BBVA in 2012

BBVA in 2012

BBVA in 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

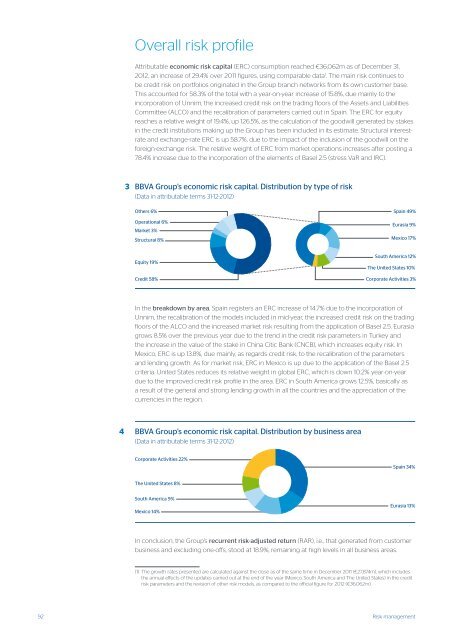

Overall risk profileAttributable economic risk capital (ERC) consumption reached €36,062m as of December 31,<strong>2012</strong>, an <strong>in</strong>crease of 29.4% over 2011 figures, us<strong>in</strong>g comparable data 1 . The ma<strong>in</strong> risk cont<strong>in</strong>ues tobe credit risk on portfolios orig<strong>in</strong>ated <strong>in</strong> the Group branch networks from its own customer base.This accounted for 58.3% of the total with a year-on-year <strong>in</strong>crease of 15.8%, due ma<strong>in</strong>ly to the<strong>in</strong>corporation of Unnim, the <strong>in</strong>creased credit risk on the trad<strong>in</strong>g floors of the Assets and LiabilitiesCommittee (ALCO) and the recalibration of parameters carried out <strong>in</strong> Spa<strong>in</strong>. The ERC for equityreaches a relative weight of 19.4%, up 126.5%, as the calculation of the goodwill generated by stakes<strong>in</strong> the credit <strong>in</strong>stitutions mak<strong>in</strong>g up the Group has been <strong>in</strong>cluded <strong>in</strong> its estimate. Structural <strong>in</strong>terestrateand exchange-rate ERC is up 58.7%, due to the impact of the <strong>in</strong>clusion of the goodwill on theforeign-exchange risk. The relative weight of ERC from market operations <strong>in</strong>creases after post<strong>in</strong>g a78.4% <strong>in</strong>crease due to the <strong>in</strong>corporation of the elements of Basel 2.5 (stress VaR and IRC).3<strong>BBVA</strong> Group’s economic risk capital. Distribution by type of risk(Data <strong>in</strong> attributable terms 31-12-<strong>2012</strong>)Others 6%Operational 6%Market 3%Structural 8%Spa<strong>in</strong> 49%Eurasia 9%Mexico 17%Equity 19%South America 12%The United States 10%Credit 58% Corporate Activities 3%In the breakdown by area, Spa<strong>in</strong> registers an ERC <strong>in</strong>crease of 14.7% due to the <strong>in</strong>corporation ofUnnim, the recalibration of the models <strong>in</strong>cluded <strong>in</strong> mid-year, the <strong>in</strong>creased credit risk on the trad<strong>in</strong>gfloors of the ALCO and the <strong>in</strong>creased market risk result<strong>in</strong>g from the application of Basel 2.5. Eurasiagrows 8.5% over the previous year due to the trend <strong>in</strong> the credit risk parameters <strong>in</strong> Turkey andthe <strong>in</strong>crease <strong>in</strong> the value of the stake <strong>in</strong> Ch<strong>in</strong>a Citic Bank (CNCB), which <strong>in</strong>creases equity risk. InMexico, ERC is up 13.8%, due ma<strong>in</strong>ly, as regards credit risk, to the recalibration of the parametersand lend<strong>in</strong>g growth. As for market risk, ERC <strong>in</strong> Mexico is up due to the application of the Basel 2.5criteria. United States reduces its relative weight <strong>in</strong> global ERC, which is down 10.2% year-on-yeardue to the improved credit risk profile <strong>in</strong> the area. ERC <strong>in</strong> South America grows 12.5%, basically asa result of the general and strong lend<strong>in</strong>g growth <strong>in</strong> all the countries and the appreciation of thecurrencies <strong>in</strong> the region.4<strong>BBVA</strong> Group’s economic risk capital. Distribution by bus<strong>in</strong>ess area(Data <strong>in</strong> attributable terms 31-12-<strong>2012</strong>)Corporate Activities 22%Spa<strong>in</strong> 34%The United States 8%South America 9%Mexico 14%Eurasia 13%In conclusion, the Group’s recurrent risk-adjusted return (RAR), i.e., that generated from customerbus<strong>in</strong>ess and exclud<strong>in</strong>g one-offs, stood at 18.9%, rema<strong>in</strong><strong>in</strong>g at high levels <strong>in</strong> all bus<strong>in</strong>ess areas.(1) The growth rates presented are calculated aga<strong>in</strong>st the close as of the same time <strong>in</strong> December 2011 (€27,874m), which <strong>in</strong>cludesthe annual effects of the updates carried out at the end of the year (Mexico, South America and The United States) <strong>in</strong> the creditrisk parameters and the revision of other risk models, as compared to the official figure for <strong>2012</strong> (€36,062m).92 Risk management