FirstChoice Wholesale Investments - Colonial First State

FirstChoice Wholesale Investments - Colonial First State

FirstChoice Wholesale Investments - Colonial First State

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

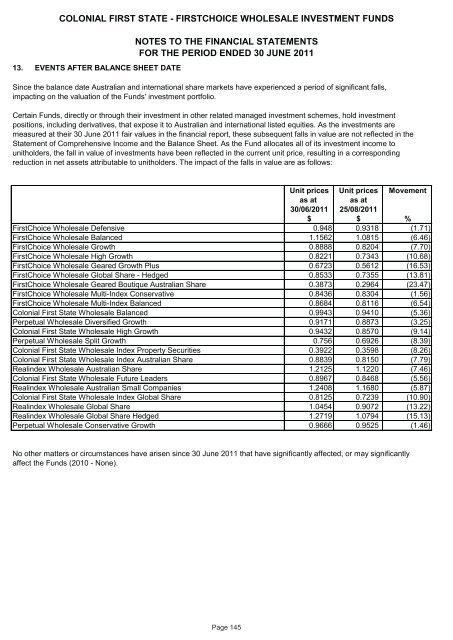

COLONIAL FIRST STATE - FIRSTCHOICE WHOLESALE INVESTMENT FUNDS13. EVENTS AFTER BALANCE SHEET DATENOTES TO THE FINANCIAL STATEMENTSFOR THE PERIOD ENDED 30 JUNE 2011Since the balance date Australian and international share markets have experienced a period of significant falls,impacting on the valuation of the Funds' investment portfolio.Certain Funds, directly or through their investment in other related managed investment schemes, hold investmentpositions, including derivatives, that expose it to Australian and international listed equities. As the investments aremeasured at their 30 June 2011 fair values in the financial report, these subsequent falls in value are not reflected in the<strong>State</strong>ment of Comprehensive Income and the Balance Sheet. As the Fund allocates all of its investment income tounitholders, the fall in value of investments have been reflected in the current unit price, resulting in a correspondingreduction in net assets attributable to unitholders. The impact of the falls in value are as follows:Unit prices Unit prices Movementas at as at30/06/2011 25/08/2011$ $ %<strong><strong>First</strong>Choice</strong> <strong>Wholesale</strong> Defensive 0.948 0.9318 (1.71)<strong><strong>First</strong>Choice</strong> <strong>Wholesale</strong> Balanced 1.1562 1.0815 (6.46)<strong><strong>First</strong>Choice</strong> <strong>Wholesale</strong> Growth 0.8888 0.8204 (7.70)<strong><strong>First</strong>Choice</strong> <strong>Wholesale</strong> High Growth 0.8221 0.7343 (10.68)<strong><strong>First</strong>Choice</strong> <strong>Wholesale</strong> Geared Growth Plus 0.6723 0.5612 (16.53)<strong><strong>First</strong>Choice</strong> <strong>Wholesale</strong> Global Share - Hedged 0.8533 0.7355 (13.81)<strong><strong>First</strong>Choice</strong> <strong>Wholesale</strong> Geared Boutique Australian Share 0.3873 0.2964 (23.47)<strong><strong>First</strong>Choice</strong> <strong>Wholesale</strong> Multi-Index Conservative 0.8436 0.8304 (1.56)<strong><strong>First</strong>Choice</strong> <strong>Wholesale</strong> Multi-Index Balanced 0.8684 0.8116 (6.54)<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Wholesale</strong> Balanced 0.9943 0.9410 (5.36)Perpetual <strong>Wholesale</strong> Diversified Growth 0.9171 0.8873 (3.25)<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Wholesale</strong> High Growth 0.9432 0.8570 (9.14)Perpetual <strong>Wholesale</strong> Split Growth 0.756 0.6926 (8.39)<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Wholesale</strong> Index Property Securities 0.3922 0.3598 (8.26)<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Wholesale</strong> Index Australian Share 0.8839 0.8150 (7.79)Realindex <strong>Wholesale</strong> Australian Share 1.2125 1.1220 (7.46)<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Wholesale</strong> Future Leaders 0.8967 0.8468 (5.56)Realindex <strong>Wholesale</strong> Australian Small Companies 1.2408 1.1680 (5.87)<strong>Colonial</strong> <strong>First</strong> <strong>State</strong> <strong>Wholesale</strong> Index Global Share 0.8125 0.7239 (10.90)Realindex <strong>Wholesale</strong> Global Share 1.0454 0.9072 (13.22)Realindex <strong>Wholesale</strong> Global Share Hedged 1.2719 1.0794 (15.13)Perpetual <strong>Wholesale</strong> Conservative Growth 0.9666 0.9525 (1.46)No other matters or circumstances have arisen since 30 June 2011 that have significantly affected, or may significantlyaffect the Funds (2010 - None).Page 145