DOING BUSINESS 2009 - JOHN J. HADDAD, Ph.D.

DOING BUSINESS 2009 - JOHN J. HADDAD, Ph.D.

DOING BUSINESS 2009 - JOHN J. HADDAD, Ph.D.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

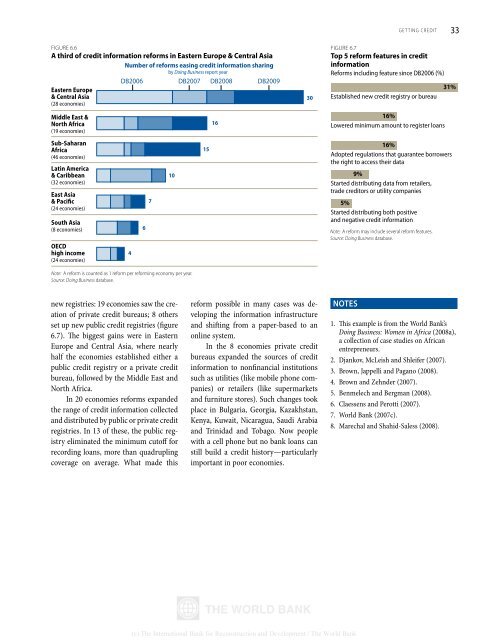

incomeincomeSource: Doing Business database.GETTING CREDIT 33FIGURE 6.6A third of credit information reforms in Eastern Europe & Central AsiaNumber of reforms easing credit information sharingby Doing Business report yearDB2006 DB2007 DB2008 DB<strong>2009</strong>Eastern Europe& Central Asia(28 economies)Middle East &North Africa(19 economies)Sub-SaharanAfrica(46 economies)Latin America& Caribbean(32 economies)East Asia& Pacific(24 economies)South Asia(8 economies)OECDhigh income(24 economies)Note: A reform is counted as 1 reform per reforming economy per year.Source: Doing Business database.46710151630FIGURE 6.7Top 5 reform features in creditinformationReforms including feature since DB2006 (%)Established new credit registry or bureau16%Lowered minimum amount to register loans16%Adopted regulations that guarantee borrowersthe right to access their data9%Started distributing data from retailers,trade creditors or utility companies5%Started distributing both positiveand negative credit informationNote: A reform may include several reform features.Source: Doing Business database.31%new registries: 19 economies saw the creationof private credit bureaus; 8 othersset up new public credit registries (figure6.7). The biggest gains were in EasternEurope and Central Asia, where nearlyhalf the economies established either apublic credit registry or a private creditbureau, followed by the Middle East andNorth Africa.In 20 economies reforms expandedthe range of credit information collectedand distributed by public or private creditregistries. In 13 of these, the public registryeliminated the minimum cutoff forrecording loans, more than quadruplingcoverage on average. What made thisreform possible in many cases was developingthe information infrastructureand shifting from a paper-based to anonline system.In the 8 economies private creditbureaus expanded the sources of creditinformation to nonfinancial institutionssuch as utilities (like mobile phone companies)or retailers (like supermarketsand furniture stores). Such changes tookplace in Bulgaria, Georgia, Kazakhstan,Kenya, Kuwait, Nicaragua, Saudi Arabiaand Trinidad and Tobago. Now peoplewith a cell phone but no bank loans canstill build a credit history—particularlyimportant in poor economies.Notes1. This example is from the World Bank’sDoing Business: Women in Africa (2008a),a collection of case studies on Africanentrepreneurs.2. Djankov, McLeish and Shleifer (2007).3. Brown, Jappelli and Pagano (2008).4. Brown and Zehnder (2007).5. Benmelech and Bergman (2008).6. Claessens and Perotti (2007).7. World Bank (2007c).8. Marechal and Shahid-Saless (2008).(c) The International Bank for Reconstruction and Development / The World Bank