COMPUTERSHARE ANNUAL REPORT 2008

COMPUTERSHARE ANNUAL REPORT 2008

COMPUTERSHARE ANNUAL REPORT 2008

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

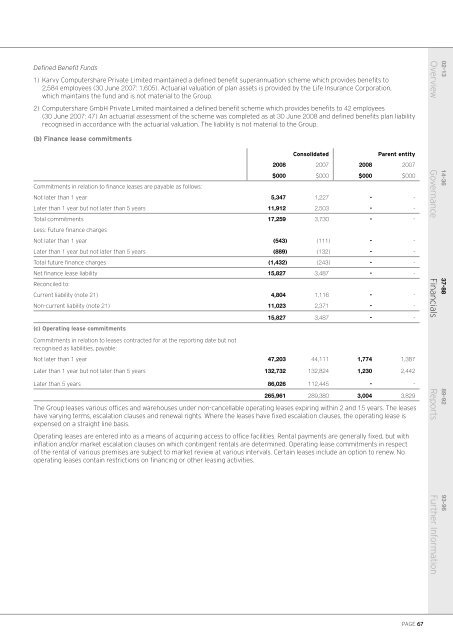

Defined Benefit Funds1) Karvy Computershare Private Limited maintained a defined benefit superannuation scheme which provides benefits to2,584 employees (30 June 2007: 1,605). Actuarial valuation of plan assets is provided by the Life Insurance Corporation,which maintains the fund and is not material to the Group.2) Computershare GmbH Private Limited maintained a defined benefit scheme which provides benefits to 42 employees(30 June 2007: 47) An actuarial assessment of the scheme was completed as at 30 June <strong>2008</strong> and defined benefits plan liabilityrecognised in accordance with the actuarial valuation. The liability is not material to the Group.02-13Overview(b) Finance lease commitmentsConsolidatedParent entity<strong>2008</strong> 2007 <strong>2008</strong> 2007$000 $000 $000 $000Commitments in relation to finance leases are payable as follows:Not later than 1 year 5,347 1,227 - -Later than 1 year but not later than 5 years 11,912 2,503 - -Total commitments 17,259 3,730 - -Less: Future finance chargesNot later than 1 year (543) (111) - -Later than 1 year but not later than 5 years (889) (132) - -Total future finance charges (1,432) (243) - -Net finance lease liability 15,827 3,487 - -Reconciled to:Current liability (note 21) 4,804 1,116 - -Non-current liability (note 21) 11,023 2,371 - -15,827 3,487 - -(c) Operating lease commitments14-36Governance37-88FinancialsCommitments in relation to leases contracted for at the reporting date but notrecognised as liabilities, payable:Not later than 1 year 47,203 44,111 1,774 1,387Later than 1 year but not later than 5 years 132,732 132,824 1,230 2,442Later than 5 years 86,026 112,445 - -265,961 289,380 3,004 3,829The Group leases various offices and warehouses under non-cancellable operating leases expiring within 2 and 15 years. The leaseshave varying terms, escalation clauses and renewal rights. Where the leases have fixed escalation clauses, the operating lease isexpensed on a straight line basis.Operating leases are entered into as a means of acquiring access to office facilities. Rental payments are generally fixed, but withinflation and/or market escalation clauses on which contingent rentals are determined. Operating lease commitments in respectof the rental of various premises are subject to market review at various intervals. Certain leases include an option to renew. Nooperating leases contain restrictions on financing or other leasing activities.89-92Reports93-96Further InformationPAGE 67