FINANCIAL STATEMENTS - Mewah Group

FINANCIAL STATEMENTS - Mewah Group

FINANCIAL STATEMENTS - Mewah Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

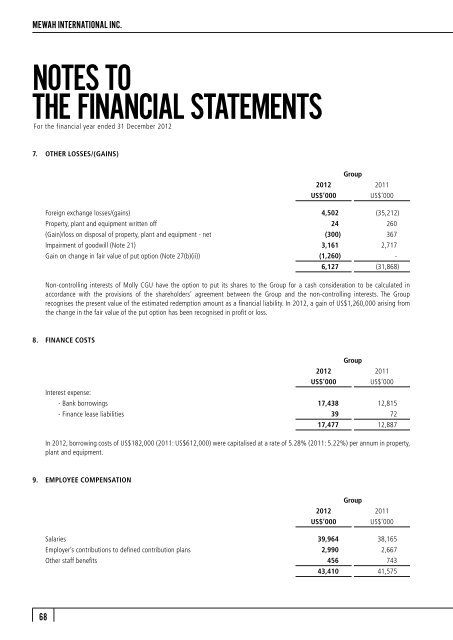

MEWAH INTERNATIONAL INC.NOTES TOTHE <strong>FINANCIAL</strong> <strong>STATEMENTS</strong>For the financial year ended 31 December 20127. OTHER LOSSES/(GAINS)<strong>Group</strong>2012 2011US$’000US$’000Foreign exchange losses/(gains) 4,502 (35,212)Property, plant and equipment written off 24 260(Gain)/loss on disposal of property, plant and equipment - net (300) 367Impairment of goodwill (Note 21) 3,161 2,717Gain on change in fair value of put option (Note 27(b)(ii)) (1,260) -6,127 (31,868)Non-controlling interests of Molly CGU have the option to put its shares to the <strong>Group</strong> for a cash consideration to be calculated inaccordance with the provisions of the shareholders’ agreement between the <strong>Group</strong> and the non-controlling interests. The <strong>Group</strong>recognises the present value of the estimated redemption amount as a financial liability. In 2012, a gain of US$1,260,000 arising fromthe change in the fair value of the put option has been recognised in profit or loss.8. FINANCE COSTSInterest expense:<strong>Group</strong>2012 2011US$’000US$’000- Bank borrowings 17,438 12,815- Finance lease liabilities 39 7217,477 12,887In 2012, borrowing costs of US$182,000 (2011: US$612,000) were capitalised at a rate of 5.28% (2011: 5.22%) per annum in property,plant and equipment.9. EMPLOYEE COMPENSATION<strong>Group</strong>2012 2011US$’000 US$’000Salaries 39,964 38,165Employer’s contributions to defined contribution plans 2,990 2,667Other staff benefits 456 74343,410 41,57568