Chibro Petition - UJVN Limited Dehradun...

Chibro Petition - UJVN Limited Dehradun...

Chibro Petition - UJVN Limited Dehradun...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

A. Specific Legal Provisions under which the <strong>Petition</strong> is being filed1) <strong>UJVN</strong> Ltd. under Section 62 and 86 of the Electricity Act, 2003 read witha. Regulation 4(1) of the Uttarakhand Electricity Regulatory Commission (Termsand Conditions for Determination of Hydro Generation Tariff) Regulations,2004, &b. Regulation 11(1) of the Uttarakhand Electricity Regulatory Commission(Terms and Conditions for Determination of Tariff) Regulations, 2011,is filing this Tariff <strong>Petition</strong> before the Hon’ble Commission for approval ofprovisional Tariffs for the financial years from 2013-14 to 2015-16 and true up forthe financial years from 2008-09 to 2010-11.B. Limitation2) In terms of Section 56(4) (Chapter VI) of Uttarakhand Electricity RegulatoryCommission Conduct of Business Regulation 2004, an application for tariffdetermination by every licensee shall be filed before the Hon’ble UttarakhandElectricity Regulatory Commission on or before 30 th November every year.3) The present petition for Tariff Determination is within the period mentionedin Para (2) above hence not barred by Limitation.C. Facts of the case4) The <strong>Petition</strong>er, <strong>UJVN</strong> Ltd. , is a company incorporated under the provisions ofthe Companies Act, 1956, having its registered office at UJJWAL, MaharaniBagh, GMS Road, <strong>Dehradun</strong>;5) It is submitted that Government of Uttaranchal (GoU) vide order datedNovember 5, 2001 (Copy of the order placed at Annexure I enclosed)transferred all hydropower assets of Uttar Pradesh Jal Vidyut Nigam <strong>Limited</strong>(UPJVNL) located in the State of Uttarakhand to <strong>UJVN</strong>L with effect fromNovember 09, 2001. In compliance to the said order, administrative andfinancial control of all hydro power plants of UPJVNL in operation or underconstruction was taken over by <strong>UJVN</strong>L with effect from November 09, 2001.GOU order also defines the basis of division of assets and liabilities betweenUPJVNL and <strong>UJVN</strong>L and is self-explanatory;

6) Though administrative and financial control was transferred to <strong>UJVN</strong>L onNovember 09, 2001, <strong>UJVN</strong>L initiated discussions with UPJVNL for formulationof transfer scheme as per the said GOU order on mutually agreed terms.7) Government of Uttrakhand (GoU) has notified the provisional transfer schemevide its notification no. 70/AS (E)/I/2008-04 (3)/22/08 dated 07/03/08. Thecopy of the said notification is placed at Annexure –II.8) The Hon’ble Uttarakhand Electricity Regulatory Commission issued thefollowing tariff regulations for hydro generating stations in the State ofUttarakhand, applicable for plants of capacity more than 25 MW.a) Uttarakhand Electricity Regulatory Commission (Terms and Conditionsfor Determination of Hydro Generation Tariff) Regulations, 2004(hereinafter referred to as the “Tariff Regulations 2004”) issued on 14thMay 2004. In accordance to the notification dated November 29, 2011,the Tariff Regulations 2004 are valid up to the date April 30, 2012.b) Uttarakhand Electricity Regulatory Commission (Terms and Conditionsfor Determination of Tariff) Regulations, 2011 (hereinafter referred toas the “Tariff Regulations 2011”) issued on 19 th December 2011. Theseregulations are applicable from April 1, 2013 onwards.9) As per Provision 4(1) of the Tariff Regulations 2004, <strong>UJVN</strong>L is required toobtain approval for its tariff from the Hon’ble Commission based on provisionsof the Tariff Regulations.10) As per Provision 11(1) of Tariff Regulations 2011 - The applicant shall submitunder affidavit and as per the UERC (Conduct of Business) Regulations, 2004,the forecast of Aggregate Revenue Requirement and expected revenue fromtariff for each year of the Control Period.11) Based on the provisions of the Section 4(1) of the Tariff Regulations 2004 andprovisions of Section 11(2) and 11(3) of the Tariff Regulations 2011, the<strong>Petition</strong>er is filing this <strong>Petition</strong> fora) True Up from FY 2008-09 to FY 2010-11.b) Determination of Generation Tariff from FY 2013-14 to FY 2015-16.12) It is submitted that in development of these petitions, <strong>UJVN</strong>L has been guidedby principles that are inherent in the Tariff Orders of the Commission dated12/07/06, 14/03/07, 18/03/08, 21/10/09, 05/04/10, 10/05/11 and04/04/2012 to the extent the same are acceptable to the <strong>Petition</strong>er.

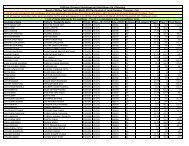

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16TABLE OF CONTENTSCHAPTER DESCRIPTION PAGEChapter 1. Truing Up of FY 2008-09, FY 2009-10 and FY 2010-11 _______________ 11.1 Capital Cost _________________________________________________ 11.2 Additional Capitalisation ______________________________________ 21.3 Debt Equity Ratio ____________________________________________ 41.4 Return on Equity _____________________________________________ 41.5 Depreciation ________________________________________________ 51.6 Interest on loan capital ________________________________________ 71.7 O&M Expenses ______________________________________________ 81.8 Interest on Working Capital ___________________________________ 131.9 Non Tariff Income __________________________________________ 141.10 Total Fixed Charges _________________________________________ 141.11 Normative Capacity Index ____________________________________ 151.12 Design Energy ______________________________________________ 151.13 Average Tariff for Truing Up __________________________________ 16Chapter 2. Tariff Determination for FY 2013-14, FY 2014-15 and FY 2015-16 _____ 172.1 Additional Capitalisation _____________________________________ 172.2 Return on Equity ____________________________________________ 172.3 Depreciation _______________________________________________ 192.4 Interest on Loan Capital ______________________________________ 222.5 O&M Expenses _____________________________________________ 232.6 Interest on Working Capital ___________________________________ 242.7 Total Fixed Charges _________________________________________ 252.8 Design Energy and NAPAF ___________________________________ 25I

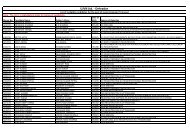

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY162.9 Capacity Charges and Energy Charge Rate: _______________________ 26Chapter 3. Status of Directives in Tariff Order Dated 4 April 2012 _____________ 273.1 Action Taken by <strong>UJVN</strong>L on the Directives _______________________ 27Chapter 4. Relief Sought_______________________________________________ 304.1 Relief Sought ______________________________________________ 304.2 Particulars of Fee Remitted ____________________________________ 31LIST OF TABLESTABLE DESCRIPTION PAGEcTable 1: Opening GFA as on January 2000 (Rs. Crore) ........................................ 1Table 2: Additional Capitalisation as per Tariff Order dated May 10, 2011 (Rs.Crore)..................................................................................................................... 2Table 3: Components of Additional Capitalisation Till FY 2007-08 (Rs. Crore) ..... 2Table 4: Additional Capitalisation Components for True Up Years (Rs. in Crores) 3Table 5: Return on Equity for True Up Years (Rs. Crores) ..................................... 5Table 6: Rates of Depreciation (Tariff Regulations 2004) ..................................... 6Table 7: Depreciation for FYs 2008-09 on Additional Capitalisation (Rs. Crore) .. 6Table 8: Depreciation for FY 2009-10 on Additional Capitalisation (Rs. Crore) .... 6Table 9: Depreciation for FY 2010-11 on Additional Capitalisation (Rs. Crore) .... 7Table 10: Weighted Average Rate of Interest for MB-II HEP ................................ 8Table 11: Interest on Loan Capital for Truing Up (Rs. Crore) ................................ 8Table 12: O&M Expenses for True Up Years (Rs. Crore) ..................................... 10Table 13: Total O&M Expenses for <strong>Chibro</strong> Power Project (Rs. Crore) ................. 13Table 14: Interest on Working Capital for Truing Up (Rs. Crore) ........................ 14Table 15: Annual Fixed Charges (Rs. Crore) ........................................................ 14Table 16: Design Energy and Net Primary Energy .............................................. 15Table 17: Proposed Average Tariff (Rs./kWh) ..................................................... 16Table 18: Calculation of RoE for FY 2013-14 to 2015-16 (Rs. Crores) ................. 19Table 19: Rates of Depreciation as per Tariff Regulations 2011 ........................ 20Table 20: Depreciation in FY 2012-13 ................................................................. 20Table 21: Calculation of Actual Depreciation Recovered Till FY 2012-13 ........... 21Table 22: Proposed Depreciation % for FY 2013-14 to FY 2015-16 .................... 21Table 23: Proposed Depreciation (Rs. Cr.) for FY 2013-14 to FY 2015-16 ........... 22II

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16Table 24: Interest on Loan for FY 2013-14, 2014-15 and 2015-16 (Rs. Cr.) ........ 23Table 25: Proposed O&M Expenses for FY 2013-14 to 2015-16 ......................... 24Table 26: Proposed Interest on Working Capital for FY 2013-14 to 2015-16 ..... 25Table 27: Proposed Fixed Charges for FY 2013-14 to 2015-16 ........................... 25Table 28: Capacity Charges for FY 2013-14, 2014-15 and 2015-16 (Rs. Cr.) ...... 26Table 29: Energy Charge Rate (Rs./kWh) ............................................................ 26LIST OF ANNEXURESAnnexure 1: GoU order dated November 5, 2001 regarding transfer of allhydropower assets from UPJVNLAnnexure 2: Government of Uttrakhand (GoU) notified provisional transferscheme (notification no. 70/AS (E)/I/2008-04 (3)/22/08 dated 07/03/08)Annexure 3: Annual Audited Accounts for FY 2008-09Annexure 4: Annual Audited Accounts for FY 2009-10Annexure 5: Annual Audited Accounts for FY 2010-11Annexure 6: Allocation of capital expenditure for the FY 2008-09 to 2011-12Annexure 7: UPCL vide letter no. 2185/<strong>UJVN</strong>L/MD/UERC dated May 18, 2012Annexure 8: Colony Consumption for FY 2008-09, 2009-10 and 2010-11Annexure 9: Separation of Insurance PoliciesIII

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16Chapter 1. Truing Up of FY 2008-09, FY 2009-10 and FY 2010-111.1 Capital Cost1.1.1 <strong>Petition</strong>er has already informed along with detailed explanation to theHon’ble Commission in the previous tariff petitions for various financial years(from FY 2007 to FY 2013) that there has been limited transfer of historicaldata from UPJVNL to <strong>UJVN</strong>L. Despite the <strong>Petition</strong>er’s repeated follow-up,complete technical details are yet to be received. Certain essential documentssuch as the Detailed Project Reports, CEA clearances or Project CompletionReports have also not been provided. <strong>UJVN</strong>L is therefore not in a position toprovide details regarding the break-up of original cost of fixed assets andthose approved by a competent authority on COD.1.1.2 Transfer Scheme between UPJVNL & <strong>UJVN</strong>L is still not finalized. This matterhas also been appraised to GoU from time to time. GoU had notified the valueof GFA for the purpose of RoE provisionally by notification dated 7/03/08.Further, the Hon’ble Commission has considered the amount of Rs. 2.21 Crorefor additional capitalization on the date of commissioning of MB-I HEP. Thevalue of the Gross Fixed Assets (GFA) for nine large hydro projects (LHPs),notified by the GoU and considered by the Hon’ble Commission in its TariffOrder dated April 4, 2012 is tabulated below:Table 1: Opening GFA as on January 2000 (Rs. Crore)PlantAmountDhakrani 12.40Dhalipur 20.37<strong>Chibro</strong> 87.89Khodri 73.97Kulhal 17.51Ramganga 50.02Chilla 124.89Maneri Bhali-I 111.93Khatima 7.19Total 506.17<strong>Chibro</strong> HEP November 2012 Page 1

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY161.1.3 It is respectfully submitted that in view of the facts stated above the value ofopening GFA of Rs. 506.17 Crores determined by the Hon’ble Commission for9 LHPs which are transferred to <strong>UJVN</strong>L by UPJVNL may also be considered forthe purpose of this Tariff Order, pending finalisation and notification of theTransfer Scheme.1.1.4 Accordingly, the value of opening GFA, as on January 2000, transferred to<strong>UJVN</strong>L for <strong>Chibro</strong> Power House amounting to Rs. 87.89 Crores may beconsidered by Hon’ble Commission pending finalisation and notification of theTransfer Scheme.1.2 Additional Capitalisation1.2.1 Hon’ble Commission, during Truing Up exercise, in its Tariff Order dated May10, 2011 has already approved Additional Capitalisation for <strong>Chibro</strong> HEP till FY2007-08 based on audited annual accounts. The approved figures are asunder:Table 2: Additional Capitalisation as per Tariff Order dated May 10, 2011 (Rs. Crore)1.2.2 The <strong>Petition</strong>er, as per observations of the Hon’ble Commission, is maintainingproper asset books of various components of Additional Capitalisation. Thebreakup of components of Additional Capitalisation presented in the abovetable is as under:Table 3: Components of Additional Capitalisation Till FY 2007-08 (Rs. Crore)<strong>Chibro</strong> HEP November 2012 Page 2

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY161.2.3 It is now respectfully submitted that the item-wise addition in GFA of <strong>Chibro</strong>Power House from FY 2008-09 to FY 2010-11 on audited accounts basis andfor FY 2011-12 on provisional accounts basis is as follows:Table 4: Additional Capitalisation Components for True Up Years (Rs. in Crores)1.2.4 The status of Annual Accounts of <strong>Petition</strong>er from FY 2008-09 to FY 2010-11 isas follows:-1.2.4.1 FY 2008-09: The Audited Accounts for the FY 2008-09 is placed at Annexure- 3 for ready reference.1.2.4.2 FY 2009-10: The Audited Accounts for the FY 2009-10 is placed at Annexure– 4 for ready reference.1.2.4.3 FY 2010-11: The Audited Accounts for the FY 2010-11 is placed at Annexure- 5. for ready reference.1.2.5 It is further respectfully submitted that the accounts are maintained centrallyfor the various HEPs. In certain instances one - to - one correlation of theaccounting divisions is possible with individual stations. However, for others,some form of apportionment is necessary for allocating certain expenses thatare incurred by accounting units that serves more than one station.1.2.6 In view of the above, the additional capital expenses incurred by suchaccounting divisions serving more than one station have been allocated as perthe procedure followed in earlier filings and considered by the Hon’bleCommission detailed below:-<strong>Chibro</strong> HEP November 2012 Page 3

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY161.2.6.1 Head Office/ Corporate Office: 80% of the additional capital expenses havebeen apportioned on 9 LHPs which further have been allocated to each LHPon the basis of the installed capacity.1.2.6.2 General Manager Office/ DGM/ Civil Division: allocated on LHPs within thecontrol of the concerned GM/ DGM which further has been allocated toeach LHP on the basis of the installed capacity.1.2.6.3 The detailed working of such allocation of capital expenditure for the FY2008-09 to 2010-11 is placed at Annexure-6 enclosed.1.2.7 It is respectfully submitted that in order to ensure efficiency and safety as wellas ensuring continuous operation of the plants the additional capitalizationwas required to be incurred which may kindly be considered and allowed bythe Hon’ble commission. Kind attention is invited to Regulation 16 (2) of theTariff Regulations 2004 explicitly permit additional works/service, which maybecome necessary for efficient and successful operation of the plant.1.2.8 The <strong>Petition</strong>er respectfully prays that the additional capital expenditureincurred/ accrued as detailed above may kindly be approved.1.3 Debt Equity Ratio1.3.1 In accordance with the Regulation 18 of Tariff Regulations 2004, normativedebt-equity ratio of 70:30 has been considered for True-up of FY-2009, FY-2010 and FY-2011. This normative debt-equity ratio has been considered onGFA as on January 2000 and additional capitalisation incurred till respectivefinancial year.1.4 Return on Equity1.4.1 As explained in Section 1.3, Return on Equity has been computed on anormative equity of 30% on capital base and additional capitalisation.1.4.2 In accordance with Opening GFA of Rs. 87.89 crores as on January 2000,equity amount has been calculated Rs. 26.367 Crores as in FY 2000. Further,after taking into account normative equity percentage of 30% on additional<strong>Chibro</strong> HEP November 2012 Page 4

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16capitalisation as approved by the Hon’ble Commission till 2007-08, theopening equity for FY 2008-09 is calculated as Rs. 27.65 Crores. Based on theAdditional Capitalisation occurred from 2008-09 onwards as explained in thesection 1.2 the equity base is increasing at a rate of 30% of additionalcapitalisation in each year from FY 2008-09 onwards. In accordance with TariffRegulations 2004, 14% Return on Equity has been adopted for <strong>Chibro</strong> HEP. Theresultant returns are as follows:Table 5: Return on Equity for True Up Years (Rs. Crores)1.4.3 It is respectfully prayed that the Return on Equity proposed in accordancewith above table as Rs. 3.91 Crore, Rs. 3.97 Crore and Rs. 4.01 Crore for the FY2008-09, FY 2009-10 and FY 2010-11 respectively may kindly be consideredand allowed by the Hon’ble Commission.1.5 Depreciation1.5.1 The accumulated depreciation in the end of FY 2007-08 on opening capitalcost of Rs. 87.89 Crores is Rs. 79.10 Crores.1.5.1 In the Tariff Order dated April 4, 2012, Hon’ble Commission instructed the<strong>Petition</strong>er to claim the depreciation on additional capitalisation from the nextTariff filing in accordance with the rates specified under the Regulations fordifferent class of assets instead of claiming it at 2.66%.1.5.2 It is submitted that the depreciation on Additional Capitalisation from FY2001-02 onwards has been computed based on the rates specified under theTariff Regulations 2004 and 2011 as applicable for relevant year.1.5.3 In the previous Tariff Orders methodology of calculation of depreciation wasbased on only opening balance of additional capitalisation of financial year for<strong>Chibro</strong> HEP November 2012 Page 5

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16which depreciation is being calculated. However, this methodology does notconsider the depreciation of asset and usage of such asset for a particularperiod of the financial year in which asset is commissioned. Hence, <strong>Petition</strong>eris proposing to calculate depreciation based on the average of opening andclosing balance of Additional Capitalisation of Asset.1.5.4 The following rates have been considered for the purpose of calculatingdepreciation:1.5.4.1 On Opening GFA – No Depreciation is claimed since 90% depreciation hasalready been recovered.1.5.4.2 On Additional Capitalisation from FY 2001-02 to FY 2011-12 onwards: Ratesof depreciation are as underTable 6: Rates of Depreciation (Tariff Regulations 2004)Table 7: Depreciation for FYs 2008-09 on Additional Capitalisation (Rs. Crore)Table 8: Depreciation for FY 2009-10 on Additional Capitalisation (Rs. Crore)<strong>Chibro</strong> HEP November 2012 Page 6

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16Table 9: Depreciation for FY 2010-11 on Additional Capitalisation (Rs. Crore)1.5.5 It is respectfully prayed that the depreciation proposed in accordance withabove tables as Rs. 0.30 Crore, Rs. 0.36 Crore and Rs. 0.41 Crore for the FY2008-09, FY 2009-10 and FY 2010-11 respectively may kindly be consideredand allowed by the Hon’ble Commission.1.6 Interest on loan capital1.6.1 It is submitted that in terms of the directives of the Hon’ble Commission,interest on normative debt has been considered on the value equivalent to70% of additional capitalisation only.1.6.2 As far as actual loans on operating hydro power projects are concerned, actualloan data is available for MB-II HEP. Hence, <strong>Petition</strong>er claims that weighted<strong>Chibro</strong> HEP November 2012 Page 7

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16average rate of interest and finance charges of MB-II hydro electric projectshould also be considered for interest rates on normative loan for other largehydro projects.1.6.3 The details of loans for MB-II hydro power project is attached as Annexure-7Summary of principal amount due and actual interest and finance chargespaid during respective financial years is given as under:Table 10: Weighted Average Rate of Interest for MB-II HEP1.6.4 Accordingly, the interest on normative debt has been calculated as under:-:Table 11: Interest on Loan Capital for Truing Up (Rs. Crore)1.6.5 It is respectfully prayed that the Interest on Loan proposed in accordance withabove table as Rs. 0.48 Crore, Rs. 0.57 Crore and Rs. 0.69 Crore for the FY2008-09, FY 2009-10 and FY 2010-11 respectively may kindly be consideredand allowed by the Hon’ble Commission.1.7 O&M Expenses1.7.1 It is respectfully submitted that O & M expenses for the FY 2008-09, FY 2009-10 and FY 2010-11 have been considered as per the audited accounts.1.7.2 The components of total O&M expenses have been bifurcated into direct andindirect expenses. Direct expenses have been allotted to respective hydro<strong>Chibro</strong> HEP November 2012 Page 8

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16power project for which corresponding expenses being incurred. Indirectexpenses i.e. corporate office, other common expenses have been divided inthe ratio of 80:10:10 to 9 LHPs, MB-II HEP and Small Hydro Projects includingproject under construction respectively. The 80% of total indirect expenseshave further been divided into 9 LHPs based on their installed capacity in MW.1.7.3 Hon’ble Commission vide Tariff Order dated October 21, 2009, directed the<strong>Petition</strong>er to submit the probable alternatives for rationally allocating thecommon/indirect expenses. Further, in the Tariff Order dated May 10, 2011,Hon’ble Commission instructed the <strong>Petition</strong>er to examine the practices beingfollowed in similar utilities in other States as well as Central Sector utilities likeNTPC, NHPC, etc. In this regard it is respectfully submitted that1.7.3.1 The <strong>Petition</strong>er has sincerely made efforts to fulfil the Hon’ble Commission’sinstructions. As already informed to the Hon’ble Commission, <strong>Petition</strong>erhad requested NHPC and SJVNL to communicate the practice followed byNHPC/SJVNL of allocating indirect expenses at various power stations. Thecopies of the correspondence have already been provided to the Hon’bleCommission as mentioned in the Tariff Order dated April 4, 2012.However, it is further submitted that getting such information from otherutilities is beyond the control of the <strong>Petition</strong>er.1.7.3.2 Since there was no response received from the concerned utilities,<strong>Petition</strong>er tried to enquire if any such information is available in publicdomain. No such information was found available in the public domain also.1.7.3.3 However, during <strong>Petition</strong>er’s research and analysis and based ondiscussions with various power sector experts, it was found that there arethree methods which have been widely adopted and recognised acrossgeneration companies in India to allocation common expenses. Thesemethods are as underAllocation based on actual revenues of power projectsAllocation based on installed capacity of power projectsAllocation based on power generation in Million Units (MUs)<strong>Chibro</strong> HEP November 2012 Page 9

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY161.7.3.4 However, the above information is merely on the basis of primary researchand without any documentary evidences. Hence, may not be firmlyestablished in the present Tariff <strong>Petition</strong>.1.7.3.5 It is respectfully prayed that Hon’ble Commission may consider themethodology as adopted by the <strong>Petition</strong>er based on the following facts:There is only one major beneficiary from all the Projects of the <strong>Petition</strong>er.Since, this is a truing up exercise, whatever methodology is adopted forallocating indirect expenses, the total indirect expenses of <strong>UJVN</strong>L to berecovered from the beneficiary would not vary. Hence, there may be aprojectwise variation in the recovery of indirect expenses, however, interms of total indirect expenses recovery, neither <strong>UJVN</strong>L will be benefitednor beneficiary would have disadvantage.The share of indirect expenses is less than 10% of total O&M expenses,hence, any methodology may be adopted and the variation of allocatedexpenses among all methodologies would be negligible.1.7.4 In accordance with Hon’ble Commission’s directions in the earlier Tariff Orderissued in May 2011, impact of arrear of VIth pay commission has beenconsidered on cash basis. The O&M expenses for F.Y 2008-09, 2009-10 and2010-11 have been computed as under:-Table 12: O&M Expenses for True Up Years (Rs. Crore)<strong>Chibro</strong> HEP November 2012 Page 10

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY161.7.5 In the previous Tariff Order issued in April 2012, Hon’ble Commission did nottake up True Up exercise and stated:1.7.5.1 “The Hon’ble Commission has decided to appoint an Expert Consultant toexamine the R&M expenses incurred during FY 2008-09 and FY 2009-10 andbased on its report, the Commission will carry out the truing up for theseyears in the next Tariff proceedings.”1.7.6 It is also respectfully submitted that –1.7.6.1 The Commission in the Tariff Order dated October 21, 2009 had directedthe <strong>Petition</strong>er as under:“the Commission directs <strong>UJVN</strong>L to carry out an independent audit of all theR&M expenses for the period from FY 2001-02 onwards and submit a reportwithin six months from the date of this Order. The Commission furtherdirects <strong>UJVN</strong>L to have accounting of R&M expenses station-wise so thattruing up of R&M expenses may be done on the basis of audit report onactual R&M expenses of revenue nature for each station.”1.7.6.2 In this regard, <strong>Petition</strong>er had submitted that in accordance to the abovedirective of the Commission it has appointed M/s. Mohit Goyal & Company,Chartered Accountants through a tender process to conduct independentaudit for R&M expenses for the period from FY 2001-02 onwards and theFirm has already completed its work. Further, the <strong>Petition</strong>er submitted thatthough the work has been completed, the report is yet to be finalized.1.7.6.3 The Hon’ble Commission, in its Tariff Order dated May 10, 2011, directedthe <strong>Petition</strong>er to submit the audit report of R&M expenses before it withinone month of the date of issuance of the said Order. The <strong>Petition</strong>er, incompliance of the Commission’s directions, submitted the report to theCommission.1.7.6.4 The report, so submitted was voluminous and, hence, the Commissiondirected the <strong>Petition</strong>er to summarise the complete details for each station,clearly, showing the individual and total amount of expenses booked foreach stations for each year.<strong>Chibro</strong> HEP November 2012 Page 11

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY161.7.6.5 The <strong>Petition</strong>er vide its reply dated March 14, 2012 submitted the summarysheet. Further, the Hon’ble Commission directed asked the <strong>Petition</strong>er tosubmit the details of repairs and maintenance expenses as claimed by the<strong>Petition</strong>er for FY 2008-09 and FY 2009-10. The <strong>Petition</strong>er in its reply datedFebruary 17, 2012 submitted the details for some of the plants, as readilyavailable with the <strong>Petition</strong>er.1.7.6.6 Hon’ble Commission further asked the <strong>Petition</strong>er to submit the necessaryjustification for considering expenses of capital nature as revenueexpenditure under R&M expenses. The same was submitted by the<strong>Petition</strong>er in its reply dated March 14, 2012.1.7.7 Presently, as per current status, the independent consultant has beenappointed by the Hon’ble Commission and process of examination of R&M hasbeen started. We have been submitting the required details in accordancewith the requirement of independent consultant time to time.1.7.8 In this regard, <strong>Petition</strong>er again requests the Hon’ble Commission to considerthe O&M expenses in accordance with the Audited Accounts, which iscommon practice adopted by all Regulatory Commissions.1.7.9 Cost of concessional supplies to past and present employees residing in areasoutside the plant colonies:1.7.9.1 It is respectfully submitted that some departmental past and presentemployees of <strong>UJVN</strong>L are staying outside the colonies also. The cost ofconcessional power supply to such employee is determined by the Hon’bleCommission on the basis of the prevalent demand tariff rate undercategory RTS-1 added with duty to state govt. and fixed charges of Rs.20/connection/month.1.7.9.2 For the purpose of True Up of four years from FY 2008-09 to FY 2010-11,<strong>Petition</strong>er has considered the same amount which was approved by theHon’ble Commission in the Tariff Order of respective financial year.<strong>Chibro</strong> HEP November 2012 Page 12

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY161.7.10 The total O&M expenses after including all components as discussed aboveare tabulated as under:Table 13: Total O&M Expenses for <strong>Chibro</strong> Power Project (Rs. Crore)Components/FY 2008-09 2009-10 2010-11Net Expenses 21.908 30.130 32.170Concession -Outside ColonyEmployees 0.086 0.091 0.100Total O&M Expenses 21.994 30.221 32.2701.7.11 It is respectfully prayed that the Operation and Maintenance Expensesproposed in accordance with above table as Rs. 21.994 Crore, Rs. 30.221 Croreand Rs. 32.270 Crore for the FY 2008-09, FY 2009-10 and FY 2010-11respectively may kindly be considered and allowed by the Hon’bleCommission.1.8 Interest on Working Capital1.8.1 In accordance with the norms established under Tariff Regulations 2004, thecomponents of working capital are as follows:O&M expense at one month of projected expenses;Maintenance spares @ 1% of project cost escalated @ 6% per annum fromthe date of commercial operation (in case of <strong>UJVN</strong>L‟s stations transferredfrom UPJVNL, historical cost shall be the cost as on the date of unbundling ofUPSEB to be escalated @ 6% p.a. thereafter); andReceivables at two months of revenue from sale of electricity.1.8.2 Hon’ble Commission, in the previous Tariff Orders dated October 21, 2009,May 10, 2011 and April 4, 2012, pursuant to the request of the <strong>Petition</strong>er,while estimating the interest on working capital, had considered the prevailingPLR, so as to effectively capture the existing market conditions. Accordingly, inthe present Tariff <strong>Petition</strong> also, the <strong>Petition</strong>er has considered prevailing SBI<strong>Chibro</strong> HEP November 2012 Page 13

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16PLR as on April 1 st of respective financial year. The details of working capitaland interest thereon for are given hereunder:Table 14: Interest on Working Capital for Truing Up (Rs. Crore)1.8.3 It is respectfully prayed that the Interest on Working Capital proposed inaccordance with above table as Rs. 0.81 Crore, Rs. 1.24 Crore and Rs. 1.27Crore for the FY 2008-09, FY 2009-10 and FY 2010-11 respectively may kindlybe considered and allowed by the Hon’ble Commission.1.9 Non Tariff Income1.9.1 The non-tariff income earned by the <strong>Petition</strong>er has been deducted from theAnnual Fixed Charges to arrive at net Annual Fixed Charges.1.10 Total Fixed Charges1.10.1 The gross and net Annual Fixed Charges for <strong>Chibro</strong> power plant for each of thetariff years is provided in the table below:Table 15: Annual Fixed Charges (Rs. Crore)<strong>Chibro</strong> HEP November 2012 Page 14

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY161.10.2 It is respectfully submitted that Annual Fixed Charges Rs. 25.83 Cr., Rs. 32.60Cr. and Rs. 36.00 Cr. for FY 2008-09, FY 2009-10 and FY 2010-11 respectively,may kindly be approved and allowed for energy sales to UPCL.1.11 Normative Capacity Index1.11.1 Based on the norms for storage hydro stations and run of the river stationswith pondage, the normative capacity index for the station is 85%. The samehas been adopted by the petitioner. Hence, no deviation is sought on thisaccount from the norms as determined by the Hon’ble Commission.1.12 Design Energy1.12.1 It is respectfully submitted that in the previous Tariff Orders, Commission haddetermined the Design Energy 671.29 MU for the project, excluding theauxiliary consumption and transformation losses, based on the averagegeneration of 15 years. Commission, in the said Tariff Orders has alsoemphasised to reassess the design energy. Now, <strong>Petition</strong>er has reassessed thedesign energy and details of methodology adopted along with calculationformats are provided in the Business Plan which is being submitted to Hon’bleCommission separately. In accordance with the said business plan, the designenergy and net primary energy is reproduced as under:Table 16: Design Energy and Net Primary Energy1.12.2 In accordance with above table the net primary energy 620.6 MU is proposedto be considered for the purpose of True Up, subject to the consideration ofthe same in the detailed business plan by the Hon’ble Commission.<strong>Chibro</strong> HEP November 2012 Page 15

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY161.13 Average Tariff for Truing Up1.13.1 The average tariff has been determined on the basis of net primary energy. Inaccordance with the Tariff Regulations 2004, any energy generated aboveprimary energy would be considered secondary energy.1.13.2 In accordance with Annual Fixed Charges explained in section 1.10 and netprimary energy explained above, the average tariff (Rs./kWh) for Truing Up isproposed as under:Table 17: Proposed Average Tariff (Rs./kWh)Components/FY 2008-09 2009-10 2010-11Billed Energy (MUs) 825.28 580.90 784.83Net Primary Energy (MU) 620.64 580.90 620.64Expenditure (Rs. Cr.) 25.83 32.60 36.00Average Tariff 0.416 0.561 0.5801.13.3 It is respectfully submitted that average tariff of Rs. 0.416 per kWh for FY2008-09, Rs. 0.561 per kWh for FY 2009-10 and Rs. 0.580 per kWh for FY 2010-11, may kindly be approved and allowed. The net impact of average tariff ascompared to average tariff charged on actual basis during True Up yearsshould be allowed to be recovered from the beneficiaries immediately in theFY 2012-13.<strong>Chibro</strong> HEP November 2012 Page 16

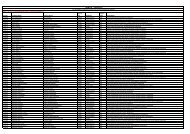

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16Chapter 2. Tariff Determination for FY 2013-14, FY 2014-15 and FY 2015-162.1 Additional Capitalisation2.1.1 It is respectfully submitted that Hon’ble Commission has accepted only theactual capital cost incurred / accrued in its earlier tariff orders. Hence noestimation for additional capitalisation has been claimed for the period fromFY 2013-14 to FY 205-16.2.2 Return on Equity2.2.1 For proposed tariff from FY 2013-14 to FY 2015-16, Section 27(2) of TariffRegulations 2011 have been considered for calculating RoE. Section 27(2) isreproduced as under:“Return on equity shall be computed on at the rate of 15.5% for GeneratingStations, Transmission Licensee and SLDC and at the rate of 16% for DistributionLicensee on a post-tax basis.”2.2.2 Also, in accordance with Regulation 35 of Tariff Regulations 2011-“Income Tax, if any, on the income stream of the regulated business ofGenerating Companies, Transmission Licensees, Distribution Licensees andSLDC shall be reimbursed to the Generating Companies, TransmissionLicensees, Distribution Licensees and SLDC as per actual income tax paid, basedon the documentary evidence submitted at the time of truing up of each yearof the Control Period, subject to the prudence check.”2.2.3 It is respectfully submitted that <strong>UJVN</strong>L pays income tax at corporate level andnot project level. Bifurcation of tax which is paid at company level intoprojects level may be a complicated process and cause dissatisfaction amongbeneficiaries.2.2.4 In this regard Regulation 15 of CERC (Terms and Conditions of TariffRegulations) Regulations 2009 may be considered. The relevant extracts ofCERC Tariff Regulation 2009 are reproduced as under:<strong>Chibro</strong> HEP November 2012 Page 17

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16Regulation 15(2) – Return on equity shall be computed on pre-tax basis at thebase rate of 15.5% to be grossed up as per clause (3) of this regulation:Regulation 15(3) - “The rate of return on equity shall be computed by grossingup the base rate with the normal tax rate for the year 2008-09 applicable to theconcerned generating company or the transmission licensee, as the case maybe:”“Provided that return on equity with respect to the actual tax rate applicable tothe generating company or the transmission licensee, as the case may be, inline with the provisions of the relevant Finance Acts of the respective yearduring the tariff period shall be trued up separately for each year of the tariffperiod along with the tariff petition filed for the next tariff period.”Regulation 15(4) – “Rate of return on equity shall be rounded off to threedecimal points and be computed as per the formula given below:Rate of pre-tax return on equity = Base rate / (1-t)Where t is the applicable tax rate in accordance with clause (3) of thisregulation.Illustration.-(i) In case of the generating company or the transmission licensee payingMinimum Alternate Tax (MAT) @ 11.33% including surcharge and cess:Rate of return on equity = 15.50/ (1-0.1133) = 17.481%(ii) In case of generating company or the transmission licensee paying normalcorporate tax @ 33.99% including surcharge and cess:Rate of return on equity = 15.50/ (1-0.3399) = 23.481%"2.2.5 Hence, it is requested to the Hon’ble Commission that for the purpose ofproposed tariff, total tax liability may be computed and provisionally approvedupfront, in the Tariff Order to be given against this Tariff <strong>Petition</strong>, based onpresent income tax rates. In case of variation of present tax rates with actual<strong>Chibro</strong> HEP November 2012 Page 18

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16tax rates, the same may be taken care at the time of Truing Up for relevantyear.2.2.6 In accordance with explanation given as above RoE has been calculated asunder:Table 18: Calculation of RoE for FY 2013-14 to 2015-16 (Rs. Crores)2.2.7 It is respectfully prayed that the Return on Equity proposed in accordancewith above table as Rs. 6.74 Crore, Rs. 6.74 Crore and Rs. 6.74 Crore for the FY2013-14, FY 2014-15 and FY 2015-16 respectively may kindly be consideredand allowed by the Hon’ble Commission.2.3 Depreciation2.3.1 Relevant provisions pertaining to depreciation under Regulation 29 of TariffRegulation 2011 are reproduced as under29(1) – “The value base for the purpose of depreciation shall be the capital costof the asset admitted by the Commission.”29(2) “The salvage value of the asset shall be considered as 10% anddepreciation shall be allowed up to maximum of 90% of the capital cost of theasset.”29(5) “Depreciation shall be calculated annually based on Straight Line Methodand at rates specified in Appendix - II to these Regulations.Provided that, the remaining depreciable value as on 31st March of the yearclosing after a period of 12 years from date of commercial operation shall bespread over the balance useful life of the assets.”29(6) In case of the existing projects, the balance depreciable value as on1.4.2013 shall be worked out by deducting the cumulative depreciation asadmitted by the Commission upto 31.3.2013 from the gross depreciable valueof the assets. The difference between the cumulative depreciation recoveredand the depreciation so arrived at by applying the depreciation rates asspecified in these Regulations corresponding to 12 years shall be spread over<strong>Chibro</strong> HEP November 2012 Page 19

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16the remaining period upto 12 years. The remaining depreciable value as on 31stMarch of the year closing after a period of 12 years from date of commercialoperation shall be spread over the balance life.”2.3.2 In accordance with above provisions and rates provided in Tariff Regulations2011, depreciation has been calculated based on rates tabulated as under:Table 19: Rates of Depreciation as per Tariff Regulations 20112.3.3 In accordance with considerations of Hon’ble Commission, <strong>Petition</strong>er hasconsidered only actual Additional Capitalisation to arrive at GFA as on 1 st April2012.2.3.4 Tariff Regulations 2011 are applicable from Ist April 2013. Hence, till FY 2012-13, <strong>Petition</strong>er has calculated depreciation based on Tariff Regulations 2004.Table 20: Depreciation in FY 2012-132.3.5 In accordance with explanation made in Section 2.3.2, Tariff Regulations 2011allows recovery of major portion of Depreciation in initial 12 years of projectoperation. Hon’ble Commission has approved depreciation till FY 2007-08<strong>Chibro</strong> HEP November 2012 Page 20

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16based on weighted average rate of 2.66% on Additional Capitalisation. From2008-09 year onwards, <strong>Petition</strong>er has claimed depreciation based on relevantcategory of asset. Hence, depreciation recovered till 2007-08 has been dividedamong relevant category of asset in proportion to the percentage of grossvalue of such category of asset in the total Additional Capitalisation.Table 21: Calculation of Actual Depreciation Recovered Till FY 2012-132.3.1 In order to calculate Depreciation from FY 2013-14 to FY 2015-16, <strong>Petition</strong>erclaims depreciation on actual Additional Capitalisation only.2.3.2 In accordance with Tariff Regulations 2011, depreciation may be recovered till12 years from the date of Commissioning of the Project at a rate mentioned inthe Regulations and shown in Section 2.3.2. Hence % of depreciation onAdditional Capitalisation from FY 2013-14 onwards needs to be reconciledwith the % of depreciation for the 12 years as per Tariff Regulations 2011.Table 22: Proposed Depreciation % for FY 2013-14 to FY 2015-16<strong>Chibro</strong> HEP November 2012 Page 21

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16Table 23: Proposed Depreciation (Rs. Cr.) for FY 2013-14 to FY 2015-162.3.3 It is respectfully prayed that the depreciation proposed in accordance withabove paragraphs Rs. 0.543 Cr., Rs. 0.503 Cr. and Rs. 0.447 Cr. for the FY 2013-14, FY 2014-15 and FY 2015-16 respectively, may kindly be considered andallowed by the Hon’ble Commission.2.4 Interest on Loan Capital2.4.1 It is submitted that in terms of the directives of the Hon’ble Commission,interest on normative debt has been considered on the value equivalent to70% of additional capitalisation only.2.4.2 Rate of Interest is assumed to be same as calculated for FY 2011-12 which isweighted average rate of interest on actual loan for MB-II hydro powerproject.2.4.3 Accordingly, the interest on normative debt has been calculated as under:-:<strong>Chibro</strong> HEP November 2012 Page 22

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16Table 24: Interest on Loan for FY 2013-14, 2014-15 and 2015-16 (Rs. Cr.)2.4.4 It is respectfully submitted that the Hon’ble Commission may kindly considerand allow the aforesaid interest on Normative Loan.2.5 O&M Expenses2.5.1 In accordance with Regulation 52(1) of Tariff Regulations 2011, Operation andMaintenance (O&M) expenses shall comprise of the following:-salaries, wages, pension contribution and other employee costs (EmployeeExpense);administrative and general expenses including insurance charges if any (A&GExpense);repairs and maintenance expenses (R&M Expense);2.5.1.1 In accordance with Regulation 52(2) of Tariff Regulations 2011, forGenerating Stations in operation for more than five years in Base Year(2011-12)-“The operation and maintenance expenses for the first year of the controlperiod will be approved by the Commission taking in to account the actualO&M expenses for last five years till base year, based on the audited balancesheets, ...............”2.5.1.2 It is respectfully submitted that the Hon’ble Commission had allowed theO&M expense components for the financial year 2012-13 for <strong>Chibro</strong> HEP inits order dated 04.04.12. In this Tariff Order, due to non finalisation ofactual figures for complete FY 2011-12, the Commission hadproportionately increase the 9 months actual employee expense to arriveat the estimated figure for FY 2011-12. This figure was further escalated by7.04% to arrive at employee expense for FY 2012-13.<strong>Chibro</strong> HEP November 2012 Page 23

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY162.5.1.3 The same escalation of 7.04% was also considered on A&G and R&Mexpense over the expenses approved for FY 2011-12 to arrive at A&G andR&M expense for FY 2012-13.2.5.1.4 In accordance with provisional accounts, the O&M expenditure figures forFY 2011-12 are available. It is now submitted that in order to arrive at O&Mexpenses for FY 2013-14, 2014-15 and 2015-16, the same escalation hasbeen considered over the O&M components for FY 2011-12, as approvedby the Commission in the Tariff Order dated April 4, 2012. The O&Mexpenses are projected as under:Table 25: Proposed O&M Expenses for FY 2013-14 to 2015-162.5.2 Hence, the O & M expenses amounting to Rs. 47.10 Cores, Rs. 50.42 Cores andRs. 53.97 Cores for the FY 2013-14, 2014-15 and 2015-16 respectively maykindly be considered and allowed.2.6 Interest on Working Capital2.6.1 In accordance with Regulation 34 of Tariff Regulations 2011:“Rate of interest on working capital shall be on normative basis and shall beequal to the State Bank Advance Rate (SBAR) of State Bank of India as on thedate on which the application for determination of tariff is made.”Interest on Working Capital Shall Cover:Operation and maintenance expenses for one month;Maintenance spares @ 15% of operation and maintenance expenses; andReceivables for sale of electricity equivalent to two months of the annualfixed charges calculated on normative capacity index.<strong>Chibro</strong> HEP November 2012 Page 24

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16Table 26: Proposed Interest on Working Capital for FY 2013-14 to 2015-162.6.2 Hence, Interest on Working Capital amounting to Rs. 3.65 Cores, Rs. 3.89Cores and Rs. 4.15 Cores for the FY 2013-14, 2014-15 and 2015-16respectively may kindly be considered and allowed.2.7 Total Fixed Charges2.7.1 The gross and net Annual Fixed Charges for <strong>Chibro</strong> power plant for each of thetariff years is provided in the table below:Table 27: Proposed Fixed Charges for FY 2013-14 to 2015-162.7.2 In accordance with above table it is requested to the Hon’ble Commission tokindly consider and allow the Annual Fixed Charges amounting to Rs. 58.89Cores, Rs. 62.41 Cores and Rs. 66.16 Cores for the FY 2013-14, 2014-15 and2015-16 respectively.2.8 Design Energy and NAPAF2.8.1 The design energy is proposed as explained in section 1.11 i.e. 628.18 MU. Thenet primary energy for FY 2013-14, 2014-15 and 2015-16 comes to 620.6 MU.Normative Plant Availability Factor (NAPAF) is calculated as 75%. The detailed<strong>Chibro</strong> HEP November 2012 Page 25

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16methodology of calculation of NAPAF is already explained in the Business Planbeing submitted to Hon’ble Commission.2.8.2 It is requested to the Hon’ble Commission to kindly approve and allow designenergy and NAPAF as explained above.2.9 Capacity Charges and Energy Charge Rate:2.9.1 In accordance with the Tariff Regulations 2011, the capacity Charges arecalculated as under:Table 28: Capacity Charges for FY 2013-14, 2014-15 and 2015-16 (Rs. Cr.)2.9.2 In accordance with the Tariff Regulations 2011, Energy Charge Rate iscalculated as under:Table 29: Energy Charge Rate (Rs./kWh)2.9.3 It is requested to the Hon’ble Commission that capacity charges amounting toRs. 29.44 Cr., Rs. 31.20 Cr. and Rs. 33.08 Cr. for FY 2013-14, 2014-15 and 2015-16 respectively may kindly be considered and allowed.2.9.4 It is requested to the Hon’ble Commission that Energy Charge Rate of Rs. 0.47per kWh, Rs. 0.50 per kWh and Rs. 0.53 per kWh for FY 2013-14, 2014-15 and2015-16 respectively may kindly be considered and allowed.<strong>Chibro</strong> HEP November 2012 Page 26

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16Chapter 3. Status of Directives in Tariff Order Dated 4 April 20123.1 Action Taken by <strong>UJVN</strong>L on the Directives3.1.1 It is respectfully submitted that the <strong>Petition</strong>er has taken following action onthe directives issued by Hon’ble Commission in the Tariff Order dated April 4,2012:3.1.1.1 In accordance with the directions of the Hon’ble Commission to the<strong>Petition</strong>er (vide tariff order dated December 30, 2009, October 21, 2009,May 19, 2009, March 18, 2008 and for FY 2004-05 to 2006-07) an amountof Rs. 92.86 crore and Rs. 105.95 is payable by UPCL to the <strong>Petition</strong>ertowards energy charges and on account of arrears of tariff revisionrespectively. Inspite of repeated follow up with UPCL, the amount has yetnot been remitted to the <strong>Petition</strong>er by UPCL. The relevant extract of TariffOrders are reproduced as under(Extract from Tariff Order March 18, 2009 )“..............the payment of approvedcharges in excess of the existing charges shall be made by UPCL to <strong>UJVN</strong>L inequal monthly installments from first day of the month following the date ofissue of this Order till 31.03.2009.”(Extract from Tariff Order December 30, 2009 for MB-II) - “Arrears of bills dueto increased tariff for the period upto the month of November 2009 shall bepayable in balance 4 months in equal installments. Incentives and secondaryenergy charges shall, however, be payable only at the year end on annual basisas stipulated in the Regulations.”3.1.1.1.1 Hence, regarding settlement of additional amount of Rs. 9.48 crorerecovered from UPCL, the <strong>Petition</strong>er has requested to the UPCL videletter no. 2185/<strong>UJVN</strong>L/MD/UERC dated May 18, 2012 to adjust theadditional amount in the pending amount payable by UPCL. The letter no.is attached as Annexure – 7.3.1.1.2 As mentioned in the relevant section of the <strong>Petition</strong>, the segregation ofconsumption of employees of other departments, offices etc. and meterinstallation is in process. The necessary information of colony consumptionfor True Up years is attached as Annexure 8.<strong>Chibro</strong> HEP November 2012 Page 27

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY163.1.1.3 Regarding handover of power distribution network in plant colony to UPCL,the <strong>Petition</strong>er has requested to the UPCL to complete necessary formalitiesrelated to the transfer the distribution network. It is requested to theHon’ble Commission to kindly give necessary directions to UPCL also toexpedite the process of transfer of such distribution network.3.1.1.4 The <strong>Petition</strong>er has already submitted benchmarking report for its fivestations. Benchmarking report for other stations is in progress and wouldbe submitted to the Hon’ble Commission shortly.3.1.1.5 The depreciation has been claimed assetwise in the present <strong>Petition</strong> to theextent the segregation of assets was available with the <strong>Petition</strong>er.3.1.1.6 Regarding DPR and transfer scheme for 9 large hydro projects, it is reportedthat even after rigorous follow-up with UPJVNL, the <strong>Petition</strong>er could not getrequired information. Hon’ble Commission may like to consider the factthat getting such information from other departments is beyond thecontrol of the <strong>Petition</strong>er. Also, in order to speed up the process offinalisation of transfer scheme, the <strong>Petition</strong>er has appointed a consultant.3.1.1.7 Regarding examining the O&M expenses allocation practices being followedin similar utilities in other states as well as central sector utilities, pleaserefer Section 1.7.3 of the <strong>Petition</strong>.3.1.1.8 Annual budget 2012-13 has already been provided to the Hon’bleCommission vide letter no. 1691 MD/<strong>UJVN</strong>L/U-6 dated April 25, 2012.3.1.1.9 Regarding the report of the Expert Committee to ascertain the Capital Costof MB-II Project, The directive has been complied vide letter no.3487/MD/<strong>UJVN</strong>L/U-6 dated June 25, 2012, submitted to the Hon’bleCommission.3.1.1.10 <strong>Petition</strong>er has separated the insurance policies taken for the hydro projectsand allocated them to 10 large hydro projects and SHPs. Please referAnnexure 9.<strong>Chibro</strong> HEP November 2012 Page 28

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY163.1.1.11 <strong>Petition</strong>er has taken necessary action to comply all directives issued byHon’ble Commission. Some other reports/information is in process andwould be submitted shortly to the Hon’ble Commission.<strong>Chibro</strong> HEP November 2012 Page 29

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY16Chapter 4.Relief Sought4.1 Relief Sought4.1.1 In view of the facts mentioned above, the <strong>Petition</strong>er respectfully prays for therelief as stated below:4.1.2 The <strong>Petition</strong>er respectfully requests that the orders of the Hon’bleCommission may adequately consider the positions expounded in the presentpetition for approval of Annual Fixed Charges for FY 2013-14, FY 2014-15 andFY 2015-16 and true up for the F.Y. 2008-09, 2009-10 and fY 2010-11. This<strong>Petition</strong> incorporates substantially improved information as compared to theearlier tariff petition. However the <strong>Petition</strong>er is making continuous efforts torefine the information system further which has started generating results.The same may be suitably considered for the orders of the Hon’bleCommission.4.1.3 The financial projections have been developed based on the <strong>Petition</strong>er’sassessment, trend available and estimates available. There could bedifferences between the projections and the actual performance of the<strong>Petition</strong>er. The Hon’ble Commission may condone the same. The <strong>Petition</strong>eralso requests the Hon’ble Commission to allow to make revisions to the<strong>Petition</strong> and submit additional relevant information that may emerge orbecome available subsequent to this filing.4.1.4 In view of the foregoing, the <strong>Petition</strong>er respectfully prays that the Hon'bleCommission may:4.1.4.1 Accept and approve the accompanying projected financial information ofthe <strong>Petition</strong>er for determination of generation tariff for the FY 2013-14, FY2014-15 and FY 2015-16 and true up for the F.Y. 2008-09, 2009-10 and fY2010-11 prepared in accordance with Tariff Regulations established by theHon’ble Commission and directives of the Hon’ble Commission contained inthe earlier tariff orders.<strong>Chibro</strong> HEP November 2012 Page 30

True-up of FY09, FY10, FY11 & MYT <strong>Petition</strong> for FY14, FY15, FY164.1.4.2 Grant suitable opportunity to the <strong>Petition</strong>er within a reasonable time frameto file additional material information that may be subsequently available;4.1.4.3 Grant the waivers prayed with respect to such filing requirements as the<strong>Petition</strong>er is unable to comply with at this stage of filing;4.1.4.4 Treat the filing as complete in view of substantial compliance and also thespecific humble requests for waivers with justification placed on record;4.1.4.5 Condone any inadvertent omissions/ errors/ shortcomings and permit the<strong>Petition</strong>er to add/ change/ modify/ alter this filing and make furthersubmissions as may be required at a future date;4.1.4.6 Consider and approve the <strong>Petition</strong>er’s application including all requestedregulatory treatments in the filing;4.1.4.7 Consider the submissions of <strong>Petition</strong>er that could be at variance with theorders and regulations of the Hon’ble Commission, but are neverthelessfully justified from a practical viewpoint;4.1.4.8 Pass such orders as the Hon’ble Commission may deem fit and properkeeping in mind the facts and circumstances of the case.4.2 Particulars of Fee Remitted4.2.1 The details of the fee remitted are as follows:Bank Draft NoIn favour of- Uttarakhand Electricity Regulatory CommissionDrawn at - PNB - Yamuna ColonyDated -<strong>Chibro</strong> HEP November 2012 Page 31