2012 Budget Summary - Chicago Park District

2012 Budget Summary - Chicago Park District

2012 Budget Summary - Chicago Park District

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

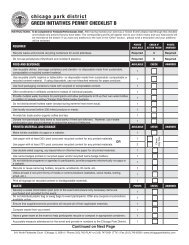

TreasuryThe Treasury Department is responsible for managing the <strong>District</strong>'s cash, investment and debtportfolios. The department monitors and adjusts the <strong>District</strong>'s cash and investment position to meetdaily liquidity needs while maximizing investment returns. An Investment Policy developed by thedepartment and adopted by the Board guides the types and duration of investment tools utilized tomanage the cash position of the <strong>District</strong>. Responsibilities for managing the debt portfolio includemaintaining record of and ensuring proper payment of all outstanding debt. Treasury also evaluatesbond transaction proposals and refunding structures in order to determine the most cost effectivemethod of financing a portion of the <strong>District</strong>'s capital needs as well as managing its long- term debtobligations.Department ExpendituresAccount 2010 Actual 2011 <strong>Budget</strong> <strong>2012</strong> <strong>Budget</strong>Personnel Services $ 373,816 $ 452,818 $ 457,488Materials & Supplies $ 11,184 $ 12,290 $ 11,755Small Tools & Equipment $ 2,156 $ 4,000 $ 2,500Contractual Services $ 1,081,168 $ 1,152,000 $ 1,426,200Total $ 1,468,324 $ 1,621,108 $ 1,897,943Personnel FTE 5 5.5 5$2,000,000$1,750,000$1,500,000$1,250,000$1,000,000$750,0002010 2011 <strong>2012</strong>2011 AccomplishmentsTreasury anticipates prior to year-end to issue an amount not to exceed $150 million in GeneralObligation Unlimited Tax Bonds (Harbor Facilities Revenues Alternate Revenue Source) for theconstruction of a new harbor and marina to be known as ‘31st Street Harbor’ and to reconfigure andupgrade the existing harbors. The <strong>District</strong> went through an extensive public process and soughtvarious approvals for the new harbor. Multiple steps have been taken to prepare for the bondissuance including obtaining a financial feasibility report of the <strong>District</strong>’s current harbor system andthe anticipated impact of the proposed harbor improvements, as well as presentations to inform the<strong>District</strong>’s Board, the various rating agencies and potential investors about the transaction.Continued to implement best practices during a volatile market by diversifying and selecting prudentinvestments to preserve and maintain the safety and principal of the <strong>District</strong>’s investment portfolio.In addition, Treasury prepared and issued a Request for Qualifications for Fund Managers tooptimize and maximize the <strong>District</strong>’s investment portfolio and expanded its’ list of approvedmunicipal depositories to provide additional investment options for the <strong>District</strong>.By strategically managing its’ cash flow, the <strong>District</strong> avoided, for the fifth straight year in a row,having to issue any short-term debt instruments thus saving approximately $2 million in annualinterest payments.<strong>2012</strong> GoalsContinue to evaluate financing and restructuring proposals to maximize capacity and savings in itsdebt portfolio due to limitations of the <strong>District</strong>’s Debt Service Extension Base (DSEB).Create a Debt Service Management Policy.Explore current technology solutions to improve and strengthen treasury management protocols.131