Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

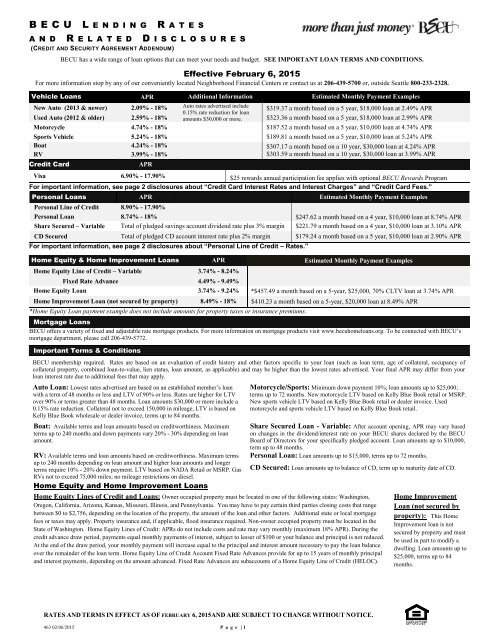

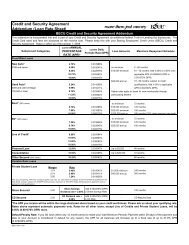

B E C U L E N D I N G R A T E SA N D R E L A T E D D I S C L O S U R E S(CREDIT AND SECURITY AGREEMENT ADDENDUM)<strong>BECU</strong> has a wide range of loan options that can meet your needs and budget. SEE IMPORTANT LOAN TERMS AND CONDITIONS.Effective February 6, 2015For more information stop by any of our conveniently located Neighborhood Financial Centers or contact us at 206-439-5700 or, outside Seattle 800-233-2328.Vehicle <strong>Loan</strong>s APR Additional Information Estimated Monthly Payment Examples<strong>New</strong> <strong>Auto</strong> (2013 & newer) 2.09% - 18% <strong>Auto</strong> rates advertised include$319.37 a month based on a 5 year, $18,000 loan at 2.49% APR0.15% rate reduction for loanUsed <strong>Auto</strong> (2012 & older) 2.59% - 18% amounts $30,000 or more. $323.36 a month based on a 5 year, $18,000 loan at 2.99% APRMotorcycle 4.74% - 18% $187.52 a month based on a 5 year, $10,000 loan at 4.74% APRSports Vehicle 5.24% - 18% $189.81 a month based on a 5 year, $10,000 loan at 5.24% APRBoat 4.24% - 18% $307.17 a month based on a 10 year, $30,000 loan at 4.24% APRRV 3.99% - 18%$303.59 a month based on a 10 year, $30,000 loan at 3.99% APRCredit CardAPRVisa 6.90% - 17.90% $25 rewards annual participation fee applies with optional <strong>BECU</strong> Rewards ProgramFor important information, see page 2 disclosures about “Credit Card Interest Rates and Interest Charges” and “Credit Card Fees.”Personal <strong>Loan</strong>s APR Estimated Monthly Payment ExamplesPersonal Line of Credit 8.90% - 17.90%Personal <strong>Loan</strong> 8.74% - 18% $247.62 a month based on a 4 year, $10,000 loan at 8.74% APRShare Secured – Variable Total of pledged savings account dividend rate plus 3% margin $221.79 a month based on a 4 year, $10,000 loan at 3.10% APRCD Secured Total of pledged CD account interest rate plus 2% margin $179.24 a month based on a 5 year, $10,000 loan at 2.90% APRFor important information, see page 2 disclosures about “Personal Line of Credit – Rates.”Home Equity & Home Improvement <strong>Loan</strong>s APR Estimated Monthly Payment ExamplesHome Equity Line of Credit – Variable 3.74% - 8.24%Fixed Rate Advance 4.49% - 9.49%Home Equity <strong>Loan</strong> 3.74% - 9.24% *$457.49 a month based on a 5-year, $25,000, 70% CLTV loan at 3.74% APRHome Improvement <strong>Loan</strong> (not secured by property) 8.49% - 18% $410.23 a month based on a 5-year, $20,000 loan at 8.49% APR*Home Equity <strong>Loan</strong> payment example does not include amounts for property taxes or insurance premiums.Mortgage <strong>Loan</strong>s<strong>BECU</strong> offers a variety of fixed and adjustable rate mortgage products. For more information on mortgage products visit www.becuhomeloans.org. To be connected with <strong>BECU</strong>’smortgage department, please call 206-439-5772.Important Terms & Conditions<strong>BECU</strong> membership required. Rates are based on an evaluation of credit history and other factors specific to your loan (such as loan term, age of collateral, occupancy ofcollateral property, combined loan-to-value, lien status, loan amount, as applicable) and may be higher than the lowest rates advertised. Your final APR may differ from yourloan interest rate due to additional fees that may apply.<strong>Auto</strong> <strong>Loan</strong>: Lowest rates advertised are based on an established member’s loanwith a term of 48 months or less and LTV of 90% or less. Rates are higher for LTVover 90% or terms greater than 48 months. <strong>Loan</strong> amounts $30,000 or more include a0.15% rate reduction. Collateral not to exceed 150,000 in mileage, LTV is based onKelly Blue Book wholesale or dealer invoice, terms up to 84 months.Boat: Available terms and loan amounts based on creditworthiness. Maximumterms up to 240 months and down payments vary 20% - 30% depending on loanamount.RV: Available terms and loan amounts based on creditworthiness. Maximum termsup to 240 months depending on loan amount and higher loan amounts and longerterms require 10% - 20% down payment. LTV based on NADA Retail or MSRP. GasRVs not to exceed 75,000 miles; no mileage restrictions on diesel.Home Equity and Home Improvement <strong>Loan</strong>sMotorcycle/Sports: Minimum down payment 10%; loan amounts up to $25,000;terms up to 72 months. <strong>New</strong> motorcycle LTV based on Kelly Blue Book retail or MSRP.<strong>New</strong> sports vehicle LTV based on Kelly Blue Book retail or dealer invoice. Usedmotorcycle and sports vehicle LTV based on Kelly Blue Book retail.Share Secured <strong>Loan</strong> - Variable: After account opening, APR may vary basedon changes in the dividend/interest rate on your <strong>BECU</strong> shares declared by the <strong>BECU</strong>Board of Directors for your specifically pledged account. <strong>Loan</strong> amounts up to $10,000,term up to 48 months.Personal <strong>Loan</strong>: <strong>Loan</strong> amounts up to $15,000, terms up to 72 months.CD Secured: <strong>Loan</strong> amounts up to balance of CD, term up to maturity date of CD.Home Equity Lines of Credit and <strong>Loan</strong>s: Owner occupied property must be located in one of the following states: Washington,Oregon, California, Arizona, Kansas, Missouri, Illinois, and Pennsylvania. You may have to pay certain third parties closing costs that rangebetween $0 to $2,756, depending on the location of the property, the amount of the loan and other factors. Additional state or local mortgagefees or taxes may apply. Property insurance and, if applicable, flood insurance required. Non-owner occupied property must be located in theState of Washington. Home Equity Lines of Credit: APRs do not include costs and rate may vary monthly (maximum 18% APR). During thecredit advance draw period, payments equal monthly payments of interest, subject to lesser of $100 or your balance and principal is not reduced.At the end of the draw period, your monthly payment will increase equal to the principal and interest amount necessary to pay the loan balanceover the remainder of the loan term. Home Equity Line of Credit Account Fixed Rate Advances provide for up to 15 years of monthly principaland interest payments, depending on the amount advanced. Fixed Rate Advances are subaccounts of a Home Equity Line of Credit (HELOC).Home Improvement<strong>Loan</strong> (not secured byproperty): This HomeImprovement loan is notsecured by property and mustbe used in part to modify adwelling. <strong>Loan</strong> amounts up to$25,000, terms up to 84months.RATES AND TERMS IN EFFECT AS OF FEBRUARY 6, 2015AND ARE SUBJECT TO CHANGE WITHOUT NOTICE.463 02/06/2015 P a g e | 1

<strong>BECU</strong> L E N D I N G R A T E SA N D R E L A T E D D I S C L O S U R E S(CREDIT AND SECURITY AGREEMENT ADDENDUM)Credit Cards Effective February 6, 2015Interest Rates and Interest ChargesAnnual Percentage0.00% Introductory APR for six (6) months from date of account opening.*Rate (APR) for PurchasesAfter that, your APR will be 6.90% to 17.90%, based on yourcreditworthiness. This APR will vary with the market based on the Prime Rate.APR for BalanceTransfers* Introductory APR is not available for <strong>BECU</strong> Student or Secured Cards.0.00% Introductory APR for six (6) months from date of transfer when transfers arecompleted within 90 days of account opening.*After that, 6.90% to 17.90%, based on your creditworthiness. This APR will vary withthe market based on the Prime Rate.APR for Cash AdvancesHow to Avoid PayingInterest on PurchasesFor Credit Card Tips fromthe Consumer FinancialProtection BureauFeesAnnual FeeTransaction FeesCash AdvanceForeign TransactionPenalty FeesLate PaymentReturned Payment* Introductory APR is not available for <strong>BECU</strong> Student or Secured Cards.6.90% to 17.90%, based on your creditworthiness.This APR will vary with the market based on the Prime Rate.Your due date is at least 23 days after the close of each billing cycle. We will not charge youinterest on purchases if you pay your entire balance by the due date each month.To learn more about factors to consider when applying for or using a credit card, visit thewebsite of the Consumer Financial Protection Bureau athttp://www.consumerfinance.gov/learnmore.None2% of the amount of cash advance, not to exceed $10.1% of the US dollar amount of the foreign transaction.Up to $25 for each payment that is 1 or more days late.Up to $25How We Will Calculate Your Balance: We use a method called "average daily balance ( including new purchases)." See yourAgreement for more details.How We Will Calculate Your Rate: After any applicable introductory rate period ends, we will establish a margin of 3.65% to14.65% based on your creditworthiness, and add this margin to the Prime Rate to determine your APR. Your APR and margin willbe stated in a Credit Voucher provided to you if you open a credit card account under your Credit and Security Agreement.Other Important Credit Card Terms and Conditions: All terms, including fees and the APRs for new transactions, may change afteraccount opening in accordance with the Credit and Security Agreement and applicable law. $25 rewards annual participationfee applies with optional <strong>BECU</strong> Rewards Program. Go to www.becurewards.com to see important details about the <strong>BECU</strong> Rewards Program.Personal Lines of Credit – Rates and FeesAPRPenalty APR and WhenIt AppliesPenalty FeesLate Payment Fee8.9%, 10.9%, 13.9%, 15.9% or 17.90% based on your creditworthiness when you open your account.Up to 19.9%This APR may be applied to your account if you fail twice within any 12 month period to make thescheduled payment within 29 days of due date or if your Account is considered in default.How long will ithe Penalty APR apply? If your APR is increased for any of these reasons, thePenalty APR will apply until you make 12 consecutive minimum payments are due.For each payment that is 10 or more calendar days late, either $25 or 5% of the minimum paymentamount, whichever is greater.$25Returned Payment FeeOther Important Personal Line of Credit Terms and Conditions: All terms, including fees and the APRs for new transactions, may changeafter account opening in accordance with the Agreement and applicable law.RATES AND TERMS IN EFFECT AS OF FEBRUARY 6, 2015 AND ARE SUBJECT TO CHANGE WITHOUT NOTICE.463 02/06/2015 P a g e | 2