Replicating Interest Rate Swaps with Eurodollar Strips - MemoFin.fr

Replicating Interest Rate Swaps with Eurodollar Strips - MemoFin.fr Replicating Interest Rate Swaps with Eurodollar Strips - MemoFin.fr

(B) A minimum liquidation time that is one day for swapson agricultural commodities, energy commodities, andmetals;(C) A minimum liquidation time that is five days for allother swaps; or(D) Such longer liquidation time as is appropriate basedon the specific characteristics of a particular productor portfolio; provided further that the Commission, byorder, may establish shorter or longer liquidationtimes for particular products or portfolios.”In short, under the new rules, market participantsmust post initial performance bonds to cover a onedayliquidation timetable for financial futurestransactions, a 5-day liquidation timetable forcentrally cleared financial swaps, and a 10-dayliquidation timetable for non-centrally clearedfinancial swaps.With respect to non-cleared financial swaps, the 10-day liquidation timetable is only proposed. Theserules will mandate that previously uncleared,bilaterally executed, plain-vanilla financial swaps becleared by a qualified central counterparty (“QCCP”)and become subject to a 5-day liquidation timetable.Margin requirements for standardized, liquid futurescontracts, such as Eurodollars, will generally be lessonerous than margins required for an analogousposition in a cleared, plain vanilla interest rate swap.This is intuitive to the extent that IRS instrumentsare customized transactions which typically cannotbe liquidated in times of market stress with equalfacility to futures.For example, the margin requirements for astructured 5-year Eurodollar futures strip thatmimics a 5-year IRS results in 50% margin savings.The margin on a 10-year structured Eurodollarfutures strip is estimated at 42% less than that of acomparable 10-year IRS.Concluding NoteBusiness practices in the OTC derivatives andexchange traded futures markets are converging ina process often referred to as “futurization.” Asevidence, consider that the Dodd-Frank financialreform bill mandated centralized counterpartyclearing of standardized IRS instruments.Similarly, Eurodollar futures may be utilized to priceand hedge and, to a degree, replicate theperformance of IRS instruments. But futures offersignificant capital efficiencies vis-à-vis comparablecleared over-the-counter IRS instruments.To learn more about this product, visitwww.cmegroup.com/eurodollar.Estimated Margin Requirementsas % of Notional Value(As of December 2012)TenorCleared Equivalent MarginIRS ED Strip Savings2-Year 0.420% 0.255% 39%5-Year 1.580% 0.795% 50%10-Year 3.250% 1.895% 42%For example, the margin requirements for astructured 2-year Eurodollar futures strip thatmimics a 2-year interest rate swap may beestimated as of December 2012 as 0.255% ofnotional value. By contrast, the marginrequirements associated with a cleared 2-yearinterest rate swap are estimated at 0.420%. Thus,one may use Eurodollar strips to replicate a riskexposure that is similar to an IRS instrument with39% margin savings.7 Replicating IRS with Eurodollar Strips | May 16, 2013 | © CME GROUP

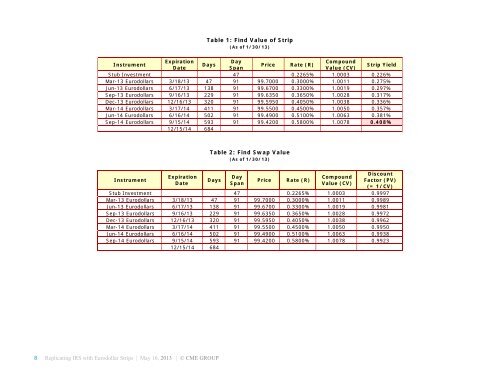

Table 1: Find Value of Strip(As of 1/30/13)InstrumentExpirationDayCompoundDaysPrice Rate (R)DateSpanValue (CV)Strip YieldStub Investment 47 0.2265% 1.0003 0.226%Mar-13 Eurodollars 3/18/13 47 91 99.7000 0.3000% 1.0011 0.275%Jun-13 Eurodollars 6/17/13 138 91 99.6700 0.3300% 1.0019 0.297%Sep-13 Eurodollars 9/16/13 229 91 99.6350 0.3650% 1.0028 0.317%Dec-13 Eurodollars 12/16/13 320 91 99.5950 0.4050% 1.0038 0.336%Mar-14 Eurodollars 3/17/14 411 91 99.5500 0.4500% 1.0050 0.357%Jun-14 Eurodollars 6/16/14 502 91 99.4900 0.5100% 1.0063 0.381%Sep-14 Eurodollars 9/15/14 593 91 99.4200 0.5800% 1.0078 0.408%12/15/14 684Table 2: Find Swap Value(As of 1/30/13)InstrumentExpirationDateDaysDaySpanPriceRate (R)CompoundValue (CV)DiscountFactor (PV)(= 1/CV)Stub Investment 47 0.2265% 1.0003 0.9997Mar-13 Eurodollars 3/18/13 47 91 99.7000 0.3000% 1.0011 0.9989Jun-13 Eurodollars 6/17/13 138 91 99.6700 0.3300% 1.0019 0.9981Sep-13 Eurodollars 9/16/13 229 91 99.6350 0.3650% 1.0028 0.9972Dec-13 Eurodollars 12/16/13 320 91 99.5950 0.4050% 1.0038 0.9962Mar-14 Eurodollars 3/17/14 411 91 99.5500 0.4500% 1.0050 0.9950Jun-14 Eurodollars 6/16/14 502 91 99.4900 0.5100% 1.0063 0.9938Sep-14 Eurodollars 9/15/14 593 91 99.4200 0.5800% 1.0078 0.992312/15/14 6848 Replicating IRS with Eurodollar Strips | May 16, 2013 | © CME GROUP

- Page 1: INTEREST RATESReplicating Interest

- Page 5: Pricing SwapsInterest rate swaps ar

- Page 10: Table 3: Confirm Par Value(As of 1/

Table 1: Find Value of Strip(As of 1/30/13)InstrumentExpirationDayCompoundDaysPrice <strong>Rate</strong> (R)DateSpanValue (CV)Strip YieldStub Investment 47 0.2265% 1.0003 0.226%Mar-13 <strong>Eurodollar</strong>s 3/18/13 47 91 99.7000 0.3000% 1.0011 0.275%Jun-13 <strong>Eurodollar</strong>s 6/17/13 138 91 99.6700 0.3300% 1.0019 0.297%Sep-13 <strong>Eurodollar</strong>s 9/16/13 229 91 99.6350 0.3650% 1.0028 0.317%Dec-13 <strong>Eurodollar</strong>s 12/16/13 320 91 99.5950 0.4050% 1.0038 0.336%Mar-14 <strong>Eurodollar</strong>s 3/17/14 411 91 99.5500 0.4500% 1.0050 0.357%Jun-14 <strong>Eurodollar</strong>s 6/16/14 502 91 99.4900 0.5100% 1.0063 0.381%Sep-14 <strong>Eurodollar</strong>s 9/15/14 593 91 99.4200 0.5800% 1.0078 0.408%12/15/14 684Table 2: Find Swap Value(As of 1/30/13)InstrumentExpirationDateDaysDaySpanPrice<strong>Rate</strong> (R)CompoundValue (CV)DiscountFactor (PV)(= 1/CV)Stub Investment 47 0.2265% 1.0003 0.9997Mar-13 <strong>Eurodollar</strong>s 3/18/13 47 91 99.7000 0.3000% 1.0011 0.9989Jun-13 <strong>Eurodollar</strong>s 6/17/13 138 91 99.6700 0.3300% 1.0019 0.9981Sep-13 <strong>Eurodollar</strong>s 9/16/13 229 91 99.6350 0.3650% 1.0028 0.9972Dec-13 <strong>Eurodollar</strong>s 12/16/13 320 91 99.5950 0.4050% 1.0038 0.9962Mar-14 <strong>Eurodollar</strong>s 3/17/14 411 91 99.5500 0.4500% 1.0050 0.9950Jun-14 <strong>Eurodollar</strong>s 6/16/14 502 91 99.4900 0.5100% 1.0063 0.9938Sep-14 <strong>Eurodollar</strong>s 9/15/14 593 91 99.4200 0.5800% 1.0078 0.992312/15/14 6848 <strong>Replicating</strong> IRS <strong>with</strong> <strong>Eurodollar</strong> <strong>Strips</strong> | May 16, 2013 | © CME GROUP