FirstChoice Wholesale Investments - Colonial First State

FirstChoice Wholesale Investments - Colonial First State

FirstChoice Wholesale Investments - Colonial First State

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

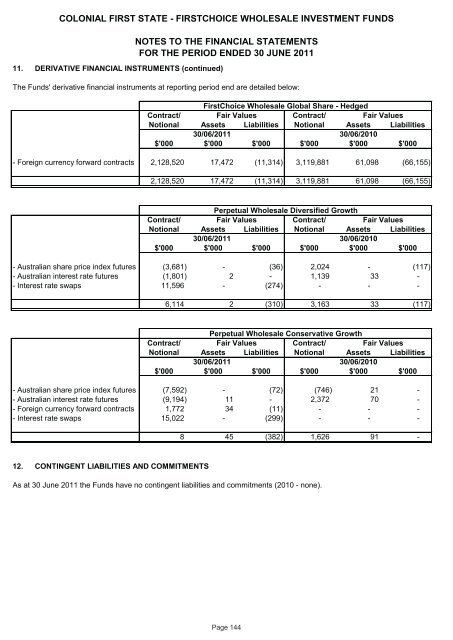

COLONIAL FIRST STATE - FIRSTCHOICE WHOLESALE INVESTMENT FUNDS11. DERIVATIVE FINANCIAL INSTRUMENTS (continued)NOTES TO THE FINANCIAL STATEMENTSFOR THE PERIOD ENDED 30 JUNE 2011The Funds' derivative financial instruments at reporting period end are detailed below:<strong><strong>First</strong>Choice</strong> <strong>Wholesale</strong> Global Share - HedgedContract/ Fair Values Contract/ Fair ValuesNotional Assets Liabilities Notional Assets Liabilities30/06/2011 30/06/2010$'000 $'000 $'000 $'000 $'000 $'000- Foreign currency forward contracts 2,128,520 17,472 (11,314) 3,119,881 61,098 (66,155)2,128,520 17,472 (11,314) 3,119,881 61,098 (66,155)- - - -Perpetual <strong>Wholesale</strong> Diversified GrowthContract/ Fair Values Contract/ Fair ValuesNotional Assets Liabilities Notional Assets Liabilities30/06/2011 30/06/2010$'000 $'000 $'000 $'000 $'000 $'000- Australian share price index futures (3,681) - (36) 2,024 - (117)- Australian interest rate futures (1,801) 2 - 1,139 33 -- Interest rate swaps 11,596 - (274) - - -6,114 2 (310) 3,163 33 (117)- - - -Perpetual <strong>Wholesale</strong> Conservative GrowthContract/ Fair Values Contract/ Fair ValuesNotional Assets Liabilities Notional Assets Liabilities30/06/2011 30/06/2010$'000 $'000 $'000 $'000 $'000 $'000- Australian share price index futures (7,592) - (72) (746) 21 -- Australian interest rate futures (9,194) 11 - 2,372 70 -- Foreign currency forward contracts 1,772 34 (11) - - -- Interest rate swaps 15,022 - (299) - - -12. CONTINGENT LIABILITIES AND COMMITMENTS8 45 (382) 1,626 91 -- - - -As at 30 June 2011 the Funds have no contingent liabilities and commitments (2010 - none).Page 144