Annual Report 2011 - Mandarin Oriental Hotel Group

Annual Report 2011 - Mandarin Oriental Hotel Group

Annual Report 2011 - Mandarin Oriental Hotel Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

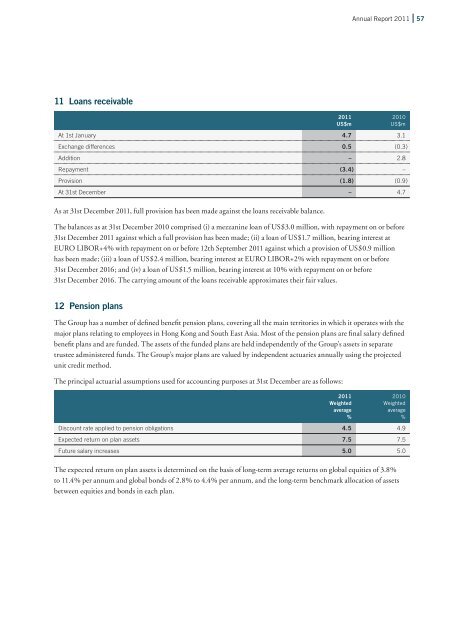

11 Loans receivable<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2011</strong> 57<br />

<strong>2011</strong> 2010<br />

US$m US$m<br />

At 1st January 4.7 3.1<br />

Exchange differences 0.5 (0.3 )<br />

Addition – 2.8<br />

Repayment (3.4 ) –<br />

Provision (1.8 ) (0.9 )<br />

At 31st December – 4.7<br />

As at 31st December <strong>2011</strong>, full provision has been made against the loans receivable balance.<br />

The balances as at 31st December 2010 comprised (i) a mezzanine loan of US$3.0 million, with repayment on or before<br />

31st December <strong>2011</strong> against which a full provision has been made; (ii) a loan of US$1.7 million, bearing interest at<br />

EURO LIBOR+4% with repayment on or before 12th September <strong>2011</strong> against which a provision of US$0.9 million<br />

has been made; (iii) a loan of US$2.4 million, bearing interest at EURO LIBOR+2% with repayment on or before<br />

31st December 2016; and (iv) a loan of US$1.5 million, bearing interest at 10% with repayment on or before<br />

31st December 2016. The carrying amount of the loans receivable approximates their fair values.<br />

12 Pension plans<br />

The <strong>Group</strong> has a number of defined benefit pension plans, covering all the main territories in which it operates with the<br />

major plans relating to employees in Hong Kong and South East Asia. Most of the pension plans are final salary defined<br />

benefit plans and are funded. The assets of the funded plans are held independently of the <strong>Group</strong>’s assets in separate<br />

trustee administered funds. The <strong>Group</strong>’s major plans are valued by independent actuaries annually using the projected<br />

unit credit method.<br />

The principal actuarial assumptions used for accounting purposes at 31st December are as follows:<br />

<strong>2011</strong> 2010<br />

Weighted Weighted<br />

average average<br />

% %<br />

Discount rate applied to pension obligations 4.5 4.9<br />

Expected return on plan assets 7.5 7.5<br />

Future salary increases 5.0 5.0<br />

The expected return on plan assets is determined on the basis of long-term average returns on global equities of 3.8%<br />

to 11.4% per annum and global bonds of 2.8% to 4.4% per annum, and the long-term benchmark allocation of assets<br />

between equities and bonds in each plan.