gayatri projects limited - Edelweiss

gayatri projects limited - Edelweiss

gayatri projects limited - Edelweiss

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

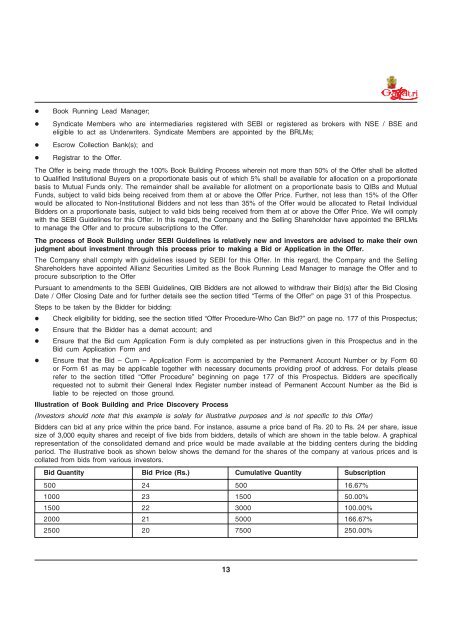

Book Running Lead Manager;Syndicate Members who are intermediaries registered with SEBI or registered as brokers with NSE / BSE andeligible to act as Underwriters. Syndicate Members are appointed by the BRLMs;Escrow Collection Bank(s); and Registrar to the Offer.The Offer is being made through the 100% Book Building Process wherein not more than 50% of the Offer shall be allottedto Qualified Institutional Buyers on a proportionate basis out of which 5% shall be available for allocation on a proportionatebasis to Mutual Funds only. The remainder shall be available for allotment on a proportionate basis to QIBs and MutualFunds, subject to valid bids being received from them at or above the Offer Price. Further, not less than 15% of the Offerwould be allocated to Non-Institutional Bidders and not less than 35% of the Offer would be allocated to Retail IndividualBidders on a proportionate basis, subject to valid bids being received from them at or above the Offer Price. We will complywith the SEBI Guidelines for this Offer. In this regard, the Company and the Selling Shareholder have appointed the BRLMsto manage the Offer and to procure subscriptions to the Offer.The process of Book Building under SEBI Guidelines is relatively new and investors are advised to make their ownjudgment about investment through this process prior to making a Bid or Application in the Offer.The Company shall comply with guidelines issued by SEBI for this Offer. In this regard, the Company and the SellingShareholders have appointed Allianz Securities Limited as the Book Running Lead Manager to manage the Offer and toprocure subscription to the OfferPursuant to amendments to the SEBI Guidelines, QIB Bidders are not allowed to withdraw their Bid(s) after the Bid ClosingDate / Offer Closing Date and for further details see the section titled “Terms of the Offer” on page 31 of this Prospectus.Steps to be taken by the Bidder for bidding: Check eligibility for bidding, see the section titled “Offer Procedure-Who Can Bid?” on page no. 177 of this Prospectus; Ensure that the Bidder has a demat account; and Ensure that the Bid cum Application Form is duly completed as per instructions given in this Prospectus and in theBid cum Application Form and Ensure that the Bid – Cum – Application Form is accompanied by the Permanent Account Number or by Form 60or Form 61 as may be applicable together with necessary documents providing proof of address. For details pleaserefer to the section titled “Offer Procedure” beginning on page 177 of this Prospectus. Bidders are specificallyrequested not to submit their General Index Register number instead of Permanent Account Number as the Bid isliable to be rejected on those ground.Illustration of Book Building and Price Discovery Process(Investors should note that this example is solely for illustrative purposes and is not specific to this Offer)Bidders can bid at any price within the price band. For instance, assume a price band of Rs. 20 to Rs. 24 per share, issuesize of 3,000 equity shares and receipt of five bids from bidders, details of which are shown in the table below. A graphicalrepresentation of the consolidated demand and price would be made available at the bidding centers during the biddingperiod. The illustrative book as shown below shows the demand for the shares of the company at various prices and iscollated from bids from various investors.Bid Quantity Bid Price (Rs.) Cumulative Quantity Subscription500 24 500 16.67%1000 23 1500 50.00%1500 22 3000 100.00%2000 21 5000 166.67%2500 20 7500 250.00%13