Annual Report 2011 - Mandarin Oriental Hotel Group

Annual Report 2011 - Mandarin Oriental Hotel Group

Annual Report 2011 - Mandarin Oriental Hotel Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

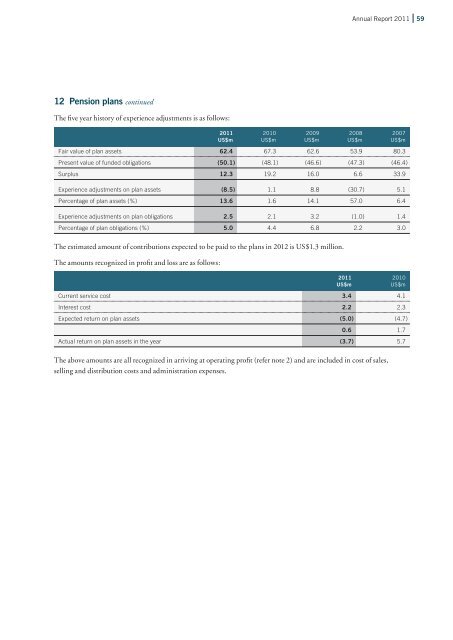

12 Pension plans continued<br />

The five year history of experience adjustments is as follows:<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2011</strong> 59<br />

<strong>2011</strong> 2010 2009 2008 2007<br />

US$m US$m US$m US$m US$m<br />

Fair value of plan assets 62.4 67.3 62.6 53.9 80.3<br />

Present value of funded obligations (50.1 ) (48.1 ) (46.6 ) (47.3 ) (46.4 )<br />

Surplus 12.3 19.2 16.0 6.6 33.9<br />

Experience adjustments on plan assets (8.5 ) 1.1 8.8 (30.7 ) 5.1<br />

Percentage of plan assets (%) 13.6 1.6 14.1 57.0 6.4<br />

Experience adjustments on plan obligations 2.5 2.1 3.2 (1.0 ) 1.4<br />

Percentage of plan obligations (%) 5.0 4.4 6.8 2.2 3.0<br />

The estimated amount of contributions expected to be paid to the plans in 2012 is US$1.3 million.<br />

The amounts recognized in profit and loss are as follows:<br />

<strong>2011</strong> 2010<br />

US$m US$m<br />

Current service cost 3.4 4.1<br />

Interest cost 2.2 2.3<br />

Expected return on plan assets (5.0 ) (4.7 )<br />

0.6 1.7<br />

Actual return on plan assets in the year (3.7 ) 5.7<br />

The above amounts are all recognized in arriving at operating profit (refer note 2) and are included in cost of sales,<br />

selling and distribution costs and administration expenses.