A. Qasem & Co. - Islami Bank Bangladesh Limited

A. Qasem & Co. - Islami Bank Bangladesh Limited

A. Qasem & Co. - Islami Bank Bangladesh Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

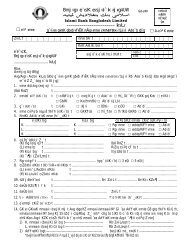

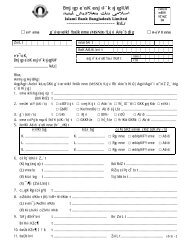

*Since 1953*A. <strong>Qasem</strong> & <strong>Co</strong>.Chartered Accountants6.5.1 Investment (Credit) Risk ManagementInvestment (Credit) risk is one of the major risk faced by the <strong>Bank</strong>. This can be described aspotential loss arising from the failure of counter party to perform as contractual agreement withthe <strong>Bank</strong>. The failure may result from unwillingness of the counter party or decline in his / herfinancial condition. Therefore, <strong>Bank</strong>’s Investment (Credit) risk management activities have beendesigned to address all these issues.6.5.2 Foreign Exchange Risk ManagementForeign Exchange risk is defined as the potential change in earnings arising due to change inmarket price. The foreign exchange risk of the <strong>Bank</strong> is minimized through proper market analysis,real time pricing of Foreign Exchange and money market product, fixation of different marketrelated risk limits (Daylight, Overnight, Stop loss and Management action trigger) & counterparties credit limits by the Management and ensure adherence of the limits by the Treasury FrontOffice (Dealing Room).Treasury Front Office (Dealing Room) independently performs the deals and the Treasury BackOffice is responsible for verification of the deals and passing of their entries in the books ofaccounts. All foreign exchange transactions are revalued at weighted average exchange rate asprovided by <strong>Bangladesh</strong> <strong>Bank</strong> at the end of each month. All Nostro accounts are reconciled on amonthly basis and outstanding beyond 30 days is reviewed by the Management for itssettlements/ reconciliation.6.5.3 Asset Liability ManagementThe Asset Liability <strong>Co</strong>mmittee (ALCO) of the <strong>Bank</strong> monitors Balance Sheet risk and liquidity risks ofthe <strong>Bank</strong>. The Balance Sheet risk is defined as potential change in earnings due to change in rateof profit, foreign exchange rates which are not trading nature. Asset Liability <strong>Co</strong>mmittee (ALCO)reviews liquidity requirement of the bank, the maturity of assets and liabilities, deposit andinvestment pricing strategy/transfer of pricing, sensitivity of Assets and Liabilities, Managementindicators/ratios and the liquidity contingency plan. The primary objective of the ALCO is tomonitor and avert significant volatility in Net Investment Income (NII), investment value andexchange earnings.6.5.4 Prevention of Money LaunderingAnti Money Laundering risk is defined as the loss of reputation and expenses incurred as penaltyfor being negligent in prevention of money laundering. For mitigating risks the <strong>Bank</strong> has formed05(five) members Central <strong>Co</strong>mpliance Unit (CCU) under the leadership of the Chief Anti MoneyLaundering <strong>Co</strong>mpliance Officer (CAMLCO) at Anti Money Laundering Department, Branches <strong>Co</strong>ntrolDepartment (BCD), Head Office. Anti Money Laundering compliance units are also functioning atZonal Offices and Branches, who independently review the transactions of the accounts to verifySuspicious Transaction Reports (STRs). A Manual for prevention of money laundering wasdeveloped and approved by the Board of Directors. IBBL has introduced (a) 13 (thirteen) numbersof Uniform Account Opening Form (AOF), (b) Know Your Customer (KYC) Profile and (c)Transaction Profile (TP) in the <strong>Bank</strong> as per instructions of <strong>Bangladesh</strong> <strong>Bank</strong>. IBBL had alreadyissued 61 (Sixty One) circulars providing with necessary instructions for Prevention of MoneyLaundering activities and also for combating of Financial Terrorism.Moreover, IBBL had conducted lot of training sessions/workshops to create awareness anddevelopment of the skill of the officials for identifying Suspicious Transactions. IBBL introduced aPolicy Guideline to combat terrorist financing in the light of Anti Terrorism Act, 2009 coupled withthe Anti Money Laundering Act, 2009 approved by the Board of Directors of the <strong>Bank</strong>.IBBL has exclusively completed the KYC procedures of Legacy Accounts (accounts opened before30 April 2002). To establish fruitful Anti Money Laundering drive at branch level, IBBL introduced26