N° 2005-09 Juin 2005 Guillaume Daudin* Jean-Luc Gaffard ...

N° 2005-09 Juin 2005 Guillaume Daudin* Jean-Luc Gaffard ... N° 2005-09 Juin 2005 Guillaume Daudin* Jean-Luc Gaffard ...

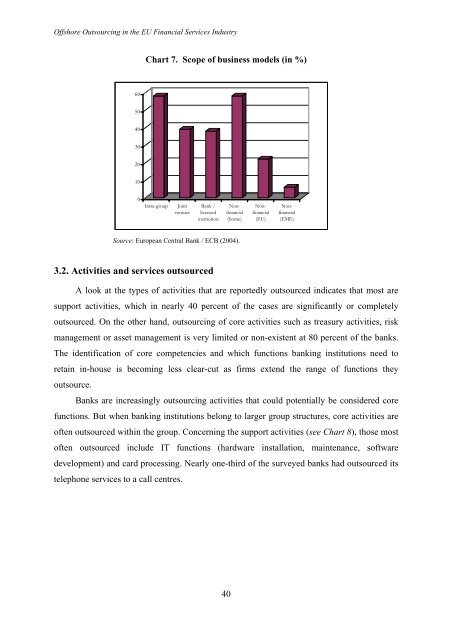

Offshore Outsourcing in the EU Financial Services IndustryChart 7. Scope of business models (in %)6050403020100Intra-groupJointventureBank /licensedinstitutionNonfinancial(home)Nonfinancial(EU)Nonfinancial(EME)Source: European Central Bank / ECB (2004).3.2. Activities and services outsourcedA look at the types of activities that are reportedly outsourced indicates that most aresupport activities, which in nearly 40 percent of the cases are significantly or completelyoutsourced. On the other hand, outsourcing of core activities such as treasury activities, riskmanagement or asset management is very limited or non-existent at 80 percent of the banks.The identification of core competencies and which functions banking institutions need toretain in-house is becoming less clear-cut as firms extend the range of functions theyoutsource.Banks are increasingly outsourcing activities that could potentially be considered corefunctions. But when banking institutions belong to larger group structures, core activities areoften outsourced within the group. Concerning the support activities (see Chart 8), those mostoften outsourced include IT functions (hardware installation, maintenance, softwaredevelopment) and card processing. Nearly one-third of the surveyed banks had outsourced itstelephone services to a call centres.40

Georges PujalsChart 8. Relative importance of EU banks’ support activities outsourcing (in %)no outsourcing few components many components full outsourcing100806040200HardwareCard processingSoftwareCall centersClearing and settlementAccountingMarketingHuman resourcesClients accountsSource: ECB (2004).3.3. Motives for outsourcingBanking institutions may choose to outsource certain activities for various motives.According to the Chart 9, the first motive for outsourcing is cost reduction, cited by almost 90percent of respondent banks. In second instance, around 60 percent of the banks’ cited accessto better technology/infrastructure and the strategy of focusing on core competencies.Chart 9. EU bank’s motives for undertaking outsourcing (in %)9080706050403020100CostreductionAccess new Focus on coretechnology activitiesScale Free resourceseconomiesImprovequality ofservicesGreaterflexibilitySource: ECB (2004).Almost 20 percent of the surveyed banks also said that outsourcing allows them torelieve resource constraints (i.e., when there is lack of internal staff or know-how), andimprove quality of services. Indeed, outsourcing might be used to develop and provide new41

- Page 1 and 2: COMPETITION FROM EMERGING COUNTRIES

- Page 3 and 4: Competition from Emerging Countries

- Page 5 and 6: I. OFFSHORE RELOCATIONS AND EMERGIN

- Page 7 and 8: Guillaume Daudin and Sandrine Levas

- Page 9 and 10: Guillaume Daudin and Sandrine Levas

- Page 11 and 12: Guillaume Daudin and Sandrine Levas

- Page 13 and 14: Guillaume Daudin and Sandrine Levas

- Page 15 and 16: Guillaume Daudin and Sandrine Levas

- Page 17 and 18: Guillaume Daudin and Sandrine Levas

- Page 19 and 20: Guillaume Daudin and Sandrine Levas

- Page 21 and 22: Guillaume Daudin and Sandrine Levas

- Page 23 and 24: Guillaume Daudin and Sandrine Levas

- Page 25 and 26: Guillaume Daudin and Sandrine Levas

- Page 27 and 28: II. OFFSHORE OUTSOURCING IN THE EU

- Page 29 and 30: Georges PujalsConcerning Europe, th

- Page 31 and 32: Georges Pujalsable to reduce costs)

- Page 33 and 34: Georges Pujals“Offshoring” - th

- Page 35 and 36: Georges Pujalsthe number of electro

- Page 37 and 38: Georges PujalsTable 3. Financial se

- Page 39: Georges PujalsOffshoring was initia

- Page 43 and 44: Georges PujalsAll those categories

- Page 45 and 46: Georges PujalsChart 11. Supervisors

- Page 47 and 48: Georges Pujalsoutsourcing should th

- Page 49 and 50: Georges PujalsMcKinsey Global Insti

- Page 51 and 52: International Relocation and Deindu

- Page 53 and 54: International Relocation and Deindu

- Page 55 and 56: International Relocation and Deindu

- Page 57 and 58: International Relocation and Deindu

- Page 59 and 60: International Relocation and Deindu

- Page 61 and 62: International Relocation and Deindu

- Page 63 and 64: Relocation: What Matters? Competiti

- Page 65 and 66: Relocation: What Matters? Competiti

- Page 67 and 68: Relocation: What Matters? Competiti

- Page 69 and 70: Relocation: What Matters? Competiti

- Page 71 and 72: Relocation: What Matters? Competiti

- Page 73: Relocation: What Matters? Competiti

- Page 78: Jean-Luc Gaffard and Michel Quéré

Offshore Outsourcing in the EU Financial Services IndustryChart 7. Scope of business models (in %)6050403020100Intra-groupJointventureBank /licensedinstitutionNonfinancial(home)Nonfinancial(EU)Nonfinancial(EME)Source: European Central Bank / ECB (2004).3.2. Activities and services outsourcedA look at the types of activities that are reportedly outsourced indicates that most aresupport activities, which in nearly 40 percent of the cases are significantly or completelyoutsourced. On the other hand, outsourcing of core activities such as treasury activities, riskmanagement or asset management is very limited or non-existent at 80 percent of the banks.The identification of core competencies and which functions banking institutions need toretain in-house is becoming less clear-cut as firms extend the range of functions theyoutsource.Banks are increasingly outsourcing activities that could potentially be considered corefunctions. But when banking institutions belong to larger group structures, core activities areoften outsourced within the group. Concerning the support activities (see Chart 8), those mostoften outsourced include IT functions (hardware installation, maintenance, softwaredevelopment) and card processing. Nearly one-third of the surveyed banks had outsourced itstelephone services to a call centres.40