Reports Voltas Ltd. - Nayan M Vala Securities Pvt. Ltd.

Reports Voltas Ltd. - Nayan M Vala Securities Pvt. Ltd.

Reports Voltas Ltd. - Nayan M Vala Securities Pvt. Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

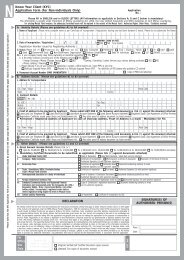

RESEARCH<strong>Voltas</strong><strong>Ltd</strong>.Key Indicators as on 28/10/2011Closing Price(Rs.) - TTMEPS (Rs.) - TTMP/E- TTMBVper Share(Rs.) - TTMPB- TTMMkt Cap (Rs.Crore) - TTMBeta - TTMMkt Cap/Sales (March 2011)Mkt Cap/PBIDTA (March 2011)Mkt Cap/PBDT (March 2011)Mkt Cap/PAT(March 2011)Mkt Cap/Cash Profit (March 2011)PBDITA Rs. in Crores (March 2011)Face ValueShares Outstanding croresEquity Sharecapital in Rs. CroresShare holding (%)PromotersPublicFIIsOthersSoource: CMIE100.858.0812.4842.232.393,336.971.310.645.916.099.498.67564.4133.08033.08Jun-1130.5317.5917.6134.27Investment Highlights:‣ ~23% of companies’marketcapitalisationis in theformcash, currentinvestments andquoted investments in otherthen subsidiary company.‣ Institution likeLIC, GovernmentPension FundGlobal, and BirlaSunLife Insurance hasincreased their stake in thecompany in last quarter.‣ Huge opportunities in domesticaswell as international market.‣ Better placedwhen comparedtoits peers.‣ Diversified business model tobebeneficial.Company Profile:<strong>Voltas</strong> <strong>Ltd</strong> was promoted as a JVbetween Tata Sons <strong>Pvt</strong> <strong>Ltd</strong> and VolkartBrothers in 1954 to take over theEngineering & Import Division of M/s.Volkart Brothers. <strong>Voltas</strong> <strong>Ltd</strong> is India’spremier air conditioningandengineering service provider. Itofferssolutions for a wide spectrum ofindustriess in areas such as heating,ventilation & air conditioning,refrigeration,electro-mechanicalprojects, water handling, textilemachinery, machinetools, mining &construction equipments and materialshandling. Besides being the largestplayerin domesticHVAC/ MEPsegment,<strong>Voltas</strong> has a significantpresencee in MEP inMiddle East andSouthEast Asia. Envisagingtheconstruction boom in Middle Easternmarket, <strong>Voltas</strong> madeits penetration inthese markets at an early stage.Pg. 1

Investment Rationale:Total value ofcash andinvestmentsother thansubsidiary inRs. 771.06crores and itsmarketcapitalisationis Rs. 3337crores withdebt at Rs.138.1 crores.Institutionshaveincreasedtheir stake by1.68% overthe past 6quarters. ~23% of companies market capitalisation is in the form of cash, current andquoted investments in other then subsidiary companies: The details ofinvestments and cash balance are given belowNo. ofParticularsSource: CMIE Share ValueLakshmi Automatic Loom Works <strong>Ltd</strong> 615200 5013880Tata Chemicals <strong>Ltd</strong> 200440 67548280Lakshmi Machine Works <strong>Ltd</strong> 600000 1159800000Reliance Industries <strong>Ltd</strong> 2640 2370720Total at Market Price (Rs. In crore) 123.473288Current Investment in Mutual Funds at book (Rs. in crore) 217.85Total 341.32Disount @ 20% 68.26273.06Cash Balance as on 31.3.2011 (Rs. In crore) 498Total value of cash and investments other than subsidiary(Rs. In crore) 771.06 Institutions have increased their stake in the company in last quarter:The below table gives the details of institutional shareholding in the companySource: CMIEJun-10Sep-10Dec-10Mar-11Jun-11Sep-11+ /-Allianz Rcm Brics Stars Fund 1.1 1.1 1.1 1.1Birla Sun Life Insurance Company <strong>Ltd</strong> 1.32 1.36 0.04Blackrock India Equities Fund Mauritius-<strong>Ltd</strong> 1.33 1.2 1.33 1.61 1.47 1.33Dsp Blackrock India T I G E R Fund 1.06 1.07 1.05-1.06General Insurance Corporation Of India 1.49 1.45 1.45 1.45 1.45 1.45-0.04Government Pension Fund Golbal 1.34 1.75 2.75 2.75Icici Prudential Life Insurance Company<strong>Ltd</strong> 4.15 4.22 4.53 4.67 4.09 3.73-0.42Life Insurance Corporation Of India 11.66 10.63 10.18 10.21 10.79 13.5 1.84New India Assurance Company <strong>Ltd</strong> 1.28 1.18 1.18 1.18 1.18 1.18 -0.1Pca India Equity Open <strong>Ltd</strong> 1.62 1.62 1.62 1.62 1.59 1.59Pca India Infrastructure Equity Open <strong>Ltd</strong> 1.39 1.39-1.39Tata Mutual Fund Tata Infrastructure Fund 1.3 1.19 -1.3Uti Infrastructure Fund 1.33 1.13 0Net + / - over the past 6 quarters. 1.68Ordervisibility fornext 12months. Huge opportunities in domestic as well as international market: <strong>Voltas</strong> isIndia’s largest provider and exporter of electromechanical projects (EMP) andservices, and covers infrastructure (airports, metros), real-estate (buildings,hospitals, hotels, IT parks) and industrial (power, cement, steel, paper and others)sectors. Some of the recent projects executed in this segment are Formula 1 racetrack in Abu Dhabi, Burj Dubai, Rajiv Gandhi International Airport, Hyderabad andChennai International Airport. It has carry forward order book worth Rs. 2634 crores.Pg. 2www.nayanmvala.com

Opportunitiesin metroprojects andmodernization33 airportsacross thecountry.Pickup indemand fromGulf countriesalreadyencountered.<strong>Voltas</strong> isunderleveragedwhencompared toits peersearning betterEPS butquoting at alower P/E toits peers.Domestic: Increased spending on urban infrastructure, pick up in constructionactivities for hospitals, airports and metros continue to be bright. We believe <strong>Voltas</strong>can target 3 metro projects that will be constructed over FY11-15E namely, ChennaiMetro Phase-I, Bengaluru Metro Phase-I and Kolkata Metro Phase-II will be builtwith a total cost of Rs.100 bn. In addition, over next five years, the country will seenew construction/modernization of 33 airports. We believe <strong>Voltas</strong> will see gooddemand for MEP services from Tier-2 cities which are also witnessing rapid growth(in the form of malls, hospitals etc).International: In the international arena, <strong>Voltas</strong> operates mainly in ASEAN andMiddle East markets and has undertaken complex and sophisticated projects inthese markets. In Singapore, the company recently undertook some prestigiousprojects, where it has a Contractor A status. In the Middle East, the companystarted with Dubai and has now expanded to other areas such as Abu Dhabi, Qatar,Saudi Arabia and Oman. Gulf Region (which contribute +60% of <strong>Voltas</strong> revenues)are seeing initial signs of pick-up in investment spends. Key markets witnessingpick-up include (1) UAE – Projects tendered worth USD 53.7 bn (2) Qatar - USD11.4 bn (3) Saudi Arabia – USD 76.1 bn. Peer Comparison: A brief comparison between its peers is given belowParticulars Source: CMIE <strong>Voltas</strong> Blue StarPledged Shares 0 1.66Borrowings 138.1 444.5Interest Coverage Ratio 33 12.01PBDITA net of PE&OI as % of Sales 8.5 8.3PBDTA net of PE&OI as % of Sales 8.2 7.6PBIT net of PE&OI as % of Sales 8.1 7.2PBT net of PE&OI as % of Sales 7.8 6.5PAT net of PE&OI as % of Sales 4.4 4.1Cash profit net of PE&OI as % of Sales 5.2 5.4Debt Equity Ratio (x) 0.07 0.73EPS (Rs.) - TTM 8.08 7.23P/E - TTM 12.48 29.23BV per Share (Rs.) - TTM 42.23 62.54PB - TTM 2.39 3.38Face Value 1 2 Diversified business model to be beneficial: <strong>Voltas</strong> offers solutions for awide spectrum of industries in areas such as heating, ventilation & air conditioning,refrigeration, electro-mechanical projects, water handling, textile machinery,machine tools, mining & construction equipments and materials handling.Pg. 3www.nayanmvala.com

Earns 67% ofitsconsolidatedrevenue fromIndianmarketsandremaining33%of itsrevenue frominternationalmarket.The operations have been organized into three independent business-specificclusters, electromechanical projects & services, engineering products & servicesand unitary cooling products.Electromechanical Projects & Services Segment: This segment contributes 60%to the top line and bottom-line and is primarily the projects segment of thecompany.Engineering Products & Services ( EP&S) Segment: This business comprises of3 key areas asunder:1. Selling agents of textile machinery including sole selling agents ofLMW.2. Tradingand/or commission based sales of construction and miningequipments.3. Manufacture and sale of forklift trucks – this business would now bedemerged to a new JV to KION where <strong>Voltas</strong> will have only a 26% stake.<strong>Voltas</strong> would however manufacture the forklift trucks for this JV out of theirfacility in Thane, Maharashtra.<strong>Voltas</strong> hasreceived sum of INR1. 1bn for thetransfer of this business to KION.Unitary Cooling (UC) Segment: The unitary cooling segment (in its new form)comprises of 5 major products namely commercial ACs, water coolers, waterdispensers, split AC and window ACs. The company has its Uttarakhand. Companyhas been able to maintain its No3 position in the AC marketSegmental Revenue (Consolidated)11%Electro‐mechanicalProjects and Services30%59%Unitary CoolingProductsEngineering Productsand ServicesGeographical Segment Wise RevenueDomesticSales (Rs. In Crores)International Sales (Rs. In Crores)(Source: Company)3468.651708.18Areas of Concerns: Volatilecommodity prices:<strong>Voltas</strong> is highly susceptible tovolatility in commodity pricesboth in domestic as well as international markets, which could also arise from currencyfluctuations. Any sharp increase in commodity prices could threaten its profitabilityas someof its international projects areof long-gestation periods. Slowingorder inflows from Middle East markets: <strong>Voltas</strong> generates ~33% of its revenuesfrom Middle East markets and any slowdown in order intakefrom the Middle East regioncould threaten its revenue stream and consequentlyimpact margins.Pg. 4

Quarterly Results – (Consolidated)(Rs. Crore) Source: CMIE Mar-10 Jun-10 Sep-10 Dec-10 Mar-11 Jun-11Total income 1,480.03 1,427.63 1,104.94 1,072.63 1,698.95 1,448.70Net sales 1,439.60 1,408.33 1,065.12 1,042.21 1,675.71 1,348.42Other & extra-ordinary income 40.43 19.3 39.82 30.42 23.24 100.28Change in stock 36.92 40.25 0.83 93.24 -10.6 37.56Total expenses 1,380.09 1,374.16 1,013.36 1,095.32 1,589.54 1,354.01Operating expenses 1,325.41 1,321.70 958.48 1,056.29 1,524.27 1,277.09Raw materials, stores & spares 802.79 758.08 607.53 634.09 921.38 716.12Purchase of finished goods 269.38 292.84 121.17 164.42 304.98 290.21Salaries and wages 139.75 135.81 126.86 144.49 149.76 146.73VRS expenses -0.25 0.74 0.07 0.11 0.11Total other expenses 113.49 134.97 102.92 113.29 148.15 124.03Extra-ordinary expenses 11.37 0 0.47 0 0 0PBDIT (operating profit) 180.17 146.18 146.82 109.58 164.08 209.17PBDIT net of P&E 167.87 146.18 128.99 94.02 156.25 127.7Interest expenses 2.6 4.55 3.73 3.4 5.6 8.46Depreciation 5.42 5.01 5.34 5.39 5.28 10.31PBT 172.15 136.62 137.75 100.79 153.2 190.4Provisions and contingencies 35.29 42.9 45.34 30.24 54.39 58.15Total tax provision 35.29 42.9 45.34 30.24 54.39 58.15Corporate tax/direct taxes 35.88 42.9 45.34 30.24 54.39 58.15Net profit (PAT) 136.86 93.72 92.41 70.55 98.81 132.25From NAYAN M. VALA SECURITIES PVT.LTD.RESEARCHBy Harsh B. ChauhanDisclaimer: The information contained herein is confidential and is intended solely for the addressee(s). Any unauthorized access; use, reproduction,disclosure or dissemination is prohibited. This information does not constitute or form part of and should not be construed as, any offer for sale orsubscription of or any invitation to offer to buy or subscribe for any securities. The information and opinions on which this communication is basedhave been complied or arrived at from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, ismade as to their accuracy, correctness and are subject to change without notice. NAYAN M. VALA SECURITIES PVT.LTD. and/ or its clients mayhave positions in or options on the securities mentioned in this report or any related investments, may affect transactions or may buy, sell or offer tobuy or sell such securities or any related investments. Recipient/s should not consider this report as only a single factor in making their investmentdecision. Neither NAYAN M. VALA SECURITIES PVT.LTD. nor any of its affiliates shall assume any legal liability or responsibility for any incorrect,misleading or altered information contained herein.MEMBER: NATIONAL STOCK EXCHANGE OF INDIA LTD CODE NO. 13511MEMBER: BOMBAY STOCK EXCHANGE LTD CODE NO. 6222MEMBER: CALCUTTA STOCK EXCHANGE LTD CODE NO. 506MEMBER: MCX-SXCODE NO.38300NAYAN M. VALA SECURITIES PVT. LTD. Tel: +91-22- 2610 5973 / 2610 5974403-404, Cosmos Court, Fax: +91-22- 2612 4310Above Waman Hari Pethe Jewellers,E-Mail: research@nayanmvala.comS. V. Road, Vile-Parle (West), Website: www.nayanmvala.comMumbai – 400056. INDIAPg. 5www.nayanmvala.com