Professor Koustubh Kanti Ray - IIM Raipur

Professor Koustubh Kanti Ray - IIM Raipur

Professor Koustubh Kanti Ray - IIM Raipur

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

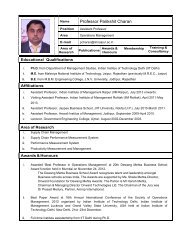

NameAreaPositionEmail<strong>Koustubh</strong> <strong>Kanti</strong> <strong>Ray</strong>Finance & AccountingAssociate <strong>Professor</strong>kkray@iimraipur.ac.inArea ofResearchPublicationsAward &HonoursMembershipTraining &ConsultancyEducational Qualification: Ph.D from Utkal University M.Phil with First Class from Utkal University M.Com with First class (rank holder) from Utkal University PGDBM, with First class from Barkatullah University B.Com with First class & distinction from Ravenshaw UniversityAffiliations: Associate <strong>Professor</strong> (Finance & Accounting), Indian Institute of Management (<strong>IIM</strong>), <strong>Raipur</strong>,from Dec, 2012 Assistant <strong>Professor</strong> (Financial Management), Indian Institute of Forest Management (IIFM), Bhopal,May 2010 to Dec 2012. Assistant <strong>Professor</strong> (Finance & Accounting), IBS, Hyderabad, Jan 2006 to April 2010.Area of Research: Financial Markets Environment Finance & Valuation Corporate Finance Behavioural Finance Sustainable Investment AnalysisAward & Honours: Qualified, National Eligibility Test (NET), conducted by UGC, India, July 2000.Professional Membership: Indian Accounting Association Global Association of Risk Professionals (GARP), UKSelected Research Publications (Referred Journals):1. <strong>Ray</strong> <strong>Koustubh</strong> <strong>Kanti</strong> and Ajay Panda, (2011), The Impact of Derivative Trading on Spot Market Volatility:Evidence for Indian Derivative Market, Interdisciplinary Journal of Research in Business (UK), July, Vol. 1, Issue.7, pp.117-131.2. <strong>Ray</strong> <strong>Koustubh</strong> <strong>Kanti</strong> (2011), Indian Stock Market Efficiency: An Empirical Study of Some Corporate Events,Abhigyan (Management Journal of FORE School of Management), Vol.XXIX,No.2,July-Sept,pp.21-36.3. <strong>Ray</strong>, <strong>Koustubh</strong> <strong>Kanti</strong> (2011) “Market Reaction to Bonus Issues and Stock Splits in India: An Empirical Study”Icfai Journal of Applied Finance, Vol. 17, No. 1.4. <strong>Ray</strong>, <strong>Koustubh</strong> <strong>Kanti</strong> and Suresh Chandra Bihari,(2011), “Evaluating Real Estate Valuation: An EmpiricalInvestigation”, Strategy of Infrastructure Finance, Edited Book Published by Macmillan, New Delhi (MacmillanAdvanced Research Series), Pp.179-191.5. <strong>Ray</strong>, <strong>Koustubh</strong> <strong>Kanti</strong> (2011) “Stock Split and Rights Issue Effect on Indian Stock Market:An Empirical Study”Indian Journal of Finance, February, Volume 5, Number 26. <strong>Ray</strong>, <strong>Koustubh</strong> <strong>Kanti</strong> (2010) “Stability of Beta over Market Phases: An Empirical Study on Indian Stock Market”

International Research Journal of Finance and Economics (IRJFE),Euro Journals, Issue, 50, pp.174-189.7. <strong>Ray</strong> <strong>Koustubh</strong> <strong>Kanti</strong>, (2010), “Stock Returns and Market Efficiency: An Empirical Study on Indian Stock Market”International Journal of Research in Commerce & Management, Issue 6, October, pp.35-41.8. <strong>Ray</strong>, <strong>Koustubh</strong> <strong>Kanti</strong> (2009). “Foreign Institutional Investors and Indian Stock Market Returns: A RelationshipStudy”, Vilakshan, XIMB Journal of Management, Vol. VI, Issue No.1, March, pp.39-58.9. <strong>Ray</strong>, <strong>Koustubh</strong> <strong>Kanti</strong> (2009). “Investment behavior and the Indian stock market crash 2008:An Empirical Studyof Student Investors”, Icfai Journal of Behavioral Finance, Vol.VI, No. 3&4, September, pp.38-65.10. <strong>Ray</strong>, <strong>Koustubh</strong> <strong>Kanti</strong> (2008) “Investor Psychology and the Behavior of Stock Market Prices”, Indian StockMarket, Excel books, New Delhi, pp.47-60.11. <strong>Ray</strong>, <strong>Koustubh</strong> <strong>Kanti</strong> (2007), “Value-Based Management Strategy: An Alternative Approach to ExecutiveCompensation at TCS”, Icfai Journal of Business Strategy, December, Vol. IV, No.4, pp.31-44.12. <strong>Ray</strong>, <strong>Koustubh</strong> <strong>Kanti</strong> and Samson Moharana (2002). “Restructuring PSEs through disinvestments: some criticalissues”, Indian Journal of commerce, Vol.55, No.1&2, Jan-June, pp.66-74.Other Publications:13. <strong>Ray</strong> <strong>Koustubh</strong> <strong>Kanti</strong> (2012),” Positioning Indian Micro Finance Institutions in the Capital Market: Some Issues”,Micro Finance & Women Empowerment- Emerging Perspective, Issues and Strategies, Edited Book Publishedby New Royal Book Company (Publisher of academic books), Lucknow, Vol. 1, Issue No.1, pp. 286-30014. <strong>Ray</strong>, <strong>Koustubh</strong> <strong>Kanti</strong> (2006). “Bank reform and financing the value chain in agriculture”, icfai, ProfessionalBanker, April.15. <strong>Ray</strong>, <strong>Koustubh</strong> <strong>Kanti</strong> and Surya Dev (2003). “Studying entrepreneurial seriousness amid small business atBhubaneswar”, Entrepreneurship Development policies and strategies, Utkal University, July, pp.23-31.16. <strong>Ray</strong> <strong>Koustubh</strong> <strong>Kanti</strong> (2000), “Orissa: A destination for investors”, Orissa Review, April, Vol.LV, No.9, pp.64-68.17. <strong>Ray</strong>, <strong>Koustubh</strong> <strong>Kanti</strong> (1999), “Merger mania 1998 and future of Indian business”, Management Accountant,ICWAI, August, pp.10-15.