2012 Budget Summary - Chicago Park District

2012 Budget Summary - Chicago Park District

2012 Budget Summary - Chicago Park District

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

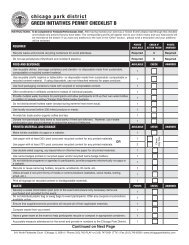

Basis of <strong>Budget</strong>ingBasis of <strong>Budget</strong>ingThe <strong>District</strong>’s annual budget is adopted on a non-GAAP (Generally Accepted AccountingPrinciples) budgetary basis for all governmental funds except the debt service funds, which atthe time of the issuance of bonds, shall provide for the levy of taxes, sufficient to pay theprincipal and interest upon said bonds as per State code, and capital project funds, whichadopts project-length budgets. The legal level of budgetary control (i.e., the level at whichexpenditures may not exceed appropriations) is at the fund and account class level.The <strong>District</strong>’s department heads may make transfers of appropriations within a department.Any transfers necessary to adjust the budget and implement park programs can be made by the<strong>District</strong>, as long as the changes do not require transfers between account classes (commongroupings of expenditures), and do not exceed the approved appropriation. Transfers ofappropriations between funds or account classes require the approval of the Board.All annual appropriations lapse at fiscal year-end if they remain unused and unencumbered.Encumbrance accounting is employed in governmental funds. Encumbrances (e.g., purchaseorders, contracts) outstanding at year-end are reported as reservations in fund balance and donot constitute expenditures or liabilities because the commitments will be carried forward andhonored during the subsequent year.As a rule, the <strong>District</strong> presents the annual budget on a modified accrual basis of accounting,with the exception of property taxes. <strong>Budget</strong>ary Basis refers to the basis of accounting used toestimate financing sources and uses in the budget.Modified Accrual is the method under which revenues and other financial resource incrementsare recognized when they become susceptible to accrual; that is, when they become both"measurable" and "available to finance expenditures of the cure period." "Available" meanscollectible in the current period or soon enough thereafter to be used to pay the liabilities ofthe current period. This is different than accrual basis where indicates revenues are recordedwhen they are earned (whether or not cash is received at the time) and expenditures arerecorded when goods and services are received (whether cash disbursements are made at thetime or not);The <strong>District</strong>’s basis of budgeting is the same as GAAP basis except for the following: 1) in thebudgetary basis, encumbrances are expenditures, whereas GAAP reflects encumbrances asreservations of fund balance; 2) for budget, the <strong>District</strong> classifies as revenues both long-termdebt proceeds and transfer-in, whereas GAAP classifies these as other financing sources; 3)interfund revenues and expenditures are included on the budgetary basis but are eliminated forGAAP, and 4) encumbrances are treated as expenditures in the year the encumbrance isestablished.33