A Guide to completing the Customs Single Administrative Document ...

A Guide to completing the Customs Single Administrative Document ...

A Guide to completing the Customs Single Administrative Document ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

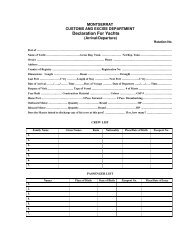

CUSTOMS & EXCISE DEPARTMENTMONTSERRATINFORMATION NOTICE NO 3A guide <strong>to</strong> <strong>completing</strong> <strong>the</strong> Cus<strong>to</strong>ms <strong>Single</strong> <strong>Administrative</strong> <strong>Document</strong>for importsA) INTRODUCTIONThis notice provides guidance on <strong>the</strong> completion of <strong>the</strong> Montserrat Cus<strong>to</strong>ms <strong>Single</strong><strong>Administrative</strong> <strong>Document</strong> or SAD. It is one of a series of information notices oncurrent Cus<strong>to</strong>ms procedures. However, <strong>the</strong> Cus<strong>to</strong>ms & Excise Department isconstantly seeking <strong>to</strong> improve its services and <strong>the</strong>refore reserve <strong>the</strong> right <strong>to</strong> changeprocedures at any time. The notice is intended as a guide and does not provide anylegal entitlement <strong>to</strong> any of <strong>the</strong> services outlined in it. The information, procedures andrequirements here may be changed without notice.B) WHAT IS THE SAD?The SAD is <strong>the</strong> form approved for use in Montserrat as <strong>the</strong> legal, written Cus<strong>to</strong>msdeclaration for all imports in<strong>to</strong> Montserrat under <strong>the</strong> Cus<strong>to</strong>ms Control andManagement Act 1994. It is <strong>the</strong> Cus<strong>to</strong>ms import declaration form (often referred <strong>to</strong> asa Cus<strong>to</strong>ms entry) in use in all OECS member states as well as many o<strong>the</strong>r Cus<strong>to</strong>msadministrations regionally and worldwide.It was introduced in 1990 as part of an OECS initiative <strong>to</strong> modernise <strong>the</strong> collection ofrevenue and trade statistical data and enables Cus<strong>to</strong>ms Departments in <strong>the</strong> memberstates <strong>to</strong> use a computer system known as ASYCUDA (Au<strong>to</strong>mated SYstem forCUs<strong>to</strong>ms DAta). The information provided in this Information Notice is based in par<strong>to</strong>n earlier guidance provided by <strong>the</strong> OECS ASYCUDA implementation team.C) WHEN IS A SAD REQUIRED?Completion of a SAD is required for Cus<strong>to</strong>ms clearance of all commercial importsin<strong>to</strong> Montserrat, except for some importations of air cargo and <strong>the</strong> importation ofsome barrels and low value consignments through <strong>the</strong> Transit Shed at Little Bay.Details of <strong>the</strong>se exceptions <strong>to</strong> <strong>the</strong> requirement <strong>to</strong> complete a SAD can be found in <strong>the</strong>relevant Information Notices for those categories of importations.D) WHERE CAN SADs BE OBTAINED?Copies of <strong>the</strong> SAD are sold in most of <strong>the</strong> stationary outlets in Montserrat. Regularimporters and Cus<strong>to</strong>ms Brokers can produce <strong>the</strong>ir own versions pre-printed with <strong>the</strong>iragreed details. SAD forms are not available at present from <strong>the</strong> Department ofCus<strong>to</strong>ms although will be available electronically in <strong>the</strong> future via <strong>the</strong> Cus<strong>to</strong>mswebsite, at a date <strong>to</strong> be announced.

E) GENERAL INFORMATION ON COMPLETING A SAD• The SAD should be completed by <strong>the</strong> importer or an authorised agent orCus<strong>to</strong>ms Broker. Cus<strong>to</strong>ms staff cannot complete a SAD on behalf of ano<strong>the</strong>rperson and should not be asked <strong>to</strong> do so.• The SAD can also be used for exports but this Information Notice relates <strong>to</strong>imports only. A separate Information Notice will be issued for exportprocedures.• The SAD may be filled in by hand, in ink and in block capitals but must belegible. Cus<strong>to</strong>ms may require a fresh declaration if <strong>the</strong> original is considered<strong>to</strong> be illegible.• It may also be completed by typewriter or computer printer.• There should be no erasures or overwriting on <strong>the</strong> form and Tippex or similarcorrecting fluids should not be used <strong>to</strong> amend any of <strong>the</strong> details.• Any alterations should be made by crossing out <strong>the</strong> original detail and addingcorrect details at <strong>the</strong> side or above <strong>the</strong> original. Any alterations made this wayshould be initialled by <strong>the</strong> person making <strong>the</strong> declaration.• Three copies of <strong>the</strong> SAD will be required for Cus<strong>to</strong>ms clearance; one copywill be retained by Cus<strong>to</strong>ms at <strong>the</strong> place of lodgement, one will act as <strong>the</strong> copyfor Cus<strong>to</strong>ms purposes at <strong>the</strong> place where <strong>the</strong> goods are held pending Cus<strong>to</strong>msclearance, one copy is for <strong>the</strong> importer’s use.• The completed SAD should be presented <strong>to</strong> Cus<strong>to</strong>ms with all supportingdocuments, including invoices (<strong>the</strong> original + 2 copies), freight information(Bill of Lading or Airway Bill), and worksheet <strong>to</strong> show calculations if neededand any licences or certificates that may be required.WARNINGIt is important <strong>to</strong> know that <strong>the</strong> lodging of a SAD with <strong>the</strong> Department of Cus<strong>to</strong>msindicates that <strong>the</strong> person concerned is declaring <strong>the</strong> goods in question for <strong>the</strong> Cus<strong>to</strong>msprocedure shown on <strong>the</strong> document.In doing this <strong>the</strong> person is accepting responsibility under <strong>the</strong> law for:1. The accuracy of <strong>the</strong> information given in <strong>the</strong> declaration:2. The au<strong>the</strong>nticity of <strong>the</strong> documents attached <strong>to</strong> <strong>the</strong> declaration3. The observance of all <strong>the</strong> obligations necessary under <strong>the</strong> declared proceduresThere is a brief pre-printed declaration on <strong>the</strong> form as <strong>to</strong> <strong>the</strong> accuracy of <strong>the</strong>information it contains, but <strong>the</strong> action of signing <strong>the</strong> document and presenting it <strong>to</strong>Cus<strong>to</strong>ms indicates a full acceptance of all responsibilities.

F) COMPLETING THE BOXES ON A SADThere are 43 Boxes on a SAD and all boxes must be completed unless indicatedo<strong>the</strong>rwise in this Notice. To avoid difficulties and delays in <strong>the</strong> clearance and releaseof goods by Cus<strong>to</strong>ms, ensure you have all <strong>the</strong> necessary documents relating <strong>to</strong> <strong>the</strong>importation and follow <strong>the</strong> guidance below.1: Consignor /Exportera) ImportsEnter <strong>the</strong> full name and address of <strong>the</strong> consignor, who is <strong>the</strong> first person or companyselling <strong>the</strong> goods, if <strong>the</strong>y are imported under a contract of sale. O<strong>the</strong>rwise it is <strong>the</strong>person or company owning <strong>the</strong> goods immediately prior <strong>to</strong> <strong>the</strong>ir importation.b) ExportsLeave blank2: RegimeEnter <strong>the</strong> appropriate Cus<strong>to</strong>ms Procedure Code (CPC), for example C4, C5 or C6.These codes indicate <strong>to</strong> Cus<strong>to</strong>ms under which regime or procedure <strong>the</strong> declaration is<strong>to</strong> be treatedIf you do not know or are unsure of <strong>the</strong> regime code, contact <strong>the</strong> Cus<strong>to</strong>ms LongroomOffice for assistance.3: No. of PagesEnter <strong>the</strong> <strong>to</strong>tal number of pages forming a copy of <strong>the</strong> entry (for example if <strong>the</strong>re is 1face sheet and 2 continuation sheets <strong>the</strong> figure 3 should be entered here) There is amaximum of 4 pages - I face sheet and up <strong>to</strong> 3 continuation sheets – permitted perentry.4: No. of itemsEnter <strong>the</strong> <strong>to</strong>tal number of items being declared including those on any continuationsheets. Each different tariff trade classification of goods is an item. There is amaximum of 22 items permitted per entry5: Importer/Consigneea) ImportEnter <strong>the</strong> full name and address of <strong>the</strong> importer. Use <strong>the</strong> full postal address including<strong>the</strong> PO Box no. if one is used. The importer is <strong>the</strong> owner of <strong>the</strong> goods or any o<strong>the</strong>rperson possessing <strong>the</strong> goods or beneficially interested in <strong>the</strong>m at any time betweenimportation and clearance by Cus<strong>to</strong>ms.Where No. is indicated in this box insert <strong>the</strong> reference number allocated by Cus<strong>to</strong>ms.Cus<strong>to</strong>ms will allocate a unique number <strong>to</strong> regular importers for use on all <strong>the</strong>irimportations. For first importations and o<strong>the</strong>rs where a reference number for <strong>the</strong>importer has not previously been allocated, enter 999.

) ExportLeave blank6: Total No. of PackagesEnter <strong>the</strong> <strong>to</strong>tal number of packages being entered on this declaration. Where <strong>the</strong> goodsare consigned on an Air way Bill or Bill of Lading and <strong>the</strong> entire consignment isbeing entered <strong>to</strong> <strong>the</strong> declaration <strong>the</strong>n <strong>the</strong> No of packages shown should match that on<strong>the</strong> relevant freight document.7: DeclarantIf <strong>the</strong> declaration is being completed by <strong>the</strong> importer himself, enter “Consignee” andleave <strong>the</strong> space for No. blankIf <strong>the</strong> declaration is being completed by an authorised agent or Cus<strong>to</strong>ms Broker onbehalf of <strong>the</strong> importer enter <strong>the</strong> full name of <strong>the</strong> agent or broker. Where No. isindicated in this box insert <strong>the</strong> reference number allocated by Cus<strong>to</strong>ms <strong>to</strong> <strong>the</strong> agent orbroker.Ref .is for use by <strong>the</strong> importer or agent. Insert reference number if you have givenone <strong>to</strong> this entry. This will enable easy reference in <strong>the</strong> case of a query.8: Country whence consigneda) ImportEnter <strong>the</strong> name of <strong>the</strong> country from which <strong>the</strong> goods were despatched. This is notnecessarily <strong>the</strong> country of origin or manufacture, or <strong>the</strong> last port of call but is <strong>the</strong>country where <strong>the</strong> goods were purchased and from where <strong>the</strong>y have been sent.b) ExportLeave blank9: Country of 1 st destinationLeave a) and b) blank10: Country of final destinationLeave blank11: Manifest No.Where known, enter <strong>the</strong> Number on <strong>the</strong> ship’s manifest for <strong>the</strong> importation. Where<strong>the</strong> number is not known, leave blank.12: B.L/A.W.B No.Enter <strong>the</strong> Bill of Lading or Airway Bill No.The Bill of Lading No. is usually found on <strong>the</strong> <strong>to</strong>p right hand corner of <strong>the</strong> document.The Airway Bill No. is usually found on <strong>the</strong> <strong>to</strong>p left hand corner of that document.

13: Additional InformationThis box provides space on <strong>the</strong> declaration <strong>to</strong> give details for which <strong>the</strong>re is nospecific box. It is used for information such as particulars of goods <strong>to</strong> be removedfrom warehouse, authorisations such as those for Duty Exemptions, o<strong>the</strong>r specialrequests and explanations. Details as <strong>to</strong> what information should be included will begiven by Cus<strong>to</strong>ms and in most cases related <strong>to</strong> <strong>the</strong> relevant procedure codes.If special documents are required <strong>to</strong> be presented with an entry (for example a licence,costing sheets or Certificate of Origin) use this box <strong>to</strong> enter <strong>the</strong> reference no of <strong>the</strong>documents produced.14: Mode of TransportEnter <strong>the</strong> description and code for <strong>the</strong> method of transport used for <strong>the</strong> carriage of <strong>the</strong>goods. The codes and Mode of Transport should be one of <strong>the</strong> following:CodeMode of Transport1 Air Transport4 Maritime Transport (Sea)5 Mail9 Unknown15: Port or AirportEnter <strong>the</strong> name and code for <strong>the</strong> Cus<strong>to</strong>ms office at <strong>the</strong> place where <strong>the</strong> goods entered<strong>the</strong> country.There are currently only three approved places of entry for cargo and applicable underthis heading. These are:• Little Bay, for entry by sea, including any small craft and yacht imports EnterCode 09 LB• Gerald’s Airport for entry by air, Enter Code 07 GA• Post Office for imports by Royal Mail. (but not for small parcels by o<strong>the</strong>rcarriers) Enter Code 04 PO16: Rotation No.Enter <strong>the</strong> number allocated by Cus<strong>to</strong>ms <strong>to</strong> identify <strong>the</strong> voyage or flight, if known. Ifnot known, leave blank17: Identify <strong>the</strong> means of transportEnter <strong>the</strong> name of <strong>the</strong> vessel if goods are imported by sea or <strong>the</strong> flight number ifimported by air. If imported by mail enter MAIL.18: Nationality of transportEnter <strong>the</strong> name and code of <strong>the</strong> country in which <strong>the</strong> means of transport is registered.If imported by mail enter <strong>the</strong> name and code of <strong>the</strong> country for <strong>the</strong> transport used for<strong>the</strong> mail shipment. If <strong>the</strong> required information is not known contact <strong>the</strong> Cus<strong>to</strong>msoffice at <strong>the</strong> Transit Shed, Little Bay or Gerald’s Airport as appropriate, forassistance.

19: Date of arrivalEnter <strong>the</strong> date of arrival of <strong>the</strong> means of transport.20: Location of goodsEnter <strong>the</strong> location where <strong>the</strong> goods are available for examination, if necessary (forexample, if held at <strong>the</strong> port, enter Little Bay).21: Marks and Nos.Enter <strong>the</strong> marks (letters and/or numbers), which identify <strong>the</strong> container, case etc. inwhich <strong>the</strong> goods have been transported. If <strong>the</strong> goods do not completely fill <strong>the</strong>container or case enter <strong>the</strong> words part case or part container followed by <strong>the</strong> marksand numbers as appropriate. If <strong>the</strong> case or container is addressed <strong>to</strong> <strong>the</strong> importer statedin Box 1 enter “as addressed”The marks and numbers declared must be sufficient <strong>to</strong> readily identify <strong>the</strong> goods or<strong>the</strong>re may be delays in clearance if <strong>the</strong> goods are required for Cus<strong>to</strong>ms examination.22: Description of <strong>the</strong> goods.Enter <strong>the</strong> normal trade description of <strong>the</strong> goods <strong>to</strong> enable immediate and unambiguousidentification and classification.23: Cus<strong>to</strong>ms ValueEnter <strong>the</strong> value of <strong>the</strong> goods for Cus<strong>to</strong>ms purposes in Eastern Caribbean Dollars. Thevalue should include <strong>the</strong> cost of <strong>the</strong> goods, freight, insurance and any o<strong>the</strong>r chargesapplicable <strong>to</strong> <strong>the</strong> goods prior <strong>to</strong> <strong>the</strong> calculation of duties and taxes.24: CPCEnter <strong>the</strong> Cus<strong>to</strong>ms Procedure Code (CPC) if known.The CPC identifies <strong>the</strong> treatment <strong>to</strong> be applied <strong>to</strong> <strong>the</strong> goods forming an item on <strong>the</strong>Cus<strong>to</strong>ms declaration. The regime has already been identified in Box 2 and this codeplus two fur<strong>the</strong>r code numbers completes <strong>the</strong> CPC. Enter <strong>the</strong> complete codeidentifying <strong>the</strong> procedure which you are requesting in this box.If you do not know or are unsure of <strong>the</strong> CPC code, contact <strong>the</strong> Cus<strong>to</strong>ms LongroomOffice for assistance.25: Tariff No.Enter <strong>the</strong> code number identifying <strong>the</strong> goods forming this item in accordance with <strong>the</strong>published Tariff.26: Net weightEnter <strong>the</strong> net weight of <strong>the</strong> goods in kilogrammes. In this instance <strong>the</strong> net weight is<strong>the</strong> weight of <strong>the</strong> goods including any packing normally going with <strong>the</strong>m <strong>to</strong> <strong>the</strong> buyerin retail sale27: Suppl. quantity.Enter any supplementary quantity that might be required in addition <strong>to</strong> <strong>the</strong> net weight.This will be indicated alongside <strong>the</strong> Tariff No. for <strong>the</strong> goods in <strong>the</strong> Cus<strong>to</strong>ms Tariff. Ifno supplementary quantity is indicated leave blank.

28: Country of origin/destination(a) ImportEnter <strong>the</strong> name and code of <strong>the</strong> country in which <strong>the</strong> goods have been produced ormanufactured if known. If you do not know <strong>the</strong> code please contact <strong>the</strong> Cus<strong>to</strong>msLongroom office for assistance.(b) ExportLeave blank29: No. and type of packagesEnter <strong>the</strong> number of individual parts and describe <strong>the</strong> packages (for example 100boxes). Enter <strong>the</strong> code description for <strong>the</strong> packages at <strong>the</strong> right hand side of this box.If you do not know <strong>the</strong> code please contact <strong>the</strong> Cus<strong>to</strong>ms Longroom office forassistance30: Exchange rateEnter <strong>the</strong> rate of exchange used in any calculation converting an invoice amount fromforeign currency. The rate of exchange used should be that current on <strong>the</strong> day that <strong>the</strong>goods arrived in Montserrat.Enter <strong>the</strong> three character currency code at <strong>the</strong> right hand side of <strong>the</strong> box. If you do notknow <strong>the</strong> code please contact <strong>the</strong> Cus<strong>to</strong>ms Longroom office for assistance31 – 35These boxes are provided for you <strong>to</strong> show <strong>the</strong> basis and method of your calculation of<strong>the</strong> taxes payable and must be completed with a line for each type of tax.Goods imported in<strong>to</strong> Montserrat are potentially liable <strong>to</strong> three taxesImport DutyConsumption TaxCus<strong>to</strong>ms Service TaxCode: 01 Description: ImpCode: 02 Description: ConCode: 03 Description: SerThe rates of Import Duty and Consumption Tax applicable <strong>to</strong> each Tariff Code are se<strong>to</strong>ut in <strong>the</strong> Montserrat Tariff. The rate of Cus<strong>to</strong>ms Service Tax is a flat rate applicable<strong>to</strong> all goods. The rate is that set out in <strong>the</strong> Cus<strong>to</strong>ms Service Tax Act. The taxes arecumulative with <strong>the</strong> rate of Import Duty applicable <strong>to</strong> <strong>the</strong> Value for Cus<strong>to</strong>msreferred <strong>to</strong> as CIF (Cost Insurance Freight); <strong>the</strong> amount of Consumption Tax is basedon <strong>the</strong> CIF + any Import Duty payable and <strong>the</strong> amount of Cus<strong>to</strong>ms Service Tax isbased on <strong>the</strong> CIF + Import Duty + any Consumption Tax payable.The way in which <strong>the</strong> boxes are <strong>to</strong> be computed is described and <strong>the</strong>n a practicalexample given31: Duty/ Tax typeEnter <strong>the</strong> tax code in <strong>the</strong> left hand column and <strong>the</strong> description in <strong>the</strong> right columnforming this box. (See above for codes and descriptions)

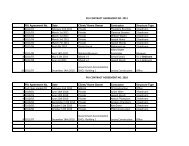

32: Duty Tax BaseEnter <strong>the</strong> appropriate code and description in <strong>the</strong> right hand column forming <strong>the</strong> box .There are three options for <strong>the</strong> tax base as per <strong>the</strong> illustration in <strong>the</strong> practical exampleshown.33: Base amountEnter <strong>the</strong> appropriate value <strong>to</strong> be taxed34: RateEnter <strong>the</strong> rate of tax applicable35: Duty/Tax dueShow <strong>the</strong> amount of duty or tax due in each caseEXAMPLE FOR COMPLETION OF BOXES 31 - 35Goods which have a Value for Cus<strong>to</strong>ms (as shown in Box 23) EC$3,000 with anImport Duty rate of 5%, Consumption Tax rate of 20% and Cus<strong>to</strong>ms Service Tax at5%31 32 33 34 35Duty/Tax Type Duty/Tax Base Base Amount Rate Duty Tax Due01 Imp. 42 CIF 3,000.00 5 % 150.0002 Con. 43 CIF+ Imp. 3,150.00 20 % 630.0003 Ser. 44 CIF+ Imp+ Cons. 3,780.00 5 % 189.0036: LicenceEnter <strong>the</strong> number of any licence presented in support of this declaration, If no licenceis applicable leave blank37: Licence quantityEnter <strong>the</strong> quantity relating <strong>to</strong> any licence presented in support of this declaration. If nolicence is applicable leave blank38: LicenceEnter <strong>the</strong> value relating <strong>to</strong> any licence presented in support of this declaration, If nolicence is applicable leave blank39: Place and date of declarationEnter <strong>the</strong> place at which <strong>the</strong> declaration is made (for example, Brades, Montserrat)and <strong>the</strong> date it is made.Enter <strong>the</strong> original hand written signature of <strong>the</strong> person making <strong>the</strong> declaration. Preprintedor facsimile copies of signatures are not acceptable.

Note: By signing this box a legal declaration is made that <strong>the</strong> details shown on <strong>the</strong>foam and any continuation sheets are true and complete and that <strong>the</strong> requirements ofany legislation have been met. See also <strong>the</strong> warning earlier in this Notice.40: O<strong>the</strong>r chargesLeave blank, not in use in Montserrat41: AmountLeave blank, not in use in Montserrat42: SummaryEnter a summary of taxes due brought forward from any continuation sheets usedwith <strong>the</strong> declaration. If no continuation sheets have been use leave blank43: Grand Total dueEnter <strong>the</strong> <strong>to</strong>tal amount of all monies due on this declaration.G) PRESENTING COMPLETED SADs TO CUSTOMSOnce completed and signed <strong>the</strong> SAD should be presented <strong>to</strong> <strong>the</strong> Cus<strong>to</strong>ms Longroomoffice at <strong>the</strong> Government Headquarters in Brades. The Office is open <strong>to</strong> <strong>the</strong> Publicbetween 8am <strong>to</strong> 4pm Mondays <strong>to</strong> Fridays (except for Public Holidays) but completedSADs can be placed in a mailbox provided for <strong>the</strong> purpose at any time. The mailboxis opened at <strong>the</strong> start of each working day and entries are processed by Cus<strong>to</strong>ms onthat day.H) CUSTOMS ACTION ON RECEIPT OF A SADa) Cus<strong>to</strong>ms staff in <strong>the</strong> Longroom Office will number all SADs on receipt and checkfor completeness and accuracy of <strong>the</strong> information provided. Entries are dealt with inturn and importers can expect <strong>to</strong> collect checked completed entries for payment ofmonies due and completion of clearance at <strong>the</strong> port or airport within 24 hours ofpresentation although processing can take longer at peak times such as <strong>the</strong> run up <strong>to</strong>Christmasb) In <strong>the</strong> event of a query on a declaration Cus<strong>to</strong>ms will return <strong>the</strong> SAD <strong>to</strong> <strong>the</strong>Importer or Broker for amendment. Advice of <strong>the</strong> query and action required will begiven by endorsement on <strong>the</strong> reverse of <strong>the</strong> SAD itself.c) If <strong>the</strong>re are no queries, Importers will receive back two copies of <strong>the</strong> SAD forpresentation, with <strong>the</strong> monies due <strong>to</strong> <strong>the</strong> Cashier who is situated in an office within<strong>the</strong> Cus<strong>to</strong>ms Longroom building.d) The Cashier’s office is open from 8.15 am <strong>to</strong> 3.15 pm, Mondays <strong>to</strong> Fridays(except for Public Holiday) and no payments can be accepted outside of <strong>the</strong>se hours.e) After payment of <strong>the</strong> monies due <strong>the</strong> two copies of <strong>the</strong> declaration will be returned<strong>to</strong> <strong>the</strong> importer or broker for <strong>the</strong>ir use and completion of Cus<strong>to</strong>ms clearance at <strong>the</strong>port or airport. Information Notices on procedures for Cus<strong>to</strong>ms clearance at <strong>the</strong>airport and port Little Bay are available from Cus<strong>to</strong>ms if required.

IJ) FEEDBACK AND CONTACTING CUSTOMSCus<strong>to</strong>ms are seeking <strong>to</strong> improve <strong>the</strong>ir processes and would welcome any feedback on<strong>the</strong> procedures set out here. Feedback forms are available at all Cus<strong>to</strong>ms Offices oryou can phone Cus<strong>to</strong>ms at <strong>the</strong> numbers shown belowIf you would like a copy of this notice sent <strong>to</strong> you electronically, please contactCus<strong>to</strong>ms and provide your e-mail address or e-mail Cus<strong>to</strong>ms at cus<strong>to</strong>ms@gov.msThe Longroom office and <strong>the</strong> Comptroller can be contacted at <strong>the</strong> main Cus<strong>to</strong>msOffice at Brades on (1) 664 491 3816 or by fax on (1) 664 491 6909For Cus<strong>to</strong>ms at <strong>the</strong> Transit Shed phone (1) 664 491 2456For Cus<strong>to</strong>ms at Gerald’s Airport phone (1) 664 491 8816