home equity system texas information closed-end - CUNA Mutual ...

home equity system texas information closed-end - CUNA Mutual ... home equity system texas information closed-end - CUNA Mutual ...

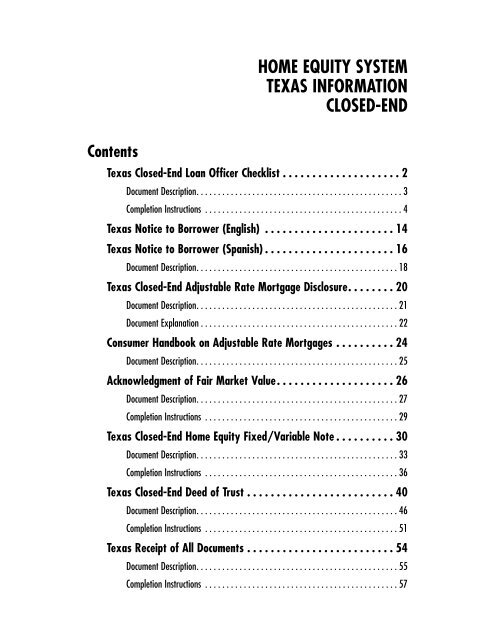

HOME EQUITY SYSTEMTEXAS INFORMATIONCLOSED-ENDContentsTexas Closed-End Loan Officer Checklist . . . . . . . . . . . . . . . . . . . . 2Document Description. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3Completion Instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4Texas Notice to Borrower (English) . . . . . . . . . . . . . . . . . . . . . . 14Texas Notice to Borrower (Spanish) . . . . . . . . . . . . . . . . . . . . . . 16Document Description. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18Texas Closed-End Adjustable Rate Mortgage Disclosure. . . . . . . . 20Document Description. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21Document Explanation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22Consumer Handbook on Adjustable Rate Mortgages . . . . . . . . . . 24Document Description. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25Acknowledgment of Fair Market Value. . . . . . . . . . . . . . . . . . . . 26Document Description. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27Completion Instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29Texas Closed-End Home Equity Fixed/Variable Note . . . . . . . . . . 30Document Description. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33Completion Instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36Texas Closed-End Deed of Trust . . . . . . . . . . . . . . . . . . . . . . . . . 40Document Description. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46Completion Instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51Texas Receipt of All Documents . . . . . . . . . . . . . . . . . . . . . . . . . 54Document Description. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 55Completion Instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57

- Page 3 and 4: Texas Closed-End Information - 1

- Page 5 and 6: Texas Closed-End Loan Officer Check

- Page 7 and 8: Texas Closed-End Loan Officer Check

- Page 9 and 10: Texas Closed-End Loan Officer Check

- Page 11 and 12: Texas Closed-End Loan Officer Check

- Page 13 and 14: Texas Closed-End Loan Officer Check

- Page 15 and 16: Texas Closed-End Loan Officer Check

- Page 17 and 18: Texas Notice to Borrower (English)

- Page 19 and 20: Texas Notice to Borrower (Spanish)(

- Page 21 and 22: Texas Closed-End Information - 19

- Page 23 and 24: Adjustable Rate Mortgage (ARM) Disc

- Page 25 and 26: Adjustable Rate Mortgage (ARM) Disc

- Page 27 and 28: Consumer Handbook on Adjustable Rat

- Page 29 and 30: Acknowledgment of Fair Market Value

- Page 31 and 32: Acknowledgment of Fair Market Value

- Page 33 and 34: Note and Disclosure StatementNOTE C

- Page 35 and 36: Note and Disclosure StatementNote a

- Page 37 and 38: Note and Disclosure StatementNOTE C

- Page 39 and 40: Note and Disclosure Statement10. Fi

- Page 41 and 42: Note and Disclosure Statement23. Th

- Page 43 and 44: Deed of Trust - Home EquityBorrower

- Page 45 and 46: Deed of Trust - Home Equityextent n

- Page 47 and 48: Deed of Trust - Home EquityUse this

- Page 49 and 50: Texas Closed-End Information - 47

- Page 51 and 52: Deed of Trust - Home Equity19. Limi

HOME EQUITY SYSTEMTEXAS INFORMATIONCLOSED-ENDContentsTexas Closed-End Loan Officer Checklist . . . . . . . . . . . . . . . . . . . . 2Document Description. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3Completion Instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4Texas Notice to Borrower (English) . . . . . . . . . . . . . . . . . . . . . . 14Texas Notice to Borrower (Spanish) . . . . . . . . . . . . . . . . . . . . . . 16Document Description. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18Texas Closed-End Adjustable Rate Mortgage Disclosure. . . . . . . . 20Document Description. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21Document Explanation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22Consumer Handbook on Adjustable Rate Mortgages . . . . . . . . . . 24Document Description. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25Acknowledgment of Fair Market Value. . . . . . . . . . . . . . . . . . . . 26Document Description. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27Completion Instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29Texas Closed-End Home Equity Fixed/Variable Note . . . . . . . . . . 30Document Description. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33Completion Instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36Texas Closed-End Deed of Trust . . . . . . . . . . . . . . . . . . . . . . . . . 40Document Description. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46Completion Instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51Texas Receipt of All Documents . . . . . . . . . . . . . . . . . . . . . . . . . 54Document Description. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 55Completion Instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57

Texas Closed-End Information – 1

Texas Closed-End Loan Officer ChecklistTexas Loan Officer ChecklistCLOSED-ENDLOAN NUMBERSHARE/SHARE DRAFT ACCOUNT NUMBERAPPLICANT’S NAMEPHONE NUMBERCO-APPLICANT’S NAMEPHONE NUMBERAPPLICANT’S ADDRESSCO-APPLICANT’S ADDRESS1 PRELIMINARY STEPSCHECKWHEN STEPCOMPLETEDAt the Time Application is Given to Borrower:Application Given to BorrowerTexas Notice Given to BorrowerVariable Rate Loans Only:ARM Disclosure Given to BorrowerCHARM Booklet Given to BorrowerDATE(OPTIONAL)___/___/______/___/______/___/______/___/___4 APPROVAL OR DENIAL OF LOANCHECKWHEN STEPCOMPLETEDORCredit Denied and ECOA Notice GivenAmount, Interest Rate and Term Approvedfor This Loan:DATE(OPTIONAL)___/___/______/___/___$ ______________ ______________% ________________AMOUNT INTEREST RATE TERM APPROVED2 CREDITWORTHINESS3 EQUITYAt the Time Application is Received from Borrower:Date Application is ReceivedApplication Fee CollectedMortgage Servicing Disclosure Given to Borrower(First Lien Position Only)Good Faith Estimate Given to BorrowerRequired Service Provider Notice Given to BorrowerAfter Application is Received:Debt/Income RatioLoan to Value RatioPrior Home Equity LoansCredit Denied and ECOA Notice Given to Borroweror Proceed With Steps BelowVerification of DepositVerification of EmploymentVerification of First MortgageResidential Mortgage Credit ReportVerification of DebtAppraisalTitle Insurance or Opinion of TitleFlood Hazard DeterminationFlood Notice (if applicable)___/___/______/___/______/___/______/___/______/___/______/___/______/___/______/___/______/___/___DATE(OPTIONAL)___/___/______/___/______/___/______/___/______/___/___DATE(OPTIONAL)___/___/______/___/______/___/______/___/___5 PREPARE DOCUMENTS — CLOSE LOANNOTE: The loan cannot close until the 12th day after the Texas Notice isgiven to Borrower or Borrower submits an application, whichever is later.DATE(OPTIONAL)ORA final itemized disclosure of all fees, points, interest,costs and charges to be paid at closing given toowner (must be at least 1 business day before closing)Acknowledgment of Fair Market ValueRESPA Escrow Account DisclosureNote/Truth in L<strong>end</strong>ing DisclosureDeed of TrustHUD-1A Settlement StatementNotice of Right to CancelInsurance: Hazard Credit Disability Credit Life FloodAutomatic Payment AuthorizationReceipt of All Documents Signed at ClosingAdditional Credit Union Forms:3-Day Right of Rescission Time ExpiredRight of Rescission ExercisedFunds DisbursedPayment of FeesDeed of Trust RecordedLetter Sent to Prior Mortgage Holder___/___/______/___/______/___/______/___/______/___/______/___/______/___/______/___/______/___/______/___/______/___/______/___/______/___/______/___/______/___/______/___/___6 LOAN PAID IN FULLORNote Cancelled and Returned to BorrowerRelease of Lien Given to BorrowerA Copy of the Endorsement and Assignment of theLien Given to BorrowerDATE(OPTIONAL)___/___/______/___/______/___/___©<strong>CUNA</strong> MUTUAL GROUP, 1991, 97, 2003, ALL RIGHTS RESERVEDTO ORDER: 1-800-356-5012ETX8012 – LOANLINER Home Equity System

Texas Closed-End Loan Officer ChecklistTexas Closed-End Loan Officer ChecklistDocument DescriptionWhen Used:Purpose:How Distributed:This document should be used each time a creditunion processes a <strong>closed</strong>-<strong>end</strong> <strong>home</strong> <strong>equity</strong> loan.This document provides a checklist your loanofficer(s) may use in processing each <strong>closed</strong>-<strong>end</strong><strong>home</strong> <strong>equity</strong> loan in Texas. It provides a listing of theitems that should be considered and the documentsthat must be given or received when processing aTexas <strong>home</strong> <strong>equity</strong> loan. It starts at the time anapplication is given to the borrower and <strong>end</strong>s whenthe loan is paid in full.This document should be placed in borrower’s fileafter completion.No. of Parts: 1Imprinting:Special Notes:Optional - Credit union name, address, telephonenumber and logoThis document can be used by your loan officer(s) toachieve consistency and accuracy in processing your<strong>closed</strong>-<strong>end</strong> <strong>home</strong> <strong>equity</strong> loans. Your credit union’sloan policies should be written to cover each itemoutlined in this document.Texas Closed-End Information – 3

Texas Closed-End Loan Officer ChecklistCompletion InstructionsThe following <strong>information</strong> will be helpful to the loan officer whenprocessing applications for <strong>closed</strong>-<strong>end</strong> <strong>home</strong> <strong>equity</strong> loans in Texas. The LoanOfficer Checklist takes you through each step when processing a <strong>home</strong><strong>equity</strong> <strong>closed</strong>-<strong>end</strong> loan. This <strong>information</strong> has been divided into six subheadingsbelow.1. Preliminary Steps – This section can be used to verify that theapplication has been given to the borrower and that the proper variablerate disclosures have been given (if applicable). This section can also beused to screen out applications clearly ineligible for a LOANLINER ®Home Equity Loan in Texas.At The Time Application is Given to BorrowerApplication given to borrower – The credit union can document when theapplication was given to the borrower. This can be important in doingvariable rate l<strong>end</strong>ing because certain disclosures must be given at thetime the application is given to the borrower.Texas Notice to Borrower – This Notice is required to be given to theborrower at least 12 days prior to closing the loan. Therefore, it ispreferable to give this Notice to the borrower as soon as possible. Forfurther details refer to the Texas Notice to Borrower section.Adjustable Rate Mortgage Disclosure (ARM Disclosure) Given to Borrower –If the credit union is offering variable rate loans, this disclosure must begiven to the borrower at the this time. For further details refer to theARM Disclosure section.Consumer Handbook on Adjustable Rate Mortgages (CHARM Booklet) Givento Borrower – If the credit union is offering variable rate loans, thisbooklet must be given to the borrower at this time. For further detailsrefer to the CHARM Booklet section.At the Time Application is Received from BorrowerDate Application is received – Regulation B Section 202.9 requires thecredit union notify the applicant of the credit decision within 30 daysafter a completed application is received.If the application is incomplete, the credit union has two options. TheOfficial Staff Commentary for Regulation B Section 202.9(a)(1)3 states:“When an application is incomplete regarding matters the applicantcan complete and the creditor lacks sufficient data for a credit decision,the creditor may deny the application giving as the reason for denialthat the application is incomplete. The creditor has the option,alternatively, of providing a notice of incompleteness under Section202.9(c).”4 – LOANLINER Home Equity System

Texas Closed-End Loan Officer ChecklistAdverse Action Notice documents are available for purchase throughLOANLINER ® L<strong>end</strong>ing Systems.Application Fee (if collected) – At the time the borrower submits anapplication, your credit union may collect an “application fee” whichcovers the cost of the appraisal, credit report, etc.Mortgage Servicing Disclosure – This disclosure is required by RESPAand applies to loans in 1st lien position only. It states that the right tocollect the mortgage payments may be transferred. LOANLINER doesnot supply this document.At the Time Application is Received or within 3 business days:Good Faith Estimate – This disclosure is required by RESPA and givesestimates of the amounts the borrower will pay at or before closing.Required Service Provider Notice – If the credit union requires theborrower to use specified settlement service providers then theproviders must be dis<strong>closed</strong>. The LOANLINER Good Faith Estimatemay be used to make this disclosure. You will want to attach a separatesheet to the Good Faith Estimate listing your required providers.After the Application is ReceivedDebt/Income Ratio – Your credit union must figure the borrower’s debtto income ratio. NCUA Letter No. 124 recomm<strong>end</strong>s that your creditunion establish a debt/income ratio. If the <strong>information</strong> on theapplication makes it clear the borrower cannot qualify for a <strong>home</strong><strong>equity</strong> <strong>closed</strong>-<strong>end</strong> loan, you may choose not to go to the expense ofverifying employment, checking credit history, determining <strong>equity</strong> andexamining title.Loan to Value Ratio – In accordance with the Texas Constitution, whenyou add the principal balances of all other indebtedness against theproperty, the ratio of the total amount of credit ext<strong>end</strong>ed to the total<strong>equity</strong> in the <strong>home</strong> should not exceed 80% of the fair market value ofthe <strong>home</strong> on the date the extension of credit is made.Prior Home Equity Loans – Only one <strong>home</strong> <strong>equity</strong> loan can be secured bythe borrower’s <strong>home</strong>stead at a time. Therefore, the borrower must payoff any existing <strong>home</strong> <strong>equity</strong> loan before he/she may obtain another.Credit Denied and ECOA Notice Given – Based on the above stepsevaluate whether credit will be granted or denied. If credit will bedenied s<strong>end</strong> a copy of an Adverse Action document completedappropriately to meet Regulation B Section 202.9 and if you used acredit report, the Fair Credit Reporting Act (FCRA). If credit is notdenied, proceed with the following steps.Texas Closed-End Information – 5

Texas Closed-End Loan Officer Checklist2. Creditworthiness – In order to verify the <strong>information</strong> on the applicationthe following <strong>information</strong> is usually needed in order to evaluate theapplicant’(s) creditworthiness.Verification of Deposit – “Request for Verification of Deposit” should beobtained from each depository institution (other than the credit union)the applicant(s) or other persons (co-applicant, spouse or formerspouse) indicated on the application. Your credit union should have theapplicant(s) or other person sign each verification of deposit befores<strong>end</strong>ing to the depository institution.The “Request for Verification of Deposit” is available for purchasethrough LOANLINER ® L<strong>end</strong>ing Systems.Verification of Employment – “Request for Verification of Employment”should be obtained from each former and current employer indicatedby the applicant(s) or other person for the period of time you chose.The credit union should have the applicant(s) or other person sign each“verification” before s<strong>end</strong>ing to the former or current employers.The “Request for Verification of Employment” is available for purchasethrough LOANLINER ® L<strong>end</strong>ing Systems.Verification of First Mortgagor – Your credit union should obtain a“Request for Verification of Mortgage” to verify existing mortgages.This obtains direct verification of mortgage payments from theinstitution indicated on the application. Many special situations mayarise. These must be evaluated by a person with experience inmortgage l<strong>end</strong>ing law.The “Request for Verification of Mortgage” is available for purchasethrough LOANLINER ® L<strong>end</strong>ing Systems.Residential Mortgage Credit Report – A detailed “Residential MortgageCredit Report” should be obtained on each applicant(s) or other personfrom a Credit Reporting Agency (Bureau). This report should give adetailed account of the credit, employment, and residence history, aswell as public record <strong>information</strong>, concerning each applicant(s) or otherperson.Verification of Debt – Your credit union should obtain a “Request forDirect Credit Verification” to verify any debts which will not appear onthe credit report. If there is any doubt that a debt will not be reflectedon the credit report a direct credit verification should be sent.The “Direct Credit Verification” is available for purchase throughLOANLINER ® L<strong>end</strong>ing Systems.6 – LOANLINER Home Equity System

Texas Closed-End Loan Officer Checklist3. Equity – This section discusses the steps your credit union should taketo determine the fair market value of the <strong>home</strong> and measure the <strong>equity</strong>.Appraisal – Obtain an appraisal to verify the value of the property andto determine the <strong>equity</strong> available in the property that is used assecurity. This appraisal should meet the appraisal guidelines outlinedin the NCUA Letter No. 124 and NCUA Regulation Part 722. Refer toLetter No. 124 to determine whether a written appraisal is needed andwhether a licensed or certified appraiser is required.Note: An Acknowledgment of Fair Market Value will be signed by theborrower and the credit union at closing.Title Insurance or Opinion of Title – Obtain a title examination (titleinsurance or opinion of title) to verify your lien priority. The guidelinesoutlined in the NCUA Letter No. 124 recomm<strong>end</strong> that all L<strong>end</strong>ersobtain Title Insurance and/or an Opinion of Title.Note: It is extremely important that the credit union verify all otherliens on the property due to the fact that a <strong>home</strong> <strong>equity</strong> loan may onlybe granted if the borrower has a loan to value ratio of the principalbalance of all loans secured by the <strong>home</strong>stead, not in excess of 80%, onthe date of closing.Flood Hazard Determination – For every loan made by a credit union(federally chartered or state chartered, federally insured) which issecured by a building or mobile <strong>home</strong>, the credit union must use astandard Flood Hazard Determination to determine whether thesecured property is or will be located in a special flood hazard area(SFHA). Either the credit union or a v<strong>end</strong>or may complete thedocument.Flood Insurance Notice – If it is determined that the building or mobile<strong>home</strong> securing the loan is located in a special flood hazard area, thenthis notice must be provided to the borrower/owner.4. Approval or Denial of Loan – Based on all the <strong>information</strong> receivedfrom the above steps evaluate whether credit will be denied orapproved.If credit will be denied, s<strong>end</strong> a copy of an adverse action noticecompleted appropriately to meet Regulation B Section 202.9 and theFCRA. If credit is approved, s<strong>end</strong> letter to applicant notifying them ofapproval and then proceed with the following steps:5. Prepare Documents – Close Loan – Once a determination has beenmade to ext<strong>end</strong> a <strong>home</strong> <strong>equity</strong> loan, various documents should beprepared for closing. In most instances, the borrower will actually signthe documents at closing. In accordance with the Texas Constitution, aTexas Closed-End Information – 7

Texas Closed-End Loan Officer Checklist<strong>home</strong> <strong>equity</strong> loan may not close until the 12th day after the later of thedate that the owner of the <strong>home</strong>stead submits an application to thel<strong>end</strong>er for the extension of credit or the date that the l<strong>end</strong>er providesthe owner a copy of the notice required by the constitutionalam<strong>end</strong>ment. Furthermore, a <strong>home</strong> <strong>equity</strong> loan cannot be <strong>closed</strong> untilthe first anniversary of the closing date of any other <strong>home</strong> <strong>equity</strong> loansecured by this property. Additionally, the loan may only be <strong>closed</strong> atthe credit union, an attorney’s office, or a title company.A final itemized disclosure of all fees, points, interest, costs and charges to bepaid at closing given to owner – The Texas Constitution provides that theloan cannot close before one business day after the date that the ownerof the <strong>home</strong>stead receives a final itemized disclosure of the actual fees,points, interest, costs and charges that will be charged at closing. If abonafide emergency or another good cause exists and the credit unionobtains the written consent of the owner, the credit union may providethe documentation to the owner or the credit union may modifypreviously provided documentation on the date of closing.Acknowledgment of Fair Market Value – The Texas Constitution requiresthe borrower and the credit union to sign an Acknowledgment of FairMarket Value at the time the loan is <strong>closed</strong>.RESPA Escrow Account Disclosure – This document discloses any escrowrequirements and specifies the amounts.Note and Disclosure Statement – The Note and Truth in L<strong>end</strong>ingDisclosure consists of three main sections: the Truth in L<strong>end</strong>ingdisclosures, the promissory note and the credit insurance applicationsection. The “Fed Box” includes the disclosures required to be givenunder Regulation Z. The promissory note contains the contractuallanguage necessary to obligate the borrower(s) to repay the loan.Your credit union will be responsible for completing the Note andTruth in L<strong>end</strong>ing Disclosure for closing.Deed of Trust – The Deed of Trust signifies the borrower(s)’ pledge ofreal property as collateral in order to secure the <strong>closed</strong>-<strong>end</strong> loan.Preparation of the Deed of Trust for closing requires your credit unionto complete applicable <strong>information</strong>. Your credit union will also need toprepare the signature and acknowledgment area for the borrower’ssignature at closing.At closing, the credit union will need to obtain the signature(s) on theDeed of Trust of those persons who have an ownership interest in theproperty being offered as security as well as the spouse of each owner.Once the Deed of Trust has been executed, and the Right of Rescission8 – LOANLINER Home Equity System

Texas Closed-End Loan Officer Checklisttime has expired, the credit union should take all necessary steps torecord the instrument and perfect their interest in the property.HUD 1A Settlement Statement – This disclosure states all of the actualfees and costs paid by the borrower at or prior to closing.Notice of Right to Cancel – It is important to alert borrowers they will notreceive any funds immediately at closing. By informing the borrowerabout the right to cancel, your credit union can avoid inconveniencewhich might arise if the borrower is under the impression they canreceive funds the day the documents are signed. Your credit unionshould not disburse any funds until the three-day right to cancelperiod has passed. The rescission period will expire at midnight on thethird business day following the consummation of the loan, delivery ofthe Notice of Right to Cancel or delivery of all material disclosures (theNote and Disclosure Statement) whichever occurs last. In preparing theNotice of Right to Cancel, your credit union should prepare notices foreach person having a right to rescind. A person has a right to rescind ifthey give a security interest in their principal dwelling.Once the rescission period has passed and the Statement ofNoncancellation is received, the credit union may disburse funds. Ifyour credit union does not receive a signed Statement ofNoncancellation, you may only disburse funds when you are satisfiedthe rescission period has passed and no eligible person has exercisedtheir right to cancel the transaction.Insurance: Hazard, Disability, Life and Flood – At closing, your creditunion must receive evidence that adequate hazard insurance is in placeand the credit union is named as a beneficiary party.Your credit union should determine whether or not the property beingoffered is located in a special flood hazard area to meet the FloodDisaster Protection Act of NCUA Regulations 12 C.F.R. Section 760. If itis determined that the property is located in such an area, the creditunion must receive documentation that adequate flood insurance hasbeen purchased.Your credit union should determine if the borrower wants CreditDisability and/or Credit Life insurance.Automatic Payment Authorization – Some credit unions will useautomatic payment features such as payroll deduction. If your creditunion offers automatic payments, you should have the borrowers signthe appropriate documents used by your credit union for this purpose.Receipt of Documents Signed at Closing – The Texas Constitution requiresthat the borrower receive a copy of all documents signed at closing.This document verifies that the borrower received them.Texas Closed-End Information – 9

Texas Closed-End Loan Officer ChecklistAdditional Credit Union DocumentsYour credit union may require additional documents in order tocomplete the <strong>home</strong> <strong>equity</strong> loan. Any additional documents should beprepared for borrower’s signature at closing.3-Day Right of Rescission Time Expired – No funds can be disbursed untilthe rescission period has expired and the credit union is reasonablysatisfied the <strong>home</strong>owners have not rescinded.After you’re certain the borrower does not wish to cancel thetransaction, it’s recomm<strong>end</strong>ed you have the borrowers return and signthe original Notice of Right to Cancel confirming their non-cancellation.When this step occurs, you’re ready to disburse the funds, pay all feesto appropriate parties, record the Deed of Trust, and notify the firstmortgage holder.Right of Rescission Exercised – If the borrower(s) exercises their right tocancel, then you must take certain steps. First, you must receive writtennotification of the desire to cancel the transaction. The borrower canuse a copy of the “Notice of Right to Cancel” you gave to them atclosing or any written statement signed and dated by the borrowerstating their intent to cancel. The date by which they must exercisetheir right to cancel is stated on the original Notice of Right to Cancel.When this occurs, you must refund any and all fees or charges theborrower paid to obtain approval for the loan. You must return theborrower's money within 20 days of receiving the notification ofcancellation. Additionally, if a lien has been filed, it must be released.Funds Disbursed – You can disburse the funds in many ways. You coulddo so in the form of a check at the credit union, check by mail, or placethe funds directly into the borrower’s account.Payment of Fees – Now is the time to pay all the fees collected with thistransaction to the appropriate parties.Deed of Trust Recorded – If you did not already do so, record the Deed ofTrust with the government agency responsible for real estate records.Letter Sent to Prior Mortgage Holder – A letter can be sent notifying theholder of any prior mortgage that the borrower has applied for a <strong>home</strong><strong>equity</strong> loan and the credit union is requesting <strong>information</strong> about theprior mortgage. Following approval of the <strong>home</strong> <strong>equity</strong> loan, the creditunion can s<strong>end</strong> a letter to the prior mortgage holder that the creditunion’s security instrument has been recorded. A sample of theseletters are on the following pages.10 – LOANLINER Home Equity System

Texas Closed-End Loan Officer ChecklistSample of Letter to S<strong>end</strong> BeforeConsummation of the Closed-End Loan______________________(Date)Name & Address ofHolder of 1st(Mortgage or Deed of Trust)RE: Borrowers’ NamesStreet Address of PropertyCity, State and ZipCredit Union Acct. No.Dear _______________:The borrowers listed above have applied to us for a <strong>home</strong> <strong>equity</strong> loan. Theborrowers’ signatures below authorize you to release to us the following<strong>information</strong> about your (Mortgage or Deed of Trust).______________ Original Balance______________ Fixed Rate______________ Current Balance______________ Variable Rate______________ Current Monthly Payment ______________ Renegotiable Rate______________ Principal and Interest ______________ FHA______________ Taxes and Insurance ______________ VA______________ Maturity Date______________ ConventionalMo/Day/Yr______________ Payment status is satisfactory (payments are made promptlyand in full).______________ Payment status is not satisfactory (please explain)____________________________________________________________________________________________________________________ Yes ____ No Your (Mortgage or Deed of Trust) permits the borrowers toplace a junior (Mortgage or Deed of Trust) on the property.Please s<strong>end</strong> this document in the en<strong>closed</strong> stamped, addressed envelope to:(name of credit union; street address; city, state, zip). Thank you for yourcooperation.Information provided by:________________________________________________________________Signature - Credit UnionTitle:____________________________Phone:__________________________Please release the <strong>information</strong> requested above to (name of your credit union).___________________________Borrower___________________________Borrower____________Date____________DateTexas Closed-End Information – 11

Texas Closed-End Loan Officer ChecklistSample of Letter to S<strong>end</strong> AfterConsummation of the Closed-End Loan______________________(Date)Name & Address ofHolder of 1st(Mortgage or Deed of Trust)RE: Borrowers’ NamesStreet Address of PropertyCity, State and ZipCredit Union Acct. No.Dear _______________:(Name of credit union) has executed a <strong>home</strong> <strong>equity</strong> loan for the borrowers listedabove. The borrowers agreed not to request or accept any future advances onthe (Mortgage or Deed of Trust) you hold. The borrowers request and authorizeyou to notify us if their account with you ever becomes delinquent.The (Mortgage or Deed of Trust) securing the loan was recorded on__________ (date) at the _____________________________________ (name ofrecording office) on ______________ page of ________________ book. Theprincipal balance of the <strong>home</strong> <strong>equity</strong> loan is $_______________.Thank you for your cooperation._______________________________Signature - Credit UnionWe have agreed not to increase the balance of the first (Mortgage or Deed ofTrust) with you. We authorize you to notify (name of credit union) if ouraccount becomes delinquent.___________________________Borrower___________________________Borrower____________Date____________Date12 – LOANLINER Home Equity System

Texas Closed-End Loan Officer Checklist6. Loan Paid in FullNote Cancelled and Returned to Borrower – In accordance with the TexasConstitution, after the loan is paid in full, within a reasonable time, thecredit union must cancel and return the Note to the borrower.Release of Lien Given to Borrower – When the loan is paid in full, thecredit union must also provide the borrower with a release of the liensecuring the debt, in recordable form, orA Copy of the Endorsement and Assignment of the Lien Sent to the Borrower– When the loan is paid in full, the credit union must provide theborrower with a copy of an <strong>end</strong>orsement and assignment of the lien toa l<strong>end</strong>er that is refinancing the extension of credit.Texas Closed-End Information – 13

Texas Notice to Borrower (English)“NOTICE CONCERNING EXTENSIONS OF CREDITDEFINED BY SECTION 50(a)(6), ARTICLE XVI, TEXAS CONSTITUTION:“SECTION 50(a)(6), ARTICLE XVI, OF THE TEXAS CONSTITUTION ALLOWS CERTAIN LOANS TOBE SECURED AGAINST THE EQUITY IN YOUR HOME. SUCH LOANS ARE COMMONLY KNOWN ASEQUITY LOANS. IF YOU DO NOT REPAY THE LOAN OR IF YOU FAIL TO MEET THE TERMS OF THE LOAN,THE LENDER MAY FORECLOSE AND SELL YOUR HOME. THE CONSTITUTION PROVIDES THAT:“(A) THE LOAN MUST BE VOLUNTARILY CREATED WITH THE CONSENT OF EACH OWNER OFYOUR HOME AND EACH OWNER’S SPOUSE;“(B) THE PRINCIPAL LOAN AMOUNT AT THE TIME THE LOAN IS MADE MUST NOT EXCEED ANAMOUNT THAT, WHEN ADDED TO THE PRINCIPAL BALANCES OF ALL OTHER LIENS AGAINST YOURHOME, IS MORE THAN 80 PERCENT OF THE FAIR MARKET VALUE OF YOUR HOME;“(C) THE LOAN MUST BE WITHOUT RECOURSE FOR PERSONAL LIABILITY AGAINST YOU ANDYOUR SPOUSE UNLESS YOU OR YOUR SPOUSE OBTAINED THIS EXTENSION OF CREDIT BY ACTUALFRAUD;“(D) THE LIEN SECURING THE LOAN MAY BE FORECLOSED UPON ONLY WITH A COURT ORDER;“(E) FEES AND CHARGES TO MAKE THE LOAN MAY NOT EXCEED 3 PERCENT OF THE LOANAMOUNT;“(F) THE LOAN MAY NOT BE AN OPEN-END ACCOUNT THAT MAY BE DEBITED FROM TIME TOTIME OR UNDER WHICH CREDIT MAY BE EXTENDED FROM TIME TO TIME UNLESS IT IS A HOMEEQUITY LINE OF CREDIT;“(G) YOU MAY PREPAY THE LOAN WITHOUT PENALTY OR CHARGE;“(H) NO ADDITIONAL COLLATERAL MAY BE SECURITY FOR THE LOAN;“(I) THE LOAN MAY NOT BE SECURED BY AGRICULTURAL HOMESTEAD PROPERTY, UNLESSTHE AGRICULTURAL HOMESTEAD PROPERTY IS USED PRIMARILY FOR THE PRODUCTION OF MILK;“(J) YOU ARE NOT REQUIRED TO REPAY THE LOAN EARLIER THAN AGREED SOLELY BECAUSETHE FAIR MARKET VALUE OF YOUR HOME DECREASES OR BECAUSE YOU DEFAULT ON ANOTHERLOAN THAT IS NOT SECURED BY YOUR HOME;“(K) ONLY ONE LOAN DESCRIBED BY SECTION 50(a)(6), ARTICLE XVI, OF THE TEXASCONSTITUTION MAY BE SECURED WITH YOUR HOME AT ANY GIVEN TIME;“(L) THE LOAN MUST BE SCHEDULED TO BE REPAID IN PAYMENTS THAT EQUAL OR EXCEEDTHE AMOUNT OF ACCRUED INTEREST FOR EACH PAYMENT PERIOD;“(M) THE LOAN MAY NOT CLOSE BEFORE 12 DAYS AFTER YOU SUBMIT A WRITTENAPPLICATION TO THE LENDER OR BEFORE 12 DAYS AFTER YOU RECEIVE THIS NOTICE, WHICHEVERDATE IS LATER; AND IF YOUR HOME WAS SECURITY FOR THE SAME TYPE OF LOAN WITHIN THE PASTYEAR, A NEW LOAN SECURED BY THE SAME PROPERTY MAY NOT CLOSE BEFORE ONE YEAR HASPASSED FROM THE CLOSING DATE OF THE OTHER LOAN;“(N) THE LOAN MAY CLOSE ONLY AT THE OFFICE OF THE LENDER, TITLE COMPANY, OR ANATTORNEY AT LAW;“(O) THE LENDER MAY CHARGE ANY FIXED OR VARIABLE RATE OF INTEREST AUTHORIZED BYSTATUTE;©<strong>CUNA</strong> MUTUAL GROUP, 1997, 2000, 03, ALL RIGHTS RESERVEDTO ORDER: 1-800-356-5012 CONTINUED ON REVERSE SIDE ETX20214 – LOANLINER Home Equity System

Texas Notice to Borrower (English)“(P) ONLY A LAWFULLY AUTHORIZED LENDER MAY MAKE LOANS DESCRIBED BY SECTION50(a)(6), ARTICLE XVI, OF THE TEXAS CONSTITUTION;MUST:“(Q) LOANS DESCRIBED BY SECTION 50(a)(6), ARTICLE XVI, OF THE TEXAS CONSTITUTION“(1) NOT REQUIRE YOU TO APPLY THE PROCEEDS TO ANOTHER DEBT EXCEPT A DEBTTHAT IS SECURED BY YOUR HOME OR OWED TO ANOTHER LENDER;“(2) NOT REQUIRE THAT YOU ASSIGN WAGES AS SECURITY;BE FILLED IN;“(3) NOT REQUIRE THAT YOU EXECUTE INSTRUMENTS WHICH HAVE BLANKS LEFT TO“(4) NOT REQUIRE THAT YOU SIGN A CONFESSION OF JUDGMENT OR POWER OFATTORNEY TO ANOTHER PERSON TO CONFESS JUDGMENT OR APPEAR IN A LEGAL PROCEEDING ONYOUR BEHALF;“(5) PROVIDE THAT YOU RECEIVE A COPY OF ALL DOCUMENTS YOU SIGN AT CLOSING;“(6) PROVIDE THAT THE SECURITY INSTRUMENTS CONTAIN A DISCLOSURE THAT THISLOAN IS A LOAN DEFINED BY SECTION 50(a)(6), ARTICLE XVI, OF THE TEXAS CONSTITUTION;“(7) PROVIDE THAT WHEN THE LOAN IS PAID IN FULL, THE LENDER WILL SIGN ANDGIVE YOU A RELEASE OF LIEN OR AN ASSIGNMENT OF THE LIEN, WHICHEVER IS APPROPRIATE;“(8) PROVIDE THAT YOU MAY, WITHIN 3 DAYS AFTER CLOSING, RESCIND THE LOANWITHOUT PENALTY OR CHARGE;“(9) PROVIDE THAT YOU AND THE LENDER ACKNOWLEDGE THE FAIR MARKET VALUEOF YOUR HOME ON THE DATE THE LOAN CLOSES; AND“(10) PROVIDE THAT THE LENDER WILL FORFEIT ALL PRINCIPAL AND INTEREST IF THELENDER FAILS TO COMPLY WITH THE LENDER’S OBLIGATIONS UNLESS THE LENDER CURES THEFAILURE TO COMPLY AS PROVIDED BY SECTION 50(a)(6)(Q)(x), ARTICLE XVI, OF THE TEXASCONSTITUTION; AND“(R) IF THE LOAN IS A HOME EQUITY LINE OF CREDIT:“(1) YOU MAY REQUEST ADVANCES, REPAY MONEY, AND REBORROW MONEY UNDERTHE LINE OF CREDIT;LEAST $4,000;“(2) EACH ADVANCE UNDER THE LINE OF CREDIT MUST BE IN AN AMOUNT OF AT“(3) YOU MAY NOT USE A CREDIT CARD, DEBIT CARD, SOLICITATION CHECK, ORSIMILAR DEVICE TO OBTAIN ADVANCES UNDER THE LINE OF CREDIT;“(4) ANY FEES THE LENDER CHARGES MAY BE CHARGED AND COLLECTED ONLY ATTHE TIME THE LINE OF CREDIT IS ESTABLISHED AND THE LENDER MAY NOT CHARGE A FEE INCONNECTION WITH ANY ADVANCE;“(5) THE MAXIMUM PRINCIPAL AMOUNT THAT MAY BE EXTENDED, WHEN ADDED TOALL OTHER DEBTS SECURED BY YOUR HOME, MAY NOT EXCEED 80 PERCENT OF THE FAIR MARKETVALUE OF YOUR HOME ON THE DATE THE LINE OF CREDIT IS ESTABLISHED;“(6) IF THE PRINCIPAL BALANCE UNDER THE LINE OF CREDIT AT ANY TIME EXCEEDS50 PERCENT OF THE FAIR MARKET VALUE OF YOUR HOME, AS DETERMINED ON THE DATE THE LINEOF CREDIT IS ESTABLISHED, YOU MAY NOT CONTINUE TO REQUEST ADVANCES UNDER THE LINE OFCREDIT UNTIL THE BALANCE IS LESS THAN 50 PERCENT OF THE FAIR MARKET VALUE; AND“(7) THE LENDER MAY NOT UNILATERALLY AMEND THE TERMS OF THE LINE OF CREDIT.“THIS NOTICE IS ONLY A SUMMARY OF YOUR RIGHTS UNDER THE TEXAS CONSTITUTION.YOUR RIGHTS ARE GOVERNED BY SECTION 50, ARTICLE XVI, OF THE TEXAS CONSTITUTION, ANDNOT BY THIS NOTICE.”Texas Closed-End Information – 15

Texas Notice to Borrower (Spanish)NOTIFICACIÓN SOBRE EL OTORGAMIENTO DE CRÉDITOSDEFINIDOS EN EL ARTÍCULO 50(a)(6), SECCIÓN XVI DE LACONSTITUCIÓN DE TEXAS:“EL ARTÍCULO 50(a)(6), SECCIÓN XVI DE LA CONSTITUCIÓN DE TEXAS PERMITE QUE CIERTOSPRÉSTAMOS ESTÉN GARANTIZADOS POR SU VIVIENDA. ESTOS PRÉSTAMOS NORMALMENTE SECONOCEN COMO SEGUNDA HIPOTECA. SI USTED NO CANCELA EL PRÉSTAMO O SI NO CUMPLE CONLAS CONDICIONES DE ÉSTE, EL PRESTAMISTA PUEDE EJECUTAR Y VENDER SU VIVIENDA. LACONSTITUCIÓN ESTIPULA QUE:(A) EL PRÉSTAMO DEBE CREARSE VOLUNTARIAMENTE, CON EL CONSENTIMIENTO DE TODOSLOS PROPIETARIOS DE LA VIVIENDA Y SUS CÓNYUGES.(B) EL CAPITAL DEL PRÉSTAMO EN EL MOMENTO EN QUE SE OTORGA NO DEBE SUPERAR UNMONTO QUE, SUMADO A LOS SALDOS DEL CAPITAL DE TODOS LOS OTROS DERECHOS DE GARANTÍASOBRE SU VIVIENDA, EXCEDA EL 80 POR CIENTO DEL VALOR RAZONABLE DE LA VIVIENDA EN ELMERCADO.(C) EL PRÉSTAMO NO PUEDE TENER GARANTÍA DE RESPONSABILIDAD PATRIMONIAL CONTRAUSTED NI CONTRA SU CÓNYUGE A MENOS QUE USTED O SU CÓNYUGE OBTUVIERAN EL CRÉDITOPOR FRAUDE.(D) LA GARANTÍA REAL DEL PRÉSTAMO SÓLO PUEDE EJECUTARSE MEDIANTE UNA ORDEN DEUN TRIBUNAL.(E) LOS CARGOS Y GASTOS DE OTORGAMIENTO DEL PRÉSTAMO NO PUEDEN SUPERAR EL 3POR CIENTO DEL MONTO DE ÉSTE.(F) EL PRÉSTAMO NO PUEDE SER UNA CUENTA ABIERTA QUE PUEDA DEBITARSEPERIÓDICAMENTE O POR LA CUAL PUEDAN OTORGARSE CRÉDITOS PERIÓDICAMENTE A MENOSQUE SEA UNA LÍNEA DE CRÉDITO CON SEGUNDA HIPOTECA.(G) USTED PUEDE CANCELAR ANTICIPADAMENTE EL PRÉSTAMO SIN CARGOS NI MULTAS.(H) EL PRÉSTAMO NO PUEDE TENER GARANTÍAS ADICIONALES.(I) NO SE PUEDE GARANTIZAR EL PRÉSTAMO CON PROPIEDADES O HACIENDAS AGRÍCOLAS,A MENOS QUE LA PROPIEDAD SE USE PRINCIPALMENTE PARA LA PRODUCCIÓN DE LECHE.(J) NO SE LE EXIGIRÁ QUE CANCELE EL PRÉSTAMO ANTES DE LO ACORDADOEXCLUSIVAMENTE POR CAUSA DE LA DISMINUCIÓN DEL VALOR RAZONABLE DE LA VIVIENDA EN ELMERCADO NI DEBIDO A SU INCUMPLIMIENTO DEL PAGO DE OTRO PRÉSTAMO QUE NO ESTÁGARANTIZADO CON SU VIVIENDA.(K) PODRÁ GARANTIZAR CON SU VIVIENDA UN SOLO PRÉSTAMO DEFINIDO EN EL ARTÍCULO50(a)(6), SECCIÓN XVI DE LA CONSTITUCIÓN DE TEXAS, EN CUALQUIER MOMENTO.(L) LA CANCELACIÓN DEL PRÉSTAMO DEBE ESTAR PROGRAMADA EN PAGOS EQUIVALENTESO QUE SUPEREN EL MONTO DE INTERESES ACUMULADOS PARA CADA PERÍODO DE PAGO.(M) EL PRÉSTAMO NO SE PUEDE CERRAR ANTES DE QUE HAYAN TRANSCURRIDO 12 DÍASDESPUÉS DE QUE USTED PRESENTE AL PRESTAMISTA UNA SOLICITUD POR ESCRITO O ANTES DEQUE HAYAN TRANSCURRIDO 12 DÍAS DESPUÉS QUE USTED RECIBIERA ESTA NOTIFICACIÓN, LO QUESEA POSTERIOR. SI SU VIVIENDA GARANTIZABA EL MISMO TIPO DE PRÉSTAMO EL AÑO ANTERIOR,NO SE PUEDE CERRAR UN NUEVO PRÉSTAMO GARANTIZADO POR LA MISMA PROPIEDAD ANTES DEQUE HAYA TRANSCURRIDO UN AÑO DESDE LA FECHA DE CIERRE DEL OTRO PRÉSTAMO.(N) EL PRÉSTAMO SE PUEDE CERRAR SÓLO EN LA OFICINA DEL PRESTAMISTA, LA DE LACOMPAÑÍA SOLICITANTE O LA OFICINA DE UN ABOGADO.(O) EL PRESTAMISTA PUEDE COBRAR CUALQUIER TASA DE INTERÉS FIJO O VARIABLEAUTORIZADA POR LA LEY.(P) SÓLO UN PRESTAMISTA LEGALMENTE AUTORIZADO PUEDE HACER PRÉSTAMOS COMOLOS QUE SE DEFINEN EN EL ARTÍCULO 50(a)(6), SECCIÓN XVI, DE LA CONSTITUCIÓN DE TEXAS.©<strong>CUNA</strong> MUTUAL GROUP, 1997, 2000, 03, TODOS LOS DERECHOS RESERVADOSPARA ORDENAR: 1-800-356-5012 CONTINÚA AL DORSO ETX22116 – LOANLINER Home Equity System

Texas Notice to Borrower (Spanish)(Q) LOS PRÉSTAMOS QUE SE DEFINEN EN EL ARTÍCULO 50(a)(6), SECCIÓN XVI DE LACONSTITUCIÓN DE TEXAS:(1) NO DEBEN EXIGIRLE QUE APLIQUE LOS FONDOS A OTRA DEUDA EXCEPTO QUEESA DEUDA ESTÉ GARANTIZADA POR SU VIVIENDA O QUE EL ACREEDOR SEA OTRO PRESTAMISTA;(2) NO DEBEN EXIGIRLE QUE HAGA USO DE SUELDOS A MANERA DE GARANTÍA;(3) NO DEBEN EXIGIRLE QUE LIBRE INSTRUMENTOS DE PAGO CON ESPACIOS ENBLANCO PARA COMPLETAR;(4) NO DEBEN EXIGIRLE QUE FIRME UNA ADMISIÓN DE SENTENCIA NI PODER DEREPRESENTACIÓN LEGAL PARA QUE OTRA PERSONA ADMITA UNA SENTENCIA O COMPAREZCA ENUN PROCESO LEGAL EN SU NOMBRE;(5) DEBEN ESTIPULAR QUE USTED RECIBA UNA COPIA DE TODOS LOS DOCUMENTOSQUE FIRME EN EL CIERRE;(6) DEBEN ESTIPULAR QUE LOS INSTRUMENTOS DE GARANTÍA CONTENGAN UNADECLARACIÓN DE QUE ESTE PRÉSTAMO SE DEFINE EN EL ARTÍCULO 50(a)(6), SECCIÓN XVI, DE LACONSTITUCIÓN DE TEXAS;(7) DEBEN ESTIPULAR QUE CUANDO EL PRÉSTAMO SE PAGUE COMPLETAMENTE, ELPRESTAMISTA FIRMARÁ Y LE ENTREGARÁ UNA CANCELACIÓN DE LA GARANTÍA REAL OTRANSFERENCIA DE LA GARANTÍA REAL, SEGÚN CORRESPONDA;(8) DEBEN ESTIPULAR QUE USTED PUEDE RESCINDIR EL PRÉSTAMO SIN CARGOS NIMULTAS DENTRO DE UN PLAZO DE 3 DÍAS DESPUÉS DEL CIERRE;(9) DEBEN ESTIPULAR QUE TANTO USTED COMO EL PRESTAMISTA RECONOCEN ELVALOR RAZONABLE DE LA VIVIENDA EN EL MERCADO A LA FECHA DE CIERRE DEL PRÉSTAMO; Y(10) DEBEN ESTIPULAR QUE EL PRESTAMISTA PERDERÁ EL DERECHO A TODO ELCAPITAL DEL PRÉSTAMO Y A LOS INTERESES SI NO CUMPLE CON SUS OBLIGACIONES A MENOS QUEEL PRESTAMISTA SUBSANE EL INCUMPLIMIENTO SEGÚN SE ESPECIFICA EN EL ARTÍCULO50(a)(6)(Q)(x), SECCIÓN XVI DE LA CONSTITUCIÓN DE TEXAS.(R) SI EL PRÉSTAMO ES UNA LÍNEA DE CRÉDITO CON SEGUNDA HIPOTECA:(1) USTED PUEDE SOLICITAR ADELANTOS, REINTEGRAR DINERO Y VOLVER ASOLICITAR DINERO PRESTADO A TRAVÉS DE LA LÍNEA DE CRÉDITO;(2) CADA ADELANTO A TRAVÉS DE LA LÍNEA DE CRÉDITO DEBE SER DE UN MONTOMÍNIMO DE $4,000;(3) USTED NO PUEDE USAR TARJETAS DE CRÉDITO, DE DÉBITO, CHEQUES DEPROMOCIÓN NI INSTRUMENTOS SIMILARES PARA OBTENER ADELANTOS A TRAVÉS DE LA LÍNEA DECRÉDITO;(4) TODOS LOS CARGOS DEL PRESTAMISTA SÓLO PUEDEN COBRARSE EN ELMOMENTO EN QUE SE ESTABLECE LA LÍNEA DE CRÉDITO. EL PRESTAMISTA NO PUEDE COBRARCARGOS EN RELACIÓN CON NINGÚN ADELANTO;(5) EL CAPITAL DE CRÉDITO MÁXIMO QUE SE PUEDE OTORGAR, SUMADO A TODASLAS OTRAS DEUDAS GARANTIZADAS POR SU VIVIENDA, NO PUEDE EXCEDER EL 80 POR CIENTO DELVALOR RAZONABLE DE LA VIVIENDA EN EL MERCADO EN LA FECHA EN QUE SE ESTABLECE LA LÍNEADE CRÉDITO;(6) SI EL SALDO DEL CAPITAL DE LA LÍNEA DE CRÉDITO EN CUALQUIER MOMENTOSUPERA EL 50 POR CIENTO DEL VALOR RAZONABLE DE LA VIVIENDA EN EL MERCADO, COMO SEDETERMINA EN LA FECHA EN QUE SE ESTABLECE LA LÍNEA DE CRÉDITO, USTED NO PUEDECONTINUAR SOLICITANDO ADELANTOS A TRAVÉS DE LA LÍNEA DE CRÉDITO HASTA QUE EL SALDOSEA MENOR AL 50 POR CIENTO DEL VALOR RAZONABLE DE LA VIVIENDA EN EL MERCADO; Y(7) EL PRESTAMISTA NO PUEDE MODIFICAR UNILATERALMENTE LAS CONDICIONESDE LA LÍNEA DE CRÉDITO.“ESTA NOTIFICACIÓN ES SÓLO UN RESUMEN DE SUS DERECHOS CONFORME A LA CONSTITUCIÓNDE TEXAS.SUS DERECHOS SE RIGEN POR EL ARTÍCULO 50, SECCIÓN XVI DE LA CONSTITUCIÓN DE TEXAS, NOPOR ESTA NOTIFICACIÓN.”Texas Closed-End Information – 17

Texas Notice to BorrowerTexas Notice to Borrower(Notice Concerning Extensions of Credit Defined by Section50(a)(6), Article XVI, Texas Constitution)Document DescriptionWhen Used: This Notice is required to be given to the borrower atleast 12 days prior to closing the loan. Therefore, itshould be given as early as possible, such as the time theapplication is given to the borrower or at the time theapplication is received.Purpose:In order to make a Texas <strong>home</strong> <strong>equity</strong> loan a credit unionmust provide the borrower with this Notice whichexplains the credit union’s responsibilities andprohibitions and the borrower’s rights and remedies.How Distributed: This Notice should be given to the borrower at the timethe application is given to the borrower or received fromthe borrower by the credit union.No. of Parts: 1 part (2 pages)Imprinting: Optional - Credit union name, address, telephonenumber and logoSpecial Notes: If discussions with the borrower are conducted primarilyin a language other than English, the credit union must,before closing, provide an additional copy of the Noticein the language in which the discussions wereconducted.There is nothing for the credit union to complete on thisdocument.Document ETX22 is the Spanish version of the TexasNotice to Borrower.18 – LOANLINER Home Equity System

Texas Closed-End Information – 19

Adjustable Rate Mortgage DisclosureADJUSTABLE RATE MORTGAGE DISCLOSUREThis disclosure describes the features of the adjustable rate mortgage (ARM) program you areconsidering. Information on other ARM programs is avilable upon request.HOW YOUR INTEREST RATE AND PAYMENT ARE DETERMINEDYour interest rate will be based on an index rate plus a margin. The index is the Prime Rate as publishedin the Wall Street Journal. When a range of rates has been published, the highest applicable rate has beenselected. Information about the index is available or published at least weekly in the Money Rates table ofthe Wall Street Journal.Ask for our current interest rate and margin. Your payment will be based on the interest rate, loan balance,and loan term.HOW YOUR INTEREST RATE CAN CHANGEYour interest rate can change annually on the first day of January.Your interest rate cannot increase or decrease more than 6 percentage points from the initial interest rate.HOW YOUR PAYMENT CAN CHANGEYour monthly payment can increase or decrease substantially based on annual changes in the interest rate.You will be notified in writing at least 25, but no more than 120, cal<strong>end</strong>ar days before a payment at a newlevel is due. This notice will contain <strong>information</strong> about your interest rates, payment amount, and loanbalance.For example, on a $10,000, 15 year loan with an initial interest rate of 9.71%, the rate in effect in July 2003,the maximum amount that the interest rate can rise under this program is 6 percentage points to 15.71%,and the monthly payment can rise from a first year payment of $105.69 to a maximum of $141.02 in thefourth year.To see what your payments would be at the interest rate used in the above example, divide your mortgageby $10,000, then multiply that amount by the first year payment in the previous example. For example, fora $60,000 mortgage: 60,000 ÷ 10,000 = 6; 6 x $105.69 = $634.14 per month.©<strong>CUNA</strong> <strong>Mutual</strong> Group, 1997, ALL RIGHTS RESERVEDETX08020 – LOANLINER Home Equity System

Adjustable Rate Mortgage (ARM) DisclosureAdjustable Rate Mortgage (ARM) DisclosureDocument DescriptionRegulation Z provides that if the interest rate may increase afterconsummation of a <strong>closed</strong>-<strong>end</strong> loan, the loan is considered to be a variable ratetransaction. For loans secured by the consumer’s principal dwelling certainvariable rate disclosures must be given at the time an application is providedto the borrower. (Reg. Z Section 226.19(b)). (A preferred rate loan, for example,when an employee receives a lower rate until leaving the credit union’semployment, is considered to be a variable rate.)The terms of the ARM Disclosure are individual to each credit union. AnARM Disclosure is created by the answers you give on the Texas Home EquityQuestionnaire.When Used:Purpose:How Distributed:The ARM Disclosure must be given to the borrowerwhen the borrower receives an application as requiredby Regulation Z Section 226.19(b)(2).The ARM Disclosure provides the disclosures requiredby Regulation Z Section 226.19(b)(2). This disclosurenotifies the borrower of important provisions specific toyour credit union’s variable rate <strong>home</strong> <strong>equity</strong> loans andare not transaction specific for each individualborrower’s loan.The ARM Disclosure must be sent out or otherwiseprovided with the application.No. of Parts: 1However, if the application is received by telephone, orthrough an intermediary agent or broker, the ARMdisclosure may be delivered or placed in the mail notlater than three business days following the creditunion’s receipt of the application. Also a nonrefundablefee may not be collected by the credit union until theARM Disclosure has been provided.Imprinting:Credit union name, address and variable rate featuresTexas Closed-End Information – 21

Adjustable Rate Mortgage (ARM) DisclosureAdjustable Rate Mortgage (ARM) DisclosureDocument ExplanationThe sample ARM Disclosure provided is a representative example of what acredit union’s ARM Disclosure may look like. The terms contained in yourcredit union’s ARM Disclosure may differ because of the answers your creditunion gave on the questionnaire.You may give the same ARM Disclosure to all borrowers interested inobtaining a <strong>home</strong> <strong>equity</strong> loan from your credit union. Since the ARMDisclosure is not transaction specific, there are no blank lines for the creditunion to complete before giving the ARM Disclosure to the borrower.The LOANLINER ARM Disclosure does not include a 15-year history of theindex, as the requirement was made optional by a recent am<strong>end</strong>ment to Truthin L<strong>end</strong>ing.An ARM disclosure for each variable rate program in which the borrowerexpresses an interest must be given at the time an application is provided orbefore the borrower pays a nonrefundable fee, whichever is earlier. TheLOANLINER ARM Disclosure provides the following disclosures:1. The fact that the interest rate and payment of the loan can change.2. The index or formula used in making adjustments, and a source of<strong>information</strong> about the index or formula.3. An explanation of how the interest rate and payment will bedetermined, including an explanation of how the index is adjusted,such as by the addition of a margin.4. A statement that the borrower should ask about the current marginvalue and interest rate.5. The fact that the interest rate will be discounted, if applicable, and astatement that the borrower should ask about the amount of theinterest rate discount.6. The frequency of interest rate and payment changes.7. If applicable, any rules relating to changes in the index, interest rate,payment amount, and outstanding loan balance including, for example,an explanation of interest rate or payment limitations, negativeamortization (prohibited in Texas), and interest rate carryover.22 – LOANLINER Home Equity System

Adjustable Rate Mortgage (ARM) Disclosure8. Payment example.9. Worst case example.10. The type of <strong>information</strong> that will be provided in notices of adjustmentsand timing of such notices.11. A statement that disclosure documents are available for the creditunion’s other variable rate loan programs.Texas Closed-End Information – 23

CONSUMERHANDBOOK ONADJUSTABLERATEMORTGAGES24 – LOANLINER Home Equity System

Consumer Handbook on Adjustable Rate MortgagesConsumer Handbook on Adjustable Rate Mortgages(CHARM Booklet)Document Description(This is only required if offering a variable rate mortgage.)When Used:Purpose:How Distributed:The CHARM Booklet is required to be given to aborrower at the time the borrower obtains a <strong>home</strong><strong>equity</strong> application as required by Regulation ZSection 226.19(b).The CHARM Booklet provides borrowers with adiscussion of general characteristics of Adjustable RateMortgages.The CHARM Booklet, along with a copy of theAdjustable Rate Mortgage Disclosure, is given to theborrower at the same time the borrower obtains anapplication.No. of Parts: 1However, if the application is received by telephone, orthrough an intermediary agent or broker, the CHARMBooklet may be delivered or placed in the mail not laterthan three business days following the credit union’sreceipt of the application. Also a nonrefundable fee maynot be collected by the credit union until the CHARMBooklet has been provided.Imprinting:NoneTexas Closed-End Information – 25

Acknowledgment of Fair Market ValueACKNOWLEDGMENT OF FAIR MARKET VALUE______________________________________________________ (“Borrower”whether one or more) and ________________________________________________(“Credit Union”) hereby acknowledge that the property of the Borrower, having theaddress _____________________________________________________________________________________________________________________________, Texas,has a fair market value in the sum of $_______________ as of the date of the closing ofthe loan in the original principal sum of $_______________ from Credit Union to Borrower.EXECUTED this ________ day of____________________________, ________.____________________________________________(Borrower 1)____________________________________________(Borrower 2)____________________________________________(Credit Union)By: ________________________________________Printed Name: ________________________________Title:________________________________________©<strong>CUNA</strong> MUTUAL GROUP, 1997, ALL RIGHTS RESERVEDTO ORDER: 1-800-356-5012 CREDIT UNION COPY ETX400 2786026 – LOANLINER Home Equity System

Acknowledgment of Fair Market ValueAcknowledgment of Fair Market ValueDocument DescriptionWhen Used: This document will be completed and signed at closing.Purpose:How Distributed:No. of Parts:Imprinting:Special Notes:The Texas Constitution requires that the credit union andthe borrower sign this Acknowledgment at closing.One copy of this document should be kept in the file andthe other should be given to the borrower.2 parts (1 page)Optional - Credit union name, address and logoThe credit union may conclusively rely on the writtenAcknowledgment as to the fair market value of theproperty as long as: (1) the value acknowledged is theestimated value in an appraisal or evaluation prepared inaccordance with any applicable state or federalrequirements and (2) the credit union does not haveactual knowledge at the time the loan is granted that thefair market value stated in the Acknowledgment isincorrect.Texas Closed-End Information – 27

Acknowledgment of Fair Market ValueACKNOWLEDGMENT OF FAIR MARKET VALUE______________________________________________________ 1(“Borrower”whether one or more) and ________________________________________________2(“Credit Union”) hereby acknowledge that the property of the Borrower, having theaddress ______________________________________________________________3_______________________________________________________________, Texas,has a fair market value in the sum of $_______________ 4 as of the date of the closing ofthe loan in the original principal sum of $_______________ 5 from Credit Union to Borrower.6EXECUTED this ________ day of____________________________, ________.78____________________________________________(Borrower 1)____________________________________________(Borrower 2)9____________________________________________(Credit Union)10By: ________________________________________Printed Name: ________________________________Title:________________________________________©<strong>CUNA</strong> MUTUAL GROUP, 1997, ALL RIGHTS RESERVEDTO ORDER: 1-800-356-5012 CREDIT UNION COPY ETX400 2786028 – LOANLINER Home Equity System

Acknowledgment of Fair Market ValueCompletion Instructions1. Enter the name(s) of the borrower(s).2. Enter the name of the credit union.3. Enter the address of the property.4. Enter the fair market value of the property.5. Enter the amount of the loan.6. Enter the date this document is signed which should be the date theloan <strong>closed</strong>.7. All borrower(s) must sign.8. The borrower’s name(s) should be typed beneath the signature.9. The credit union name should be typed in.10. The name of the credit union employee present at closing should signhis/her name, enter his/her name below and enter his/her title.Texas Closed-End Information – 29

Note and Disclosure StatementBORROWER NAME (Last - First - Middle Initial) AND ADDRESS (Street - City - State - Zip Code)Note andDisclosure StatementDATE MEMBER NUMBER NOTE NUMBERFIXEDCONTRACT NUMBERREFERENCE NUMBERMATURITY DATEVARIABLEIn this agreement “you”, “your”, or “I” mean each person who signs this agreement. “Credit Union” means the credit union whose name appears above and any successorsand assigns. The terms on the reverse side are part of this agreement.TRUTH IN LENDING DISCLOSUREANNUAL PERCENTAGE RATEThe cost of your credit as a yearlyrate.FINANCE CHARGEThe dollar amount the credit willcost you.Amount FinancedThe amount of credit provided to youor on your behalf.Total of PaymentsThe amount you will have paid when youhave made all payments as scheduled.e means an estimate% $$$ Variable Rate: Your loan contains a variable rate feature. Disclosures about the variable rate feature have been provided to you earlier.YourPaymentSchedulewill be:Late Charge:SEE YOUR CONTRACT DOCUMENTS FOR ANY ADDITIONAL INFORMATION ABOUT NONPAYMENT, DEFAULT, AND ANY REQUIRED REPAYMENT IN FULL BEFORE THE SCHEDULED DATE.NOTE CONTINUED ON REVERSE SIDEPrepayment: If you pay off early youwill not have to pay a penalty.Number of Payments Amount of Payments When Payments Are Due Property Insurance: You may obtain property insurancefrom anyone you want that is acceptable to the credit union.If you get the insurance from the credit union you will pay1. BORROWER’S PROMISE TO PAY — The following paragraph applies only if this is a fixed rate loan:You promise to pay $______________ to the Credit Union plus interest on the unpaid balance beginning on the date of the Note at ____________% peryear until what you owe has been repaid.The following paragraph applies only if this is a variable rate loan:You promise to pay $______________ to the Credit Union plus interest on the unpaid balance beginning on the date of the Note until what you owe hasbeen repaid. The initial rate of interest is ____________% per year.$Security: You are giving a securityinterest in your <strong>home</strong>.IF YOU AGREE TO MAKE AND BE BOUND BY THE TERMS OF THIS NOTE, SIGN BELOW. YOU WILL RECEIVE A COPY OF ALL DOCUMENTS YOU SIGN AT CLOSING.BORROWERBORROWERXXBORROWERBORROWERXXCREDIT INSURANCE ENROLLMENT FORM/SCHEDULE <strong>CUNA</strong> <strong>Mutual</strong> Insurance Society • Madison, WI 53701-0391 • Phone: 800/937-2644“You” or “Your” means the member and the joint insured (if applicable). Thejoint insured may only be spouses or business partners.Credit insurance is voluntary and not required in order to obtain this loan. Youmay select any insurer of your choice. You can get this insurance only if youcheck the “yes” box below and sign your name and write in the date. The rateyou are charged for the insurance is subject to change. You will receive writtennotice before any increase goes into effect. By signing below you certify that:• If you elect insurance, you authorize the credit union to add the charges forinsurance to your loan each month.YOU ELECT THE FOLLOWING INSURANCE COVERAGE(S) YES NO PREMIUM SCHEDULESINGLE CREDIT DISABILITY$ eSINGLE CREDIT LIFE$ eJOINT CREDIT LIFE$ e• You are working for wages or profit for 25 hours a week or more on the EffectiveDate. If you are off work because of temporary layoff, strike or vacation, butsoon to resume, you will be considered at work.• For Credit Life insurance, if you are not actively at work on the Effective Date,you have not, at any time during the twelve months immediately preceding theEffective Date, received a medical diagnosis or any care or treatment for cancer,high blood pressure or for any disease of the heart, lungs or blood vessels.• You are under the Maximum Age for Insurance. Insurance will be provided upto the Maximum Age.NOTE: The insurance you’re applying for contains certain terms and exclusions; Refer to your certificate for coverage details.COVERED MEMBER (Please Print)Initial Amount of Loan Insured Monthly Payment/BenefitCDCLIf you are totally disabled for at least 30 days, then thedisability benefit will begin with the 31st day of disability.Term of Certificate in Months Effective Date of CertificateCDCLINSURANCE MAXIMUMSMAX. MONTHLY TOTAL DISABILITY BENEFIT PER LOANMAX. AMOUNT OF LOAN INSURABLE PER LOANMAX. AMOUNT OF LOAN INSURABLE PER MEMBERMAX. AGE FOR INSURANCEGROUP POLICY NUMBERRATE OF INTEREST USED ON THIS LOANXXX-XXXX-XMEMBER’S DATE OF BIRTH AGE JOINT INSURED’S DATE OF BIRTH AGE SECONDARY BENEFICIARY (If you desire to name one)Expiration Date of CertificateCDCLDISABILITY LIFE$ XXX$XX,XXXN/AXXN/AN/A$XX,XXXXXXXSIGNATURE OF MEMBER (Be sure to check one of the boxes above.) DATE SIGNATURE OF JOINT INSURED (CO-BORROWER) DATE(Only required if JOINT CREDIT LIFE coverage is selected)APP.325-0892/Rev. TX (3.50 3.53)© <strong>CUNA</strong> MUTUAL GROUP, 1991, 97, 2003, 04, ALL RIGHTS RESERVED PRODUCTION WITHOUT WRITTEN PERMISSION OF <strong>CUNA</strong> MUTUAL INSURANCE SOCIETY IS FORBIDDEN BY LAW. ETX303CREDIT UNION 130 – LOANLINER Home Equity System

Note and Disclosure StatementNOTE CONTINUED FROM REVERSE SIDE2. PAYMENTS — You promise to make payments in U.S. dollars of theamount and at the time shown in the Truth in L<strong>end</strong>ing Disclosure until whatyou owe has been repaid. You promise to make payments at the placechosen by the Credit Union.When the loan is paid in full, within a reasonable time, the Credit Union willcancel and return the Note to you and give you, in recordable form, a releaseof the lien securing the loan or a copy of an <strong>end</strong>orsement and assignmentof the lien, whichever is appropriate.3. THIS NOTE SECURED BY A DEED OF TRUST — In addition to theprotections given to the Credit Union under this Note, a deed of trust (the“Deed of Trust”) dated the same date as this Note creates a lien against theproperty (the “Property”) described in the Deed of Trust and protects theCredit Union from possible losses which might result if you do not keep thepromises which you make in this Note. That Deed of Trust describes howand under what conditions the Note may be accelerated and madeimmediately due in full.You and the Credit Union will sign a written acknowledgment as to the fairmarket value of your property on the date this loan closes. Notwithstandinganything to the contrary in any other agreement you have with the CreditUnion, the only security for this loan is the Property described in the Deedof Trust.4. BORROWER’S FAILURE TO PAY AS REQUIRED — (A) Late Charge forOverdue Payments: If you are late in making a payment, you agree to paythe late charge shown in the Truth in L<strong>end</strong>ing Disclosure. If no late chargeis shown, you will not be charged one.(B) Notice From Credit Union: If you do not pay the full amount of eachregularly scheduled payment on time, the Credit Union may s<strong>end</strong> you awritten notice telling you that if you do not pay the overdue amount by acertain date you will be in default. That date will be not less than thatrequired by applicable law from the date on which the notice is mailed to youor, if it is not mailed, the date on which it is delivered to you.(C) Default: If you do not pay the overdue amount by the date stated in thenotice described in (B) above, you will be in default. If you are in default, theCredit Union may accelerate the maturity date of the outstanding principalbalance due under the Note and proceed with foreclosure of the lien againstthe Property created by the Deed of Trust. Even if, at a time when you are indefault, the Credit Union does not accelerate the maturity date of theoutstanding principal balance due under the Note and proceed withforeclosure of the lien against the property created by the Deed of Trust, asdescribed above, the Credit Union will still have the right to do so if you arein default at a later time.(D) You shall be liable for the indebtedness evidenced by this Note only to theextent of the Property described in the Deed of Trust that secures the paymentof this Note. If there is a default in the payment of such indebtedness or in theperformance of such agreements, any judicial proceedings brought by theCredit Union against you shall be limited to enforcement and foreclosure ofthe lien created by the Deed of Trust. If there is a foreclosure of such lien, nojudgment for any deficiency shall be sought or obtained by the Credit Unionagainst you. Notwithstanding the foregoing limitation of liability, you shall befully and personally liable for your actual fraud or your spouse’s actual fraudin obtaining or in connection with this Note or any instrument governing,securing or pertaining to the payment hereof.5. TRANSFER OF THE PROPERTY OR A BENEFICIAL INTEREST INBORROWER — If all or any part of the Property or any interest in it is soldor transferred without the Credit Union’s prior written consent, the CreditUnion may, at its option, accelerate the maturity date of the outstandingprincipal balance due under the Note and proceed with foreclosure of the lienagainst the Property created by the Deed of Trust. However, this option shallnot be exercised by the Credit Union if exercise is prohibited by federal law.If the Credit Union exercises this option, the Credit Union shall give you noticeof acceleration. The notice shall provide a period of not less than 30 daysfrom the date the notice is delivered or mailed within which you may pay allsums secured by the Deed of Trust in order to avoid the enforcement andforeclosure of the lien created by the Deed of Trust. If you fail to pay thesesums prior to the expiration of such period, the Credit Union may invoke anyremedies permitted by the Deed of Trust without further notice or demand onyou other than such notices required by law which cannot be waived.6. BORROWER’S PAYMENTS BEFORE THEY ARE DUE — You have the rightto make payments of principal at any time before they are due. A payment ofprincipal only is known as a “prepayment.” When you make a prepayment,you will tell the Credit Union in a letter that you are doing so. A prepayment ofall of the unpaid principal is known as a “full prepayment.” A prepayment ofonly part of the unpaid principal is known as a “partial prepayment.”You may make a full prepayment or a partial prepayment without paying anypenalty or other charge. The Credit Union will use all of your prepayments toreduce the amount of principal that you owe under this Note. If you make apartial prepayment, there will be no delays in the due dates or changes in theamounts of your regularly scheduled payments unless the Credit Unionagrees in writing to those delays or changes. You may make a full prepaymentat any time.7. BORROWER’S WAIVERS — Except as may be otherwise provided in thisNote or in the Deed of Trust, and subject to applicable law, you waive yourrights to require the Credit Union to do certain things. Those things are: (A)to give notice of intent to accelerate the maturity date of the outstandingprincipal balance of this Note (known as “notice of intent to accelerate”); (B)to demand payment of amounts due (known as “presentment”); (C) to givenotice that amounts due have not been paid (known as “notice of dishonor”);(D) to obtain an official certification of nonpayment (known as a “protest”).8. RESCISSION — You and your spouse may within three days afterclosing rescind this Note without penalty or charge.9. GIVING NOTICES — Any notice that must be given to you under thisNote will be given by delivering it or by mailing it to you at the address onthe reverse side. A notice will be delivered or mailed to you at a differentaddress if you give the Credit Union a notice of your different address.Any notice that must be given to the Credit Union under this Note will begiven by mailing it by certified mail to the Credit Union at the address statedon the reverse side. A notice will be mailed to the Credit Union at a differentaddress if you are given notice of that different address.10. RESPONSIBILITY OF PERSONS UNDER THIS NOTE — If more than oneperson signs this Note, each of you are obligated to keep all of the promisesmade in this Note. Any guarantor, surety or <strong>end</strong>orser of this Note (asdescribed in Section 7 above) is also obligated to do these things. Anyperson who takes over your rights or obligations under this Note will haveall of your rights and must keep all of your promises made in this Note. Anyperson who takes over the rights or obligations of a guarantor, surety or<strong>end</strong>orser of this Note (as described in Section 7 above) is also obligated tokeep all of the promises made in this Note.The Credit Union will forfeit all principal and interest on your loan if theCredit Union fails to correct any failure to comply with its obligations underthis loan in accordance with the terms of the Deed of Trust.Texas Closed-End Information – 31