2012 Budget Summary - Chicago Park District

2012 Budget Summary - Chicago Park District

2012 Budget Summary - Chicago Park District

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

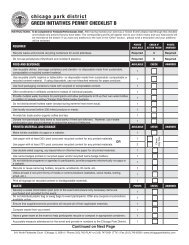

Millions<strong>2012</strong> <strong>Chicago</strong> <strong>Park</strong> <strong>District</strong> <strong>Budget</strong> <strong>Summary</strong>Major Revenue SourcesProperty TaxesThe most significant revenue source for the <strong>District</strong> is property tax. For <strong>2012</strong>, $259M is againavailable for the operating budget. Over the past five years, property tax revenue has typicallyrepresented between 55 - 65 percent of the total operating revenue.The property tax is determined by dividing the levy by the equalized assessed value (EAV) of thetaxable net property in the City of <strong>Chicago</strong>. There are a variety of restrictions on the tax levy. ByIllinois statute, the portion of the levy going to the Corporate Fund is limited to 66 cents per$100 of EAV. The portion going to the Aquarium and Museum Fund is limited to a maximum of15 cents per $100 of EAV; and 4 cents per $100 of EAV going to the Special RecreationPrograms Fund. The remaining 15 cents goes to corporate fund for general use.City Colleges,3.06%Cook County,8.58%Forest Preserve<strong>District</strong>, 1.03%MetropolitanWaterReclamation<strong>District</strong>, 5.56%<strong>Chicago</strong> <strong>Park</strong><strong>District</strong>, 6.47%Board ofEducation,52.34%City of <strong>Chicago</strong>,18.54%<strong>Chicago</strong> LibraryFund, 2.07%City of <strong>Chicago</strong>School Bldg &Improv Fund ,2.35%6yr Tax levy vs <strong>Budget</strong> Trend$394 $387 $393 $392 $398 $398$400$300$259.9 $259.9 $259.9 $259.9 $259.9 $259.9$200$100$02007 2008 2009 2010 2011 <strong>2012</strong><strong>Budget</strong>Property Tax Revenue11