TRUST DEED FORECLOSURE - Professional Liability Fund

TRUST DEED FORECLOSURE - Professional Liability Fund

TRUST DEED FORECLOSURE - Professional Liability Fund

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

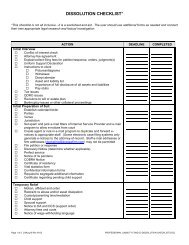

D. 2. Exemption Affidavit (if exempt from mediation requirement), and no affidavit previouslyrecorded with county). 3. Notice of default and election to sell (specify the amount of the late charge, amount ofany payment advanced, and the total amount due).Send copies to client.Step 5: Trustee's Notice of Sale(Note: The Notice of Sale must be served on all parties no less than 120 days prior to the date ofsale. Service is made personally on all occupants of the property in accordance with ORCP7(D)(2) and 7(D)(3) and by mail to all other interested parties. ORS 86.750 could be read torequire service only on one occupant. The safer practice is to serve one occupant and follow upwith substituted service on all the other occupants.) A. B. C.Prepare Trustee's Notice of Sale (SN 885) based on information in notice of default and electionto sell. Prepare the Notice to Grantor required by ORS 86.737 if the trust deed is a residentialtrust deed (see form attached as Sample 24) (the "2008 Notice"). (The Loan ModificationRequest Form, formerly Sample 25 in this packet, is no longer required.) Special Note: Thestatute requires that except in limited circumstances the Trustee must maintain a toll-freetelephone number that will allow the grantor access during regular business hours todetails regarding the loan delinquency and repayment information or person-to-personconsultation. ORS 86.737(3)(b).Compare parties named in Schedule "B" against parties named on First Supplemental Trustee'sSale Guarantee. If additional parties are named in the supplemental, check conflicts, add partiesto Notice of Sale and serve or mail copies of Notice of Sale to parties.Serve Trustee's Notice of Sale and Notice of Default and Notice. 130 DAYS BEFORE SALE 1. Prepare a file sheet (see checklist) listing the persons and agencies to be served: a. Grantor; b. All grantor's successors in interest, if any (Note: This includes successor ofrecord or whose interest trustee or beneficiary has actual notice of); c. Parties listed as junior lien holders; d. Person(s) requesting notice in writing; e. Department of Revenue, if lien holder of record; f. State agency holding lien of record, if any; g. State agency or other person holding lien of which beneficiary has actual notice; h. Any lessees. 2. Confirm addresses (and spellings of street names and individuals) by contacting thefollowing: a. b. c. d. e. f.Individual: Division of Motor Vehicles (note charge).Corporation: Corporation Division for registered agent and date of incorporation(check if corporation dissolved and if dissolution was voluntary). Online atwww.sos.state.or.us/corporation/bizreg/index.html.Partnership or Other Business: Corporation Division (check assumed names).Bank: Oregon – Division of Finance & Corporate Securities, 1-866-814-9710 orwww.cbs.state.or.us/external/dfcs/banking/regagent.htm; National – Comptrollerof the Currency 1-800-613-6743 or www.occ.treas.gov.Government Agency: Contact agency for person to serve. Review statute toconfirm correct person to serve. See OSB CLE Foreclosing Security Interests,Chapter 6, § 6.32 which discusses statutes relating to service on governmententities. If the title report discloses an IRS lien, check the current procedure fornotifying the IRS.Conservatorship: Call court for name of conservator and status.Page 3 of 41 [Rev. 7/2012]PROFESSIONAL LIABILITY FUND (<strong>TRUST</strong> <strong>DEED</strong> <strong>FORECLOSURE</strong> CHECKLIST.DOC)