Probate Checklist - Professional Liability Fund

Probate Checklist - Professional Liability Fund

Probate Checklist - Professional Liability Fund

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

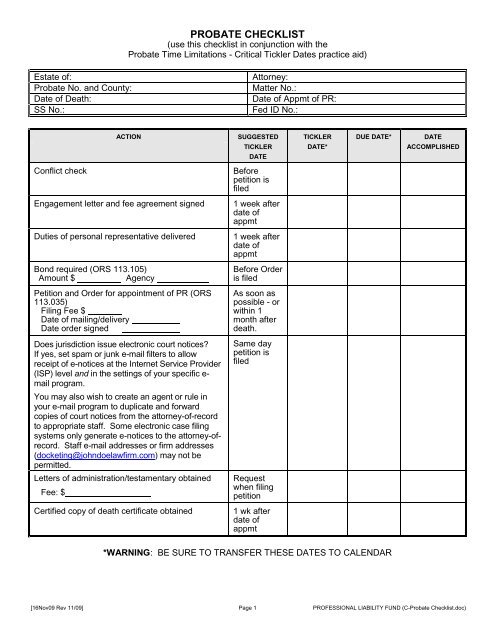

PROBATE CHECKLIST(use this checklist in conjunction with the<strong>Probate</strong> Time Limitations - Critical Tickler Dates practice aid)Estate of:<strong>Probate</strong> No. and County:Date of Death:SS No.:Attorney:Matter No.:Date of Appmt of PR:Fed ID No.:ACTIONSUGGESTEDTICKLERDATETICKLERDATE*DUE DATE*DATEACCOMPLISHEDConflict checkBeforepetition isfiledEngagement letter and fee agreement signed1 week afterdate ofappmtDuties of personal representative delivered1 week afterdate ofappmtBond required (ORS 113.105)Amount $AgencyBefore Orderis filedPetition and Order for appointment of PR (ORS113.035)Filing Fee $Date of mailing/deliveryDate order signedAs soon aspossible - orwithin 1month afterdeath.Does jurisdiction issue electronic court notices?If yes, set spam or junk e-mail filters to allowreceipt of e-notices at the Internet Service Provider(ISP) level and in the settings of your specific e-mail program.Same daypetition isfiledYou may also wish to create an agent or rule inyour e-mail program to duplicate and forwardcopies of court notices from the attorney-of-recordto appropriate staff. Some electronic case filingsystems only generate e-notices to the attorney-ofrecord.Staff e-mail addresses or firm addresses(docketing@johndoelawfirm.com) may not bepermitted.Letters of administration/testamentary obtainedFee: $Requestwhen filingpetitionCertified copy of death certificate obtained1 wk afterdate ofappmt*WARNING: BE SURE TO TRANSFER THESE DATES TO CALENDAR[16Nov09 Rev 11/09] Page 1 PROFESSIONAL LIABILITY FUND (C-<strong>Probate</strong> <strong>Checklist</strong>.doc)

Estate ofPROBATE CHECKLISTACTIONSUGGESTEDTICKLERDATETICKLERDATE*DUE DATE*DATEACCOMPLISHEDNotice to interested persons (within 30 days afterappmt) (ORS 113.155)NewspaperDate of mailing to newspaperDate of first publicationAffidavit received and checkedAffidavit mailed for filingAs soon asOrder isreceivedInformation to devisees, heirs and otherinterested persons (Due 30 days afterappointment) (ORS 113.145)Dated mailed or deliveredAffidavit mailed for filing2 weeks afterdate ofappmtCopy of notice and death certificate to EstateAdministration Office, Department of HumanServices, PO Box 14021, Salem, OR 97309-50242 weeks afterdate ofappmtExplanatory letter to heirs and devisees w/request for SSN’s sent2 weeks afterdate ofappmtForward mail to personal representative orattorneyas soon asOrder isreceivedPersonal property tax release filed (If requiredby county)30 days afterdate ofappmtNotify county assessor(s) of mailing address fortax statements2 weeks afterdate ofappmtFederal tax ID obtained (IRS Form SS-4)As soon asOrder isreceivedNotice of fiduciary relationship filed(IRS Form 56)2 weeks afterdate ofappmtSSN for decedent obtained (Applies only ifdecedent did not have valid SSN at time ofdeath) (Rev. Ruling 64-113, 1964-1 CB 483)1 month fromdate ofappmtEstate bank account opened (be sure accountis set up to receive cancelled checks or followlocal court rule)As soon asreceive ID#[16Nov09 Rev 11/09] Page 2 PROFESSIONAL LIABILITY FUND (B-<strong>Probate</strong> <strong>Checklist</strong>.doc)

Estate ofPROBATE CHECKLISTACTIONSUGGESTEDTICKLERDATETICKLERDATE*DUE DATE*DATEACCOMPLISHEDMarshal assets of estate and obtain valuation2 weeks afterdate ofappmtInventory (Due 60 days after appointment ofPR) (ORS 113.165)Amount $Extra filing fee required?45 days afterdate ofappmtConsider Petition for Spousal Support (ORS114.015)1 month fromdate ofappmtConsider new Will for surviving spouse afterinventory filed/tax liability determined3 monthsafter date ofappmtDeadline to claim elective share (Later of 90days after Will admitted to probate or 30 daysafter filing inventory) (ORS 114.145)90 days afterdate ofappmtExpiration of period to identify claimants (3months from the date PR is appointed) (ORS115.003)3 monthsafter date ofappmtNotice to claimants (Must be given no later than30 days after end of search) (ORS 115.003)3 monthsafter date ofappmtAffidavit of compliance re claimants filed (Notlater than 60 days after end of search)(ORS 115.003)4 monthsafter date ofappmtDeadline for Will contest (Later of 4 monthsafter publication or mailing/ delivering notice toheirs and devisees) (ORS 113.075)4 monthsafter date ofappmtFiscal year selected (Review issues wheninventory has been filed and tax liabilityassessed. Elect on first Form 1041)3 monthsafter date ofappmtDeadline for creditors to file claims (4 monthsafter date of first publication of notice tointerested persons) (ORS 115.005)4 monthsafter 1stpublicationReview and make determination on all claims(ORS 115.135) (Claims not disallowed within 60days after presentation are deemed allowed)2 weeks fromreceipt ofclaimDetermine estate tax alternative valuation date(6 months after date of death) (IRC Sec. 2032)6 monthsafter date ofdeath[16Nov09 Rev 11/09] Page 3 PROFESSIONAL LIABILITY FUND (B-<strong>Probate</strong> <strong>Checklist</strong>.doc)

Estate ofPROBATE CHECKLISTACTIONSUGGESTEDTICKLERDATETICKLERDATE*DUE DATE*DATEACCOMPLISHEDDetermine if widow qualifies for veteranproperty tax exemption (Apply for each year onor before April 1) (ORS 307.260)1 month afterdate of deathDecedent’s final individual income tax returns(April 15th of year following year of death) (IRCSec. 6012(a)(1); 6012(b)(1); 6072(a))March 15Decedent’s final gift tax returnApril 15 th ofthe yearfollowingdeathFile disclaimer (No later than 9 months afterdate of death) (IRC Sec. 2518(b)(2))6 monthsafter date ofdeathDeath Tax Returns (Due 9 months after date ofdeath if applicable) (IRC Sec. 6075(a))IRS Form 712 orderedFederal Estate Tax Return (706) filedOregon Inheritance Tax Return (IT-1) filedFederal closing letter receivedOregon clearance received7 monthsafter date ofdeathFiduciary income tax returns due (file by the15 th day of the fourth month following close offiscal year) (IRC Sec. 6012(a)(3), 6012(b)(1),6072(a)3 monthsafter close offiscal yrFederal release from liability (Federal incomeand gift taxes)Letter requesting PR release (Sec. 6905)Letter requesting audit of decedent’s finalreturns (Sec. 6501(d))File IRS Form 4810 requesting promptassessment for all decedent’s and fiduciaryincome tax returnsMay 15 ofthe yearreturns arefiledrequestingrelease fromOregon release from liability (ORS 316.387(4)File ODR Forms 150-101-151 and150-101-1521 month aftertax return isfiled[16Nov09 Rev 11/09] Page 4 PROFESSIONAL LIABILITY FUND (B-<strong>Probate</strong> <strong>Checklist</strong>.doc)

Estate ofPROBATE CHECKLISTACTIONSUGGESTEDTICKLERDATETICKLERDATE*DUE DATE*DATEACCOMPLISHEDConsider partial distribution (At least 4 monthsafter date of first publication) (ORS 116.013)Filing fee $Petition filedOrder signedDistribution accomplishedReceipts filed6-9 monthsafter death (ifgoal is tocarry outincome)anytime after4 months ifnotConsider partial award of PR fees and attorneyfees (ORS 116.183) (check local rulesregarding any limitations)6-9 monthsafter deathFirst Accounting (Due 60 days after 1 year fromthe date of PR’s appointment) (ORS 116.083)Filing fee $First Accounting submitted1 yr anniv. ofdate ofappmtQuarterly estimated tax payments (For anyestate tax year ending 2 or more years afterdeath/could apply as early as 1 year.) (15th dayof 4th, 6th, 9th, & 13th months after end of taxyear.) (IRC Sec. 6654(1))2 monthsafter appmtClaim for refund of federal estate taxes (Later of3 years from date return filed or 2 years fromdate the tax was paid. IRC Sec. 6511(a))After returnis filedFinal accounting and petition for final judgmentof distribution (ORS 116.083)Filing fee for Final Accounting $Final accounting/verified statement filedVouchers (if required by local court rules)Attorney fee affidavit filedPersonal Representative’s feesEstimate of accounting fees for final fiduciaryreturnsNotice waivedExpiration of objection periodFiling fee for Judgment $Judgment of Distribution submittedJudgment of Distribution signed10 monthsafter appmtto determineif final orannual acct[16Nov09 Rev 11/09] Page 5 PROFESSIONAL LIABILITY FUND (B-<strong>Probate</strong> <strong>Checklist</strong>.doc)

Estate ofPROBATE CHECKLISTACTIONSUGGESTEDTICKLERDATETICKLERDATE*DUE DATE*DATEACCOMPLISHEDAdministrative tasks to close estatePersonal representative’s deedAssignmentsSpecific devisesDistributionSpecial considerationsTrustsOther11 monthsafter appmtReceipts submitted2 weeks aftermailing tobeneficiariesSupplemental Final Accounting (Stronglyrecommended, though discretionary on the partof the PR)Filing fee $Supplemental Final Accounting submittedBeforesubmittingdischargeorderOrder of DischargeFiling fee $Order of Discharge submittedAfterdistributionreceipts filedBond released/agent notified of distribution anddischargeWhendischargeOrder issignedFinal vouchers retrieved from court if filed (Mustbe retained by PR for 1 year after date of finalaccounting) (ORS 116.083)1 month afterestate isclosedFinal fiduciary income tax returns filed (4months and 15 days following the close of theestate) (IRC Sec. 6.012(a)(3); 6.012(b)(1);6.072(a))1 month afterestate isclosedTermination of fiduciary relationship filed (IRSRevocation Form 56)After finalreturns filedDisengagement letter sentAfter finalreturns filed[16Nov09 Rev 11/09] Page 6 PROFESSIONAL LIABILITY FUND (B-<strong>Probate</strong> <strong>Checklist</strong>.doc)