Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong><br />

<strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> S.p.A. and subsidiary companies<br />

Interim Report on the six months ended<br />

30th June 2001<br />

<strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong><br />

1

FOREWORD<br />

2<br />

Interim Report on the six months<br />

ended 30th June 2001<br />

for the <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Group<br />

Interim Report on the six months<br />

ended 30th June 2001<br />

for the parent company<br />

<strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> S.p.A.

This interim report was prepared by the Board of Directors on 13th September 2001.<br />

This report is divided into two sections; the first part shows the performance of the <strong>Savino</strong> <strong>Del</strong><br />

<strong>Bene</strong> Group during the first six months of the year 2001 while the second part shows the<br />

performance of the parent company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> S.p.A.<br />

This report has been prepared in accordance with the Italian Civil Code and in compliance with<br />

the Italian Stock Exchange Commission (Consob) regulations.<br />

The Company has chosen to show the result for the period prior to taxation, taking advantage of<br />

the possibility offered by paragraph 7 of Article No. 81 of the Consob circular No. 12475 of 6th<br />

April 2000.<br />

The figures contained in this report are expressed in millions of Italian lire.<br />

Comparative figures are given for the corresponding period of the previous year and for the<br />

previous year end.<br />

SAVINO DEL BENE GROUP<br />

INTERIM REPORT ON THE FIRST SIX MONTHS OF THE YEAR 2001<br />

3

BOARD OF DIRECTORS, BOARD OF STATUTORY AUDITORS<br />

AND INDEPENDENT AUDITORS<br />

(In accordance with Consob Circular No. 97001574 of 20.2.1997)<br />

BOARD OF DIRECTORS<br />

(appointed up until the date of the approval of the financial statements for the year ended on<br />

31.12.2001)<br />

Chairman<br />

Nocentini Paolo<br />

Responsibilities: the ordinary and extraordinary administration, with the exception of actions for which the<br />

Board of Directors’ authorisation is specifically required by law and actions of significant economic<br />

importance such as the purchase and sale of real estate, companies, investments and the granting of<br />

guarantees for amounts in excess of Lire 300 million.<br />

Vice-chairman<br />

Macucci Giuliano<br />

Responsibilities: the same as those attributed to the Chairman, to be carried out in the Chairman’s<br />

absence or impediment.<br />

Managing Director<br />

Brandani Silvano<br />

Responsibilities: the logistics organisation of the Company, the control and management of the Livorno<br />

branch and management co-ordination of relations with the American subsidiary companies.<br />

Directors<br />

Lapi Francesca<br />

* BOARD OF STATUTORY AUDITORS<br />

(appointed up until the date of the approval of the financial statements for the year ended on<br />

31.12.2001)<br />

Acting Auditors<br />

Annibale Viscomi – Chairman<br />

Luca Porciani<br />

Roberto Zaffina<br />

Substitute Auditors<br />

Franco Vannucchi<br />

Muzio Clementi<br />

4

GROUP PERFORMANCE<br />

In consideration of the parent company’s preponderant importance within the Group, and of the<br />

fact that the companies included in the consolidation area operate in the same markets, have<br />

the same characteristics and are equally dependent upon external factors, for information<br />

regarding the performance of the individual consolidated companies, reference should be made<br />

to the comments contained in the Directors' Report on the interim financial statements of the<br />

parent company, <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> S.p.A. for the first six months of the year 2001.<br />

The results for the period can be seen from the summarised interim income statement and<br />

balance sheet shown below.<br />

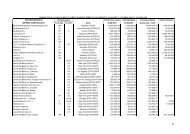

30.6.2001 31.12.2000 30.6.2000<br />

Net sales of goods and<br />

services<br />

455,144 761,538 335,568<br />

Other income and revenues 2,004 3,630 2,074<br />

Purchases of materials and<br />

services<br />

(382,556) (629,038) (275,666)<br />

Added value 74,592 136,130 61,976<br />

Labour costs (50,995) (77,135) (35,339)<br />

Other operating expenses (1,645) (3,513) (629)<br />

Gross operating margin 21,952 55,482 26,008<br />

Amortisation and depreciation (4,844) (7,086) (2,770)<br />

Provisions for risks (2,543) (3,793) (2,221)<br />

Operating income 14,565 44,603 21,017<br />

Financial income (expenses)<br />

net<br />

5,765 5,018 3,880<br />

Group share of income from<br />

companies valued at net<br />

equity<br />

330 0 15<br />

Income before extraordinary<br />

items<br />

20,660 49,621 24,912<br />

Extraordinary income<br />

(expenses), net<br />

(136) 2,625 (289)<br />

Income before taxes 20,524 52,246 24,623<br />

Income taxes for the period 0 (22,619) 0<br />

Net income for the period 20,524 29,627 24,623<br />

Income/(losses) attributable to<br />

minority interests<br />

(2,837) (1,812) (1,417)<br />

Group share of net income 17,687 27,815 23,206<br />

30.6.2001 31.12.2000 30.6.2000<br />

Amounts due from shareholders 0 0 0<br />

Fixed assets 78,132 64,183 48,155<br />

Trade receivables 226,217 183,453 152,136<br />

Other assets 20,927 23,841 15,999<br />

Trade payables (124,370) (112,522) (95,668)<br />

Provisions for risks and charges (5,129) (4,400) (4,206)<br />

Other liabilities (45,607) (42,022) (22,942)<br />

Capital invested – liabilities 150,170 112,533 93,474<br />

Employee termination indemnity (15,118) (12,761) (12,007)<br />

Net capital invested 135,052 99,772 81,467<br />

Financed by:<br />

5

Group share of net equity 123,967 112,902 94,943<br />

Minority interest share of net equity 10,626 6,187 4,841<br />

Net medium/long term indebtedness 6,936 4,917 5,079<br />

Net short term indebtedness (6,477) (24,234) (23,396)<br />

Total sources of finance 135,052 99,772 81,467<br />

An analysis of the above figures shows a significant growth in consolidated turnover (+ 35.63 %)<br />

and in added value (+ 20.36%) with respect to the first six months of the year 2000, and an<br />

equally important decrease in gross operating margin (-15.6%) and in net operating profit (-<br />

30.7%).<br />

The Group share of net income before taxes has fallen by 23.78% with respect to the first six<br />

months of the year 2000.<br />

The increase in turnover and profitability margins has been possible due to the following factors:<br />

- The expansion of the consolidation area and the acquisition of certain important business<br />

segments from third party companies which enabled the Group to fight the negative trend in<br />

the US economy which was particularly evident from the first months of the year 2001<br />

onwards;<br />

- the containment of both general and administrative expenses and of freight charges;<br />

- the provision of a high quality professional service which enabled us to maintain important<br />

traffic in both the air and sea sector and, in certain cases, has also enabled us to increase<br />

our market share.<br />

The expansion of the Group's activities and the increased demand for space on air and marine<br />

carriers during the year 2000 led to a significant increase in freight charges which did not<br />

however have any significant negative effects on added value as a result of the particularly<br />

favourable economic situation which enabled the Group to significantly expand its turnover.<br />

During the year 2001 and particularly during the second quarter, the slight drop in sales revenue<br />

(in terms of homogeneous consolidation area) was not matched by an immediate and<br />

proportional decrease in freight charges. This has led to a percentage increase in the incidence<br />

of materials and service costs on turnover which, in turn, affected added value.<br />

We would also add that, due to the difficult situation on the US market particularly as from the<br />

beginning of the year 2001, it was also extremely difficult to maintain our charges to customers<br />

at the same levels as those of the previous months and therefore it was necessary in certain<br />

cases to apply further reductions.<br />

The gross operating margin showed a significant decrease in its percentage incidence on<br />

turnover (4.82% at 30.06.2001, against 7.28% at 31.12. 2000 and 7.75% at 30.06.2000) due<br />

mainly to the significant increase in the percentage incidence of labour costs on turnover<br />

(11.20% at 30.06.2001, against 10.12% at 31.12. 2000 and 10.53% at 30.06.2000). In fact, as<br />

part of its strategy of expanding its export business from the USA towards Europe and the rest<br />

of the world, the Group had carried out significant investment in human resources, which at the<br />

moment weigh heavily on the income statement and are not being utilised to their full potential<br />

by the Group. Nevertheless, it is undeniable that the globalisation strategy adopted by the <strong>Savino</strong><br />

<strong>Del</strong> <strong>Bene</strong> Group is essential for its future development and expansion and that such investment<br />

is necessary and that the positive effects thereof shall become apparent in the coming years.<br />

The Group's net financial position was slightly negative at 30.06.2001, with a net indebtedness of<br />

Lire 459 million, against a net liquidity of Lire 18.3 billion at 30.6.2000 and Lire 19.3 billion at<br />

31.12. 2000. This figure (considering the investment made in order to obtain control of the<br />

company Leonardi S.p.A) confirms the Group's financial solidity and its ability to resort to<br />

financial leverage if necessary, should any interesting investment opportunities arise.<br />

6

PERFORMANCE FIGURES<br />

The table below shows an analysis of air and sea traffic by geographical area and the analysis of<br />

the number of Teus shipped shows a significant increase in the volume of shipments,<br />

particularly in North America, where the Group is greatly intensifying its activities. The Far East<br />

and South America also showed excellent results.<br />

(Teus) 30.6.2001 30.6.2000<br />

North America 51,658 46,376<br />

Central America 822 357<br />

South America 2,882 2,247<br />

Europe 2,053 1,307<br />

Africa 2,530 778<br />

Middle East 3,711 1,214<br />

Far East 4,302 1,883<br />

Australia and South Pacific 1,149 552<br />

South Asia 876 62<br />

Total 69,983 54,776<br />

We would emphasise the importance of the contribution to this increase made by the company<br />

Leonardi (not consolidated at 30.06.2000 as it had not yet been acquired by the Group) which<br />

shipped approx. No. 14,000 Teus during the first six months of the year 2001.<br />

The following table shows the geographical distribution of air traffic:<br />

( Kgs.) 30.6.2001 30.6.2000<br />

North America 11,917,717 11,187,725<br />

Central America 251,939 120,940<br />

South America 931,245 541,282<br />

Europe 1,208,549 1,179,871<br />

Africa 396,414 207,320<br />

Middle East 729,849 441,294<br />

Far East 3,603,309 2,479,968<br />

Australia and South Pacific 124,781 66,237<br />

South Asia 569,498 368,017<br />

Total 19,733,301 16,592,654<br />

The most important variation during the period, apart from the normal expansion of the North<br />

American business, is the significant increase in traffic towards the Far East, which<br />

demonstrates the particular attention which the Group's management is dedicating to the<br />

globalisation of traffic and to the development and expansion of exports from the USA towards<br />

the rest of the world.<br />

7

STRATEGY AND PROSPECTS FOR THE FUTURE<br />

During the first six months of the year 2001 the Group has continued its strategy of globalisation<br />

of its activities and diversification towards new market outlets with new investments in both<br />

traditional geographic areas (principally the USA) and in other areas considered strategically<br />

important and with high potential. In particular a new office has been opened in Argentina and<br />

the Group has acquired a further share (30%) of the South African company Strategic Logistical<br />

Alliance.<br />

Management intends to carefully examine every potential investment opportunity which could<br />

enable it to further integrate its services and extend its operative and commercial base both in<br />

Europe and abroad.<br />

INTER COMPANY TRANSACTIONS<br />

The parent company is an international shipping company which organises the logistics side of<br />

the transport of goods, without using its own carriers, in the manner and timing most suited to<br />

the specific customer requirements. The use of third party carriers enables the Company to<br />

maintain a more flexible structure and enables it to adapt to eventual fluctuations in demand,<br />

without a high incidence of fixed costs. La creation of an international network of subsidiary and<br />

associated companies and commercial offices enables the Group to guarantee its customers a<br />

highly professional and personalised service capable of satisfying the most varied demand. In<br />

this respect the <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Group includes companies which operate mainly in the IT and<br />

logistic support sector (mainly warehousing, customs clearing services etc.).<br />

As regards the principal transactions and relationships between Group companies, reference<br />

should be made to the comments on the parent company's interim financial statements for the<br />

period ended 30.6.2001.<br />

DISCLOSURE OF RELATED PARTY TRANSACTIONS<br />

In accordance with the CONSOB recommendation No. DAC/98015375 of 27th February 1998, we would<br />

point out that the Group company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> S.L. Spain has received services from the company<br />

Amazzone S.a.s. (5.059 % held by the parent company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> S.p.A.) for a total of Lire 50<br />

million related to the supply of the commercial know-how necessary for the running of the company's<br />

operating activities.<br />

SIGNIFICANT POST BALANCE SHEET EVENTS<br />

No significant events have taken place after the end of June 2001, with the exception of those<br />

disclosed in the Directors’ interim report on the parent company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong>.<br />

FORECAST FOR THE REMAINDER OF THE CURRENT YEAR<br />

The prospects for the year 2001 shall clearly be dependent upon the prospects of a recovery in<br />

the US economy. However the Group’s management is reasonably optimistic because, even in<br />

the event that the current difficult economic situation should persist, freight charges should fall<br />

even further more or less in line with the drop in the volumes of goods transported in the whole<br />

world.<br />

8

CONSOLIDATION PRINCIPLES<br />

a) Consolidation method<br />

The consolidation was carried out in accordance with the line-by-line (global integration) method.<br />

The main consolidation principles adopted are summarised below:<br />

-the book value of the investments held by the holding company or other Group companies in<br />

consolidated subsidiaries is eliminated against the related shareholders’ equity, and their assets, liabilities,<br />

income and expenses are consolidated on a line-by-line basis;<br />

-the difference between the book value and the net equity value of the consolidated companies is<br />

allocated, if positive, to the value of the assets acquired (such as land, buildings and plant, on the basis of<br />

assessments carried out by independent surveyors) within the limits of the fair value of such assets and<br />

any excess is allocated to the heading “Consolidation differences”. The depreciation of these assets is<br />

made on the basis of their estimated useful economic lives.<br />

If negative, the difference is allocated to the heading “Consolidation reserves”;<br />

-all receivables, payables, income and charges between companies included in the consolidation area are<br />

eliminated, as are any gains or losses deriving from operations carried out between consolidated<br />

companies and not yet realised at the balance sheet date.<br />

-the minority shareholders’ interest in net equity and results for the period are shown separately in the<br />

consolidated balance sheet and income statement;<br />

-all dividends received from consolidated companies are eliminated;<br />

b) Translation of foreign currency financial statements and of balances expressed in foreign<br />

currencies.<br />

- Financial statements expressed in currencies adhering to the Single European Currency, "Euro", are<br />

translated into Italian Lire at the fixed Euro exchange rate established on 31.12.1998 by the European<br />

Commission. Financial statements expressed in other foreign currencies are translated into Italian Lire<br />

at the exchange rates as of 29.6.2001, with the exception of shareholders' equity balances, which are<br />

translated at historical exchange rates. The resulting exchange differences are recorded under the<br />

heading " Other reserves".<br />

The following exchange rates were utilised:<br />

CURRENCY JUNE 2001 DECEMBER 2000<br />

US Dollar 2,283.33 2,080.89<br />

Canadian Dollar 1,497.84 1,386.51<br />

Pounds Sterling 3,210.52 3,102.49<br />

Spanish Peseta 11.6372 11.6372<br />

Portuguese Escudo 9.65807 9.65807<br />

Korean Won 1.755 1.644<br />

French Franc 295.182 295.182<br />

Singapore Dollar 1,253.16 1,200.71<br />

Hong Kong Dollar 292.739 266.784<br />

Japanese Yen 18.375 18.109<br />

Indian Rupee 47.776 45.036<br />

Brazilian Real 994.051 1,063.79<br />

Turkish Lira 0.001 0.003<br />

9

Malaysian Ringit 600.957 547.675<br />

Indonesian Rupee 0.2 0.216<br />

Nuevo sol 650.004 590.156<br />

Swiss Franc 1,271.51 1,240.612<br />

CONSOLIDATION AREA<br />

CONSOLIDATION AREA<br />

The consolidated interim financial statements of the <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Group at 30th June 2001 derive<br />

from the consolidation at that date of <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> S.p.A. (the parent company) and of the companies<br />

in which it holds, either directly or indirectly, a controlling interest in accordance with Art. 2359 of the Italian<br />

Civil Code.<br />

The consolidation area changed during the period following the inclusion of the company<br />

Leonardi & Co. S.p.A, acquired during the first six months of the year 2001.<br />

The list of the investments included in the consolidation area, together with information regarding the<br />

consolidation method used, is shown in Schedule No. 1 attached to this report.<br />

The following information is given in addition to that contained in the abovementioned schedule:<br />

1) The direct investment in the company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> USA Inc. (64%) is held by the company<br />

S.D.B. Finanziaria S.A., with head offices in Luxembourg.<br />

2) The direct investments (100%) in the companies <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Inc. New York, <strong>Savino</strong> <strong>Del</strong><br />

<strong>Bene</strong> (Texas) Inc., <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Inc. California, <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Inc. Miami, <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong><br />

(Georgia) Inc., <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> International Freight Forwarders Inc. Chicago, <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong><br />

Inc. Masachussets, Fashion Distribution Services Inc. New Jersey, <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Inc.<br />

Charlotte, <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Inc. Seattle and Superb Custom Brokers Inc. are held by the company<br />

<strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> USA Inc.<br />

3) The direct investment in the company Brewer Enterprises Inc. (36%) is held by the company S.D.B<br />

Finanziaria S.A., with head offices in Luxembourg.<br />

4) The direct investment in the company Savitransport Inc. Chicago (95 %) is held by the company<br />

Savitransport S.p.A<br />

5) The direct investment in the company Savitransport Inc. New York (95 %) is held by the company<br />

Savitransport S.p.A.<br />

6) The direct investment in the company Albatrans Inc. New York (80 %) is held by the company<br />

Albatrans S.p.A.<br />

7) The direct investment in the company General Freight Inc. (100%), with head offices in New York, is<br />

held by the company General Noli S.p.A.<br />

8) The direct investments in the company General Freight Inc. (100%), with head offices in Montreal, are<br />

held by the company General Noli S.p.A.<br />

9) The direct investments in the company General Noli S.L. (100%), with head offices in Valencia, are<br />

held, for 51% by the company General Noli S.p.A and for 49% by the company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong><br />

International S.A. Luxembourg.<br />

10) The direct investment in the company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Portuguesa Lda, with head offices in Perafita<br />

in Portugal (5%) is held by the company Tavoni Arimar S.p.A.<br />

11) The direct investment in the company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> France (99.94 %) is held by the company<br />

<strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> International S.A. Luxembourg.<br />

10

12) The direct investments in the company S.D.B Finanziaria S.A (100 %) are held, for 99.86 % by the<br />

company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> International S.A. Luxembourg and for 0.14% by the company Cavallino<br />

S.r.l.<br />

13) The direct investment in the company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Naklyiati Ltd. (99%), with head offices in<br />

Istanbul, is held by the company S.D.B. Finanziaria S.A. with head offices in Luxembourg.<br />

14) The direct investment in the company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> (S) Pte Ltd (100 %), with head offices in<br />

Singapore, is held by the company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> International S.A. Luxembourg.<br />

15) The direct investment in the company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> K.L Sdn. Bhd. (100%) is held by the company<br />

S.D.B. Finanziaria S.A. with head offices in Luxembourg.<br />

16) The direct investment in the company PT <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Indonesia (100%) is held by the company<br />

S.D.B. Finanziaria S.A. with head offices in Luxembourg.<br />

17) The direct investment in the company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Japan Co. Ltd. (100 %) is held by the<br />

company S.D.B Finanziaria S.A. with head offices in Luxembourg.<br />

18) The direct investment in the company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Freight Forwarders India Pvt. Ltd. (100%) is<br />

held by the company S.D.B. Finanziaria S.A. with head offices in Luxembourg.<br />

19) The direct investment in the company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Do Brasil LTDA (99%) is held by the company<br />

S.D.B. Finanziaria S.A. with head offices in Luxembourg.<br />

20) The direct investment in the company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Peru S.A.C. (99%) is held by the company<br />

S.D.B. Finanziaria S.A. with head offices in Luxembourg.<br />

21) The direct investment in the company Novibrama S.r.l. (5 %) is held by the company Cavallino S.r.l.<br />

22) The direct investment in the company C.R.T. S.r.l. (95%) is held by the company Novibrama S.r.l.<br />

23) The direct investment in the company Savitransport Triveneto S.r.l (51%) is held by the company<br />

Savitransport S.p.A.<br />

24) The direct investment in the company L.S. Logistic Group S.r.l (50%) is held by the company<br />

Leonardi & Co. S.p.A.<br />

25) The direct investment in the company Strategical Logistical Alliance (Pty) Ltd. (50%) is held by the<br />

company S.D.B. Finanziaria S.A. with head offices in Luxembourg.<br />

26) The direct investment in the company Hansa Express Speditionsgesellschaft MBH (35%) is held by<br />

the company S.D.B. Finanziaria S.A. with head offices in Luxembourg.<br />

27) The direct investment in the company Leonardi Cameroon (24,5 %) with head offices in<br />

Douala (Cameroon) is held by the company Leonardi & Co. S.p.A.<br />

28) The direct investment in the company Tavoni International Algeria (15 %) with head offices<br />

in Algiers (Algeria) is held by the company Tavoni Arimar S.p.A.<br />

29) The direct investment in the company Direct European Transportation (100%) is held by the<br />

company SDB UK Ltd .<br />

30) The direct investment in the company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> S.A. (98,8%) with head offices in<br />

Chiasso is held by the company S.D.B. Finanziaria S.A. with head offices in Luxembourg.<br />

31) The direct investment in the company Leonardi & Co. Usa Inc. (100 %) is held by the<br />

company Leonardi & Co. S.p.A.<br />

32) The direct investment in the company Albatrans France S.a.r.l. (80 %) is held by the company<br />

Albatrans S.p.A.<br />

11

33) The direct investment in the company Albatrans Spain S.l. (80 %) is held by the company<br />

Albatrans S.p.A.<br />

34) The direct investment in the company Leonardi Iberia S.A (100 %) with head offices in<br />

Valencia (Spain) is held by the company Leonardi & Co. S.p.A.<br />

35) The direct investment in the company Alpha Line Limited (99%) is held by the company<br />

S.D.B. Finanziaria S.A. with head offices in Luxembourg.<br />

36) The direct investment in the company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Pte Thailand Ltd. (100%) is held by the<br />

company S.D.B. Finanziaria S.A. with head offices in Luxembourg.<br />

37) The direct investment in the company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Egypt Ltd. (100%) is held by the company<br />

S.D.B. Finanziaria S.A. with head offices in Luxembourg.<br />

38) The direct investment in the company General Noli do Brasil Ltda (100%) with head offices<br />

in San Paolo (Brazil) is held by the company S.D.B. Finanziaria S.A. with head offices in<br />

Luxembourg for 98% and by the company General Noli S.p.A for 2%.<br />

39) The direct investment in the company Tavoni International S.A (100 %) with head offices in<br />

Mexico City is held by the company Tavoni Arimar S.p.A.<br />

40) The direct investment in the company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Argentina Ltd. (99%) with head<br />

offices in Buenos Aires is held by the company S.D.B. Finanziaria S.A. with head offices in<br />

Luxembourg.<br />

12

ACCOUNTING PRINCIPLES<br />

The accounting principles adopted in the preparation of the consolidated interim financial statements for<br />

the six-month period ended 30th June 2001 are consistent with those of the year ended 31st December<br />

2000 with the exception of the following:<br />

a) Income taxes<br />

No current or deferred taxation has been calculated on the income for the period.<br />

b) Minority interest share of income for the period<br />

As a result of the above, the result for the period attributable to minority interests has<br />

been calculated on income for the period before current and deferred tax.<br />

13

COMMENTS ON THE PRINCIPAL ASSET HEADINGS<br />

AMOUNTS DUE FROM SHAREHOLDERS FOR SHARE PAYMENTS DUE<br />

No balance exists for this heading at 30.6.2001, as was also the case at 31.12. 2000 and 30.6.2000.<br />

FIXED ASSETS<br />

Intangible Fixed Assets<br />

These amount to Lire 9,475 million at 30.06.2001, against Lire 1,784 million at 31.12.2000 and Lire 1,692<br />

million at 30.06.2000.. They comprise mainly costs sustained for the purchase of software and for<br />

improvements to third party assets. The movements during the period are shown in Schedule No.2<br />

attached to this report.<br />

Intangible fixed assets are comprised of the following:<br />

Starting up and expansion costs<br />

These amount to Lire 250 million at 30.06.2001, against Lire 77 million at 31.12. 2000 and Lire<br />

259 million at 30.06.2000.<br />

They comprise principally the following costs sustained:<br />

- for the increase in share capital by means of a bonus issue resolved by the Extraordinary<br />

Shareholders’ Meeting of the parent company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> S.p.A. dated 16th September 1998<br />

(Lire 33 million);<br />

- for the bonus issue of share capital resolved by the Board of Directors on 17th May 1999 in exercising<br />

the powers conferred on them by the extraordinary shareholders’ meeting of 16th September 1998 (Lire<br />

4 million);<br />

- for legal and fiscal charges relative to the stipulation of contracts for the acquisition of companies and<br />

to the statutory amendments resolved by the extraordinary shareholders' meeting of 28th April 2000<br />

relative to the conversion of the Company's share capital from Italian lire into Euro and to the transfer to<br />

secondary premises (Lire 4 million);<br />

- for legal and fiscal charges relative to the bonus issue of share capital increase resolved by the Board<br />

of Directors on 30th March 2001 in exercising the powers conferred on them by the Extraordinary<br />

Shareholders’ Meeting of the parent company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> on 16th September 1998 (Lire 5 million);<br />

- for legal and fiscal charges relative to the acquisition of the business segment of the<br />

company Tavoni and the consequent changes to the company’s statute (Lire 52 million).<br />

- for costs sustained relative to the acquisition of the business segment of a brokerage<br />

company by the company Albatrans Inc. with head offices in New York (Lire 129 million).<br />

- for legal and fiscal charges relative to the merger by incorporation of the companies<br />

Darimec Commerciale S.r.l. and Chriseco S.r.l. in the company Cavallino S.r.l. (Lire 4<br />

million).<br />

14

The variation during the period is due mainly to the additions during the period (Lire 202<br />

million) and the amortisation charges for the period (Lire 40 million).<br />

Research, development and advertising expenses<br />

These show a nil balance at 30.06.2001, as was also the case at 31.12.2000 and at<br />

30.06.2000.<br />

Concessions, licences, trademarks and similar rights<br />

These amount to Lire 403 million at 30.06.2001, against Lire 282 million at 31.12.2000 and Lire 140<br />

million at 30.06.2000.<br />

They comprise mainly the costs of applications software purchased for use under licence.<br />

The movements during the period are due to changes in the consolidation area for Lire 141<br />

million, additions during the period of Lire 80 million, and amortisation charges of Lire 93<br />

million.<br />

Goodwill<br />

This amounts to Lire 2,512 million at 30.06.2001, against Lire 630 million at 31.12. 2000 and<br />

Lire 230 million at 30.06.2000.<br />

The variation during the period is due principally to the goodwill paid by the company Arimar<br />

S.r.l. for the acquisition of the business segment of the company Tavoni (Lire 1,685 million)<br />

and by the company Albatrans Inc. New York for the acquisition of the business segment of<br />

the company Chase Leavitt with head offices in New York , and also to the amortisation charge<br />

for the period (Lire 274 million).<br />

Fixed assets in progress and advances to suppliers<br />

These amount to Lire 114 million at 30.06.2001. No such balance existed at either 31.12.2000<br />

or 30.6.2000.<br />

These relate to advance payments made by the parent company for the acquisition of a<br />

building in Genoa (Lire 34 million) and advance payments made by the company General Noli<br />

S.p.A for rewiring and other work on the electrical system in their offices (Lire 80 million).<br />

Other intangible fixed assets<br />

These amount to Lire 905 million at 30.06.2001, against Lire 582 million at 31.12. 2000 and<br />

Lire 530 million at 30.06.2000.<br />

.<br />

They include the costs sustained for :<br />

- improvements to leased assets (Lire 843 million);<br />

- the attainment of the ISO 9002 quality certificate (Lire 3 million);<br />

- legal fees sustained by the company Cavallino S.r.l. relative to the receipt of a mortgage loan (Lire 2<br />

million);.<br />

- increase due to the extension of the consolidation area (Lire 57 million)<br />

15

The variation during the period was due mainly to the amortisation charge for the period (Lire<br />

215 million), to costs sustained for improvements to leased assets (Lire 483 million) and to<br />

increase due to changes in the consolidation area (Lire 68 million) .<br />

Consolidation differences<br />

These amount to Lire 5,291 million at 30.06.2001, against Lire 213 million at 31.12.2000 and<br />

Lire 533 million at 30.06.2000.<br />

The variation during the period is due to the goodwill paid by the parent company for the acquisition of<br />

51% of the company Leonardi & Co. S.p.A. (Lire 5,672 million) and to the amortisation of the positive net<br />

consolidation differences arising as a result of the changes in the consolidation area during the year 2000<br />

and during the first six months of the year 2001 only partially covered by the residual consolidation<br />

reserves at that date (Lire 594 million).<br />

Consolidation differences are amortised over a period of five years.<br />

Tangible fixed assets<br />

These amount to Lire 61,284 million at 30.06.2001, against Lire 56,321 million at 31.12.2000<br />

and Lire 38,101 million at 30.06.2000.<br />

The movements during the period are shown in Schedule No.3 attached to this report. This schedule<br />

shows the movements in historical cost and in accumulated depreciation.<br />

The components of tangible fixed assets are:<br />

Land and buildings<br />

These amount to Lire 43,388 million at 30.06.2001, against Lire 42,913 million at 31.12.2000<br />

and Lire 26,272 million at 30.06.2000<br />

This asset category also includes consolidation differences relative to the year 1999 (for a total<br />

of Lire 687 million, net of accumulated depreciation) arising from the acquisition by the<br />

company S.D.B. Finanziaria S.A. with head offices in Luxembourg, of 36% of the entire share<br />

capital of the company Brewer Enterprises Inc.<br />

The depreciation charge for the period amounted to Lire 1,198 million.<br />

Plant and machinery<br />

These amount to Lire 167 million at 30.06.2001, against Lire 60 million at 31.12.2000 and Lire<br />

65 million at 30.06.2000.<br />

Purchases during the period amounted to Lire 107 million.<br />

The depreciation charge for the period amounts to Lire 10 million.<br />

Industrial and commercial equipment<br />

These amount to Lire 1,428 million at 30.06.2001, against Lire 1,278 million at 31.12.2000 and<br />

Lire 1,153 million at 30.06.2000.<br />

The following movements took place during the period: purchases for Lire 309 million,<br />

disposals for Lire 42 million , ordinary depreciation charges for Lire 215 million, utilisation of<br />

accumulated depreciation on disposals for Lire 42 million.<br />

16

The purchases and disposals which took place during the period relate mainly to changes made by the<br />

parent company in order to improve the efficiency of its warehouse.<br />

Other assets<br />

These amount to Lire 16,074 million at 30.06.2001, against Lire 11,820 million at 31.12.2000<br />

and Lire 10,490 million at 30.06.2000.<br />

The movements are due mainly to additions during the period (in particular to the purchase of<br />

electronic machinery, motor vehicles, plant and equipment for a total value of Lire 5,907<br />

million, to disposals (Lire 1,236 million), to ordinary depreciation charges ( Lire 2,205 million),<br />

and to the reversal of accumulated depreciation on disposals for approximately Lire 980<br />

million. The increase due to the extension of the consolidation area amounted to Lire 542<br />

million.<br />

Advances to suppliers of fixed assets<br />

These amount to Lire 227 million at 30.06.2001, against Lire 250 million at 31.12.2000 and Lire<br />

121 million at 30.06.2000.<br />

This balance has increased by Lire 227 million following the advances paid by the parent<br />

company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> S.p.A. for the acquisition of the ground lease on council land in<br />

Genoa for office use (Lire 182 million) for restructuring work to be carried out on the<br />

Company’s Livorno building (Lire 40 million) and for the purchase of equipment Lire 5 million).<br />

Financial Fixed Assets<br />

Equity investments<br />

These are comprised as follows:<br />

Investments in non-consolidated subsidiary companies<br />

30.06.01 31.12.00 30.06.00 % direct % indirect<br />

possession possession<br />

<strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Fiume 39 39 39 90 0<br />

Schiassi Spedizioni S.r.l. 0 303.9 * 0 100<br />

General Freight Inc. Canada ** ** 0.1 0 100<br />

Direct Eur. Transportation 0 0 0 0 100<br />

<strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> S.A. Chiasso 296.7 296.7 296.7 0 98.8<br />

Alpha Line Ltd. 17.6 17.6 17.6 0 99<br />

Albatrans Spain S.L. 104.7 104.7 40.3 10 40<br />

Albatrans France S.r.l 13.2 13.2 13.2 10 40<br />

Da Verrazzano Incentive S.r.l. *** *** 1 0 100<br />

Da Verrazzano S.r.l *** *** 454.2 51 49<br />

Vespucci S.r.l *** *** 68.4 5 95<br />

<strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> France ** ** 1,013.1 0 99.94<br />

Leonardi Usa Inc. 3.5 **** **** 0 51<br />

Leonardi Iberia S.A 314.3 **** **** 0 51<br />

General Noli do Brasil 460.3 **** **** 0 100<br />

Tavoni International S.A 40 **** **** 0 100<br />

<strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Argentina 208.5 **** **** 1 99<br />

<strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> K.L. ** ** 115.3 0 100<br />

<strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Naklyiati Ltd ** ** 182.9 0 100<br />

<strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Pte Thailand 173.3 173.3 173.3 0 100<br />

<strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Egypt 198.9 198.9 198.9 0 100<br />

<strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Perù ** ** 211.6 1 99<br />

<strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Indonesia ** ** 41.5 0 100<br />

17

Total 1,870 1,147.3 2,867.1<br />

18

* At 30th June 2000 the subsidiary company Schiassi Spedizioni S.r.l. was consolidated on a<br />

line-by-line basis. This company was not consolidated at 31.12.2000, as it had been placed into<br />

liquidation on 31.12.2000.<br />

** At 31st December 2000 and at 30th June 2001 the subsidiary companies <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong><br />

Naklyiati Ltd. , General Freight Inc. Canada, <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> K.L. Sdn. Bhd, PT <strong>Savino</strong> <strong>Del</strong><br />

<strong>Bene</strong> Indonesia, <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Perù S.A.C and <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> France were consolidated<br />

on a line-by-line basis.<br />

*** The companies Da Verrazzano S.r.l., Vespucci S.r.l and Da Verrazzano Incentive S.r.l. were<br />

sold on 14th July 2000. Therefore they were not consolidated at 31st December 2000 and at<br />

30th June 2001.<br />

**** these companies were not part of the <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Group at 30th June and 31st<br />

December 2000.<br />

In accordance with Art. 28 of Law No. 127/91, the subsidiary companies listed above have not been<br />

consolidated but rather have been valued at cost as the extent of their operations, as a whole, are<br />

extremely limited (in terms of total assets, total net equity, normal revenue).<br />

Investments in associated companies<br />

30.06.01 31.12.00 30.06.00 % direct % indirect<br />

possession possession<br />

F.lli Ghelardi 52 52 52 49<br />

L.S.Log Group S.r.l. 8.2 * * 24.5<br />

Levitrans S.r.l. 1,350.6 1,467.4 1,700 40<br />

Strategical Logistic 463 463 463 50<br />

Hansa Express 53.3 53.3 53.3 35<br />

Do.ca S.r.l 990.5 775.4 975.6 39.1788<br />

Total 2,917.6 2,811.1 3,243.9<br />

* this company was not part of the <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Group at 30th June and 31st December<br />

2000.<br />

Investments in other companies<br />

30.06.01 31.12.00 30.06.00 % direct % indirect<br />

possession possession<br />

Aereop.Vicentini S.p.A 1.7 1.7 1.7 immaterial<br />

Leonardi Camerun 14.7 * * 12.495<br />

Tavoni International 5 * * 15<br />

Cons. Spedifiere 10 * * N/A<br />

Cons. Inter. Fiumicino 150 150 150 N/A<br />

Total 181.4 151.7 151.7<br />

* these companies were not part of the <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Group at 30th June and 31st<br />

December 2000.<br />

19

Receivables<br />

At 30.06.2001 the receivables due within 12 months from non-consolidated subsidiary<br />

companies amounted to Lire 100 million, against a nil balance at 31.12.2000 and Lire 179 million<br />

at 30.06.2000. The above balance relates entirely to a loan granted by the company Leonardi &<br />

Co. S.p.A to its subsidiary Leonardi USA Inc.<br />

At 30.06.2001 the receivables due within 12 months from associated companies amounted to<br />

Lire 75 million, against Lire 46 million at 31.12.2000 and a nil balance at 30.06.2000. The<br />

variation during the period relates entirely to a receivable due towards the company Leonardi &<br />

Co. S.p.A by the subsidiary company Leonardi Camerun.<br />

The receivables due after 12 months from others (Lire 2,119 million at 30.06.2001, against Lire 1,858<br />

million at 31.12.2000 and Lire 1,843 million at 30.06.2000) are comprised of guarantee deposits given<br />

mainly for supply contracts, real estate rental, licences and similar, and of receivables due from the fiscal<br />

authorities following the payment of the advance tax on employee termination indemnity in accordance<br />

with Law. No. 79/97.<br />

CURRENT ASSETS<br />

Inventories<br />

These amount to Lire 60 million at 30.06.2001, against Lire 29 million at 31.12.2000 and Lire 27 million at<br />

30.06.2000. They relate mainly to computers and electronic machinery to be disposed of during the<br />

coming year.<br />

Receivables<br />

These amount to Lire 244,685 million at 30.06.2001, against Lire 206,229 million at 31.12.2000 and Lire<br />

166,260 million at 30.06.2000. They comprise the following:<br />

30.06.01 31.12.00 30.06.00<br />

Trade receivables 224,244 182,588 149,536<br />

Due from non-consolidated<br />

subsidiary companies<br />

1,272 492 2,309<br />

Due from associated companies 701 373 291<br />

Due from others 18,468 22,776 14,124<br />

Total 244,685 206,229 166,260<br />

The trade receivables include receivables from correspondents and agents arising in the course of normal<br />

shipping activities. These are classified as current receivables (Lire 223,460 million against Lire 182,003<br />

million at 31.12.2000 and Lire 149,058 million at 30.06.2000) and non-current receivables (Lire 784 million<br />

at 30.06.2001, against Lire 585 million at 31.12.2000 and Lire 478 million at 30.06.2000). They are shown<br />

net of a specific provision for doubtful debts set up to cover the risks of non-recovery of receivables. The<br />

amount accrued during the period to adjust the receivables to their estimated realisable value was Lire<br />

1,846 million, against Lire 2,729 million at 31.12.2000 and Lire 1,592 million at 30.06.2000.<br />

The receivables due from non-consolidated subsidiary companies relate mainly to trade<br />

receivables for freight charges due within 12 months that these companies shall, in turn, charge<br />

to their customers.<br />

These include receivables due to consolidated Group companies from the following companies:<br />

Direct European Transportation (Lire 54 million), , Strategic Logistic Alliance (Lire 47 million),<br />

Albatrans France S.r.l (Lire 123 million), Albatrans Spain (Lire 81 million), <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong><br />

Egypt Ltd (Lire 104 million), <strong>Savino</strong> del <strong>Bene</strong> Thailandia (Lire 334 million), <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong><br />

20

Argentina (Lire 176 million), Leonardi Iberia S.A (Lire 90 million), Leonardi Usa Inc. (Lire 207<br />

million), Tavoni International Mexico (Lire 34 million) and certain foreign liaison offices (Lire 22<br />

million).<br />

Receivables due from associated companies amount to Lire 701 million at 30.06.2001, against<br />

Lire 373 million at 31.12.2000 and Lire 291 million at 30.06.2000. They are comprised of<br />

receivables due from the company Do.ca S.r.l. (Lire 409 million), Do.Ca Venezuela (Lire 159<br />

million), Leonardi Camerun (Lire 34 million) and from the company Levitrans S.r.l. for Lire 99<br />

million.<br />

Receivables due from others are divided into current and non-current receivables in relation to the<br />

expected date of receipt. The resulting analysis is as follows:<br />

Receivables due within 12 months<br />

30.06.01 31.12.00 30.06.00<br />

Advances to suppliers 1,198 969 973<br />

Fiscal authorities for advance<br />

payments of taxes<br />

8,047 13,305 5,930<br />

Fiscal authorities for tax withheld at<br />

source<br />

57 107 45<br />

Fiscal authorities for tax credits 65 37 675<br />

VAT credit 885 1,033 803<br />

Fiscal authorities for advance<br />

taxation<br />

642 549 321<br />

Other receivables 2,379 2,582 1,225<br />

Total 13,273 18,582 9,972<br />

The category “Other receivables" comprises mainly refunds due from the Italian welfare<br />

institution (INPS), receivables from INAIL, together with short-term advances to employees for<br />

Lire 368 million.<br />

Receivables due after 12 months<br />

30.06.01 31.12.00 30.06.00<br />

Fiscal authorities for sundry tax refunds 53 55 95<br />

Insurance companies 2,872 2,675 2,384<br />

Fiscal authorities for income tax refunds 57 56 56<br />

Advances to employees 760 724 762<br />

Fiscal authorities for advance taxation 1,411 624 794<br />

Other receivables 42 60 61<br />

Total 5,195 4,194 4,152<br />

Current Financial Assets<br />

These amount to Lire 12,570 million at 30.06.2001, against Lire 12,423 million at 31.12.2000<br />

and Lire 11,548 million at 30.06.2000. They comprise the following:<br />

Own shares<br />

These amount to Lire 1,079 million at 30.06.2001, against Lire 1,497 million al 31.12.2000 and Lire 963<br />

million at 30.06.2000. The purchase and sale of own shares has been carried out in accordance with the<br />

resolutions of the Ordinary Shareholders’ Meeting of 28th April 2000 and 2nd May 2001. The nominal<br />

value of the own shares in portfolio at 30th June 2001 amounts to Lire 224 million. The trading in own<br />

shares during the period has resulted in a net loss of Lire 352 million.<br />

Other securities<br />

21

30.06.01 31.12.00 30.06.00<br />

Administered securities 11,257 10,615 10,340<br />

Ducato Fund Euro Bonds 2000 80 80 77<br />

Nomura Asian Fund 60 75 74<br />

Other securities 94 156 94<br />

Total 11,491 10,926 10,585<br />

The decrease in the value of the Nomura fund is due to the crisis on the Japanese stock market<br />

which represents the fund's main area of operation.<br />

Liquid funds<br />

These amount to Lire 40,716 million at 30.06.2001, against Lire 47,937 million at 31.12.2000 and Lire<br />

35,849 million at 30.06.2000. Of this total, Lire 38,403 million represent current bank account balances,<br />

Lire 1,909 million relate to cheques on hand and Lire 404 million relate to cash on hand at the various<br />

Group companies.<br />

ACCRUED INCOME AND PREPAID EXPENSES<br />

These amount to Lire 2,399 million at 30.06.2001, against Lire 1,036 million at 31.12.2000 and<br />

Lire 1,848 million at 30.06.2000.<br />

The accrued income relates mainly to interest income matured on current accounts and on fixed interest<br />

securities.<br />

The prepaid expenses relate to that part of costs sustained during the period (insurance, financial leases<br />

and others) relative to subsequent periods.<br />

They comprise the following:<br />

30.06.01 31.12.00 30.06.00<br />

Accrued income 126 71 16<br />

Prepaid expenses 2,273 965 1,832<br />

Total 2,399 1,036 1,848<br />

COMMENTS ON THE PRINCIPAL LIABILITY AND NET EQUITY HEADINGS<br />

SHAREHOLDERS' EQUITY<br />

22

The movements which took place in the various components of Shareholders’ equity are shown in<br />

Schedule No. 4 attached to this report.<br />

Detail of the principal components of Shareholders’ equity and the movements therein is given below:<br />

Share Capital<br />

The share capital shown in the consolidated interim financial statements as of 30th June 2001 represents<br />

the share capital (fully paid up) of the parent company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> S.p.A., comprised of No. 36,<br />

540,000 ordinary shares with a nominal value of Euro 0.52 each.<br />

On 30th March 2001, the Board of Directors of the parent company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> S.p.A., in<br />

exercising the powers conferred upon it by the extraordinary shareholders’ meeting of 16th<br />

September 1998 (which authorised the directors to increase the share capital up to a maximum<br />

of Lire 38 billion, in one or more issues, within the following five years, by means of the issue of<br />

No. 2,109,600 ordinary shares with a nominal value of Lire 1,000 per share), resolved to create<br />

a profit-sharing incentive scheme for employees with a bonus issue of share capital for a total of<br />

Euro 83,200. As a result of this increase, the share capital rose from Euro 18,917,600 to Euro<br />

19,000,800.<br />

No dividend bearing shares, convertible bonds or other securities were issued by any other<br />

Group company during the period.<br />

Share Premium Reserve<br />

No such reserve existed at 30.06.2001, nor at 31.12. 2000 or 30.06.2000.<br />

Revaluation Reserves<br />

These amount to Lire 11,662 million, against Lire 11,662 million at 31.12.2000 and Lire 210 million at<br />

30.06.2000. They have been formed from the revaluation reserves originated in accordance with Law No.<br />

413/1991(for Lire 210 million) and Law No. 342/2000 ( for Lire 11,452 million).<br />

Legal Reserve<br />

This amounts to Lire 2,794 million, against Lire 1,942 million at both 31.12.2000 and 30.06.2000.<br />

The increase of Lire 852 million during the period is due to the allocation of 5% of the net profit<br />

of the year 2000 to this reserve, as resolved by the Shareholders' Meeting of the parent<br />

company, <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> S.p.A., held on 2nd May 2001 for the approval of the financial<br />

statements of the company for the year ended on 31.12.2000.<br />

Reserve For Own Shares<br />

This amounts to Lire 3,000,000,000, at 30.06.2001, unchanged with respect to 31.12.2000 and 30.6.2000.<br />

This reserve was created by means of a resolution passed by the Ordinary Shareholders’ Meeting dated<br />

21.10.1994 in order to comply with the third paragraph of Art. 2357 of the Italian Civil Code.<br />

On 27th June 1997, and subsequently on 16th September 1998, 29th June 1999, 28th April 2000 and 2nd<br />

May 2001, the Ordinary Shareholders’ Meetings of the parent company renewed the authorisation<br />

conferred upon its Board of Directors for the purchase and sale of own shares for a period of 18 months<br />

from the date of the meeting, in accordance with Art. 2357 e 2357 bis of the Italian Civil Code.<br />

Other Reserves<br />

23

These amount to Lire 52,033 million, against Lire 31,853 million at 31.12.2000 and Lire 29,955<br />

million at 30.06.2000.<br />

.<br />

The movements which took place in these reserves are summarised in the schedule “Movements in<br />

consolidated net equity" shown as an appendix to these financial statements.<br />

These reserves include the reserve for translation adjustments for an amount of Lire 1,512 million but do<br />

not include consolidation reserves.<br />

Income for the Period<br />

This amounts to Lire 17,687 million against Lire 27,815 million at 31.12.2000 and Lire 23,206<br />

million at 30.06.2000.<br />

This amount is shown net of the minority interest share (Lire 2,837 million) of income for the period.<br />

Comments on the principal income statement headings are given below, after the notes to the balance<br />

sheet.<br />

Minority Interest Share of Equity<br />

This amounts to Lire 10,626 million at 30.06.2001, against Lire 6,187 million at 31.12.2000 and Lire 4,841<br />

million at 30.06.2000. It shows the portion of consolidated shareholders’ equity pertaining to the minority<br />

shareholders.<br />

PROVISIONS FOR RISKS AND CHARGES<br />

These comprise the following:<br />

30.06.01 31.12.00 30.06.00<br />

Leaving indemnity, pension funds<br />

and similar<br />

2,887 2,641 2,381<br />

Taxation provision 693 352 359<br />

Others 1,549 1,407 1,090<br />

Exchange rate fluctuations 0 0 376<br />

Total 5,129 4,400 4,206<br />

The leaving indemnity, pension funds and similar represent the provision resolved by the shareholders’<br />

meetings of the companies <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> S.p.A., Savintransport S.p.A., Fiorino Shipping S.r.l. and Lulli<br />

S.r.l. in order to recognise an indemnity to the long-term members of the Board of Directors at the end of<br />

their collaboration. The increase in this reserve is due mainly to the provisions accrued during the period.<br />

The taxation provision comprises the risks of fiscal penalties and sanctions. During the first six months of<br />

the year this provision was increased by Lire 306 million.<br />

The taxation provision also includes a provision for deferred taxation of Lire 376 million.<br />

The category “Others” is comprised entirely of the provision for litigation, penalties and disputes. No<br />

provision exists at 30.06.2001 for the coverage of losses sustained by non-consolidated subsidiary and<br />

associated companies.<br />

During the period the provision for litigation, penalties and disputes was increased by Lire 361 million and<br />

was utilised for Lire 27 million. Part of the increase (Lire 210 million) was due to the extension of the<br />

consolidation area.<br />

The provision for exchange rate fluctuations was utilised for Lire 192 million.<br />

24

EMPLOYEE TERMINATION INDEMNITY<br />

The following movements took place during the period:<br />

Balance at 1.1.2001 12,761<br />

Indemnity matured and accrued in the income<br />

statement<br />

1,533<br />

Changes in consolidation area and translation<br />

adjustments<br />

673<br />

Other movements 896<br />

Indemnity paid out during the period -745<br />

Balance at 30.06.2001 15,118<br />

PAYABLES<br />

The payables due within 12 months amount to Lire 208,988 million, against Lire 188,713 million at 31.<br />

12.2000 and Lire 140,982 million at 30.6.2000, and comprise the following:<br />

30.06.01 31.12.00 30.06.00<br />

Payables towards banks 46,658 36,030 23,851<br />

Payables towards other providers of finance 151 96 150<br />

Advances received from customers 900 829 844<br />

Trade payables 122,466 110,646 92,699<br />

Payables towards associated companies 249 138 151<br />

Payables towards non-consolidated<br />

715 459 1,974<br />

subsidiary companies<br />

Taxes payable 18,437 28,009 8,133<br />

Payables towards social welfare institutions 4,756 3,643 3,488<br />

Other payables 14,656 8,863 9,692<br />

Total 208,988 188,713 140,982<br />

Payables Towards Banks<br />

Payables towards banks at 30.06.2001 may be divided as follows:<br />

30.06.01 31.12.00 30.06.00<br />

Due within 12 months 46,658 36,030 23,851<br />

Due after 12 months 6,030 4,157 4,740<br />

Total 52,688 40,187 28,591<br />

The payables due within 12 months relate mainly to short-term loans or to current account<br />

overdrafts. The average interest charged by the banks on the short term loans (normally for<br />

periods not exceeding 3 months) and on bank overdrafts varies from a minimum of 7.5% to a<br />

maximum of 8. 5% p.a. and from a minimum of 4.5% to a maximum of 7 % p.a. on advances in<br />

foreign currency.<br />

25

The payables due after 12 months consist of:<br />

- Lire 178 million relative to a mortgage loan issued by the Banca Nazionale del Lavoro for the purchase<br />

of real estate by the company Albatrans S.p.A. The expiry of this loan is foreseen for the year 2002. This<br />

loan is guaranteed by a mortgage on the building in question for a total value of Lire 2,257,000,000.<br />

- Lire 718 million relative to a loan granted by Monte dei Paschi to the company Cavallino S.r.l.<br />

stipulated in 1998 for an original amount of Lire 1,000 million and repayable on 31.12.2008, with an<br />

annual interest rate of 6.35%. The part due after 5 years amounts to Lire 331 million.<br />

- Lire 1,500 million relative to a loan granted by the Banca Mediocredito to the company<br />

Leonardi & Co. S.p.A stipulated on 21st February 2001 for an original amount of Lire<br />

1,500,000,000, with maturity date 31st March 2004 repayable in 6 six-monthly instalments of Lire<br />

250,000,000 as from 30th September 2001. The interest rate on this loan is equivalent to the<br />

5.95% p.a. up until 31st March 2001 and, for the following six-monthly periods as from 1 st April<br />

and 1 st October each year , at the Euribor six-monthly rate plus 1.25 percentage points.<br />

- Lire 637 million relative to a loan granted by the Rolo Banca to the company Leonardi & Co.<br />

S.p.A stipulated on 31.12.1998 for an original amount of Lire 1,500,000,000, with maturity date<br />

31st December 2003 repayable in 10 six-monthly instalments as from 30th June 1999. The<br />

interest rate on this loan is equivalent to the RIBOR rate + 0,4% .<br />

- Lire 2,997 million relative to two loans granted by the Ing Bank to the company Brewer Enterprises, the<br />

first of which for an amount of US$ 660,000 at an annual interest rate of 12%, repayable over a period of<br />

five years in 60 monthly instalments and the second for an amount of US$ 1,200,000 at an annual interest<br />

rate of 10%, repayable over a period of ten years in 120 monthly instalments (with the option to extinguish<br />

the loan after a period of five years). The interest rates applied are in line with the average interest rates<br />

on the American market for unsecured loans.<br />

Payables Towards Other Providers Of Finance<br />

The payables towards other providers of finance due within 12 months amount to Lire 151 million, against<br />

Lire 96 million at 31.12.2000 and lire 150 million at 30.6.2000.<br />

The payables towards other providers of finance due after 12 months amount to Lire 906 million,<br />

against Lire 760 million at 31.12.2000 and Lire 339 million at 30.06.2000.<br />

Advances Received From Customers<br />

These amount to Lire 925 million at 30.06.2001, against Lire 851 million at 31.12.2000 and Lire 844<br />

million at 30.06.2000. They relate mainly to advances received from customers relative to services still to<br />

be completed.<br />

Trade Payables<br />

These amount to Lire 122,481 million at 30.06.2001, against Lire 111,074 million at 31.12.2000 and .<br />

Lire 92,699 million at 30.06.2000. They represent short-term payables of a commercial nature. They<br />

include the supplements relative to services concluded on or before 30.06.2001.<br />

Payables Towards Non-Consolidated Subsidiary Companies<br />

These amount to Lire 715 million at 30.06.2001, against Lire 459 million at 31.12.2000 and<br />

Lire1,974 million at 30.06.2000.<br />

26

They comprise payables due by the consolidated Group companies towards the following nonconsolidated<br />

Group companies: <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Fiume (Lire 13 million), <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> S.A.<br />

Chiasso (Lire 2 million), Direct European Transportation (Lire 2 million), Albatrans France S.r.l<br />

(Lire 265 million), Albatrans Spain S.l. (Lire 172 million), <strong>Savino</strong> del <strong>Bene</strong> Egypt Ltd ( Lire 16<br />

million), <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Thailand Pte (Lire 218 million), <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Argentina (Lire 17<br />

million) and other foreign liaison offices (Lire 10 million).<br />

Payables Towards Associated Companies<br />

These amount to Lire 249 million at 30.06.2001, against Lire 138 million at 31.12.2000 and Lire 151 million<br />

at 30.06.2000 and relate payables towards the associated companies Do.Ca. S.r.l. (Lire 49 million) ,<br />

Levitrans S.r.l. (Lire 47 million), Leonardi Cameroon (Lire 1 million) and Hansa Express (Lire 152 million).<br />

Payables Towards Fiscal Authorities<br />

The payables towards fiscal authorities due within 12 months comprise the following:<br />

30.06.01 31.12.00 30.06.00<br />

Income taxes 12,808 21,027 6,378<br />

VAT payable 89 100 105<br />

Withholding taxes 2,365 1,717 1,450<br />

Substitutive tax Law No. 342/2000 2,870 4,303 0<br />

Substitutive tax 111 516 185<br />

Other payables towards fiscal authorities 194 346 15<br />

Total 18,437 28,009 8,133<br />

Payables Towards Social Welfare Institutions<br />

These amount to Lire 4,756 million at 30.06.2001, against Lire 3,643 million at 31.12.2000 and Lire 3,488<br />

million at 30.06.2000. They represent obligatory contributions matured and yet to be paid to government<br />

health and insurance institutions.<br />

Other Payables<br />

These are comprised of the following:<br />

30.06.01 31.12.00 30.06.00<br />

Payables towards employees 7,939 3,888 5,257<br />

Payables towards shareholders 205 0 205<br />

Payables towards directors 406 230 187<br />

Payables towards third parties for the<br />

acquisition of equity quotas or shares<br />

2,026 0 0<br />

Other payables 4,080 4,745 4,043<br />

Total 14,656 8,863 9,692<br />

Payables towards third parties for the acquisition of equity quotas or shares represents the<br />

residual debt due to third parties by the parent company for the acquisition of quotas of the<br />

company Levitrans S.r.l. and of 51% of the company Leonardi & Co. S.p.A.<br />

Other payables comprise sundry payables and include various liabilities of an uncertain nature<br />

that the Group has decided to maintain in its financial statements for prudential reasons.<br />

27

ACCRUED LIABILITIES AND DEFERRED INCOME<br />

These are made up as follows:<br />

30.06.01 31.12.00 30.06.00<br />

Accrued liabilities 1,807 960 962<br />

Deferred income 1,235 524 649<br />

Total 3,042 1,484 1,611<br />

The accrued liabilities relate to costs matured during the period and comprise mainly interest charges<br />

from banks.<br />

The deferred income comprises portions of income relative to subsequent periods and refers principally to<br />

income from recharging insurance premiums and to rental income.<br />

Memorandum Accounts<br />

The memorandum accounts amount to a total of Lire 40,283 million at 30.06.2001, against Lire 22,063<br />

million at 31.12.2000 and Lire 31,737 million at 30.06.2000.<br />

They comprise the following:<br />

- bank guarantees granted to third parties on behalf of the Group for Lire 20,836 million for the<br />

carrying out of commercial activities and to guarantee the honouring of commitments.<br />

- commitments for the residual instalments of financial leasing contracts for Lire 990 million.<br />

- fidejussions granted to third parties on the Group’s behalf for Lire 4,857 million.<br />

- guarantees received from third parties for Lire 6,463 million.<br />

- mortgages on land and buildings for Lire 7,137 million registered against loans received from<br />

banking institutions.<br />

No commitments have been assumed by Group companies other than those resulting from the balance<br />

sheet nor have any commitments been assumed by those subsidiary companies not consolidated in<br />

accordance with Art.28 of Law No. 127/91.<br />

28

COMMENTS ON THE PRINCIPAL INCOME STATEMENT HEADINGS<br />

VALUE OF PRODUCTION<br />

The total value of production amounts to Lire 457,148 million at 31.06.2000 against Lire 765,168<br />

million at 31.12.2000 and Lire 337,642 million at 30.06.2000.<br />

It comprises the following:<br />

- Revenue from sales of goods and services (Lire 455,144 million)<br />

- Other income and revenue (Lire 2,004 million)<br />

Revenue from sales of goods and services<br />

These derive from the Company’s characteristic shipping and transport management activities. They are<br />

shown net of rebates and discounts.<br />

Sales revenue may be analysed by transport sector:<br />

30.06.01 31.12.00 30.06.00<br />

Revenue by sea 269,781 426,361 181,209<br />

Revenue by air 113,649 203,481 88,897<br />

Revenue by land 24,010 52,251 27,534<br />

Other revenue 47,704 79,445 37,928<br />

Total 455,144 761,538 335,568<br />

Other Income and Revenue<br />

These amount to Lire 2,004 million at 30.06.2001, against Lire 3,630 million at 31.12.2000 and Lire 2,074<br />

million at 30.06.2000.<br />

The main components of this heading are comprised of income from the rental of real estate, gains on<br />

disposal of assets, other non-recurring income deriving from normal operations and sundry services<br />

charged to customers.<br />

COST OF PRODUCTION<br />

Raw, Ancillary and Consumable Materials and Goods For Resale<br />

These amount to Lire 2,842 million, against Lire 4,150 million at 31.12. 2000 and Lire 2,501<br />

million at 30.06.2000.<br />

They include the costs sustained for the purchase of packing materials, stationery, printed matter, fuel and<br />

oil, tyres and other items of a limited value.<br />

Services<br />

These amount to Lire 374,625 million at 30.06.2001, against Lire 619,181 million at 31.12. 2000<br />

and Lire 270,782 million at 30.06.2000.<br />

They comprised the following at 30th June 2001:<br />

30.06.01 31.12.00 30.06.00<br />

Freight charges 229,233 419,655 178,839<br />

29

Haulage charges 83,985 83,539 40,155<br />

Agents and correspondents’ fees 25,159 49,344 21,841<br />

Customs clearing costs 5,666 14,309 6,976<br />

Other costs 30,582 52,334 22,971<br />

Total 374,625 619,181 270,782<br />

Other Operating Costs<br />

These amount to Lire 1,645 million at 30.06.2001, against Lire 3,513 million at 31.12. 2000 and<br />

Lire 629 million at 30.06.2000.<br />

They comprise the following:<br />

30.06.01 31.12.00 30.06.00<br />

Losses on assets 71 18 7<br />

Non-recurring charges 229 58 43<br />

Subscriptions and advertising 464 712 293<br />

Deductible taxes 154 277 0<br />

Bonuses, gifts to employees 3 154 1<br />

Registration fees 34 38 18<br />

Non-deductible taxes and duties 92 535 263<br />

Sundry purchases 471 1,350 3<br />

Losses not covered by reserves 16 314 0<br />

Others 111 57 1<br />

Total 1,645 3,513 629<br />

FINANCIAL INCOME AND EXPENSES<br />

Net financial income amounted to Lire 5,765 million, against Lire 5,018 million at 31.12.2000 and Lire<br />

3,880 million at 30.06.2000.<br />

This balance is comprised of financial income, interest and other financial charges<br />

Other Financial Income<br />

This amounts to Lire 15,319 million at 30.06.2001, against Lire 27,309 million at 31.12.2000 and Lire<br />

10,255 million at 30.06.2000, and comprises the following:.<br />

Other Financial Income from Securities held as Current Assets, from Securities held as Fixed Assets and from<br />

Receivables included in Fixed Assets<br />

30.06.01 31.12.00 30.06.00<br />

Interest income on bonds 0 2 0<br />

Gains on disposal of own shares 6 46 46<br />

Gains on disposal of fixed interest securities 82 22 4<br />

Total 88 70 50<br />

Other financial income other than the above from others<br />

30.06.01 31.12.00 30.06.00<br />

30

Interest income from banks 534 1,087 724<br />

Interest income from customers 64 318 89<br />

Gains on exchange 13,861 25,224 8,965<br />

Rebates and financial discounts 13 21 12<br />

Others 753 580 410<br />

Total 15,225 27,230 10,200<br />

Other financial income other than the above from subsidiary companies<br />

These amount to Lire 6 million at 30.06.2001, against Lire 9 million at 31.12.2000 and Lire 5 million at<br />

30.06.2000. They relate to income received by the company <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> U.K. from the subsidiary<br />

company, Direct European Transportation.<br />

Income from equity investments received by the parent company during the first six months of<br />

the year has been eliminated in the interim financial statements as of 30.06.2001. Similarly, the<br />

economic and equity effects of the tax credits on dividends received by the parent company<br />

have also been eliminated.<br />

Interest and Other Financial Charges<br />

These amount to Lire 9,554 million at 30.06.2001, against Lire 22,291 million at 31.12. 2000 and<br />

Lire 6,375 million at 30.06.2000.<br />

They comprise the following:<br />

30.06.01 31.12.00 30.06.00<br />

Interest charges from banks 1,984 2,795 1,202<br />

Losses on exchange 5,853 16,901 4,303<br />

Bank charges 661 1,057 468<br />

Other financial charges 1,056 1,538 402<br />

Total 9,554 22,291 6,375<br />

ADJUSTMENTS TO THE VALUE OF FINANCIAL ASSETS<br />

These show a positive balance of Lire 98 million at 30.06.2001. At 31.12.2000 and at 30.06.2000 they<br />

showed a negative balance of Lire 579 million and Lire 57 million respectively.<br />

This balance is comprised almost entirely of the revaluation of the investments in companies valued at net<br />

equity for the Group share of their income for the period (Lire 330 million) and the write-down of the<br />

investments in the associated companies Do.ca S.r.l. (Lire 113 million) and Levitrans S.r.l (Lire 119<br />

million).<br />

The following investments were written down during the period:<br />

30.06.01 31.12.00 30.06.00<br />

Do.ca S.r.l. 113 200 0<br />

Levitrans S.r.l. 119 239 0<br />

<strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> France 0 0 74<br />

Albatrans Spain S.L. 0 0 71<br />

Total 232 439 145<br />

EXTRAORDINARY INCOME AND EXPENSES<br />

Net extraordinary expenses amount to Lire 136 million, against a net extraordinary income of Lire 2,625<br />

million at 31.12.2000 and net extraordinary expenses of Lire 289 million at 30.06.2000.<br />

31

The net balance is comprised of extraordinary income for Lire 110 million and extraordinary<br />

expenses of Lire 246 million.<br />

Extraordinary income relates principally to insurance indemnities and refunds of social welfare<br />

contributions and other non recurrent income of an extraordinary nature due principally to the<br />

write-off of debts no longer payable.<br />

Extraordinary expenses relate mainly to losses on disposals of an extraordinary nature.<br />

Workforce<br />

During the period ended on 30.06.2001 the <strong>Savino</strong> <strong>Del</strong> <strong>Bene</strong> Group employed an average of No. 1,125<br />

persons as follows:<br />

30.06.01 31.12.00 30.06.00<br />

Managers 43 42 37<br />

Clerical and supervisory staff 1,014 857 783<br />

Manual workers 68 59 50<br />

Total 1,125 958 870<br />

The exact number of employees at 30.06.2001 amounted to No 1,142 persons.<br />

For the purposes of clarity we would point out that the category "Managers" includes No. 33 managers of<br />

foreign companies, who would be considered as being supervisory staff under Italian legislation.<br />

The Chairman of the Board of Directors<br />

32