2012 Budget Summary - Chicago Park District

2012 Budget Summary - Chicago Park District

2012 Budget Summary - Chicago Park District

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

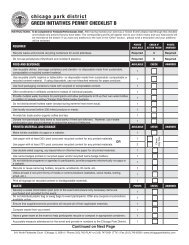

Detailed Expenses<strong>2012</strong> Operating <strong>Budget</strong> - Expenes (All Funds)$407,519,803Contractual Services3%Utilities6%Privatized, MgmtFees8%Other Expenses10%Aquarium, Museumand Zoo9%Operating <strong>Budget</strong> – ExpensesSalary & Wages32%Debt Service22%Other9%Withholding Taxes1%Health, Dental,Life Benefits5%Unemloyment, WorkersCompensation1%Pension3%PersonnelPersonnel costs represent 42% of total budgeted expenditures. The number of full-timepositions budgeted for <strong>2012</strong> is 1,528, a reduction of 13 full-time positions from 2011. Totalpersonnel costs are projected at $156 million, about 4% above the previous year’s budget,primarily due to increased healthcare expenditures and negotiated cost of living increases.Health, Dental, and Life InsuranceHealth, dental and life insurance expenses make up 4% of the <strong>District</strong>’s budget. Each year the<strong>District</strong> must absorb more of the escalating expense related to health benefits. In <strong>2012</strong> the<strong>District</strong> saw a less dramatic increase in healthcare costs. With continued efforts to emphasize ahealthy lifestyle to employees and better managed healthcare, the <strong>District</strong> has been able tostabilize benefit costs to a minimal increase of less than 1%.PensionEmployees are required by state statute to contribute 9% of their salary to the Pension Fund.The <strong>District</strong> appropriates funds to match employee contributions based upon the requirementsof the Illinois Compiled Statues. By law, the <strong>District</strong> is required to levy 110% of the contributionsmade by covered employees in the fiscal year two years prior to the year in which theapplicable tax is levied. In addition 0.039% of the PPRT funds are allocated to the Pension Fund.In <strong>2012</strong>, the <strong>District</strong> must levy $10.4 million in property taxes to the Pension. This is 3% lessthan the 2011 budget.51