FORM-I MONTHLY VALUE ADDED TAX RETURN To The ...

FORM-I MONTHLY VALUE ADDED TAX RETURN To The ...

FORM-I MONTHLY VALUE ADDED TAX RETURN To The ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

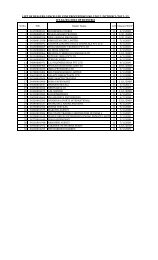

Annexure – IA. Adjustments in Output Tax(<strong>To</strong> be attached with the return where adjustments in Output Tax or Tax Credit are claimed) Nature of adjustment1.Sale has been cancelled2.Nature of sale has changed3.Change in agreed consideration4.Sales return5.Tax payable on goods held on the date of cancellation ofregistration6.Purchase tax7.Others, if any (specify)Increase in Output Tax(I)Decrease in Output Tax(II)8.<strong>To</strong>talB. Net Increase / (decrease) in Output Tax (I-II)C. Adjustments in Tax CreditNature of adjustment1.Tax credit carried forward from previous tax period(s)2. On receipt of debit note from the seller3. On receipt of credit note from seller4. Purchase return or rejects5. Goods subsequently used, fully or partly, for purposes other thanfor which credit is allowed6. Branch/consignment transfer of goods from the state to other stateson which previously input tax credit has been taken7. Tax credit on Second-hand goods8. Input tax credit upon withdrawal from Composition Scheme9. Tax credit on trading stock and raw material held at the time ofregistration10. Goods lost, stolen or destroyed, used as gift / sample.11. ITC on purchase of Capital Goods12. ITC on Goods purchased for transfer of right to use.13. Purchase tax (if ITC is available)14. Others, if any (specify)<strong>To</strong>talIncrease in Tax Credit(III)Decrease in Tax Credit(IV)D. Net Increase / (decrease) in Tax Credit (III-IV)Signature