Letno poroÄilo 2007 - UniCredit Banka Slovenija dd

Letno poroÄilo 2007 - UniCredit Banka Slovenija dd

Letno poroÄilo 2007 - UniCredit Banka Slovenija dd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

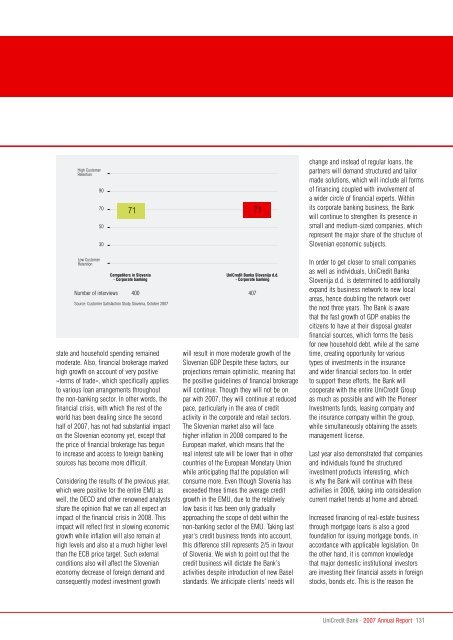

High CustomerRetention9070503071 71change and instead of regular loans, thepartners will demand structured and tailormade solutions, which will include all formsof financing coupled with involvement ofa wider circle of financial experts. Withinits corporate banking business, the Bankwill continue to strengthen its presence insmall and medium-sized companies, whichrepresent the major share of the structure ofSlovenian economic subjects.Low CustomerRetentionCompetitors in Slovenia- Corporate bankingstate and household spending remainedmoderate. Also, financial brokerage markedhigh growth on account of very positive››terms of trade«, which specifically appliesto various loan arrangements throughoutthe non-banking sector. In other words, thefinancial crisis, with which the rest of theworld has been dealing since the secondhalf of <strong>2007</strong>, has not had substantial impacton the Slovenian economy yet, except thatthe price of financial brokerage has begunto increase and access to foreign bankingsources has become more difficult.Considering the results of the previous year,which were positive for the entire EMU aswell, the OECD and other renowned analystsshare the opinion that we can all expect animpact of the financial crisis in 2008. Thisimpact will reflect first in slowing economicgrowth while inflation will also remain athigh levels and also at a much higher levelthan the ECB price target. Such externalconditions also will affect the Slovenianeconomy decrease of foreign demand andconsequently modest investment growth<strong>UniCredit</strong> <strong>Banka</strong> <strong>Slovenija</strong> d.d.- Corporate bankingNumber of interviews 400 407Source: Customer Satisfaction Study Slovenia, October <strong>2007</strong>will result in more moderate growth of theSlovenian GDP. Despite these factors, ourprojections remain optimistic, meaning thatthe positive guidelines of financial brokeragewill continue. Though they will not be onpar with <strong>2007</strong>, they will continue at reducedpace, particularly in the area of creditactivity in the corporate and retail sectors.The Slovenian market also will facehigher inflation in 2008 compared to theEuropean market, which means that thereal interest rate will be lower than in othercountries of the European Monetary Unionwhile anticipating that the population willconsume more. Even though Slovenia hasexceeded three times the average creditgrowth in the EMU, due to the relativelylow basis it has been only graduallyapproaching the scope of debt within thenon-banking sector of the EMU. Taking lastyear’s credit business trends into account,this difference still represents 2/5 in favourof Slovenia. We wish to point out that thecredit business will dictate the Bank’sactivities despite introduction of new Baselstandards. We anticipate clients’ needs willIn order to get closer to small companiesas well as individuals, <strong>UniCredit</strong> <strong>Banka</strong><strong>Slovenija</strong> d.d. is determined to a<strong>dd</strong>itionallyexpand its business network to new localareas, hence doubling the network overthe next three years. The Bank is awarethat the fast growth of GDP enables thecitizens to have at their disposal greaterfinancial sources, which forms the basisfor new household debt, while at the sametime, creating opportunity for varioustypes of investments in the insuranceand wider financial sectors too. In orderto support these efforts, the Bank willcooperate with the entire <strong>UniCredit</strong> Groupas much as possible and with the PioneerInvestments funds, leasing company andthe insurance company within the group,while simultaneously obtaining the assetsmanagement license.Last year also demonstrated that companiesand individuals found the structuredinvestment products interesting, whichis why the Bank will continue with theseactivities in 2008, taking into considerationcurrent market trends at home and abroad.Increased financing of real-estate businessthrough mortgage loans is also a goodfoundation for issuing mortgage bonds, inaccordance with applicable legislation. Onthe other hand, it is common knowledgethat major domestic institutional investorsare investing their financial assets in foreignstocks, bonds etc. This is the reason the<strong>UniCredit</strong> Bank · <strong>2007</strong> Annual Report 131