Letno poroÄilo 2007 - UniCredit Banka Slovenija dd

Letno poroÄilo 2007 - UniCredit Banka Slovenija dd

Letno poroÄilo 2007 - UniCredit Banka Slovenija dd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

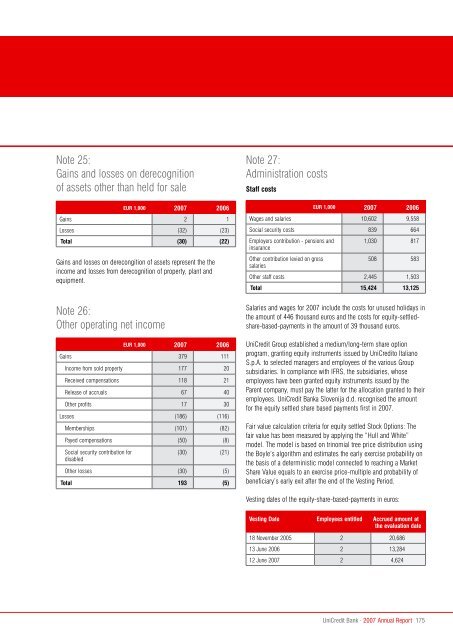

Note 25:Gains and losses on derecognitionof assets other than held for saleEUR 1,000 <strong>2007</strong> 2006Gains 2 1Losses (32) (23)Total (30) (22)Gains and losses on derecongition of assets represent the theincome and losses from derecognition of property, plant andequipment.Note 26:Other operating net incomeEUR 1,000 <strong>2007</strong> 2006Gains 379 111Income from sold property 177 20Received compensations 118 21Release of accruals 67 40Other profits 17 30Losses (186) (116)Memberships (101) (82)Payed compensations (50) (8)Social security contribution fordisabled(30) (21)Other losses (30) (5)Total 193 (5)Note 27:Administration costsStaff costsEUR 1,000 <strong>2007</strong> 2006Wages and salaries 10,602 9,558Social security costs 839 664Employers contribution - pensions andinsuranceOther contribution levied on grosssalaries1,030 817508 583Other staff costs 2,445 1,503Total 15,424 13,125Salaries and wages for <strong>2007</strong> include the costs for unused holidays inthe amount of 446 thousand euros and the costs for equity-settledshare-based-paymentsin the amount of 39 thousand euros.<strong>UniCredit</strong> Group established a medium/long-term share optionprogram, granting equity instruments issued by <strong>UniCredit</strong>o ItalianoS.p.A. to selected managers and employees of the various Groupsubsidiaries. In compliance with IFRS, the subsidiaries, whoseemployees have been granted equity instruments issued by theParent company, must pay the latter for the allocation granted to theiremployees. <strong>UniCredit</strong> <strong>Banka</strong> <strong>Slovenija</strong> d.d. recognised the amountfor the equity settled share based payments first in <strong>2007</strong>.Fair value calculation criteria for equity settled Stock Options: Thefair value has been measured by applying the “Hull and White”model. The model is based on trinomial tree price distribution usingthe Boyle’s algorithm and estimates the early exercise probability onthe basis of a deterministic model connected to reaching a MarketShare Value equals to an exercise price-multiple and probability ofbeneficiary’s early exit after the end of the Vesting Period.Vesting dates of the equity-share-based-payments in euros:Vesting Date Employees entitled Accrued amount atthe evaluation date18 November 2005 2 20,68613 June 2006 2 13,28412 June <strong>2007</strong> 2 4,624<strong>UniCredit</strong> Bank · <strong>2007</strong> Annual Report 175