Indonesia's booming coal industry - The ASIA Miner

Indonesia's booming coal industry - The ASIA Miner

Indonesia's booming coal industry - The ASIA Miner

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

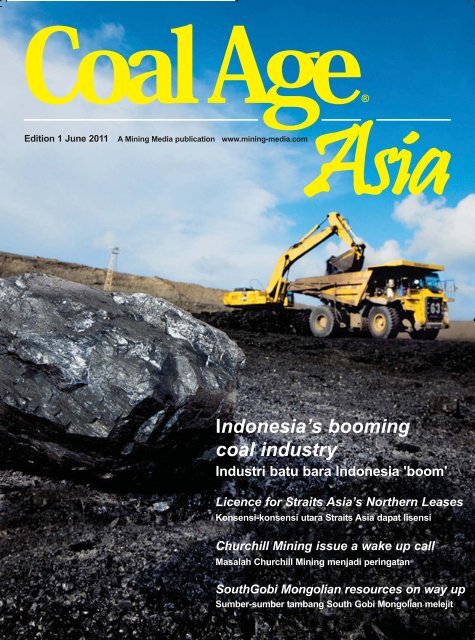

Coal AgeAsia®Edition 1 June 2011 A Mining Media publication www.mining-media.comIndonesia’s <strong>booming</strong><strong>coal</strong> <strong>industry</strong>Industri batu bara Indonesia 'boom'Licence for Straits Asia’s Northern LeasesKonsensi-konsensi utara Straits Asia dapat lisensiChurchill Mining issue a wake up callMasalah Churchill Mining menjadi peringatanSouthGobi Mongolian resources on way upSumber-sumber tambang South Gobi Mongolian melejit

AsiaFEATURESSpotlight on IndonesiaA partnership between Australian resources company Pan Asia Corporation and internationalunderground <strong>coal</strong> mining group Kopex is accelerating development of the TCM Coal Projectin South Kalimantan..................................................................................................................10Coal AgeAsia®Edition 1 June 2011 A Mining Media publication www.mining-media.comUpdated resource and reserve statements indicate that Kangaroo Resources will have totalresources of 3.146 billion tonnes at three projects upon completion of the transaction for thePakar project ...................................................................................................................11Challenger Deep Resources is advancing its strategy to establish a portfolio of <strong>coal</strong>exploration projects and progress the projects to production stage. ...................................12C @ Ltd has signed an agreement with PT Ethica Trada Cermelang which will see bothcompanies focus on accelerating the identification and development of coking and highenergy thermal <strong>coal</strong> projects in Indonesia. ......................................................................17NEWSConstruction work has started on a rail line to link the massive Tavan Tolgoi project withMongolia’s national rail network at Sainshand. ..................................................................4For the first time in a five year plan, China’s Congress has established targets to tackleclimate change. ..................................................................................................................5Indonesia’s <strong>coal</strong> bed methane (CBM) <strong>industry</strong> appears to be following in the footsteps of the<strong>coal</strong> <strong>industry</strong> with new areas opening, exploration increasing and production starting.........6.AROUND THE REGIONMongoliaIndicated resources at SouthGobi Resources’ Ovoot Tolgoi Complex in southern Mongoliahave increased by 7% while inferred resources are up by 190%. ......................................28Indonesia’s <strong>booming</strong><strong>coal</strong> <strong>industry</strong>Licence for Straits Asia’s Northern LeasesChurchill Mining issue a wake up callSouthGobi Mongolian resources on way upStraits Asia Resources is ramping up productionat its Sebuku Coal Project in SouthKalimantan to a steady-state annual target ofbetween 4.5 million and 5 million tonnes overthe medium term from only 1.1 million tonnes in2010. <strong>The</strong> company has already more thandoubled annual production at the nearbyJembayan project to about 6 million tonnes injust three years. It has also been granted a borrowand use licence, for the Northern Leases atSebuku. See page 4.Photo courtesy Straits Asia Resources.ChinaChina’s first manned test of an underground refuge chamber is complete. ......................28AustraliaBandanna Energy has received EIS Guidelines for two Bowen Basin projects ..................29AustraliaEstimated resources at Rey Resources’ Duchess Paradise project have increased 9% .... 32IndiaClean Global Energy has signed a UCG technology agreement with Essar .......................30DEPARTMENTSAdvertisers’ index .............................................44Events ...............................................................37From the Editor ...................................................2Product news ................................................... 42Supplier news ....................................................39Orpheus trial B26 shipment - 14 Adaro increases production - 27 China Coal Corp funds boost -32June 2011 l Coal Age Asia l 1

NewsPINJAM PAKAI FOR NORTHERN LEASESOverlooking Straits Asia Resources’ Sebuku project in South Kalimantan.INDONESIA’S Minister of Forestry has formallyissued the Izin Pinjam Pakai, or borrowand use licence, for the NorthernLeases at Straits Asia Resources’ Sebukuproperty. Granting of the IPP enables thestart of exploration work and mining activityin the Northern Leases.This has triggered a decision by StraitsAsia to ramp up annual production atSebuku mine to a steady‐state target ofbetween 4.5 million and 5 million tonnesover the medium term from only 1.1 milliontonnes in 2010.Exploration of the area will begin almostimmediately so that a clear and robustmine plan can be developed for expansionin planned phases.<strong>The</strong> experience gained by Straits Asia atthe Jembayan project, where productionhas more than doubled in only three years,will be a valuable asset for the aggressiveproduction targets that will be set forSebuku. Annual infrastructure capacity forthe mine is already rated at well over 6 milliontonnes. Sebuku <strong>coal</strong>, one of Indonesia’shighest grades of thermal <strong>coal</strong>, is a recognizedbrand in the international market.Sebuku Island lies on the most easternposition of South Kalimantan, affordingeasy access to open, deep water seas and tothe major shipping routes in and out ofAsia. <strong>The</strong> island’s highest point is only 125metres with Straits Asia’s mining areadefined mainly by marshy swamps andhills ranging from 5 to 25 metres.Sebuku has a population of about 5000 ofwhich more than 750 are employed at theoperations. Straits Asia’s concession areatotals more than 18,000 hectares on thewest portion of Sebuku and extending intoa shallow sea water basin about 3 to 5metres deep between Sebuku and the largerneighbouring island of Pulau Laut.<strong>The</strong> Northern Leases are simply extensionsof the seams that have been minedover the last five years and are expected toproduce the same quality of <strong>coal</strong> for sale tothe same customer base that Straits Asiahas developed since Sebuku first beganproduction in 1998.Straits Asia and its mining contractor,PAMA, have a clear plan for mobilizationin the Northern Leases with overburdenremoval and <strong>coal</strong> mining scheduled to startin about two months and an initial focus onan area that is directly adjacent to the existingTanah Putih pit where strip ratios startat about 3:1.Straits Asia is now set to enter a periodwhen its two <strong>coal</strong> mines are both expandingwith the extra benefit of expected significantcost reductions as volumesincrease at Sebuku.Work on Tavan Tolgoi rail linkMUCH has been written and said in thepast 12 months about the potential of theTavan Tolgoi (TT) Coal Project in Mongoliabut the words are now being put in toaction. Infrastructure has been touted asone of the major barriers to fast tracking ofthe project but this is now being addressedby a government determined to see theproject come to fruition as soon as possible.Construction work has started on a railline to link TT with the national rail networkat Sainshand. This was marked by aceremony involving the laying of a foundationstone for the railway.<strong>The</strong> ceremony was held in Khar toirom,10km from Sainshand soum in Dornogobiprovince, and was attended by nationaland provincial government officials as wellas transport and railway chiefs and otherdignitaries.<strong>The</strong> TT‐Sainshand line is the first part ofan ambitious 1100km rail project that willsee the west‐east line continue on toChoibalsan to link with the transport networkto Russia’s eastern seaports.During the ceremony, the managementsof state‐owned Mongolian RailwayCompany and Eastern Railway Companywere given special government permits tobuild the basic structure of the railway. Atender to build a 100km railroad fromSainshand towards Baruun‐Uurt, wasawarded to Mongolian Railway and onefor laying 100km of rail from Sainshandtowards the TT deposit went to EasternRailway.It is also understood that construction ofa new 246km‐long highway linking theGanqimaodao border crossing in InnerMongolia, China, with TT is under way.Inner Mongolian officials say Chineseimporters have funded the RMB59 millionproject. It is expected that imports viaGanqimaodao may hit 12‐15 million tonnesthis year, up from 7.71 million in 2010.Mongolia has chosen four banks to managethe multi‐billion dollar initial publicoffering of Erdenes‐Tavan Tolgoi Co, whichcontrols the TT <strong>coal</strong> deposit. Erdenes MGLLLC chief executive officer B Enebish saysthat Goldman Sachs Group, DeutscheBank, BNP Paribas and Macquarie Groupare handling the IPO of the state‐ownedcompany.He says the government plans to sell up4 l Coal Age Asia l June 2011

Newsto a 30% stake in Erdenes‐TT to internationalinvestors and an additional 10% tolocal companies, as well as give away 10%to Mongolian citizens. <strong>The</strong> governmentwill continue to hold about 50%.TT has about 6 billion tonnes of reserves,including 1.4 billion tonnes of coking <strong>coal</strong>and 4.66 billion tonnes of thermal <strong>coal</strong>. <strong>The</strong>government is due to award a mining contractlicence for the eastern half shortly. <strong>The</strong>contract is likely to be for a 4‐5 year periodwith annual production capacity of 15 milliontonnes.<strong>The</strong> government has shortlisted sixgroups from an initial 15 applications todevelop the central‐west part of thedeposit. <strong>The</strong> groups are ArcelorMittal, ValeSA, Peabody Energy. Xstrata Plc, a venturebetween Mitsui & Co and China’s ShenhuaGroup, and the Russia‐Japan‐Korea consortiumled by OAO Russian Railways. <strong>The</strong>western side of the central area holds morethan 1 billion tonnes of <strong>coal</strong>, 68% of whichcan be used for steelmaking and the rest asfuel for power plants.When questioned recently about thetimeframe for TT, B Enebish says ErdenesMGL is now at the third stage of discussionswith investor consortiums and willsoon select the successful bidder. He says itis not just the mine that is being discussedbut also the railways, infrastructure andfactories for value added products.Vallar increases Bumi interestUK‐BASED Vallar Plc expected to boost itsstake in Indonesia’s largest <strong>coal</strong> producerPT Bumi Resources to almost 50% througha share‐swap deal by the end of May.Vallar, which completed the acquisition ofa 25% stake in March, offered to swap 57.7shares of Bumi for a share of Vallar.Vallar’s co‐chairman Nathaniel Roth ‐schild says, “Under an ideal scenario in anideal world we would end up owning closeto 50% of Bumi, which would really cementthe relationship between Bumi and Vallar.”Vallar agreed last November to invest $3billion in Bumi and PT Berau Coal Energyin a stock and cash transaction to tap accessto a growing mining sector in Indonesia,the world’s largest thermal‐<strong>coal</strong> exporter,amid rising demand for the fuel from Indiaand China. Vallar will be renamed BumiPlc and is expected to be listed on the FTSE100 Index on the London Stock Exchangeby the end of June.“<strong>The</strong> acquisition has brought togethersignificant holdings in Indonesia’s largestand fifth‐largest <strong>coal</strong> producers to create aLondon‐listed Indonesian <strong>coal</strong> champion,”Total <strong>coal</strong> production from PT Bumi Resources’ Indonesian operations isexpected to reach an annual rate of 111 million tonnes by the end of 2012Nathaniel Rothschild said. “Both Bumi andBerau have strong organic growth profiles,with operations and projects that are perfectlypositioned to take full advantage ofthe current high demand for <strong>coal</strong> from thefast growing markets of Asia.”Bumi plans to repay the first tranche ofdebt to China Investment Corp ahead ofschedule in October this year, while continuingits business relations with the Chinesesovereign wealth fund. “I think given theChinese appetite for resources, they havestrong desire to build on the relationshipthey have already got with this group,”Nathaniel Rothschild says.Vallar, which completed acquiring a 75%stake in Berau Coal in April, may offer tobuy an additional stake at 540 rupiahapiece. Vallar may keep a 5% stake of Beraufree‐float in the market after the tenderoffer and is planning to increase it to 20%within the next two years, to comply withIndonesian regulations. Vallar agreed tobuy 26.2 billion shares of Berau Coal at 540rupiah each or for a total of 14.1 trillionrupiah from PT Bukit Mutiara.Bakrie Group, the owner of Bumi, andBukit Mutiara, received shares in Vallar aspart of the transactions. Bakrie Group nowowns about 54.6% and Bukit Mutiara hasabout 13.2% in the company.Bumi has recently declared its intentionto use company internal cash to finance anincrease in <strong>coal</strong> production by 2013 toreach 111 million tonnes. This year it is targetingproduction of 66 million tonnes, upfrom 60 million in 2010. Bumi’s directorand corporate secretary Dileep Srivastavasays the company targets to control 30‐40%of the global <strong>coal</strong> market by 2013. “We willnot looking for bank loans or money fromany financial institution. We have no planto issue bonds as well. It will be whollyfrom our internal cash.”China climate change targetsFOR the first time in a five year plan, China’sCongress has established targets to tackle climatechange. It plans to reduce carbon dioxideemissions per unit of GDP by 17% from2010 levels by 2015 and reduce energy consumptionby 16% by 2015.<strong>The</strong>se initiatives have been set out in adraft of the country’s 12th Five Year Plan,which covers the period from 2011 to 2015.<strong>The</strong>y follow some of the measuresachieved in the 11th plan during whichChina reached a 19.1% reduction in energyintensity, out of a planned 20%, and produced9.1% of primary energy from nonfossilfuel sources, achievements wereimproved by a number of last minutemeasures in late 2010 that saw a number oflocal officials implement blackouts andforced factory closures.Tackling climate change will not be easyin a country that is growing fast and whosepopulation is increasingly embracingurbanization, industrialization and commercialization.Power consumption is soaring and in thefirst two months of 2011 reached 702.2TWh,12.3% higher than 2010. It is estimated thatthis year’s total consumption will reach4600TWh, up 10% on 2010.In a bid to meet energy demand, the 12thplan sets out aggressive energy targetswhile inefficient <strong>coal</strong> plants will continueJune 2011 l Coal Age Asia l 5

NewsPetrocom Energy’s CBF plant in Lianyungang, China.to be phased out. About 70GW of inefficient<strong>coal</strong>‐fired capacity was phased out inthe 11th plan and 8GW is scheduled to bephased out this year.<strong>The</strong> new plan includes an increased percentageof ‘new energy’ consumption, witha target of 11.4% by 2015.New energy includes cleaner <strong>coal</strong> and<strong>coal</strong>‐bed methane power projects as well assmart grid projects. About 40GW of this wasexpected to come from nuclear power by2015 but after the Japanese nuclear crisis,China’s media has reported that plans havebeen pulled back to 80GW from the 90GWpreviously expected to be built by 2020.<strong>The</strong> new plan also calls for a 75GWexpansion of new hydroelectric capacity, a13GW to 33GW surge in gas generationand 90GW in new wind capacity, 5GW ofwhich is to be offshore wind.Despite the plans for cleaner energy,China will continue to source a majority ofits power from <strong>coal</strong> and plans to add anestimated 260GW of <strong>coal</strong> power by 2015,which will see <strong>coal</strong>’s share to fall to 63%from the current 72%. <strong>The</strong> government islikely to better control <strong>coal</strong> <strong>industry</strong>growth and will cap annual productioncapacity at 3.8 billion tonnes by 2015, upfrom the current capacity of 3.2 billion.Coal blending for IndonesiaINDONESIAN electricity provider PT PLNhas signed a memorandum of understandingwith Hong Kong‐based PetrocomEnergy Ltd (PEL) to conduct a joint studyon the construction of PEL’s Coal BlendingFacilities (CBF) in Indonesia.PEL has patented CBF technology whichinvolves the process of blending <strong>coal</strong> of differentspecifications in a controlled mannerto produce <strong>coal</strong> that is acceptable for commercialuse, primarily in <strong>coal</strong>‐fired powergenerators. Much of the <strong>coal</strong> that can betreated in this manner is unacceptable tothe market in its raw state.<strong>The</strong> benefits of high quality <strong>coal</strong> blendinginclude better fuel efficiency, lower sulphur,lower emissions of nitrogen oxide, bettercaloric value and, most importantly, lesspollutants. <strong>The</strong> low‐grade <strong>coal</strong>s can bemixed with better grade <strong>coal</strong> without deteriorationin the thermal performance of boilers,thus reducing the cost of generation.As one of world’s leading <strong>coal</strong> suppliers,Indonesia has an opportunity to capitalizeon an exponentially growing <strong>coal</strong> exportmarket. PT PLN is responding to this challengeby adding another 10GW of capacitybetween 2012 and 2014. In coming years asmore market compliant <strong>coal</strong> is exportedand consumed domestically, the quality ofthe remaining <strong>coal</strong> reserves becomes lesscompliant, less marketable and less usable.<strong>The</strong> need for a reliable method to extendthe life of reserves has prompted PT PLNto examine the CBF technology.In China PEL, in collaboration with governmentsat national, provincial and locallevels, has identified 25 prospective locationsto build the CBFs and PEL aims tobuild 100 plants in China in the next fiveyears. Its first CBF in China, Lianyungang,began commissioning in May 2008.Working with Dutch engineering firmIV‐Bouw, PEL is building CBFs in Chinabased on the proven design of EMO CBF atEurope’s largest <strong>coal</strong> terminal, EMORotterdam.<strong>The</strong> EMO CBF was designed and built byIV‐Bouw and has been in successfully operatingsince 1994. It supplies blended <strong>coal</strong> ofhigh and consistent quality to power plantsin the Netherlands and Germany.Strong Indonesian CBM pushINDONESIA’S <strong>coal</strong> bed methane (CBM)<strong>industry</strong> appears to be following in the footstepsof the <strong>coal</strong> <strong>industry</strong> with new areasbeing opened up, exploration gatheringpace and production starting.Development of the <strong>industry</strong> comes in thewake of government wishes to curb thecountry’s dependence on oil‐based energysources by seeking new and renewableenergies.Companies are supporting the CBMpush with local and international energy<strong>industry</strong> players becoming involved inKalimantan as well as Sumatra, areaswhich also boast major <strong>coal</strong> reserves.Nine new CBM cooperation contractshave recently been signed by the governmentand these were among 14 new oil, gasand CBM contracts signed in the hope ofboosting exploration activities to crank upthe country’s oil and gas production.Indonesia’s Energy and <strong>Miner</strong>alResources Minister Darwin Zahedy Salehsaid the total investment for exploration inthe first three years would top US$68.95million with the government receiving$16.9 million from signing bonuses.Of the nine CBM blocks, three weredirectly offered to potential operators,while the operators of the remaining sixblocks were decided in auctions.<strong>The</strong> three directly offered blocks are theTanjung IV block in Central Kalimantan,which was awarded to a consortium of PTPertamina Hulu Energi (PHE), MetanaTanjung IV and BP Tanjung IV, the MuaraEnim II block in South Sumatera, awardedto a consortium of PT PHE MetanaSumatera 5, PT Metana Enim Energi andPT Indo CBM Sumbagsel 2, and the MuaraEnim block III, awarded to a consortium ofPT PHE Metana Sumatera 4 and PTBaturaja Metana Indonesia.Three of the six auctioned blocks arelocated in Central Kalimantan ‐ Kapuas I,Kapuas II and Kapuas III. A consortium ofPT Transasia CBM and BP Kapuas I wonthe auction of the first block, a consortiumof PT Kapuan CBM Indonesia and BPKapuas II won the second, and a consortiumof PT Gas Methan Utama and BPKapuas III took the third.<strong>The</strong> remaining three blocks are the KutaiTimur block in East Kalimantan, whichwas won by a consortium of Senyiur CBMand Total E&P Kutai Timur, the Kutai Baratblock in the same province, won by PT GasMethan Abadi, and the Sijunjung block inWest Sumatera, won by a consortium ofInti Gas Energi and PT Bukit Asam. <strong>The</strong>total investment for the nine blocksamounted to $42.55 million with a totalsigning bonus of $11.3 million.PHE’s president director Dwi Martonosaid the signing showed that the companieswere seriousness about supporting thegovernment of Indonesia in developingnew and renewable energies to curb thecountry’s dependence on oil‐based energysources. “We hope that this strategy cantackle the gas supply shortfall.”BP, which secured four CBM blocks, saidin a statement that it had significant experienceand expertise in the development ofunconventional gas, including CBM, andlooked forward to apply this in tappingIndonesia’s <strong>coal</strong> resources.6 l Coal Age Asia l June 2011

NewsMeanwhile, Dart Energy has reportedthe first CBM gas flows at the SangattaWest project in East Kalimantan, which isamong the first in Indonesia from a dedicatedCBM pilot well.<strong>The</strong> SCBM1 pilot well began flowing gasin a controlled operation on March 25 afterthe installation of a down hole pumpsimultaneous with the dewatering process.Continual gas flow has been sustainedsince then.Dart intends the gas produced from thewell will initially be sold under anapproved pilot‐to‐power scheme. Dart’soperating partner in Sangatta West,Ephindo, has signed an MoU with GW andlocal gas‐fired genset supply company,Navigat, with an aim to supply gas‐firedelectricity to the local grid.Dart and Medco Energy, co‐owner of theMuralim CBM PSC in South Sumatra, arein talks with state‐owned electricity companyPT Perusahaan Listrik Negara (PLN)for CBM supply to their existing gas‐firedor dual‐fired power plants in SouthSumatra.Prophecy seeks new landPROPHECY Resource Corp intends acquiringan exploration licence adjacent to itsUlaan Ovoo project in northern Mongolia.<strong>The</strong> company has entered into an optionagreement with a private Mongolian companyholding the licence.<strong>The</strong> new land northeast of Ulaan Ovoo.<strong>The</strong> agreement grants Prophecy the rightto acquire 100% ownership for US$2 millionwithin the first year, or US$4 million inthe second year of the execution of theagreement.<strong>The</strong> 4773‐hectare property has an existing,fully transferable exploration licence17km northeast of the producing UlaanOvoo <strong>coal</strong> mine.It is contiguous to Prophecy's existingexploration licence covering 7392 hectares.<strong>The</strong>se exploration licenses are in the samestructural basin as the company’s UlaanOvoo mine.Recent reconnaissance programs includinggeophysical work to date indicates thepresence of shallow sedimentary rocks upto 100 metres in thickness, which demonstratesthe potential for <strong>coal</strong> discovery.Prophecy plans to begin drilling on theproperty in June 2011.Prophecy paid the owner US$200,000 inApril upon signing the agreement and hasthe right the right to acquire the property<strong>The</strong> opening ceremony for Prophecy’s Ulaan Ovoo projectbefore April 21, 2012, by payment of a furtherUS$1.8 million with 50% payable inProphecy shares; or by April 22, 2013 bypayment of a further US$500,000 on April22, 2012, and US$3.3 million before April21, 2013 with 50% of the final amountpayable in Prophecy shares.A 2% net royalty on production from theproperty is payable to the seller, which canbe purchased at any time at Prophecy's discretionfor US$1 million on or before April21, 2013. Half of the royalty purchase priceshall be payable through the issuance ofProphecy shares.Prophecy Resource Corp is an internationallydiversified company engaged indeveloping energy, nickel and platinumgroup metals projects.<strong>The</strong> company controls more than 1.4 billiontonnes of surface minable thermal <strong>coal</strong>resources in Mongolia. Its Ulaan Ovoo <strong>coal</strong>mine is fully operational and itsChandgana mine mouth power plant isbeing permitted.8 l Coal Age Asia l June 2011

IndonesiaPAN <strong>ASIA</strong> AND KOPEX ACCELERATE TCMA PARTNERSHIP between emerging Aust ‐ra lian resources company Pan Asia Corp or ‐ation and international underground <strong>coal</strong>mining group Kopex is accelerating developmentof the TCM Coal Project in SouthKalimantan. TCM boasts JORC resourcesof 53.2 million tonnes of high calorific thermal<strong>coal</strong>, including 22.4 million indicatedtonnes and 30.8 million inferred tonnes.Pan Asia has recently updated the TCMresource from the initial 30 million tonnesto the current figure and is confident of furtherexpanding the resource through anaggressive exploration campaign, which isbeing co‐funded by Kopex. TCM covers3440 hectares in the Mantewe District ofTanah Bumbu Regency and has a government‐approvedIUP production licencegranted for 15 years which is extendablefor a further two 10‐year periods under<strong>Indonesia's</strong> new mining laws. It is close towell established infrastructure which currentlyservices the nearby ATA mine operatedby PT Arutmin.Kopex is co‐funding an accelerated infilldrilling program and a bankable feasibilitystudy in return for pre‐emptive rights toparticipate in the project. It has just releasedresults on preliminary studies at the site.Pan Asia’s CEO Alan Hopkins says,“Having a closer engagement with a largeexperienced underground <strong>coal</strong> operatorwith the ability to deliver TCM to productionwas a major step forward in advancingthe project. Kopex is a world leader inunderground <strong>coal</strong> mining with the capacityto undertake mining operations as wellas providing the required mining equipment.Kopex has recognized the value ofour TCM project and we are now ahead ofschedule as we move through to the bankablefeasibility study.”Results of phase two drilling, which tookplace earlier this year, reveal the quality ofthe <strong>coal</strong> has an average calorific value of6566 kcal/kg (ADB), 6.41% total moisture,13.52% ash and 1.52% sulphur. This compareswith quality tests from the first phaseof drilling which showed an averagecalorific value of 6682 kcal/kg, 4.64% totalmoisture, 12.09% ash and 1.83% sulphur.Alan Hopkins says “<strong>The</strong> TCM projectfeatures strongly in our corporate strategyto be a major supplier of key resources intothe expanding Asian markets. <strong>The</strong> substantialincrease in the project’s JORC resourcePan Asia’s TCM concession is adjacent to PT Arutmin’s ATA <strong>coal</strong> operations.estimate is great progress. We are confidentthis project has great potential to re‐rate thecompany, and we look forward to movingforward rapidly to the next phase.”<strong>The</strong> company will use underground, longwallmining techniques to exploit the <strong>coal</strong>reserves and Kopex is preparing a preliminaryengineering study to outline the anticipatedoptimum scale of the operations.Alan Hopkins says the country’s investmentlaws only opened up in 2009, makingit an opportune time to be getting involvedin local projects. <strong>The</strong> company’s managersspent much of last year travelling betweenthe Subiaco office in Western Australia andKalimantan to investigate the potential ofIndonesia’s untapped deposits. Pan Asianow boasts several Indonesian partners ona range of prospective local <strong>coal</strong> projects.“Our whole approach to Indonesia is it’s acountry that‘s resource‐rich and well locatedto the Asian market.”Pan Asia is building a portfolio of <strong>coal</strong>and manganese assets in Indonesia withthe aim of being a top tier resources companywithin the next three years. <strong>The</strong> company,which began life as a seafood supplybusiness, is advanced in its aim to acquire anumber of significant <strong>coal</strong> assets, after onlylodging a prospectus with the AustralianSecurities and Investment Commission(ASIC) last November.Its current diversified portfolio of assetsincludes TCM, a flagship exploration projectwith a large tonnage target, and cashflowprojects to finance existing productionat mines including the Nadvara open pitproject in East Kalimantan, where Pan Asiais contracted to sell 4.8 billion tonnes of<strong>coal</strong> over the next four years.Pan Asia dan Kopex percepat TCMKERJASAMA antara sebuah perusahaanpertambangan baru Australia, Pan AsiaCorporation dan grup pertambangan batubara dunia Kopex telah mempercepatperkembangan Proyek Batubara TCM diKalsel. TCM mengetengahkan 53.2 jutatonnes batubara berkalori tinggi dari sumberJORC, termasuk 22.4 juta tonnes terindikasidan 30.8 juta tonnes estimasi.Baru‐baru ini Pan Asia telah mening ‐katkan hasil TCM dari 30 juta tones ke angkaterkini dan mereka yakin akan peningkatansumber ini melalui eksplorasi yang agresifyang dibiayai bersama dengan Kopex. TCMmencakup 3440 hektar di KecamatanMantewe Kabupaten Tanah Bumbu danmemiliki izin produksi IUP dari pemerintahuntuk selama 15 tahun yang menurutUndang‐undang RI dapat diperpanjangselama dua periode masing‐masing 10tahun. Lokasinya pun berhampiran denganinfrastruktur lengkap yang pada waktu inihanya digunakan oleh pertambangan ATAyang dikelola oleh PT Arutmin.Kopex ikut membiayai pencepatan programdrilling infill dan studi kelayakanbankable dengan imbalan kesempatan awalikut serta dalam proyek tersebut. Merekabaru saja menerbitkan hasil dari studi awalmengenai lokasi itu.10 l Coal Age Asia l June 2011

IndonesiaDirut Pan Asia Alan Hopkins mengatakan:“Mempunyai hubungan dekat dengansebuah operator batubara bawah tanahyang berpengalaman dan mampu memproduksiTCM adalah langkah maju yang besardalam meningkatkan proyek ini. Kopexadalah pemimpin dunia dalam hal pertambanganbatubara bawah tanah dengankemampuan melaksanakan operasi pertambangandan menyediakan sarana pertambanganyang diperlukan. Kopex telah mengakuinilai proyek TCM kami dan saat kamimenyelesaikan studi kelayakan bankable ini,kami berada didepan jadwal.Hasil dari pemboran tahap kedua yangdilaksanakan awal tahun ini, memperlihatkanmutu batubara yang mempunyainilai kalorifik rata‐rata sebesar 6566 kcal/kg(ADB), keseluruhan kelembaban 6.41%,13.52% abu dan 1.52% sulfur ketimbangujian mutu dari pemboran tahap pertamayang menunjukkan nilai kalorifik rata‐ratasebesar 6682kcal/kg, keseluruhan kelembaban4.64%, 12.09% abu dan 1.83% sulfur.Kata Alan Hopkins:”Dalam Strategi Peru ‐sahaan kami Proyek TCM ini dilihat sebagaipemasok besar dari hasil‐hasil tambangutama di pasaran Asia yang terus berkembang.Estimasi peningkatan sumber JORCyang substantive adalah kemajuan yang sangatbaik. Kami yakin bahwa proyek ini mempunyaipotensi besar untuk memugar kembaliperusahaan, dan kami mendambakanpergerakan cepat ke tahap yang berikut.”Perusahaan akan menggunakan teknikteknik tambang long‐wall bawah tanah bagimengeksploit batubara, sedangkan Kopexsedang menyiapkan studi teknik awal untukmemperkirakan skala operasi yang optimum.Kata Alan Hopkins undang‐undanginvestasi negara baru keluar pada tahun2009 sehingga sekarang waktunya tepatuntuk berpartisipasi dalam proyek‐proyeksetempat. Tahun lalu para manajer kamisibuk mundar mandir antara kantor kami diSubiaco di Australia Barat dan Kalimantanmenyelidiki potensi cadangan tambang diIndonesia. Pan Asia sekarang mempunyaibeberapa mitra local dalam berbagai proyekbatubara setempat. “Pendekatan kami ialahbahwa Indonesia adalah sebuah negarayang kaya sumber tambang dan terletaksecara strategis di pasaran Asia.”Pan Asia sedang membangun portfolioasset batubara dan manganese di Indonesiadengan tujuan untuk menjadi perusahaansumber tambang teratas dalam waktu tigatahun. Bermula sebagai bisnis mensuplaimakanan laut, perusahaan ini sekarang telahmapan dalam rencananya mendapatkanbeberapa asset batubara yang signifikan,setelah baru saja memasukkan prospektuske Komisi Sekuritas dan Investasi Australiadi bulan Nopember yang lalu.Pada waktu ini potfolio asset beragamnyatermasuk TCM, sebuah proyek eksplorasiflagship dengan tonnase yang besar danproyek‐proyek tunai untuk membiayai produksiyang ada di tambang‐tambang termasukproyek tambang terbuka Nadvara diKalTim. Disini Pan Asia telah diberikan kontrakuntuk menjual 4.8 milyar tonnesbatubara selama empat tahun kedepan.Kangaroo <strong>coal</strong> resources leapUPDATED JORC <strong>coal</strong> resource and reservestatements indicate that Kangaroo Resourceswill have total resources of 3.146 billiontonnes at three projects upon completion ofthe transaction for the Pakar project with PTBayan Resources. <strong>The</strong>re are 3.019 billiontonnes of resources for Pakar, including totalopen cut reserves of 442 million tonnes, 10.49million tonnes of resources for Mamahakand 117 million tonnes of resources for theGPK project. <strong>The</strong> projects have a variety of<strong>coal</strong> types ranging from low‐rank thermal<strong>coal</strong> to coking <strong>coal</strong>.Kangaroo has formed a strategic alliancewith Bayan which involves an offtake fromMamahak and purchase of the Pakar project.<strong>The</strong> Pakar transaction is advancing with anindependent expert’s report being compiledand due diligence being carried out. It isexpected that the transaction will be completeduring this quarter pending finalshareholder approval.Kangaroo is acquiring 99% of Pakar fromAerial view of Kangaroo’s Pakar project.Bayan for $277 million in an all script dealwhich will see Bayan emerge with a 57%stake in the Australian‐listed producer.Bayan has started work targeting the fasttracking of initial production, includingmine optimization studies, bathymetric andhydrographic surveys, preparation of tenderingdocuments to appoint subcontractorsto complete on‐site infrastructure, and preliminarywork in ordering equipment for thestart of operations following completion ofthe transaction.Kangaroo has also finalized a new salescontract with Bayan for <strong>coal</strong> from the Mama‐June 2011 l Coal Age Asia l 11

Indonesiahak Coking Coal project in East Kalimantan.<strong>The</strong> one‐year contract is for <strong>coal</strong> sales of upto 300,000 tonnes at a market price, FOBMamahak jetty. Coal haulage continues toramp up at Mamahak with the completion ofthe mobilization of additional haulagetrucks. <strong>The</strong> company reported total <strong>coal</strong>sales of 34,946 tonnes during the Marchquarter. Kangaroo and Bayan have beenworking together to ramp up Mamahakoperations and this has resulted in progresstoward increasing production rates.As well as additional new equipment,other operational improvements include initialupgrading of the capacity of the bargeloader, recruiting additional staff and thesubmission of additional forestry permitapplications to open up new mining areas.<strong>The</strong> companies are designing an explorationprogram targeting an expansion of theupdated JORC resource estimate. This workwill provide the basis for definition ofreserves with a target of increasing currentproduction levels.<strong>The</strong> updated GPK resource of 117 milliontonnes includes 58 million indicated tonnesand 59 million inferred tonnes. More than95% of the resources lie at depths less than 60metres, increasing the potential for a highlevel of conversion of resources to reserves.Kangaroo plans to conduct a limiteddrilling program at GPK targeting specificareas of the concession with the aim of utilizingthis data to increase the level of confidencein the geological model used for thecurrent resource and to prepare a JORCreserve statement to support the planneddevelopment of mining operations.Cadangan batubara Kangaroo’smelompat naikPERNYATAAN‐pernyataan JORC terkiniakan sumber dan cadangan batubara memberikanindikasi bahwa Kangaroo Resourcesakan mempunyai 3.146 milyar tonnes sumbertambang di tiga proyek dengan selesainyatgransaksi untuk Proyek Pakar denganPT Bayan Resources. Pakar mempunyai3.019 milyar tonnes sumber tambang, termasukcadangan total tambang terbuka sejumlah442 juta tonnes, 10.49 juta tonnes dariMamahk dan 117 juta tonnes di proyek GPK.Proyek‐proyek ini terdiri dari beberapamacam jenis batubara dari batubara thermalberdaya rendah ke batubara coking.Kangaroo telah membentuk hubunganstrategis dengan Bayan menyangkut offtakedari Mamahak dan pembelian proyek Pakar.Transaksi Pakar terus berlangsung dengansebuah laporan independen seorang ahlisedang disiapkan dan ‘due diligence’ telahdilaksanakan. Diperkirakan transaksi iniakan selesai dalam kwartal ini menunggupersetujuan pemegang saham.Akuisisi Kangaroo sebanyak 99% Pakardari Bayan memakan biaya $277 juta semuadalam bentuk kertas dan ini akan memungkinBayan mempunyai 57% dari produsenyang terdaftar di Australia tersebut.Bayan telah memulai kerja‐kerja mempercepatproduksi awal, termasuk studi‐studioptimisasi tambang, survey‐survei bathymetricdan hydrographic, persiapan dokumen‐dokumentender bagi menunjuk subcontractor‐subcontractoruntuk menyiapkaninfrastruktur lapangan dan kerja‐kerja awalmemesan alat‐alat untuk memulai operasibegitu transaksi selesai.Kangaroo juga telah menyelesaikan kontrakpenjualan baru dengan Bayan untukbatubara dari proyek batubara cokingMamahak di KalTim. Kontrak setahun ituadalah untuk penjualan sampai dengan300,000 tonnes dengan harga pasaran, FOBpelabuhan Mamahak.Operasi pengangkutan batubara terusmeningkat di Mamahak dengan siapnyamobilisasi truk pengangkutan tambahan.Dalam kwartal Maret dilaporkan bahwapenjualan batubara berjumlah keseluruhan34,946 tonnes. Kangaroo dan Bayan telahbekerjasama meningkatkan operasi‐operasimereka yang menghasilkan peningkatantaraf produksi.Disamping penambahan alat‐alat baru,perbaikan‐perbaikan operasi yang lain termasukpeningkatan permulaan dari kapasitastongkang loader, pengambilan staftambahan dan membuat tambahan permohonan‐permohonankehutanan untuk izinmembuka area‐area pertambangan baru.Perusahaan‐perusahaan tersebut sedangmempersiapkan program eksplorasi menjurukepada pembaruan estimasi pengembangantambang JORC. Kerja ini akan menyediakandasar untuk definisi cadangan yangberperan meningkatkan taraf produksi.Angka tambang GPK yang berjumlah 117juta tonnes terdiri dari 58 juta tonnes nyatadan 59 juta tonnes diperkirakan. Lebih dari95% sumber tambang berada dikedalamankurang dari 60 meter dan ini meningkatkanlagi kemungkinan konversi hasil tambangke cadangan.Kangaroo berencana untuk melaksanakanprogram pengeboran terbatas di area‐areatertentu dengan maksud menggunakan dataini bagi meningkatkan keyakinan padamodel geologis untuk sumber tambangpada waktu ini dan menyiapkan pernyataancadangan JORC yang mendukung perkembanganoperasi pertambanganCoal loading at the Mahakam River.Challenger advances strategyCHALLENGER Deep Resources is advancingits strategy to establish a portfolio of <strong>coal</strong>exploration projects and progress the projectsto production stage. It is fulfilling itsaims in <strong>coal</strong>‐rich areas of Kalimantan.<strong>The</strong> Canadian‐based company has identifieda number of near‐term productionopportunities, is negotiating several acquisitionsand is exploring the Tabang project inEast Kalimantan.Phase one exploration at Tabang has providedevidence of at least eight separateseams in the northern half of the property. Ascout drill program is being undertaken totest the quality, continuity, width and numberof <strong>coal</strong> seams at depth.Exploration to date has included geologicmapping, outcrop sampling, trenching andexcavation of test pits. Work completed covers55% of the project area and has focusedon the north and central parts.As well as drilling, the ongoing programincludes outcrop mapping of the remainderof the property, excavation of test pits to fullyexpose foot wall and hanging wall of <strong>coal</strong>seams and interpretation of results. <strong>The</strong>scout drilling includes at least 1000 metres ofdrilling in 25 to 30 holes.Through its exploration, Challenger hasdiscovered 56 <strong>coal</strong> outcrops. Preliminaryinterpretation of the outcrops <strong>coal</strong> is that atleast eight separate seams are evident. <strong>The</strong>width and number of seams cannot be confirmeduntil initial drilling has been completed.Based on the sample analysis performed,<strong>coal</strong> quality is in the 5000‐6000 Kcal/kg range.This quality of <strong>coal</strong> is highly marketable.<strong>The</strong> 2900ha Tabang project is in theRegency of Kutai Kartanegara. <strong>The</strong> area isaccessible by vehicle with well establishedlogging roads and is close to the BelayanRiver, a major tributary of the Mahakam,which is the <strong>coal</strong> transport route to MuaraJawa, the anchorage point for mother vesselsand export to market.Challenger Deep’s wholly‐owned subsidiaryPT Bestindo Energy has entered intoa Memorandum of Understanding with the12 l Coal Age Asia l June 2011

Indonesiaprincipal shareholder of PT Bara MandiriUtama (PT BMU) which may lead to the purchaseof a project in East Kalimantan. <strong>The</strong>MoU gives Challenger the exclusive right topurchase all shares of PT BMU through executionof a Conditional Share PurchaseAgreement (CSPA).PT BMU is a private Indonesian companywhich owns four contiguous IUP applicationsof between 91 and 98.7 hectares in theSamboga District, Regency of KutaiKartanegara. <strong>The</strong> project is on the coast, justsouth of the Mahakam estuary. <strong>The</strong> area coversthe Kampung Baru geological formationwhich is known to host thick seams of mediumCV thermal <strong>coal</strong>.Coal outcrops have been observed on theproject area, however quality and extenthave not been confirmed. <strong>The</strong> area is immediatelyadjacent to an independent <strong>coal</strong> loadingterminal which is under construction,with a multi‐use haul road passing directlythrough the project. <strong>The</strong> target for the area islow strip ratio, marketable thermal <strong>coal</strong>strategically located with adjacent port andhaul facilities.Challenger memajukan strategiCHALLENGER Deep Resources sedangmemajukan strateginya untuk membangunsebuah portfolio proyek‐proyekeksplorasi batubara dan membawanyake taraf produksi. Ia memenuhi citacitaini di kawasan‐kawasan kayabatubara di Kalimantan.Perusahaan yang berkedudukan diKanada ini telah menidentifikasi beberapapeluang produksi dalam jangkapendek, sedang membicarakan beberapaakuisisi dan tengah mengeksplorasiproyek Tabang di KalTim.Tahap pertama dari eksplorasi diTabang telah memberikan buktiadanya delapan lapisan terpisah dibagian utara dari tanahnya. Sebuah programbor cobaan sedang dilaksanakanuntuk menguji mutu, kontinuitas, lebar danjumlah lapisan batubara di dalamnya.Sampai saat ini eksplorasi termasukpemetaan geologis, membuat sampel hasil,penggalian jalur dan ekskavai lubang uji.Kerja‐kerja yang sudah selesai menyangkut55% dari kawasan proyek dan bertumpu inbagian‐bagian utara dan tengah.Disamping pemboran, program selanjutnyatermasuk pemetaan hasil dari selebihnyakawasan, ekskavasi lubang uji untukmendedahkan total tembok kaki dan tembokgantung dari lapisan batubara dan interpretasidari hasil‐hasilnya. Bor cobaan termasukpaling sedikit 1000 meter pemborandi 25 sampai 30 lubang.Melalui eksplorasinya, Challenger telahmenemukan 56 hasil batubara. Interpretasiawal dari hasil‐hasil batubara ini menunjukkandelapan lapisan terpisah. Lebar danjumlah daripada lapisan‐lapisan tidak dapatdikonfirmasi sebelum pemboran awal selesai.Berdasarkan analisa sampel yang sudahdilaksanakan, mutu batubara adalah antara5000‐6000 kcal/kg. Mutu batubara demikiansangat dapat dipasarkan.Proyek Tabang seluas 2900 ha ini beradadi Kabupaten Kutai Kartanegara. Daerahnyadapat didatangi dengan kendaraan, mempunyaijalan‐jalan pengangkutan kayu dandekat dengan Sungai Belayan, sebuah anaksungai besar dari Sungai Mahakam, yaitujalur pengangkutan batubara ke MuaraJawa, dermaga untuk kapal‐kapal besar danekspor ke pasaran.Anak perusahaan yang keseluruhannymilik Challenger Deep, PT Bestindo Energytelah membuat MoU dengan pemegamsaham utama PT Bara Mandiri Utama (PTBMU), hal yang menuju kepada pembeliansebuah proyek di KalTim. MoU ini memberikanhak eksklusif kepada Challengeruntuk membeli semua saham‐saham PTBMU dengan mengeksekusi perjanjianConditional Share Purchase (CSPA).Pre-stripping work at Orpheus Energy Group’sB26 Coal Project in East Kalimantan.PT BMU adalah sebuah perusahaanswasta Indonesia yang memiliki empat permohonanIUP berantai antara 91 dan 98.7hektar di Kecamatan Samboga, KabupatenKutai Kartanegara. Proyek ini terletak dipesisir, di selatan muara Mahakam.Kawasan ini termasuk formasi geologisKampung Baru yang diketahui mempunyailapisan tebal batubara DV thermal.Hasil batubara telah nampak di kawasanproyek, namun mutu dan jumlah belumdapat dikonfirmasi. Kawasannya langsungberdampingan dengan dermaga menaikkanbatubara independen yang sedang dibangundengan sebuah jalan pengangkutanmulti guna langsung liwat proyek ini.Tujuan dari kawasan ialah rasio pembersihanyang rendah, batubara yang mudahdipasarkan yang terletak secara strategis danberdampingan dengan sarana pelabuhandan pengangkutan.Trial shipment from B26TRIAL mining is progressing at OrpheusEnergy Group’s joint venture B26 CoalProject in East Kalimantan with <strong>coal</strong> loadedonto barge loaders in Longbok River, EastKalimantan, ready for trial shipment.<strong>The</strong> trial shipment forms part of the supplyof <strong>coal</strong> under an offtake agreement forthe first 25,000 tonnes which has alreadybeen paid with an advance of US$500,000.Orpheus and its Indonesian joint venturepartner PT Mega Coal International continueto progress operations at B26 with heavyearth moving machinery continuing to prestrip the overburden to expose the <strong>coal</strong>allowing trial mining.<strong>The</strong> joint venture partners are also undertakinga drilling program to advance theexisting database and mine plan to JORCstandard for conversion to a JORC classifiedresource. <strong>The</strong> drilling is testing areas of morecomplex structure and other features whichmay affect seam continuity within and outsidethe current mining area at B26.Orpheus has also signed a furtherjoint venture agreement with PT MegaCoal in relation to five exploration tenementsat the Kintap Coal Project,which are prospective for export qualitythermal <strong>coal</strong>. <strong>The</strong> Joint Venturedeed provides for Orpheus to spendUS$750,000 on exploration and a minefeasibility study with a view to early<strong>coal</strong> production. Upon a JORC measuredresource being establishedOrpheus is to pay US$0.50/tonne of<strong>coal</strong> to Mega in consideration of Orpheusreceiving 50% of the joint venture.Orpheus Energy Group is a whollyownedsubsidiary of Australian‐listedCoalworks and is proposed for divestmentthis year into a separate listed companycalled Orpheus Energy. As part of the listingproposal, Coalworks will receive 35 millionshares in the new company.Coalworks says lodgement of the Orpheusprospectus is pending and the proposed listingis expected to take place shortly.Orpheus Energy recently raised $3.45 millionthrough a private placement of unlistedconverting notes which are expected to convertinto shares on or after the listing.As well as the B26 project, the divestmentby Coalworks will see Orpheus take on the14 l Coal Age Asia l June 2011

IndonesiaHodgson Vale <strong>The</strong>rmal Coal Project in southeastQueensland and the Ashford LimestoneProject in northern New South Wales. <strong>The</strong>divestment will allow Coalworks to focus onits core Australian properties.Percobaan pengapalan dari B26PERCOBAAN penambangan sedang berjalandi Proyek patungan Batubara B26Orpheus Energy Group di KalTim denganmemuatkan batubara ke tongkang loaders diSungai Longbok, Kal Tim, siap untuk percobaanpengapalan.Percobaan pengapalan ini adalah sebagiandari pengiriman batubara di bawah perjanjianpembelian 25,000 tonnes pertama yangtelah dibayar dengan uang muka sebesarUS$500,000.Orpheus bersama mitra patungannya PTMega Coal International terus beroperasi diB26 menggunakan mesin‐mesin berat pengalihtanah membuang timbunan diatasbatubara supaya dapat memulai mencobamenambang.Para mitra patungan juga melaksanakanprogram pemboran bagi meningkatkanpangkalan data dan rencana penambanganke taraf JORC untuk diklasifikasi sebagaitambang JORC. Dengan pengeboran inidaerah‐daerah berstruktur dan mempunyaicirri‐ciri yang kompleks dapat diujiperiksakarena ini dapat mempengaruhi kesinambunganlapisan tambang di dalam dan luardaerah pertambangan B26.Orpheus juga telah menandatangai perjanjianpatungan dengan PT Mega Coal mengenailima daerah eksplorasi di ProyekBatubara Kintap yang mempunyai kemungkinanuntuk mengekspor batubarabermutu. Perjanjian tersebut menyetujuiOrpheus mengeluarkan biaya sebanyakUS$750,000 untuk studi penambangan dankelayakan dengan maksud produksi awalbatubara. Begitu pengukuran JORC menjadikenyataan Orpheus akan membayarUS$0.50/tonne batubara ke Mega denganpertimbangan bahwa Orpheus menerima50% dari hasil patungan tersebut.Orpheus Energy Group adalah anakperusahaan yang dimiliki penuh ofCoalworks yang terdaftar di Australia yangtahun ini direncanakan untuk divestasi menjadiperusahaan terpisah yang juga terdaftar.Sebagai bagian dari rencana pendaftaran,Coalworks akan menerima 35 juta saham didalam perusahaan baru itu.Coalworks mengatakan bahwa pengajuanprospektus Orpheus sedang diproses danrencana pendaftaran akan berlangsungdalam waktu dekat.Baru‐baru ini Orpehus Energy berhasilAn aerial view of the camp site at Churchill’s East Kutai Coal Project.mendapatkan $3.45 juta melalui penukarantunai yang diperkirakan akan ditukar kesaham‐saham setelah pendaftaran.Selain dari proyek B26, dengan divestas i ‐kannya Coalworks, Orpheus akan mendapatkanProyek Hodgson Vale <strong>The</strong>rmal Coal ditenggara Queensland dan Proyek AshfordLimestone di utara New South Wales. Inijuga akan memungkinkan Coalworks untukmenumpukan perhatian ke pertambanganbatubara di Australia.Churchill attracts investorsCHURCHILL Mining has attracted the interestof two new Indonesian partners who aresubscribing for shares worth £7.7 million fora total of 16.5% of the company. <strong>The</strong>investors are Rachmat Gobel and FaraLuwia who are acquiring 19.3 million sharesat 40 pence each, a 60% mark‐up to the 20‐day average stock price.Churchill is embroiled in a legal battleover the future of its East Kutai Coal Projectin East Kalimantan, and the company hopesthe two new influential partners will help inits bid to hold onto the mine.Rachmat Gobel is the head of GobelInternational, which has partnerships withJapan’s Matsushita Corporation and is thelocal representative of Qatar Telecom, whilebusinesswoman Fara Luwia is developingone of the largest rice mills in the country inpartnership with a Swiss commodity trader.Churchill’s chairman David Quinlivansays, “<strong>The</strong>y have a significant on‐groundpresence in Indonesia and Churchill believesthey will provide the local expertise and exp ‐erience necessary to advance the East KutaiCoal Project through to its production phasein the most expeditious manner possible.”Rachmat Gobel says, “I am looking forwardto working with Churchill to advancethe East Kutai Coal Project into development.I believe that this project will be a significantcontributor to East Kalimantan'seconomy and bring substantial benefits tothe region and Indonesia as a whole.”To date more than 2.73 billion tonnes ofthermal <strong>coal</strong> resource has been defined toJORC standard at East Kutai. A feasibilitystudy has been completed, indicating an economicand desirable project and the studyforms the platform for the next stage indevelopment of the project. In addition toEast Kutai, Churchill has interests in theSendawar Coal Bed Methane Project in EastKalimantan.Earlier this year Churchill completed thepurchase of land to be used as the site of thefuture port facility for the shipment of <strong>coal</strong>from East Kutai. <strong>The</strong> port is a key componentfor the direct access of exporting thermal<strong>coal</strong> to the international markets.<strong>The</strong> port stockyard comprises an area ofmore than 340 hectares and will have fourstockpiles of about 500 metres each in lengthwith a total storage capacity of 852,000tonnes. Transportation of <strong>coal</strong> from the portstockyard will be by a series of conveyors onto a jetty extending 1500 metres to deepwater. <strong>The</strong> facility at the end of the jetty willbe equipped with two dedicated ship loaderscapable of annually handling 30 milliontonnes of <strong>coal</strong>.Churchill menghimbau investorCHURCHILL Mining telah menarik minatdua mitra Indonesia yang menginginkansaham seharga £7.7 juta untuk 16.5% dariperusahaan. Investor‐investor ini adalahRachmat Gobel dan Fara Luwia yang mendapatkan19.3 juta saham seharga 40 pencesatu, suatu kenaikan 60% dari harga sahamrata‐rata selama 20 hari.Churchill sedang menghadapi pertikaianhukum mengenai masa depan ProyekBatubara Kutai timur di Kaltim, dan merekaberharap kedua mitra berpengaruh ini dapat16 l Coal Age Asia l June 2011

Indonesiamembantu mereka untuk terus memiliki tambang ini.Rachmat Gobel adalah kepala Gobel International, yang bermitradengan Matsushita Corporation dari Jepang dan wakil setempatnyaQatar Telecom, sedangkan pengusaha wanita Fara Luwia tengahmembangun salah satu pabrik beras terbesar di negara itu bersamadengan sebuah pedagang komoditas Swiss.Ketua Churchill David Quinlivan berkata, “Mereka mempunyaikeberadaan setempat yang besar di Indonesia dan Churchill beranggapanbahwa mereka akan memberikan ketrampilan dan pengalamanyang diperlukan bagi memajukan Proyek Batubara KutaiTimur ke tahap produksi selekas mungkin.”Rachmat Gobel mengatakan, “Saya ingin bekerja sama denganChurchill untuk memajukan Proyek Batubara Kutai Timur ke tahappengembangan. Saya perkirakan proyek ini akan menjadi sebuahpenunjang besar ekonomi Kal Tim dan memberikan faedah‐faedahsubstantive ke daerah dan Indonesia secara keseluruhan.”Sampai saat ini lebih dari 2.73 milyar tonnes sumberdaya batubarathermal telah didefinisikan sebagai standar JORC di Kutai Timur.Sebuah studi kelayakan telah selesai, memperlihatkan bahwa proyekini diingini serta ekonomis dan menjadi landasan berikutnya bagipengembangan proyek. Di samping Kutai timur, Churchill mempunyaiandil di Proyek Methane Dasar Batubara Sendawar di KalTim.Pada awal tahun ini Churchill telah menyelesaikan pembeliantanah untuk digunakan sebagai lokasi sarana pelabuhan untuk pengangkutanlaut batubara dari Kutai Timur. Sarana ini adalah komponenkunci untuk memungkinkan pengeksportan langsung batubarathermal ke pasaran dunia.Kawasan pelabuhan mencakup lebih dari 340 hektar dan akanmempunyai empat tempat penumpukan yang panjangnya 500meter dengan kapasitas penyimpanan berjumlah 852,000 tonnes.Batubara diangkut dari kawasan penyimpanan pelabuhan ini dengankonveyor ke dermaga sejauh 1500 meter ke daerah air dalam. Dihujung dermaga akan dilengkapi dengan dua pengisi kapal yangberkapasitas 30 juta tonnes batubara per tahun.Ethica management, and access to their established services to the<strong>coal</strong> <strong>industry</strong> in Indonesia.“<strong>The</strong> company is on track with its strategy in Mongolia andIndonesia, two countries identified for their prospective coking andthermal <strong>coal</strong> project opportunities, having recently secured a numberof significant licences in Mongolia under a similar model.”C @ mendapatkan kesempatan-kesempatanC@LTD yang berkedudukan di Australia telah menandatangani perjanjiandengan PT Ethica Trada Cermelang yang berdua akanmenumpukan perhatian kepada pencepatan identifikasi dan pembangunanproyek‐proyek batubara coking dan energi thermal tinggidi Indonesia.Ethica adalah sebuah firma jasa professional industri batubara diIndonesia yang berpengetahuan luas mengenai pasar tempatan.Perjnajian ini memberikan C@ sebuah mitra strategis yang menyediakanketrampilan setempat, kapabilitas dan bantuan setempat untukmengidentifikasi dan mengevaluasi kemungkinan‐kemungkinanpengembangan aset batubara Indonesia. Perjanjian ini sesuai denganstrategi investasi C@ untuk membangun aset batubara bermutu tinggidi Mongolia dan di Indonesia.C@ telah mulai menilai proyek‐proyek yang diidentifikasi olehEthica dan merasa optimis karena walaupun di sebuah pasarbatubara yang sudah berkembang seperti Indonesia, masih ada jalurpipa potensi proyek‐proyek.Perjanjian teras ini adalah untuk enam bulan dengan opsi untukenam bulan lagi kalau diingini oleh C@. Dalam masa ini C@ akanmembayar kembali Ethica untuk pengeluaran menyangkut kegiatankegiatanini.C @ sees opportunitiesAUSTRALIAN‐based C @ Ltd has signed an agreement with PTEthica Trada Cermelang which will see both companies focus onaccelerating the identification and development of coking and highenergy thermal <strong>coal</strong> projects in Indonesia.Ethica is a professional services firm to the <strong>coal</strong> <strong>industry</strong> inIndonesia with extensive local market intelligence. <strong>The</strong> agreementprovides C @ with a strategic partner that brings along the expertise,capabilities and local support to identify and evaluate suitableIndonesian <strong>coal</strong> asset development opportunities. <strong>The</strong> agreement isin line with C @’s investment strategy of acquiring and developinghigh quality <strong>coal</strong> assets in Mongolia and Indonesia.C @ has already started reviewing projects identified by Ethica andis encouraged that even in a relatively well established and developed<strong>coal</strong> market such as Indonesia, a pipeline of potential projectsis still available.<strong>The</strong> Heads of Agreement is for six months with a further six monthoption available at C @’s election. During this period C @ will reimburseEthica for expenditure related to these activities.Upon identifying a suitable Indonesian <strong>coal</strong> opportunity, an unincorporatedjoint venture will be established with Ethica to acquirethe project assets with C @ to retain the majority interest in any jointventure projects. Ethica will also have the opportunity to acquire anadditional minority contributing interest in the JV.C @’s managing director Mark Earley says “<strong>The</strong> agreement bringsextensive in‐country business experience and networks through theJune 2011 l Coal Age Asia l 17

IndonesiaBegitu kesempatan batubara Indonesiayang sesuai ditemui, sebuah proses patunganyang tidak dikorporasikan denganEthica akan dibentuk bagi mendapatkanaset‐aset proyek dengan C@ terusmemegang saham mayoritas. Ethica jugamempunyai kesempatan untuk mendapatkansaham minoritas tambahan diperusahaan patungan itu.Dirut C@ Mark Earley mengatakan“Perjanjian ini menyediakan pengalamanbisnis setempat dan jaringan‐jaringanyang luas melalui manajemen Ethica, danakses untuk jasa‐jasa pada industribatubara Indonesia mereka yang sudahberkembang.“Perusahaan berada tepat waktu denganstrateginya di Mongolia danIndonesia, dua Negara yang telah diidentifikasimempunyai kesempatan‐kesempatanuntuk proyek‐proyek batubara coking danthermal, setelah mendapatkan beberapa izinsubstantif di Mongolia menggunakanmodel yang sama.”Underground operations at aCoal India mine.Coal India has eyes on IndonesiaINDIA’S biggest <strong>coal</strong> producer Coal India isleading the charge as far as Indian investmentinto Indonesia’s vast <strong>coal</strong> opportunitiesis concerned. It is investing in operating andnear‐development mines as well as valueaddingprospects as it endeavours to securesupplies to meet the sub‐continent’s demandfor power and steel.Coal India is seeking supplies fromIndonesia and other global sources as anindividual entity and as part of India’sInternational Coal Ventures Pvt Ltd (ICVL)consortium, which also comprises the SteelAuthority of India Limited (SAIL), NTPCLimited, National <strong>Miner</strong>al DevelopmentCorp and Rashtriya Ispat Nigam. SAIL andCoal India hold 28.5% each in the companyand the three others each hold 14.29%.Individually Coal India is targeting prod ‐uction of 452 million tonnes in the 2012 Ind ‐ian financial year, up from 431 million tonnesin 2011 fiscal year. To achieve these targets itis seeking bids from 16 short‐listed overseascompanies to import <strong>coal</strong> with Indonesianand Australian operations to the fore.It was recently stated during an infrastructuresummit in Jakarta that Coal India plansto invest up to US$3 billion in a coking <strong>coal</strong>mine, steel plant and sea port in Kalimantan.Central Kalimantan Governor Agustin TerasNerang said that Coal India was expected tocomplete feasibility studies on these integratedprojects centred on the province inJune. He said that the company would ‘prepare’all funds for the projects with the feasibilityfollowing the signing of agreements byall parties earlier this year.Central Kalimantan has about 4.8 billiontonnes of reserves with coking <strong>coal</strong> estimatedto represent around 40% of the total.As part of ICVL, Coal India is also confidentof gaining further supplies fromIndonesia. ICVL is believed to be close toclinching a deal to acquire a stake inSingapore‐based MEC Coal, which has substantialreserves in East Kalimantan.According to <strong>industry</strong> sources, ICVL islooking at 24% stake in MEC for aboutUS$200 million. Through its subsidiary PTTekno Orbit Persada, MEC is developingtwo <strong>coal</strong> mines in East Kalimantan with estimatedreserves of 1.5‐2 billion tonnes.Recently, ICVL signed a memorandum ofunderstanding with the Indonesian governmentfor developing mineral assets, settingup facilities and other infrastructure.Coal India punya minatterhadap IndonesiaPRODUSER batubara India terbesar CoalIndia telah menjadi pemimpin terdepaninvestasi India untuk peluang‐peluang besarbatubara di Indonesia. Mereka menginvestasidi pelaksanaan dan pra pengembangantambang‐tambang serta juga dalam prospekprospekpenambahan nilai karena merekaberniat untuk menjamin masokan‐masokanuntuk memenuhi keperluan untuk energydan besi.Coal India mencari masokan dariIndonesia dan sumber‐sumber dunia lainnyasebagai badan individu dan juga sebagaibagian dari konsorsium India yaituInternational Coal Ventures Ltd (ICVL),yang juga terdiri dari Steel Authority ofIndia Limited (SAIL), NTPC Limited,National <strong>Miner</strong>al Development Corp danRashtriya Ispat Nigam. SAIL dan Coal Indiahold masing‐masing 28.5 % dalam perusahaandan yang tigal lain memegang 14.29%.Secara individu Coal India merencanakproduksi sejumlah 452 juta tonnes padatahun finansial India 2012, meningkat dari431 juta tonnes in tahun fiskal 2011. Untukmencapai targe‐target ini ia mencari tawarandari 16 perusahaan yang sudah di daftarpendekkanuntuk mengimpor batubara denganoperasi‐operasi Indonesia dan Australiaberada dimuka.Pada sebuah KTT infrastruktur diJakarta baru‐baru ini dikatakan bahwaCoal India berencana untuk menginvestasisampai US$3 milyar di sebuah tambangbatubara coking, pabrik besi danpelabuhan di Kalimantan. Gubernur KalTeng Agustin Teras Nerang mengatakanbahwa Coal India diperkirakan menyelesaikanstudi kelayakannya dalam proyekproyektergabung berpusat di propinsinyapada bulan Juni. Katanya perusahaan ituakan menyiapkan semua dana untukproyek‐proyek itu dengan kelayakanmenyusul penandatanganan perjanjian‐perjanjianoleh semua pihak awal tahun ini.KalTeng mempunyai kira‐kira 4.8 milyartonnes sumber batubara dengan batubaracoking diperkirakan berjumlah sekitar 40%dari seluruhnya.Sebagai bagian dari ICVL, Coal India jugayakin mendapatkan masokan lagi dariIndonesia. ICVL dipercayakan sudah hampirmendapatkan andil di MEC Coal berkedudukandi Singapura yang mempunyaicadangan besar di KalTim.Menurut sumber‐sumber <strong>industry</strong>, ICVLsedang melihat kemungkinan 24% andil diMEC seharga US$200 juta. Melalui anakperusahaannya PT Tekno Orbit Persada,MEC sedang membangun dua tambangbatubara di Kal Tim dengan cadangandiperkirakan sebesar 1.5‐2 milyar tonnes.Baru‐baru ini ICVL telah menandatangaiMoU dengan pemerintah Indonesia untukmengembangkan aset pertambangan, membangunsarana‐sarana dan infrastruktur lain.Paramount and Antam sign MoUPARAMOUNT Mining has signed a comprehensiveMemorandum of Understanding(MoU) with PT Antam (Persero) Tbk whichwill enable both parties to identify prospective<strong>coal</strong> mining and related infrastructureprojects in Indonesia that are suitable forjoint venture projects.<strong>The</strong> agreement has been concludedbetween Antam’s recently established <strong>coal</strong>mining subsidiary, PT Indonesia CoalResources, and Paramount’s Indonesian subsidiaryPT Paramindo Energi.Paramount’s involvement starts fromexploration project identification, to developmentof mining operations and associated18 l Coal Age Asia l June 2011

Indonesiainfrastructure, through to <strong>coal</strong> market developmentand sales. At the same time, theMOU provides for a subsequent <strong>coal</strong> supplyagreement, which will give Paramountaccess to Antam’s <strong>coal</strong> production for exportto key regional markets at a time of stronginternational demand.With a market capitalization of US$2.4 billion,Antam is a leading Indonesian diversifiedmining and minerals processing company.It has identified in Paramount a partnerwith needed experience in the <strong>coal</strong> sector,and the expertise to develop key projectsfrom grass roots through to sales.<strong>The</strong> new agreement is integral toParamount’s strategy to grow its Indonesianfocusedgold and <strong>coal</strong> project portfolio.Paramount’s chairman Mo Munshi says,“We are delighted to have secured thisagreement, which we regard as a key steptoward achieving Paramount’s objectives.”In June 2010, Paramount concluded astrategic cooperation agreement withZurily Resources and Trading, aSingapore commodity trading company.In the past four decades, Antam hasgrown to become a vertically integrated,export‐oriented, diversified mining andmetals company, with operations spreadthroughout the mineral‐rich Indonesianarchipelago. Its shares are traded on theIndonesia Stock Exchange and, since 2002, onthe ASX.Antam undertakes all activities fromexploration, excavation and processingthrough to the marketing of nickel ore, ferronickel,gold, silver and bauxite. Due to thevastness of Antam's licensed explorationareas as well as its known large holdings ofhigh quality reserves and resources, Antamhas formed several joint ventures with internationalpartners to profitably develop geologicalore bodies into profitable mines.Antam recently established PT IndonesiaCoal Resources to facilitate its expansion into<strong>coal</strong> mining and off‐taking.Paramount is an ASX‐listed, Indonesiafocusedgold and <strong>coal</strong> exploration companywith its key asset being the Gunung Julangepithermal gold‐silver project, which isabout 20km west of Antam’s multi‐millionounce Pongkor epithermal gold‐silver mine,and about 100km south‐west of Jakarta.Paramount dan Antammenandatangani MoUPARAMOUNT Mining telah menandatanganisebuah Memorandum Pengertian(MoU) yang lengkap dengan PT Antam(Persero) Tbk yang akan memungkin keduaduapihak mengidentifikasi kemungkinanpenambangan batubara dan proyek‐proyekinfrastruktur terkait di Indonesia yang cocokuntuk proyek‐oroyek patungan.Perjanjian ini telah diselesaikan anakperusahaan Antam yang baru‐baru inididirikan, PT Indonesia Coal Resources, dananak perusahaan Paramount di IndonesiaPT Paramindo Energi.Keterlibatan Paramount bermula dari iden ‐t i fikasi proyek eksplorasi, ke pembangunanoperasi‐operasi penambangan dan infrast ru ‐ktur terkait, sampai ke pengembangan pas a ‐ran batubara dan penjualan. Pada waktu ber ‐s a maan, MoU tersebut menyediakan perjanjiansuplai batubara selanjutnya, yang akanmemberikan Paramount akses ke produksibatubara Antam untuk ekspor ke pasaranpasaranutama serantau sewaktu permintaankeperluan dunia sedang sangat kuat.A thick <strong>coal</strong> seam at one of PeabodyEnergy’s <strong>coal</strong> projectsDengan kapitalisasi pasar sebesar US$2.4milyar, Antam adalah perusahaan pertambanganberagam dan pemeroses logam terdepanIndonesia. Dengan Paramount merekamendapatkan mitra yang mempunyai pengalamanyang dibutuhkan di sektor batubaradan ketrampilan mengembangkan proyekproyekinti dari dasar sampai penjualan.Perjanjian baru ini menjadi bagian terpadudari strategi Paramount dalam mengembangkanportfolio emas dan proyekbatubaranya di Indonesia. Ketua ParamountMo Mushi mengatakan, “Kami sangat gembiramendapatkan perjanjian ini, yang kamianggap sebagai langkah kunci kedepan bagimencapai objektif‐objektif Paramount.”Dibulan Juni 2010 Paramount menyelesaikanperjanjian kerjasama strategis denganZurily Resources and Trading, sebuah per u ‐sahaan perdagangan komoditas Singa pura.Selama empat dekade terakhir ini, Antamtelah berkembang menjadi sebuah perusahaanpertambangan beragam dan logamyang terpadu secara vertikal, berorientasiekspor dengan kegiatan operasi tersebar dis ‐e luruh rantau Indonesia yang kaya denganmineral. Sahamnya diperdagangkan di Jak ‐arta Stock Exchange dan sejak 2002 di ASX.Antam melaksanakan berbagai kegiatanmulai dari eksplorasi, ekskavasi danpemerosesan sampai ke penjualan hasil tambangnickel, ferronickel, emas, perak danbauksit. Oleh karena luasnya wilayah eksplorasiyang telah mendapat lisensi danbesarnya simpanan sumber tambang bermutuyang dimilikinya, Antam telah membuatbeberapa proyek patungan dengan mitrainternasional untuk mengembangkan buktibijih tambang geologis menjadi tambangtambangyang menguntungkan.Baru‐baru ini Antam menubuhkan PTIndonesia Coal Resources untuk membantuberkembang ke penambangan dan penjualanbatubara.Paramount adalah sebuah perusahaaneksplorasi emas dan batubara yang terdaftarpada ASX dan berfokus Indonesia denganaset utamanya proyek emas‐perak epithermalGunung Julang terletak 20 km di sebelahbarat tambang multi‐juta ons emasperakepithermal Pongkornya Antamdan sekitar 100 km di sebelah barat dayaJakarta.Peabody boosts <strong>coal</strong> exportsUS <strong>coal</strong> giant Peabody Energy hassigned additional <strong>coal</strong> supply agreementswhich are expected to add about6 million tonnes to its trading and brokeragesupply platform. <strong>The</strong> company is targetingtotal 2011 global sales of 245‐265 milliontonnes, including 28‐30 million tonnes fromAustralia, 195‐205 million from the US andthe remainder from trading and brokerageactivities.St Louis‐based Peabody is the world’slargest private‐sector <strong>coal</strong> company and aglobal leader in clean <strong>coal</strong> solutions. Its <strong>coal</strong>products fuel about 10% of US power and2% of worldwide electricity.It has recently signed an agreement with<strong>Indonesia's</strong> PT Cahaya Energi Mandiri (PTCEM) to source 2 million tonnes of <strong>coal</strong> toimprove exports. Indonesia is the world'slargest supplier of seaborne thermal <strong>coal</strong>.Coal secured from PT CEM’s EastKalimantan mine over two years will beexported to Asian countries and Peabodywill conduct exports through COALTRADE,its international trading hub in Singapore.Peabody is confident that the relationshipwith PT CEM will be expanded over time.It is the third agreement Peabody hasreached recently to source Indonesian <strong>coal</strong>,including a deal signed in December with PTSupra Bara Energi. Its <strong>coal</strong> trading and brokerageplatform continues to expand toserve high‐growth Asia‐Pacific markets andthe company says it will continue to increaseits <strong>coal</strong> sourcing in Indonesia going forward.20 l Coal Age Asia l June 2011

IndonesiaSeaborne <strong>coal</strong> demand is projected toexceed 1 billion tonnes this year with theAsia Pacific region comprising the vastmajority of demand growth. Peabody servescustomers in more than 25 countries on sixcontinents and has trading and businessoffices in Indonesia, Singapore, China,Australia, the UK and the US.Peabody meningkatkanekspor batubaraRAKSASA batubara AS Peabody Energytelah menandatangani perjanjian‐perjanjiansuplai batubara tambahan di Indonesia yangdiperkirakan menambah lebih kurang 6 jutatonnes ke landasan perdagangan dan perjualbeliansuplainya. Perusahaan inimenginginkan penjualan total di tahun 2011sejumlah 245‐265 juta tonnes, termasuk 28‐30juta tonnes dari Austrlia, 195‐205 juta tonnesdari AS dan selebihnya dari kegiatankegiatanperdagangan dan penjualbelian.Peabody yang berkedudukan di St Louisadalah perusahaan batubara sektor swastayang terbesar di dunia dan pemimpin duniadalam hal penyelesaian‐penyelesaianbatubara bersih. Hasil‐hasil batubaranyamenyediakan bahan bakar untuk kira‐kira10% dari energi AS dan 2% dari listrik seanterodunia.Baru‐baru ini ia menandatangani perjanjiandengan PT Cahaya Energi Mandiri (PTCEM) Indonesia untuk mendapatkan 2 jutatonnes batubara bagi meningkatkan ekspor.Indonesia adalah sumber terbesar duniauntuk batubara thermal.Batubara yang didapatkan dari tambangPT CEM di KalTim selama dua tahun akandiekspor ke negara‐negara Asia dan Peabodyyakin bahwa kerjasamanya dengan PT CEMakan dikembangkan lanjut di masa depan.Ini adalah perjanjian ketiga yang telahdiperoleh Peabody baru‐baru ini untukmendapatkan batubara Indonesia, termasukperjanjian yang ditandatangani pada bulanDesember dengan PT Supra Bara Energi.Landasan perdagangan dan penjualbelianbatubara nya terus meningkat bagi mem‐en ‐uhi pasaran Asia‐Pasifik yang berkembangpesat dan perusahaan ini mengatakanbahwa ia akan meneruskan peningkatanpencarian batubara di Indonesia.Permintaan batubara tahun ini diperkirakanakan melampaui 1 milyar tonnes dengankawasan Asia‐Pasifik membentuk pertumbuhankeperluan yang terbesar. Pea ‐body melayani pelanggan‐pelanggan dilebih dari 25 negara di 6 benua dan mempunyaikantor‐kantor perdagangan dan bisnisdi Indonesia, Singapura, China,Australia, UK dan AS.GMR Energy starts miningINDIAN‐BASED energy provider GMREnergy expected to start mining at its SouthSumatra project during May. <strong>The</strong> companyintends to use the <strong>coal</strong> for its thermal powerprojects in India.GMR, which is part of the Bangalore headquarteredGMR Group, hopes that <strong>coal</strong> fromits Indonesian projects will also help circumventthe volatility of prices for its coastalpower plants in India, which are largelyfired by imported <strong>coal</strong>.In 2009 GMR acquired Indonesian <strong>coal</strong>miner PT Barasentosa Lestari (PT BSL) forabout U$80 million. PT BSL held a <strong>coal</strong> mininglicence under a Coal Contract of Workissued by the Indonesian Government andthis provided a 25 year mining permit overtwo separate <strong>coal</strong> blocks in South Sumatra. Ithad <strong>coal</strong> reserves of 110 million tonnes.GMR has been seeking captive mines as itembarks on a huge expansion of its flagshipJune 2011 l Coal Age Asia l 21