon reform as the multiplier effects on theeconomic activities triggered by SEZ materializes.Sharma, Manoranjan, Atlantic Publishers andArguments against SEZ Distributors, New Delhi, 2005.People protest against displacement caused by Agrawal, A.N., “Indian Economy ProblemsSEZs implementation are already intense and it of Development and Planning, 32nd Editionsometimes led to violence as witnessed in Nandi Articlesgram and Singur in West Bengal.. However theKennedy, M. Maria John and Vennila,ndgovernment has thought to drop the idea till Jan 22K.,”Special Economic Zones: Problems andth2007 but soon it was regained on April 15 2007 by prospects”, Southern Economist, Vol.47, no.2,the empowerment group of Union Ministers. pp 43-44, May15th 2008.It is thought that SEZ will acquire thousands of Sampathlakshmi N, “Special Economichectares of land with minimum land ceiling Zones “, Kisan World”, Vol.35No.3 pp23-25.provisions which will disrupt the livelihood of May 2008.people and therefore stiffly resisted by peasants andSampat Preeti,” Special Economic Zones infarmers. Therefore, desirability and feasibility ofIndia “Economic and Political Weekly”each project should be judged in terms of cost andVol.XLIII No.28, pp-25-29 July12-18, 2008.benefit that will accrue to the society at large.WebsitesGenerally, projects should be set up on wasteland,degraded or unirrigated land and acquisition of http://www.sez.icrindia.org.agricultural land should be avoided.http://www.accomodationtimes,comConcluding Observationshttp://www.infochangeindia.org/2007SEZ have strong linkages with the globalmarket which attract latest technology and businessknow-how. This information and flow of knowledgehas ultimately improved the economic and socialwell being. It may generate sustainable value ifReferencesBookshttp://www.ibef.org/artdisplay.aspx.Anchal Singh is a Research Fellow atFaculty Of Commerce. B.H.U., Varanasi-221005She can be contacted atanchalsingh.com@gmail.com21January-March-2010

e-trackIMPACT OF INFORMATION TECHNOLOGY ON BANKING SECTOR.IT has improved the ability ofman to process and analyze dataand communicate the sogave a new concept of core banking. In fact itenabled banks to provide the facilities of phone &mobile banking to its customers.-Sadhana Misraobtained information with To compete with the private and foreign bankstremendous speed & accuracy. the nationalized banks in India have greatlyThe communication or transfer improved upon their number of computerizedof this information from one to many to accomplish branches. This computerization made transactionsome common goal is the centrality of any social fast and easy thereby saving the time of theactivity. Today hardly any sector of social activity is customer's Indian banks have actively harnessed theleft untouched by the impact of IT. Many technology to handle distributed operations, highorganizationshave implemented IT, to provide volume transactions and data management. This inbetter services and thereby are able to improve their turn has helped banks to achieve customerbusiness manifold. In earlier days IT was used satisfaction which is the basic requirement of today'smainly in the manufacturing sectors for product internet driven market.designing and development, product modification,Electronic banking in the Indian bankingetc. But later on after realizing its importance it wassector has shown the benefit of web technology. E-applied in the service sector too.<strong><strong>Bank</strong>ing</strong> which is also termed as cyber-bankingIT basically involves fine modern online-banking, virtual banking or home-bankingtechnologies, i.e. electronic & photonic provides remote banking facility electronically.technologies, computer technology, communicationE-banking provides web user an onlinetechnology, artificial intelligence and humanbanking facility. E-<strong><strong>Bank</strong>ing</strong> services range frommachine interface technology. Combination ofsimple bill payment and account balance monitoringInternet & IT has greatly revolutionized the banking to securing a loan. <strong>For</strong> the bank it is a quick,and financial sector. In today's competitive world, inexpensive way of offering services. E-<strong><strong>Bank</strong>ing</strong>customer's loyalty cannot be taken for granted, and also relieves personnel from the arduous paper workthat compels banks to constantly find innovative and provides 24 hrs services, which no physicalmethods to attract and retain their customers. The branch otherwise can offer. Where as for theadvent of web technology has provided great customer it is cost effective, easy and available 24x7improvement in the services of banking sector of the for doing business. The services offered todevelopingcustomers include bill payment, tax computationon-line stock trading, electronic cheque, portfoliocountries. It has given great opportunities ofmanagement record keeping, tracking of bankinterpersonal interactions for different purposes. It accounts, credit cards, etc. <strong>For</strong> example, ICICI <strong>Bank</strong>also passed way for internet & intranet facilities and has launched 'Infinity', on Internet banking serviceJanuary-March-201022

e-trackthat offers services such as account information, means of doing banking transactions provides afund transfer within accounts, stock payment major indicator of customers requirement. Theinstructions, requests & intimations for cheque success of EFT depends heavily on networks tobooks, bill payments, communication with account provide reliable and efficient inter connections.manager etc.ATM's are specialized terminals that dispense cashThe impact of IT on financial services hasand require wide area network (WAN)been most significant in payment services whereincommunication with the central banking computer.ATM, credit cards, Debit cards and other modes of 3. Electronic or Digital Cash (E-cash).payments have brought a drastic change in theIt is a system of transferring funds through apayment mechanism. This has been made possiblenetwork such as the internet. Here cash exists in theby making cash available any time at any place in theform of validated tokens represented by a string ofworld. In fact IT has changed the concept of cash &digits. E-cash can be purchased from onlinecredit throughout the world. The technologicalcurrency server, i.e. usually a bank or Financialadvancements which have taken place in the worldInstitution. It deals with the circumstances in whichof business payment are as followsthepayer is not present at the point of sale or service,1. Electronic Fund Transfer (EFT)-It is a system of transferring funds on requestbut can communicate electronically, for e.g. it isconnected to the Internet, or to some other form ofusing a wide area network. It covers a wide range ofglobal information infrastructure, such as a cable-transaction services like-TV installation with enhanced capabilities.* <strong><strong>Bank</strong>ing</strong> Services4. Credit & Debit Cards:* Funds transfer between accounts at the sameDuring the 21st Century the usage of creditbank or at different banks.card has expanded significantly throughout theworld. Debit cards have been introduced more* Stock brokerage servicesrecently and together they represent the most rapidly* Retail ATM services. growing method of payments in many countries.* Business transactions like fund transfer, Today credit & debit cards are preferred methods ofinvestments, overdraft arrangements etc. settling small value payments associated with thepurchase of specific goods and services. Separate* Apart from these services intermediate orelectronic clearing and settlement systems haveovernight fund transfer, online creditbeen established by the major credit card companies.authorization, reduced need for customers to<strong>For</strong> instance, Master card and visa have establishedcarry cash or cheque are some of thetheir own networks which are used for verifyingadvantages of EFT.transactions world-wide.2. Automatic Teller Machine (ATM):-5. Smart Card:Today the number of growing ATM networksSmart cards are just like credit cards but serveis the greatest advantage of EFT environment. Thea different purpose. It contains a chip which has awide spread acceptance of ATM's by the public as a23January-March-2010

e-trackprocessor and memory unit. Smart card generatesencrypted random numbers with a lifetime of aroundone minute. It generates one time password whenuser enters a PIN. This password is calculated usingdata encryption which is stored in the card. Thisprovides means for storing passwords, private keysor digital cash on the card. These cards have becomepopular due to limitation of pure password basedsystems.6. Electronic Data Interchange (EDI)It is the exchange of structured data betweenthe computer systems of trading partners. It isdefined as the interchange of standard formatteddata between computer application systems oftrading partners with minimal manual intervention.EDI communicates information relevant forbusiness transactions between the computer systemsof business organizations governmentorganizations, small business houses, banks andfinancial Institutions.The banking and insurance companies use theIT to keep track of their customers transactions andfinancial needs, stock markets use IT for onlinetrading with the help of computer based terminalsconnected to trading services, depositories andcustodial services use IT to maintain records ofshares & securities held by them on behalf of theircustomers where as investment consultancy servicesuse IT to analyze the financial positions, investmentopportunities available for their customers & riskfactors, etc.Thus Financial Institutions today facecompetition from many fronts. The traditional banksare facing increased pressure from all sides. Thecustomer has a variety of options for services,delivery channels, products & vendors. Thereforeretaining the customer has become a challenge forthe banks and in doing so the most effective way is toinvest strategically in IT. <strong>For</strong>eign and upcomingprivate banks in India have led the way toautomation of financial services industry. The initialresistance to technology is fading as topmanagement of several Indian banks are viewing ITas a business enabler and a vital part of their strategy.Thus various banks have now gone for substantial ITinvestments in core & Internet technologies.Sadhana Misra is Librarian atNavyug Kanya Mahavidhalaya,Rajendra Nagar, LucknowFood for thoughtHappiness is when what you think, what you say, and what you do are in harmony.– Mohandas GandhiWithout continual growth and progress, such words as improvement, achievement, and success haveno meaning.– Benjamin FranklinLife is a series of collisions with the future; it is not the sum of what we have been, but what we yearnto be.– Jose Ortega y GassetAlways bear in mind that your own resolution to succeed is more important than any other.– Abraham LincolnJanuary-March-201024

Book ReviewEmployee Identity in Indian Call Centres: The Notion of ProfessionalismAuthor: Ernesto Noronha and Premilla D CruzISBN: 9788132100799, Publisher: Response, Binding: Paperback, Price: Rs 395e-trackThis book presents the lived experience ofcall centre agents, and the perspectives ofmanagers and trade unionists regarding employeeexperiences in the international call centres inMumbai and Bangalore in India. This bookhighlights how employee identity is invoked togain employee commitment, for realizingorganizational goals and ensuring competitiveadvantage. While professional identity isassociated with a host of privileges, it not onlyresults in agents justifying and complying withorganizational requirements and absorbing jobrelatedstrain, but also precludes their engagementwith collectivist endeavours aimed at representingand protecting their interests, causing the nascenttrade union movement in this sector to reinvent it.Challenging the 'professionalism' plank of callcentres, the authors find lack of transparency inmany areas. <strong>For</strong> instance, a common practice is totalk the CTC (cost-to-company) lingo at the time ofrecruiting agents. While CTC is the total amount ofexpenditure an organisation undertakes for anemployee in a particular year, including gross pay,variable pay, long-term benefits, leave travelallowance, medical reimbursement, transport,food, other allowances and loyalty bonus, thisfigure does not translate into the monthly salarythat agents receive which is a much lower amount,finds the author.“However, agents, most of whom arefreshers entering the job market for the first time,do not realise that this is the case until they receivetheir first salary. Nonetheless, even at this juncture,agents believe not only that their returns are muchbetter than what they wouldreceive in other sectors butalso that numerous othercomponents of the CTCwhich do not form part oftheir salary accrue to them insome form and representemployers' investment int h e m . ” T h i s b o o k i sorganized into the followingchapters:-Call Centres as WorkplacesThe Call Centre Industry in IndiaThe Research ProcessProfessionalism as Lived ExperienceProfessionalism and the Reinvention of the TradeUnion Movement Professionalism ContestedFinal WordThis book is unique in being based onempirical research and its multiple sources of data,in its use of qualitative methods, and in its focus onmultiple thematic areas such as identity, control,collectivization and professionalism. It includes adetailed study of the dynamics of a subtlepsychology that is at work in the Indian call centresregarding the notions associated with the term'professional'. Providing new and holistic insightsgained via rigorous academic research, this book isof value to HR and OB professionals and scholars,industrial relations experts, sociologists,psychologists and trade unionists, as well as readersinterested in India's ITES-BPO sector.Reviewed by Sanjay Srivastava(Librarian) PNBIIT, Lucknow25January-March-2010

e-trackPayment of Interest in SF accounts on dailyProduct basisIn view of the present satisfactory level ofcomputerization in commercial bank branches,payment of interest on savings bank accounts byscheduled commercial banks is to be made on adaily product basis with effect from April 1, 2010.Further, banks were advised that in order to ensure asmooth transition, they may work out the modalitiesin this regard.Source :www. rbi.org.inUp-gradation of RTGS System to Windows 2008RTGS system is presently running onWindows 2000 advanced server with Oracle version9i and IBM Websphere MQ series 5.3. It has beendecided to upgrade RTGS system to the latestavailable software versions i.e. Microsoft Windows2008 Enterprise Edition, Oracle 11g and IBMWebsphere MQ series 7.0. The process offinalization of the Hardware Security Modulesystem has now been completed. Safenet's Luna PCIExpress 7000 HSM Card has been found to becompatible with the upgraded RTGS System inWindows 2008 server environment. This HSM cardwill be supplied by M/s.Safenet India Pvt. Ltd.Source :www. Rbi.org.inSteps for rupee to be fully convertible shortlyFinance minister Pranab Mukherjee said thegovernment will take steps to make the rupee fullyconvertible in a calibrated manner so thatmechanisms can be in place for tackling any adverseimpact. The full convertibility of the Indian currencymeans that the rupee would be made freelyexchangeable into other currencies and vice versa.The rupee was made partially convertible in 1994.Currently, it can be changed freely into foreigncurrency for business and trade expenses but notFINANCIAL / TECHNICAL NEWSfreely for activities like acquiring overseas assets.Full convertibility of the rupee was one of thebottlenecks telecom firm Bharti Airtel faced in itsbid to acquire South African firm MTN.Government was adopting a cautiousapproach, taking into consideration all aspects andthe risks involved in opening up the economy byallowing convertibility of the currency.(www.efinancialnews.com)Technology that allows bosses to spy onemployeesA Japanese phone company has come up witha new technology that can track most minimalmovement of mobile phone users and beams theinformation back to HQ.KDDI Corporation, which has developed thetechnology, intends to offer the service to clientssuch as managers, foremen and employmentagencies, or whoever may be interested keeping incheck the activities of their employees. The newsystem uses analytical software to detect morecomplex behaviour, unlike sensor systems.The software is held on a server back at base,to match patterns of common movements.Because this technology will make centralmonitoring possible with workers at severaldifferent locations, businesses especially are veryinterested in using such technology to improve theefficiency of their workers.(Source: Economictimes.indiatimes.com)IT spending will rise, but not rebound in 2010Global IT expenditure is expected to rise thisyear for the first time since the onset of thedownturn, according to industry analyst.CIO attitudes towards IT spending vary by countryand vertical industry, yet some importantcommonalities have emerged. The rising sentimentJanuary-March-201026

"A couple weeks ago, Biz [Stone, Twitter co-founder] explained how Twitter users were beingvictimized by phishing scams spread primarilythrough links in direct messages," the post said."Basically, people click the link and bad thingshappen. My team can only detect these scams aftermalicious links have already been sent out."that the global economy is starting to show signs ofrecovery is having a positive impact on planned ITbudgets in 2010. The perception gap betweenforecast and actual changes in IT expenditure haswidened. IT spending trends vary wildly by region,yet all vertical industries have suffered from lowerIT spending compared to pre-recessionary levels.Fundamentally, IT spending is trending upwards,however most increases, as well as decreases will beslight, between 1-5 percent. The vast majority ofenterprises will continue to experience flat budgetgrowth in 2010.IT projects that are most likely to be readilygreen-lighted are those that do not require a forkliftupgrade of existing IT systems and businessprocesses, but rather those that make modificationswithin existing and proven boundaries in anincremental manner and in response to businesschanges.(Source: siliconindia news bureau)Microsoft races to plug IE hole after exploitcode releasedMicrosoft is testing a patch to fix a new hole inInternet Explorer 6 and IE 7 following the release ofexploit code on the Internet.The company will be issuing a patch for thehole before the next Patch Tuesday in about fourweeks, if the testing of the patch goes quickly.Twitter to block malicious links(Source: news.cnet.com)Twitter is launching a new service designed tostop users of the social-media site from gettingduped by phishinglinks that stealt h e i r l o g i ncredentials andother attacks.e-trackThe company will route all links submitted tothe site through a filter created to catch links thatlead to malware, the company said on the Twitterblog on Tuesday.FCC tool collects broadband speed data(Source: cnet.com)The Federal Communications Commissionwants to help you make sure you get what you payfor when it comes to broadband.The agency has launched a new tool thatallows consumers to test the download and uploadspeeds of their broadband connections. The tool,which can be found at www.broadband.gov, testswireless or landline-based broadband connections.It also allows consumers to see the latency, the timeit takes for data to be sent from a computer to thetesting server and back, and jitter, the variability inthe delay between a computer and the testing server,that's being detected on their connections.The way it works is that consumers go to thewww.broadband.gov Web site, type in their address,indicate whether they are a home user or businesscustomer, and then click on a button to begin the test.Within a minute, they can get information on theirDSL and cable modem speeds. The FCC is usingexisting speed testing tools from Ookla and a toolfrom M-LAB.(Source: news.cnet.com)27January-March-2010

e-trackAdvanced Diploma in <strong><strong>Bank</strong>ing</strong> Technology-“Batch III”The ADBT course is offered to students with MCA/ BE / B Tech in Computer Science, Electronic and Communication or ITwith minimum 55% marks after a rigorous screening. The course aims at training the students in such a way that they are able tofulfill the requirements of the employer from the day one without further need of on the job training at the cost of the company. TheInstitute prepares students to meet the ever increasing technological and social challenges with its tradition of self-discipline, hardwork and all round personality development. The ADBT aims to bridge the gap between knowledge provided by the formaleducational Institutes and functional requirements of BFI sector.Our Past Recruiters<strong><strong>Bank</strong>ing</strong> Overview- The concept of banking, functions and controls collection and clearing services, alternate delivery channels .of RBI, Monetary policy, role of technology in banking industry, Corporate and International Operations- This section willlegal aspects of bankingsharpen the skill of assessment of working capital requirement,Financial System- Details of Indian Financial System and concept, methods of financial analysis, corporate / business Credit and alsoaccounting principles, knowledge of financial mathematics, exposure to <strong>For</strong>ex and International Business etc.financial analysis and accounting.Application Software in <strong><strong>Bank</strong>ing</strong> Operations- The concept,Retail <strong><strong>Bank</strong>ing</strong>- This part will give the details of different technology and entire working in Core <strong><strong>Bank</strong>ing</strong> .customers and accounts of the bank, various modes of remittances,Curriculum of ITAdvanced Database Management System using Oracle 10gDatabase Components & ArchitectureCore <strong><strong>Bank</strong>ing</strong> Application Software ArchitectureConcepts,Structure,InstallationOnline Services ArchitectureAdvanced Concept of Operating System Using Linux/UnixBasic and advanced Unix/Linux CommandsLinux / Unix File System, Client/Server/User ManagementShell Scripting, Workflow Scripting, Groups and PermissionNetwork Management, Package Management, KernelSalient features of the courseCurriculum of bankingand Customization, SQL/PLSQLBackup and RecoveryOracle <strong>For</strong>ms 10g, Oracle Reports 10g, Oracle NetworkingServices, System ServicesAdvanced Topics in Users, Groups and PermissionsEssential System Administration ToolsInstallation and TroubleshootingSystem Performance and SecurityWeb Concepts and Commercial NetworkingWeb Interface to Core <strong><strong>Bank</strong>ing</strong> Application SoftwareWeb fundamentalsCommercial NetworkingIntroduction to Switches and RoutersNetwork ConfigurationIntroduction to TCP/IPImplementation & TroubleshootingVarious Network Severs ConfigurationWi-Fi NetworksCurriculum of soft skillsThe participants are groomed on goal setting, time management, stress management, communication skills, bodylanguage, social etiquettes and memory improvement etc.After successful placement of two batches, third batch of ADBT was launched in December 2009 and thestudents will pass out in June 2010. <strong>Bank</strong>s and IT companies are invited for campus recruitment at theInstitute during May 17 – 29, 2010 and benefit from employing trained resources.<strong>For</strong> detailed arrangements, kindly contact:Mr. Pramod Dikshit (Course Coordinator) or Ms. Pratima Trivedi (Co-coordinator)at :- bankingtech@pnbiit.co.inJanuary-March-201028