OTIS European Breakdown Cover insurance policy - Online Travel ...

OTIS European Breakdown Cover insurance policy - Online Travel ...

OTIS European Breakdown Cover insurance policy - Online Travel ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

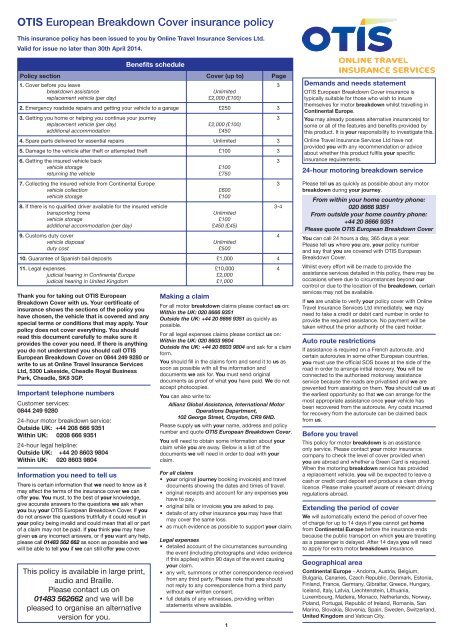

<strong>OTIS</strong> <strong>European</strong> <strong>Breakdown</strong> <strong>Cover</strong> <strong>insurance</strong> <strong>policy</strong>This <strong>insurance</strong> <strong>policy</strong> has been issued to you by <strong>Online</strong> <strong>Travel</strong> Insurance Services Ltd.Valid for issue no later than 30th April 2014.Benefits schedulePolicy section <strong>Cover</strong> (up to) Page1. <strong>Cover</strong> before you leavebreakdown assistancereplacement vehicle (per day)2. Emergency roadside repairs and getting your vehicle to a garage3. Getting you home or helping you continue your journeyreplacement vehicle (per day)additional accommodation4. Spare parts delivered for essential repairs5. Damage to the vehicle after theft or attempted theft6. Getting the insured vehicle backvehicle storagereturning the vehicle7. Collecting the insured vehicle from Continental Europevehicle collectionvehicle storage8. If there is no qualified driver available for the insured vehicletransporting homevehicle storageadditional accommodation (per day)9. Customs duty covervehicle disposalduty cost10. Guarantee of Spanish bail deposits11. Legal expensesjudicial hearing in Continental Europejudicial hearing in United KingdomThank you for taking out <strong>OTIS</strong> <strong>European</strong><strong>Breakdown</strong> <strong>Cover</strong> with us. Your certificate of<strong>insurance</strong> shows the sections of the <strong>policy</strong> youhave chosen, the vehicle that is covered and anyspecial terms or conditions that may apply. Your<strong>policy</strong> does not cover everything. You shouldread this document carefully to make sure itprovides the cover you need. If there is anythingyou do not understand you should call <strong>OTIS</strong><strong>European</strong> <strong>Breakdown</strong> <strong>Cover</strong> on 0844 249 9280 orwrite to us at <strong>Online</strong> <strong>Travel</strong> Insurance ServicesLtd, 5300 Lakeside, Cheadle Royal BusinessPark, Cheadle, SK8 3GP.Important telephone numbersCustomer services:0844 249 928024-hour motor breakdown service:Outside UK: +44 208 666 9351Within UK: 0208 666 935124-hour legal helpline:Outside UK: +44 20 8603 9804Within UK: 020 8603 9804Information you need to tell usThere is certain information that we need to know as itmay affect the terms of the <strong>insurance</strong> cover we canoffer you. You must, to the best of your knowledge,give accurate answers to the questions we ask whenyou buy your <strong>OTIS</strong> <strong>European</strong> <strong>Breakdown</strong> <strong>Cover</strong>. If youdo not answer the questions truthfully it could result inyour <strong>policy</strong> being invalid and could mean that all or partof a claim may not be paid. If you think you may havegiven us any incorrect answers, or if you want any help,please call 01483 562 662 as soon as possible and wewill be able to tell you if we can still offer you cover.This <strong>policy</strong> is available in large print,audio and Braille.Please contact us on01483 562662 and we will bepleased to organise an alternativeversion for you.Making a claimUnlimited£2,000 (£100)£250£2,000 (£100)£450Unlimited£100£100£750£600£100Unlimited£100£450 (£45)Unlimited£500£1,000£10,000£2,000£1,000133333333-4For all motor breakdown claims please contact us on:Within the UK: 020 8666 9351Outside the UK: +44 20 8666 9351 as quickly aspossible.For all legal expenses claims please contact us on:Within the UK: 020 8603 9804Outside the UK: +44 20 8603 9804 and ask for a claimform.You should fill in the claims form and send it to us assoon as possible with all the information anddocuments we ask for. You must send originaldocuments as proof of what you have paid. We do notaccept photocopies.You can also write to:Allianz Global Assistance, International MotorOperations Department,102 George Street, Croydon, CR9 6HD.Please supply us with your name, address and <strong>policy</strong>number and quote <strong>OTIS</strong> <strong>European</strong> <strong>Breakdown</strong> <strong>Cover</strong>.You will need to obtain some information about yourclaim while you are away. Below is a list of thedocuments we will need in order to deal with yourclaim.For all claims• your original journey booking invoice(s) and traveldocuments showing the dates and times of travel.• original receipts and account for any expenses youhave to pay.• original bills or invoices you are asked to pay.• details of any other <strong>insurance</strong> you may have thatmay cover the same loss.• as much evidence as possible to support your claim.Legal expenses• detailed account of the circumstances surroundingthe event (including photographs and video evidenceif this applies) within 90 days of the event causingyour claim.• any writ, summons or other correspondence receivedfrom any third party. Please note that you shouldnot reply to any correspondence from a third partywithout our written consent.• full details of any witnesses, providing writtenstatements where available.444Demands and needs statement<strong>OTIS</strong> <strong>European</strong> <strong>Breakdown</strong> <strong>Cover</strong> <strong>insurance</strong> istypically suitable for those who wish to insurethemselves for motor breakdown whilst travelling inContinental Europe.You may already possess alternative <strong>insurance</strong>(s) forsome or all of the features and benefits provided bythis product. It is your responsibility to investigate this.<strong>Online</strong> <strong>Travel</strong> Insurance Services Ltd have notprovided you with any recommendation or adviceabout whether this product fulfils your specific<strong>insurance</strong> requirements.24-hour motoring breakdown servicePlease tell us as quickly as possible about any motorbreakdown during your journey.From within your home country phone:020 8666 9351From outside your home country phone:+44 20 8666 9351Please quote <strong>OTIS</strong> <strong>European</strong> <strong>Breakdown</strong> <strong>Cover</strong>You can call 24 hours a day, 365 days a year.Please tell us where you are, your <strong>policy</strong> numberand say that you are covered with <strong>OTIS</strong> <strong>European</strong><strong>Breakdown</strong> <strong>Cover</strong>.Whilst every effort will be made to provide theassistance services detailed in this <strong>policy</strong>, there may beoccasions where due to circumstances beyond ourcontrol or due to the location of the breakdown, certainservices may not be available.If we are unable to verify your <strong>policy</strong> cover with <strong>Online</strong><strong>Travel</strong> Insurance Services Ltd immediately, we mayneed to take a credit or debit card number in order toprovide the required assistance. No payment will betaken without the prior authority of the card holder.Auto route restrictionsIf assistance is required on a French autoroute, andcertain autoroutes in some other <strong>European</strong> countries,you must use the official SOS boxes at the side of theroad in order to arrange initial recovery. You will beconnected to the authorised motorway assistanceservice because the roads are privatised and we areprevented from assisting on them. You should call us atthe earliest opportunity so that we can arrange for themost appropriate assistance once your vehicle hasbeen recovered from the autoroute. Any costs incurredfor recovery from the autoroute can be claimed backfrom us.Before you travelThis <strong>policy</strong> for motor breakdown is an assistanceonly service. Please contact your motor <strong>insurance</strong>company to check the level of cover provided whenyou are abroad and whether a Green Card is required.When the motoring breakdown service has provideda replacement vehicle, you will be expected to leave acash or credit card deposit and produce a clean drivinglicence. Please make yourself aware of relevant drivingregulations abroad.Extending the period of coverWe will automatically extend the period of cover freeof charge for up to 14 days if you cannot get homefrom Continental Europe before the <strong>insurance</strong> endsbecause the public transport on which you are travellingas a passenger is delayed. After 14 days you will needto apply for extra motor breakdown <strong>insurance</strong>.Geographical areaContinental Europe - Andorra, Austria, Belgium,Bulgaria, Canaries, Czech Republic, Denmark, Estonia,Finland, France, Germany, Gibraltar, Greece, Hungary,Iceland, Italy, Latvia, Liechtenstein, Lithuania,Luxembourg, Madeira, Monaco, Netherlands, Norway,Poland, Portugal, Republic of Ireland, Romania, SanMarino, Slovakia, Slovenia, Spain, Sweden, Switzerland,United Kingdom and Vatican City.

InsurerYour <strong>OTIS</strong> <strong>European</strong> <strong>Breakdown</strong> <strong>Cover</strong> is underwrittenby AGA International SA and is administered in theUnited Kingdom by Allianz Global Assistance.How your <strong>policy</strong> worksYour <strong>policy</strong> and certificate of <strong>insurance</strong> is a contractbetween you and us. We will pay for any claim youmake which is covered by this <strong>policy</strong> and happensduring the period of <strong>insurance</strong>. Unless specificallymentioned the benefits and exclusions within eachsection, apply to the insured vehicle. Your <strong>policy</strong> doesnot cover all possible events and expenses. Certainwords have special meanings as shown under theheading ‘definitions’. These words have beenhighlighted by the use of bold print throughout the<strong>policy</strong> document.Cancellation rightsIf your cover does not meet your requirements, pleasenotify <strong>Online</strong> <strong>Travel</strong> Insurance Services Ltd within 14days of receiving your certificate of <strong>insurance</strong> andreturn all your documents to them for a refund of yourpremium. If during this 14 day period you havetravelled, made a claim or intend to make a claim thenwe can recover all costs that you have used for thoseservices. Please note that your cancellation rights areno longer valid after this initial 14 day period.Renewal of your <strong>insurance</strong> coverIf you have annual multi-trip cover, <strong>Online</strong> <strong>Travel</strong>Insurance Services Ltd will send you a renewal noticeat least 21 days prior to the expiry of the period of<strong>insurance</strong> as shown on your certificate of <strong>insurance</strong>.We may vary the terms of your cover and the premiumrates at the renewal date.Financial Services CompensationScheme (FSCS)For your added protection, the insurer is covered bythe FSCS. You may be entitled to compensation fromthe scheme if the insurer cannot meet its obligations.This depends on the type of business and thecircumstances of the claim. Insurance providesprotection for 90% of the claim, with no upper limit.Further information about the compensation schemearrangements is available from the FSCS, telephonenumber 0800 678 1100 or 020 7741 4100 or by visitingtheir website at www.fscs.org.uk.Governing lawUnless agreed otherwise, English law will apply and allcommunications and documentation in relation to this<strong>policy</strong> will be in English. In the event of a disputeconcerning the <strong>policy</strong> the English courts shall haveexclusive jurisdiction.Data protectionInformation about your <strong>policy</strong> may be shared between<strong>Online</strong> <strong>Travel</strong> Insurance Services Ltd, Voyager InsuranceServices Ltd, us and the insurer for underwriting andadministration purposes. You should understand thatthe sensitive health and other information you providewill be used by us, our representatives, the insurer,other insurers and industry governing bodies andregulators to process your <strong>insurance</strong>, handle claimsand prevent fraud. This may involve transferringinformation to other countries (some of which mayhave limited or no data protection laws). We havetaken steps to ensure your information is held securely.Your information may be used by us, the insurer andmembers of The Allianz Global Assistance Group andshared with <strong>Online</strong> <strong>Travel</strong> Insurance Services Ltd andVoyager Insurance Services Ltd for marketing andresearch purposes, or to inform you from time to timeabout new products or services. If you do not want toreceive marketing information please write to us at 102George Street, Croydon, CR9 6HD. You have the rightto access your personal records.Contracts (Rights of Third Parties) Act1999We, the insurer and you do not intend any term of theagreement to be enforceable by any third party pursuantto the Contracts (Rights of Third Parties) Act 1999.DefinitionsThroughout this <strong>policy</strong> and certificate of <strong>insurance</strong>, thewords and phrases listed below have the meaningsgiven next to them and are printed in bold.Appointed adviser means any solicitor or appropriatelyqualified person, firm or company, including us,appointed to act for you, according to the terms of this<strong>policy</strong>.<strong>Breakdown</strong> means electrical or mechanicalbreakdown, road accident, damage or destruction byfire or attempted theft or loss of keys which means theinsured vehicle cannot be moved.Continental Europe means Andorra, Austria, Belgium,Bulgaria, Canaries, Czech Republic, Denmark, Estonia,Finland, France, Germany, Gibraltar, Greece, Hungary,Iceland, Italy, Latvia, Liechtenstein, Lithuania,Luxembourg, Madeira, Monaco, Netherlands, Norway,Poland, Portugal, Republic of Ireland, Romania, SanMarino, Slovakia, Slovenia, Spain, Sweden, Switzerland,United Kingdom and Vatican City.Home means the place you usually live in the UnitedKingdom.Insured event means;• your defence if you are prosecuted for a motoringoffence committed, or alleged to have beencommitted, by you arising solely in connection withthe use of the insured vehicle.• a claim brought by you for the pursuance of anuninsured loss claim against a negligent third partywhere you are involved in any road traffic accidentcausing;- death or bodily injury to you whilst in or getting into or out of the insured vehicle, and- damage to the insured vehicle.Insured vehicle means;The vehicle shown on the certificate of <strong>insurance</strong> mustbe:• a car, motorcycle over 150cc, motorised caravan,minibus, light van, estate car or 4x4 sport utilityvehicle registered in the United Kingdom. Towedcaravans or trailers are not covered unless agreed inwriting by us and the extra premium paid.• less than 10 years old at the date you buy the <strong>policy</strong>.• not more than 3,500kg in weight (including any load),7 metres long, 3 metres high and 2.3 metres wide.• not carrying more than the recommended number ofpassengers (maximum being 8 including the driver).• kept in a safe and roadworthy condition and servicedin accordance with the manufacturer’s specifications.Insurer means AGA International SA.Journey means a trip that takes place during theperiod of <strong>insurance</strong> which begins when you leavehome and ends when you get back home, whicheveris earlier.• you will only be covered if you are aged 80 or underat the date your <strong>policy</strong> was issued.• any other trip which begins after you get back is notcovered.• a trip which is booked to last longer than 90 days isnot covered.Legal action means work carried out to support aclaim that we have agreed to. This includes settlementnegotiations, hearings in a civil court, arbitration andany appeals resulting from such hearings other than anapplication by you;• to the <strong>European</strong> Court of Justice, <strong>European</strong> Court ofHuman Rights or similar international body, or• to enforce a judgment or legally binding decision.Legal costs means fees, costs and expenses (includingValue Added Tax or the equivalent local goods andservices tax) which we agree to pay for you inconnection with legal action. Also, any costs which youare ordered to pay by a court or arbitrator (other thandamages, fines and penalties) or any other costs weagree to pay.Period of <strong>insurance</strong> means the cover under section1 - cover before you leave begins 7 days before thebeginning of your journey (but not before your <strong>policy</strong>was issued) and ends at the beginning of your journey.The cover for all other sections starts at the beginningof your journey and finishes at the end of yourjourney.2All cover ends on the expiry date shown on yourcertificate of <strong>insurance</strong>, unless you cannot finish yourjourney due to a breakdown or theft covered by this<strong>policy</strong>. In these circumstances we will extend cover freeof charge until you can reasonably finish that journey.Relative means your mother (in-law), father (in-law),step parent (in-law), sister (in-law), brother (in-law),wife, husband, son (in-law), daughter (in-law), stepchild, foster child, grandparent, grandchild, uncle, aunt,nephew, niece, cousin, partner (including common lawand civil partnerships) or fiancé(e).Resident means a person who has their main home inthe United Kingdom and has not spent more than sixmonths abroad during the year before the <strong>policy</strong> wasissued.United Kingdom, UK means England, Scotland, Wales,Northern Ireland, the Channel Islands and the Isle ofMan.We, our and us means Mondial Assistance (UK) Limitedtrading as Allianz Global Assistance which administersthe <strong>insurance</strong> on behalf of the insurer.You, your and person(s) insured means any person inthe insured vehicle on the journey.

Section 1<strong>Cover</strong> before you leaveWhat each insured vehicle is covered forIn the event of a breakdown occurring to the insuredvehicle within 7 days of the start of your journey (butnot before the date your <strong>policy</strong> was issued) we will dothe following;AssistanceArrange assistance at your home or the roadside andrecovery to the nearest repairer (if required).Replacement vehicleWe will arrange and pay up to the amount shown in thebenefits schedule for a replacement vehicle if;• the insured vehicle cannot be repaired or recoveredprior to the start of your journey, or• the insured vehicle is stolen within 7 days of thestart of your journey (but not before the date your<strong>policy</strong> was issued) and not recovered or replacedprior to your journey.What each insured vehicle is not covered forUnder Assistancea. any repairs to the insured vehicle that are notdescribed in this section.b. any insured vehicle which has not been serviced tothe manufacturer’s recommendations and kept in asafe and roadworthy condition.c. any insured vehicle which has a recurring electricalor mechanical fault.d. any help or payment if the breakdown servicecannot reasonably get to your insured vehiclebecause of bad weather.e. the cost of essential spare parts or repair costs at agarage.Under Replacement vehiclea. the cost of any personal accident <strong>insurance</strong>.b. the cost of any fuel or oil used.Note• we will try to provide a vehicle of similar size to theinsured vehicle subject to availability. Unfortunatelymotorcycles, motor caravans, minibuses, tow bars,caravans and trailers cannot be provided.• if you have a replacement vehicle, you must meetthe requirements of the car hire company. Forexample, these could include your age, putting downcash or credit card deposits and having a cleanrelevant driving licence.Please refer to sections general exclusions,conditions and making a claim that also apply.Section 2Emergency roadside repairs and gettingyour vehicle to a garageWhat each insured vehicle is covered forIn the event of a breakdown occurring to the insuredvehicle during your journey we will arrange assistanceat the roadside and recovery to the nearest repairer (ifrequired) up to the amount shown in the benefitsschedule.What each insured vehicle is not covered fora. any repairs to the insured vehicle that are notdescribed in this section.b. any insured vehicle which has not been serviced tothe manufacturer’s recommendations and kept in asafe and roadworthy condition.c. any insured vehicle which has a recurring electricalor mechanical fault.d. any help or payment if the breakdown servicecannot reasonably get to your insured vehiclebecause of bad weather.e. the cost of essential spare parts or repair costs at agarage.Please refer to sections general exclusions,conditions and making a claim that also apply.Section 3Getting you home or helping youcontinue your journeyWhat each insured vehicle is covered forWe will help arrange and pay for the following if duringyour journey you cannot use the insured vehicle for atleast 8 hours because of theft or breakdown and itcannot be repaired or recovered within that time.Replacement vehicle or additional transport costsUp to the amount shown in the benefits schedule forthe cost of hiring a replacement vehicle or thereasonable additional transport costs to enable you to;• continue to your journey destination and back againto collect the insured vehicle after the repair hasbeen done, or• return to your home in the United Kingdom.Additional accommodationFor each person insured up to the amount shown in thebenefits schedule additional hotel or bed & breakfastaccommodation where the costs are more than whatyou would have had to pay if the insured vehicle didnot have a breakdown or had not been stolen.What each insured vehicle is not covered fora. any costs after the insured vehicle is available andcan be driven.b. the cost of any personal accident <strong>insurance</strong>.c. the cost of any fuel or oil used.d. any hotel or bed and breakfast arrangements if yourmain accommodation is a tent.d. any sundry expenses resulting from an incidentclaimed for under this section. For example telephoneor mobile phone calls, faxes, food and drink.e. any costs incurred (other than a replacement vehicle)if the insured vehicle has a breakdown, in theUnited Kingdom, on the outward journey toContinental Europe and you want to continue withyour journey.f. the cost of a replacement vehicle if you have alreadygot one under section 1 - cover before you leave.Note• we will try to provide a vehicle of similar size to theinsured vehicle subject to availability. Unfortunatelymotorcycles, motor caravans, minibuses, tow bars,caravans and trailers cannot be provided.• if you have a replacement vehicle, you must meetthe requirements of the car hire company. Forexample, these could include your age, putting downcash or credit card deposits and having a cleanrelevant driving licence.Please refer to sections general exclusions,conditions and making a claim that also apply.Section 4Spare parts delivered for essential repairWhat each insured vehicle is covered forWe will help arrange and pay to send the spare parts,including keys that are lost or stolen, to a specialistrepairer, if the insured vehicle has a breakdown inContinental Europe and the parts that are needed torepair the insured vehicle are not available locally.What each insured vehicle is not covered fora. any journey within the United Kingdom.b. the cost of repairs to the insured vehicle.c. the cost of the essential spare parts.d. the cost of sending spare parts if we have notarranged to take the insured vehicle to a specialistrepairer.Please refer to sections general exclusions,conditions and making a claim that also apply.Section 5Damage to the insured vehicle after theftor attempted theftWhat each insured vehicle is covered forWe will help arrange and pay up to the amount shownin the benefits schedule for the following if there isdamage to the insured vehicle caused by it beingstolen or someone trying to steal it or your personalpossessions, in Continental Europe;a. temporary emergency repairs, orb. replacing parts if they are stolen or someone tried tosteal them.What each insured vehicle is not covered fora. any help or payment where there is no evidence of aforced entry into the insured vehicle.b. any help or payment where you do not get a policereport within 24 hours of the event and send it to us.c. damage to paintwork or other accessories.Please refer to sections general exclusions,conditions and making a claim that also apply.3Section 6Getting the insured vehicle backWhat each insured vehicle is covered forWe will help arrange and pay for the following if theinsured vehicle has a breakdown or it is stolen.Storage costsThe cost of any storage charges up to the amountshown in the benefits schedule for the insured vehiclebefore it is brought back to the United Kingdom.Returning the insured vehicleThe cost of getting the insured vehicle to your homeor a repairer in the United Kingdom up to the amountshown in the benefits schedule.We will provide this cover if any of the followingapply;• Local repairs cannot be done.• Local repairs can be done in less than 5 days, butnot before the date you are due to return to theUnited Kingdom.• Your vehicle is stolen and not found until after thedate you are due to return to the United Kingdom.What each insured vehicle is not covered fora. costs which are more than the vehicle’s market valuein the United Kingdom.b. theft of your personal possessions left in or on theinsured vehicle when it is being brought back to theUnited Kingdom.Please refer to sections general exclusions,conditions and making a claim that also apply.Section 7Collecting the insured vehicle fromContinental EuropeWhat each insured vehicle is covered forWe will help arrange and pay for the following;Vehicle collectionThe reasonable cost of travel for one person to travel toand from the United Kingdom to collect the insuredvehicle up to the amount shown in the benefitsschedule.Vehicle storageThe cost of storing the insured vehicle for a reasonabletime before and after the repair has been done up to theamount shown in the benefits schedule.We will provide this cover if either of the followingapply;• the repairs, following a breakdown, can be donewithin 5 days but not before you are due to return tothe United Kingdom, or• the insured vehicle was stolen and is only foundafter your return to the United Kingdom and can bedriven legally and is mechanically safe.What each insured vehicle is not covered fora. any journey within the United Kingdom.b. the cost of <strong>insurance</strong> to cover collecting theinsured vehicle.c. you will still be covered under this motor breakdown<strong>insurance</strong> <strong>policy</strong> when the insured vehicle iscollected before the end of your journey as shownon your journey confirmation.Please refer to sections general exclusions,conditions and making a claim that also apply.Section 8If there is no qualified driver available forthe insured vehicleWhat each insured vehicle is covered forWe will help arrange and pay for the following.Vehicle storageUp to the amount shown in the benefits schedule intotal for the cost of storing the insured vehicle before itis brought back to the United Kingdom.Transporting homeThe reasonable extra costs of transporting the insuredvehicle and your personal possessions to your home.

Additional accommodationFor each person insured up to the amount shown inthe benefits schedule for extra hotel or bed & breakfastaccommodation where the costs are more than youwould have paid if there had been a qualified driver, butonly until the insured vehicle can be transported.We will provide this cover if either of the followingapply;• because of death, serious injury or serious illnessthere is no suitable person to drive the insuredvehicle, or• the only qualified driver has to return urgently to theUnited Kingdom because of the death, seriousinjury or serious illness of the driver’s relativeor close business associate living in the UnitedKingdom. There must not be time for the qualifieddriver to return with the insured vehicle.What each insured vehicle is not covered fora. any journey within the United Kingdom.b. costs if medical evidence of death, injury or illnesswas not given to us before the arrangements weremade.c. any transport not arranged by us. (Normally weprovide a qualified driver to drive the insured vehicleback to the United Kingdom).d. costs which are more than the vehicle’s market valuein the United Kingdom.e. any hotel or bed & breakfast arrangements if yourmain accommodation is a tent.Please refer to sections general exclusions,conditions and making a claim that also apply.Section 9Customs duty coverWhat each insured vehicle is covered forWe will help arrange and pay for the following.Vehicle disposalWe will help deal with the customs requirements todispose of the insured vehicle if it has a breakdown orit is stolen outside the UK during your journey and it isbeyond economical repair.Duty costWe will pay up to the amount shown in the benefitsschedule for the duty cost you have to pay becauseyou unintentionally fail to;• take the insured vehicle permanently out of acountry in Continental Europe within the set timeafter it is imported, or• follow the import conditions which allow yourinsured vehicle to be imported from ContinentalEurope for a set time without paying duty.Please refer to sections general exclusions,conditions and making a claim that also apply.Section 10Guarantee of Spanish bail depositsWhat each insured vehicle is covered forWe will help arrange and pay up to the amount shownin the benefits schedule for a guarantee or deposit forbail which the Spanish Authorities may ask for to avoidthe insured vehicle or driver being held because of anaccident involving the insured vehicle. If you lose theguarantee or deposit in any legal action against you,you must repay the money to us immediately.Please refer to sections general exclusions,conditions and making a claim that also apply.Section 11Legal expensesYou can call our 24-hour legal helpline 365 days a yearfor advice on any motor related legal problem to do withyour journey, arising under the law of England, Wales,Scotland and Northern Ireland.Within the UK020 8603 9804 OR textphone 020 8666 9562.Outside the UK+44 208 603 9804 OR textphone +44 208 666 9562.What each insured person is covered forLegal costsWe will pay up to the amount shown in the benefitsschedule for legal costs for legal action if an insuredevent occurs during your journey.Judicial HearingIf it is necessary for you to attend a judicial hearing foran offence, or alleged offence, covered under this<strong>policy</strong>, we will pay for reasonable travel costs (but notboard and lodging) for you to attend such a hearing upto the amounts shown in the benefits schedule.Special conditions to this section• you must conduct your claim in the way requestedby the appointed adviser.• you must keep us and the appointed adviser fullyaware of all facts and correspondence including anyclaim settlement offers made to you.• we will not be bound by any promises orundertakings which you give to the appointedadviser, or which you give to any person aboutpayment of fees or expenses, without our consent.• we can withdraw cover after we have agreed to theclaim, if we think a reasonable settlement is unlikelyor that the cost of the legal action could be morethan the settlement.• you must make every effort to assist us and yourappointed adviser in recovering our outlay.What each insured vehicle is not covered forAny claim;• not reported to us within 90 days after the eventgiving rise to the claim.• for uninsured loss recovery where we think areasonable settlement is unlikely or where the cost ofthe legal action could be more than the settlement.• where another insurer or service provider hasrefused your claim or where there is a shortfall in thecover they provide.• where you have been charged with solvent abuse,alcohol or drugs related offences or dangerous driving.• arising from parking or fixed penalty offencescommitted, or alleged to have been committed, byyou.• for an insured event occurring while the insuredvehicle is being;i. used for any purpose not permitted by the effectivecertificate of motor <strong>insurance</strong>.ii. driven by any person not described in the effectivecertificate of motor <strong>insurance</strong> as a person entitled todrive or any person not insured by this <strong>policy</strong>.iii. driven by a person insured who does not have avalid driving licence to drive the insured vehicle orwho has been disqualified from holding or obtainingsuch a licence.• against us, the insurer, another person insured orour agent.• for an application by you;i. to the <strong>European</strong> Court of Justice, <strong>European</strong> Courtof Human Rights or similar international body, orii. to enforce a judgment or legally binding decision.Legal costs• for legal action that we have not agreed to.• incurred before we agreed to support the legal action.• if you refuse reasonable settlement of your claim.• if you withdraw from a claim without our agreement.If this occurs legal costs that we have paid must berepaid to us and all legal costs will become yourresponsibility.• that cannot be recovered by us, you, or yourappointed adviser when you receive anycompensation. Any repayment will not be more thanhalf of the compensation you receive.• awarded as a personal penalty against you or theappointed adviser (for example not complying withcourt rules and protocols).• for legal action in more than one country for thesame insured event.• for legal action if your affairs are in the hands of anyinsolvency practitioner.Note• if you have a replacement vehicle from us while theinsured vehicle is unavailable as a result of abreakdown covered by this <strong>policy</strong> it will, for thepurposes of this section only, be treated as theinsured vehicle.• we will nominate an appointed adviser to act foryou. If you and we cannot agree on an appointedadviser, the matter can be referred to an alternativeresolution facility.• where there is a dispute between you and usregarding the administration of this section thematter may be referred to an alternative resolutionfacility such as mediation.Please refer to sections general exclusions,conditions and making a claim that also apply.4General exclusions1. we will not cover you for any loss, injury, damage,illness, death or legal liability caused by thefollowing;a. war, invasion, act of foreign enemy, hostilities(whether war is declared or not), civil war, civilcommotion, rebellion, revolution, insurrection,military force, coup d’etat, terrorism, weapons ofmass destruction.b. your property being held, taken, destroyed ordamaged under the order of any government orcustoms officials (except where cover is given undersection 10 - guarantee of Spanish bail deposits).c. you not answering accurately any question(s) wehave asked you at the time of buying this <strong>policy</strong>,where your answer(s) may have affected ourdecision to provide you with this <strong>policy</strong>.d. ionising radiation or radioactive contaminationfrom nuclear fuel or nuclear waste or any risk fromnuclear equipment.e. any currency exchange rate changes.f. the failure or fear of failure or inability of anyequipment or any computer program, whether ornot you own it, to recognise or to correctly interpretor process any date as the true or correct date, or tocontinue to function correctly beyond that date.g. any epidemic or pandemic.2. any loss caused as a direct or indirect result ofanything you are claiming for (unless it saysdifferently in the <strong>policy</strong>).3. we will not provide cover for any goods, services,advice or arrangements supplied, given or made byus, any insurer providing cover which forms part ofthis <strong>policy</strong>, or any agent acting for them. This doesnot affect your legal rights.4. we will not pay for the following;a. anything caused by the insured vehicle beingused for;i. carrying goods or materials, orii. hire or reward, oriii. motor racing, rallies, speed or other tests.b. anything caused by you;i. causing damage or injury on purpose, orii. breaking the law, oriii. deliberately putting yourself at risk (unless youwere trying to save another person’s life), oriv. being under the influence of alcohol or drugs(other than those prescribed by a registered doctorbut not when prescribed for the treatment of drugaddiction), orv. not following the laws of the country or its localauthorities.

General conditionsWe will act in good faith in all our dealings with you.We will only pay your claim if you meet the followingconditions.1. you are a resident of the United Kingdom.2. you take reasonable care to protect your insuredvehicle against breakdown or theft and yourselfand your property against accident, injury, loss anddamage.3. you have a valid <strong>policy</strong> number.4. you write to us as soon as possible with full detailsof anything which may result in a claim.5. you send us every writ, summons or othercommunication to do with a claim as soon as youget it.6. you give us all the information and documents weneed (including details of your household or motor<strong>insurance</strong> and other information asked for under the‘making a claim’ section). You must do this at yourown expense.7. you do not admit liability or offer to pay any claimunless you have our written permission.8. you accept that we will not extend the period ofcover for a journey if the original <strong>policy</strong> plus anyextensions have either ended, been in force for morethan 12 months or you know you will be making aclaim.9. you accept that no alterations to the terms andconditions of the <strong>policy</strong> apply unless we confirmthem in writing to you.10.you must contact our motoring breakdown servicewhen the insured vehicle has a breakdown or it isstolen. We will not provide cover if we have notauthorised it.11.you must get our authorisation for service costs atthe time the insured vehicle has a breakdown or itis stolen. This must be organised by us and carriedout according to our instructions.12.you must keep the insured vehicle in a safe androadworthy condition.13.you must do everything necessary to get therepairs to the insured vehicle carried out quickly.14.you must not abandon the insured vehicleor any parts to be dealt with by us.15.you must tell the police, as soon as reasonablypossible but within 24 hours, of loss or damagecaused by theft. (You also have to tell the police ifyou are involved in a road accident.)16.you must tell us immediately of any extra orreplacement car you want to have insured. If youdo not tell us and an incident happens with the carconcerned, this will make the <strong>policy</strong> invalid.We have the right to do the following;1. Cancel the <strong>policy</strong> and make no payment if you makea fraudulent claim.2. Cancel the <strong>policy</strong> and make no payment if theappropriate premium is not paid to <strong>Online</strong> <strong>Travel</strong>Insurance Services Ltd.3. Take over and deal with, in your name, any claim youmake under this <strong>policy</strong>.4. Take legal action in your name (but at our expense)to recover any payment we have made under this<strong>policy</strong>.5. Cancel the cover given on this <strong>policy</strong> for a journeywithout refunding your premium if you cancel or cutshort that journey.6. Only refund or transfer your premium, if you decidethat the <strong>policy</strong> does not meet your needs and youhave contacted us within 14 days from the date youreceive your certificate of <strong>insurance</strong>. We are entitledto recover all costs that you have used if you havetravelled, made a claim or intend to make a claim.7. Pay any claim on this <strong>policy</strong> under the law of thecountry you usually live in within the UnitedKingdom.8. Not to provide help if the insured vehicle has anelectrical or mechanical fault which keeps happeningor has not been serviced to the manufacturer’srecommendations and kept in a safe and roadworthycondition.9. Decide on the best way of dealing with your callfor help. We will take account of your own wisheswhenever possible as well as the conditions andrules in force in the country where you need help.10.Not pay for any event which is covered by another<strong>insurance</strong> <strong>policy</strong> or any motoring organisation’sservice.Complaints procedureIt is the intention to give you the best possible servicebut if you do have any questions or concerns about this<strong>insurance</strong> or the handling of a claim you should followthe complaints procedure below.Complaints regarding:A. The sale of your <strong>policy</strong>, please contact;Voyager Insurance Services Ltd,13-21 High StreetGuildfordSurrey, GU1 3DGTel: 01483 562662Fax: 01483 569676Email: enquiries@voyagerins.comComplaints regarding:B. Your claim, please contact:Customer Support,Allianz Global Assistance,102 George Street,Croydon, CR9 6HDTelephone: 020 8603 9853Email: customersupport@allianz-assistance.co.ukIn all correspondence please quote <strong>OTIS</strong> <strong>European</strong><strong>Breakdown</strong> <strong>Cover</strong>.If you are still not satisfied, you have the right to askthe Financial Ombudsman Service to review your case.This will not affect your right to take action against us.The address is:Financial Ombudsman Service,South Quay Plaza,183 Marsh Wall,London, E14 9SRTel: 0300 123 9123 or 0800 023 4567Fax: 0207 964 1001Email: complaint.info@financial-ombudsman.org.ukThe FOS is an independent body that arbitrates oncomplaints about general <strong>insurance</strong> products. It willonly consider complaints after we have provided youwith written confirmation that our internal complaintsprocedure has been exhausted. Please alwaysquote your <strong>insurance</strong> reference and claim numberand enclose copies of relevant documentation. Thisprocedure is intended to provide you with prompt andpractical assistance in dealing with any complaints butdoes not affect your legal rights.Your statutory rights are not affected if you do notfollow the complaints procedure above. For furtherinformation about your statutory rights contact yourlocal authority, Trading Standards Service or CitizensAdvice Bureau.<strong>Online</strong> <strong>Travel</strong> Insurance Services Ltd. Registered office,30 City Road, London, EC1Y 2AB.Registered in England No. 05833635.This <strong>insurance</strong> is sold by <strong>Online</strong> <strong>Travel</strong> InsuranceServices Ltd and arranged by Voyager InsuranceServices Ltd, Correspondence address: 13-21 HighStreet, Guildford, Surrey, GU1 3DG.Registered number: 325842. Registered office BuzzardsHall, Friars Street, Sudbury, Suffolk, CO12 2AA.<strong>OTIS</strong> <strong>European</strong> <strong>Breakdown</strong> <strong>Cover</strong> is underwritten byAGA International SA and is administered in the UK byAllianz Global Assistance. Allianz Global Assistanceis a trading name of Mondial Assistance (UK) Limited,Registered in England No 1710361 .Registered Office: 102 George Street, Croydon CR96HD.Mondial Assistance (UK) Limited, Voyager InsuranceServices Ltd and <strong>Online</strong> <strong>Travel</strong> Insurance Services Ltdare authorised and regulated by the Financial ConductAuthority (FCA).AGA International SA is authorised by Autorité deContrôle Prudentiel in France and authorised andsubject to limited regulation by the Financial ConductAuthority. Details about the extent of our authorisationand regulation by the Financial Conduct Authority areavailable from us on request.Allianz Global Assistance acts as an agent for AGAInternational SA for the receipt of customer money,settling claims and handling premium refunds.Voyager Insurance Services Ltd acts as an agent forAGA International SA for the receipt of customer moneyand handling premium refunds.5