1 INCOME TAX APPELLATE TRIBUNAL, MUMBAI BENCHES ... - ITAT

1 INCOME TAX APPELLATE TRIBUNAL, MUMBAI BENCHES ... - ITAT

1 INCOME TAX APPELLATE TRIBUNAL, MUMBAI BENCHES ... - ITAT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

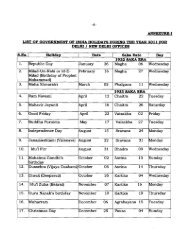

<strong>INCOME</strong> <strong>TAX</strong> <strong>APPELLATE</strong> <strong>TRIBUNAL</strong>, <strong>MUMBAI</strong> <strong>BENCHES</strong>, <strong>MUMBAI</strong>STATEMENT SHOWING THE LIST OF SPECIAL BENCH CASES PENDING AS ON 06.04.2012.Sr.NoAppeal No.<strong>MUMBAI</strong> <strong>BENCHES</strong>Name of theAssesseeTo whom assigned theSpecial BenchPoints involvedRemark1. ITA No. 5568 &5569/M/1995 &6448/M/1994A.Y. 1991-92 to 1993-94DHL OperationsB.V. Netherlands1.2.3.Hon’ble Vice-President( MZ)Shri. P.M.Jagtap, A.M.Shri.B.Ramakotaiah,A.M.“Whether, or not, on the facts and inthe circumstances of the case and on aproper interpretation of Art. 5.5 andArt. 5.6 of the DTA (with Netherlands)and having regard to its activities, itcan be said that Airfreight Ltd. was theagent of the assessee so that it can beheld that the assessee had a PE inIndia? And if the answer is in theaffirmative, whether or not the incomefrom inbound shipments can be treatedas attributable to the PE?”Fixed on13.06.2012.2. ITA No.6591/Mum/2007A.Y.2003-04Tandon InformationSolutions Pvt. Ltd.1.2.3.4.5.Hon’ble President,I.T.A.TShri.B.R.Mittal,J.M.Shri.R.S.Syal, A.M.Shri.I.C.Sudhir, J.M.Shri.J.S.Reddy,A.M.“Whether, or not, on the facts and inthe circumstances, deduction u/s 10 Ais to be allowed without setting off ofbrought forward losses of earlier year”?Fixed beforeDivisionBench on07.06.2012forwithdrawal1

3. ITA No.5059, 5018 to5022/M/20104. ITA Nos.5034/M/20045035/M/20042060/M/20082061/M/20083021/M/20057095/M/2004C.O.41-44/M/2008A.Y.1998-1999 to2003-2004M/s. Allcargo GlobalLogistics Ltd.M/s.Chance LLPClifford1.2.3.1.2.3.Hon’ble President,I.T.A.TShri.D.K.Agarwal,J.M.Shri.K.G.Bansal, A.M.Hon’ble President,I.T.A.T.Hon’ble Vice-President(MZ)Shri.P.M.Jagtap,A.M.1. “Whether, on the facts and in law,the scope of assessment u/s 153 Aencompasses additions, not based onany incriminating material foundduring the course of search?”2. “Whether, on the facts and in thecircumstances of the case, the ld.CIT(Appeals) was justified in upholding thedisallowance of deduction u/s.80IA (4)of the Act, on merits”?1. “Whether, the substitution of theExplanation to Section 9 by the FinanceAct, 2010 with retrospective effect from01.06.1976 changes the position of lawas far as the assessee is concerned, bymaking the ratio of the judgment of theHon’ble Bombay High Court in theassessee’s own case for the assessmentyear 1986-87 inapplicable to theassessment years now in appeal?”2. “Whether on a true and correctinterpretation of the term “directly orindirectly attributable to the permanentestablishment” in Article 7(1) of theIndia – UKDTAA, it is correct in law tohold that the consideration attributableto the services rendered in the state ofresidences is taxable in the sourcestate?”Fixed on07.05.2012Fixed on15.05.20122

5. ITA 521/Mum/2008 Kotak MahindraCapital Companyltd.6. ITA 5996/Mum/1993ITA 1055/Mum/1994ITA 1056/Mum/19941.2.3.GTC Industries Ltd. 1.2.3.Hon’blePresident,I.T.A.T.Shri.P.M.Jagtap,A.M.Shri.N.V.Vasudevan,J.M.Hon’bleVice-President(MZ)Shri.R.S.Syal,A.M.Shri.B.Ramakotaiah,A.M.“Whether the provisions of section 74which deal with carry forward and setoff of lossess under the head “capitalgains” as amended by Finance Act,2002will apply only to the unabsorbedcapital loss for the assessment year2003-04 and onwards or will also applyto the unabsorbed capital lossessrelating to the assessment years prior tothe assessment year 2003-04.”Fixed on09.05.2012Fixed on30.04.2012DELHI <strong>BENCHES</strong>1. ITA No.1976/Del/2006M/s C.L.C. & SonsPvt. Ltd.1.2.3.Hon’ble President,I.T.A.T.Hon’ble Vice-President(Zonal)Shri. Rajpal Yadav,JM.“Whether, on the facts andcircumstances of the case, assessee isentitled to claim depreciation on thevalue of all intangible assets falling inthe category of “any other business orcommercial rights”, without coherenceof such rights with the distinct genusis/category if intangible assets like knowhow, patents, copyrights, trade marks,licences and franchises as defined U/s32(1) (II) of the I.T. Act.”Fixed afterthe disposalof Hon’bleHigh Courtin the case ofCLC GlobalLtd. which ispendingbeforeHon’ble HighCourt.3

A.Y. 1999-2000A.Y.2000-2001AHMEDABAD<strong>BENCHES</strong>1. ITA No.2654/AHD/2004A.Y.2001-02Chennai 2.3.Sardar Sarover 1.Narmada Nigam Ltd.2.3.Shri. N.S.Saini,A.M.Smt.P.Madhavidevi,J.M.Hon’ble Vice-President(AZ)Shri.N.V.Vasudevan,J.M.Shri.A.K.Garodia, A.M.liability could be taxed as interestunder the Interest-Tax Act, 1974?”1. “Whether, interest expenditureincurred by the assessee on amountthough borrowed for the purpose ofbusiness but pending such utilization,is actually utilized for earning interestincome can such interest expenditurebe held as expended for the purpose ofearning interest income in view of theprovisions of section 57 (iii) of the Actor not?”Yet to befixed2. “Whether on the facts andcircumstances of the case, interestexpenditure incurred on borrowedfunds which were actually utilized forearning of interest income is to beallowed as deduction from the grossinterest receipts or not for computingthe income assessable under section56 of the Act?”2. ITA No. 36/Ahd/2004,ITA No. 48/Ahd/2004,A.Y. 1999-2000, ITAGujarat GasFinancial ServicesLtd., Ahmedabad.1.2.Hon’ble Vice-President(AZ)Shri.D.K. Tyagi, J.M.“Whether, on the fact and it thecircumstances of the case, the assesseecompany is financial company underFixed on28.05.20126

No. 35/Ahd/2005,A.Y. 2001-02 & ITANo. 1095/Ahd/2006,A.Y. 2002-03, ITA No.515/Ahd/2005, A.Y.2001-02.3. Shri.A.K.Garodia, A.M. the Interest tax Act,1974 liable to taxthereunder on the rev income earned onits financial transaction?”3. ITA 2170/Ahd/2005 M/s NanubhaiD.Desai, SuratRAJKOT BENCH1.2.3.Hon’ble President,I.T.A.T.Hon’ble Vice-President(AZ)Shri.R.S.Syal,A.M.“Whether, Shri Deepak R.Shah,advocate and ex-Accountant Member ofthe Income Tax Appellate Tribunal, isdebarred from practicing before theIncome Tax Appellate Tribunal in viewof the insertion of Rule 13 E in theIncome Tax Appellate TribunalMembers (Recruitment and Conditionsof Service) Rules,1963?”Refixed forfresh hearingon30.04.20121. ITA 397/Raj/2009 Saffire Garments 1.2.3.Hon’bleVice-President(AZ)Shri.T.K.Sharma,J.M.Shri.D.K.Tyagi,J.M.1. “Whether, this Tribunal can condonethe delay or extend the time limit forfurnishing the return of income u/s.139(1) for the purpose of claimingdeduction u/s.10A?2. “Whether, the Proviso to section10A(1A) which requires the assessee tofurnish the return of income on orbefore the due date specified undersection (1) of section 139 is mandatoryor directory?”Pending7

AMRITSAR BENCH1. ITA No. 65(ASR)/2010 Sh. Vinod KumarJain, Prop.M/s V,K,MetalWorks, Jammu1.2.3.Hon’ble Zonal Vice-PresidentSenior most JudicialMember, ChandigarhSeniormostAccountant Member,Chandigarh1. “Whether, in the facts andcircumstances of the case, the exciseduty refund set off is a capital receipt orrevenue receipt.”2. “If the excise duty refund/set off isheld to be revenue receipt, whether thesaid amount is to be included in thebusiness profits for the purpose ofdeduction u/s 80IB of the Income-taxAct.”Pendingfixation.for2. ITA No. 68/ASR/2010 M/s. Balaji RosinIndustries, Jammu12.3.Zonal Vice-PresidentSenior Most J.M.(CH)Senior Most A.M. (CH)1.”Whether, in the facts andcircumstances of the case, the exciseduty refund set off is a capital receipt orrevenue receipt”.Pendingfixation.for2.”If the excise duty refund/set off isheld to be revenue receipt whether thesaid amount is to be included in thebusiness profits for the purpose ofdeduction u/s.80IB of the Income-taxAct.”8

JODHPUR BENCH1. ITA No.27/JDPR/06C.O.No.37/Ju/06(A/o ITA No.27/JDPR/06) BlockA.Y. 1997-98 to 2003-04)M/s Shree RamLime Products’ Ltd.,Jodhpur1.2.3.Zonal Vice-PresidentShri I.P.Bansal, J.M.Shri P.M.Jagtap,A.M.“Whether on the facts and in thecircumstances of the case the period oflimitation for completion of the blockassessment as per sec. 158BE readwithExplanation 2 is to be reckoned fromthe end of the month in which ‘lastPanchanama on the conclusion ofsearch is drawn on the assessee’ or ‘lastPanchnama of the last authorizationeven when it is not last Panchanamadrawn on the assessee and one or morevalid Panchanamas are drawn on theassessee thereafter in execution of anyformer authorization’.”AdjournedSine-dieAs per order dt. 14.11.2007 of theHon’ble President “Special Benchcomprising of S/Shri.R.P.Garg, Vice-President, I.C.Sudhir,J.M.Hari Om Maratha, J.M. would hear theentire appeal. Can also modify thequestion referred to Special Bench.”9

<strong>INCOME</strong> <strong>TAX</strong> <strong>APPELLATE</strong> <strong>TRIBUNAL</strong>,<strong>MUMBAI</strong> <strong>BENCHES</strong>,<strong>MUMBAI</strong>LIST OF SPECIAL BENCH CASES HEARD AND PENDING FOR ORDERS AS ON 06.04.2012Sr.No.Appeal No.Name of theAssesseeTo whom assigned theSpecial BenchPoints involvedRemarkDELHI <strong>BENCHES</strong>1. ITA No.4986/Del/07(Assessee)& ITANo.4771/Del/07(Deptt.)M/s.EngineeringLtd.D.Dun.Clough1.2.3.Hon’ble PresidentShri R.P.Tolani,JMShri K.G.Bansal,AM“Whether, the CIT(A) erred in treatingthe interest income as business incomeas against 15% as provided in para 6 ofArticle 12 of DTAA between India andthe UK.”Heard on28.03.2011BANGALORE<strong>BENCHES</strong>10

1. ITA No.546/Bang/08M/s Nandi SteelsLtd.12.3.Shri. N.BharathvajaShankar, Vice-President (BZ)Shri. G.C.Gupta,Vice-PresidentSmt.P. Madhavi Devi,JM“That the learned CIT(A) erred in lawand on facts that the appellant is notentitled to set off carry forwardbusiness loss of Rs. 39,99,652 againstthe long term capital gain arising onsale of land used for the purpose ofbusiness. That the authorities belowought to have appreciated that there isno cessation of business and theappellant is entitled to set off the carryforward business loss.”Heard on17.10.2011INDORE BENCH1. ITA 900 &777/Ind/2004 &295/Ind/2006M/s Maral OverseasLtd., Khargone1.2.3.Hon’ble President,I.T.A.T.Hon’ble Vice-President (AZ)Shri.R.C. Sharma,A.M.1. “Whether, an undertaking claimingexemption u/s 10B of the Income-taxAct, 1961, as it existed prior to1.4.1999 would be entitled forexemption/deduction u/s 10B forextended period of ten years as per theamended provisions of law brought onstatute with effect from 01.04.1999?”Heard on06.01.20122. “Whether, in the facts andcircumstances of the case, theundertaking is eligible for deduction onexport incentive received by it in terms11

of provisions of Section 10B(1) readwith Section 10B (4) of the Act?”AHMEDABAD<strong>BENCHES</strong>1. ITA 3002/Ahd/2009 Vishnu AnantMahajan1.2.3.Hon’ble President,I.T.A.T.Hon’ble Vice-President(AZ)Shri.K.G.Bansal, A.M.“Whether the Ld. CIT(A) was justified indisallowing 76% of the depreciationand other related expenses byapportioning them in the ratio ofexempt to taxable income by applyingprovisions of section 14A of the Act onthe share income from the firm whichis exempt from tax u/s 102(A) of theAct?”Heard on19.04.2012&20.04.2012HYDERABADBENCH1. ITA No.1034/H/2004 Dr.(Late) B.V.Raju,Hyderabad123Shri.P.M.Jagtap,A.M.Shri.N.V.Vasudevan.J.M.Shri.Chandra Poojari,A.M.“Whether, on the facts and in thecircumstances of the case theconsideration receivable by theassessee in terms of the agreementdated 27-7-1999 is assessable to taxas capital gains in accordance with theamended provisions of law prevailing atthe relevant point of time relating tothe levy of tax on capital gains?Heard on06.01.201212

VISHAKHAPATNAMBENCH1. ITA 477/Viz/2008A.Y.2005-2006M/s. MerilynShipping&Transports, Vizg1.2.3.Hon’ble Vice-President, (MZ)Shri.S.V.Merhotra,A.M.Shri. Mahavir Singh,J.M.“Whether, Sec.40(a)(ia) of the I.T.Actcan be involved only to disallowexpenditure of the nature referred totherein which is shown as “payable” ason the date of the balance sheet or itcan be involved also to disallow suchexpenditure which become payable atany time during the relevant previousyear and was actually paid within theprevious year?”Heard on16.12.201113