IPOS Annual Report 2011/12 - Intellectual Property Office of Singapore

IPOS Annual Report 2011/12 - Intellectual Property Office of Singapore

IPOS Annual Report 2011/12 - Intellectual Property Office of Singapore

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

BUILDING ANIP HUBoF ASIA<strong>IPOS</strong> ANNUAL REPORT<strong>2011</strong>/<strong>12</strong>

VISIONAN IPHUBOFASIA

06 CHAIRMAN'S MESSAGE10 CHIEF EXECUTIVE’S MESSAGE13 BOARD OF DIRECTORS17 SENIOR MANAGEMENT21 CORPORATE PROFILE23 ORGANISATION CHART

25 INTERNATIONAL ENGAGEMENTS27 INTERNATIONAL RANKINGS28 PROVIDING THE IP INFRASTRUCTURE34 PROMOTING THE IP SERVICES SECTOR37 BUILDING THE IP CAPACITY39 OUR PEOPLE41 AWARDS AND ACCOLADES45 STATISTICS 2010 – <strong>2011</strong>57 FINANCIAL STATEMENTS

MISSIONTO PROVIDE THEINFRASTRUCTURE,BUILD EXPERTISEAND GROW THEECOSYSTEMIN SUPPORT OF THEGREATER CREATION,PROTECTION ANDEXPLOITATION OF IP.

MR QUEK TONG BOONChairman<strong>Intellectual</strong> <strong>Property</strong> <strong>Office</strong> <strong>of</strong> <strong>Singapore</strong>

06Despite continuinguncertainties in the globaleconomy and signs <strong>of</strong>slowdown in the <strong>Singapore</strong>economy over the last fewmonths, it is noteworthy thatthe World <strong>Intellectual</strong><strong>Property</strong> Organization (WIPO)has reported record number<strong>of</strong> IP filings. Global patentfilings under the WIPOadministeredPatentCooperation Treaty (PCT)went up by 10.7 per cent to181,900 in <strong>2011</strong>, making itthe biggest increase since2005. Internationaltrademarks filed usingWIPO's Madrid System alsogrew by 6.5% in <strong>2011</strong> to arecord 42,270 applications.Similarly, there was a 5.7%increase in internationaldesign applications in <strong>2011</strong>to a total <strong>of</strong> 2,521applications. These trendsreflect the growingimportance <strong>of</strong> IP creationand management in a globaleconomy that is becomingincreasingly knowledgebased.In fact, the global IP industryis itself growing. A study doneby WIPO found that theglobal market for IP is nowworth about US$180 billiona year. Global royalty andlicensing revenue has alsomore than doubled to overUS$200 billion in the pastdecade.To ensure that our IP regimeremains business- andinnovation-friendly, <strong>IPOS</strong> hasbeen actively participating ininternational negotiationsand co-operations. Forinstance, we signed the Anti-Counterfeiting TradeAgreement (ACTA) on 1October <strong>2011</strong> in Tokyo afteractive participation in variousrounds <strong>of</strong> negotiations.These meetings havefacilitated the sharing andlearning <strong>of</strong> best practiceswith IP counterparts aroundthe world. <strong>IPOS</strong> had alsosigned a Memorandum <strong>of</strong>Understanding (MOU) withWIPO on 28 September<strong>2011</strong> to establish aframework for collaborationbetween <strong>IPOS</strong> and the WIPOArbitration and MediationCentre. With this MOU,disputes involving multipleparties in differentjurisdictions would have analternative dispute resolutionoption through mediation.Such internationalCHAIRMAN / SMESSAGE

07collaborations have beenhelpful in enabling <strong>Singapore</strong>to better serve regional andinternational businesses thathad chosen to invest on ourshores.Our efforts to establish an IPregime that is conducive forIP creation, protection,management andexploitation have beenrecognised by internationalsurveys, which consistentlyranked <strong>Singapore</strong> as one <strong>of</strong>the best IP regimes in theworld. <strong>Singapore</strong> was rankedsecond in the world by theWorld Economic Forum’sGlobal Competitiveness<strong>Report</strong> <strong>2011</strong>/<strong>12</strong> for our IPprotection efforts. In <strong>2011</strong>,the Political and EconomicRisk Consultancy (PERC) alsoranked <strong>Singapore</strong> first in Asiain terms <strong>of</strong> IP protection forthe second time in a row. Inaddition, the International<strong>Property</strong> Rights Index 20<strong>12</strong>has ranked <strong>Singapore</strong> top inAsia for our IP efforts.However, <strong>Singapore</strong> will notrest on its laurels. In March20<strong>12</strong>, the Minister for Law,Mr K Shanmugamannounced the formation<strong>of</strong> an IP Steering Committeeto look into strategies todevelop <strong>Singapore</strong> as anIP Hub <strong>of</strong> Asia. We aim togrow <strong>Singapore</strong> into a vibrantmarket-place to transactand commercialise IP,as well as build world-classIP capabilities andinfrastructure to facilitateIP activities in and beyond<strong>Singapore</strong>.

08We aim togrow<strong>Singapore</strong>into a vibrantmarket-placeto transactandcommercialiseIP, as well asbuild worldclassIPcapabilitiesandinfrastructureto facilitate IPactivities inand beyond<strong>Singapore</strong>.Given <strong>IPOS</strong>’ mission <strong>of</strong>providing the infrastructure,building expertise andgrowing the ecosystem insupport <strong>of</strong> the greatercreation, protection andexploitation <strong>of</strong> IP, it clearlyhas a critical role to play inthe success <strong>of</strong> the variousIP-related initiatives. I thankour many stakeholders, myfellow <strong>IPOS</strong> Board members,the <strong>IPOS</strong> management andstaff, and our many partnersfor journeying with us to bring<strong>IPOS</strong> and the <strong>Singapore</strong> IPsystem to where it is today.I look forward to yourcontinued support in the nextstage <strong>of</strong> our journey to shapethe IP landscape, address itschallenges and harness itsopportunities in bringing the<strong>Singapore</strong> IP system to newheights.Quek Tong BoonChairman

BG (NS) TAN YIH SANChief Executive<strong>Intellectual</strong> <strong>Property</strong> <strong>Office</strong> <strong>of</strong> <strong>Singapore</strong>

10The <strong>Intellectual</strong> <strong>Property</strong><strong>Office</strong> <strong>of</strong> <strong>Singapore</strong> (<strong>IPOS</strong>)celebrated 10 th Anniversarylast year. This marked adecade <strong>of</strong> service to ourNation as a Statutory Board.Over the past decade, wehave to deal with a majorcrisis in SARs and twoeconomic downturns.Notwithstanding, our servicedelivery to <strong>Singapore</strong>’seconomic and socialwell-beings remaineduninterrupted. <strong>IPOS</strong>continued to grant theprotection and encouragethe exploitation <strong>of</strong> IP as<strong>Singapore</strong> marched towardsa knowledge-basedeconomy. This service toour Nation will continueand be enhanced in thecoming years.Last year was yet anotherchallenging year. As a selffinancingStatutory Board,we had to navigate in a worldthat was shrouded withuncertain economic overcastand thwarted by competingforces <strong>of</strong> globalisation. Thiswas manifested in the fastchangingIP landscapeacross the globe.Despite the challenges, ourIP eco-system registerednoticeable growth forCalendar Year (CY) 11/<strong>12</strong>.Trade Marks and Designsapplications saw recordincrease <strong>of</strong> 14.6% and 14%- the largest since 2004 and2006 respectively. Foreignregistration <strong>of</strong> patents sawa dip due largely to theEuropean's economicsituation. However, this wasmore than compensated withan increase <strong>of</strong> 18.4% in localregistration. Overall, patentsregistrations have increasedslightly by 0.2%.We have also revised ourVision, Mission and Valuesto re-position <strong>IPOS</strong> for thefuture. Our new visionenunciated the strategic shiftin <strong>IPOS</strong>’ orientation so as toposition <strong>Singapore</strong>internationally as an IP Hub<strong>of</strong> Asia. The next decadewould see Asia demandingmore and greatersophistication <strong>of</strong> IP servicesthat could be served by a fewspecialised nodes.<strong>Singapore</strong> would do well tobe one <strong>of</strong> them. This newVision would also necessitateCHIEFEXECUTIVE / SMESSAGE

11a larger mission set. Inaddition to strengthening ourIP regime, and promoting ourIP services sector, we havealso incorporated IP capacitybuilding as the third pillar inour mission area andbrought in IP Academy as asubsidiary. Organisationally,we have begun the journeyto further corporatize oursystem with the desire tobuilding a value-basedorganisation with qualitypeople.STRENGTHENINGOUR IP REGIMEEfforts have begun tostrengthen our IP regimethrough raising <strong>of</strong> the quality<strong>of</strong> our IP system. Workingwith IP practitioners and theindustry, we have proposedamendments to the PatentsAct for the change from aself-assessment to a positivegrant patent system. Toensure quality control <strong>of</strong> ourpatent system, we have alsobegun our foundational workin building our indigenouspatent search andexamination capabilities.These were by far the mostsignificant change to ourpatent system in the pastdecades. Another area <strong>of</strong>enhancement was to renderbetter services to ourCustomers. By early nextyear, we would integrate ourIP registration systems andprocesses so as to deliverfaster, simpler, andaffordable services to IPcreators who are looking t<strong>of</strong>ile their IP with us.PROMOTING THE IPSERVICES SECTORFeedback from Industryplayers and IP practitionersrevealed the need for a Hubservices in <strong>Singapore</strong> toassist them to venturedeeper into the emergingmarkets <strong>of</strong> the region, as wellas for the Asian-basedcompanies to reach out tothe world. We look forwardto the recommendation fromIP Steering Committee t<strong>of</strong>urther the growth <strong>of</strong> ourservices sector.An equally important effortwas to support the growth <strong>of</strong>local enterprises. Wecontinued to engender thedevelopment <strong>of</strong> IPManagement (IPM)capabilities in private andpublic sectors. Through theIPM Programme for Small-Medium Enterprises (SMEs),<strong>IPOS</strong> successfully reachedout to more than 11,000local firms which took theirbusinesses to greaterheights by committing closeto $5 million grants for thesefirms to undertake IPManagement projects lastyear. This was expected togenerate close to $160million economic value-addand about 600 jobs in<strong>Singapore</strong>. As for the PublicSector, <strong>IPOS</strong> started theCommunity <strong>of</strong> Practitioners(CoP) initiative to nurture aself-directing community <strong>of</strong>IPM practitioners acrosspublic agencies to lead in theadoption <strong>of</strong> effective IPMpractices within the Whole<strong>of</strong> Government. This initiativehas since reached out tomore than 3,000 <strong>of</strong>ficersand has grown to an activecommunity <strong>of</strong> almost 160IPM practitioners from 46public agencies.We have also taken activesteps to raise publicawareness and respect forIP in our public domain.Through a series <strong>of</strong> outreachactivities such as the

<strong>12</strong>appointment <strong>of</strong> IPAmbassadors, IP Race, IPChampion Music Fiesta andMovie Trailer Launch, ourreach had extended to morethan 72,000 people. Theincrease in IP awareness wasshown in an IP PerceptionSurvey, which revealed that95.3% <strong>of</strong> the respondentswere aware <strong>of</strong> the differentacts <strong>of</strong> IPR infringement, andnearly 4 in 5 respondentsfrowned upon IPRinfringement and saw IPRinfringement as a form <strong>of</strong>theft. <strong>IPOS</strong> intends to stepup our efforts to bring IPcloser to the people andencourage more to embracea pro-IP way <strong>of</strong> life.BUILDING THE IP CAPACITYSince 1 April 20<strong>12</strong>, the IPAcademy (IPA) <strong>of</strong>ficiallybecame a subsidiary under<strong>IPOS</strong>. As the capacity-buildingarm <strong>of</strong> <strong>IPOS</strong>, it has providedIP pr<strong>of</strong>essionals with thetechnical knowhow andexpertise as well as position<strong>Singapore</strong> as a thoughtleader in IP matters. One <strong>of</strong>the key projects included thealignment <strong>of</strong> IP CompetencyFramework (IPCF) to IPA’scurricula so that IPA couldmastermind the development<strong>of</strong> IP workers in the whole <strong>of</strong><strong>Singapore</strong>. In the comingyear, IPA will be intensifyingits engagements with theindustry, local universitiesand international IP institutesto <strong>of</strong>fer more specialisedprogrammes and providequality skill sets to meetmarket demand in the region.Going forward, <strong>IPOS</strong> iscommitted to developing<strong>Singapore</strong> into an IP hub <strong>of</strong>Asia through providing theinfrastructure, buildingexpertise, and growing the<strong>IPOS</strong> continuedto grant theprotection andencourage theexploitation <strong>of</strong>IP as <strong>Singapore</strong>marched towardsa knowledgebasedeconomy.This service to ourNation willcontinue and beenhanced in thecoming years.ecosystem in support <strong>of</strong> thegreater creation, protectionand exploitation <strong>of</strong> IP. Whilewe are enthused <strong>of</strong> ourfuture, we will remaingrounded to service ourcustomers well. We areconfident that with the talent,creativity and teamwork <strong>of</strong>our Board, stakeholders, andco-workers in <strong>IPOS</strong> and IPA,we will again deliver apositive experience for ourcustomers, our economy and<strong>Singapore</strong>. I look forward toanother productive year, andworking with all to building abetter future for our IPeco-system.Tan Yih SanChief Executive

13BOARD OFDIRECTORSAs at August 20<strong>12</strong>DEPUTY CHAIRMANDR STANLEY LAIHead <strong>of</strong> IP & TechnologyAllen & Gledhill LLPBG (NS) TAN YIH SANChief Executive /Director-General<strong>Intellectual</strong> <strong>Property</strong> <strong>Office</strong><strong>of</strong> <strong>Singapore</strong>CHAIRMANMR QUEK TONG BOONChief Defence Scientist /Chief Research & Technology <strong>Office</strong>rMinistry <strong>of</strong> Defence

14MR HUGH LIMDeputy SecretaryMinistry <strong>of</strong> LawMR KEOY SOO EARNHead, M&A Transaction Services Head,Valuation Services,<strong>Singapore</strong> and Southeast AsiaDeloitte & Touche LLP (<strong>Singapore</strong>)ASSOCIATE PROFESSOR LEE CHEE WEECEO and FounderLYNK Biotechnologies Pte LtdChairmanDynaLynk Pharma Pte Ltd

15MR LOH CHOO BENGExecutive Vice President(Retail and Financial Services)<strong>Singapore</strong> Post LimitedMS JACQUELINE POHDivisional DirectorMinistry <strong>of</strong> ManpowerMR POR KHAY TIBoard DirectorAdventech (S) Pte Ltd

16MR GUY PROULXManaging DirectorTranspacific IPManagement Group Pte LtdMR KELVIN THESEIRAManaging CounselAgilent Technologies<strong>Singapore</strong> (Sales) Pte LtdNot in photo:PROFESSOR FREDDY BOEYDeputy President and ProvostNanyang Technological UniversityPROFESSOR BERNARD YEUNGDean and Stephen RiadyDistinguished Pr<strong>of</strong>essor <strong>of</strong> FinanceNational University <strong>of</strong> <strong>Singapore</strong>Business School

17SENIORMANAGEMENTAs at August 20<strong>12</strong>MR VIKTOR CHENG CHOONG HUNGDeputy Chief Executive /Deputy Director-GeneralMS CHIAM LU LINDeputy Chief Executive /Deputy Director-GeneralBG (NS) TAN YIH SANChief Executive /Director-GeneralMR DAREN TANGDeputy Chief Executive /Deputy Director-General

18MR DARRYN FRANCIS LIMActing Director(Legal Policy & International Affairs)MR SEOW HUNG MING SIMONDirector(Registry <strong>of</strong> Patents)MS TAN MEI LINDirector(Registry <strong>of</strong> Trade Marks)MS DIANE LOODirector(Public Outreach Department)Covering Director(Public Relations Department)

19MRS ANG-ONG BEE LIANDirector(Computerisation Department)Covering Director(Customer Service Department)DR ERIC GANDirector(Capability Development Department)MR NG BENG LIMDirector(Information TechnologyDepartment)MR CHIA POH CHOONDirector(Finance Department)MR NG KOK WANDirector(Strategic Planning &Policy Department)

20MS ANNE LOO VOON VOONDirector(Registry <strong>of</strong> Designs,Registry <strong>of</strong> Plant Varieties) /(Hearings & Mediation Division)MR WOO YEW CHUNGDirector(Human Capital Department)MR YUEN KUM CHEONGDirector(Enterprise DevelopmentDepartment)MR LIM ENG HANNDirector(Programs & Operations)IP Academy

21CORPORATEPROFLIEThe <strong>Intellectual</strong> <strong>Property</strong><strong>Office</strong> <strong>of</strong> <strong>Singapore</strong> (<strong>IPOS</strong>), astatutory board under theMinistry <strong>of</strong> Law since April2001, is the leadgovernment agency thatadvises on and administersintellectual property (IP) laws,promotes IP service sector,awareness and provides theinfrastructure to facilitate thedevelopment <strong>of</strong> IP in<strong>Singapore</strong>. With IP fastbecoming a critical resourcein today’s new economy, athorough review <strong>of</strong> ourcorporate pr<strong>of</strong>ile was donein 20<strong>12</strong>. In working towardsa backdrop <strong>of</strong> a changing IPlandscape, we are guided bythe following:Our VisionAn IP Hub <strong>of</strong> Asia

22Our MissionTo provide the infrastructure, buildexpertise and grow the ecosystem insupport <strong>of</strong> the greater creation,protection and exploitation <strong>of</strong> IPOur Core ValuesIntegrityPr<strong>of</strong>essionalismTeamworkPeople FocusGreater IP awareness helpsto provide fundamentalbuilding blocks for IPcreation, greater IPprotection helps to increasebusiness confidence in ourregime, and greater IPexploitation helps to driveour economy. Througheducation, training and arobust infrastructure, <strong>IPOS</strong>makes it our mission toprovide the infrastructure,build expertise and grow theecosystem in support <strong>of</strong> thegreater creation, protectionand exploitation <strong>of</strong> IP.Our Strategic ThrustsStrengthening our IP RegimePromoting the IP services sectorBuilding the IP capacity

23ORGANISATIONCHARTAs at August 20<strong>12</strong>BOARD OF DIRECTORSChief Executive/RegistrarBG (NS) Tan Yih SanDeputy Chief ExecutiveMr Daren TangDeputy Chief ExecutiveMr Viktor ChengRegistries Group Policy Group Infrastructure & CapabilityDevelopment GroupRegistry <strong>of</strong> PatentsRegistry <strong>of</strong> Trade MarksRegistry <strong>of</strong> DesignsRegistry <strong>of</strong> Plant VarietiesStrategic Planning &Policy DepartmentLegal Policy & InternationalAffairs Department #Public OutreachDepartmentEnterprise DevelopmentDepartmentIndustry DevelopmentDepartmentComputerisationDepartmentCustomer ServiceDepartment*Ms Chiam Lu Lin is holding concurrent appointment as Executive Director, IPA.#Provide administrative support to the Copyright Tribunal in the performance <strong>of</strong>the Tribunal’s functions under the Copyright Act (Cap 63)

24Internal Audit DepartmentDeputy Chief ExecutiveMs Chiam Lu Lin*Corporate Services GroupCapacity Building GroupHearings & Mediation GroupFinanceDepartmentHuman CapitalDepartmentCapability DevelopmentDepartmentInternational Co-OperationDepartmentInformation TechnologyDepartmentKnowledge ManagementDepartmentPublic RelationsDepartmentIP AcademyBoard <strong>of</strong> DirectorsManagementTrainingThoughtLeadershipIP ResearchPublicSectorIP BusinessConsultants& SMEsTech Transfer<strong>Office</strong>s &TertiaryInstitutionsPatentAgents &Lawyers

25INTERNATIONALENGAGEMENTSTo raise <strong>Singapore</strong>’spositioning in theinternational arena and beat the forefront <strong>of</strong> IPdevelopment, <strong>IPOS</strong> workedwith our colleagues in MFA,MTI and EDB to play anactive role in WIPO and the<strong>Intellectual</strong> <strong>Property</strong> Rights(IPR) committees <strong>of</strong> theWorld Trade Organization(WTO), APEC and ASEAN.These fora has enabledintegration into the globaltrading and IP system, andengendered more businessfriendly initiatives.MULTILATERAL ENGAGEMENTLeading to the adoption <strong>of</strong>the ASEAN <strong>Intellectual</strong><strong>Property</strong> Rights Action Plan<strong>2011</strong>-2015 at the 36thASEAN Working Group on<strong>Intellectual</strong> <strong>Property</strong>Cooperation (AWGIPC)Meeting in July <strong>2011</strong>, <strong>IPOS</strong>participated actively indiscussions among regionalASEAN IP <strong>of</strong>fices. Inparticular, <strong>IPOS</strong> leddiscussions at the ASEANlevel on refining the ASEANPatent ExaminationWIPO Director-General Mr Francis Gurry (left) and <strong>IPOS</strong> Chief Executive BG(NS)Tan Yih San (right) at the Memorandum <strong>of</strong> Understanding (MOU) SigningCeremony on 28 September <strong>2011</strong> to establish a framework <strong>of</strong> collaborationbetween <strong>IPOS</strong> and the WIPO Arbitration and Mediation Centre.Cooperation (ASPEC)programme. ASPEC is awork-sharing initiativeamongst eight ASEAN IP<strong>Office</strong>s first initiated by<strong>Singapore</strong> in 2009, andenhanced in November<strong>2011</strong> to operate in EnglishLanguage. The ASPECprogramme seeks toimprove the quality <strong>of</strong> searchand examination (S&E)reports in participatingASEAN IP <strong>Office</strong>s, by sharingS&E results amongst theparticipating <strong>of</strong>fices to allowapplicants to obtain patentsfaster and more efficiently.The programme hadreduced duplication on theS&E work done, therebysaving time and effort.Additionally, S&E work doneon a correspondingapplication also serves as auseful reference inproducing quality reports.BILATERAL ENGAGEMENTThe international bilateralpatent work-sharingarrangements with the USPatent <strong>Office</strong> (USPTO) andJapan Patent <strong>Office</strong> (JPO)under the respective PatentProsecution Highway (PPH)framework saw increasedusage in FY<strong>2011</strong>.Currently, there areongoing discussions toenter into more PPHarrangements with otherstrategic partners such asUKIPO, SIPO, KIPO, JPO

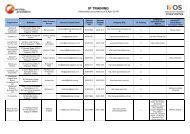

26UNITEDSTATESTrade Mark Local Filers:6,513 (1.7% increase)Patent Local Filers:1,056 (18.4% increase)BRAZILUNITEDKINGDOMWIPO*Trans-PacificPartnership FTAEU-SG FTAPatentCooperationTreatyPatentProsecutionHighwaysINDIACHINASINGAPORERUSSIAKOREAJAPANASEAN PatentExaminationCooperation (ASPEC)Designs Local Filers:661 (21.7% increase)ASEAN PatentExaminationCooperation(ASPEC)Patent ProsecutionHighways (PPH) -UKPIO, SIPO, KIPO,JPO, USPTO, BRIC- BRIC Patent CooperationTreaty (WIPO-SG)EU-<strong>Singapore</strong>FTATrans-PacificPartnership FTA* Trade Marks Applications filedunder Madrid Protocol 16,146(23.9% increase)PCT Applications entering NationalPhase 6,726 (2% drop)and USPTO to create anetwork <strong>of</strong> PPH for thegreater benefit <strong>of</strong> patentapplicants. <strong>IPOS</strong> is alsostudying the current patentagent registration andqualifying regime with a viewto further refinements tobetter support <strong>IPOS</strong>’ mission<strong>of</strong> growing IP expertise in<strong>Singapore</strong>.<strong>Singapore</strong> remains as one<strong>of</strong> the Patent CooperationTreaty (PCT) contractingstates, which facilitatesapplicants in seekingpatent protection forinventions in severalcountries simultaneouslyby filing an internationalapplication with a single<strong>of</strong>fice, in one languageand a single set <strong>of</strong> formsand fees. The PCT isadministered by theInternational Bureau (IB)<strong>of</strong> the WIPO based in Geneva.<strong>IPOS</strong> participated innegotiations on the EuropeanUnion-<strong>Singapore</strong> Free TradeAgreement (EUSFTA), whichis a bilateral FTA between<strong>Singapore</strong> and the EU,intended to strengtheneconomic ties between thetwo parties. <strong>Singapore</strong> alsoparticipated actively in theTrans-Pacific StrategicEconomic PartnershipAgreement, which is currentlybeing negotiated among9 countries (BruneiDarussalam, New Zealand,Chile, Australia, Malaysia,Peru, Vietnam, the UnitedStates <strong>of</strong> America and<strong>Singapore</strong>). This is intendedto be a “comprehensive,next-generation regionalagreement that liberalisestrade and investment andaddresses new andtraditional trade issues and21 st century challenges”.Moving forward, <strong>IPOS</strong> willcontinue to strengthen tieswith our bilateral, regionaland global partners, enhancecooperation with existingpartners and forge new ties.

27INTERNATIONALRANKINGSOver the past decade,<strong>Singapore</strong>’s legislativeframework and infrastructurehave been considerablystrengthened, givingcompanies confidence toinvest in and create IP in<strong>Singapore</strong>. The highinternational rankings for<strong>Singapore</strong>’s IP regime beartestament to this. Our IPregime has been consistentlyranked as one <strong>of</strong> the best inthe world by internationalsurveys. In <strong>2011</strong>, the WorldEconomic Forum’s GlobalCompetitiveness <strong>Report</strong>ranked <strong>Singapore</strong> second inthe world and top in Asia interms <strong>of</strong> IP protection. ThePolitical and Economic RiskConsultancy <strong>Report</strong> (PERC)<strong>2011</strong> and the <strong>Intellectual</strong><strong>Property</strong> Rights Index (IPRI)<strong>2011</strong> similarly ranked<strong>Singapore</strong> top in Asia for ourIP protection efforts.International Surveys 2010 <strong>2011</strong>World Economic Forum’s GlobalCompetitiveness <strong>Report</strong> –IP protectionPolitical and Economic RiskConsultancy <strong>Report</strong> –IP protection (Among Asiancountries)<strong>Intellectual</strong> <strong>Property</strong> Rights Index(IPRI) – IP protection, patentprotection, copyright piracy level(Among Asian countries)IMD Competitiveness Yearbook– Patent and CopyrightProtection / Protection <strong>of</strong> IPRights3rd1st1st5th2nd1st1st9th

28PROVIDING THEIP INFRASTRUCTUREBoosted by the increase indemand for IP servicesworldwide, IP filings in<strong>Singapore</strong> saw an overallgrowth. Trade mark filingsrose for the secondsuccessive year in CalendarYear (CY) <strong>2011</strong>. A record34,928 classes <strong>of</strong> trademark applications wasreceived, which translates toTRADE MARK APPLICATIONS IN SINGAPORE(BASED ON CY)a growth <strong>of</strong> 14.6% – thelargest since 2004. Patentapplications saw a slightincrease <strong>of</strong> 0.2% to 9,794.Despite a decline inEuropean filings, filings bylocal R&D research nodesand companies haveincreased by 18.4% year-onyear,amounting to thelargest increase in the past10 years. Direct nationalfilings have also increasedby 7.7% 1 . As for designs,<strong>IPOS</strong> witnessed nationalfilings and internationalregistrations at its highest inthe past 5 years. On thenational front, designs filingsfor CY <strong>2011</strong> showed anincrease <strong>of</strong> 14.3% from theprevious year. These trendsreflect the growingimportance <strong>of</strong> IP creationand management in a globaleconomy that is becomingincreasingly knowledgebased.PATENTS APPLICATIONS FILED IN SINGAPORE(BASED ON CY)1 Local filings refer to the number <strong>of</strong>applications filed by local-based entities,whilst direct national filings refer to thenumber <strong>of</strong> patent applications fileddirectly in <strong>Singapore</strong>.DESIGN APPLICATIONS FILED IN SINGAPORE(BASED ON CY)Total applicationsApplications by local-based entities

29IMPROVING QUALITY,TIMELINESS AND EFFICIENCY<strong>IPOS</strong> maintained a strongfocus on quality and reducedbacklog <strong>of</strong> existingapplications while exceedingall <strong>of</strong> its targets for the year.First action pendency – thelength <strong>of</strong> time between thereceipt <strong>of</strong> an IP applicationand when the <strong>IPOS</strong> makes apreliminary decision – wasconsistently maintainedthroughout the year. Fortrade marks, <strong>IPOS</strong> achieved90% within 4 months and100% within 6 months. 70%<strong>of</strong> patents grants wereprocessed within 4 months.85% <strong>of</strong> designs registrationcertificates were issuedwithin 2 months.As a result <strong>of</strong> the growth ininternational designsapplications, <strong>Singapore</strong>(22.1%) was also ranked the5th most designated countryafter EU (76.2%), Switzerland(68.5%), Turkey (41.8%) andUkraine (23%) for theInternational Registrationsunder the Geneva Act <strong>of</strong>the Hague agreement inTrademarks(% first action within 4 mths)(% first action within 6 mths)Patents (% grants processedwithin 4 mths)Designs (% issuance <strong>of</strong>certificates <strong>of</strong> registrationwithin 2 mths)<strong>2011</strong>. There were 592registrations from Haguedesignating <strong>Singapore</strong> ascompared to 569 from theprevious year.There has been a steadyincrease <strong>of</strong> registrationscoming in from Hague eversince <strong>Singapore</strong> becamemember to the agreementin Year 2005.LEGISLATIVE CHANGESTo position <strong>Singapore</strong> as anIP Hub <strong>of</strong> Asia, <strong>IPOS</strong> strivesTarget90%100%FY <strong>2011</strong>Actual99.4%100%70% 99.6%85% 90%to keep up with the latestglobal IP trends anddevelopments, and havemade legislative changesto not just keep abreastwith global developmentsbut also to keep in syncwith technologicaladvancements, and ensurean optimum balance <strong>of</strong>rights between IP ownersand IP users.<strong>IPOS</strong> is working on thefollowing enhancements tothe IP Regulatory Regime:

30• New Integrated Platformfor <strong>Intellectual</strong> <strong>Property</strong><strong>IPOS</strong> will also be lookinginto continuedimprovements andenhancements <strong>of</strong> ourRegistries’ servicedelivery in areas such asquality <strong>of</strong> examinationreports and ease <strong>of</strong>application services. Tomake it easier and moreconvenient for ourcustomers to executetransactions and accessinformation, <strong>IPOS</strong> will berolling out an integratedIT system to streamlineand harmonise commonprocedures acrossRegistries. The newsystem seeks to improveoperational efficiency,business processturnaround time,customer-centricity andprovide value-addedservices. This IntegratedPlatform for <strong>Intellectual</strong><strong>Property</strong>, or IP2SG, isslated for implementationin stages in 2013.• Change from the “Self-Assessment” to “PositiveGrant” Patent SystemA fundamental review<strong>of</strong> the patent systemgained momentum inFY<strong>2011</strong>. A series <strong>of</strong>public consultationswas conducted in thelast quarter <strong>of</strong> thefinancial year to gatherfeedback on a proposalto change from thecurrent self-assessmentsystem to a positive grantsystem, where a fullypositive examinationreport would be requiredbefore a patent is grantedin <strong>Singapore</strong>. The positivegrant patent systemwill strengthen therobustness and quality<strong>of</strong> the patent grants,and that will in turnincrease businessand investor confidencein <strong>Singapore</strong>’s patentregime. A two-daydialogue session betweenpatent examiners andusers was conducted inNovember <strong>2011</strong> to allowusers to betterunderstand the patentexamination process andfor examiners to gainbetter insight <strong>of</strong> userconcerns. Further workon this will continue andis expected to enter int<strong>of</strong>orce within the nextfinancial year.• Building IndigenousSearch and ExaminationCapabilities<strong>IPOS</strong> is developing inhousesearch andexamination (S&E)capabilities in keytechnological areas.Having our own worldclassS&E capabilities ispart <strong>of</strong> the effort todevelop a comprehensivesuite <strong>of</strong> IP capabilities in<strong>Singapore</strong>. <strong>Singapore</strong>aims to provide worldclassS&E servicesefficiently and at acompetitive cost toinventors and companiesfiling in <strong>Singapore</strong>.

31• Liberalisation <strong>of</strong> thePatent Agent Regime<strong>Singapore</strong> is amendingthe regulatoryrequirements to allowforeign-qualified patentagents and firms to setup in <strong>Singapore</strong> toundertake <strong>of</strong>fshorepatent agency work,e.g. the drafting andfiling <strong>of</strong> patents for otherjurisdictions. This is toappeal to firms with anestablished and growingclient base in Asia.• Strategic Review <strong>of</strong>Designs LawIn the year ahead, <strong>IPOS</strong>will also commission astudy <strong>of</strong> the existingRegistered Designs lawto ensure its continuedrelevance and currencyfor local and foreignapplicants in the face<strong>of</strong> a changing globaldesign industry.DEVELOPING ALTERNATIVEDISPUTE RESOLUTIONCAPABILITIES<strong>IPOS</strong> also contributed to thedevelopment <strong>of</strong> <strong>Singapore</strong>’sstrong IP arbitrationcapabilities, allowingbusinesses to have accessto easy and affordablemeans to resolve legaldisputes. In 2010, WIPOestablished an Arbitrationand Mediation Centre (AMC)in <strong>Singapore</strong> (its only centreoutside Geneva) to supportIP dispute resolution in Asia.Following <strong>IPOS</strong>’ discussionswith WIPO AMC, it culminatedin a Memorandum <strong>of</strong>Understanding (MOU)signed between <strong>IPOS</strong>’Chief Executive BG (NS)Tan Yih San and WIPO’sDirector-General Dr FrancisGurry, at the sidelines <strong>of</strong> theWIPO General Assembly on28 September <strong>2011</strong>.The collaboration frameworkbetween <strong>IPOS</strong> and the WIPOAMC allows internationalparties to settle IP disputesvia mediation at the WIPOAMC. <strong>IPOS</strong> is also lookinginto setting up a panel <strong>of</strong> IPexpert adjudicatorscomprising eminent IPpr<strong>of</strong>essionals to hear IPregistration disputes on anad-hoc basis. Theseinitiatives are aimed atpositioning <strong>Singapore</strong> as thepreferred choice system forIP litigation and arbitration.The new mediation optionwas launched on 3 January20<strong>12</strong>. With this launch, allCase ManagementConferences after the filing<strong>of</strong> pleadings now promotemediation as an option forparties to resolve theirtrademark disputes.Information about the newoption has also been placedon <strong>IPOS</strong>’ website to educateusers. <strong>IPOS</strong> has alsoproactively reviewed casesdue for hearing andconducted ad hoc CaseManagement Conferences

32to encourage parties toconsider mediation as analternative to adjudication.In total, <strong>IPOS</strong> hadconducted 49 CaseManagement Conferences(per mark per class) from theMOU till end <strong>of</strong> FY11.In the coming FY, <strong>IPOS</strong> isalso moving the hearingsand mediations processfrom a manual system toan automated one, alongwith the development <strong>of</strong>IP2SG. This is a milestoneas such automation willresult in a more effectivedispute resolution process.Following the MOU, <strong>IPOS</strong>and IP Academy wereinvolved in the organisation<strong>of</strong> a mediation workshoptogether with WIPO on8-9 December <strong>2011</strong>,aimed at promotingawareness <strong>of</strong> mediation inIP disputes and equippingour IP pr<strong>of</strong>essionals withmediation skills. TheHearings and MediationGroup (HMG) also developeda specific trademark casescenario for use in therole play at the workshop.The case scenario waswell received by participantswho found it to be relevantand useful for fleshing outissues and interests <strong>of</strong> theparties. It was also said tobe illustrative <strong>of</strong> the potentialbenefits <strong>of</strong> mediation asthe case involved multiplejurisdictions and varioustricky, intertwined issueswhich could go either wayif adjudication was usedinstead <strong>of</strong> mediation.With this MOU, <strong>IPOS</strong> hasentered into a deeper level<strong>of</strong> collaboration with WIPO,strengthening our linkageswith WIPO in discussingIP issues and exchangingperspectives and feedback.For example, WIPO AMC’srepresentative in <strong>Singapore</strong>attended the CaseManagement Conferences,which were conducted by<strong>IPOS</strong> between January andMarch 20<strong>12</strong>, to introduceWIPO mediation and fieldquestions from partiesand agents to proceedingsfiled at <strong>IPOS</strong>. Followingfeedback on the cost <strong>of</strong>mediation, WIPO AMC wasvery responsive in suggestingways to reduce costs.This was a critical factor inpersuading parties in onecase to submit to mediation.Besides the alternativedispute resolution option,<strong>IPOS</strong> also issued 8 practicecirculars in relation to trademark disputes in <strong>2011</strong>.These circulars (publishedin the Trade Marks e-Journaland posted on the <strong>IPOS</strong>website) provided usefulguidance on trade markdisputes filed at <strong>IPOS</strong>and provided greatertransparency andconsistency in the Registrar’sexercise <strong>of</strong> discretion inthe hearings processes, suchas the following:

33CASE HIGHLIGHT: “SUBWAY” CASEIn Doctor’s Associates Inc v Sim Meng Seh (T0709717I), the American “Subway”chain opposed a local sole proprietor’s application for a "Subway" trademarkfor women’s clothing. The sole proprietor has been trading in “Subway” clothingthat were supplied to departmental stores like Sogo (which has closed down)and BHG since 1988. The Opponents’ “Subway” sandwich chain came to <strong>Singapore</strong>after, even though it could not be established whether they came to <strong>Singapore</strong>in 1989 or 1996 or even later.The sole proprietor also owned a registration for the “Subway” mark from 1988-2005. When the mark was due for a second round <strong>of</strong> renewal in 2005, the renewalwas overlooked due to inadvertence. By the time he attempted to renew it in2007, the renewal was not possible. When he sought a fresh application in 2007,the application was opposed by the American “Subway” chain.However, the Registrar ruled in favour <strong>of</strong> the sole proprietor on the basis thatthe public would not draw a connection between the American “Subway” sandwichchain and the sole proprietor for women’s clothing because <strong>of</strong> the differencein the two trades and market segments.Even though it was found that the “Subway” brand was well known to a relevantsector <strong>of</strong> the public, its renown did not reach the level <strong>of</strong> brands like “Nutella”and therefore the brand reach is not as far reaching as to encroach into marketsthat are very different from that <strong>of</strong> the Opponents’ sandwich business.On the whole, the opposition fails on all grounds. Accordingly, Trade MarkApplication T0709717I proceeded to registration.

34PROMOTING THEIP SERVICES SECTORTo further develop<strong>Singapore</strong>’s IP ecosystem,<strong>IPOS</strong> continually fine-tunesour initiatives andprogrammes to encouragegreater adoption <strong>of</strong> IPmanagement practices.REVIEWING THE NEEDSOF THE IP SERVICES SECTORTo better understand theIP landscape and addressexisting gaps, <strong>IPOS</strong> set up aCommittee to conduct a studyon the state <strong>of</strong> supply anddemand for IP services.Specifically, the objectives<strong>of</strong> the survey were to identifythe types <strong>of</strong> IP services thathave propelled the IP servicessector and provide estimateson the size and growth <strong>of</strong> theIP services sector in <strong>Singapore</strong>.The respondents included5<strong>12</strong> users <strong>of</strong> IP services and79 IP service providers. Thesalient findings <strong>of</strong> each <strong>of</strong> thisgroup are as follows:IP services users • The top 3 IP services used are trade mark filing and renewal,IP brokerage/market intermediary work and patent draftingservices.• Top IP activities outsourced by companies are patentprosecution and renewal, patent drafting, trademark filingand renewal, and IP brokerage/market intermediary work.• 1 in 5 <strong>of</strong> the businesses that use IP services has in-housefull time employers (FTEs) for IP work. Those who handle IPwork in-house generally hire 3 or more FTEs.IP servicesproviders• 73% <strong>of</strong> the IP services providers <strong>of</strong>fer trade mark filing andrenewal services. Other common services include due diligenceservices, patent prosecution and renewal, IP strategy/management, IP education and training, and patent draftingservices.• One-third <strong>of</strong> the IP services providers shared that revenuefrom IP work contributed at least 50% <strong>of</strong> their annual income.• IP brokerage/market intermediary work, IP valuation, and IPsupport services are usually outsourced.

35The Originals IP Music Fiesta <strong>2011</strong> – students at thecompetition.The Originals IP Music Fiesta <strong>2011</strong> winners fromCedar Girls got their opportunity to record theirwinning song pr<strong>of</strong>essionally at the Ocean ButterfliesMusic recording studio.Both groups foresee growthin trade mark filing andrenewal, patent drafting, anddue diligence services until1st quarter <strong>of</strong> 20<strong>12</strong>.Regular environmentmonitoring and trendsgleaned from the IP ServicesSurvey indicated potentialgrowth in the demand for IPservices. In this regard, <strong>IPOS</strong>has been working closelywith the Ministry <strong>of</strong> Law andEconomic DevelopmentBoard to reach out toreputable IP serviceproviders to service the localmarket. At the same time,we will be starting groundwork to attract foreign IPfirms to base their operationshere to service customersthat are moving to Asia.SUPPORTING IP CREATIONAND EXPLOITATIONAimed at bridging the gapbetween IP creation andexploitation, <strong>IPOS</strong> launchedan online portal calledIdeas2IP which <strong>of</strong>fers analternative venue for IPworthyideas. The platformgives inventors theopportunity to share theirideas with potential investorsin a secure environment.<strong>Singapore</strong> is the first in SouthEast Asia to provide suchplatform. Investors with themeans and experience canhelp to fund and guide thefurther development <strong>of</strong> theideas into a form that hascommercial potential. Withthis platform, <strong>IPOS</strong> hopes toencourage IP owners,intermediaries and privatesector companies to turnideas into commercial reality.To date, Ideas2IP hasreached out to more than9,000 persons, where 220registered users contributed140 ideas on this platform,resulting in an increase in IPfilings and services.ENCOURAGING INDUSTRY-LED INITIATIVE<strong>IPOS</strong> also engaged theCollective ManagementOrganisations (CMOs) formusic and related works witha view to facilitating thecreation <strong>of</strong> a self-regulatoryframework to establishindustry standards and bestpractices. This could resultin enhancing transparency,good corporate governanceand public accountability <strong>of</strong>the CMO’s business andlicensing processes.

36electronic mailers. <strong>IPOS</strong> alsoassisted interested companiesto take their businesses togreater heights by committingclose to $5 million grants toundertake IP Managementprojects last year. This isexpected to generate closeto $160 million economicvalue-add and almost600 jobs.Law Minister Mr K Shanmugam (middle) with the winners <strong>of</strong> “The Originals Get ReelContest” on 13 January 20<strong>12</strong>.DEVELOPING ANIP-SAVVY NATIONIn FY <strong>2011</strong>, <strong>IPOS</strong> had alsotaken active steps to raiseIP awareness andcapabilities. The impactcould be felt by many acrossthe various target segments:A. General Public<strong>IPOS</strong> organised severaloutreach programmes underthe auspice <strong>of</strong> the Honour<strong>Intellectual</strong> <strong>Property</strong> (HIP)Alliance to facilitate deeperengagements with members<strong>of</strong> the public. More than72,000 took part in variousonline activities and <strong>of</strong>flineevents. Some <strong>of</strong> the keyhighlights included “TheOriginals IP Race” which washeld in conjunction with theWorld IP Day, as well as thelaunch <strong>of</strong> two new movietrailers in cinemas islandwide.These trailers were thewinning entries from TheOriginals Get Reel TrailerContest and were producedentirely by our creativeyouths in depicting thetheme <strong>of</strong> supportingoriginality.B. Small Medium EnterprisesLeveraging well-establishednetworks built over the yearswith various businesses aswell as trade associations,<strong>IPOS</strong> proactively engagedsome 11,000 local firms viacommunication platformssuch as seminars andC. Public AgenciesTasked to deepen IPawareness and improveIP management (IPM)capabilities within publicagencies as well as at theWhole-<strong>of</strong>-Government level,<strong>IPOS</strong> also providesconsultancy services on IPMcapability building projects.A Community <strong>of</strong> Practitioners(CoP) initiative was startedto nurture a self-directingcommunity <strong>of</strong> IPMpractitioners across publicagencies to better deal withthe IPM knowledge domainand lead in the adoption <strong>of</strong>effective IPM practices withinthe Whole-<strong>of</strong>-Government.This initiative has sincereached out to more than3,000 public service <strong>of</strong>ficersand has grown to an activecommunity <strong>of</strong> almost 160IPM practitioners from46 public agencies with agood mix <strong>of</strong> senior and keypublic <strong>of</strong>ficers.

37BUILDING THEIP CAPACITY<strong>IPOS</strong> foresees continued growth in demand for IP services and aims to develop programmesto build up the IP manpower and capability in <strong>Singapore</strong>:EUROPE ASIA PATENT AND PATENT INFORMATION CONFERENCE (EAP 2 IC)As part <strong>of</strong> our capacity building efforts and in collaboration with the EPO and WIPO, the 9 thedition <strong>of</strong> the Europe Asia Patent and Patent Information Conference (EAP 2 IC) shed light tothe 144 delegates on how to protect and manage firms’ IP assets and align them to theirbusiness strategies, with particular focus on how to gain a competitive edge in the MedicalTechnology and Biotechnology industries. A 2-day public workshop was run focusing on themethodologies on how to conduct patent searching, examination and landscaping, and ledby an EPO Examiner.Chairman Mr Quek Tong Boon speaking atthe Europe Asia Patent and Patent InformationConference (EAP2IC) <strong>2011</strong>.Chief Executive BS (NS) Tan Yih San withdelegates at the Europe Asia Patent and PatentInformation Conference (EAP2IC) <strong>2011</strong>.IP CONSULTThe IP Consult Series aims to foster an IP-savvy <strong>Singapore</strong> by educating the business communityand general public to appreciate and leverage IP for competitive advantage. An interactivefirst-level platform between local companies/creators and IP pr<strong>of</strong>essionals, the goal <strong>of</strong> theIP Consult is to provide basic information on IP types and general/personalised consultationon IP creation, protection and exploitation issues. In <strong>2011</strong>, 4 public sessions were run at theNational library Board (NLB) with another 7 sessions conducted in collaboration withassociations, such as the Associations <strong>of</strong> Small and Medium Size Enterprises (ASME), <strong>Singapore</strong>Chinese Chamber <strong>of</strong> Commerce and Industry (SCCCI), and the <strong>Singapore</strong> Manufacturers’Federation (SMa). Attended by 239 participants, the coverage ranged from general IPawareness ones to thematic areas such as IP Management in Asia and the Lifestyle sector.

38IP COMPETENCY FRAMEWORKThe first <strong>of</strong> its kind in the world on a nationwide scale, the IP Competency Framework (IPCF),is a strategic tool to transform IP manpower development by continuously advancing pr<strong>of</strong>essionalcompetencies through quality training and skills upgrading. As part <strong>of</strong> the IPCF, the IP WorkforceSkills Qualification (WSQ) was created in collaboration with the <strong>Singapore</strong> WorkforceDevelopment Agency (WDA) in <strong>2011</strong> to leverage on the WSQ system and methodology. Todate, 4 key IP occupational levels and 6 pr<strong>of</strong>essional certification pathways have been defined.Of the 78 competency units listed in the IPCF, 15 have been developed and validated intocompetency standards with key industry experts from the IP services sector, academia, andthe legal pr<strong>of</strong>ession. <strong>IPOS</strong> will also accredit training providers under the IPCF who woulddevelop structured training programmes and certify successful programme participants.THE ESTABLISHMENT OF NEWCAPACITY BUILDING GROUPTo meet the growing demand<strong>of</strong> IP services and theincreasingly changing andcomplex global environment,<strong>IPOS</strong> also embarked on a keyreorganisation in Q3 <strong>of</strong>FY<strong>2011</strong>. Under the reorganisation,the IP Academy(IPA), a company limited byguarantee, was restructuredand became a full subsidiary<strong>of</strong> <strong>IPOS</strong>, with effect from1 April 20<strong>12</strong>. Therestructured IPA will <strong>of</strong>ferworld-class resource forthe development <strong>of</strong>knowledge and capabilitiesin the protection, exploitationand management <strong>of</strong> IP. Inthe coming year, IPA willalign its training programmesfor IP pr<strong>of</strong>essionals,businesses and publicagencies, as well as a range<strong>of</strong> IP thought-leadershipprogrammes to look into IPand related areas.

39OURPEOPLE“People focus” and“Teamwork” were chosen astwo <strong>of</strong> our core values in an<strong>IPOS</strong>-wide survey conductedin 20<strong>12</strong>. People are at thevery heart <strong>of</strong> ourorganisation. We believe thatthe ability to achieve and theeffectiveness in achievingour mission and vision lie inthe synergistic behaviour <strong>of</strong>a motivated workforce.<strong>IPOS</strong>ians and their family membersposing for a “family” portrait atMarina Bay Sands’ new Art ScienceMuseum on 16 July <strong>2011</strong>.To foster stronger spirit <strong>of</strong>camaraderie and teamwork,regular staff bondingactivities were conductedthroughout the financial year.As the lead governmentagency for IP matters, we notonly encourage innovativepursuits in <strong>Singapore</strong>, butalso within our ownorganisation. <strong>IPOS</strong> organisedan Innovation Carnival on 17October <strong>2011</strong>, where<strong>IPOS</strong>ians were given aplatform to showcase theircreations to fellowcolleagues and“commercialise” their ideas.<strong>IPOS</strong>ians proudlyshowcasingtheir creationsat theInnovationCarnivalorganised by<strong>IPOS</strong> on 17October <strong>2011</strong>.

40Mr Dick Lee recognised as<strong>Singapore</strong>’s IP Ambassadorat <strong>IPOS</strong>’ 10th AnniversaryMs Tay Kewei,also <strong>Singapore</strong>’sIP Ambassador,singing at <strong>IPOS</strong>’10th AnniversaryCelebrations.<strong>IPOS</strong>ians dressed in “action” atthe annual dinner and dance on24 November <strong>2011</strong>.On 16 July <strong>2011</strong>, Family Daysaw <strong>IPOS</strong>ians and theirfamily members gatheringbright and early at MarinaBay Sands’ new Art ScienceMuseum where theirimagination were stimulatedby the surreal works <strong>of</strong>Salvador Dali. At our annualDinner and Dance on24 November <strong>2011</strong>,we witnessed great sportand ingenuity when <strong>IPOS</strong>iansfound creative means <strong>of</strong>dressing to the theme <strong>of</strong> the“Pr<strong>of</strong>essionals in Action”!

41AWARDSANDACCOLADESWith the help <strong>of</strong> ourmotivated workforce, <strong>IPOS</strong>continues to make strides inthe pursuit <strong>of</strong> serviceexcellence.<strong>IPOS</strong>’ knowledgemanagement (KM) system,KENNY, was presentedas a case study at KM<strong>Singapore</strong> on 31 Augustto 2 September <strong>2011</strong> andKM Asia on 8 to 10November <strong>2011</strong>. These twoevents brought the KMcommunity in <strong>Singapore</strong>together to exchange insightsabout the latestdevelopment in KM with thesharing <strong>of</strong> regional andinternational case studiesfrom both governmentagencies and businessenterprises.As part <strong>of</strong> regular review, alldepartments in theInfrastructure & CapabilityDevelopment Group (ICDG)underwent an assessmentto improve overallproductivity and efficiency.In <strong>2011</strong>, EnterpriseDevelopment Department(EDD) clinched the MinLawWITS Gold award forachieving operationalefficiency in its execution <strong>of</strong>IP Management grantprocesses.Over the years, there wasalso an increase in thenumber <strong>of</strong> <strong>IPOS</strong> staffrecognised for good service.In fact, <strong>IPOS</strong> achieved arecord 27 recipients for thenational level ExcellentService Award administeredby SPRING <strong>Singapore</strong> in<strong>2011</strong>:

42Ms Heng LishanMs Neo Gim YoongMrs Wong-Teo Li LianMr Dan Choo Khin YongMs Haslinda Binte MasudMs Cheong Yin MayMs Alinah Bte Md AliMs Corinne Yip Pui LaiMs Erlina Bte AdamMs Wang PeiqiMs Tan Yong HwiMs Suriati Bte Ra’atMs Yam Lai WahMs Foong Shu LingMs Noridah Binte JamaluddinMs Foo Wee YingMs Jasmine Chan Pui WanMs Yeo Li SungMs Ferlin Ong Tuan LengMs Low Jin WeiMs Chung Ka YeeMs Lee Joo Kim ConstanceMs Huang QinyiMs Fong Phoa Si GraceMs Siti Farisha d/o Osman Aboo BakarMs Norlela Binti NasirMs Mariana Binte Jumari

43Our <strong>of</strong>ficers were alsorecognised for various forms<strong>of</strong> merit and service to thenation in the NationalDay Awards 20<strong>12</strong>. Theprestigious CommendationMedal was awarded to MsChristine Chua Kiat Tze,Principal Assistant Director<strong>of</strong> Human CapitalDepartment, for superiorperformance, consistentdiligence and dedication inher work. Besides that, theLong Service Medals werealso given to our DeputyChief Executive, Ms ChiamLu Lin, and her PersonalAssistant, Ms Chan SookFun, after having served ournation for 25 years.Last but not least, we alsorecognised dedicatedemployees who have beenwith <strong>IPOS</strong> for a significantnumber <strong>of</strong> years. This year,<strong>IPOS</strong> handed out long serviceawards to the followingemployees:10YEARS5YEARSMs Ho Sok YinMs Kathryn Tham Lai ThengMs Lim May YenMs Neeta Devi d/o SathasivamMs Ng Cze SinMdm Saadiah IsmailMs Sandra Lynn MerindaMs Tay Kay LingMr Eric Toh Hock ChyeMs Fatehah Muhd KhairuddinMr James Yee Wai MunMr Jeffrey Wong Chern WeiMs Pyait Hlaing OoMs Samantha Yio Phui Ling

4440YEARSMrs Kam-Foo Kim Pong25YEARSMs Chiam Lu LinMs Jenny Chan Sook Fun15YEARSMs Suriati Bte Ra’atMoving forward, <strong>IPOS</strong> iscommitted to nurturing thecapabilities <strong>of</strong> our peoplealong with cultivating thedevelopment <strong>of</strong> the nationas an IP Hub <strong>of</strong> Asia.

45STATISTICS20I0 - 20II

58FINANCIALSTATEMENTSFor the financial year ended 31 March 20<strong>12</strong>INTELLECTUAL PROPERTY OFFICE OF SINGAPOREFINANCIAL STATEMENTSFor the financial year ended 31 March 20<strong>12</strong>Audit AllianceCertified Public Accountants

INTELLECTUAL PROPERTY OFFICE OF SINGAPOREFINANCIAL STATEMENTSFor the financial year ended 31 March 20<strong>12</strong>Audit AllianceCertified Public Accountants59

INTELLECTUAL PROPERTY OFFICE OF SINGAPOREFINANCIAL STATEMENTSFor the financial year ended 31 March 20<strong>12</strong>ContentsPageStatement by Board <strong>of</strong> Directors 61Independent Auditor’s <strong>Report</strong> 62 & 63Statement <strong>of</strong> Comprehensive Income 64Statement <strong>of</strong> Financial Position 65 & 66Statement <strong>of</strong> Changes in Equity 67Statement <strong>of</strong> Cash Flows 68 - 82Notes to the Financial Statements 83 - 9360

INTELLECTUAL PROPERTY OFFICE OF SINGAPORESTATEMENT BY BOARD OF DIRECTORSFor the financial year ended 31 March 20<strong>12</strong>In our opinion:(a)(b)(c)the accompanying financial statements <strong>of</strong> <strong>Intellectual</strong> <strong>Property</strong> <strong>Office</strong> <strong>of</strong> <strong>Singapore</strong> (the “<strong>Office</strong>”) as setout on pages 64 to 93 are properly drawn up in accordance with the provisions <strong>of</strong> the <strong>Intellectual</strong> <strong>Property</strong><strong>Office</strong> <strong>of</strong> <strong>Singapore</strong> Act 2001 (No. 3 <strong>of</strong> 2001) (the “Act”) and Statutory Board Financial <strong>Report</strong>ingStandards so as to give a true and fair view <strong>of</strong> the state <strong>of</strong> affairs <strong>of</strong> the <strong>Office</strong> as at 31 March 20<strong>12</strong> and <strong>of</strong>the results, changes in equity and cash flows <strong>of</strong> the <strong>Office</strong> for the year ended on that date;at the date <strong>of</strong> this statement, there are reasonable grounds to believe that the <strong>Office</strong> will be able to payits debts as and when they fall due; andnothing came to our notice that caused us to believe that the receipts, expenditure, and investment <strong>of</strong>monies and the acquisition and disposal <strong>of</strong> assets by the <strong>Office</strong> during the financial year have not beenin accordance with the provisions <strong>of</strong> the Act.The Board <strong>of</strong> Directors has, on the date <strong>of</strong> this statement, authorised these financial statements for issue.ON BEHALF OF THE BOARD OF DIRECTORS____________________Mr Quek Tong BoonChairman_____________________BG (NS) Tan Yih SanChief Executive25 July 20<strong>12</strong>161

INDEPENDENT AUDITORS’ REPORT TO THE MEMBER OFINTELLECTUAL PROPERTY OFFICE OF SINGAPORE<strong>Report</strong> on the financial statementsWe have audited the financial statements <strong>of</strong> <strong>Intellectual</strong> <strong>Property</strong> <strong>Office</strong> <strong>of</strong> <strong>Singapore</strong> (the “<strong>Office</strong>”), which comprisethe statement <strong>of</strong> financial position as at 31 March 20<strong>12</strong>, and the statement <strong>of</strong> comprehensive income, statement <strong>of</strong>changes in equity and statement <strong>of</strong> cash flows for the year then ended, and a summary <strong>of</strong> significant accountingpolicies and other explanatory notes, as set out on pages 64 to 93.Management’s Responsibility for the Financial StatementsThe <strong>Office</strong>’s management is responsible for the preparation <strong>of</strong> financial statements that gives a true and fair viewin accordance with the provisions <strong>of</strong> the <strong>Intellectual</strong> <strong>Property</strong> <strong>Office</strong> <strong>of</strong> <strong>Singapore</strong> Act 2001 (No. 3 <strong>of</strong> 2001) (the“Act”) and Statutory Board Financial <strong>Report</strong>ing Standards (“SB-FRS”), and for devising and maintaining asystem <strong>of</strong> internal accounting controls sufficient to provide reasonable assurance that assets are safeguardedagainst loss from unauthorised use or disposition; and transactions are properly authorised and that they arerecorded as necessary to permit the preparation <strong>of</strong> true and fair pr<strong>of</strong>it and loss account and balance sheet and tomaintain accountability <strong>of</strong> assets.Auditors’ ResponsibilityOur responsibility is to express an opinion on these financial statements based on our audit. We conducted ouraudit in accordance with <strong>Singapore</strong> Standards on Auditing. Those standards require that we comply with ethicalrequirements and plan and perform the audit to obtain reasonable assurance about whether the financial statementsare free from material misstatement.An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in thefinancial statements. The procedures selected depend on the auditor’s judgement, including the assessment <strong>of</strong> therisks <strong>of</strong> material misstatement <strong>of</strong> the financial statements, whether due to fraud or error. In making those riskassessments, the auditor considers internal control relevant to the entity’s preparation <strong>of</strong> the financial statementsthat gives a true and fair view in order to design audit procedures that are appropriate in the circumstances, but notfor the purpose <strong>of</strong> expressing an opinion on the effectiveness <strong>of</strong> the entity’s internal control. An audit alsoincludes evaluating the appropriateness <strong>of</strong> accounting policies used and the reasonableness <strong>of</strong> accountingestimates made by management, as well as evaluating the overall presentation <strong>of</strong> the financial statements. Webelieve that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our auditopinion.62

OpinionIn our opinion, the financial statements are properly drawn up in accordance with the provisions <strong>of</strong> the Actand SB-FRS so as to give a true and fair view <strong>of</strong> the state <strong>of</strong> affairs <strong>of</strong> the <strong>Office</strong> as at 31 March 20<strong>12</strong>, and <strong>of</strong>the results, changes in equity and cash flows <strong>of</strong> the <strong>Office</strong> for the financial year ended on that date.<strong>Report</strong> on Other Legal and Regulatory RequirementsIn our opinion, the accounting and other records required by the Act to be kept by the <strong>Office</strong> have beenproperly kept in accordance with the provisions <strong>of</strong> the Act.During the course <strong>of</strong> our audit, nothing came to our notice that caused us to believe that the receipt,expenditure, and investments <strong>of</strong> moneys and the acquisition and disposal <strong>of</strong> assets by the <strong>Office</strong> during thefinancial year have not been in accordance with the provisions <strong>of</strong> the Act.Audit AlliancePublic Accountants and Certified Public Accountants<strong>Singapore</strong>25 July 20<strong>12</strong>63

INTELLECTUAL PROPERTY OFFICE OF SINGAPORESTATEMENT OF COMPREHENSIVE INCOMEFor the financial year ended 31 March 20<strong>12</strong>Note 20<strong>12</strong> <strong>2011</strong>S$ S$Operating incomeRegistration fees 6 36,097,990 31,317,004Other fees and charges 428,637 1,055,75036,526,627 32,372,754Operating expenditureEmployee benefits expense 7 (16,363,377) (17,334,705)Maintenance <strong>of</strong> <strong>of</strong>fice premises and computers (5,319,234) (5,374,736)Rental <strong>of</strong> <strong>of</strong>fice premises (2,162,784) (2,163,3<strong>12</strong>)General and administrative expenses (3,007,290) (2,507,998)Depreciation expense 17 (1,578,655) (1,924,995)Operating surplus 8 8,095,287 3,067,008Non-operating incomeInvestment and interest income 9 424,760 391,414Surplus before grants and contribution toConsolidated Fund 8,520,047 3,458,422GrantsOperating grants 468,685 1,456,908Deferred capital grants amortised- Government 10 <strong>12</strong>5,864 137,167- Infocomm Development Authority <strong>of</strong> <strong>Singapore</strong> 11 - 17,991Surplus before contribution to Consolidated Fund 9,114,596 5,070,488Contribution to Consolidated Fund <strong>12</strong> (1,549,481) (861,983)Net surplus for the year 7,565,115 4,208,505Other comprehensive incomeReclassification to pr<strong>of</strong>it or loss from equity on disposal<strong>of</strong> available-for-sale investmentsil bl f l i- (420,224)Total comprehensive income for the year 7,565,115 3,788,281The accompanying notes form an integral part <strong>of</strong> these financial statements.Auditors’ <strong>Report</strong> – Page 62 & 63.64

INTELLECTUAL PROPERTY OFFICE OF SINGAPORESTATEMENT OF FINANCIAL POSITIONAs at March 31, 20<strong>12</strong>Note 20<strong>12</strong> <strong>2011</strong>S$ S$EquityShare capital 13 1,000 1,000Accumulated surplus 49,244,314 41,680,199Total equity 49,245,314 41,681,199Current assetsCash and cash equivalents 14 73,633,344 64,633,297Trade receivables 15 2,311,204 1,362,662Other receivables 16 523,290 668,348Grant receivable - 306,631Total current assets 76,467,838 66,970,938Non-current assetEquipment 17 3,911,215 3,543,928Total assets 80,379,053 70,514,866Current liabilitiesTrade payables 18 3,733,623 3,393,672Other payables 19 4,478,152 4,022,362Deferred revenue 2(o) 2,074,374 2,<strong>12</strong>7,439Grant received in advance 5,000 -Provision for contribution to Consolidated Fund <strong>12</strong> 1,549,481 861,983Patent deposits 2(j) 9,588,281 9,031,538Current portion <strong>of</strong> finance lease 23 106,292 138,547Deferred capital grants- Government 10 30,709 <strong>12</strong>5,864Total current liabilities 21,565,9<strong>12</strong> 19,701,405The accompanying notes form an integral part <strong>of</strong> these financial statements.Auditors’ <strong>Report</strong> – Page 62 & 63.65

INTELLECTUAL PROPERTY OFFICE OF SINGAPORESTATEMENT OF FINANCIAL POSITIONAs at March 31, 20<strong>12</strong>Non-current liabilitiesNote 20<strong>12</strong> <strong>2011</strong>S$ S$Deferred revenue 2(o) 9,483,740 8,911,174Finance lease 23 - 106,292Deferred capital grants- Government 10 84,087 114,796Total non-current liabilities 9,567,827 9,132,262Total liabilities 31,133,739 28,833,667Net assets <strong>of</strong> the <strong>Office</strong> 49,245,314 41,681,199Funds held on behalf <strong>of</strong> others 22 66,479 25,223Funds’ net assets held on behalf <strong>of</strong> others 22 (66,479) (25,223)- -The accompanying notes form an integral part <strong>of</strong> these financial statements.Auditors’ <strong>Report</strong> – Page 62 & 63.66

INTELLECTUAL PROPERTY OFFICE OF SINGAPORESTATEMENT OF CHANGES IN EQUITYFor the financial year ended 31 March 20<strong>12</strong>NoteShare Accumulated Fair valuecapital surplus reserve TotalS$ S$ S$ S$At 1 April 2010 1,000 37,721,694 420,224 38,142,918Total comprehensive incomefor the year - 4,208,505 (420,224) 3,788,281Dividends 20 - (250,000) - (250,000)At 31 March <strong>2011</strong> 1,000 41,680,199 - 41,681,199Total comprehensive incomefor the year - 7,565,115 - 7,565,115Dividends 20 - (1,000)-(1,000)At 31 March 20<strong>12</strong> 1,000 49,244,314 - 49,245,314The accompanying notes form an integral part <strong>of</strong> these financial statements.Auditors’ <strong>Report</strong> – Page 62 & 63.67

INTELLECTUAL PROPERTY OFFICE OF SINGAPORESTATEMENT OF CASH FLOWSFor the financial year ended 31 March 20<strong>12</strong>Operating activitiesNote 20<strong>12</strong> <strong>2011</strong>S$ S$Surplus before grants and contribution toConsolidated Fund 8,520,047 3,458,422Adjustments for:Depreciation expense 17 1,578,655 1,924,995Interest on finance lease 8 5,022 24,<strong>12</strong>1Interest income 9 (424,760) (361,201)Investment interest income 9 - (17,674)Investment dividend income 9 - (<strong>12</strong>,539)Gain on disposal <strong>of</strong> available-for-sale investments 8 - (383,874)Loss/(Gain) on disposal <strong>of</strong> equipment 31,245 (254)9,710,209 4,631,996Changes in working capital:Trade and other receivables (803,484) 147,645Trade and other payables 490,008 3,394,282Deferred revenue 519,501 449,860Patent deposits 556,743 346,070Cash from operations 10,472,977 8,969,853Interest received 424,760 180,475Investment interest income received - 78,169Investment dividend income received - <strong>12</strong>,539Contribution to Consolidated Fund (1,549,481) (904,490)Net cash from operating activities 9,348,256 8,336,546Investing activitiesPurchase <strong>of</strong> equipment (Note A) (1,042,399) (922,286)Proceeds on disposal <strong>of</strong> equipment 58,443 281Proceeds on disposal <strong>of</strong> available-for-sale investments - 8,286,821Increase in fixed deposits and cash with fund manager - -Net cash (used in)/from investing activities (983,956) 7,364,816The accompanying notes form an integral part <strong>of</strong> these financial statements.Auditors’ <strong>Report</strong> – Page 62 & 63.68

INTELLECTUAL PROPERTY OFFICE OF SINGAPORESTATEMENT OF CASH FLOWSFor the financial year ended 31 March 20<strong>12</strong>Financing activitiesNote 20<strong>12</strong> <strong>2011</strong>S$ S$Grants received 780,316 1,294,427Dividends paid 20 (1,000) (250,000)Repayment <strong>of</strong> finance lease obligations (143,569) (145,916)Net cash from financing activities 635,747 898,511Net increase in cash and cash equivalents 9,000,047 16,599,873Cash and cash equivalents at beginning <strong>of</strong> year 64,633,297 48,033,424Cash and cash equivalents at end <strong>of</strong> year 14 73,633,344 64,633,297Note AThe <strong>Office</strong> acquired equipment amounting to S$2,035,630(<strong>2011</strong>: S$1,177,791) <strong>of</strong> which S$57,876 (<strong>2011</strong>:S$238,671) was invoiced but unpaid, and S$935,355(<strong>2011</strong>: S$16,846) was accrued for. There were noassets acquired (<strong>2011</strong>: S$366,634) under finance lease arrangement as at the end <strong>of</strong> the current reportingperiod. Cash payment <strong>of</strong> S$1,042,399(<strong>2011</strong>: S$922,286) was made to purchase equipment during the year.The accompanying notes form an integral part <strong>of</strong> these financial statements.Auditors’ <strong>Report</strong> – Page 62 & 63.69

INTELLECTUAL PROPERTY OFFICE OF SINGAPORESTATEMENT OF CASH FLOWSFor the financial year ended 31 March 20<strong>12</strong>1 GeneralThe <strong>Intellectual</strong> <strong>Property</strong> <strong>Office</strong> <strong>of</strong> <strong>Singapore</strong> (the “<strong>Office</strong>”), <strong>of</strong>ficially established under the<strong>Intellectual</strong> <strong>Property</strong> <strong>Office</strong> <strong>of</strong> <strong>Singapore</strong> Act 2001 (No. 3 <strong>of</strong> 2001) on 1 April 2001, is domiciledin <strong>Singapore</strong>. The <strong>Office</strong>’s place <strong>of</strong> business is situated at 51 Bras Basah Road #04-01 ManulifeCentre, <strong>Singapore</strong> 189554.The principal activities <strong>of</strong> the <strong>Office</strong> are:(a)(b)(c)(d)(e)(f)(g)administering the systems <strong>of</strong> protection <strong>of</strong> intellectual property (“IP”) in <strong>Singapore</strong>;formulating and reviewing <strong>of</strong> IP rights policies and legislations;maintaining and disseminating <strong>of</strong> IP information and documents;representing the Government internationally on IP matters;nurturing and training <strong>of</strong> IP agents;co-operating with other organisations and IP <strong>of</strong>fices on IP programmes; andpromoting the awareness and effective use <strong>of</strong> IP rights.The financial statements <strong>of</strong> the <strong>Office</strong> for the year ended 31 March 20<strong>12</strong> were authorised for issueby the Board <strong>of</strong> Directors on 25 July 20<strong>12</strong>.2 Summary <strong>of</strong> Significant Accounting Policies(a) Basis <strong>of</strong> PreparationThe financial statements have been prepared in accordance with the historical cost basis exceptas disclosed in the accounting policies below, and are drawn up in accordance with theprovisions <strong>of</strong> the <strong>Intellectual</strong> <strong>Property</strong> <strong>Office</strong> <strong>of</strong> <strong>Singapore</strong> Act 2001 (No. 3 <strong>of</strong> 2001) andStatutory Board Financial <strong>Report</strong>ing Standards (“SB-FRS”). The SB-FRS include StatutoryBoard Financial <strong>Report</strong>ing Standards, Interpretations <strong>of</strong> SB-FRS and SB-FRS Guidance Notesas prescribed by the Accountant-General.The financial statements are presented in <strong>Singapore</strong> dollars which is the <strong>Office</strong>’s functionalcurrency.Interpretations and amendments to published accounting standards effective in <strong>2011</strong>/20<strong>12</strong>The following is the new and revised SB-FRSs and Interpretations <strong>of</strong> SB-FRS (“INT SB-FRS”)that is relevant to the <strong>Office</strong>:SB-FRS 24 (Revised)Related Party DisclosuresThe adoption <strong>of</strong> the above new/revised SB-FRSs and INT SB-FRSs does not result in changes tothe <strong>Office</strong>’s accounting policies during the financial period or any significant impact on thesefinancial statements.The accompanying notes form an integral part <strong>of</strong> these financial statements.Auditors’ <strong>Report</strong> – Page 62 & 63.70

INTELLECTUAL PROPERTY OFFICE OF SINGAPORESTATEMENT OF CASH FLOWSFor the financial year ended 31 March 20<strong>12</strong>2 Summary <strong>of</strong> Significant Accounting Policies (continued)(a) Basis <strong>of</strong> Preparation (continued)Future changes in Statutory Board Financial <strong>Report</strong>ing Standards (SB-FRS)At the date <strong>of</strong> authorisation <strong>of</strong> these financial statements, the following new SB-FRSs and amendmentsto SB-FRS that are relevant to the <strong>Office</strong> were issued but will be effective in future:SB-FRS No.SB-FRS 1TitleAmendments to SB-FRS 1- Presentation <strong>of</strong>Items <strong>of</strong> Other Comprehensive IncomeEffective Date forperiods beginning on orafter1 July 20<strong>12</strong>SB-FRS 19 Employee Benefits 1 January 2013The management anticipates that the adoption <strong>of</strong> the above SB-FRSs and amendments to SB-FRS infuture periods will not have a material impact on the financial statements <strong>of</strong> the <strong>Office</strong> in the period <strong>of</strong>their initial adoption.(b)Revenue RecognitionRevenue is measured at the fair value <strong>of</strong> the consideration received or receivable.(i) Registration feeRegistration fee is recognised when the registration service has been rendered. Revenue fromrenewal for trademark is recognised over the effective protection period <strong>of</strong> 10 years on a straightlinebasis.(ii) Other fees and chargesOther fees and charges comprise regulatory charges, conference and workshop service chargesand membership feesThese are recognised when the relevant services have been rendered.(iii) Interest incomeInterest income is recognised on an accrual basis by reference to the principal outstanding andat the effective interest rate applicable which is the rate that exactly discounts estimated futurecash receipts through the expected life <strong>of</strong> the financial asset to the net carrying amount(iv) Investment income from funds with fund managers, net <strong>of</strong> management feeInvestment income is recognised on an accrual basis.(v) Dividend incomeDividend income is recognised when the right to receive payment is established.The accompanying notes form an integral part <strong>of</strong> these financial statements.Auditors’ <strong>Report</strong> – Page 62 & 63.71

INTELLECTUAL PROPERTY OFFICE OF SINGAPORESTATEMENT OF CASH FLOWSFor the financial year ended 31 March 20<strong>12</strong>2 Summary <strong>of</strong> Significant Accounting Policies (continued)(c) Retirement Benefit CostsPayments to defined contribution retirement benefit plans are charged as an expense when employeeshave rendered the services entitling them to the contributions. Payments made to state-managedretirement benefit schemes, such as the <strong>Singapore</strong> Central Provident Fund, are dealt with as paymentsto defined contribution plans where the <strong>Office</strong>’s obligations under the plans are equivalent to thosearising in a defined contribution retirement benefit plan.(d) Employee Leaves EntitlementEmployee entitlements to annual leave are recognised when they accrue to employees. Aprovision is made for the estimated liability for annual leave as a result <strong>of</strong> services rendered byemployees up to the end <strong>of</strong> the reporting period.(e) Government GrantsGovernment grants relating to the purchase <strong>of</strong> equipment are included in the statement <strong>of</strong> financialposition as deferred capital grant accounts and are credited to pr<strong>of</strong>it or loss on a straight-line basisover the expected lives <strong>of</strong> the related assets. Government grants relating to expenditures which arenot capitalised are credited to pr<strong>of</strong>it or loss as and when the underlying expenses are included andtaken to pr<strong>of</strong>it or loss to match such related expenditure.(f)Funds Held on Behalf <strong>of</strong> OthersFunds held on behalf <strong>of</strong> others such as the Patent Agent Manpower Capability and DevelopmentFund (“PAMCDF”) are set up to account for monies held in trust for external parties.These funds are maintained separately from the <strong>Office</strong>’s financial statements.(g) Financial InstrumentsFinancial assets and financial liabilities are recognised on the <strong>Office</strong>’s statement <strong>of</strong> financialposition when the <strong>Office</strong> becomes a party to the contractual provisions <strong>of</strong> the instrument.Effective interest methodThe effective interest method is a method <strong>of</strong> calculating the amortised cost <strong>of</strong> a financialinstrument and <strong>of</strong> allocating interest income or expense over the relevant period. The effectiveinterest rate is the rate that exactly discounts estimated future cash receipts or payments (includingall fees paid or received that form an integral part <strong>of</strong> the effective interest rate, transaction costsand other premium discounts) through the expected life <strong>of</strong> the financial instrument, or whereappropriate, a shorter period. Income and expense is recognised on an effective interest basis fordebt instruments.Financial assetsFinancial assets comprise investments in equity and debt securities, trade and other receivables,grant receivables and cash and cash equivalents. They are initially measured at fair value plustransaction costs, except for those financial assets classified as at fair value through pr<strong>of</strong>it or losswhich are initially measured at fair value.The accompanying notes form an integral part <strong>of</strong> these financial statements.Auditors’ <strong>Report</strong> – Page 62 & 63.72