COMPUTERSHARE ANNUAL REPORT 2008

COMPUTERSHARE ANNUAL REPORT 2008

COMPUTERSHARE ANNUAL REPORT 2008

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

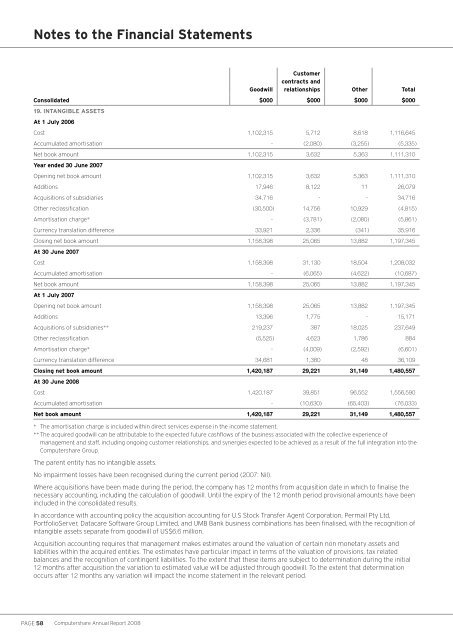

Notes to the Financial StatementsGoodwillCustomercontracts andrelationships Other TotalConsolidated $000 $000 $000 $00019. INTANGIBLE ASSETSAt 1 July 2006Cost 1,102,315 5,712 8,618 1,116,645Accumulated amortisation - (2,080) (3,255) (5,335)Net book amount 1,102,315 3,632 5,363 1,111,310Year ended 30 June 2007Opening net book amount 1,102,315 3,632 5,363 1,111,310Additions 17,946 8,122 11 26,079Acquisitions of subsidiaries 34,716 - - 34,716Other reclassification (30,500) 14,756 10,929 (4,815)Amortisation charge* - (3,781) (2,080) (5,861)Currency translation difference 33,921 2,336 (341) 35,916Closing net book amount 1,158,398 25,065 13,882 1,197,345At 30 June 2007Cost 1,158,398 31,130 18,504 1,208,032Accumulated amortisation - (6,065) (4,622) (10,687)Net book amount 1,158,398 25,065 13,882 1,197,345At 1 July 2007Opening net book amount 1,158,398 25,065 13,882 1,197,345Additions 13,396 1,775 - 15,171Acquisitions of subsidiaries** 219,237 387 18,025 237,649Other reclassification (5,525) 4,623 1,786 884Amortisation charge* - (4,009) (2,592) (6,601)Currency translation difference 34,681 1,380 48 36,109Closing net book amount 1,420,187 29,221 31,149 1,480,557At 30 June <strong>2008</strong>Cost 1,420,187 39,851 96,552 1,556,590Accumulated amortisation - (10,630) (65,403) (76,033)Net book amount 1,420,187 29,221 31,149 1,480,557* The amortisation charge is included within direct services expense in the income statement.** The acquired goodwill can be attributable to the expected future cashflows of the business associated with the collective experience ofmanagement and staff, including ongoing customer relationships, and synergies expected to be achieved as a result of the full integration into theComputershare Group.The parent entity has no intangible assets.No impairment losses have been recognised during the current period (2007: Nil).Where acquisitions have been made during the period, the company has 12 months from acquisition date in which to finalise thenecessary accounting, including the calculation of goodwill. Until the expiry of the 12 month period provisional amounts have beenincluded in the consolidated results.In accordance with accounting policy the acquisition accounting for U.S Stock Transfer Agent Corporation, Permail Pty Ltd,PortfolioServer, Datacare Software Group Limited, and UMB Bank business combinations has been finalised, with the recognition ofintangible assets separate from goodwill of US$6.6 million.Acquisition accounting requires that management makes estimates around the valuation of certain non monetary assets andliabilities within the acquired entities. The estimates have particular impact in terms of the valuation of provisions, tax relatedbalances and the recognition of contingent liabilities. To the extent that these items are subject to determination during the initial12 months after acquisition the variation to estimated value will be adjusted through goodwill. To the extent that determinationoccurs after 12 months any variation will impact the income statement in the relevant period.PAGE 58 Computershare Annual Report <strong>2008</strong>