key information memorandum cum application form - Rrfinance.com

key information memorandum cum application form - Rrfinance.com

key information memorandum cum application form - Rrfinance.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

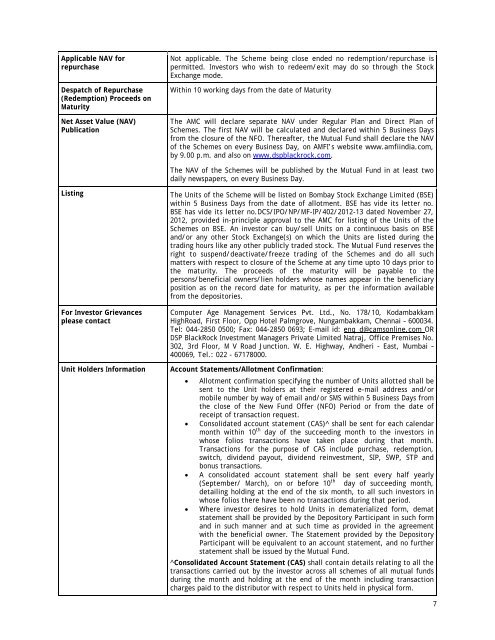

Applicable NAV forrepurchaseDespatch of Repurchase(Redemption) Proceeds onMaturityNet Asset Value (NAV)PublicationNot applicable. The Scheme being close ended no redemption/repurchase ispermitted. Investors who wish to redeem/exit may do so through the StockExchange mode.Within 10 working days from the date of MaturityThe AMC will declare separate NAV under Regular Plan and Direct Plan ofSchemes. The first NAV will be calculated and declared within 5 Business Daysfrom the closure of the NFO. Thereafter, the Mutual Fund shall declare the NAVof the Schemes on every Business Day, on AMFI’s website www.amfiindia.<strong>com</strong>,by 9.00 p.m. and also on www.dspblackrock.<strong>com</strong>.The NAV of the Schemes will be published by the Mutual Fund in at least twodaily newspapers, on every Business Day.ListingFor Investor Grievancesplease contactUnit Holders In<strong>form</strong>ationThe Units of the Scheme will be listed on Bombay Stock Exchange Limited (BSE)within 5 Business Days from the date of allotment. BSE has vide its letter no.BSE has vide its letter no.DCS/IPO/NP/MF-IP/402/2012-13 dated November 27,2012, provided in-principle approval to the AMC for listing of the Units of theSchemes on BSE. An investor can buy/sell Units on a continuous basis on BSEand/or any other Stock Exchange(s) on which the Units are listed during thetrading hours like any other publicly traded stock. The Mutual Fund reserves theright to suspend/deactivate/freeze trading of the Schemes and do all suchmatters with respect to closure of the Scheme at any time upto 10 days prior tothe maturity. The proceeds of the maturity will be payable to thepersons/beneficial owners/lien holders whose names appear in the beneficiaryposition as on the record date for maturity, as per the <strong>in<strong>form</strong>ation</strong> availablefrom the depositories.Computer Age Management Services Pvt. Ltd., No. 178/10, KodambakkamHighRoad, First Floor, Opp Hotel Palmgrove, Nungambakkam, Chennai – 600034.Tel: 044-2850 0500; Fax: 044-2850 0693; E-mail id: enq_d@camsonline.<strong>com</strong> ORDSP BlackRock Investment Managers Private Limited Natraj, Office Premises No.302, 3rd Floor, M V Road Junction. W. E. Highway, Andheri - East, Mumbai –400069, Tel.: 022 - 67178000.Account Statements/Allotment Confirmation: Allotment confirmation specifying the number of Units allotted shall besent to the Unit holders at their registered e-mail address and/ormobile number by way of email and/or SMS within 5 Business Days fromthe close of the New Fund Offer (NFO) Period or from the date ofreceipt of transaction request. Consolidated account statement (CAS)^ shall be sent for each calendarmonth within 10 th day of the succeeding month to the investors inwhose folios transactions have taken place during that month.Transactions for the purpose of CAS include purchase, redemption,switch, dividend payout, dividend reinvestment, SIP, SWP, STP andbonus transactions. A consolidated account statement shall be sent every half yearly(September/ March), on or before 10 th day of succeeding month,detailing holding at the end of the six month, to all such investors inwhose folios there have been no transactions during that period. Where investor desires to hold Units in dematerialized <strong>form</strong>, dematstatement shall be provided by the Depository Participant in such <strong>form</strong>and in such manner and at such time as provided in the agreementwith the beneficial owner. The Statement provided by the DepositoryParticipant will be equivalent to an account statement, and no furtherstatement shall be issued by the Mutual Fund.^Consolidated Account Statement (CAS) shall contain details relating to all thetransactions carried out by the investor across all schemes of all mutual fundsduring the month and holding at the end of the month including transactioncharges paid to the distributor with respect to Units held in physical <strong>form</strong>.7