UnionBanCal Corporation 2008 Annual Report - Union Bank

UnionBanCal Corporation 2008 Annual Report - Union Bank

UnionBanCal Corporation 2008 Annual Report - Union Bank

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong><strong>Union</strong>BanCal</strong> <strong>Corporation</strong><strong>2008</strong> <strong>Annual</strong> <strong>Report</strong>Invest in you ®

<strong><strong>Union</strong>BanCal</strong> <strong>Corporation</strong> Financial HighlightsFOR YEAR ENDED: 2007 <strong>2008</strong>(Amounts in thousands, except percentage data)Income from continuing operations $ 573,364 $ 283,940Net income 608,094 268,885Return on average assetsFrom continuing operationsNet income1.07%1.14%0.47%0.44%Return on average stockholder’s equityFrom continuing operationsNet income12.46%13.21%5.49%5.20%Net interest margin 1 3.54% 3.71%AT YEAR END:Total loans (gross) $ 41,204,188 $ 49,585,550Allowance for credit losses 2 493,100 863,141Total assets 55,727,748 70,121,390Total deposits 42,680,191 46,049,769Stockholders’ equity 4,737,981 7,484,305Risk-based capital ratiosTier 1Total8.30%11.21%8.78%11.63%Tangible common equity to total assets 7.73% 6.96%Nonperforming assets to total assets 0.10% 0.62%1Taxable-equivalent2Includes allowance for losses related to off-balance sheet commitments

To our Valued Customers & Employees<strong>2008</strong> was a year that produced economicand financial turmoil of unprecedentedproportions, defying even the mostthoughtful predictions. Developmentsduring the year exerted a stunningimpact on financial markets in theU.S. and around the world. Despitethis turbulence, however, the companyproduced solid results and remainedstable and strong.We generated significant year-over-year loan growth in all categories, including commercial loans and residentialand commercial real estate, due to increased loan demand and weakened competition. We also generated growthin total revenue, up 12 percent year-over-year, and a rise in net interest income, up 19 percent year-over-year,while maintaining a stable deposit base.In the face of deteriorating market conditions, we kept a close eye on credit quality in <strong>2008</strong>, and took appropriatesteps to protect our balance sheet. We provided $550 million for credit losses, compared to $90 million in 2007.We expect a continued recessionary environment throughout this year and we will continue to emphasizeprudence in new lending and careful risk management of the loan portfolio, being especially vigilant where newand emerging risks are concerned.Despite these challenges, we continue to move the company forward on many fronts. Thanks to the hardwork and dedication of hundreds of employees, we enjoy a close working relationship with the Office of theComptroller of the Currency (OCC), having proved that we are a well-run bank that understands the importanceof compliance.<strong><strong>Union</strong>BanCal</strong> <strong>Corporation</strong> <strong>2008</strong> <strong>Annual</strong> <strong>Report</strong> 1

In <strong>2008</strong>, we invested in building a foundation for the future with the introduction of new and enhancedproducts and services for our customers. With a constant focus on how to best serve our customers todayand beyond, we expect to achieve a clear competitive advantage in the marketplace. We also approved aninitiative to build a next-generation data center by the end of 2009 to accommodate future business growth,achieve savings by providing more computing power at less cost per square foot, and improve the overallefficiency of our data operations.At the end of last year, we changed our name from <strong>Union</strong> <strong>Bank</strong> of California to <strong>Union</strong> <strong>Bank</strong>, reflecting our goalsfor expansion beyond the borders of California. As I write this letter, we have chosen a new logo to complementour new name and we are planning for a public roll-out in July. Our new look is important, but we will stillremain the same customer-focused and service-oriented bank that you have come to count on for more thana century, in good economic times and bad.Last November, we became a wholly owned subsidiary of The <strong>Bank</strong> of Tokyo-Mitsubishi UFJ, Ltd. (BTMU),which had been the company’s majority stockholder. Going from a publicly traded company on the New YorkStock Exchange to a privately owned entity was an enormously complicated effort for the Special Committeeof the Board of Directors, and for our employees. Most importantly, this effort was accomplished with nocompromise or interruption of service to our customers. Our new ownership structure allows us to fully benefitfrom the financial strength of one of the world’s largest banks and will allow us to pursue our expansion goals,as well as provide new opportunities for our employees.Shortly after going private, we, along with BTMU, were granted financial holding company status by federalregulators, enabling us to offer a much wider range of products and services to our customers. This is anotheraffirmation of our business stability and strength.<strong>2008</strong> also brought about a number of changes in management and the board of directors. Sadly, we mournedthe loss of our General Counsel, John H. McGuckin, Jr., who served our institution with distinction for 27 years.He was a good friend and mentor to me and an exceptionally gifted attorney. It is hard to envision <strong>Union</strong> <strong>Bank</strong>without him. We are delighted that Morris Hirsch, the company’s Deputy General Counsel, has moved into theGeneral Counsel position. Morris’ experience and banking expertise will serve the company well.2 <strong><strong>Union</strong>BanCal</strong> <strong>Corporation</strong> <strong>2008</strong> <strong>Annual</strong> <strong>Report</strong>

We also experienced changes in our roster of directors. Ronald Havner, a member of the board since 2004,announced his resignation effective January 2009. In addition, Lead Director Richard Farman, who has servedthe company as a director since 1988, and Mary Metz, a board member since 1988, will retire in April 2009.Richard will be succeeded as Lead Director by David Andrews, who provides continuity as a board member since2000 and outstanding leadership, as demonstrated by his tremendous record of service in both the private andpublic sectors. We thank Ron, Mary, and Richard for their exceptional service to the company and wish themall the best in the future.The board was also honored to welcome two new members last year. In December, Nobuo Kuroyanagi, ChiefExecutive Officer of Mitsubishi UFJ Financial Group, Inc. (MUFG), succeeded Shigemitsu Miki, Senior Advisorfor BTMU. Yoshiaki Kawamata also joined the board last December, following his appointment to ResidentManaging Officer for the United States of MUFG in April <strong>2008</strong>. Kyota Omori, Deputy President and ChiefCompliance Officer of MUFG, replaced Norimichi Kanari as the board’s chairman after Mr. Kanari retired asDeputy President of BTMU. We thank Mr. Miki and Mr. Kanari for their contributions and strategic guidanceduring their tenure.2009, like <strong>2008</strong>, will be a difficult year for everyone in the banking industry, regardless of how sound or securethey may be. The Obama Administration has proposed a number of measures to help turn the economyaround, but seeing results from these efforts will take time. Even then, we cannot accurately predict what theoutcome will be, or exactly how our economic landscape will emerge from this recession. Here at <strong>Union</strong> <strong>Bank</strong>,we are committed to moving forward through these troubling times with confidence and prudence as ourwatchwords. We firmly believe that we operate on a secure foundation and with sound principles that have servedus well in the past. We will continue to be effective stewards of our own, as well as our customers’, resources.In closing, I express my appreciation to our employees, who so ably contributed to our positive performance lastyear, and I express my gratitude to our customers, to whom we pledge the highest levels of personal service andbanking expertise.Masaaki TanakaPresident andChief Executive OfFicerMarch 23, 2009<strong><strong>Union</strong>BanCal</strong> <strong>Corporation</strong> <strong>2008</strong> <strong>Annual</strong> <strong>Report</strong> 3

About <strong>Union</strong> <strong>Bank</strong>For nearly 150 years, our company has been a steadfast presencein the state of California. The bank’s earliest roots trace backto The <strong>Bank</strong> of California, which was one of the first banksfounded after the Gold Rush in the late 19th century. <strong>Union</strong> <strong>Bank</strong>has grown steadily and substantially over the years, establishinga deep footprint in communities across California, as well asWashington and Oregon.<strong>Union</strong> <strong>Bank</strong>, N.A., is the primary subsidiary of <strong><strong>Union</strong>BanCal</strong> <strong>Corporation</strong>, a financial holding company withassets of $70.1 billion as of December 31, <strong>2008</strong>.We are a full-service commercial bank providing an array of financial services to individuals, small businesses,middle-market companies, and major corporations. Headquartered in San Francisco, with more than 10,000full- and part-time employees, <strong>Union</strong> <strong>Bank</strong> has 335 banking offices in the United States and two internationaloffices. We are the fifth-largest bank in California by deposits.In November of <strong>2008</strong>, we completed another significant milestone in our forward-thinking growth strategyby becoming a private, wholly owned subsidiary of The <strong>Bank</strong> of Tokyo-Mitsubishi UFJ, Ltd.The <strong>Bank</strong> of Tokyo-Mitsubishi UFJ, Ltd., is the commercial banking subsidiary of Mitsubishi UFJ FinancialGroup, Inc., one of the world’s leading financial companies with consolidated total assets of approximately$2.2 trillion as of December 31, <strong>2008</strong>.<strong>Union</strong> <strong>Bank</strong>’s heritage is one driven by a culture of stability, strength, and discipline. Having carefully andprudently avoided many of the major missteps made by other banks in recent years, <strong>Union</strong> <strong>Bank</strong> is uniquelypositioned for growth in 2009 and beyond. Across each of the bank’s four major business lines, we stand readyto embrace the opportunities for organic growth and geographic expansion in the years ahead.4 <strong><strong>Union</strong>BanCal</strong> <strong>Corporation</strong> <strong>2008</strong> <strong>Annual</strong> <strong>Report</strong>

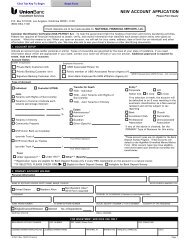

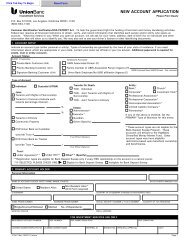

Personal <strong>Bank</strong>ingFrom your most basic financial needs to your most complex,<strong>Union</strong> <strong>Bank</strong> has a broad selection of banking products andservices to meet your unique goals.At <strong>Union</strong> <strong>Bank</strong>, we understand the value of your time andthat properly managing your banking needs for today is asimportant as planning for your future. We will work withyou to understand your financial objectives and customizesolutions for you and your family at every step.We also believe that banking should be made easy. We offera one-stop banking approach, providing you with a completerange of solutions, including home and auto loans, homeequity lines of credit, credit cards, as well as estate, business,and personal insurance protection. Additionally, you canbank in person at one of our 335 full-service banking officesin the United States, or you can bank online or by telephone.When you require more sophisticated banking solutions,our Priority <strong>Bank</strong>ing program gives you access to a suite ofspecialized services that are geared toward the distinct needsof affluent consumers and entrepreneurs. Also, you willwork closely with your own priority banker, who will helpyou create innovative and advanced solutions that are individuallytailored to your specific personal or business goals.As you look to your future, <strong>Union</strong> <strong>Bank</strong> can provide youwith specialized services and investment expertise to helpyou achieve your financial goals. Working with one of ourregistered financial advisors at <strong>Union</strong>Banc InvestmentServices, the bank’s brokerage subsidiary, you can receivequalified advice on investment and retirement strategiesthat help you plan for a financially secure future.Wealth ManagementSuccessful individuals and professional service firms turnto <strong>Union</strong> <strong>Bank</strong> for comprehensive wealth managementsolutions and the personalized attention of dedicatedrelationship managers.Using a team-based approach, our relationship managers andprivate bankers collaborate with specialized professionals todeliver advice across banking and financing services, investmentand brokerage services, trust and estate services, andbusiness services for professional firms.Our wealth management teams can provide you with loans,deposits, cash management services, foreign exchange,interest rate hedges, and a wide range of other banking solutions.Trust specialists can administer your wealth for futuregenerations through the use of personal and philanthropictrust structures, estate settlement services, and specializedasset management.Objective wealth planners will analyze your current andfuture income and cash requirements, expenditures, andrisk tolerance, and construct a long-term approach for yourwealth, as well as respond quickly to your immediate needs.Our portfolio management specialists with HighMarkCapital Management, a subsidiary of <strong>Union</strong> <strong>Bank</strong>, willwork closely with you to build an investment strategy andcustomized portfolio that helps you meet your near- andlong-term financial goals.<strong>Union</strong>Banc Investment Services, the bank’s brokeragesubsidiary, has a team of financial advisors who combinepersonalized service with comprehensive tools to delivera full range of brokerage services.Whether you are growing or preserving your assets, buildingor selling a business, or creating a lasting legacy, <strong>Union</strong> <strong>Bank</strong>can help you manage your wealth and achieve your goals.<strong><strong>Union</strong>BanCal</strong> <strong>Corporation</strong> <strong>2008</strong> <strong>Annual</strong> <strong>Report</strong> 5

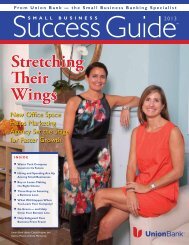

Small Business <strong>Bank</strong>ingCommitted to small business growth in our communities,<strong>Union</strong> <strong>Bank</strong> combines innovative business financing,merchant, payroll, and other services with the expertise ofbanking professionals who are committed to helping smallbusiness owners succeed.As a small business, you know the importance of havinga bank on your side. At <strong>Union</strong> <strong>Bank</strong>, you are backed by ahighly qualified banking professional at every stage of yourbusiness. Our team of professionals specializes in solutionsand relationship-driven banking tailored to meet thefinancial needs of attorneys, doctors, CPAs, wholesalers,manufacturers, and other small business professionals.We understand that small businesses need financing to growand stay competitive. As your business grows, we will workwith you to develop a business financing program that willaddress your specific goals and needs and, ultimately, helpyou take your business to the next level. <strong>Union</strong> <strong>Bank</strong> offersloans to meet all of your business needs, such as traditionalloans, lines of credit, commercial real estate financing, andfinancing options for businesses owned by ethnically diverseindividuals, women, and service-disabled veterans.If your business focus is global, we can help you increaseyour international sales and purchasing opportunities withour customized global trade and foreign exchange services.Our advisors will develop business solutions that structureand streamline financing to help you effectively mitigaterisk and enhance profitability.Whatever your focus, <strong>Union</strong> <strong>Bank</strong> has the products, services,and expertise to customize a plan for you that will help yourun your business successfully.Commercial <strong>Bank</strong>ingRecent market events have proven the importance ofworking with a bank you can count on. For nearly 150 years,<strong>Union</strong> <strong>Bank</strong>’s conservative, consistent lending policies havekept us stable and strong through difficult market cycles,and we move forward well-capitalized for growth.Whether you need a business loan or financing, globaltreasury management services, global trade and foreignexchange services, or investment management, you arepaired with relationship managers who are experts in theirfield and committed to understanding your business.At <strong>Union</strong> <strong>Bank</strong>, we also specialize in serving select industries,including energy, entertainment, real estate, retail, andgovernment. Our relationship managers are experts in theirindustries, and they combine their in-depth knowledge ofyour business with the ample resources of <strong>Union</strong> <strong>Bank</strong> tostructure or underwrite customized transactions.Being able to manage your funds quickly and effectively intoday’s environment is more important then ever. Our globaltreasury management services blend highly personalizedservice along with the speed and security of innovativetechnology.Market conditions will change and evolve, and so will yourbusiness objectives over time. Our relationship managerswill work with you at every step to minimize your exposurethrough risk and liquidity management.When it’s time for you to increase your international salesand purchasing opportunities, our global trade andforeign exchange advisors will provide solutions fittingyour specific needs.6 <strong><strong>Union</strong>BanCal</strong> <strong>Corporation</strong> <strong>2008</strong> <strong>Annual</strong> <strong>Report</strong>

Credit QualityNonperforming Assets to Total Loans<strong><strong>Union</strong>BanCal</strong> <strong>Corporation</strong> Median Top 50 <strong>Bank</strong>s *2.5%2.0%1.5%1.0%0.5%0.0%2004 2005 2006 2007 <strong>2008</strong>* Median top 50 banks by asset size at 12/31/08. Source: SNL FinancialLoan Portfolio DistributionAs of December 31, <strong>2008</strong>c o m m e rc i a lloans 37%residentialmortgageloans 32%c o m m e rc i a lmortgageloans 17%consumerloans 7%constructionloans 6%leases 1%<strong><strong>Union</strong>BanCal</strong> <strong>Corporation</strong> <strong>2008</strong> <strong>Annual</strong> <strong>Report</strong> 7

Officers and DirectorsAs of December 31, <strong>2008</strong>Board of DirectorsAida M. AlvarezFormer Administrator,U.S. Small Business AdministrationDavid R. AndrewsFounder and Co-Chair,MetaJure, Inc.Nicholas B. BinkleyGeneral Partner,Forrest Binkley & BrownL. Dale CrandallPresident, Piedmont CorporateAdvisors, Inc.Murray H. DasheRetired Chairman, President, andChief Executive Officer,Cost Plus, Inc.Richard D. FarmanChairman Emeritus,Sempra EnergyPhilip B. FlynnVice Chairman and Chief Operating Officer,<strong><strong>Union</strong>BanCal</strong> and <strong>Union</strong> <strong>Bank</strong>Christine GarveyReal Estate ConsultantMichael J. GillfillanPartner, Meriturn Partners, LLCMohan S. GyaniVice Chairman, Roamware, Inc.Ronald L. Havner, Jr.Vice Chair, Chief Executive Officer,and President, Public Storage, Inc.Yoshiaki KawamataSenior Managing Executive Officer andChief Executive Officer for the Americas ofThe <strong>Bank</strong> of Tokyo-Mitsubishi UFJ, Ltd., andResident Managing Officer for the United Statesof Mitsubishi UFJ Financial Group, Inc.Nobuo Kuroyanagi*Chairman of The <strong>Bank</strong> of Tokyo-MitsubishiUFJ, Ltd., and President andChief Executive Officer of Mitsubishi UFJFinancial Group, Inc.Mary S. MetzRetired President,S.H. Cowell FoundationJ. Fernando NieblaPresident, International TechnologyPartners, LLCKyota OmoriChairman of <strong><strong>Union</strong>BanCal</strong> and<strong>Union</strong> <strong>Bank</strong> and Deputy President andChief Compliance Officer of theMitsubishi UFJ Financial Group, Inc.Barbara L. RamboVice Chair,Nietech <strong>Corporation</strong>Masaaki TanakaPresident and Chief Executive Officer,<strong><strong>Union</strong>BanCal</strong> and <strong>Union</strong> <strong>Bank</strong>Dean A. YoostRetired Partner,PricewaterhouseCoopers*UNBC Director onlyExecutive Management CommitteeMasaaki TanakaPresident and Chief Executive OfficerPhilip B. FlynnVice Chairman andChief Operating OfficerDavid I. MatsonVice Chairman andChief Financial OfficerJohn C. EricksonVice Chairman andChief Risk OfficerGrant K. AhearnSenior Executive Vice President,Specialized Financial Services8 <strong><strong>Union</strong>BanCal</strong> <strong>Corporation</strong> <strong>2008</strong> <strong>Annual</strong> <strong>Report</strong>JoAnn M. BourneSenior Executive Vice President,Commercial Deposits andTreasury ManagementBruce H. CabralSenior Executive Vice President andChief Credit OfficerRobert C. DawsonSenior Executive Vice President,Commercial <strong>Bank</strong>ingPaul E. FearerSenior Executive Vice President andDirector of Human ResourcesMorris W. HirschSenior Executive Vice President,General Counsel, and SecretaryJ. Michael StedmanSenior Executive Vice President,Real Estate IndustriesTimothy H. WennesSenior Executive Vice President,Retail <strong>Bank</strong>ingJohn M. WiedSenior Executive Vice President,Independent Risk Monitoring GroupJohannes H. WorsoeSenior Executive Vice President,Global and Wealth MarketsJames YeeSenior Executive Vice President andChief Information OfficerDesign: ARGUS, LLC, San Francisco / ARGUSSF.com. Photography: Alain McLaughlin

<strong><strong>Union</strong>BanCal</strong> <strong>Corporation</strong> is a financial holding company.Its primary subsidiary, <strong>Union</strong> <strong>Bank</strong>, N.A., is a full-servicecommercial bank providing an array of financial services toindividuals, small businesses, middle-market companies,and major corporations.As of December 31, <strong>2008</strong>, <strong><strong>Union</strong>BanCal</strong> <strong>Corporation</strong> hadassets of $70.1 billion. <strong>Union</strong> <strong>Bank</strong> is the fifth-largestbank in California by deposits. The bank has 335 bankingoffices in California, Oregon, and Washington, andtwo international offices.Effective November 4, <strong>2008</strong>, <strong><strong>Union</strong>BanCal</strong> <strong>Corporation</strong>became a wholly owned subsidiary of The <strong>Bank</strong> ofTokyo-Mitsubishi UFJ, Ltd. The <strong>Bank</strong> of Tokyo-MitsubishiUFJ, Ltd., is the commercial banking subsidiary of MitsubishiUFJ Financial Group, Inc., one of the world’s leading financialcompanies, with consolidated total assets of approximately$2.2 trillion as of December 31, <strong>2008</strong>.CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATIONThis publication includes forward-looking statements, which include statements regarding the economic environment, the company’svision and strategies, and the expected benefits of its strategies, the company’s competitive position, expected benefits of thecompany’s ownership structure, the company’s loan portfolio, plans and expectations for the company’s operations and business,and assumptions for those expectations. Do not rely unduly on forward-looking statements. Actual results might differ significantlyfrom the company’s expectations. Please refer to item 1A, “Risk Factors,” in the Form 10-K for a discussion of some factors that maycause results to differ. All forward-looking information is based on information available as of the date of this report. <strong><strong>Union</strong>BanCal</strong><strong>Corporation</strong> assumes no obligation to update any forward-looking information.

A Member of MUFG400 California StreetSan Francisco, CA 94104www.unionbank.com<strong><strong>Union</strong>BanCal</strong> <strong>Corporation</strong> 84900-08Printed on Recycled Paper