A. Qasem & Co. - Islami Bank Bangladesh Limited

A. Qasem & Co. - Islami Bank Bangladesh Limited

A. Qasem & Co. - Islami Bank Bangladesh Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

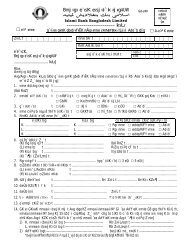

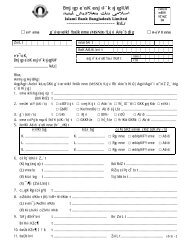

*Since 1953*A. <strong>Qasem</strong> & <strong>Co</strong>.Chartered Accountants04.09.1995, BRPD Circular No.16 dated 06.12.1998, BRPD Circular No. 09 dated 18.06.2002and BRPD Circular No. 05 dated 05.06.2006.The Provision rates are given below:ClassifiedParticulars UC SMA SS DF BLSmall Enterprise Financing 1% 5% 20% 50% 100%<strong>Co</strong>nsumer Investment for House Building& Professional2% 5% 20% 50% 100%Other than House Building & 5% 5% 20% 50% 100%ProfessionalAll Other 1% 5% 20% 50% 100%Off Balance Sheet Items 1%Investment to Stock Dealers & Stock Broker 2%3.9 Sharing of Investment IncomeIn case of Investment, Mudaraba fund gets preference over cost free fund. The investmentincome earned through deployment of Mudaraba Fund is shared by the <strong>Bank</strong> and the MudarabaDepositors at the pre-determined ratio fixed by the <strong>Bank</strong>.3.10 Profit/ Rent/ <strong>Co</strong>mpensation Suspense Account and Irregular IncomeProfit/Rent/<strong>Co</strong>mpensation accrued on Special Mentioned Account and Classified Investments aresuspended and accounted for as per Circulars issued by the <strong>Bangladesh</strong> <strong>Bank</strong> in this regard fromtime to time.Moreover, Income which is irregular (doubtful) as per Shari’ah is not included in the distributableincome of the <strong>Bank</strong>. <strong>Bank</strong> charges compensation on overdue Bai-Murabaha and Bai-Muazzalinvestments.Such compensation is not permissible as per Shari’ah to take into regular income of the <strong>Bank</strong>.Therefore, the total amount of doubtful Income and <strong>Co</strong>mpensation are temporarily used to makeprovision for bad and doubtful investments. However, realized amount of Doubtful Income and<strong>Co</strong>mpensation are transferred/utilised for charitable purposes after deduction of applicable IncomeTax.Interest received from the balances held with Foreign <strong>Bank</strong>s abroad and from Foreign CurrencyClearing Account with <strong>Bangladesh</strong> <strong>Bank</strong> are also not credited to regular income, since it is notpermissible as per Shari’ah. These are transferred/utilised for charitable purposes as per decisionof the Board of Directors after payment of Income Tax thereon.3.11 Profit Paid on Deposits (PPD)As per Mudaraba principle of <strong>Islami</strong>c Shari’ah as well as agreement between the MudarabaDepositors and the <strong>Bank</strong>, the Mudaraba Depositors are entitled to get minimum 65% of theInvestment Income earned through deployment of Mudaraba Fund as per weightage assigned toeach type of Mudaraba Deposit. In the year 2010, IBBL paid 67.00% of Investment Incomeearned through deployment of Mudaraba Fund. Moreover, in some Mudaraba Deposits, additionalrate was allowed over the rate arrived as per weightage. Mudaraba Depositors do not share anyincome derived from various banking services where the use of fund is not involved and anyincome derived from Investing <strong>Bank</strong>’s Equity and other <strong>Co</strong>st Free Fund. Al-Wadeeah Depositors donot share any income of the <strong>Bank</strong>.Profit is paid/provided to Mudaraba Deposit accounts at provisional rate on half yearly/anniversary basis considering overall growth, performance and profitability of the <strong>Bank</strong> during theyear. Final Rates of profit of any accounting year are declared after finalization of ShariahInspection and certifying the Investment Income of the <strong>Bank</strong> by the Statutory Auditors.17